This communication is provided for informational and educational purposes only. Unless otherwise disclosed to you, in providing this information, Fidelity is not undertaking to provide impartial investment advice, or to give advice in a fiduciary capacity, in connection with any investment or transaction described herein. Fiduciaries are solely responsible for exercising independent judgment in evaluating any transaction(s) and are assumed to be capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies. Fidelity has a financial interest in any transaction(s) that fiduciaries, and if applicable, their clients, may enter into involving Fidelity’s products or services.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Investments in mutual funds will continue to be subject to each fund's underlying fees and expenses. See a fund's prospectus for information on fund fees and expenses.

Fidelity® Portfolio Advisory Service at Work is a service of Strategic Advisers, Inc., a registered investment adviser and a Fidelity Investments company. This service provides discretionary money management for a fee.

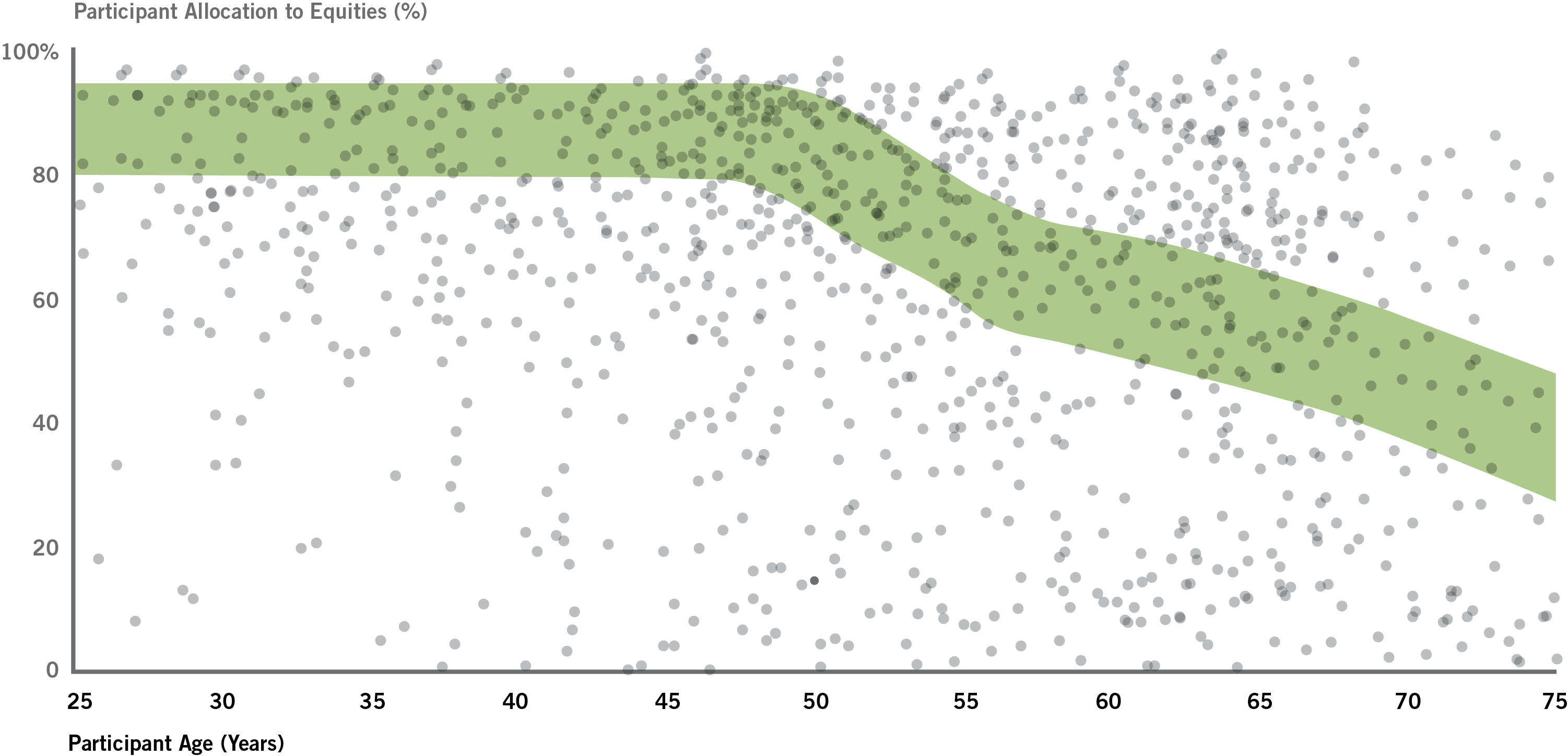

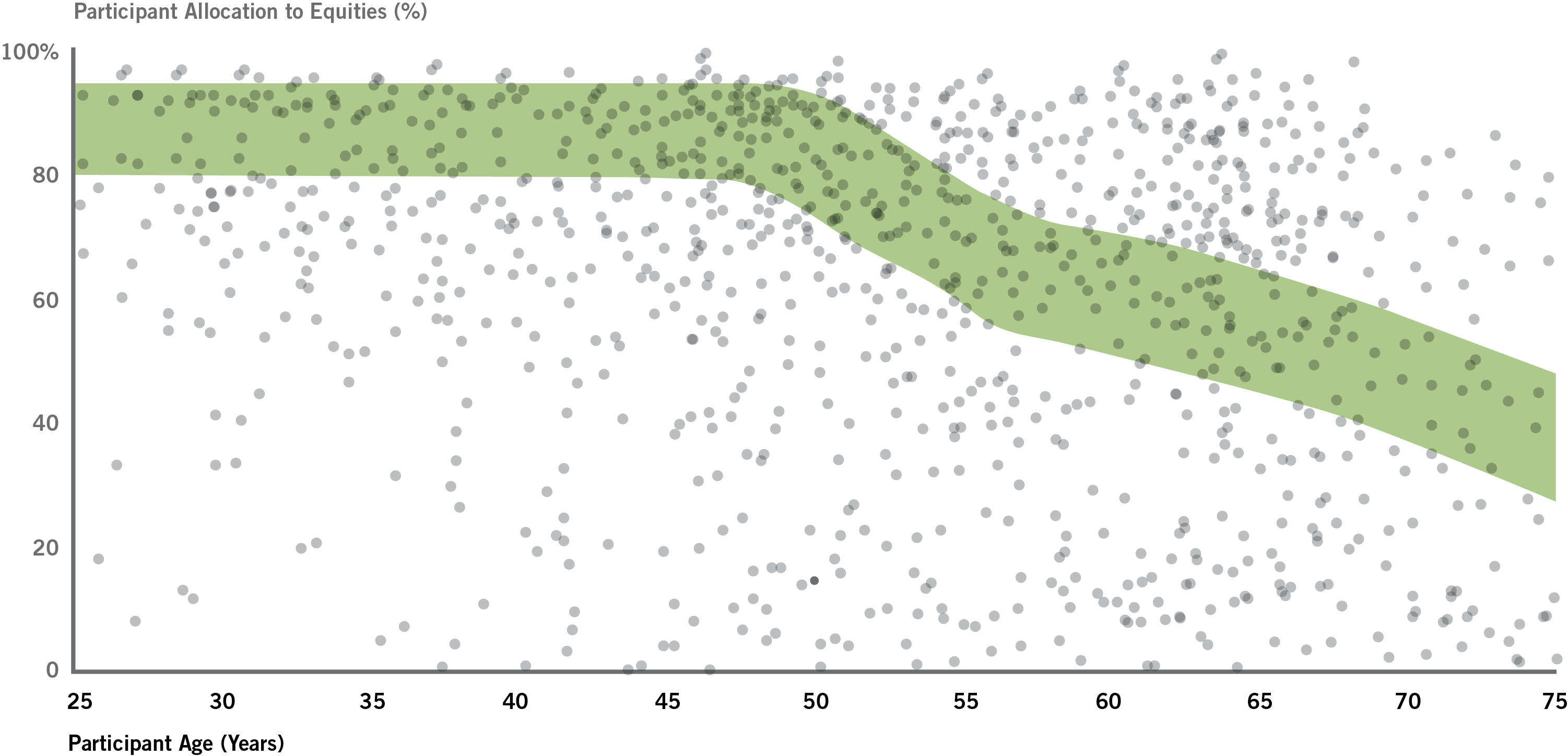

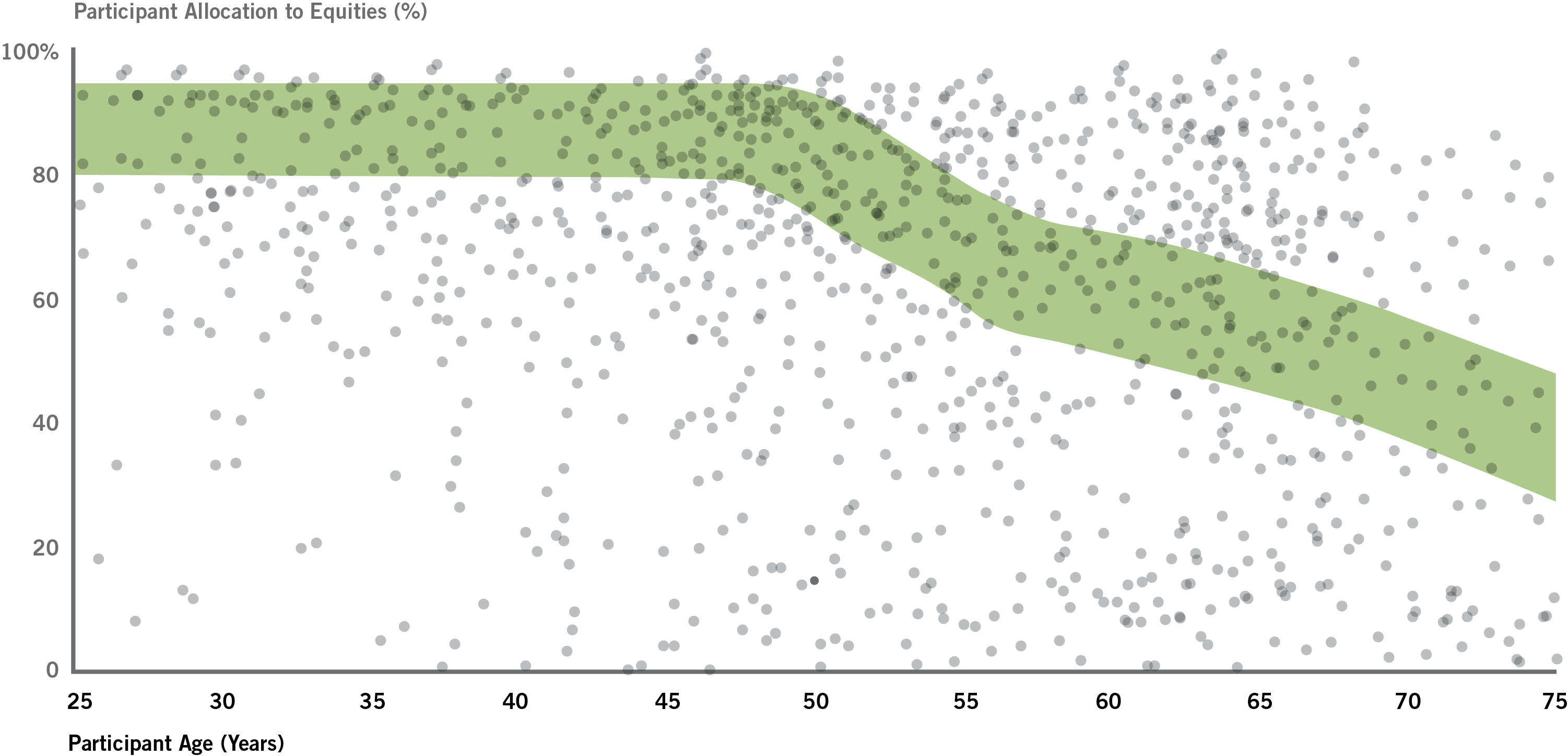

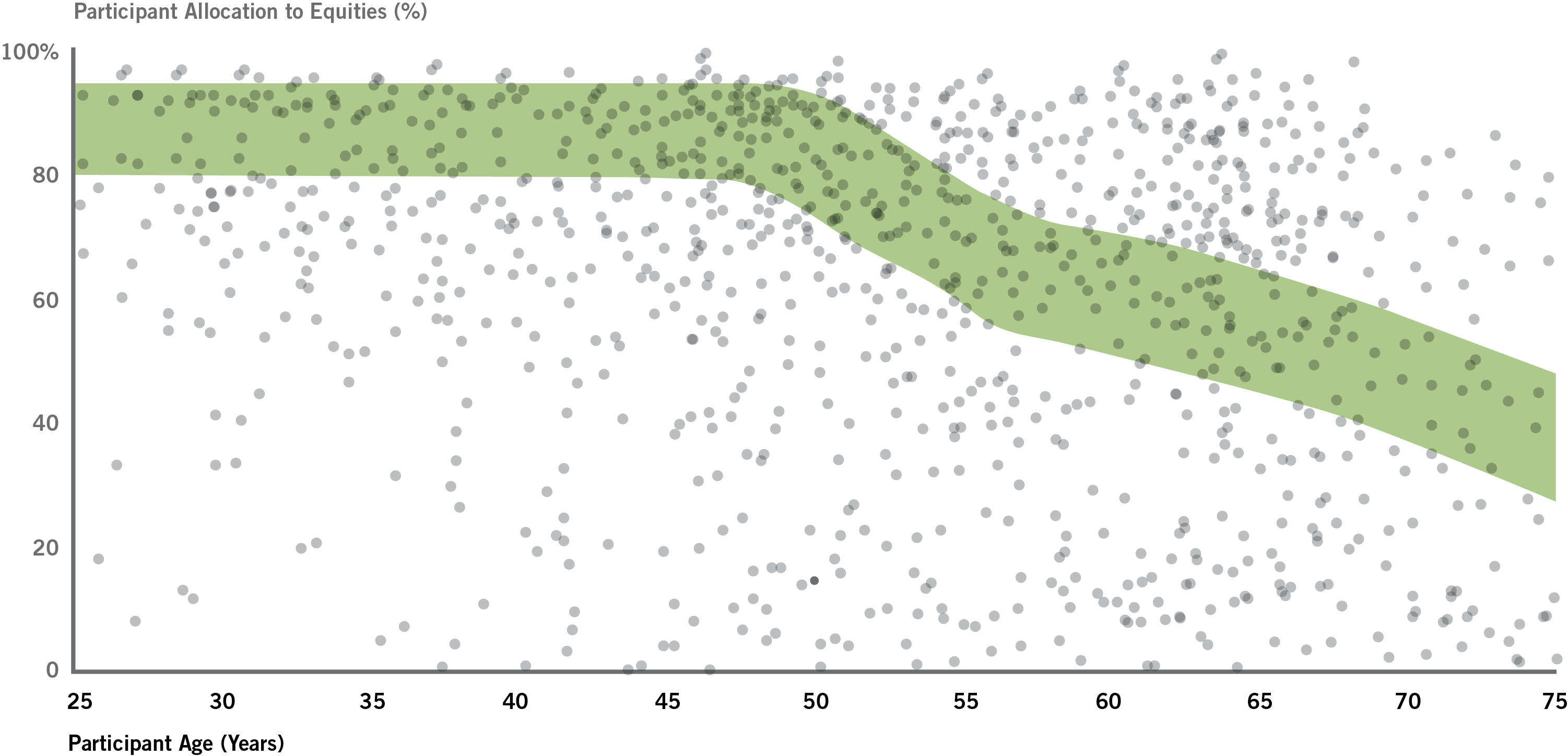

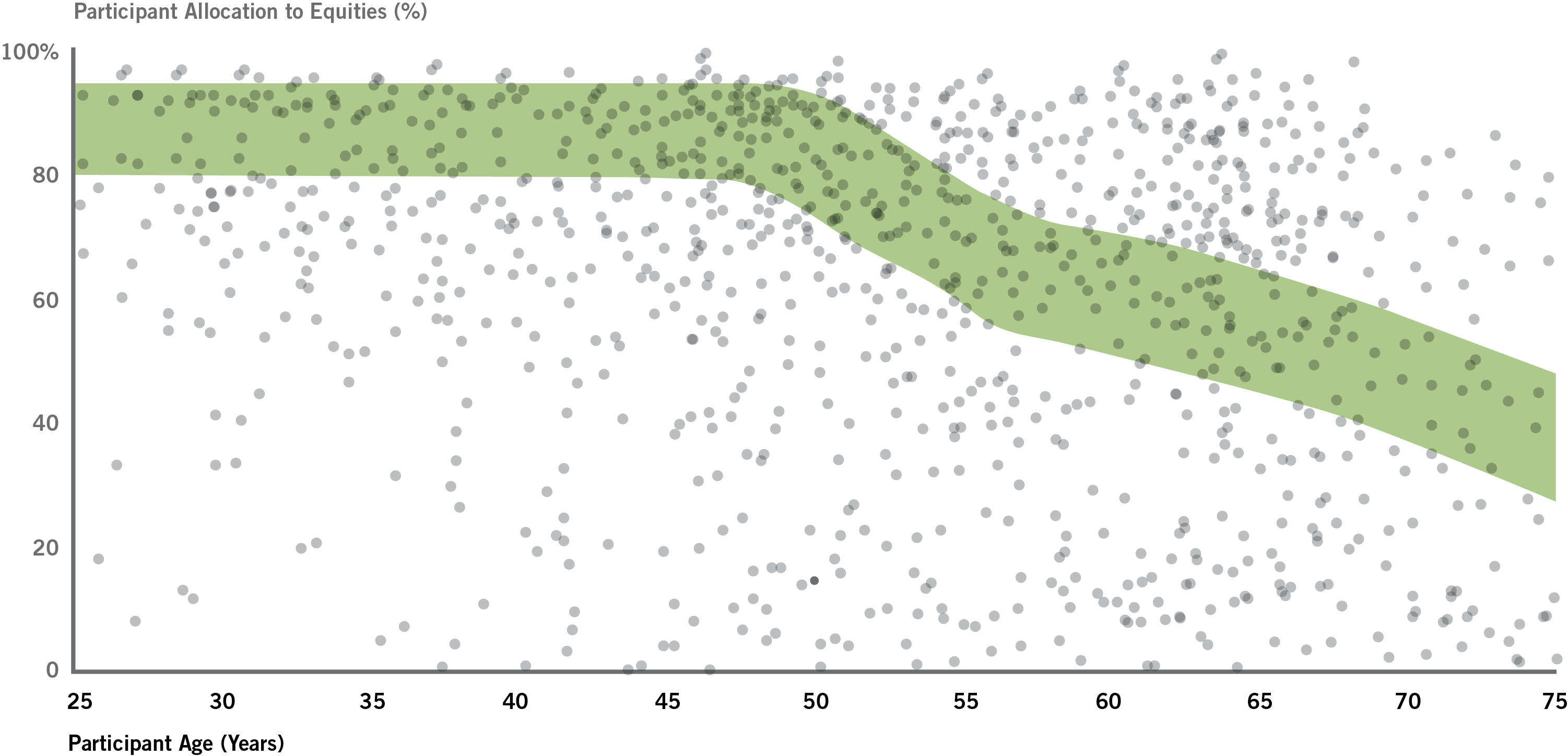

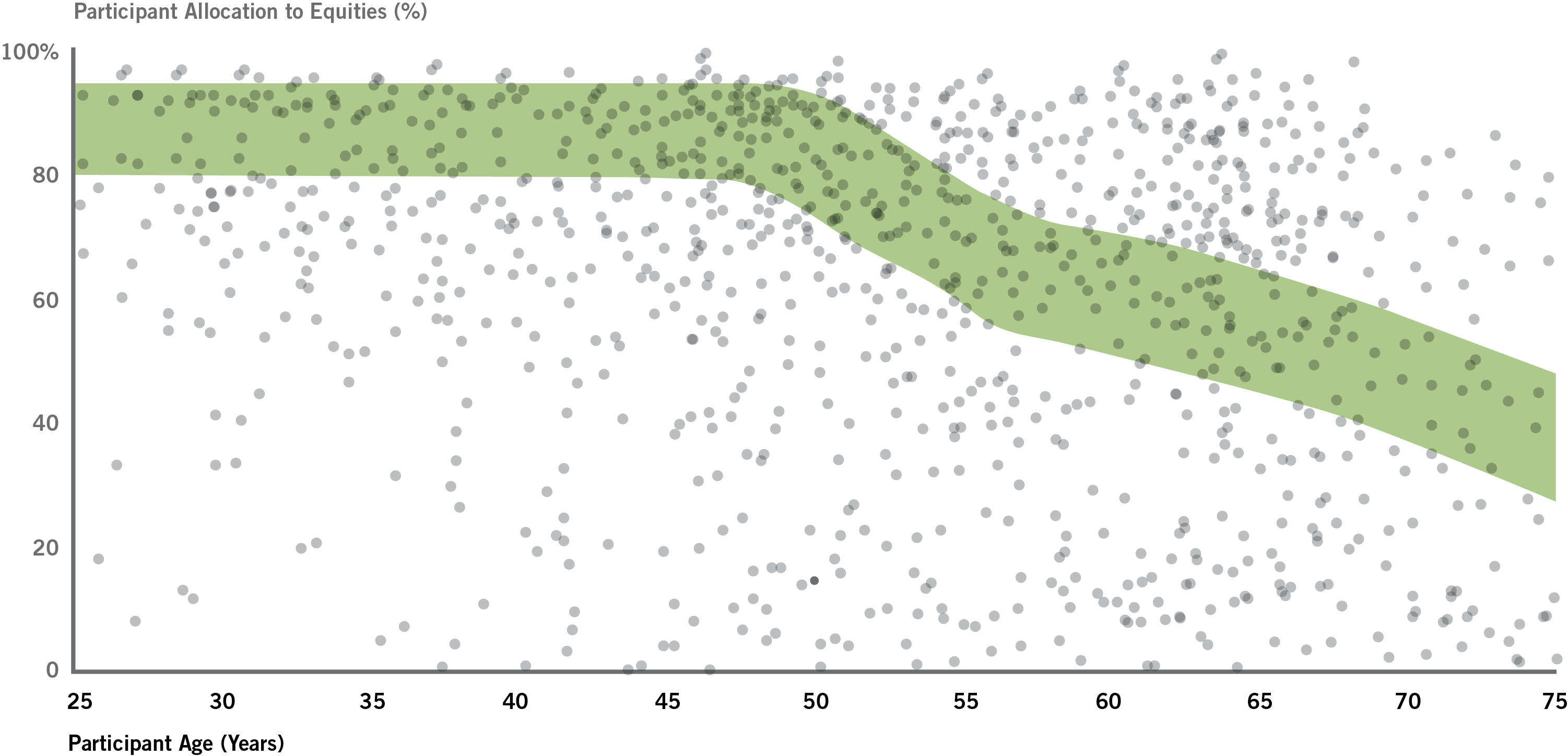

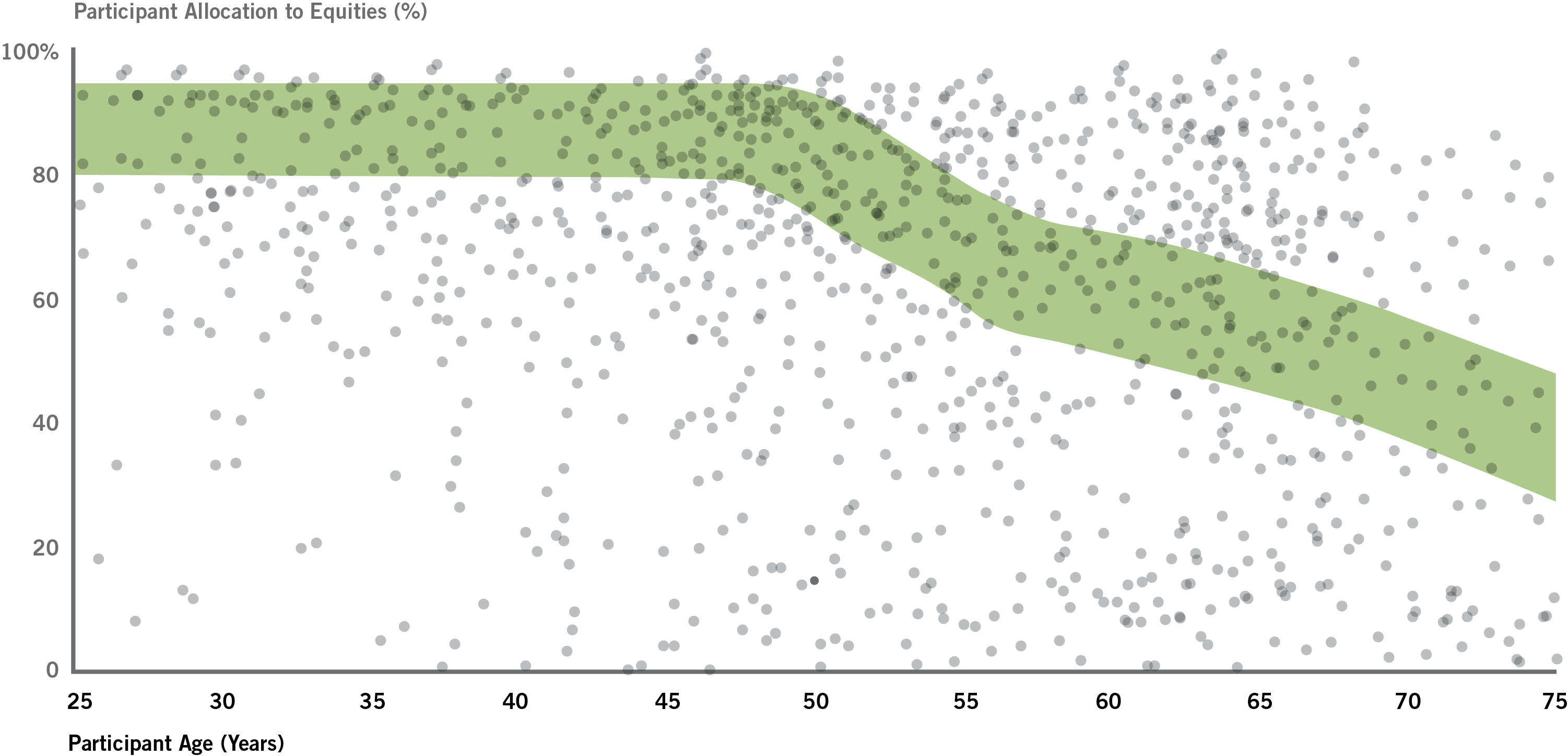

