ALLEN MATKINS | UCLA ANDERSON FORECAST

17.9

%

%

10%

15%

35%

30%

25%

2024

I am excited to present the Summer 2025 edition of the Allen Matkins/UCLA Anderson Forecast Commercial Real Estate Survey and Index. With AI, a new U.S. President, and a host of challenges, such as the recent wildfires in Los Angeles County, the world is changing rapidly. Although these developments are often national or global in nature, they deeply impact the outlook for commercial real estate in California.

Spencer B. Kallick

Here are the four key takeaways from the report:

2020

2025

2017

2018

DOWNLOAD SURVEY

– Tim Hutter, Partner

Allen Matkins

It is hard to envision a scenario in which COVID-19 and its fallout could remedy the underlying housing affordability issues that California faced coming into 2020. In light of that ongoing concern, we expect demand for multi-family housing to continue to be high.

San Francisco

Orange County

East Bay

San Diego

Silicon Valley

BACK TO TOP

05%

2019

DOWNLOAD SURVEY

Winter 2022

Summer 2021

Winter 2021

ALLEN MATKINS | UCLA ANDERSON FORECAST

DOWNLOAD SURVEY

DOWNLOAD SURVEY

“I think the continued improvement to the state's density bonus law has been and will continue to be a real driver for new activity. It presents opportunities for properties that previously didn’t pencil because of the added density, and can also be a force for innovation at the local level as some cities improve upon and modify some of the state law language in order to give special benefits within their cities.”

