Absorbent Hygiene:

A Look 10 Years Ahead

THE PERSPECTIVES OF 120 INDUSTRY INSIDERS ACROSS THE GLOBE

The world of absorbent hygiene is always in flux, and especially now. From shifting demographics and rapid expansion in various regions and segments to the strong push to be more sustainable, many hygiene professionals see big changes on the horizon.

To get a general sense of the industry’s outlook, we surveyed 120 individuals connected to the absorbent hygiene industry. Respondents came from companies located in 10 countries* across North America, Europe, and Asia Pacific**. They included business managers, buyers, marketers, production team members, sales departments, R&D scientists, and others. Our respondents’ companies ranged in size from under 250 employees to over 5000. What follows are the highlights of these industry insiders’ perspectives for absorbent hygiene over the next 10 years.

EXPECTATIONS FOR MARKET CHANGE

Which segments will grow or decline, and by how much?

Which factors will contribute to this growth or decline?

Which changes do you expect to see for article producers?

What would you be willing to pay more for from your suppliers?

1

2

3

4

5

6

7

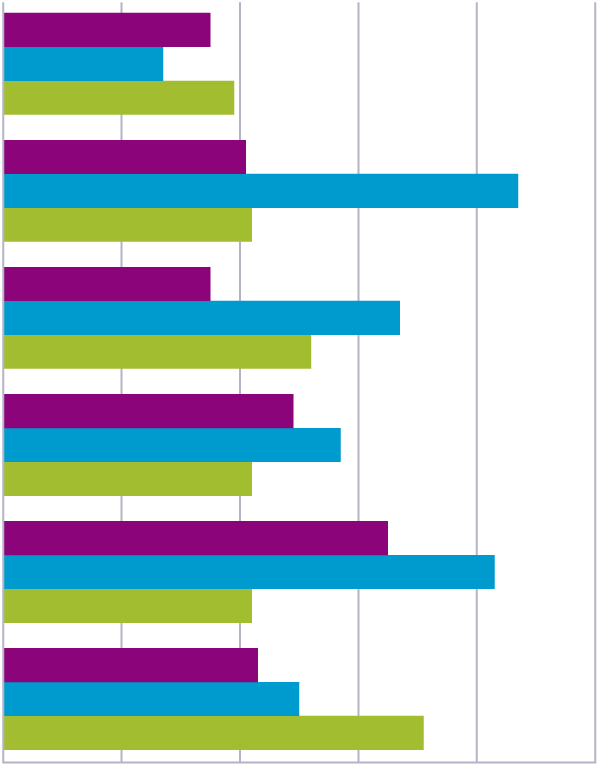

Globally, the only item to garner more than 50% who said ‘yes’ was biodegradable raw materials.

Other sustainable raw materials fell just below 50% who were willing to pay more.

Regionally, Western Europe considered all four options around sustainability to be of more value than did their counterparts elsewhere.

What would you be willing to pay more for from your suppliers?

Key points to note:

Those serving the Asia Pacific region valued a guaranteed supply chain substantially more than their counterparts based in North America and Europe.

Locally-made products were not of high value to any of the regions’ respondents.

However, Materials Engineers/R&D and Business Managers tended to think locally-made products were worth the added expense.

Click to see the data

Click to see the data

Click to see the data

Click to see the data

Materials Engineers/R&D Scientists had the highest rate of saying ‘yes’ to all sustainability categories.

Sustainability Managers seemed to place value on bio-based raw materials (60% answered yes). The other two options, biodegradable and industrially compostable, only garnered 40% each.

What Industry Insiders Are Thinking About

Changing Style

Preferences

Premium Features and Market Share Drivers

Regional Growth

Sustainability

About Bostik Hygiene

Final Take-Aways

68% predicted new players and brands will emerge.

67% anticipated a consolidation of producers.

59% expected more private label/retail brands.

Only 4% expected no change.

Which changes do you expect to see for article producers?

However, for Period Care the economy was ranked in the top three change drivers.

