Practical strategies for navigating the SEC regulatory scheme that investors face when buying, holding, and selling equity securities — written for hedge fund managers and other institutional investors active in the U.S. equity market.

Co-chair of Barnes & Thornburg’s

Private Funds and Asset Management Group

Scott Beal

A year and a half away from the FTX collapse, we’ve seen significant recoveries in bitcoin and other cryptocurrencies. The SEC’s approval of bitcoin ETFs is a big deal for the industry and may also increase the willingness of allocators to make investments in private crypto funds and other nonregulated products.

Barnes & Thornburg’s 2024 Investment Funds Outlook Report

Get the full Barnes & Thornburg Investment Funds Outlook Report

There are numerous instances where incorporating AI could benefit fund managers, from market analysis to automating research processes to simply freeing up managers’ time. It follows that such technologies will have a positive overall impact on fund performance.

Equity Investing Under the U.S. Securities Laws

Navigating the U.S. federal securities laws governing equity investing can be a challenging task. Hedge fund managers, private equity and venture firms, family offices, and other asset managers regularly face questions about reporting thresholds, liquidity restrictions, and enforcement risks. Missteps can result in regulatory risk or lost opportunities.

This comprehensive guide helps you:

download the guide

Get Your Digital Copy of the Guide

Turn Regulatory Complexity Into Actionable Knowledge that Serves Your Investment Program

Nicholas Sarokhanian

Chair, Artificial Intelligence

Practice

Email

Kaitlyn Stone

Partner

Email

Brian McGinnis

Co-Chair, Data Security and

Privacy

Email

Lyric D. Menges

Associate

Email

William Carlucci

Associate

Email

Contributors

A Hedge Fund Manager’s Guide to

Decode complex SEC reporting rules (Sections 13 & 16, Form 13F, large trader reporting)

Evaluate liquidity opportunities under Rule 144, Section 4(a)(1-½), Section 4(a)(7), and Rule 144A