Los

Angeles

San Francisco

Orange County

East Bay

San Diego

Silicon Valley

Click on the markets to find out more

2012

2018

2017

2019

2020

2021

2013

2014

2015

2016

100

90

80

70

60

50

40

30

20

10

0

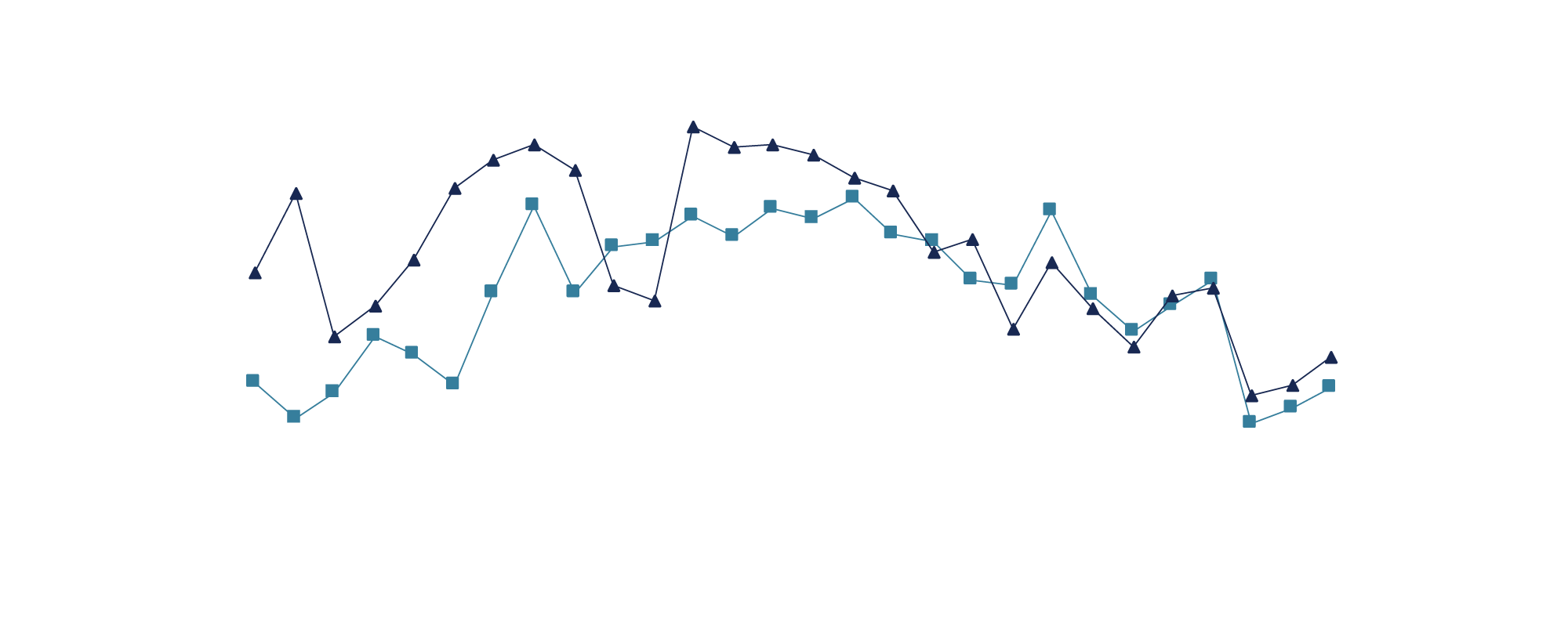

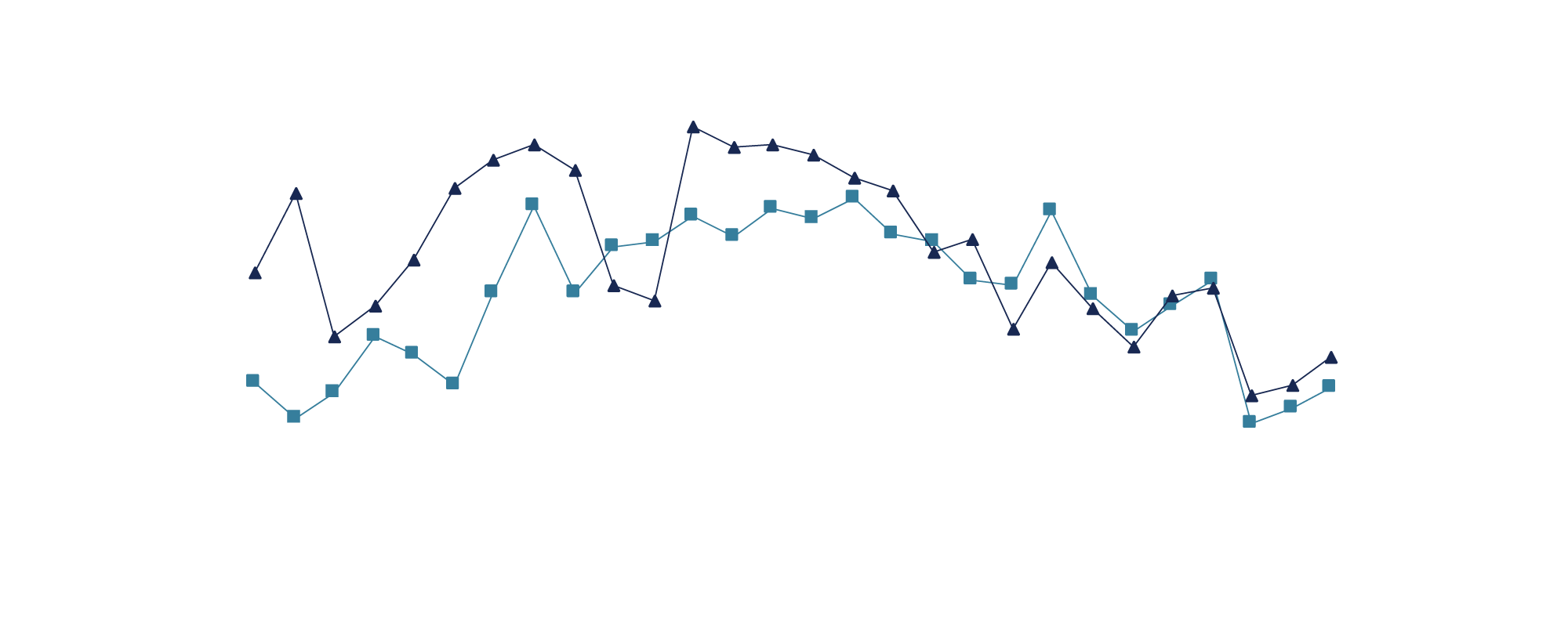

Rental Rates

VACANCY Rates

California MULTIFAMILY Markets

Indexes of Survey RESPONSES

San Diego

Silicon Valley

East Bay

Orange County

San Francisco

Los Angeles

2022

Summer 2022

Winter 2020

Summer 2020

2022

2021

What Should California CRE

Markets Anticipate in 2023?