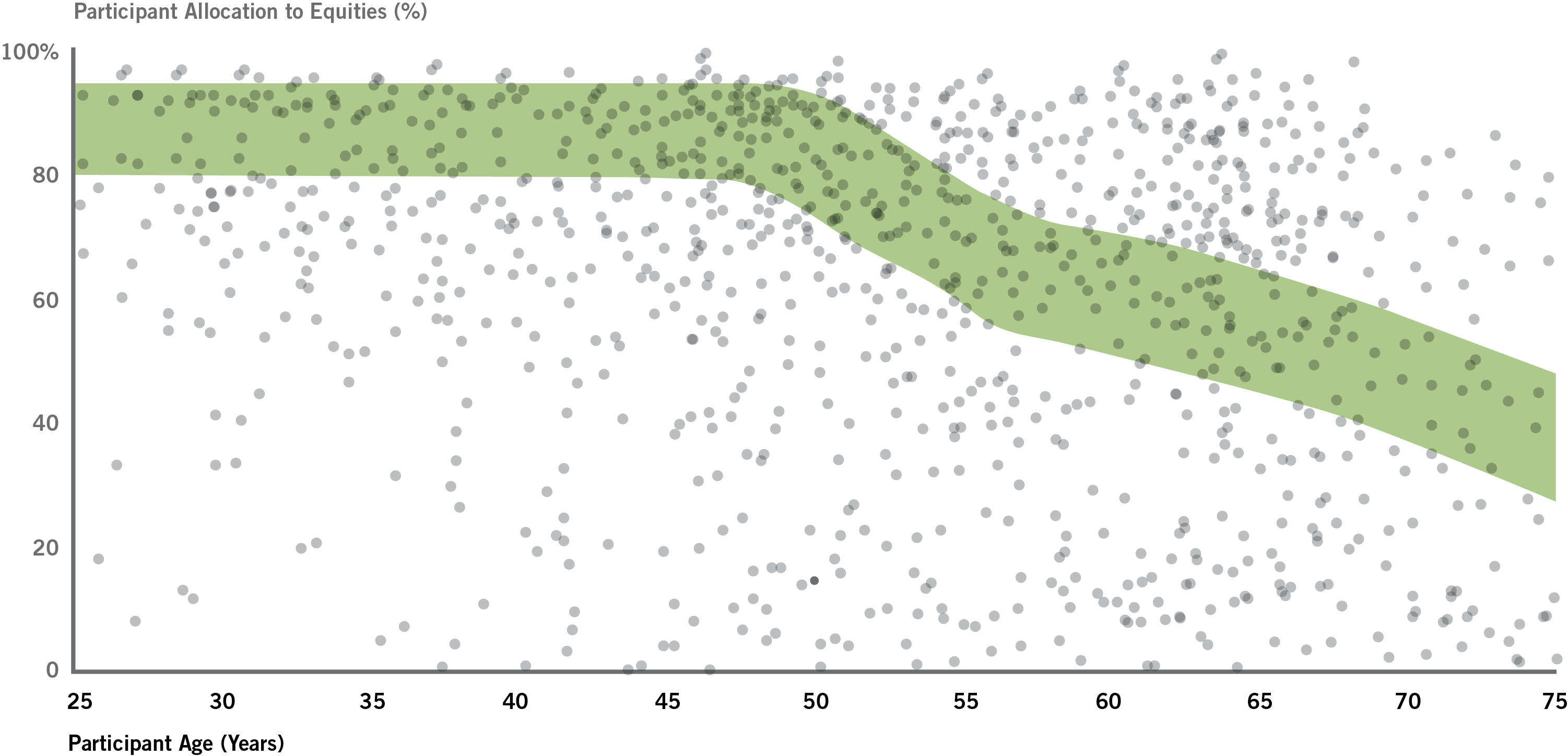

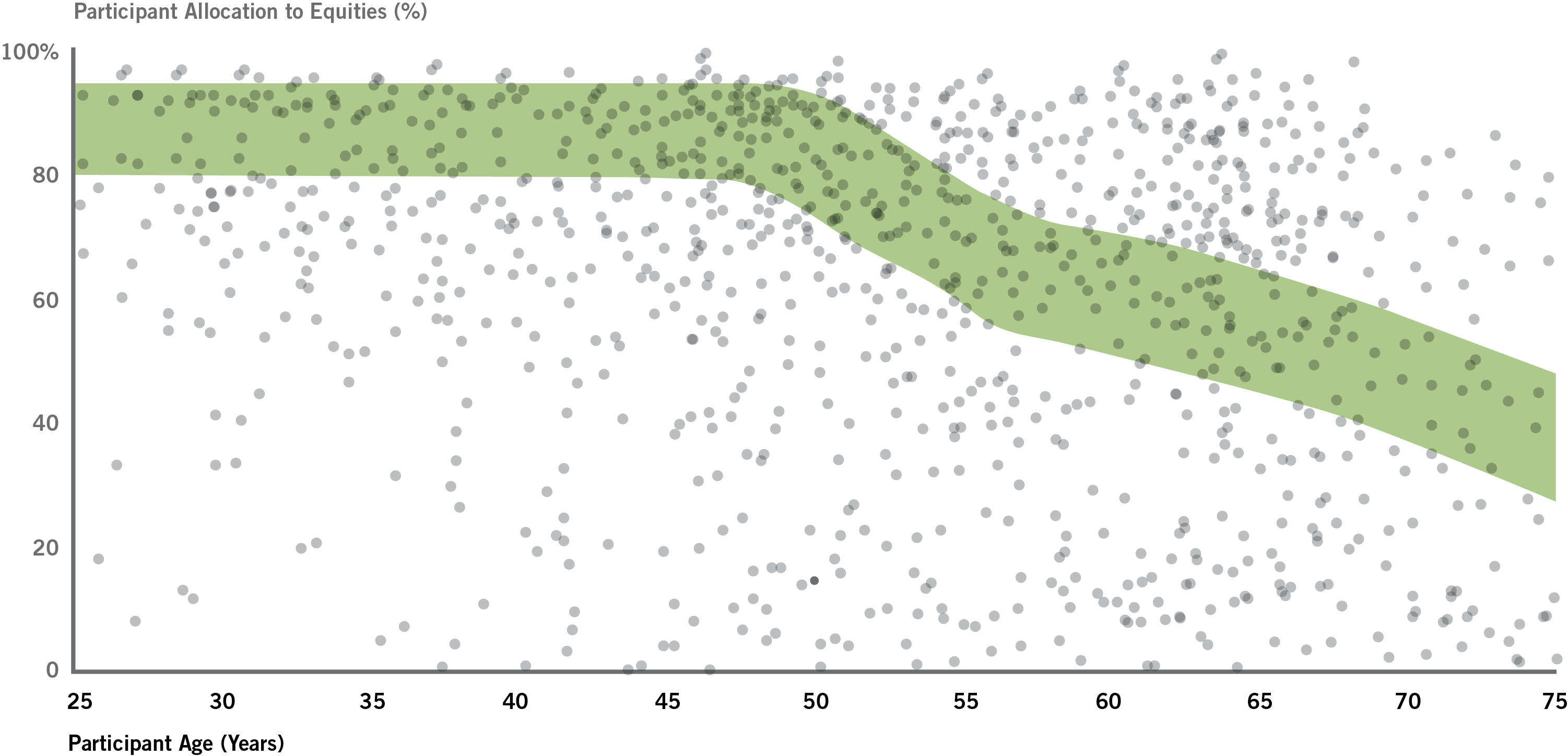

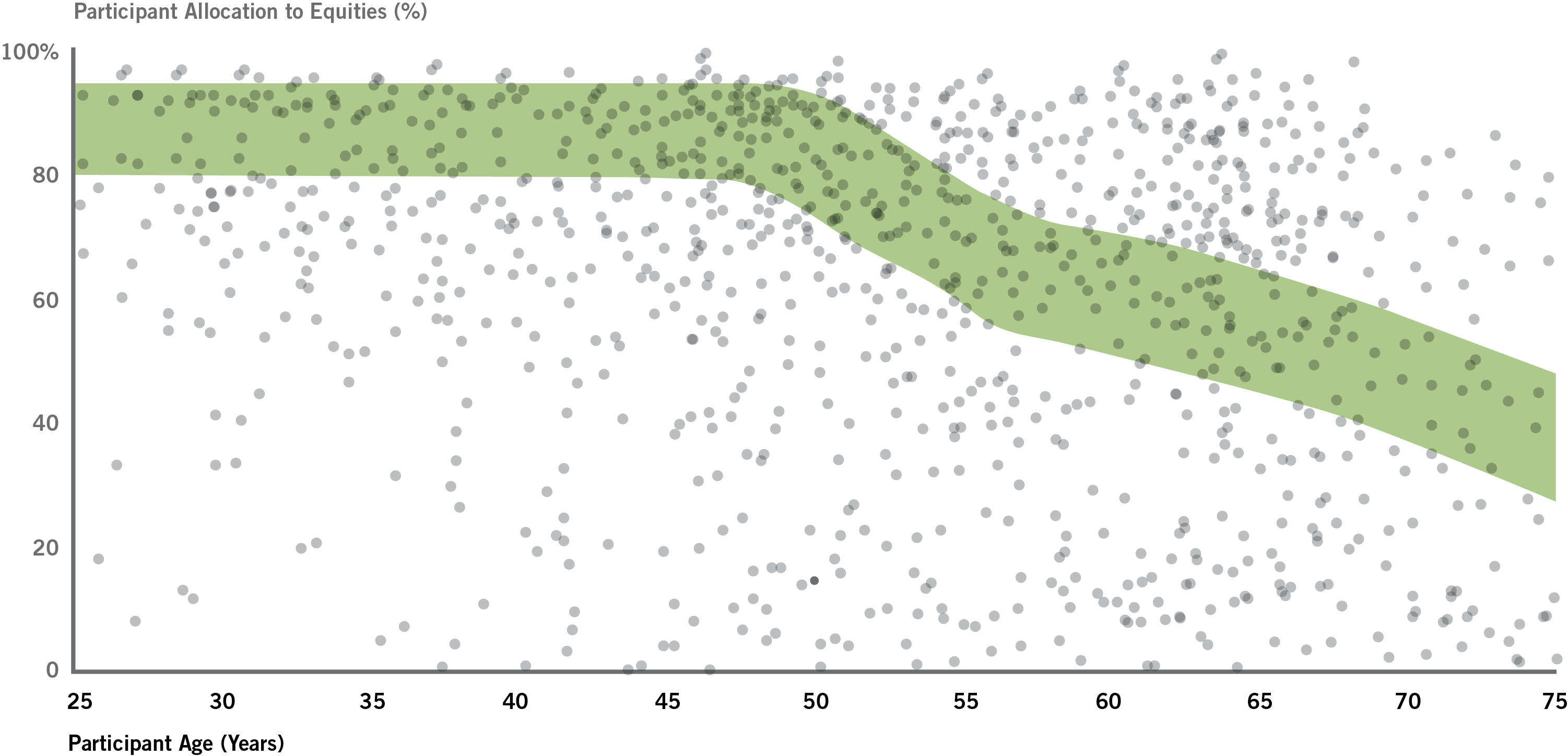

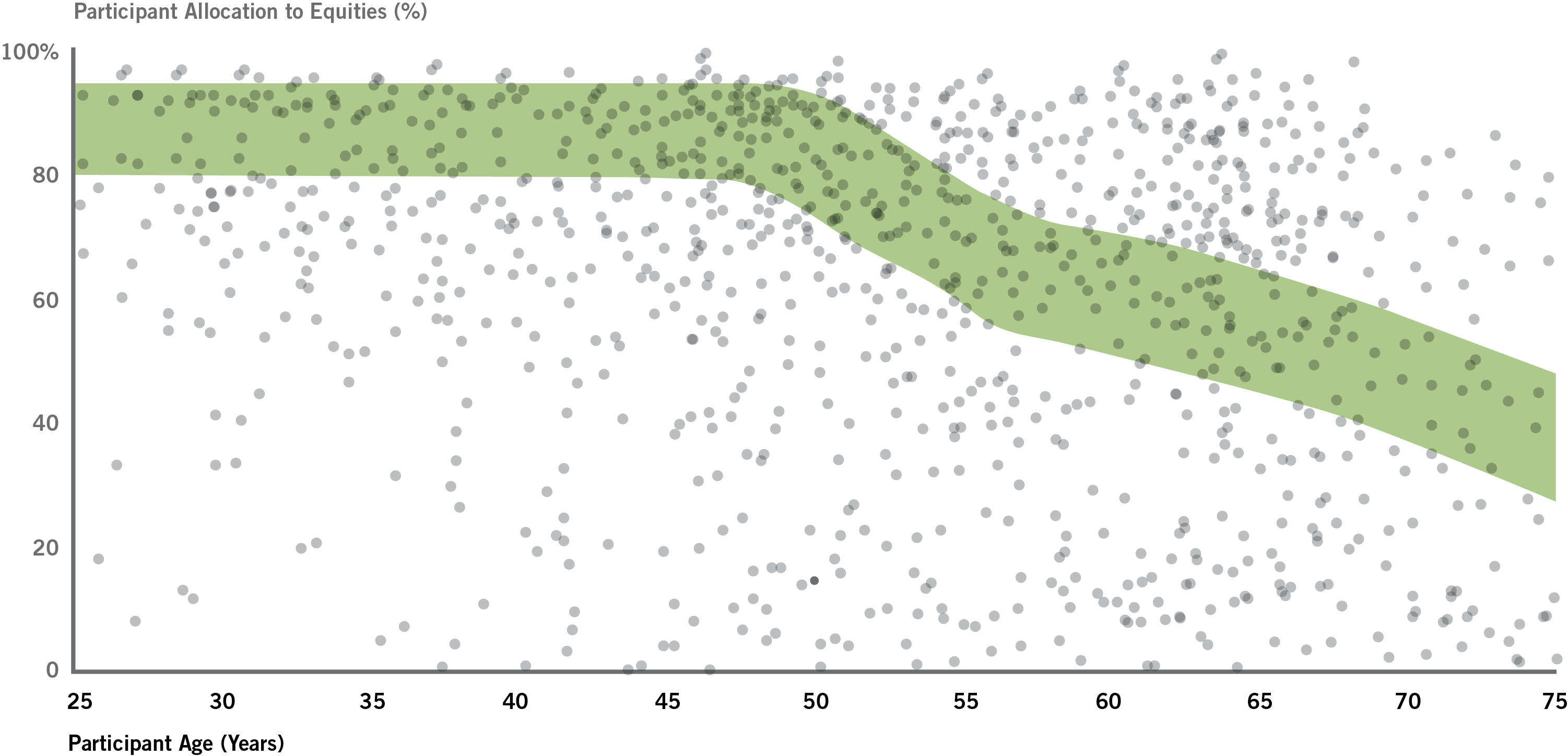

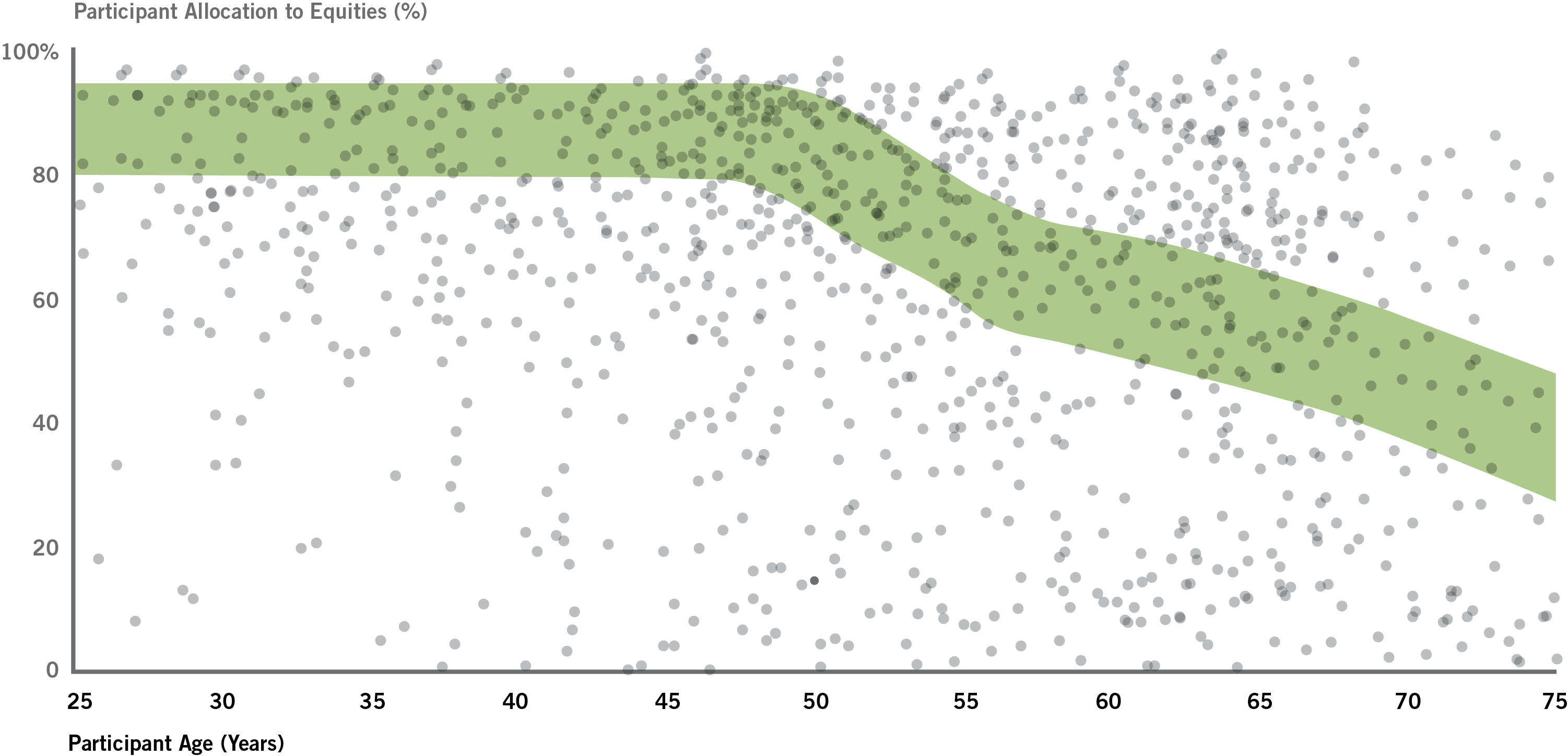

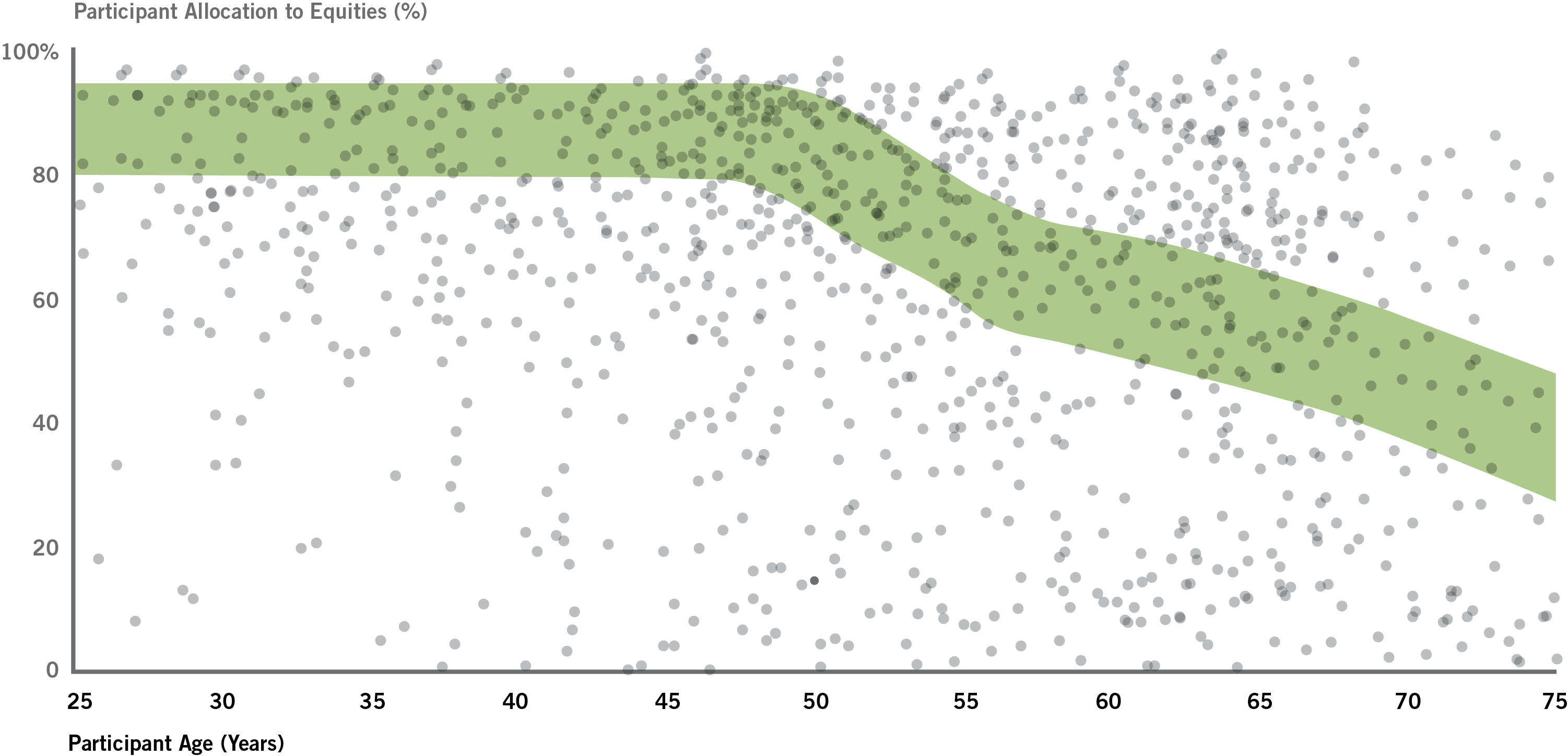

*Investors should allocate assets based on individual risk tolerance, investment time horizon, and personal financial situation. A particular asset allocation may be achieved by using different allocations in different accounts or by using the same one across multiple accounts. The equity roll down shown is not intended as a benchmark for individual investors; rather, it is a range of equity allocations that may be appropriate for many investors