BTVisual: Joanna Lum, Chaytanya Bandishte

The trouble with

pricing carbon

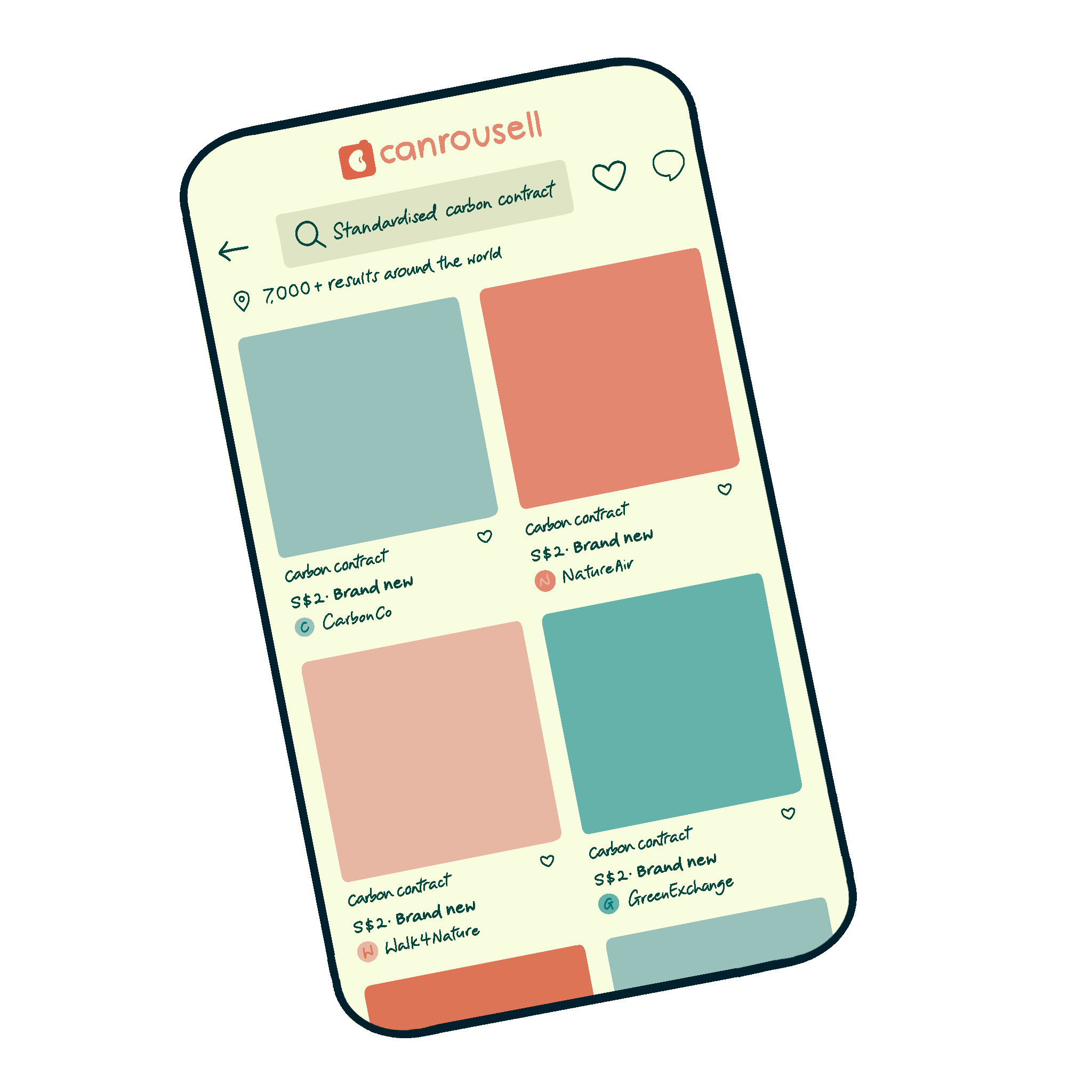

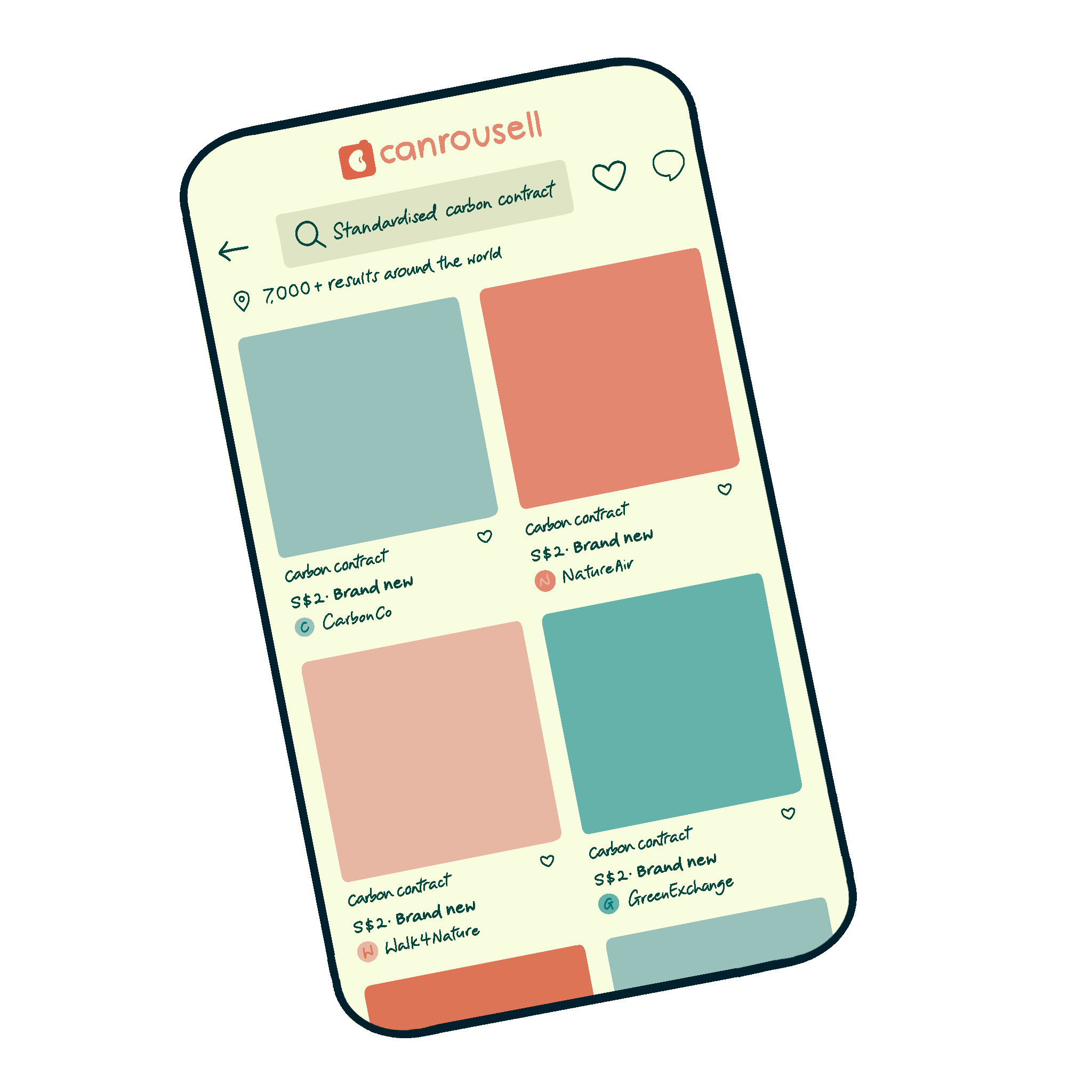

Prices of voluntary carbon credits are all over the place, and the market has yet to agree on a common benchmark. With Singapore’s Climate Impact X being the latest to offer a solution, The Business Times spills the beans on the carbon markets’ price problem.