Prepare for unique situations like reorganization securities and tender offers

Anticipate enforcement risks and common pitfalls in compliance

Preview the Insights Inside

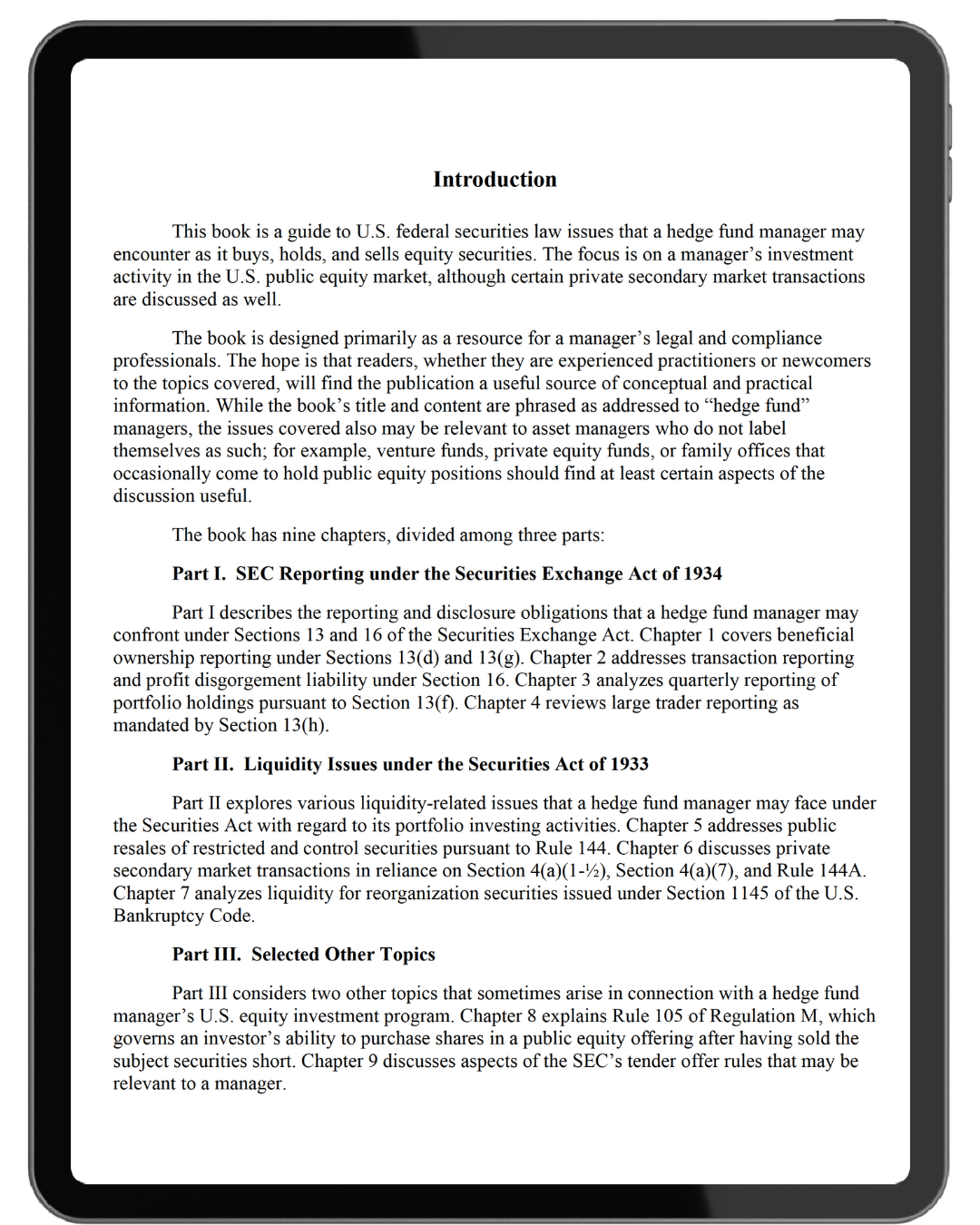

The regulatory environment for investing in the U.S. equity market is dense and fast-moving. Hedge fund managers must comply with SEC reporting requirements, manage liquidity challenges, and anticipate enforcement risks. Many of these same issues also can affect private equity funds, venture funds, and even family offices that occasionally take public positions. This guide translates the complexity into practical understanding and workable strategies.

Highlights from the Table of Contents:

Beneficial Ownership Reporting under Sections 13(d) and 13(g) of the Exchange Act

Transaction Reporting and Profit Disgorgement Liability under Section 16 of the Exchange

Quarterly Portfolio Holdings Reporting under Section 13(f) of the Exchange Act

Large Trader Reporting under Section 13(h) of the Exchange Act

Rule 144: Unregistered Public Resales of Restricted and Control Securities

Selling or Acquiring Securities in Exempt Private Secondary Market Transactions

Liquidity for Reorganization Securities Issued under Section 1145 of the Bankruptcy Code

Rule 105 of Regulation M: Short Selling in Advance of a Public Equity Offering

The Tender Offer Rules as Applicable to Hedge Fund Managers

1

About Scott Budlong

Scott C. Budlong, a partner in Barnes & Thornburg’s New York office, advises private fund managers, family offices, and other market participants on securities regulatory and transactional matters. His career includes leadership roles at a boutique Wall Street law firm and a Fortune 500 company, as well as several years at a leading international law firm. He brings deep experience in guiding clients through complex U.S. securities laws.

take a look

Read the Introduction to the Guide

download the guide

Get Your Digital Copy of the Guide

2

3

4

5

6

7

8

9

Decode complex SEC reporting rules (Sections 13 & 16, Form 13F, large trader reporting)

Evaluate liquidity opportunities under Rule 144, Section 4(a)(1-½), Section 4(a)(7), and Rule 144A

Prepare for unique situations like reorganization securities and tender offers

Anticipate enforcement risks and common pitfalls in compliance