Alternative Asset

Class Rankings

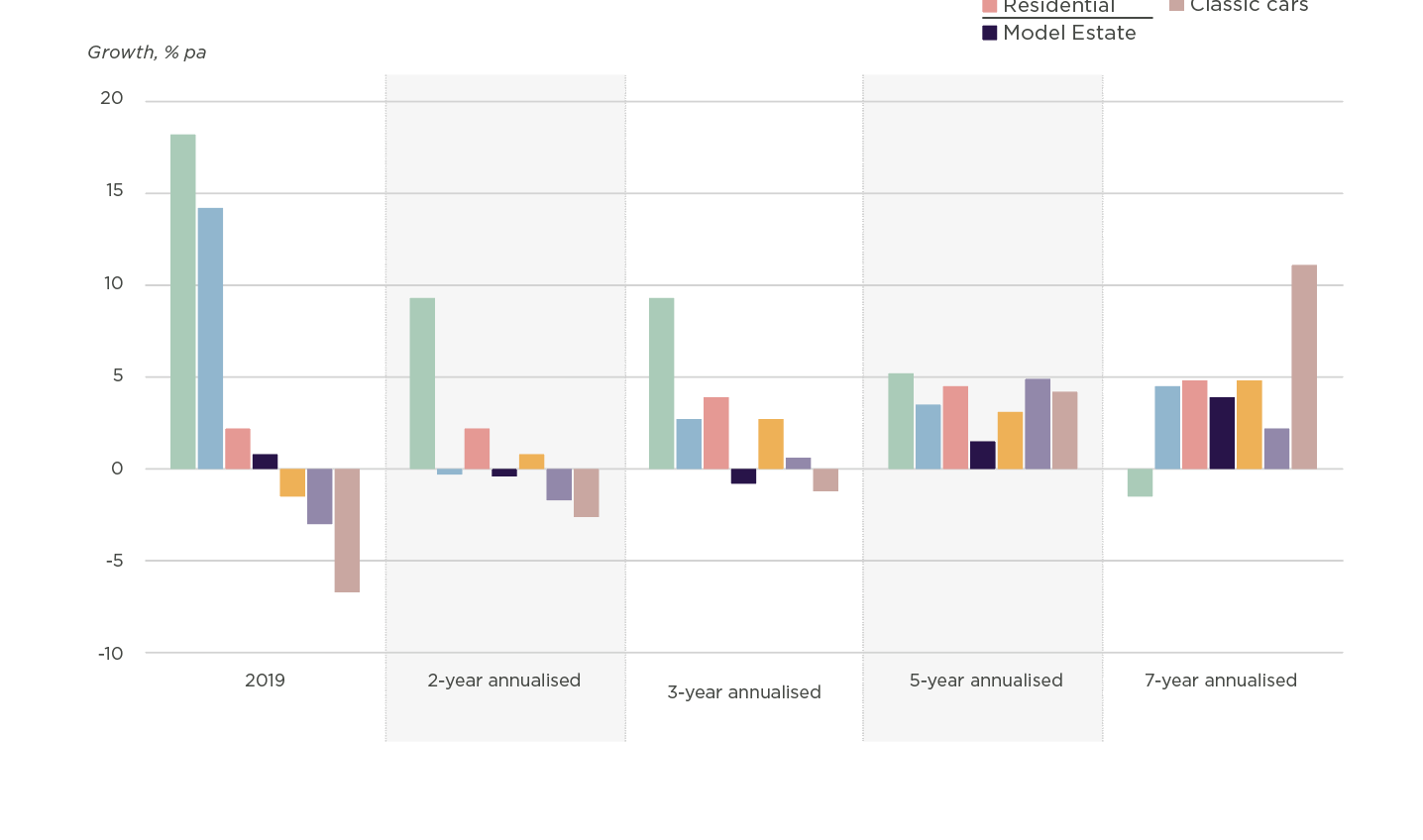

