2021 Weather, Climate and Catastrophe Insight

Navigating New Forms of Volatility

Driving the Deal

Transaction Risks & Opportunities for the TMT Sector

Discover More

Explore the Report

Why This Is Important

Section 1

What Can We Do?

Section 2

Find Out More

Section 3

Close

If you would like to discuss any aspects of these insights, or to better understand our capabilities in this area, please do not hesitate to get in contact with our team.

Talk With Us

Contact Us

Website

Legal

Privacy

Cookie Notice

Sign Up to Receive Insights

Sign Up to Receive Insights

Share the Insights

Home

Contact Us

Legal

Privacy

Cookie Notice

Explore aon.com

Natural Resource

Food, Agribusiness and Beverage

Transportation and Logistics

North America

(non U.S.)

Europe

Middle East

Africa

Asia

Oceania

Sarah LaBarre

If you don’t have the capability to offer increased cash and equity, there are still a lot of powerful tools available to managers and HR leaders. Aon’s recent digital report on future skills and talent resilience in the life sciences sector provides a comparative view of organizational approaches to total rewards from 2020 to 2021, highlighting the increased focus on employee-centered strategies and wellbeing. More specifically, many life sciences companies are offering additional paid time off, including targeted recharge days, summer shutdowns and extra days around holidays. While there is a strong emphasis on flexibility, finding a balance is key. Companies that can offer work-from-home options should also encourage in-person meetings, lunches and other gatherings to foster connection and engagement. This directly improves company culture — a core component of retention.

Career advancement and accelerated promotions are extremely important to all employees across generations, particularly when it comes to providing a pathway for development. “Almost immediately after being hired, employees are asking what career growth options they have, and it’s important to have an answer. Every company should take the time to determine real definitions around career opportunities for employees,” says Sarah LaBarre, an associate partner focused on rewards solutions in the life sciences sector for Aon’s human capital practice.

Understanding job levels and families, as well as where any overlaps lie is essential. Companies should view career frameworks holistically, connecting job architecture, rewards, salary structures and incentives to create career paths that are no longer exclusively linear. If people are given new opportunities across different job families within the organization, there will be less reason for them to leave.

Almost immediately after being hired, employees are asking what career growth options they have, and it’s important to have an answer. Every company should take the time to determine real definitions around career opportunities for employees.

“

“

Transportation and Logistics

• While the pandemic played a part in the rising costs in the Food, Agribusiness and Beverage (FAB) sector, the reasons for the increases go much deeper. Increased fertilizer costs, adverse weather, labor shortages, fuel costs, supply chain issues in addition to cyber attacks have led to dramatic price increases and put pressure on crop yields. These conditions are hampering efforts to get to market in an industry where an efficient end-to-end delivery model is critical. Food inflation, which stood at a modest 2.2 percent in 2021, jumped to 7 percent at the start of 2022, its sharpest rise since 1981.

The price of meat, dairy and cereals trended upward from late 2021. Prices for feed grains and wheat, rice and soybeans are all higher. Global production of commodities such as wheat, corn and soybeans have decreased due to a variety of factors including current global political disruptions. Such disruptions are also impacting traditional supply routes. Between April 2020 and December 2021 alone, the price for soybeans increased 52 percent and corn and wheat grew 80 percent, according to the International Monetary Fund.

Supply chain issues can certainly be felt across most global industries, however, they are particularly acute in the FAB sector where speed to market is essential and the delivery delay of just one commodity -- when multiple ingredients must come together in the process of creating a single product -- can be devastating for businesses that operate on the thinnest of margins.

The pandemic is one reason behind the current supply chain issues – according to Aon’s Operational Resilience in the Food Agribusiness and Beverage Industry report, 42 percent of businesses surveyed experienced supply chain acceleration, however, 40 percent faced raw material supply issues due to the impact of COVID-19.

Issues in the FAB industry go beyond the pandemic. Climate disruptions, including drought, flooding and freezes, and also recent global conflict, have put serious stress on traditional global supply routes, and the FAB industry overall.