Regulations and E-commerce were considered the least significant factors in all three market categories.

Which factors will contribute to this growth or decline?

The next series of questions looked for the reasons they saw behind these changes. Respondents selected yes or no to Demographics, Economy, Regulations, Ecommerce, Consumer Preferences, and Sustainability.

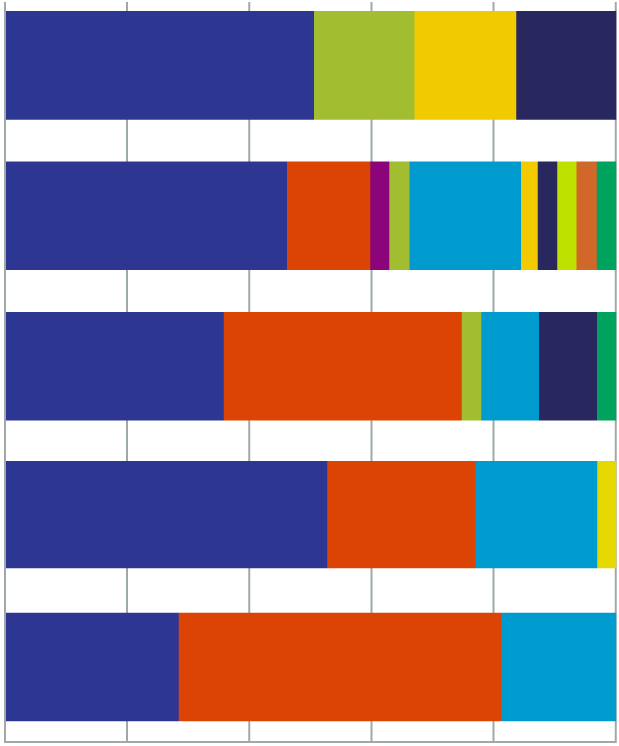

Respondents predicted growth by almost a 4:1 margin for all categories.

However, they varied in the anticipated degree of change, with baby diapers tending toward slightly lower growth expectations.

Which segments will grow or decline, and by how much?

We used a series of questions to understand whether respondents expected growth or decline in baby care, period care and incontinence, and by how much.

Take a closer look at which factors were expected to affect category growth, either positively or negatively.

0

20

40

60

80

100

Guaranteed Supply Security

Biodegradable Raw Materials

Industrial Compostable Raw Materials

Bio-based Raw Materials

Sustainable Raw Materials

Locally Made Products

What Would You Be Willing To Pay More For?

Percent of Respondents

APAC

W. Europe

North America

20

40

60

80

100

20%+

16-20%

11-15%

6-10%

1-5%

1-5%

6-10%

11-15%

16-20%

Over 20%

Incontinence

Period Care

Baby Care

Expectations for Market Change

RESPONDENTS PREDICTING INCREASE OF

RESPONDENTS PREDICTING DECLINE OF

20

0

10

20

30

40

50

60

Percent of Respondents

No Changes

Privitisation

Consolidation

New Players

Expected Changes in Producers

0

10

20

30

40

50

60

70

80

Sustainability

Preferences

E-Commerce

Regulations

Economy

Demographics

Factors Affecting Growth in Baby Care

Increase Significantly

Decrease Significantly

Increase Moderately

Decrease Moderately

0

10

20

30

40

50

60

70

80

Sustainability

Preferences

E-Commerce

Regulations

Economy

Demographics

Factors Affecting Growth in Period Care

Percent of Respondents

0

10

20

30

40

50

60

70

80

Sustainability

Preferences

E-Commerce

Regulations

Economy

Demographics

Factors Affecting Growth in Incontinence

Percent of Respondents

While many in the absorbent hygiene industry expect changes to come, including an increased focus on various aspects of sustainability, over 80% believe that disposable products as we know them will continue to be used. And in fact, just under 80% believe there will be growth in the industry. From there, however, predictions become much more varied.

