The LODI Advantage

AAM SLC Low Duration Income ETF (LODI) is an actively managed fixed income ETF sub-advised by Sun Life Capital Management U.S. LLC, an SLC Management company.��SLC Management has decades of experience managing U.S. Fixed Income portfolios across the curve and quality spectrum. Their rigorous investment process aims to generate outperformance over time in an effort to help investors achieve their long-term objectives.

LODI seeks to add value through its issue selection and sector rotation process while being interest rate neutral to the benchmark.

LODI seeks to outperform the Bloomberg 1-3 Yr Gov/

Credit Index on a total return basis.

LODI seeks to provide a higher level of income versus the

Bloomberg 1-3 Yr Gov/Credit Index.

Learn more about the LODI difference

Meet SLC Management

Meet the LODI Portfolio Management Team

For more information on AAM SLC Low Duration Income ETF, please contact your Financial Professional or complete the form below and we'll be in touch shortly.

This form is for use by financial professionals only who reside in the U.S. We're unable to act on any requests to buy, sell or exchanges securities included in the submission of this form. AAM will never share your contact information outside of AAM. By completing this form, you're agreeing to be contacted via email.

LODI Fact Card

Spotlight Flyer

View Disclosures

The investment objectives, risks, charges and expenses must be considered carefully before investing. The fund’s statutory and summary prospectus contains this and other important information about the investment company, and may be obtained by calling 800.617.0004 or visiting www.aamlive.com.

Read it carefully before investing.

18925 Base Camp Road • Monument, CO 80132 • www.aamlive.com | CRN: 2025-0221-12347 R

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV) and may trade at a discount or premium to NAV. Shares are not individually redeemable from the Fund and may only be acquired or redeemed from the fund in creation units. Brokerage commissions will reduce returns. Diversification does not assure a profit or protect against a loss in a declining market.��Past performance does not guarantee future results.��Principal Risks: Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Mortgage-backed/Asset-backed Securities are subject to higher interest rate and prepayment risk; the value of these investments may be reduced or become worthless if they are “subordinated” and receive interest or income payments only after other interests in the same mortgage or asset pool are satisfied. Active trading may increase the Fund’s transaction costs, affect performance, and increase your taxable distributions. CLOs are securities backed by an underlying portfolio of loan obligations. CLOs issue classes or “tranches” that vary in risk and yield and may experience substantial losses due to actual defaults, decrease of market value due to collateral defaults and removal of subordinate tranches, market anticipation of defaults and investor aversion to CLO securities as a class. High-yield securities (also known as “junk bonds”) carry a greater degree of risk and are considered speculative by the major credit rating agencies. Privately Issued Securities Risk: The Fund may invest in privately issued securities issued under Rule 144A or Regulation S under the Securities Act of 1933, as amended. Sales of privately issued securities are subject to numerous restrictions including, but not limited to, that sales of privately issued securities may typically be made only to qualified institutional buyers, in privately negotiated transactions, to a limited number of purchasers, or in limited quantities after being held for a specific period of time. New Fund Risk: The Fund is a recently organized investment company with no operating history. As a result, prospective investors have no track record or history on which to base their investment decision. Management Risk: The Fund is actively managed and may not meet its investment objective based on the Adviser’s success or failure to implement investment strategies for the Fund.��Definitions: Effective Duration is the duration for a bond with an embedded option when the value is calculated to include the expected change in cash flow caused by changes in market interest rates. Bloomberg 1-3 Year Government/Credit Index is an unmanaged index comprised of the US Government/Credit component of the US Aggregate Index. Bloomberg 1-5 Yr Government/Credit Index tracks USD-denominated, investment grade, fixed-rate bonds, including treasuries, government-related and corporate issues, with at least one, and up to, but not including, five years until final maturity. Bloomberg 5-10 Yr Gov/Credit Index measures investment grade, US dollar-denominated, fixed-rate nominal Treasuries, government-related and corporate securities with 5-10 year maturities. Bloomberg Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market. It is not possible to invest directly in an index. Indices do not include cash. Volatility is a measure of the variation in the price of an asset over time.