Further, a lack of labor in the fields, processing plants and in the supply chain, together with high turnover, are some of the FAB sector’s biggest obstacles as well. The lack of skilled labor can lead to potential food safety issues, and a deterioration of workplace safety.

These issues are compounded by the threat of cyber attacks, which can disrupt production and distribution and cause business interruption issues. Such attacks can destroy operations and supply chains, resulting in significant revenue loss, material costs and reputational damage. Aon reports that nearly eight in 10 FAB leaders surveyed rank cyber ris

Twenty-three individual events in the U.S. exceeded the $1 billion economic loss threshold in 2021.

“

Food, Agribusiness and Beverage

Axxxx

Global natural resource prices have risen sharply, from March 2021 to March 2022: Coal (up 275 percent), aluminum (up 56 percent), copper (up 13 percent), nickel (up 163 percent), brent crude oil (up 63 percent), and natural gas (up 97 percent). Metal prices have increased in the past 12 months due to increased demand for base metals and a fall in Chinese steel production. U.S. steel prices rose more than 200 percent in 2021, however, prices have since retreated in 2022.

Alongside legacy pandemic-related forces, currency exchange rates, interest rate hikes and political upheaval are increasing the cost of natural resources.

In the short term, energy prices remain highly uncertain. Recent international volatility helped push brent crude oil to well over $100 a barrel in March, leading gasoline prices to record highs. Natural gas also rose steeply, averaging $4.69 per million British thermal units. Global renewable energy, meanwhile, continues to grow. Renewables are set to account for nearly 95 percent of the increase in global power capacity through 2026.

Monetary conditions have also tightened. The U.S. Federal Reserve has begun increasing rates; the European Central Bank, meanwhile, has committed to maintaining its key interest rates at current levels awaiting progress toward stabilizing inflation at its medium-term target.

Less friendly monetary policies in advanced economies will likely pose challenges for central banks and governments in emerging markets with developing economies. Higher returns elsewhere will likely incentivize capital to flow overseas, putting downward pressure on emerging markets and developing economy currencies and raising inflation. Without commensurate tightening, this will likely increase the burden on foreign-currency borrowers, both public and private. Businesses with international exposures, both in property and equipment, are likely to be impacted.

Txxxx.

“

“

Natural Resource

Undervaluing Intellectual Property at Deal Stage

Detailed assessments of digital performance are often part of the process of valuing a company’s IP. Like plant and property, a company’s IP (including its data, source code, algorithms and other assets) can be assigned a monetary value. IP valuations can be used to secure loans or other financial benefits if the IP collateral is insured. Termed IP financing is increasingly seen as a viable option for companies to raise capital without diluting their equity stakes. Insuring the collateral gives lenders confidence that the IP has been given a fair valuation.

David Molony

TMT Industry Leader david.molony@aon.com

While the pandemic played a part in the rising costs in the Food, Agribusiness and Beverage (FAB) sector, the reasons for the increases go much deeper. Increased fertilizer costs, adverse weather, labor shortages, fuel costs, supply chain issues in addition to cyber attacks have led to dramatic price increases and put pressure on crop yields. These conditions are hampering efforts to get to market in an industry where an efficient end-to-end delivery model is critical. Food inflation, which stood at a modest 2.2 percent in 2021, jumped to 7 percent at the start of 2022,⁷ its sharpest rise since 1981.⁸

The price of meat, dairy and cereals trended upward from late 2021. Prices for feed grains and wheat, rice and soybeans are all higher. Global production of commodities such as wheat, corn and soybeans have decreased due to a variety of factors including current global political disruptions. Such disruptions are also impacting traditional supply routes. Between April 2020 and December 2021 alone, the price for soybeans increased 52 percent and corn and wheat grew 80 percent, according to the International Monetary Fund.

Supply chain issues can certainly be felt across most global industries, however, they are particularly acute in the FAB sector where speed to market is essential and the delivery delay of just one commodity -- when multiple ingredients must come together in the process of creating a single product -- can be devastating for businesses that operate on the thinnest of margins.