CLICK HERE

What Should California CRE

Markets Anticipate in 2023?

CLICK HERE

Winter 2023

2023

2023

Retail’s Flight to Quality

Veering in the Direction of a Turnaround

Industrial’s Positive Momentum

Activating Vitality

in the Housing Sector

ALLEN MATKINS | UCLA ANDERSON FORECAST

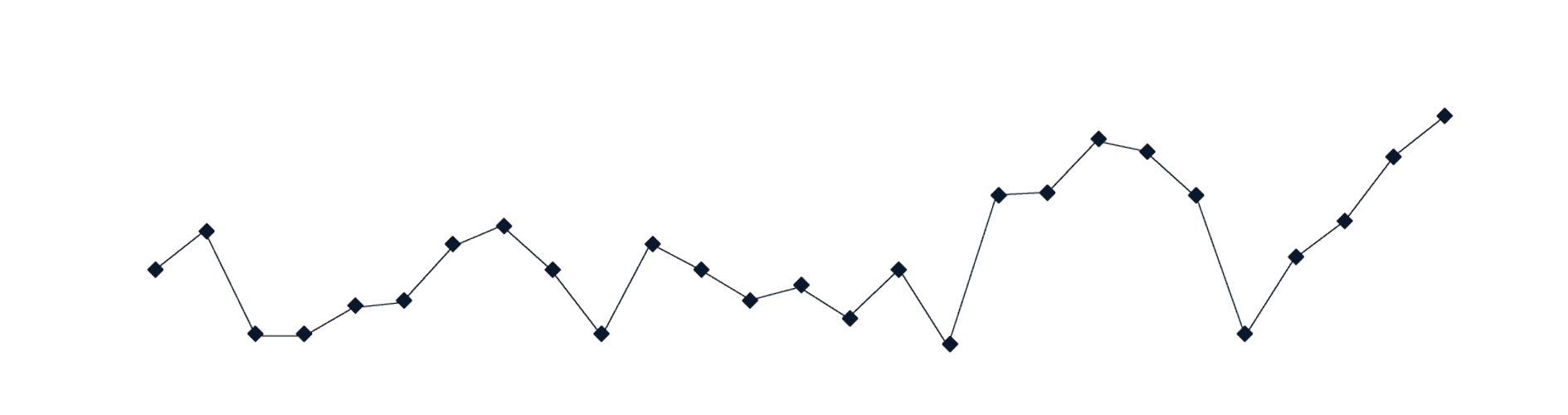

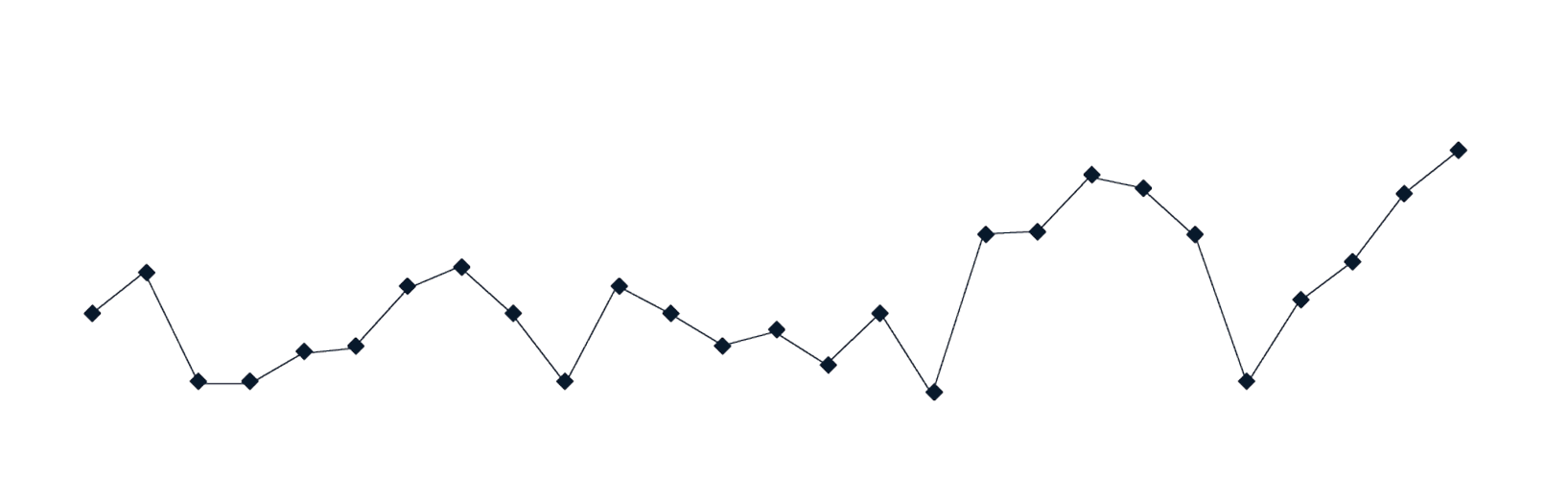

The Summer 2025 Allen Matkins / UCLA Anderson Forecast California Commercial Real Estate Survey finds trends highlighting cautious optimism, underpinned by stabilizing vacancy