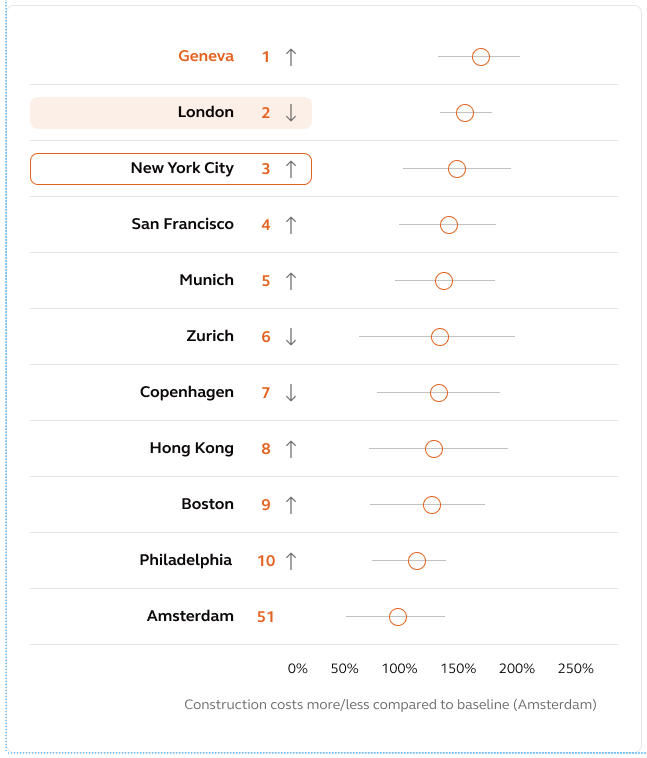

International Construction Costs: Top Cities

London

1

0%

50%

100%

150%

200%

250%

Construction costs more/less compared to baseline (Amsterdam)

London regained its top spot in the ICC index for 2024. Construction output in the capital was down over 10% year-on-year in 2023 but remained above the long-term trend. Housing suffered badly, but was offset by other sub-sectors, including Commercial. Much of this was due to retrofit activity. Orders for new work in the capital have been falling since the end of 2022, accelerating in the last quarter of 2023 as high interest rates impacted scheme viability. Regulatory changes also resulted in design and planning delays, pushing up costs. Sentiment improvement at the start of 2024 could see the market start to recover as the year progresses.

London

Up from 1 last year

Geneva

2

Geneva slipped back to second place in this year’s ICC rankings, swapping places with London. Construction was challenging in Switzerland in 2023, characterized by delays in obtaining construction permits and on-site start-ups, which led to stagnant growth for the year. A response to environmental and regulatory changes has been an increased focus on energy efficiency, the use of ecological materials, and the adoption of digitization to improve project management. The recent positive momentum in data center construction looks set to continue in the year ahead.

Down 1 from last year

Geneva

Zurich

3

Munich

4

New York City

5

Zurich ranks third in the ICC for 2024, up three places in the index from the previous year. Zurich saw tender price inflation of 6.5% in 2023, but this is forecast to fall to 1% in 2024. Construction activity fell by 0.9% in real terms in 2023, according to the Swiss Association of Master Builders, with activity impacted by higher interest rates and increased construction costs. Rises in residential and private civil engineering were offset by declines in commercial and in public building and civil engineering activity.

Up 3 from last year

Zurich

Munich has continued rising through ICC rankings in 2024, up one place to fourth this year. The city saw tender price inflation of 6.5% in 2023 as rising interest rates, increasingly expensive building materials and a very tight labor market took hold. The volume of office space under construction in the city fell by 20% in 2023, although some growth in the city center helped offset the declines in city fringes. Despite the headwinds, the trend for prime space in well-connected locations is encouraging some developers to start construction. However, a raft of property developer failures in 2023, including that of Munich-based Euroboden, highlights the challenges in the German construction market.