The pandemic is one reason behind the current supply chain issues – according to Aon’s Operational Resilience in the Food Agribusiness and Beverage Industry report, 42 percent of businesses surveyed experienced supply chain acceleration, however, 40 per

cent faced raw material supply issues due to the impact of COVID-19.

Issues in the FAB industry go beyond the pandemic. Climate disruptions, including drought, flooding and freezes, and also recent global conflict, have put serious stress on traditional global supply routes, and the FAB industry overall.

Further, a lack of labor in the fields, processing plants and in the supply chain, together with high turnover, are some of the FAB sector’s biggest obstacles as well. The lack of skilled labor can lead to potential food safety issues, and a deterioration of workplace safety.

These issues are compounded by the threat of cyber attacks, which can disrupt production and distribution and cause business interruption issues. Such attacks can destroy operations and supply chains, resulting in significant revenue loss, material costs and reputational damage. Aon reports that nearly eight in 10 FAB leaders surveyed rank cyber risk as a top five corporate threat.⁹

Quote in here.

X

x

X

X

x

x

x

x

Name Here

“

Global natural resource prices have risen sharply, from March 2021 to March 2022: Coal (up 275 percent), aluminum (up 56 percent), copper (up 13 percent), nickel (up 163 percent), brent crude oil (up 63 percent), and natural gas (up 97 percent).⁴ Metal prices have increased in the past 12 months due to increased demand for base metals and a fall in Chinese steel production. U.S. steel prices rose more than 200 percent in 2021, however, prices have since retreated in 2022.

Alongside legacy pandemic-related forces, currency exchange rates, interest rate hikes and political upheaval are increasing the cost of natural resources.

In the short term, energy prices remain highly uncertain. Recent international volatility helped push brent crude oil to well over $100 a barrel in March, leading gasoline prices to record highs. Natural gas also rose steeply, averaging $4.69 per million British thermal units. Global renewable energy, meanwhile, continues to grow. Renewables are set to account for nearly 95 percent of the increase in global power capacity through 2026.⁵

Monetary conditions have also tightened. The U.S. Federal Reserve has begun increasing rates; the European Central Bank, meanwhile, has committed to maintaining its key interest rates at current levels awaiting progress toward stabilizing inflation at its medium-term target.

Less friendly monetary policies in advanced economies will likely pose challenges for central banks and governments in emerging markets with developing economies. Higher returns elsewhere will likely incentivize capital to flow overseas, putting downward pressure on emerging markets and developing economy currencies and raising inflation. Without commensurate tightening, this will likely increase the burden on foreign-currency borrowers, both public and private.⁶ Businesses with international exposures, both in property and equipment, are likely to be impacted.

Transportation and logistics issues also compound inflation. Interconnected supply chains continue to be hampered by container shortages and lack of dock and truck driver labor. Global shipping container rates rose from less than $2,000 to a peak of nearly $11,000 in late 2021.¹⁰

Shipping costs continue to increase overall – ocean freight costs are up 29 percent and shipping by truck is up 18.3 percent in January 2022 in the U.S. alone.¹¹ As ocean cargo supply chain delays have continued, shippers have increasingly turned to air freight to deliver their goods. However, recent political conflicts have caused a surge in jet fuel costs and shippers have paid the price. Air cargo rates from China to Europe jumped 80 percent to $11.36 a kilogram in early March, according to Freightos, a freight booking platform.

Aon classifies complex supply chain risk as one of the six largest risks facing businesses today, along with loss of intellectual property, cyber attacks, damage to reputation, climate change and the COVID-19 pandemic. All are interconnected and evolving fast.

Supply chain disruptions due to the pandemic are well-documented and substantial. According to Aon’s COVID-19 Risk Management and Insurance Survey the largest percentage of disruption in the supply chain due to the pandemic was because of a drop in consumer demand (36 percent), which affected hospitality and energy sectors that are heavily led by demand.

Increased cyber attacks have also caused broad disruptions in the supply chain. Ransomware attacks are threatening the shipping industry, which relies heavily on the interaction between a number of different digital systems, from ports and cities to individual ships and the companies that own them.