rates, generally rising rental rates, and evolving capital requirements as developers and investors respond to changing market dynamics..

Office Space

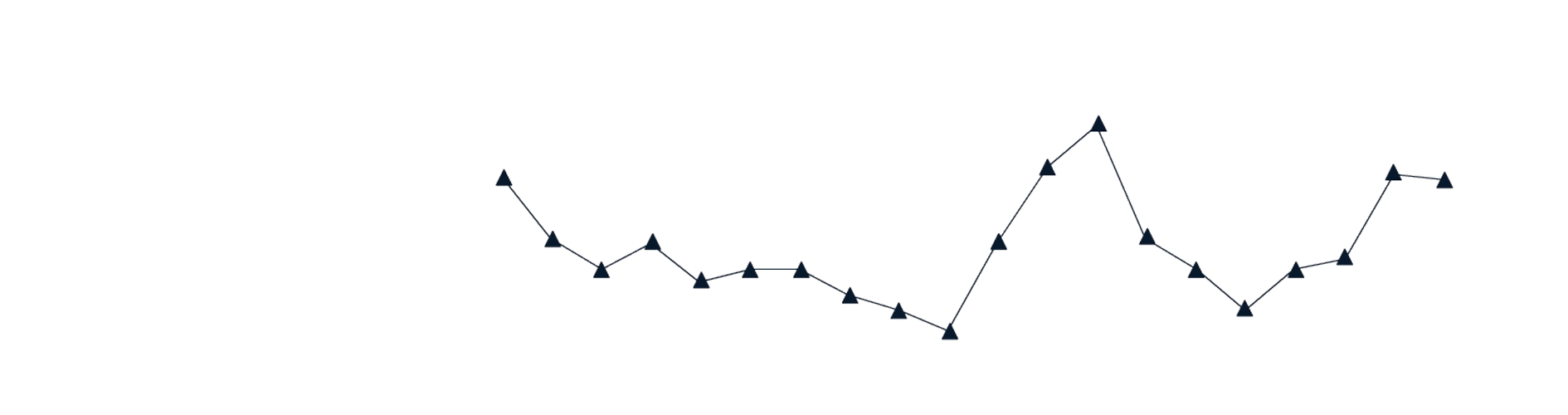

Office market sentiments are broadly improving, with positive sentiment prevailing across most regions except Sacramento, Los Angeles, and Inland Empire, where caution persists. Sentiments have improved elsewhere, although they are still negative in Los Angeles, the Inland Empire and Sacramento, while they are borderline optimistic in the East Bay.