Not FDIC Insured • No Bank Guarantee • May Lose Value

©2025 Advisors Asset Management. Advisors Asset Management, Inc. (AAM) is an SEC-registered investment advisor and member FINRA/SIPC. AAM ETFs are distributed by Quasar Distributors, LLC. Quasar and AAM are not affiliated.

Disclosures

Close

AAM SLC Low Duration Income ETF (LODI) is an actively managed fixed income ETF sub-advised by SLC Management. SLC Management is a global asset manager offering institutional investors traditional, alternative, and yield-oriented investment solutions across public and private fixed income markets.

SLC Management has decades of experience managing U.S. Fixed Income portfolios across the curve and quality spectrum. Their rigorous investment process aims to generate outperformance over time to reach its objectives.

$286B+

SLC Management assets under management

Experience On Your Side

LODI seeks to add value through its 100% bottom-up issue selection process and tactical sector rotation. The underlying investment strategy of LODI has been managed by SLC Management for their institutional clients since 2015. SLC Management believes absolute return can occur through income generation and the more esoteric and less efficient nature of the securitized market provides a higher potential of deep value opportunities.

corporate issuer selection

770+

investment professionals

1400+

clients served

150 years

experience managing assets

Top 100

Data as of 12/31/2024.

Relative value and technical analysis:

Comparison to other investments currently available. Considers supply, demand, market factors, equity, and spreads.

Fundamental analysis

Positions in smaller deal sizes/issuers

securitized issuer selection

Securitized fundamental credit trends

analysis of:

Commercial real estate (CMBS), residential real estate (RMBS), consumer credit (ABS) bank loans (CLO)

Structural features such as overcollateralization and prepayment protections reduce convexity risk and improve structural protection

Credit upgrades play a strong role in driving returns

Reasons to Consider a LODI Allocation

LODI’s managers are part of a globally recognized institutional asset manager and have decades of experience managing U.S.-based fixed income portfolios. The same portfolio management team has been working together for 10+ years employing their repeatable investment process while delivering consistent results for their large institutional clients.

Institutional Caliber, Active Management

1

SLC Management Investment Process

Being benchmark agnostic, LODI has a wider pool of eligible fixed income asset classes relative to the Bloomberg 1-3 Yr Gov/ Credit Index. LODI tactically manages sector exposures based on market conditions and manager convictions.

Multi-Sector, Benchmark Agnostic Approach

The portfolio is constructed with high quality investment-grade securities in an effort to reduce credit risk and issuer defaults, provide credit diversification and an avenue for yield enhancement and greater downside protection.

High Quality Issuers

Portfolio Goals

Yield Enhancement & Ability to Keep Up with Inflation

OBJECTIVE:

LODI strategically incorporates allocations to securitized investments in an effort to increase inflation-adjusted returns.

Potential Benefits:

Securitized assets have historically provided meaningful yield relative to 2-year U.S. treasuries. See graph to the right.

LODI may provide increased diversification by investing in a wider pool of eligible fixed income sectors relative to its benchmark.

The strategy can be ideal for investors looking to preserve capital while minimizing volatility.

Reduce Volatility & Enhance Income of Core Fixed Income

Portfolio Goals

OBJECTIVE:

LODI seeks to be duration neutral relative to the Bloomberg 1-3 Yr Gov/Credit Index

Potential Benefits:

Idea Generation

& Security Selection

Portfolio Construction

& Risk Management

Daily

Monitoring

Risk-Controlled

Active Portfolio

Team determines security selection, sector and sub-sector allocations.

Market Data

Technical, fundamental and quantitative analysis

Global Resources

Credit and structured credit research team

Derivatives

Team determines security selection, sector and sub-sector allocations.