There was no strong consensus on a wide variety of topics, such as:

Which end-of-life options will be most common, or, indeed, have the greatest chance of success

The one thing that remains clear:

As the industry moves forward, improved corporate social responsibility is likely to remain a point of consideration for companies and consumers alike. By working together, the suppliers and manufacturers can explore options and build a viable path to ever-greater sustainability for the absorbent hygiene industry.

Which raw materials (excluding fossil-based products) do you expect will likely be used in absorbent hygiene products

Click to see the data

What change do you expect to see in reusable products for...?

Click to see the data

What are the top 2 reasons why your organisation is transitioning to more sustainable products?

Click to see the data

Click to see the data

How did COVID-19 affect the following…

What will drive increased market share for successful brand owners?

Click to see the data

How much more will consumers be willing to pay for premium features?

Click to see the data

Click to see the data

What premium features will rise in demand among consumers in 10 years?

What are the most popular incontinence product types now? In 10 years?

Click to see the data

What are the most popular period care product types now? In 10 years?

Click to see the data

Click to see the data

What are the most popular diapers product types now? In 10 years?

Within these regions, where do you foresee the most growth?

Click to see the data

Click to see the data

Which regions do you expect to grow most?

How will the industry change in the next ten years?

The survey began with an open-ended question to learn what topics were on the minds of our 120 respondents. Their responses were divided into 10 overall categories. The top three were:

Bostik delivers smart adhesive solutions simply, consistently, and collaboratively, wherever you are in the world. Applying our deep understanding of the hygiene market, we enable the creation of sustainable absorbent hygiene products, improve consumer satisfaction, and bring value to your operational and business objectives.

Bostik, a subsidiary of the Arkema Group and a global player in specialty adhesives for the construction, consumer, and industrial markets, develops innovative and multifunctional sealing and bonding solutions that have been shaping our daily lives for over 130 years. With annual sales of around € 11.5 billion, a presence in some 55 countries, and 21,100 employees worldwide, the company is committed to meeting the major ecological, energy, and technological challenges through its innovations. It is focused on continuous improvement and operational excellence to meet the expectations of its customers and partners. www.bostik.com

About Bostik, the adhesive solutions segment of Arkema

All information contained herein is believed to be accurate as of the date of publication, is provided “as-is” and is subject to change without notice. This is not a warranty, an agreement, or substitute for expert or professional advice. Bostik, Inc. (“Company”) expressly disclaims and assumes no liability for the use of the products or reliance on this information. It is the sole responsibility of the user to determine the suitability of any products for user’s application(s). NO WARRANTY OF FITNESS FOR ANY PARTICULAR PURPOSE OR ANY OTHER WARRANTY, EXPRESS OR IMPLIED (INCLUDING SUITABILITY FOR USE IN ANY MEDICAL DEVICE OR MEDICAL APPLICATION), IS MADE CONCERNING THE PRODUCTS OR THE INFORMATION PROVIDED HEREIN. The information provided relates only to the specific products designated herein and may not be valid where such products are used in combination with other materials or in any process. The performance of the product, its shelf life, and application characteristics depends on many variables, and changes in these variables can impact product performance. You are responsible to test the suitability of any product in advance for any intended use or application and before commercialization. Nothing herein shall be construed as a license for the use of any product in a manner that might infringe any patent and it should not be construed as an inducement to infringe any patent. Please carefully review the Safety Data Sheet for the product.

The Company adheres to a strict policy that applies to the use of any of its products in medical device applications. This policy can be found at https://www.arkema.com/global/en/social-responsibility/innovation-and-sustainable-solutions/responsible-product-management/medical-device-policy/ which is incorporated herein by reference and made a part hereof. Except as expressly authorized, the Company (i) has designated specific medical grade compositions for products used in medical device applications and Company products not so designated are not authorized for use in medical device applications and (ii) strictly prohibits the use of any of its products in medical device applications that are implanted in the body or in contact with bodily fluids or tissues for greater than 30 days. The Company does not design, manufacture and/or directly sell any medical devices. The Company does not co-design, or offer assistance to any purchaser of its products, in their design, manufacture and/or sale of products for medical devices. It is the sole responsibility of the manufacturer of medical devices to determine the suitability of all raw material, products and components, including any medical grade products, in order to ensure that the medical device is safe for end-use and complies with all applicable legal and regulatory requirements and to conduct all necessary tests and inspections. Published as of December 9th, 2022.

