Considering Bitcoin for an Institutional Portfolio

Download white paper

CRYPTOCURRENCY INVESTING

Examining the role of bitcoin

Even for the most hardened skeptics, the time has come to seriously examine what role bitcoin might play in an institutional multi-asset portfolio, particularly in an era of rising geopolitical and inflation risks.

Despite robust valuations and the conviction of ardent crypto enthusiasts, direct investment in bitcoin or other cryptocurrencies currently offers little benefit to institutional investors – as well as considerable volatility and regulatory risk.

2,000,000

A single BTC transaction has a carbon footprint (1,180 kg CO2) equivalent to two million Visa transactions.

“

Bitcoin’s correlation with equities and commodities has been unstable and trending higher since 2020.”

The crypto ecosystem

At the 2022 Milken Institute Global Conference David Hunt, CEO and President of PGIM discusses that most cryptocurrencies are currently 0 for 3 when it comes to PGIM’s criteria for a fiduciary investment – consistent regulatory oversight, a store of value beyond what someone else will pay for it, and an understanding of the correlation with other asset classes. While we believe direct ownership is purely speculative, there is an emerging constellation of compelling investment opportunities in the broader ecosystem around cryptocurrencies.

Source: PGIM Thematic Research.

+ Click to enlarge

EXPLORE

Bitcoin: Not quite a currency

OPPORTUNITIES IN the

CRYPTO ECOSYSTEM

Download white paper

portfolio diversifier

A hedge against inflation

Risk-adjusted Returns

Safe-Haven Asset

portfolio diversifier

A hedge against inflation

Risk-adjusted Returns

Safe-Haven Asset

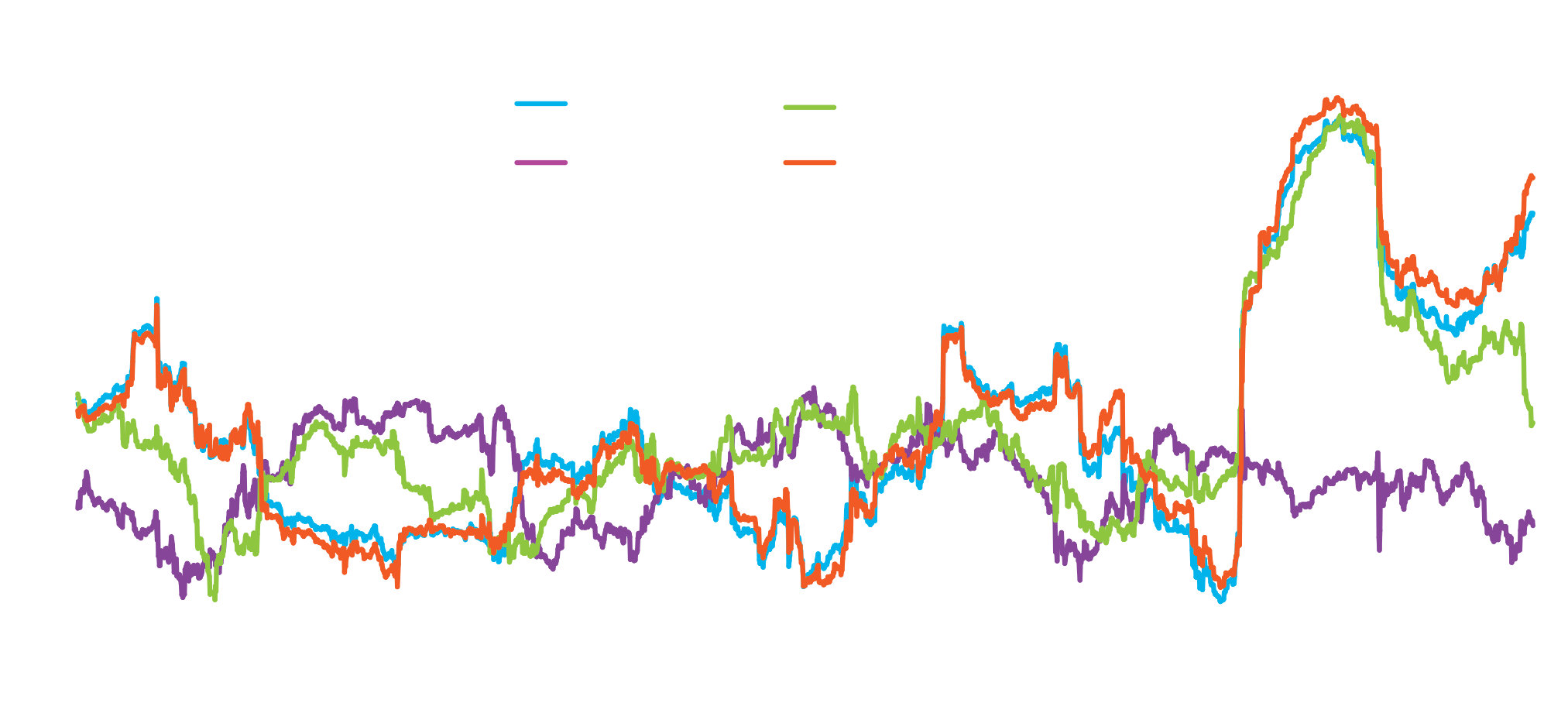

Bitcoin has not offered steady portfolio diversification. Between 2013 and 2019, it had a near-zero average correlation with broad U.S. equities and commodities. Starting in 2020, its correlation with U.S. equities and commodities spiked sharply and has remained consistently positive since.