Daily attribution analysis utilized to confirm portfolio positioning relative to benchmark. Check assumptions and assess risk levels.

Team seeks to generate consistent alpha generation across different market environments.

Click on each stage to learn more

LODI Sector Allocations (%), as of 9/30/2025

LODI Credit Rating Allocations (%),

as of 9/30/2025

Securitized assets have typically provided meangingful yield pick-up relative to 2-year U.S. treasuries (bps)

Source: ICE Data Indices, LLC, FRED, measured from 3/31/2015 to 6/30/2025

0-3 Yrs U.S. MBS

Past performance does not guarantee future results

0-3 Yrs U.S. ABS

0-3 Yrs U.S. CMBS

1-3 Yr U.S. Gov/Credit

Potential to lower portfolio volatility through duration reduction.

Opportunity to potentially enhance income and total return with a modest increase in duration and credit risk.

Can be ideal for investors seeking to redirect their cash into higher yielding investments.

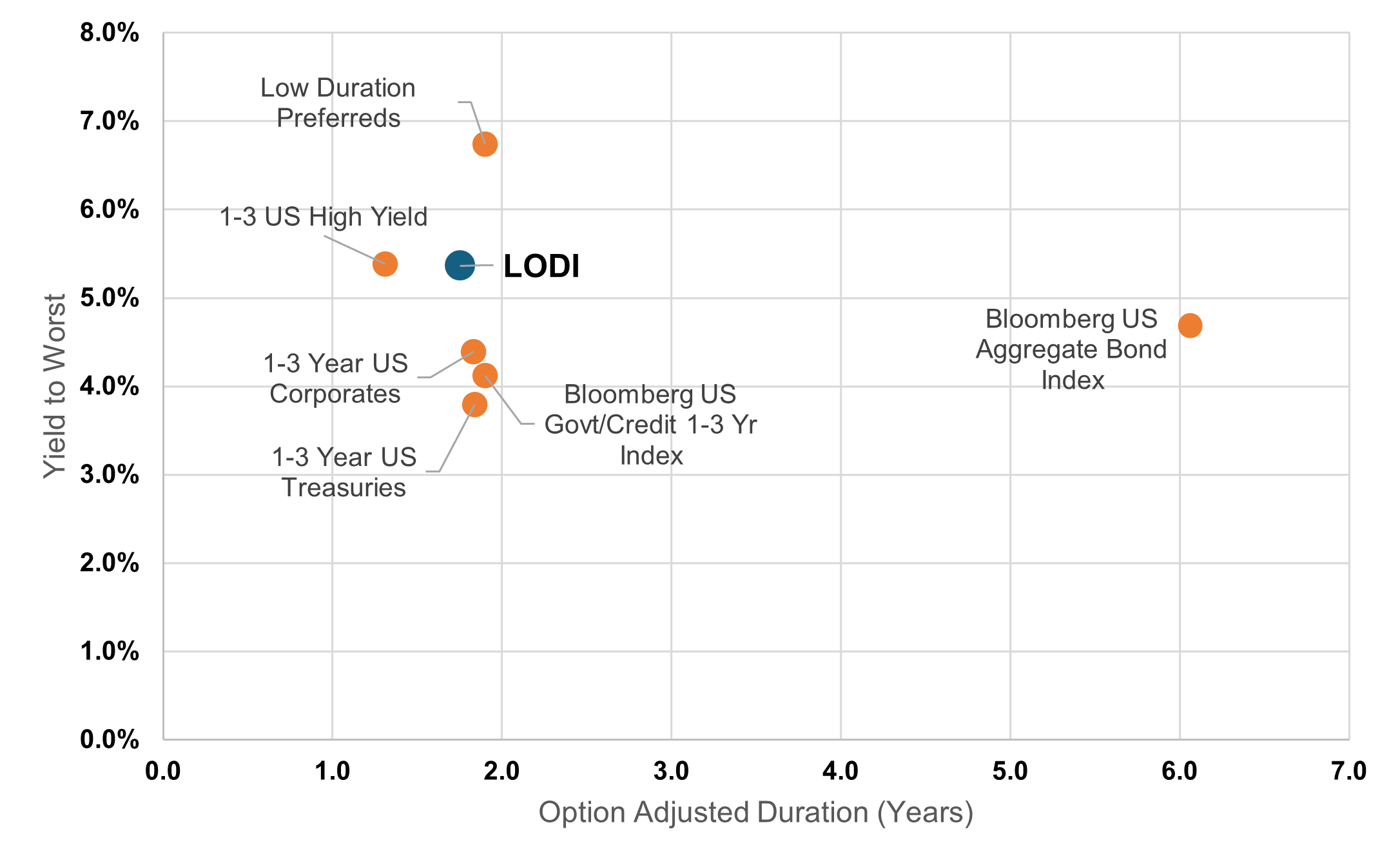

LODI seeks to be duration neutral relative to the Bloomberg 1-3 Yr Gov/Credit; As of 9/30/2025

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

Option Adjusted Duration (Years)

Yield to Worst

LODI

ICE BoFA

1-3 Yr US Corporate Index

Bloomberg US

Aggregate Bond Index

Bloomberg US

Gov/Credit 1-3Yr Index

ICE BofA 1-3 Yr US Treasury Index

See Fact Card for Standardized Performance. 30-Day SEC Yield as of 9/30/25 is 4.95% (Subsidized) and 4.71% (Unsubsidized). Past performance does not guarantee future results. Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 800.617.0004

Meet the LODI Portfolio Management Team +

Meet the LODI Portfolio Management Team

Richard Familetti, CFA

Chief Investment Officer,

U.S. Total Return Fixed Income

2009 | 1991

Michael Donelan, CFA

Senior Managing Director, Senior Portfolio Manager

2003 | 1988

Daniel J. Lucey, Jr., CFA

Senior Managing Director, Senior Portfolio Manager

2009 | 2003

Close

Philip Mendonca