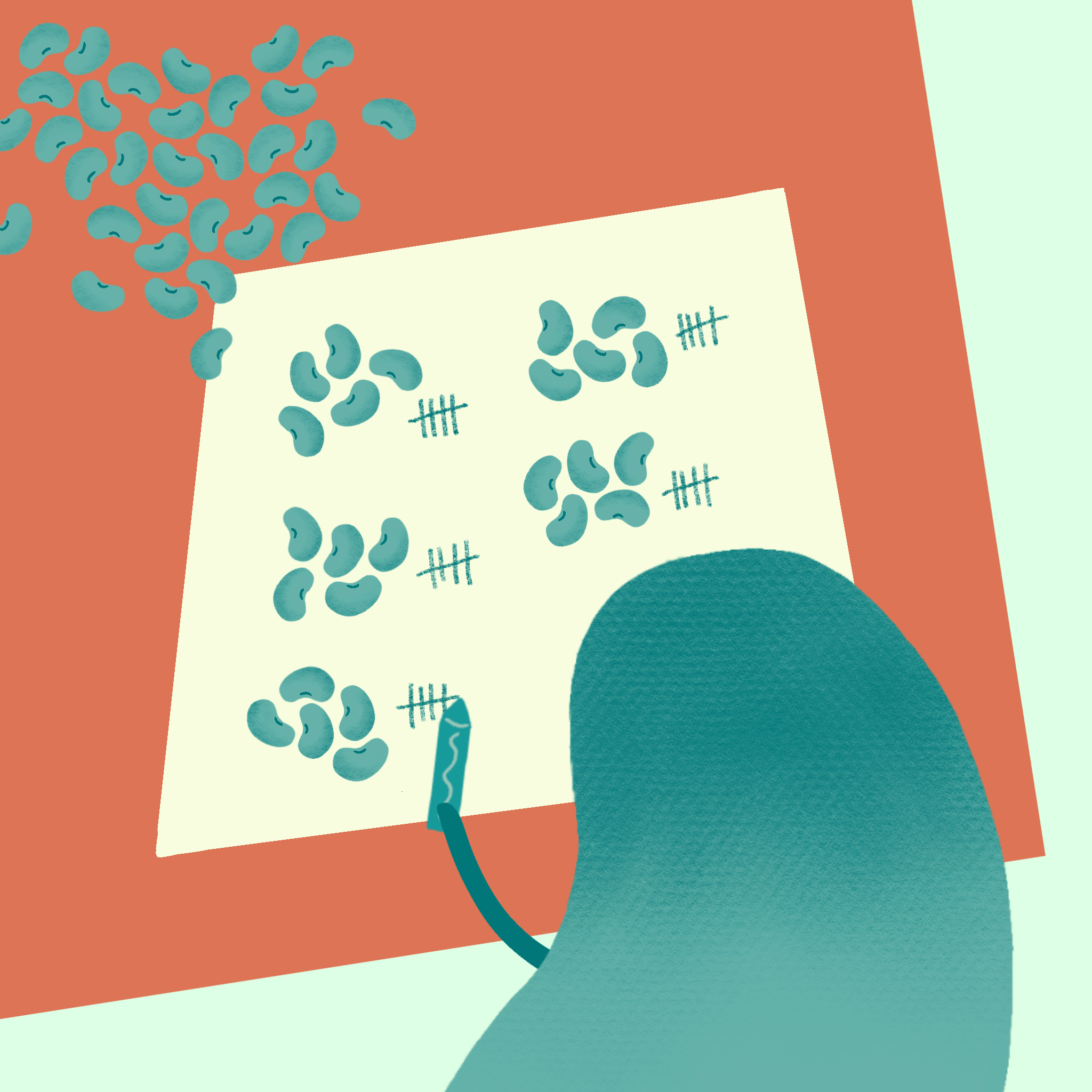

But no one knows how much each credit is worth because there are so many different kinds.

