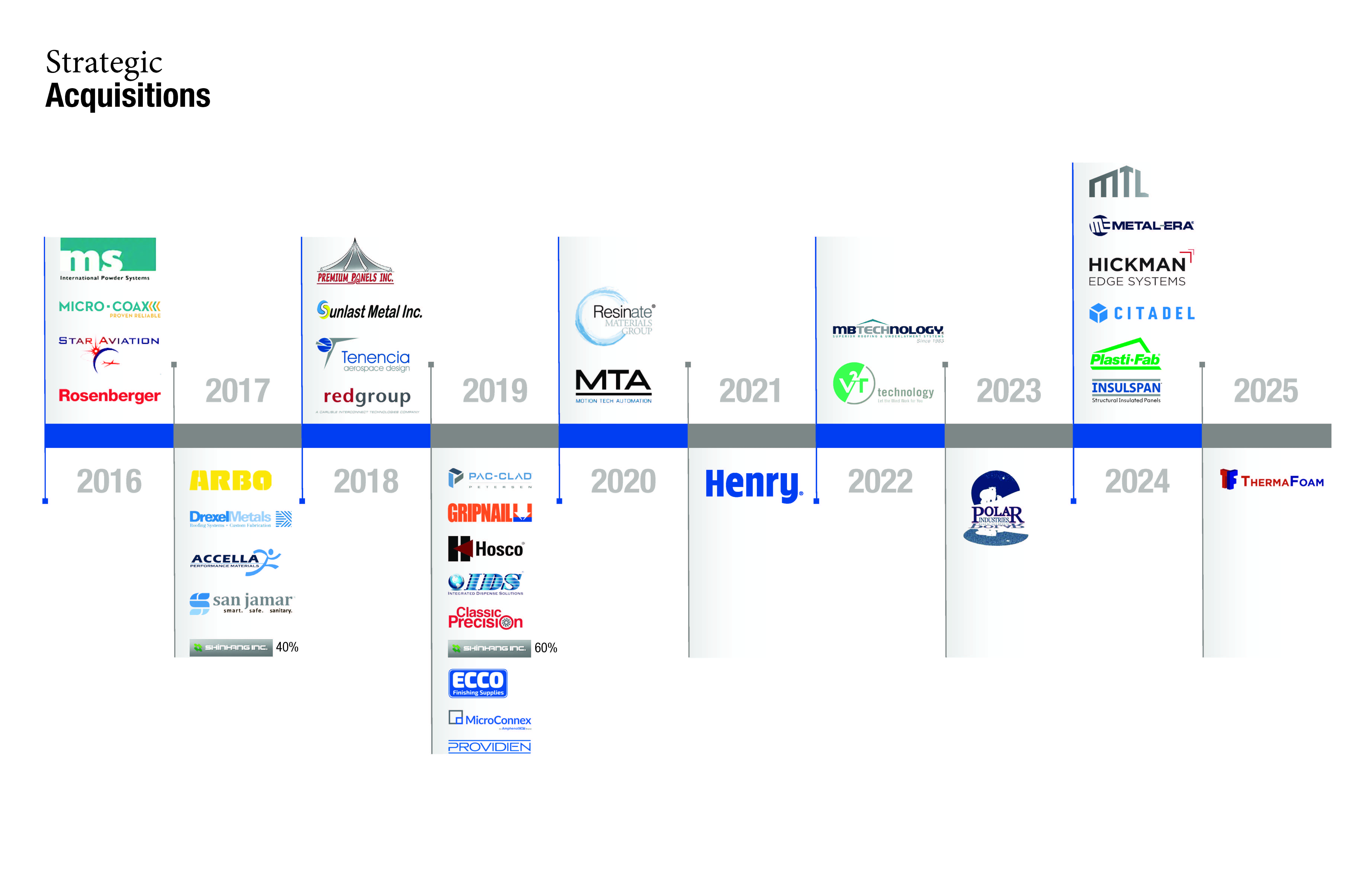

Strategic Acquisitions

Disciplined M&A to Enhance Our Building Envelope Businesses

A Drexel Metals roof on the Hershey Gardens Conservatory, Hershey Gardens, PA

$8 Billion

Revenue

20%

Operating margins

15%

ROIC

A Decade of Acquisitions

Click on a company to learn more

2021

2017-2019

2017

Asset Overview

Total Addressable Market

Expected Market Growth

Highlights

Exceeded target $30M synergies

Attractive secular growth given spray foam’s higher insulation properties

•

•

•

COS continues to drive margin expansion

•

Integration into CWT segment underway

•

Taking share in highly fragmented market

•

Expanding geographic reach

•

Expanding ~20% EBITDA margin

•

Excellent complement to energy-efficient solutions

•

Achieving both cost and revenue synergies with core single-ply roofing operations

Spray Foam Insulation

Growing High-Single Digit

$4B market

Architectural Metal

$5B market

Growing Mid-Single Digit

Weatherproofing Technologies

$5B market

Growing Mid-Single Digit

•

Synergies ahead of $30M target

•

EPS accretion now $1.50+, above initial $1.25 target

•

Henry established new Weatherproofing Technologies (CWT) segment

•

Seeking complementary M&A

Our Approach to M&A

M&A Criteria

Our Approach to M&A

Carlisle's well-defined M&A playbook will continue to drive significant returns on deals and provide a strategic competitive advantage.

We aim to maximize value creation by employing a disciplined integration process while ensuring acquisition targets align strategically, leveraging our M&A playbook, and adhering to our key M&A investment criteria.

Our Approach to M&A

Recent History

Results

M&A Criteria

A solid organic growth story already underway in the target company

A talented management team

Identified and meaningful cost synergies

The ability to add value through integration with our proven M&A playbook

M&A Criteria

Recent History

Since 2008, we have deployed over $6 billion into over 30 acquisitions.

During that time, we have evolved our strategy from one prioritizing diversification to weather varying cycles and ensure consistent growth, to one that applies a returns-based focus to capital deployment.

Recent History

Results

We continue to simplify our portfolio under Vision 2025. The 2021 acquisition of Henry Company and divestiture of Brake & Friction are consistent with Carlisle's Vision 2025 strategy to streamline the portfolio with a focus on investing in high returning assets and to generate in excess of $15 of earnings per share.

Results