Up 1 from last year

Munich

New York slipped two places to fifth in the ICC 2024 index. The city saw tender price inflation at about 2% in 2023, and this is forecast to rise to about 2.6% in 2024 as a tight labor market impacts project deliveries. Mega transportation infrastructure projects continue to fuel the construction sector, aided by sustained investment from the federal government as well as state and city governments. Much of the infrastructure investment and capital program is focused on projects which advance resiliency and sustainability, including the $16 billion Hudson Tunnel Project in New York, dubbed "one of the most significant in the U.S." by President Biden.

Down 2 from last year

New York City

San Francisco is sixth in this year’s ICC rankings, dropping two places from last year. High interest rates and above-trend construction costs led to 2023 being the weakest year for residential construction in a decade with just over 2,000 housing units completed, down 30% from 2022 levels. A $15 billion program of real estate development in the San Francisco Bay area was canceled by Google and Lendlease in November as market conditions worsened. New city and state legislation aims to ease barriers to construction, and authorities will be encouraged by recent plans, including office-to-residential conversion projects in various city regions. Additionally, California’s high-speed rail line was granted $3.1 billion in federal funding, providing new momentum for the ≈ $88 billion project.

Down 2 from last year

San Francisco

Philadelphia rose three places to seventh in 2024 ICC rankings. Tender price inflation was 2.1% in 2023 and could rise to 2.7% in 2024, at current forecasts. Last year saw a continuation of the apartment construction boom in the city, particularly in the multi-unit rental space. Most of the schemes currently under construction were given permission before a change in the city’s housing policy saw the halving of a 10-year property tax abatement for new construction. In the commercial segment, several small-scale office-to-residential conversions are planned. New leadership in the mayor’s office and City Council could likely see new priorities for the CBD in 2024.

Up 3 from last year

Philadelphia

Copenhagen dropped to eighth in this year’s ICC rankings. Tender price inflation fell from 12% in 2022 to just 2.5% last year and is forecast to be just 2% in 2024. Design work is moving forward on the planned new M5 low-carbon metro line in the city. The project will see 10 new stations and is targeting a 50% smaller carbon footprint compared to existing lines. Meanwhile, Copenhagen Airport is spending €670 million to remodel and expand its Terminal 3 building which is due to complete in 2027. In Commercial, the market for sustainable and flexible offices is increasing, with research showing many investors and tenants willing to pay a premium for this.

Down 1 from last year

Copenhagen

Hong Kong slipped down to ninth in the 2024 ICC rankings. Construction activity showed signs of recovery in 2023, with the overall gross value of works performed seeing an increase across both the private and public sectors. Construction inflation was 4% for 2023 and is currently forecast to be 2% in 2024. Efforts to overcome a predicted 40,000-person shortfall in skilled construction workers by 2027 have included an allocation of US$280 million to a construction innovation fund to increase the use of high productivity construction methods, plus the introduction of 12,000 quotas of imported construction workers under the Labor Importation Scheme. These should ease concerns about project delivery and stabilize labor costs.

Down 1 from last year

Hong Kong

Bristol climbed three places to enter the Top 10 in the ICC index for the first time. As with many UK cities this year, the declared average construction inflation of 2% for 2023 will have risen by many factors. In the office segment, for example, BREEAM Outstanding has become the norm for new schemes, albeit at higher costs. About 130 hectares of brownfield land is being developed close to the city’s Temple Meads Station. This will see 10,000 homes delivered along with improved station hub access. Plans have also been submitted for a major mixed-use development on the former Filton airfield site, and permission was secured for building a 17,000-capacity arena at the site.