Loss of income from this risk in the past 12 months has risen from 21 percent to 35 percent, whereas risk readiness has declined from 70 percent to 63 percent. The results are consistent with those in Aon's COVID-19 survey, in which 36 percent of surveyed companies cited disruption to their supply chains and nearly 20 percent had trouble sourcing materials.

Economists initially felt inflation would be a transitory issue. However, many now believe inflation may be more persistent -- there are too many interconnected variables present to suggest this is a short-term phenomenon.

The International Monetary Fund expects ongoing supply chain disruptions and high energy costs to continue to boost inflation, only decreasing in late 2022 as supply demand imbalances wane and monetary policy in major economies responds.¹²

Opportunities Through M&A – The Top Three

Zamani Ngidi

TMT Industry Deputy Leader zamani.ngidi2@aon.co.za

Ian McCaw

Head of Digital M&A

ian.mccaw@aon.co.uk

Jake Tobin

Financial Sponsors Industry Leader

jake.tobin@aon.co.uk

Reinsurance Solutions Website

Contact Us

Legal

Privacy

Cookie Notice

Explore aon.com

What’s Driving M&A for TMT?

In the other articles in this M&A series, we discuss the core drivers of M&A for technology, media and telecommunications organizations and how global trends are impacting transactional activity.

Access More M&A Insights

M&A Global Trends

There was an accelerated move towards digital during the pandemic, which reinforces the vital relationship between technology and competitiveness. Digitally-enabled business models will account for an estimated 70 percent of new value created in the global economy in the next 10 years, according to the World Economic Forum. With digital so central to how businesses operate and drive revenue, buyers need to evaluate the digital assets and capabilities of the companies they have in their sights for acquisition. It’s important to assess how much is manual, how much is automated, and if improvements to efficiencies can be made.

Buyers and sellers should quantify digital performance and assets to ensure their scalability to support growth and resiliency. A forensic examination of the company’s technology operations to gauge the resilience of its platforms is critical. Digital performance assessment should take in a company’s digital KPIs, including the number of active users, platform performance and scalability to achieve business forecasts across existing and future digital channels. The existence of any fraudulent interceptions need to be monitored, and the quality of the company’s source code should be evaluated for IP infringement and maintainability. Businesses are bought to be grown and scaled up, so their systems must be capable of handling more activity.

Uncovering and addressing cyber vulnerabilities is the other critical component of digital assessment. Cyber risks must be identified and managed ahead of transactions, as insuring these risks is becoming more difficult.

The cyber-risk radar is constantly moving and uncovering technology weaknesses or vulnerabilities during due diligence, which could lead a potential buyer to walk away.

The Digital Future

A surge in SPAC activity over the last couple of years has turned what was traditionally a two-track M&A process for sellers (both direct sale and IPO) into a triple-track process. Engaging with SPACs can involve unfamiliar risk for all participants.

Regulatory initiatives to align SPAC listings across different markets are addressing some of the governance weaknesses. The Financial Conduct Authority (FCA) in the U.K. updated its rules for SPACs in July 2021 to strengthen investor protection.

Activist influence has also increased in the last few years. Activist shareholders are demanding better preparation to ensure the maximum possible value from a deal is achieved. Warranties and Indemnities (W&I) insurance may be used within the deal stage to mitigate the risks associated with SPACs; this effort allows the investors the benefit of protection from a myriad of W&Is in the sales and purchase agreement.