Legal Disclaimer

About

Bostik Hygiene

About Bostik, The Adhesive Solutions Segment Of Arkema

Legal

Disclaimer

UNITED STATES

Wauwatosa, WI

+1 414 774 2250

A dedicated Bostik team where you need it

0

5

10

15

20

25

30

35

40

INDIVIDUALS ON TOPIC

Market Decline

Personalisation

More Competition

No Change

Digitisation

Pricing

Regulations

Innovation

Market Growth

Sustainability

What Industry Insiders Are Thinking About

34%

Sustainability

Growth

28%

Innovation

14%

4% mentioned regulations

Of all the roles, business managers and buyers were most focused on sustainability.

Materials scientists/R&D, on the other hand, mentioned industry growth twice as often as sustainability.

Click to see the data

Which segments will grow or decline, and by how much?

The industry is evolving toward reusable items and a reduced carbon footprint.

Consumers and industries alike appreciate disposable products that produce less pollution and are better for the human body.

Future products will be more humanised.

How will the industry change in the next ten years?

Increase Significantly

Decrease Significantly

Increase Moderately

Decrease Moderately

Increase Significantly

Decrease Significantly

Increase Moderately

Decrease Moderately

The next series of questions asked which regions' respondents expected to see the most growth in general. We followed that up with questions about nations (or groups of nations) within those regions.

What product design changes will be used to make a more sustainable product?

Click to see the data

In 10 years, how do you expect renewable products to affect the market?

Click to see the data

In 10 years, what will be the leading end-of-life solution for AHPs?

Click to see the data

What operational changes will be considered to make a more sustainable product?

Click to see the data

How likely are disposable, absorbent hygiene products to still be used in 10 years?

Click to see the data

What do you see as the biggest challenges to composting and recycling as end-of-life options for absorbent hygiene products?

Click to see the data

How will the industry change in the next 10 years

What products, features, and materials will be in demand

Which types of reusable products would be most popular

North American respondents expected the use of disposable tape-style diapers to decline in favour of reusable pocket and pre-fold styles.

Those in Europe expected both disposable tape and reusable pocket styles to decline, in favour of reusable all-in-one and pre-fold styles.

APAC experts foresaw the use of disposable pant-style diapers to decline, with reusable all-in-one and pre-fold styles rising.

Respondents from smaller companies were more likely to predict a change toward reusable items.

All regions anticipate a shift toward reusable products. However, there are differing opinions regarding which will gain the most ground.

Most reusable diapers fall into one of three categories:

What are the most popular period care product types now? In 10 years?

Respondents in both North America and APAC expected disposable cups to gain market share, along with reusable cloth options.

In addition, these two groups both expected disposable pads to lose market share more than disposable tampons.

Conversely, those based in Europe expected reusable period underwear to steal market share from most other categories.

Respondents from smaller companies were more likely to predict a change toward reusable items.

The anticipated shift toward reusable products was also seen here, with one notable exception.

What are the most popular diapers product types now? In 10 years?

Pre-fold diapers are made from a rectangular piece of absorbent fabric (cotton and bamboo are common), divided into three sections. The middle section is the most absorbent. Pre-fold diapers require the user to fold and secure them in place with pins, fasteners, or diaper covers. They tend to be more affordable and dry quickly.

Respondents based in North America foresaw a rise in the use of pant-style products of both disposable and reusable types.

They predicted a large decline in disposable briefs, and a small decline in their reusable counterparts.

Conversely, their counterparts in Europe and Asia expected both disposable styles to decline, though both expect disposable pants to decline much less.

Experts in both Europe and Asia anticipated the popularity of reusable options to grow.