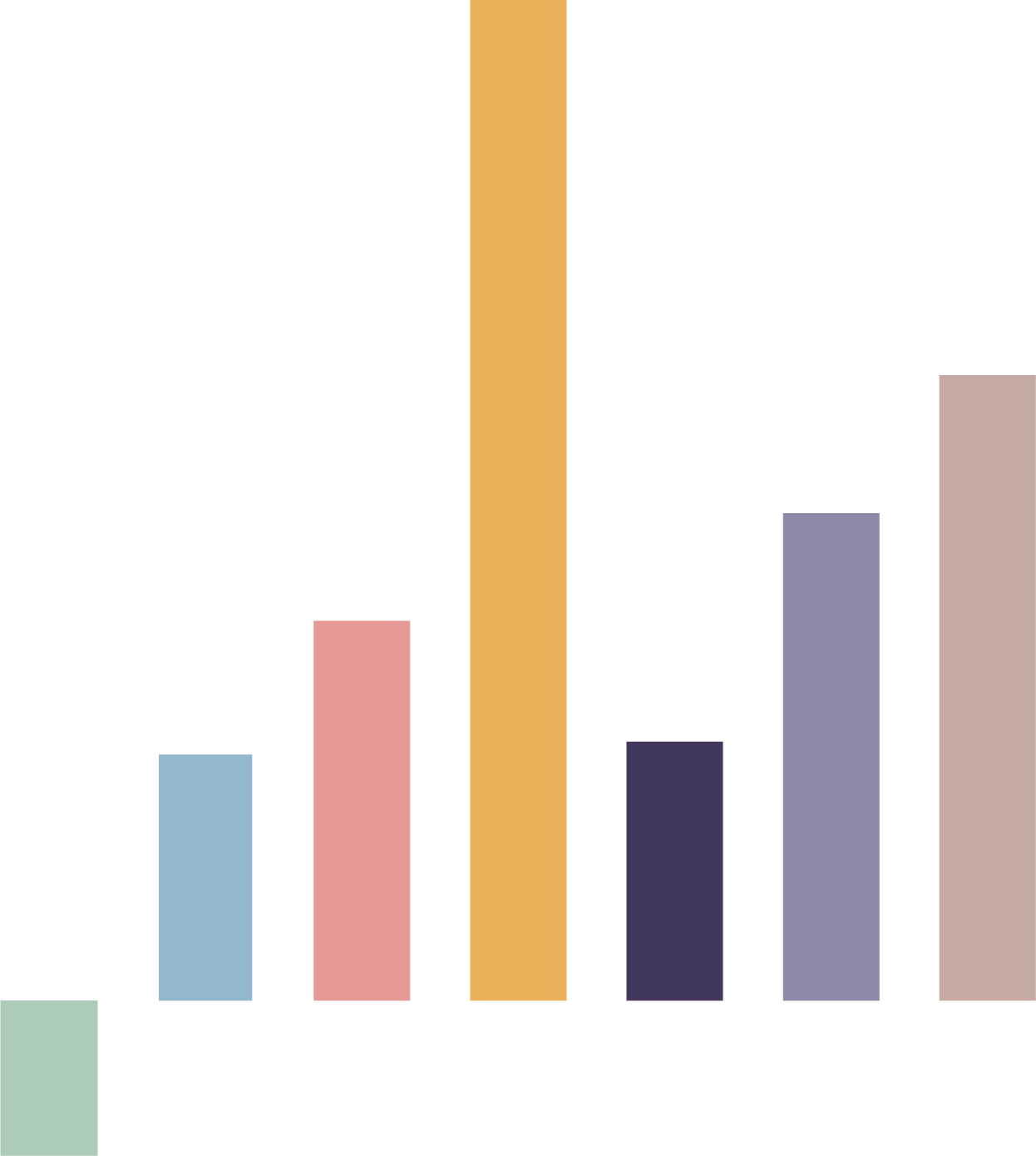

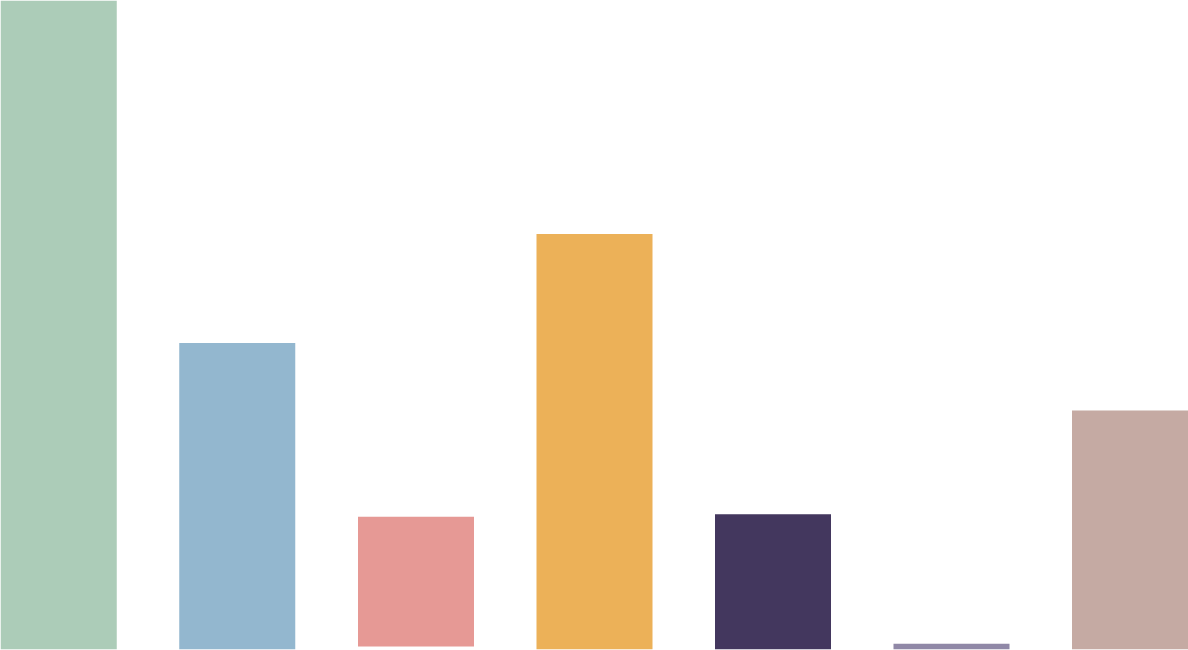