Up 3 from last year

Bristol

San Francisco

6

Philadelphia

7

Hong Kong

9

Copenhagen

8

Bristol

10

Amsterdam slipped further three places to 65 in ICC rankings for 2024, down from 51 just two years ago. The city saw tender price inflation fall to -1% in 2023, with budget constraints delaying investments in the metro as well as a new bridge over the Ij, the city’s waterfront. New housing construction for the Netherlands shrank by 7% in 2023 as rules about pollution impacted delivery. Amsterdam authorities are seeking to change planning rules to allow more housing in existing neighborhoods, with the ambition to add an extra 90,000 affordable homes by 2035.

Down 3 from last year

Amsterdam

Amsterdam

65

We have identified five key prompts to help clients interrogate their current approach to asset management. These prompts will help clients to identify whether they are considering and acting on all relevant issues that affect long-term returns and asset value.

Discover our action plan to assure the delivery

of fast, complex programs

1

Clarity of purpose

Is the project organization

fit for purpose?

2

Client's role

What tasks must the client undertake to ensure success?

3

Protecting the end date

Is the Day 1 objective driving the program?

4

Enabling effective change

Can the team anticipate and facilitate low-pain change?

5

Assured decision making

Is the right data available to support assured delivery?

Scale-up in response to the level of innovation and size of the task

Build-in resilience to deal with setbacks

Assure the maturity and effectiveness of the client organization including leadership

•

•

•

Focus on leadership, team culture, stakeholders and money

Own the scale challenge and enable the team to manage it

Engage fully in the management of risk — including ownership

where needed

•

•

•

Outcome thinking — define what Day 1 is and identify the critical milestones and end-date sequence

Model program interdependencies to prepare for disruption

Respond to implications of missed dates across the program

•

•

•

Develop a ready-for-change culture – keep it clear and simple

Prioritize assurance over certainty — secure an economic balance

of risk transfer

Understand and transparently report the consequences of change

•

•

•

Use live data and integrated models to break down silos

Invest in data and controls to increase levels of confidence

Avoid paralysis by analysis — trust the direction of travel as well as the detail

•

•

•

Clarity of purpose

Is the project organization

fit for purpose?

Client's role

What tasks must the client undertake to

ensure success?

Protecting the end date

Is the Day One objective

driving the program?

Enabling effective change

Can the team anticipate and facilitate

low-pain change?

Assured decision making

Is the right data available to support

assured delivery?

Geneva returned to first place in this year’s 2023 ICC rankings, swapping with the previous top-spot holder London. Both new orders and order backlog in Switzerland are at very high levels according to the latest index from Credit Suisse. The public sector building segment is set to be boosted by the recent award of the construction permit for the CHF 837m upgrade of the UN’s European headquarters in Geneva. Construction of industrial and logistics hubs and data centers are likely to see positive momentum in 2023.

Up from 2 last year

Geneva

Geneva

Click through this year's top cities to read more about how they ranked. To find out where your city features, download our full report.

5

4

Identify repositioning opportunities

3

Track and adapt to changes in user demand

2

Identify and quantify the full range of risks

5

Build and measure a benefits case

4

Identify repositioning opportunities

3

Track and adapt to changes in user demand

2

Identify and quantify the full range of risks

1

Plan ahead for regulation and governance

Map the local timeline for developments in building design regulation, financial markets and reporting standards, including known changes and likely direction of travel.

Identify changes that will have a material impact on leasing, refinancing or asset valuation – e.g., new carbon intensity standards for loan portfolios.

Build mitigation steps into the long-term renew/reinvest/disposal asset management plan.

•

•

•

Anticipate and follow market trends. Invest in understanding how tenant and user expectations are evolving. Build closer relationships with occupiers using flexible leasing models and opportunities for collaboration.

Use digital technologies to enhance the connection with your occupiers and investors – from BIM and digital twins to apps and virtual environments, use adaptable digital solutions to increase the attractiveness, flexibility, and value of your assets.

Understand how your buildings are used. Develop building intelligence capability including predictive analytics to track and anticipate building performance and user behaviors in real time.