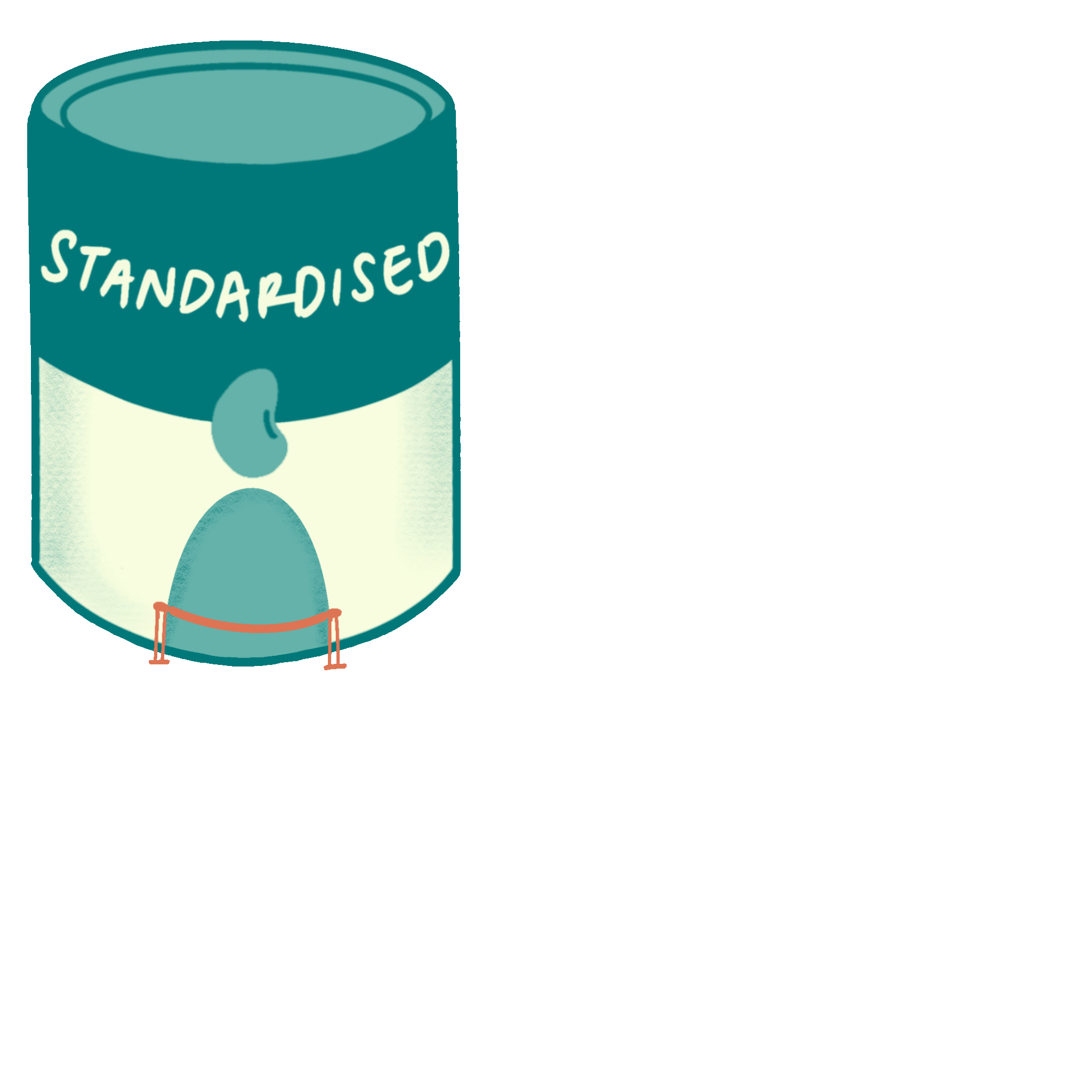

The commodities markets have a solution called a standardised contract that helps price discovery.

There are a lot of credits out in the world, and a lot of companies that want to buy them to offset the companies’ carbon footprints.

In theory, if we know that every bundle is alike, we can trade them and figure out their market value.

In the case of carbon contracts, that means making sure every credit in the bundle has the same issuance year (vintage),

the same method of removing carbon (nature or tech-based),

and the same quality assurance (verification).

But the voluntary carbon markets haven’t settled on a benchmark. As it turns out, the quality of a carbon credit depends on many more factors than vintage, methodology and verification. Location, for instance, matters too.

Existing contracts are hard to price because there’s still so much variation in the value of each credit within the bundle.

Climate Impact X (CIX), a carbon exchange started by DBS, Singapore Exchange, Standard Chartered and Temasek, thinks it’s figured out how to create a benchmark contract.

The contract is for nature-based projects that are aligned with the United Nations framework on Reducing Emissions from Deforestation and Forest Degradation in developing countries, or REDD+.

CIX says its new Nature X contract meets four key criteria.

The first is that the contract represents only credits from sizeable projects. The projects underlying Nature X account for close to two-thirds of all global REDD+ market volumes.

Next, these projects are well-known to market participants, and widely rated by major independent carbon rating agencies.

Finally, standalone credits from the projects should have already been actively traded in the spot market.

Also, the projects must not feature any non-standard characteristics.