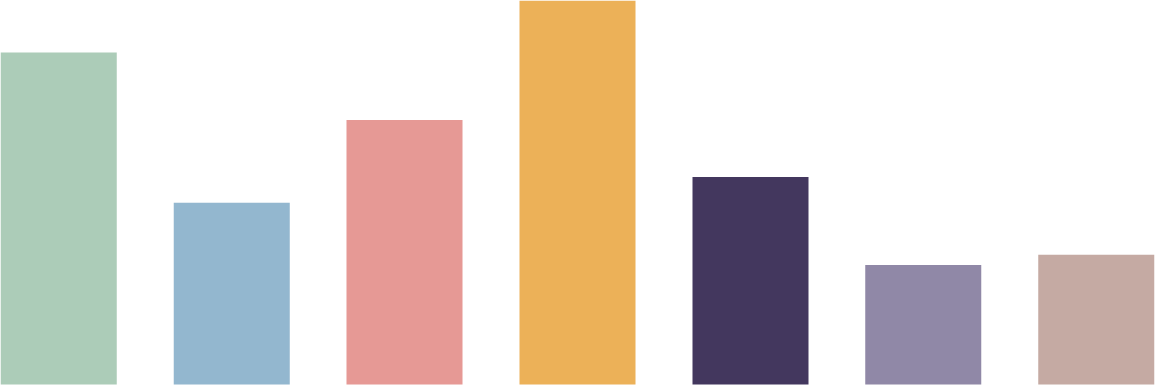

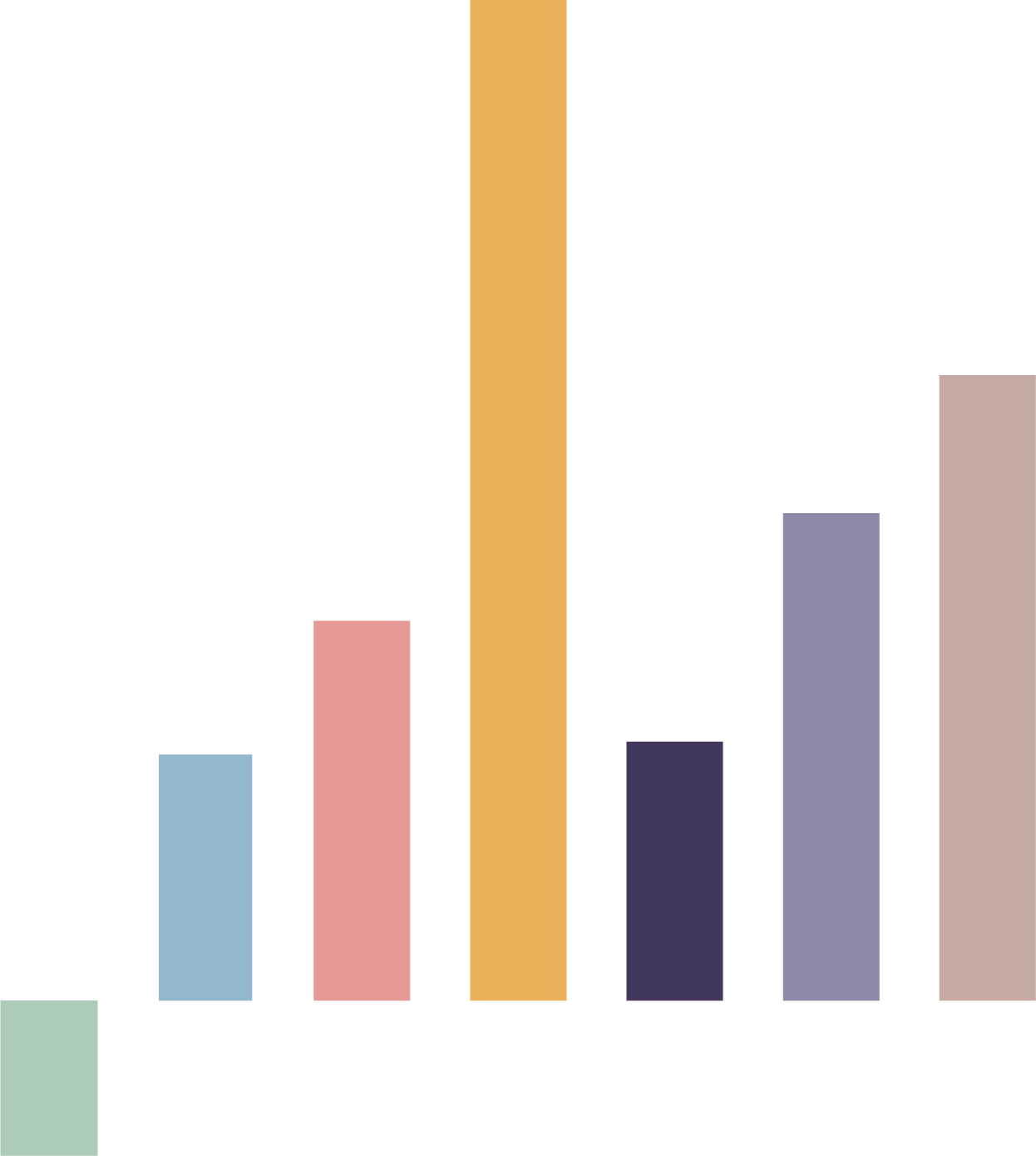

