ALLEN MATKINS | UCLA ANDERSON FORECAST

17.9

%

%

10%

15%

35%

30%

25%

2024

I am excited to present the Winter 2026 edition of the Allen Matkins/UCLA Anderson Forecast Commercial Real Estate Survey and Index. Change has been a constant since our last Survey in Summer 2025, with the continued growth of AI, lower interest rates, tariffs, and a changing global political climate. Here in California, the commercial real estate market is taking all of these developments in stride with a cautiously optimistic outlook for 2026 and beyond.

Spencer B. Kallick

Here are the four key takeaways from the report:

2020

2025

2017

2018

DOWNLOAD SURVEY

– Tim Hutter, Partner

Allen Matkins

It is hard to envision a scenario in which COVID-19 and its fallout could remedy the underlying housing affordability issues that California faced coming into 2020. In light of that ongoing concern, we expect demand for multi-family housing to continue to be high.

San Francisco

Orange County

East Bay

San Diego

Silicon Valley

BACK TO TOP

05%

2019

DOWNLOAD SURVEY

Winter 2022

Summer 2021

Winter 2021

ALLEN MATKINS | UCLA ANDERSON FORECAST

DOWNLOAD SURVEY

DOWNLOAD SURVEY

“I think the continued improvement to the state's density bonus law has been and will continue to be a real driver for new activity. It presents opportunities for properties that previously didn’t pencil because of the added density, and can also be a force for innovation at the local level as some cities improve upon and modify some of the state law language in order to give special benefits within their cities.”