saving for retirement. Green Band shows +/- 10 Percentage points of the Fidelity Equity Band. “Equities” are defined as domestic equity, international equity, company stock, and the equity portion of blended investment options.

Past performance is no guarantee of future results.

Diversification and/or asset allocation do not ensure a profit or protect against loss.

For investment professional use only. Not for distribution to the public as sales material in any form. Fidelity Investments & Pyramid Design logo are registered service marks of FMR LLC

Fidelity Clearing & Custody Solutions provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.

For retirement intermediary, institutional or investment professional use only.

Strategic Advisers, Inc. is a subsidiary of FMR LLC

© 2017 FMR LLC. All rights reserved.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Fidelity Institutional Services Company, Inc. 500 Salem Street, Smithfield, RI 02917

748134.3.0

x

Cancel

OK

You are now leaving Fidelity.com for a web site that is unaffiliated with Fidelity. Fidelity has

not been involved in the preparation of the content supplied at the unaffiliated site and does not guarantee or assume any responsibility

for its content.

+

TAP OR CLICK TO LEARN how Fidelity’s Workplace Managed Account service takes into account a participant's personal situation, to place them in a portfolio to help meet their financial goals.

* Source: Based on Fidelity Investments data of nearly 21,600 corporate defined contribution (DC) plans and 13.5 million participants, on Fidelity's recordkeeping platform, as of December 2015. Excludes NonQual plans, TEM Pooled plans, DB cash balance plans, plans with 0 participants, and FMR Co. plans. 11.8 is the average number of investments held by PAS-W participants, as opposed to 4.5 for Do-it-yourself participants who were not enrolled in a Managed Account service and did not have 100% of their account balances in a target date or Managed Account product for this time period.

** Do-it-yourself participants are defined as not having 100% of their account balances in a target date or not enrolled in a Managed Account service for this time period.

Fidelity® Portfolio Advisory Service at Work is a service of Strategic Advisers, Inc., a registered investment adviser and a Fidelity Investments company. This service provides discretionary money management for a fee.

For investment professional use only.

Tap or click here for important information

The average number of options held by participants in Fidelity’s Workplace Managed Account vs. 5* for ‘do-it-yourself’ investors**

12

Percentage of participants who maintained a Portfolio Advisory Service at Work account on Fidelity's recordkeeping platform, measured from

January 1, 2010 to February 28, 2015.