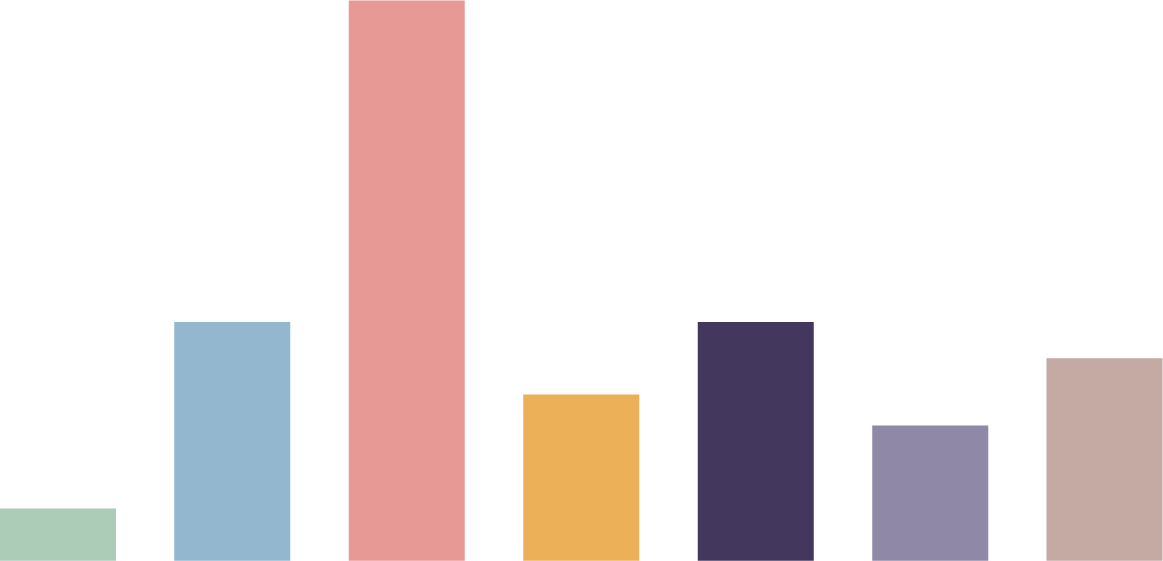

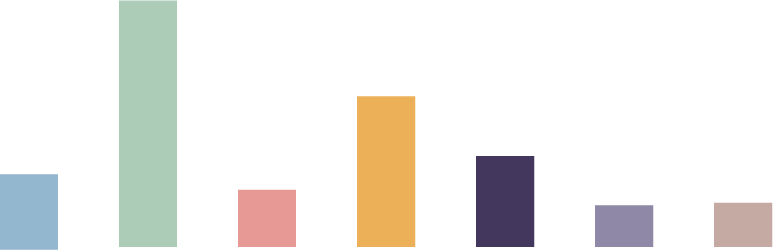