Los

Angeles

San Francisco

Orange County

East Bay

San Diego

Silicon Valley

Click on the markets to find out more

2012

2018

2017

2019

2020

2021

2013

2014

2015

2016

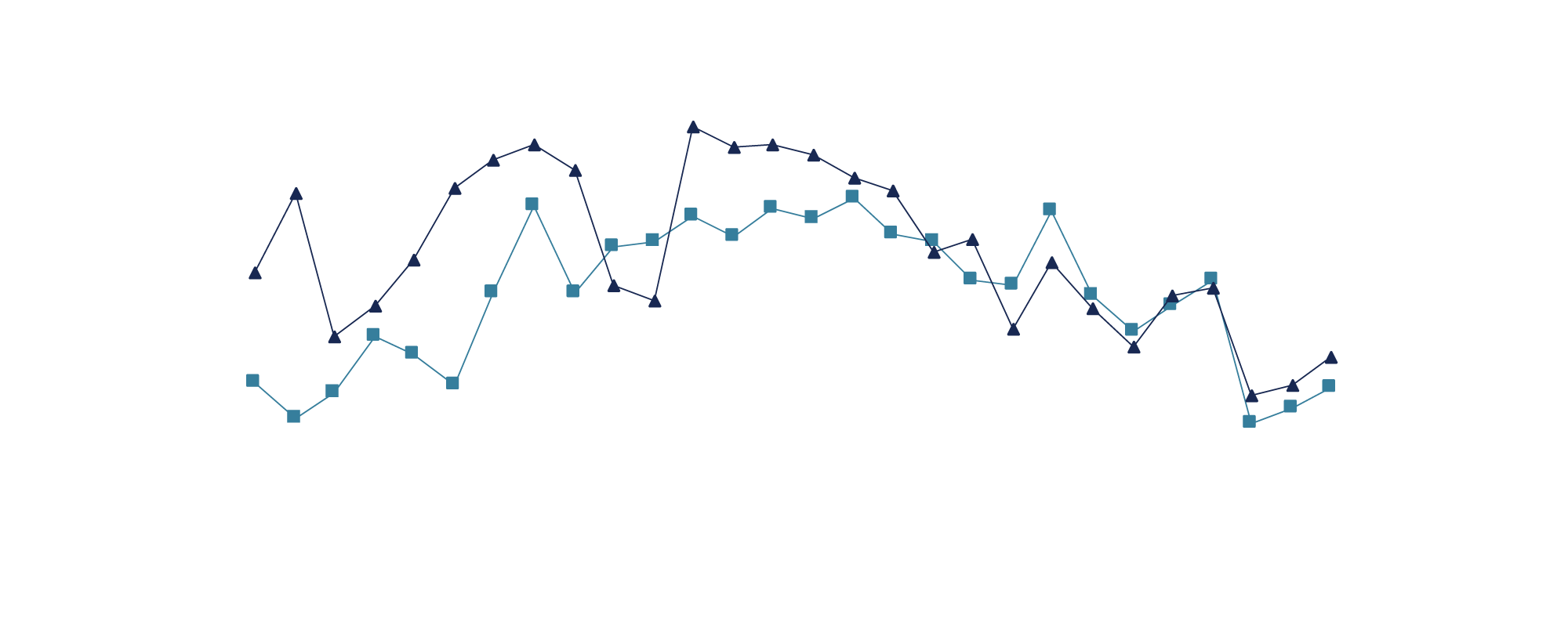

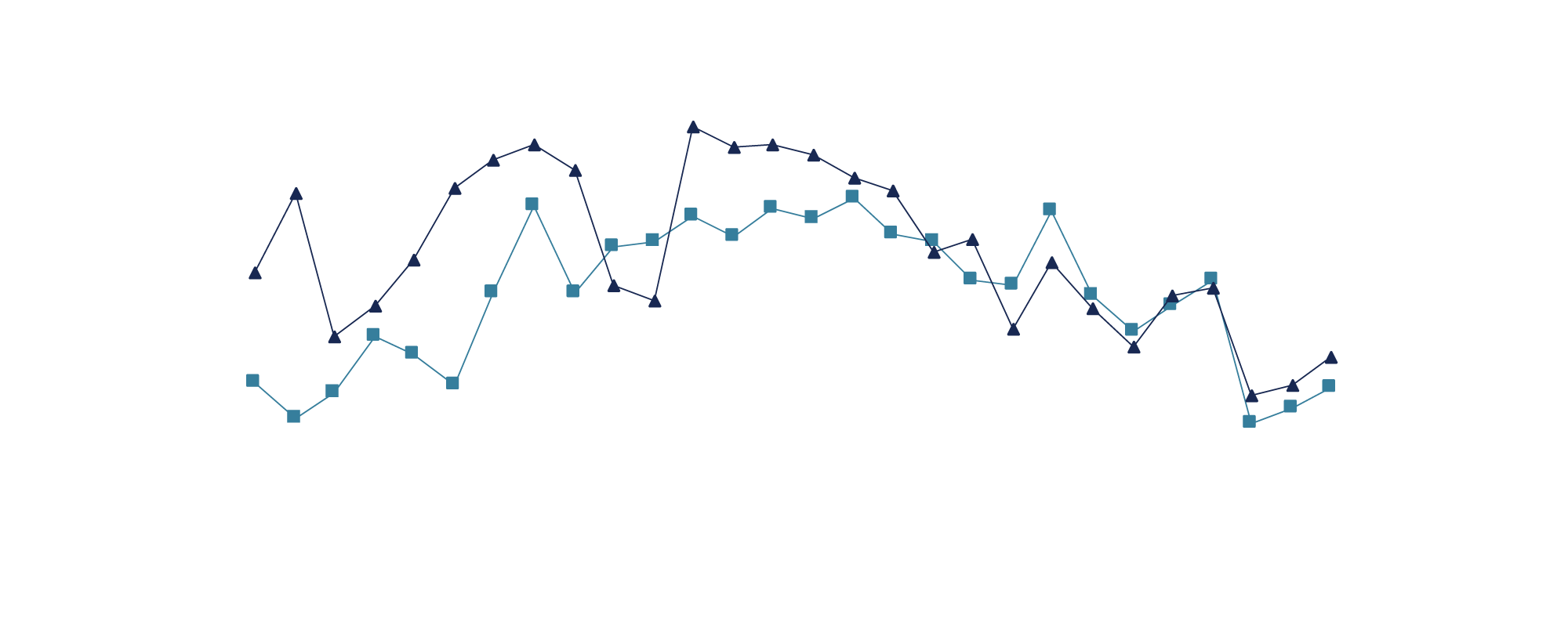

100

90

80

70

60

50

40

30

20

10

0

Rental Rates

VACANCY Rates

California MULTIFAMILY Markets

Indexes of Survey RESPONSES

San Diego

Silicon Valley

East Bay

Orange County

San Francisco

Los Angeles

2022

Summer 2022

Winter 2020

Summer 2020

2022

2021

What Should California CRE

Markets Anticipate in 2023?