(<50 market weakening, >50 market tightening)

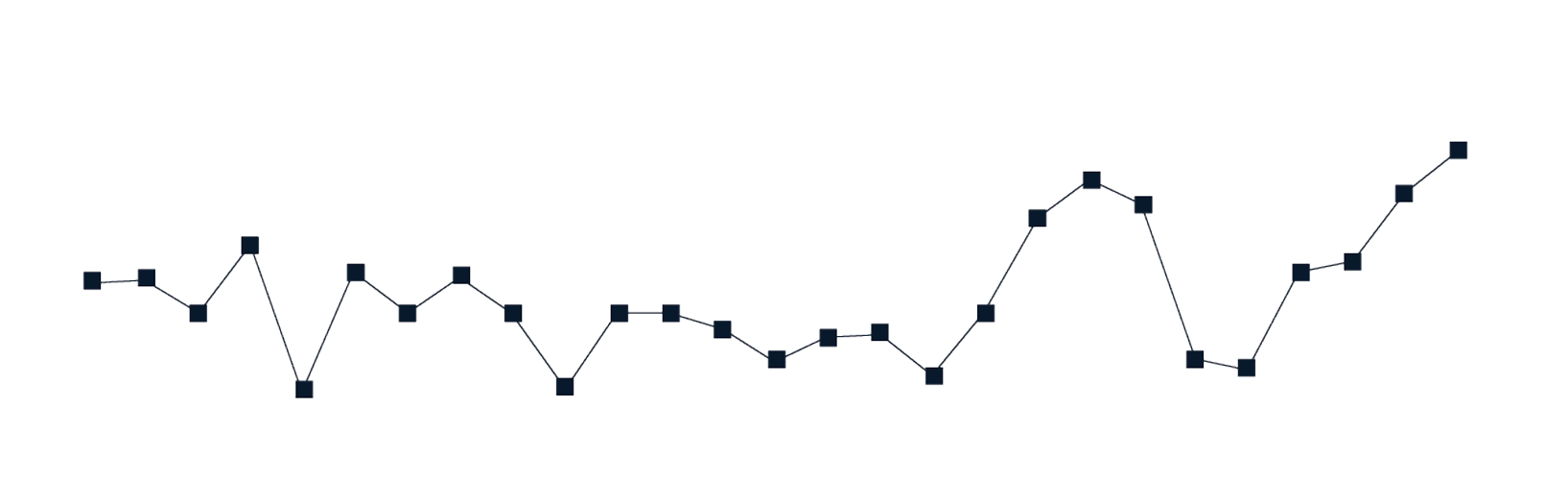

The industrial sector continues to show strong momentum across California, with widespread optimism among developers and investors. Rental rates are expected to grow moderately in nearly all major markets, while vacancy rates are projected to remain steady or decline, particularly in East Bay and Silicon Valley, indicating tightening supply.

DOWNLOAD SURVEY

DOWNLOAD SURVEY

ALLEN MATKINS | UCLA ANDERSON FORECAST

Industrial Space

Retail Space

Percent Without New Development Plans

Summer SURVEY

Paige Gosney

Partner / Allen Matkins

“The industrial market is holding strong with a particular focus on non-infill areas, such as Banning/Beaumont and the high and low desert areas in the Inland Empire as well as the Santa Clarita Valley and east Ventura County. There is a level of price discrepancy between buyers and sellers as the parties try to determine the market’s ‘sweet spot’ but reason for

optimism is — and remains — high.”