Understanding SPACs

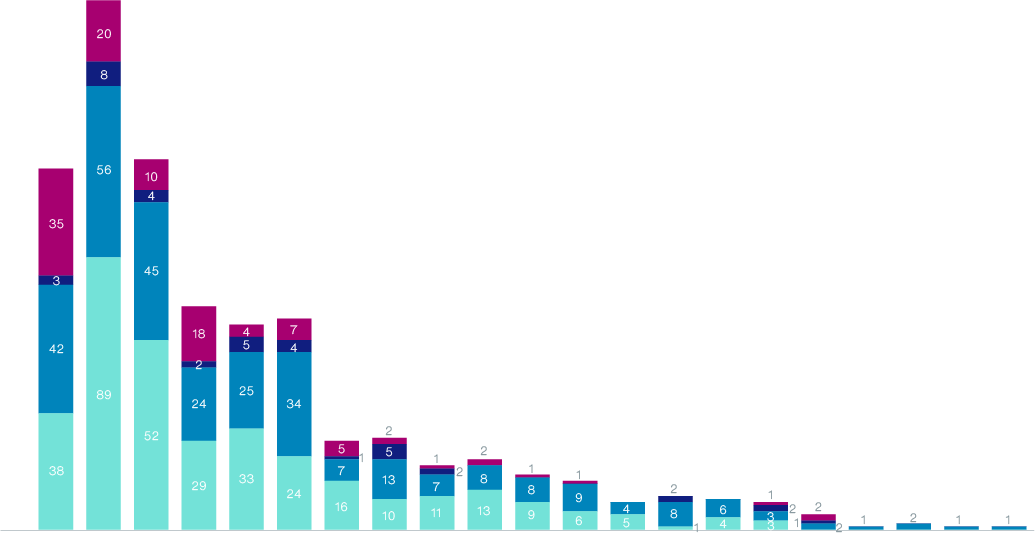

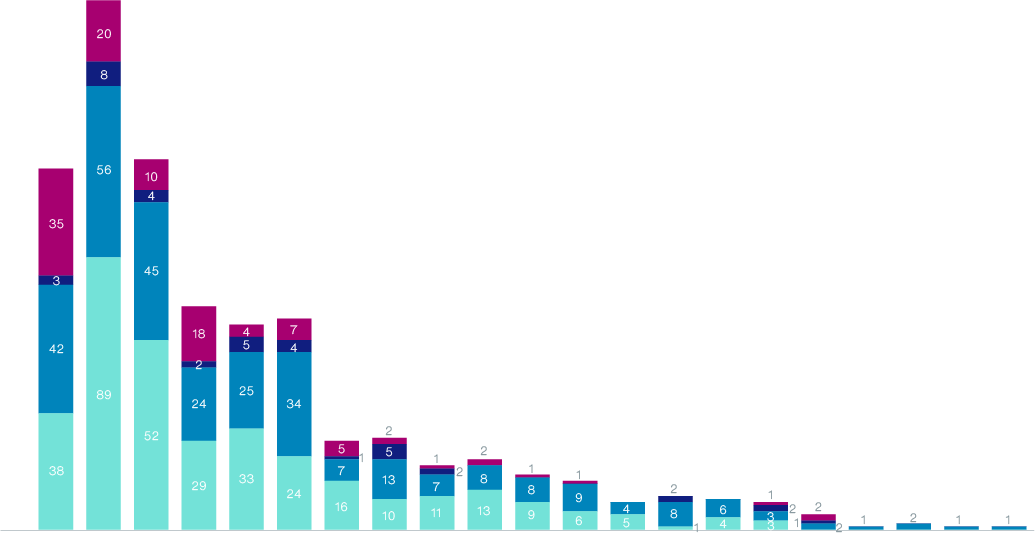

Strong Demand from Corporate Buyers for W&I Insurance Across Most Deal Sizes

Whichever transaction route is selected, assessing IP value and digital risk is essential if an IPO is the chosen divestment route. The likelihood of IP litigation increases by 220 percent when a company decides to embark on an IPO, and when an organization has experienced three lawsuits per year prior to its IPO, it will lose 1.25 percent of its market value to litigation each year.¹

1. Baker Tilly 2021

‘Going-Public’ Risks

Public markets are becoming harder for dealmakers to navigate due to a combination of factors, including the role played by special purpose acquisition companies (SPACs) to increase shareholder activism and more rigorous disclosure requirements – all increasing the complexity of public market transactions for buyers, sellers and investors.