Managing Director, Senior Portfolio Manager

2003 | 2003

Matthew Salzillo

Managing Director,

Portfolio Manager

2004 | 2004

Annette Serrao, CFA

Managing Director,

Portfolio Manager

2010 | 2010

Active Management

total return

income potential

2

3

Meet

Why go active for your low duration fixed income strategy?

When allocating to fixed income, relative value and quality opportunities can be found across various debt sectors. Investors using strict, rules-based index strategies may limit the full potential of their fixed income allocation with narrow access to the asset class.

An actively managed fixed income portfolio may offer the benefits of enhanced yield and outperformance through a hands-on security selection process. Active management, unlike a passive solution, has the potential to adjust the portfolio in response to adverse/opportunistic market events in a more timely manner.

Bottom Line:

Active managers such as SLC Management have the flexibility to adapt to changing market environments to potentially deliver enhanced yield and total return.

To learn more about AAM SLC Low Duration Income ETF talk to your financial professional or visit

aamlive.com/ETF

Richard Familetti, CFA

Chief Investment Officer,

U.S. Total Return Fixed Income

(2009 | 1991)

Michael Donelan, CFA

Senior Managing Director, Senior Portfolio Manager

(2003 | 1988)

Daniel J. Lucey, Jr., CFA

Senior Managing Director, Senior Portfolio Manager

(2009 | 2003)

Philip Mendonca

Managing Director, Senior Portfolio Manager

(2003 | 2003)

Matthew Salzillo

Managing Director,

Portfolio Manager

(2004 | 2004)

Annette Serrao, CFA

Managing Director,

Portfolio Manager

(2010 | 2010)

LODI

AAM SLC Low Duration Income ETF

Market Data

Technical, fundamental and quantitative analysis

Global Resources

Credit and structured credit research team

Derivatives

(Firm Start | Industry Start)

Past performance does not guarantee future results

SAWS Fact Card

Spotlight Flyer