Fidelity® Portfolio Advisory Service at Work is a service of Strategic Advisers, Inc., a registered investment adviser and a Fidelity Investments company. This service provides discretionary money management for a fee.

For investment professional use only.

Tap or click here for important information

Retention rate among participants

who join our managed account service

97%

33%

Investing involves risk, including risk of loss

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Fidelity Institutional Services Company, Inc. 500 Salem Street, Smithfield, RI 02917

For investment professional use only.

Tap or click here for important information

Source: Data includes proprietary managed accounts only. Data is based on Fidelity Investments record kept data, including both defined contribution (DC) and tax‐exempt (TEM) clients and plans, as of 12/31/2016. *Do-it-Yourself investors are defined as participants that are not receiving professional management by being 100% invested in a Target Date Fund or enrolled in a workplace managed account. Unengaged refers to participants who have not made a fund exchange, updated how their savings are invested, or engaged online or with a phone representative in at least two years.

Fidelity® Portfolio Advisory Service at Work is a service of Strategic Advisers, Inc., a registered investment adviser and a Fidelity Investments company. This service provides discretionary money management for a fee.

Of do-it-yourself investors* haven’t engaged or made any changes to their investments in over two years.

This communication is provided for informational and educational purposes only. Unless otherwise disclosed to you, in providing this information, Fidelity is not undertaking to provide impartial investment advice, or to give advice in a fiduciary capacity, in connection with any investment or transaction described herein. Fiduciaries are solely responsible for exercising independent judgment in evaluating any transaction(s) and are assumed to be capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies. Fidelity has a financial interest in any transaction(s) that fiduciaries, and if applicable, their clients, may enter into involving Fidelity’s products or services.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Investments in mutual funds will continue to be subject to each fund's underlying fees and expenses. See a fund's prospectus for information on fund fees and expenses.

Fidelity® Portfolio Advisory Service at Work is a service of Strategic Advisers, Inc., a registered investment adviser and a Fidelity Investments company.

This service provides discretionary money management for a fee.

*Investors should allocate assets based on individual risk tolerance, investment time horizon, and personal financial situation. A particular asset allocation may be achieved by using different allocations in different accounts or by using the same one across multiple accounts. The equity roll down shown is not intended as a benchmark for individual investors; rather, it is a range of equity allocations that may be appropriate for many investors saving for retirement. Green Band shows +/- 10 Percentage points of the Fidelity Equity Band. “Equities” are defined as domestic equity, international equity, company stock, and the equity portion of blended investment options.

Past performance is no guarantee of future results.

Diversification and/or asset allocation do not ensure a profit or protect against loss.

For investment professional use only. Not for distribution to the public as sales material in any form. Fidelity Investments & Pyramid Design logo are registered service marks of FMR LLC

Fidelity Clearing & Custody Solutions provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.

For retirement intermediary, institutional or investment professional use only.

Strategic Advisers, Inc. is a subsidiary of FMR LLC

© 2017 FMR LLC. All rights reserved.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

748134.3.0

x

x

Tap or click the X to close

••••••••

• 65 years old

• Established in her career and thinking

about retiring

• Contributing 12% to retirement plan

• Not married, no outside assets, and does

not have a pension

• High tolerance for risk

Based on Jill’s personal situation and short investment time horizon, we propose a growth portfolio with a lower equity allocation of 74%, despite her high tolerance for risk.

Short-Term Securities

Fixed Income

International Equity

U.S. Equity

Participant Allocation to Equities (%)*

Today Jill is

in a portfolio

with an equity allocation of 100%.

+

Tap or click here to see how Jill

may benefit from

a workplace managed account.

MEET

JILL

x

••••••••

Tap or click the X to close

• 55 years old

• Established in her career

• Contributing 12% to retirement plan

• Not married, no outside assets, and does

not have a pension

• Low tolerance for risk

Based on Alice’s personal situation, limited investment time horizon, and low tolerance for risk, we propose a balanced portfolio with a lower equity allocation of 55%.

Short-Term Securities

Fixed Income

International Equity

U.S. Equity

Today Alice is

in a portfolio

with an equity allocation of 80%.

+

Tap or click here to see how Alice may benefit

from a workplace managed account.

MEET

ALICE

x

Tap or click the X to close

••••••••

• 45 years old

• Established in his career

• Contributing 8% to retirement plan

• Married with spousal assets

• Has an IRA and some outside assets

• Neutral tolerance for risk

Based on Hugo’s personal situation and neutral tolerance for risk, we propose a growth portfolio with a lower equity allocation of 57%.

Short-Term Securities

Fixed Income

International Equity

U.S. Equity

Today Hugo is

in a portfolio

with an equity allocation of 90%.

+

Tap or click here to see how Hugo may benefit

from a workplace managed account.

MEET

HUGO

x

Tap or click the X to close

••••••••

• 45 years old

• Established in his career

• Contributing 8% to retirement plan

• Not married, no outside assets, and does

not have a pension

• Low tolerance for risk

Based on Ted’s personal situation and investment time horizon, we propose a balanced portfolio with a slightly higher equity allocation of 55%, despite his low tolerance for risk.

Short-Term Securities

Fixed Income

International Equity

U.S. Equity

Today Ted is

in a portfolio

with an equity allocation of 45%.

+

Tap or click here to see how Ted may benefit

from a workplace managed account.

MEET

TED

••••••••

Participant Age (Years)

••••••••

Tap or click the X to close

• 35 years old

• Established in her career

• Contributing 4% to retirement plan

• Married with spousal assets

• Some outside assets

• High tolerance for risk

Based on Lydia’s personal situation, long time horizon, and high tolerance for risk, we propose an aggressive growth portfolio with a higher equity allocation of 67%.

x

Short-Term Securities

Fixed Income

International Equity

U.S. Equity

Today Lydia is

in a portfolio

with an equity allocation of 55%.

+

Tap or click here to see how Lydia may benefit

from a workplace managed account.

Tap or click here to see how Lydia may benefit from a managed account.

MEET LYDIA

x

••••••••

Tap or click the X to close

Short-Term Securities

Fixed Income

International Equity

U.S. Equity

• 35 years old

• Newly established in her career

• Contributing 4% to retirement plan

• Married with some outside spousal assets

• Neutral tolerance for risk

Based on Grace’s personal situation and neutral tolerance for risk, we propose a growth portfolio with a lower equity allocation of 76%.

+

Tap or click here to see how Grace may benefit

from a workplace managed account.

Today Grace is

in a portfolio

with an equity allocation of 92%.

MEET GRACE

The Power of a Fidelity Workplace Managed Account

TAP OR CLICK ANY BLINKING CIRCLE ( ) to see a participants financial situation and how a Fidelity Workplace Managed Account

may help.

For additional information on Fidelity Portfolio Advisory Service at Work, contact your Fidelity representative.

For illustrative purposes only.

Fidelity® Portfolio Advisory Service at Work is a service of Strategic Advisers, Inc., a registered investment adviser and a Fidelity Investments company.

Investors should allocate assets based on individual risk tolerance, investmenttime horizon, and personal financial situation. A particular asset allocation may beachieved by using different allocations in different accounts or by using the sameone across multiple accounts. The equity roll down shown is not intended as abenchmark for individual investors; rather, it is a range of equity allocations thatmay be appropriate for many investors saving for retirement.

Tap or click here for important information