What are the most popular incontinence product types now? In 10 years?

0

10

20

30

40

50

In 10 Years

Now

Reusable Pocket

Reusable Prefold

Reusable All-in-One

Disposable Tape

Disposable Pant

Diapers in North America

0

5

10

15

20

25

30

35

In 10 Years

Now

Reusable Prefold

Reusable Pocket

Reusable All-in-one

Disposable Tape

Disposable Pant

Diapers in Western Europe

0

10

20

30

40

50

In 10 Years

Now

Reusable Prefold

Reusable Pocket

Reusable All-in-One

Disposable Tape

Disposable Pant

Diapers in Asia Pacific

Period Care in Western Europe

0

5

10

15

20

25

30

35

Reusable Underwear

Reusable Cups

Reusable Cloth

Disposable Cups

Disposable Tampons

Disposable Pads

In 10 Years

Now

0

10

20

30

40

50

Reusable Pants

Reusable Briefs

Disposable Pants

Disposable Briefs

Adult Incontinence in North America

In 10 Years

Now

Adult Incontinence in W. Europe

0

5

10

15

20

25

30

35

40

Reusable Pants

Reusable Briefs

Disposable Pants

Disposable Briefs

In 10 Years

Now

Adult Incontinence in Asia Pacific

0

5

10

15

20

25

30

35

40

Reusable Pants

Reusable Briefs

Disposable Pants

Disposable Briefs

In 10 Years

Now

Other Takeaways:

0

5

10

15

20

25

30

35

40

Reusable Underwear

Reusable Cups

Reusable Cloth

Disposable Cups

Disposable Tampons

Disposable Pads

Period Care in North America

In 10 Years

Now

0

5

10

15

20

25

30

35

40

Reusable Underwear

Reusable Cups

Reusable Cloth

Disposable Cups

Disposable Tampons

Disposable Pads

Period Care in Asia Pacific

In 10 Years

Now

Locally-made products were expected to be the least demanded feature.

Overall, opinions about what consumers will pay more for matched closely with each group’s answers regarding demand.

Sustainable materials were expected to gain share overall compared to other features; in all three regions, just over half of those predicting higher demand.

A similar expectation for end-of-life options was shared by 50% of those based in Europe and Asia Pacific. For those at North American companies, however, only 1 in 3 believed sustainable end-of-life options will rise in demand.

On average, about half believed demand for softness, odour prevention, and increased comfort will rise. However, those working for companies in Europe lagged well behind the others in this estimation.

What premium features will rise in demand among consumers in 10 years?

42% of respondents predicted consumers would be willing to pay no more than 20% extra for these features.

Conversely, more than a third believed they would pay more than 50% extra.

How much more will consumers be willing to pay for premium features?

New premium features were considered a success driver by 60% or more in each region.

Those based in Asia Pacific were almost twice as likely as those in North America to believe better packaging would be rewarded.

At 2:1, Asia Pacific respondents were most likely to predict a sales increase due to biodegradable raw materials.

Conversely, respondents based in North America were more likely than those elsewhere to focus on sustainable raw materials.

Respondents were able to select all factors that they believed applied. Notable items included:

What will drive increased market share for successful brand owners?

Asia was the most popular response when predicting growth potential, followed closely by Europe.

The options were North America, South America, Europe, Africa, and Asia. Respondents were allowed to select more than one.

Which regions do you expect to grow most?

North America

Respondents were allowed to select one or two options.

Within these regions, where do you foresee the most growth?

How did COVID-19 affect the following…

Global Sustainability Goals are the top motivation cited by all regions.

In North America, organisational goals are the second highest.

Western Europe was more likely to mention regulations than other regions.

The APAC region is the most likely to cite consumer demand and regional sustainability goals.

What are the top 2 reasons why your organisation is transitioning to more sustainable products?

Respondents, by a 4:1 margin, expect each of the three categories to show an increase in reusable products.

All three product categories received virtually the same breakdown.

Respondents were asked to make predictions for each of the three major market categories.