Bitcoin has not been an effective inflation hedge. During the inflationary period that began in 2021, the price of bitcoin moved with inflation only for a brief time before falling sharply. Gold, on the other hand, has demonstrated that it can be a reasonably effective and reliable long-term inflation hedge since the 1970s.*

Bitcoin had an extraordinary risk-return profile early on. However, it has not retained this superior performance. Since 2018, its Sharpe ratio has been similar to other assets.

The true test for a safe-haven asset is how it retains its value during a period of extreme and widespread market volatility. Bitcoin was not exactly a steady force in early 2020 when global asset prices spiraled downward due to worldwide COVID-induced shutdowns.

Do Cryptocurrencies Meet Institutional Investors Objectives?

Considering Bitcoin for an Institutional Portfolio

CRYPTOCURRENCY INVESTING

*CoinMarketCap, as of May 9, 2022. < www.coinmarketcap.com >

UNDERSTANDING THE CRYPTO CURRENCY ECOSYSTEM

ESG alignment

Bitcoin Correlation with Various Assets (Rolling 1-year)

Source: PGIM analysis; Refinitiv and Bloomberg.

Note: The Bloomberg Commodity Index and Bloomberg Aggregate Bond Index were used for Commodity and Bonds respectively.

ESG alignment

*Parikh, Harsh, “Institutional Gold!” PGIM Institutional Advisory & Solutions, November 2019. < https://www.pgim.com/white-paper/institutional-gold >

U.S. Inflation vs. Bitcoin Price

Source: Bloomberg and Federal Reserve Economic Data.

*Parikh, Harsh, “Institutional Gold!” PGIM Institutional Advisory & Solutions, November 2019. < https://www.pgim.com/white-paper/institutional-gold >

Sharpe Ratios of Select Asset Classes

Source: PGIM Thematic Research; Refinitiv and Bloomberg.

Note: The MSCI World Index, Bloomberg Aggregate Bond Index, Bloomberg Inflation-Linked Bond Index, U.S. Dollar Index, MSCI Emerging Markets Index, London Bullion Market Association Gold Price, and Bloomberg Commodity Index were used for Global Equities, Bond Index, TIPS, USD, EM Equities, Gold, and Commodities respectively.

COVID Market Drawdown

Source: Refinitiv and Bloomberg.

Note: The MSCI World Index, London Bullion Market Association Gold Price, and Bloomberg Treasury Index were used for Global Equities, Gold and Treasuries respectively.

Environmentally, the most worrying aspect of cryptocurrency is its massive energy consumption. Major blockchains – including bitcoin and the original Ethereum – currently utilize a proof-of-work mechanism to validate transactions that is extremely energy intensive.

Annualized Bitcoin Power Usage and Carbon Footprint

Source: “Bitcoin Energy Consumption Index,” Digiconomist, March 2022.

Annualized Bitcoin Footprints

Single Bitcoin Transaction

Czech Republic

2 Million

73 Days

Thailand

The annual carbon footprint of BTC (114 Mt CO2) is comparable to the annual carbon emissions of the Czech Republic.

A single BTC transaction has a carbon footprint (1,180 kg CO2) equivalent to two million Visa transactions.

BTC uses as much electricity annually (204 TWh) as the entire nation of Thailand.

A single BTC transaction

consumes sufficient electrical power (2,200 kWh) to power an average U.S. household for 73 days.

Electrical Energy

Carbon Footprint

Environmentally, the most worrying aspect of cryptocurrency is its massive energy consumption. Major blockchains – including bitcoin and the original Ethereum – currently utilize a proof-of-work mechanism to validate transactions that is extremely energy intensive. From a governance perspective, the anonymity and difficulty in identifying cryptocurrency ownership raises significant concerns around anti-money laundering and sanction evasion.

portfolio diversifier

A hedge against inflation

Risk-adjusted Returns

Safe-Haven Asset

ESG alignment

Annualized Bitcoin Footprints

Single Bitcoin Transaction

David Hunt on investing in cryptocurrencies at Milken

This material is for informational and educational purposes only and should not be construed as investment advice or a recommendation. Investing involves risk, including possible loss of principal.

This material is for informational and educational purposes only and should not be construed as investment advice or a recommendation. Investing involves risk, including possible loss of principal.

ENGLISH

ENGLISH

GERMAN

GERMAN

JAPANESE

JAPANESE

Simplified Chinese

Simplified Chinese

ITALIAN

ITALIAN

Traditional Chinese

Traditional Chinese

ENGLISH

ENGLISH

GERMAN

GERMAN

JAPANESE

JAPANESE

CHINESE

CHINESE

ITALIAN

ITALIAN

Download white paper

Download executive summary

ENGLISH

GERMAN

JAPANESE

Simplified Chinese

ITALIAN

Traditional Chinese

Download white paper