•

•

•

Maximize the value of the location and the site. How will the location develop in the future? Could a change of use enhance value? Can the potential of a site be enhanced through a new approach?

Exploit the strengths of the existing asset – identify opportunities to reuse and extend the existing fabric. Maximize reuse of the fabric to minimize embodied carbon.

Exploit the power of digital modeling to understand all the opportunities over the asset lifecycle. Model the implications of new proposals for future adaptability.

•

•

•

Develop a dashboard of asset performance metrics that support the business case for investment. Combine specification benchmarks and in-use KPIs.

Measure the wider social and environmental value of the asset in its current and future uses. Align to the targets of partners including users and funders.

Acknowledge the value of longevity by highlighting enhancements to asset resilience.

•

•

•

5

Build and measure a benefits case

4

Identify repositioning opportunities

3

Track and adapt to changes in user demand

2

Identify and quantify the full range of risks

5

Build and measure a benefits case

4

Identify repositioning opportunities

3

Track and adapt to changes in user demand

2

Identify and quantify the full range of risks

1

Plan ahead for regulation and governance

•

•

•

Map the local timeline for developments in building design regulation, financial markets and reporting standards, including known changes and likely direction of travel.

Identify changes that will have a material impact on leasing, refinancing or asset valuation – e.g., new carbon intensity standards for loan portfolios.

Build mitigation steps into the long-term renew / reinvest / disposal asset management plan.

Screen across a wider range of risk types and timescales – e.g., climate change, health and well-being, and business risks. Consider risks to 2050 and beyond to account for long-term asset value implications.

Size the big risks – even if they are far in the future. Use the 80:20 rule to focus effort. Identify the mitigation steps that could be taken now with little impact.

Identify no-regret actions that can be taken as a part of planned investment programs to improve risk resilience – e.g., energy efficiency measures to reduce sky-high running costs.

•

•

•

Anticipate and follow market trends. Invest in understanding how tenant and user expectations are evolving. Build closer relationships with occupiers using flexible leasing models and opportunities for collaboration.

Use digital technologies to enhance the connection with your occupiers and investors – from BIM and digital twins to apps and virtual environments, use adaptable digital solutions to increase the attractiveness, flexibility, and value of your assets.

Understand how your buildings are used. Develop building intelligence capability including predictive analytics to track and anticipate building performance and user behaviors in real time.

•

•

•

Maximize the value of the location and the site. How will the location develop in the future? Could a change of use enhance value? Can the potential of a site be enhanced through a new approach?

Exploit the strengths of the existing asset – identify opportunities to reuse and extend the existing fabric. Maximize reuse of the fabric to minimize embodied carbon.

Exploit the power of digital modeling to understand all the opportunities over the asset lifecycle. Model the implications of new proposals for future adaptability.

•

•

•

Develop a dashboard of asset performance metrics that support the business case for investment. Combine specification benchmarks and in-use KPIs.

Measure the wider social and environmental value of the asset in its current and future uses. Align to the targets of partners including users and funders.

Acknowledge the value of longevity by highlighting enhancements to asset resilience.

•

•

•

Click through this year's top cities to read more about how they ranked. To find out where your city features, download our full report.

Back to the chart

Back to the chart

Back to the chart

Back to the chart

Back to the chart

Back to the chart

Back to the chart

Back to the chart

Back to the chart

Back to the chart

Back to the chart

Click through this year's top cities to read more about how they ranked. To find out where your city features, download our full report.

Plan ahead for regulation and governance

Plan ahead for regulation and governance

Track and adapt to changes in user demand

Identify repositioning opportunities

Build and measure a benefits case

The technology and advanced manufacturing sectors are experiencing rapid growth, and the specific nature of new mega-programs within these sectors are expected to pose challenges in the race to market. Drawing on our experience, we’ve outlined key points to guide clients in finding opportunities to boost delivery performance on complex programs, even amid the ever-changing delivery market:

•

•

•

Assured decision making