What change do you expect to see in reusable products for...?

Cotton was the most popular answer (65% overall).

Mechanically recycled materials were the next most expected (59% overall).

Chemically recycled materials and bamboo tied for third place. (52% overall).

Just under half expect to see banana leaf, hemp, mass balance, PLA, and seaweed as likely (42-48% overall).

Which raw materials (excluding fossil-based products) do you expect will likely be used in absorbent hygiene products

Almost 2/3 believed renewable products will remain a luxury alternative.

Less than 1 in 5 believed renewable products will replace petroleum-based products by 2033.

Slightly more than 1 in 5 anticipated no real change.

In 10 years, how do you expect renewable products to affect the market?

Repairable, partially disposable, and smaller products ranked very low (25-28%).

North America respondents led the group in selecting recyclable packaging, reusable products, and more efficient/longer use.

Conversely, those based in Asia Pacific were more likely than their counterparts elsewhere to consider reusable packaging, bulk packaging, thinner, smaller, and partially disposable products as likely design changes to improve sustainability.

What product design changes will be used to make a more sustainable product?

The top responses are:

What operational changes will be considered to make a more sustainable product?

Respondents each ranked the options 1-6. Results are based on a weighted average.

In 10 years, what will be the leading end-of-life solution for AHPs?

Interesting quotes

What do you see as the biggest challenges to composting and recycling as end-of-life options for absorbent hygiene products?

82% of respondents believed it likely that disposable products will still be used in 10 years.

More said ‘somewhat likely’ than those who believed it was ‘very likely’.

Only 4% rated it very unlikely.

How likely are disposable, absorbent hygiene products to still be used in 10 years?

Every respondent within one of these countries selected their own nation.

(Only 44% of survey participants responded.)

Europe

Respondents each selected only one region.

Africa

Respondents were allowed to select one or two options. Those who responded were the same individuals who predicted high growth in Africa.

South America

Respondents were allowed to select one or two options.

Chile

Paraguay

Peru

Asia

Respondents were allowed to select one or two options.

0%

20%

40%

60%

80%

100%

TOTAL GROUP

Digitisation

Innovation

Regulations

Personalisation

Sustainability

Growth

More Competition

Pricing

Decline

No Change

N/A

Other

Sustainability

Sales

Ops/Production

Materials/R&D

Marketing

Buyer

Business Manager

Respondents in companies with 1001-5000 employees had the highest focus on sustainability. Those with 250 or less and 251-500 were not far behind.

Employees of the largest companies were more likely to focus on growth than any other group, followed by those in the 501-1000 range.

Other Takeaways:

0

20

40

60

80

100

5000+

1001-5000

501-1000

250-500

1-250

Digitisation

Innovation

Regulations

Personalisation

Sustainability

Growth

More Competition

Pricing

Decline

No Change

N/A

*For simplicity, this report will treat all respondents as if they reside in the same country where the company for which they work is based.

**We recognise that certain regions are not represented in the response pool. Despite this data gap, we nonetheless find value in the results we received.

All-in-One (AIO) diapers are designed for maximum convenience. They consist of a waterproof outer layer and an absorbent inner layer, bonded together. While they are the the simplest to use, they can take longer to dry after washing.

All-in-One (AIO) Diapers

Pre-fold Diapers

Pocket Diapers

Pocket diapers consist of a waterproof outer shell with a moisture-wicking inner layer with a pocket designed to hold absorbent inserts. Typical insert materials include microfibre, bamboo, and hemp. Adding or removing layers allows the caregiver to customise absorbency to suit the baby’s absorbency needs. The trade-off for this flexibility is the added time to ready the diaper for use.

Number of Respondents

MEXICO

Naucalpan de Juarez

+52 55 21 22 72 50

BRAZIL

Sao Paulo

+55 11 3622 1979

ARGENTINA

Buenos Aires

+54 11 4784 6464

THE NETHERLANDS

Roosendaal

+31 165 590 590

EGYPT

Cairo

+20 2 3828 9100

CHINA

Shanghai

+86 21 60763100

JAPAN

Futamata, Yao, Osaka

+81 729 48 8286

Moderate and significant increases were by far the most common answers in all categories.