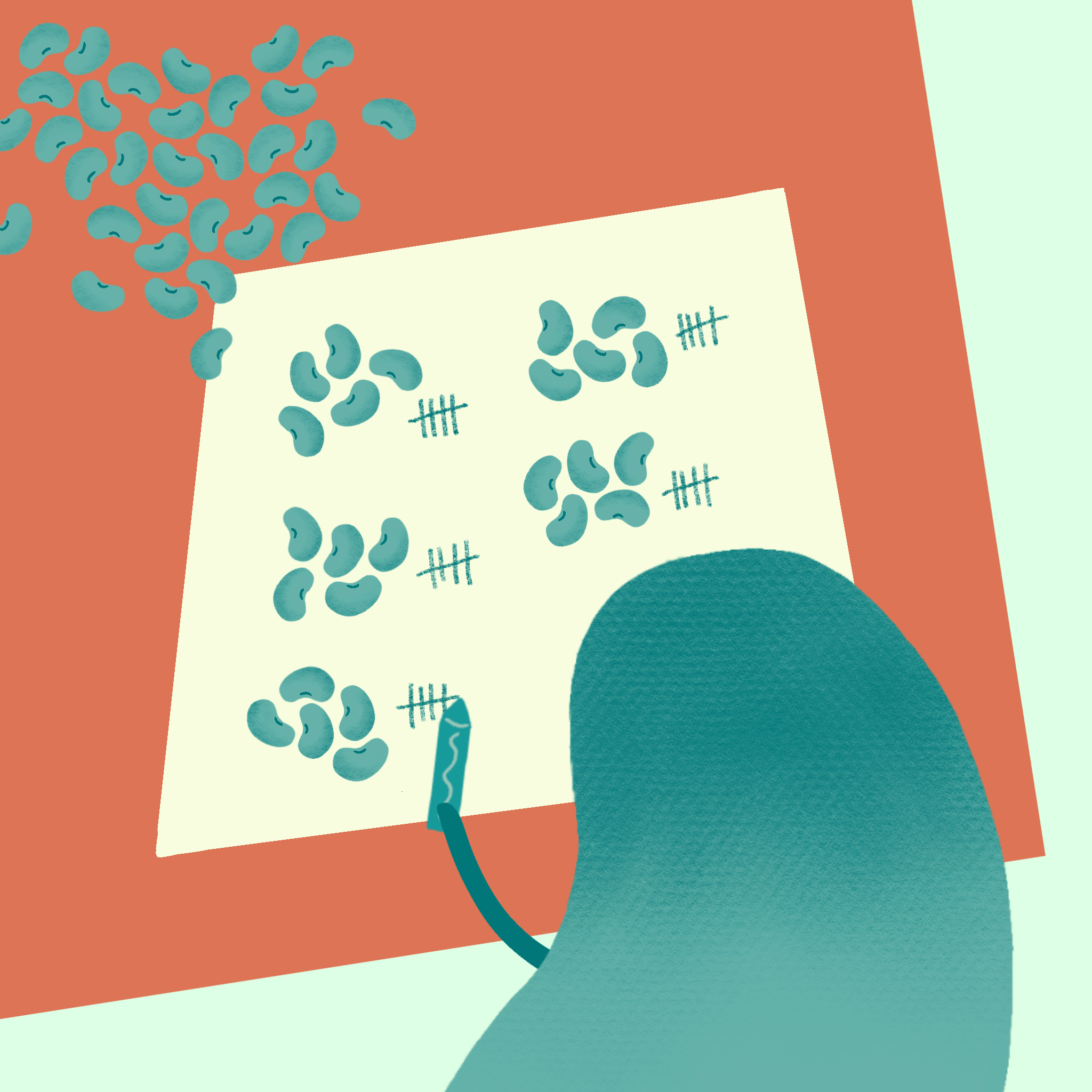

Has CIX cracked the code? It’s anyone’s guess at this time, but one thing’s for sure: There’s a lot of money in being the benchmark, and whoever takes the prize will have some happy bean counters.

Illustrations: Natalie Tan

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

This is a voluntary carbon credit.

If a contract becomes popular enough, it becomes a benchmark that everyone else can use as a price reference.

The way it works is, you create bundles of things that are alike, kind of like beans in a can.

The way it works is, you create bundles of things that are alike, kind of like beans in a can.