Public Market Transactions

Technology, Media & Telecommunications

Cyber

Corey Green

Head of Strategy & Execution corey.green@aon.com

ESG

John McLaughlin

Chief Commercial Officer, EMEA john.mclaughlin@aon.com

Human Capital

Ik Onyiah

Director, Human Capital Solutions

ik.onyiah@aon.com

There was an accelerated move towards digital during the pandemic, which reinforces the vital relationship between technology and competitiveness. Digitally enabled business models will account for an estimated 70 percent of new value created in the global economy in the next 10 years, according to the World Economic Forum. With digital so central to how businesses operate and drive revenue, buyers need to evaluate the digital assets and capabilities of the companies they have in their sights for acquisition. It’s important to assess how much is manual, how much is automated, and if improvements to efficiencies can be made.

Buyers and sellers should quantify digital performance and assets to ensure their scalability to support growth and resiliency. A forensic examination of the company’s technology operations to gauge the resilience of its platforms is critical. Digital performance assessment should take in a company’s digital KPIs, including the number of active users, platform performance and scalability to achieve business forecasts across existing and future digital channels. The existence of any fraudulent interceptions need to be monitored, and the quality of the company’s source code should be evaluated for IP infringement and maintainability. Businesses are bought to be grown and scaled up, so their systems must be capable of handling more activity.

Uncovering and addressing cyber vulnerabilities is the other critical component of digital assessment. Cyber risks must be identified and managed ahead of transactions, as insuring these risks is becoming more difficult.

The cyber-risk radar is constantly moving and uncovering technology weaknesses or vulnerabilities during due diligence, which could lead a potential buyer to walk away.

A Catalyst for Change

Due to the rapid pace of change in the industry, many TMT organizations recognize that they might have an outdated operating model to meet the changing demands of the sector today. M&A forces a business to rethink its operating model and presents an opportunity to assess its operations to become more relevant to the future trading environment.

1

M&A helps organizations deliver on short term goals and more strategic financial benefits, including rationalization, head office synergies and procurement savings. If managed well, efficiencies can make the combined organization more competitive, and the revenue benefits can also drive improvements in market share.

Making Savings, Delivering Value

2

M&A has the potential to provide new opportunities to retain top talent and acquire new skills and leaders via the integration process, leaving a business with a refreshed leadership team and a more engaged workforce.

Talent Refocus

3

Take

Deals are increasing in complexity. What would have been typically unfamiliar to dealmakers a few years ago – such as intellectual property (IP), environmental, social and governance (ESG) and cyber – are now driving value creation as well as making the deal structure more complex and demanding. Despite the rapidly changing risks, M&A remains a catalyst for change, enabling organizations to evolve their business models and grow in a digital world.

Meredith Jones

ESG

meredith.jones@aon.com

Benoit Geurts

Managing Director, IP Solutions, EMEA

benoit.geurts@aon.com

Intellectual Property Solutions

Will Kier

Head of IP Solutions, EMEA

will.kier@aon.co.uk

Robin Ganguly

Executive Director, Litigation Risk Group

robin.ganguly@aon.co.uk

Nick Moore

Director, Litigation Risk Group nicholas.moore@aon.co.uk

Paul Jeroen van de Grampel

Managing Director, M&A and Transaction Solutions pj.vandegrampel@aon.co.uk

M&A Litigation

Contact Us

Website

Legal

Privacy

Cookie Notice

David Molony

TMT Industry Leader david.molony@aon.com

If you would like to discuss any aspects of these insights, or to better understand our capabilities in this area, please do not hesitate to get in contact with our team.

Talk With Us

Detailed assessments of digital performance are often part of the process of valuing a company’s IP. Like plant and property, a company’s IP (including its data, source code, algorithms and other assets) can be assigned a monetary value. IP valuations can be used to secure loans or other financial benefits if the IP collateral is insured. Termed IP financing is increasingly seen as a viable option for companies to raise capital without diluting their equity stakes. Insuring the collateral gives lenders confidence that the IP has been given a fair valuation.

Undervaluing Intellectual Property at Deal Stage

Find Out More

Section 3

What Can We Do?

Section 2

Why This Is Important

Section 1

Explore the Report

Close

2021 Weather, Climate and Catastrophe Insight

Share the Insights