In each category, less than 12% of respondents noted a decrease of focus within their organisation.

57%

47%

43%

42%

31-36%

More efficient for longer use

Recyclable packaging

Reusable packaging

Reusable products

Thinner products and bulk packaging

In all regions, the top three were (#1) recycling, (#2) biodegradation, and (#3) industrial composting.

Respondents in Europe and APAC ranked home composting as #4.

North Americans overall placed landfill as #4.

Incineration was #5 by all regions.

Interesting responses for ‘other’ included:

For this open-ended question, we reviewed responses and divided them into seven basic categories.

Process complexity was the most selected answer, by nearly a 2:1 margin over the second-place option.

The difficulty in gaining public participation was cited next most often, again by a 2:1 margin over all other options.

Inconsistencies in the recycling line due to a long chain of third-party players that will have to work together to ensure all waste material reaches the composting and recycling streams.

One unexpected thought shared regarding alternatives that might be used instead:

0

20

40

60

80

100

95

90

85

80

75

70

65

60

55

50

45

40

35

30

25

20

15

10

5

UPCHARGE (%)

PERCENT OF RESPONDENTS

Respondents

At Least

How Much More Will Consumers Pay for Premium Features?

0

10

20

30

40

50

At Least 75% More

50-70% More

25-45% More

5-20% More

PERCENT OF RESPONDENTS

How much more will they pay?

0

10

20

30

40

50

60

70

80

Increased Comfort

Better Odour Prevention

Locally-made Products

Softer Products

Sustainable End-of-life Options

Sustainable Materials

APAC

W. Europe

North America

What Premium Features Will Rise in Demand?

0

10

20

30

40

50

60

70

80

New Premium Features

Better Packaging of Disposable AHPs

Increased Use of Biodegradable Raw Materials

Increased Use of Sustainable Raw Materials

APAC

W. Europe

North America

What Will Drive Success?

Many seemed unaware of the growth potential in Africa and India which is predicted by Euromonitor and others in the industry. However, this may be an artifact of our response pool’s focus in other regions.

87%

United States

49%

Canada

Breakdown by Respondent's Role

Breakdown by Company Size

...more policies set by the [U.S.] federal government in regards to the materials we use to make our product

0

20

40

60

80

100

Significant Increase

Moderate Increase

Moderate Decline

Significant Decline

Awareness of Circular Economy

Developments in Regulation

Innovation

Consumer Environmental Awareness

Organisational Focus

20

COVID-19's Impact on Key Areas of Focus

0

10

20

30

40

50

60

70

80

APAC

W. Europe

North America

My Organisation Is Not Transitioning

Organisational Goals

Regional Sustainability Goals

Global Sustainability Goals

Regulations

Consumer Demand

Top 2 Reasons for Making More Sustainable Products

0

20

40

60

80

Reusable Incontinence

Reusable Period Care

Reusable Diapers

Significant Increase

Moderate Increase

Moderate Decline

Significant Decline

20

Forecast for Reusable Products

0

10

20

APAC

W. Europe

North America

30

40

50

60

70

80

Chemically Recycled

Mechanically Recycled

Mass Balance

Banana Leaf

Bamboo

PLA

Seaweed

Hemp

Cotton

Considered Likely or Very Likely, by Region

61%

17%

17%

6%

The Renewable Market Will...