Learn more

Learn more

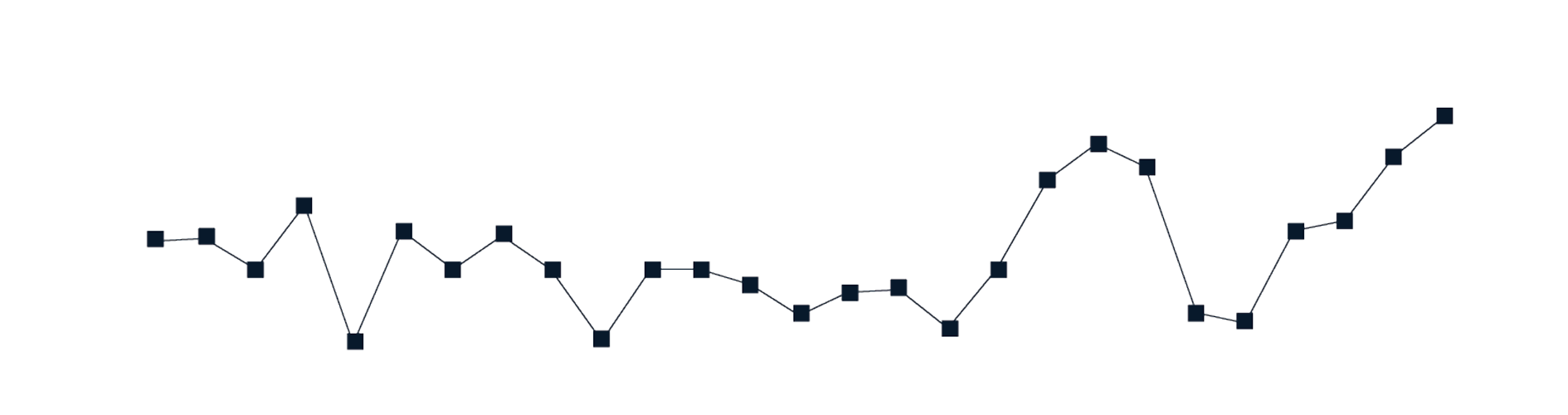

The multifamily outlook remains robust, with positive sentiment across all regions except for borderline sentiment in the Inland Empire. Notable improvements are seen in San Francisco and Silicon Valley. Community-oriented features closely followed by

in-home office/workspaces or co-working spaces are expected to be the top design elements influencing multifamily housing development, a majority (70%) of which are expected to be rentals.

DOWNLOAD SURVEY

DOWNLOAD SURVEY

ALLEN MATKINS | UCLA ANDERSON FORECAST

Multifamily Space

HEATHER RILEY

partner / allen matkins

“The biggest question in multifamily housing is how to take advantage of the recent CEQA reform bills — the response to the state’s efforts should start showing up in future surveys. In the meantime, and as the housing crisis continues, our clients are looking for any solutions that will help them bring units online as quickly as possible. Demand continues to outpace supply across the state, especially for highly amenitized rental product that offers work from home space. Despite rising costs, our clients are actively looking to build at a rate we have not seen in years.”

Learn more

Learn more

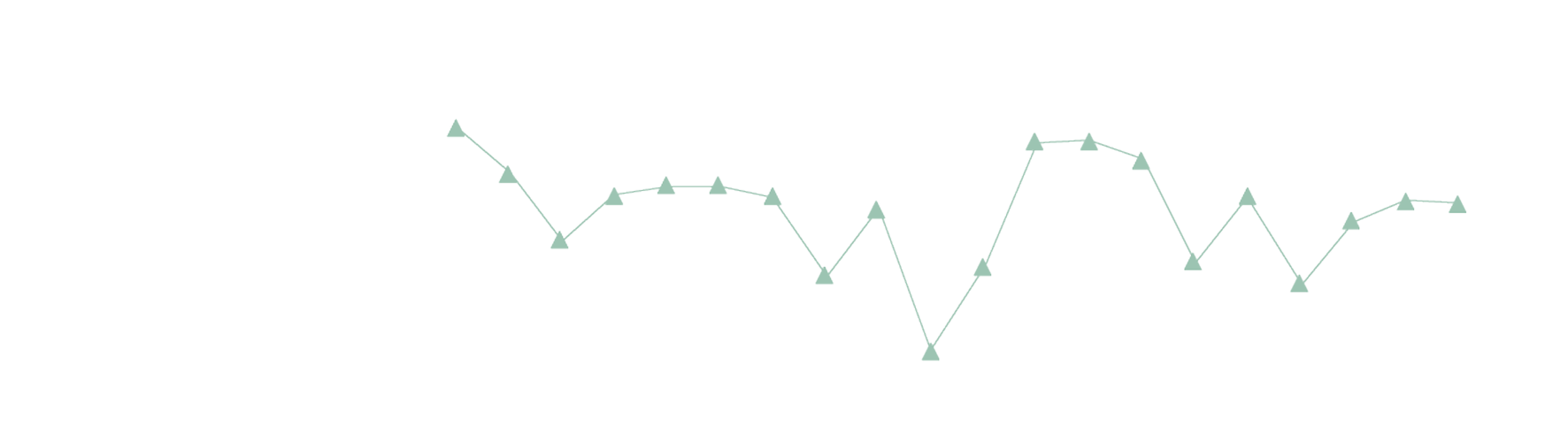

Relative to the Winter 2025 Survey, sentiments remain optimistic across most markets, except for Sacramento, Los Angeles, and Inland Empire. Notably, San Francisco exhibits improved sentiment. Overall, 38% of respondents expect retail to enter a new growth development cycle in the next three years, with most of the new retail development expectations to be focused on residential-serving retail stores, excluding stand-alone big box and malls and specialty stores in existing retail districts.