CLICK HERE

What Should California CRE

Markets Anticipate in 2023?

CLICK HERE

Winter 2023

2023

2023

Signals Point to Rent Growth

Location is

the Story

Stronger Fundamentals

Still a

Bright Spot

ALLEN MATKINS | UCLA ANDERSON FORECAST

The Winter 2026 Allen Matkins/UCLA Anderson California Commercial Real Estate Survey suggests California’s CRE market is entering 2026 with measured optimism, as expectations for new development turn cautiously positive and concerns around distress begin to stabilize.

Office Space

Office market conditions remain uneven, though sentiment has improved in select regions. Developer sentiment is optimistic in San Francisco, Silicon Valley, and Orange County; borderline in the East Bay, Los Angeles, and San Diego; and pessimistic in Sacramento and the Inland Empire. Significant sentiment gains were recorded in San Francisco and Silicon Valley, while San Diego experienced a notable decline.

(<50 market weakening, >50 market tightening)

The industrial sector continues to exhibit strong and broadly improving fundamentals across California. Developer sentiment remains positive in nearly all markets and has strengthened since the Summer 2025 survey, with the notable exception of Sacramento, where sentiment has declined modestly and now sits at the border between optimism and pessimism. Elsewhere, confidence remains elevated, reflecting sustained tenant demand and relatively tight market conditions.

DOWNLOAD SURVEY

DOWNLOAD SURVEY

ALLEN MATKINS | UCLA ANDERSON FORECAST

Industrial Space

Retail Space

Percent Without New Development Plans

WINTER SURVEY

ANDREW MORROW

Executive Managing Director

Cushman & Wakefield

“The tariffs really affected our industrial market in the Inland Empire and across Southern California more than anything I've seen in my 20 plus years doing this. I think this year there's some renewed optimism. There's a feeling of a soft landing.”

Learn more

Learn more

The multifamily outlook remains positive across both Northern and Southern California, though overall sentiment has taken minor dips relative to the Summer 2025 Survey. While still firmly in positive territory, sentiment declined slightly in most regions, reflecting a more cautious outlook heading into 2026. Overall, multifamily continues to be viewed as one of the most resilient segments of the commercial real estate market.

DOWNLOAD SURVEY

DOWNLOAD SURVEY

ALLEN MATKINS | UCLA ANDERSON FORECAST

Multifamily Space

Retail developer sentiment has strengthened meaningfully since the Summer 2025 Survey and is now optimistic across all California markets. The largest improvements were observed in Orange County, Los Angeles, and the Inland Empire. Northern California markets remain firmly positive, reflecting improved confidence heading into 2026.

DOWNLOAD SURVEY

DOWNLOAD SURVEY

ALLEN MATKINS | UCLA ANDERSON FORECAST

Retail Space

“The biggest retail trend that I have seen recently is that developers are looking to lease to traditional food operators, as well as service providers and new experiential opportunities. Service providers seem to be a much bigger draw than your traditional brick-and-mortar retail.”

Learn more

Learn more

Past Surveys

SUMMer 2023

DOWNLOAD SURVEY

DOWNLOAD SURVEY

“As retail tenants change, they want flexibility to pivot to different trends, such as entertainment-focused retail, or experience-based retail. We're seeing a lot of flexibility not only in permitted uses, but also in a lack of prohibited uses that we used to see, especially from big box tenants.”

“There is a major skilled labor shortage, and I think that's driving where the hubs for industrial and distribution are really growing the most."