No Change, Due to Convenience

No Change, Due to Comfort

Replace Petroleum Raw Materials

Remain a Premium Alternative

0

APAC

W. Europe

North America

10

20

30

40

50

60

70

80

Reusable Packaging

Recyclable Packaging

Bulk Packaging

Repairable

Reusable

More Efficient/Longer Use

Partially Disposable

Thinner Products

Smaller Products

Product Design Changes for Improved Sustainability

0

APAC

W. Europe

North America

10

20

30

40

50

60

70

Local Production

Smaller Operational Footprint

Reusing Spoiled Products

Reusing Scrap

Decreased Waste/Scrap

Renewable Energy

Energy Efficient Equipment

Operational Changes That Will Be Considered

-50

-40

-30

-20

-10

0

10

20

30

40

50

60

70

80

Landfill

Incineration

Home Compost

Industrial Compost

Biodegrade

Recycle

Most likely End Of Life

0

5

10

15

20

25

30

Lacking Technology

Cost

True Sustainability

Infrastructure

Health Concerns

Public Participation

Process Complexity

Leading Challenges to Recycling and Composting

0

10

20

30

40

50

Very Unlikely

Somewhat Unlikely

Somewhat Likely

Very Likely

Disposable Absorbent Hygiene Products in 10 Years

19%

Mexico

(Only 51% of survey participants responded.)

(Only 18% of survey participants responded.)

(Only 17% of survey participants responded.)

49%

Canada

16%

Northern Europe

5%

Eastern Europe

79%

Western Europe

53%

North America

20%

South America

61%

Europe

63%

Asia

21%

Africa

7%

North Africa

4%

Western Africa

7%

Southern Africa

48%

East Africa

43%

Middle Africa

(Only 53% of survey participants responded.)

44%

Southeast Asia

41%

South Central Asia

13%

Central Asia

5%

Western Asia

68%

East asia

30%

Brazil

45%

Argentina

Bolivia

Ecuador

SurinamE

Venezuela

Colombia Guyana UrUguay

ColOmbia

Guyana

UrUguay

Bolivia

Ecuador

SurinamE

Venezuela

Chile

Peru

Paraguay

<15%

15%

20%

Respondents from Eurpoean companies in general predicted less growth across all three categories than their counterparts based elsewhere.

We also examined whether there was a difference in response based on the respondent's region.

Currently, the market penetration rate shows that customers are focusing on customised products, which can also boost the market in the future.

Greater focus on product sustainability, breakthroughs in absorbent materials

Disposable hygiene will become dissolvable items, thus saving on waste

Honestly, I really don't expect to see any type of changes in the market

Sterilisation of bacteria and viruses in the recycling process is a challenge

The main challenge companies and municipalities face when considering recycling options is establishing and planning for the infrastructure to collect and separate the waste.

The most challenging part of recycling and breaking down is the energy it produces, which creates more emissions in the environment.

0

20

40

60

80

100

Incontinence

Period Care

Baby Care

Percents Predicting Growth, by Region

APAC

North America

W. Europe

Sustainability and Personal Preferences were in the top three for all product categories.

Demographics were considered a leading factor for both Baby Care and Adult Incontinence, completing the top three.

Respondents could choose one or more of the following categories: locally made products, sustainable raw materials, bio-based raw materials, industrial compostable raw materials, biodegradable raw materials, and guaranteed supply security.

Key points to note:

See Question 3 in this Section 'How much more will consumer be willing to pay for premium features?' for more information.

1. Their organisation’s focus on sustainability

2. Consumer environmental awareness

3. Innovation

4. Developments in Regulation

5. Awareness of the Circular Economy

Respondents were invited to give their opinion in five categories:

?

?

?

?

A groundbreaking substance that can be applied directly to fabric

Pick-Up Service

Partial recycling/partial composting

Anaerobic digestion/conversion to fuel

©2023 Bostik, All rights reserved MT-23C16

FOLLOW US

Decreased scrap/waste

58%

Renewable utilities/energy

55%

Energy efficient equipment

52%

Reusing scrap

48%

Sustainability Continued

Contact Us

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE

MENU

MENU

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE

MENU

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE

MENU

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE

MENU

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE

MENU

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE

MENU

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE

MENU

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE

MENU

About Bostik

Take-Aways

7

Sustainability

6

Regional Growth

5

Premium Drivers

4

Product Styles

3

Market Changes

2

What Industry Insiders Are Thinking About

1

Home

CLOSE