DOWNLOAD SURVEY

DOWNLOAD SURVEY

ALLEN MATKINS | UCLA ANDERSON FORECAST

Retail Space

Brian Michel

Partner / Allen Matkins

“The retail outlook continues to remain stable as a whole, with San Diego, Orange County, the Inland Empire, parts of Los Angeles, Silicon Valley, and the East Bay expected to outperform San Francisco and Sacramento.”

Learn more

Learn more

Past Surveys

SUMMer 2023

DOWNLOAD SURVEY

DOWNLOAD SURVEY

“As retail tenants change, they want flexibility to pivot to different trends, such as entertainment-focused retail, or experience-based retail. We're seeing a lot of flexibility not only in permitted uses, but also in a lack of prohibited uses that we used to see, especially from big box tenants.”

“There is a major skilled labor shortage, and I think that's driving where the hubs for industrial and distribution are really growing the most."

X

kevin donner

vice chairman / Newmark

“One of the trends we're seeing in office space is that tenants are investing in smaller, better space, and there are a few ways we're seeing this. One is a flight to quality where tenants are moving to smaller space in markets that have more amenities.”

Learn more

2024

X

Learn more

michael longo

SENIOR VICE PRESIDENT / CBRE

X

Learn more

PRINCIPAL / BRICKSTAR CAPITAL

DAVID MIRHAROONI

X

Learn more

shawn gehle

co-founder | Principal / officeuntitled

PARTNER / ALLEN MATKINS

WINTER 2024

0%

10%

20%

40%

50%

60%

70%

80%

30%

NorCal

SoCal

2025

SUMMER 2024

Here are the three key takeaways from the report:

X

KEVIN DONNER

VICE CHAIRMAN / NEWMARK

“Now we’re not just going to the big PE funds to buy a loan pool. We’re going to individual investors who underwrite the deal they’re interested in. Either you get paid off or buy at a discount. But that's where a lot of the deals are getting done.”

Learn more

X

David Mirharooni

Brian W. Michel

pRINCIPAL / bRICKSTAR cAPITAL

Learn more

“I see more impact from the tariffs, not because of the price of goods, but the sentiment of the outside world toward America, and tourists not coming to America because of that sentiment.”

X

Michael Longo

Senior Vice President / CBRE

“The penetration of e-commerce is a real trend that doesn't seem to be ending. Amazon certainly was in the game early, and now every other retailer has to build e-commerce into their systems. Developers view it as a growth area for sure.”

Learn more

X

sHAWN GEHLE

CO-FOUNDER | PRINCIPAL / OFFICEUNTITLED

“You have great buildings that do exist that have the potential to have a life beyond what the original use case was. I think that's a huge opportunity.”

Learn more

Principal, Runyon Group

WINTER 2024

Although inflation and rising costs continue to be an issue, multifamily development has not slowed. Vacancy rates across the state are showing improvement, particularly in San Francisco. The recent Los Angeles Wildfires will continue to increase demand in the multifamily sector, as well as the ongoing housing shortage across the state.

Partner, Real Estate

Allen Matkins

OFFICE IS ALIVE

PoDCAST:

Activating Vitality in the Housing Sector

PoDCAST:

LISTEN NOW

LISTEN NOW

LISTEN NOW

LISTEN NOW

Winter 2025

Julie hoffman

Partner / Allen Matkins

“After a prolonged period of uncertainty, the office market sentiment is starting to turn a corner — albeit slowly. Developers are testing the waters again, especially in Northern California, where vacancy rates and rental rates seem to have stabilized. But broad-based recovery is still a few years out.”

Learn more

Learn more

2024

SUMMER 2024

DOWNLOAD SURVEY

DOWNLOAD SURVEY

Summer 2025 Allen Matkins/UCLA Anderson Forecast California CRE Survey Webinar

WEBINAR:

WATCH NOW

WATCH NOW

Activating Vitality in the Housing Sector

PoDCAST:

LISTEN NOW

LISTEN NOW