X

NATHANIEL TOUBOUL

partner / allen matkins

“One of the trends we're seeing in office space is that tenants are investing in smaller, better space, and there are a few ways we're seeing this. One is a flight to quality where tenants are moving to smaller space in markets that have more amenities.”

Learn more

2024

X

Learn more

joey reaume

exECUTIVE VICE PRESIDENT AND PRINCIPAL / SRS INDUSTRIAL

X

Learn more

partner

allen matkins

jonathan lorenzen

X

Learn more

songyi wang

dirECTOR OF INVESTMENTS

GREYSTAR

WINTER 2024

0%

10%

20%

40%

50%

60%

70%

80%

30%

NorCal

SoCal

2025

SUMMER 2024

Here are the four key takeaways from the report:

X

Nathaniel Touboul

PARTNER / ALLEN MATKINS

“Sentiment is generally optimistic in the office sector, but varies from asset to asset, depending on its classification. Here in the Bay Area as well as in most gateway markets, class-A, highly amenitized tier-one assets in prime locations are generally in a league of their own, commanding historically high rents and low vacancy rates.”

Learn more

X

JONATHAN LORENZEN

Brian W. Michel

pARTNER / ALLEN MATKINS

Learn more

“One of the main trends I'm seeing right now in the retail sector is an increased investment in existing shopping centers, mainly those that are in good locations in close proximity to areas where customers really work and live.”

X

JOEY REAUME

Executive Vice President and Principal / SRS Industrial

“If we look at a 30,000-foot view of the overall industrial market for Southern California and the Inland Empire, 2025 was actually a pretty active year. Rental rates have, for the most part, stabilized in the West. The east we believe had a little bit of a dip in 2025. Hopefully, it will start stabilizing in 2026.”

Learn more

X

SONGYI WANG

Director of Investments / Greystar

“The Bay Area has continued to recover and is the best performing market across the West Coast and nationally. Both San Francisco and San Jose saw really strong rent growth in the spring and summer of 2025.”

Learn more

Principal, Runyon Group

WINTER 2024

Although inflation and rising costs continue to be an issue, multifamily development has not slowed. Vacancy rates across the state are showing improvement, particularly in San Francisco. The recent Los Angeles Wildfires will continue to increase demand in the multifamily sector, as well as the ongoing housing shortage across the state.

Partner, Real Estate

Allen Matkins

Activating Vitality in the Housing Sector

PoDCAST:

LISTEN NOW

LISTEN NOW

Winter 2025

JOON CHOI

Principal / Harbor Associates

“We're seeing a lot of investment interest picking up in office, not only from owner-users and private high net worths. We're also starting to see institutions coming back to office. Some of the institutional funds that have been recently raised are now able to invest in select office deals.”

Learn more

Learn more

2024

SUMMER 2024

DOWNLOAD SURVEY

DOWNLOAD SURVEY

Summer 2025 Allen Matkins/UCLA Anderson Forecast California CRE Survey Webinar

WEBINAR:

WATCH NOW

WATCH NOW

SUMMer 2025

90%

SANDY JACOBSON

Partner / Allen Matkins

TIMOTHY HUTTER

Partner / Allen Matkins

“There continues to be a strategic or financial advantage for the affordable housing developers who are able to set up a capital stack that's less reliant on market forces and on market rates.”

Learn more

Learn more

TIMOTHY HUTTER

partner

allen matkins

“The tariffs really affected our industrial market in the Inland Empire and across Southern California more than anything I've seen in my 20 plus years doing this. I think this year there's some renewed optimism. There's a feeling of a soft landing.”

Learn more

Learn more

sandy jacobson

partner

allen matkins

“The tariffs really affected our industrial market in the Inland Empire and across Southern California more than anything I've seen in my 20 plus years doing this. I think this year there's some renewed optimism. There's a feeling of a soft landing.”

Learn more

Learn more

Winter 2025

joon choi

PRINCIPAL

HARBOR ASSOCIATES

“The tariffs really affected our industrial market in the Inland Empire and across Southern California more than anything I've seen in my 20 plus years doing this. I think this year there's some renewed optimism. There's a feeling of a soft landing.”

Learn more

Learn more