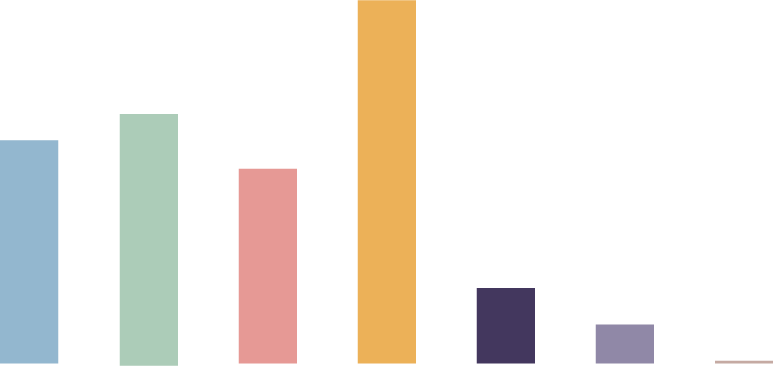

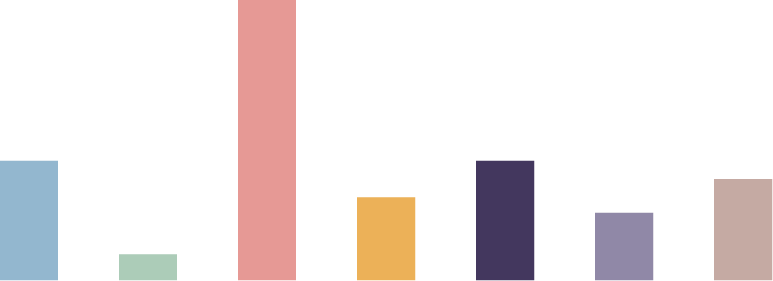

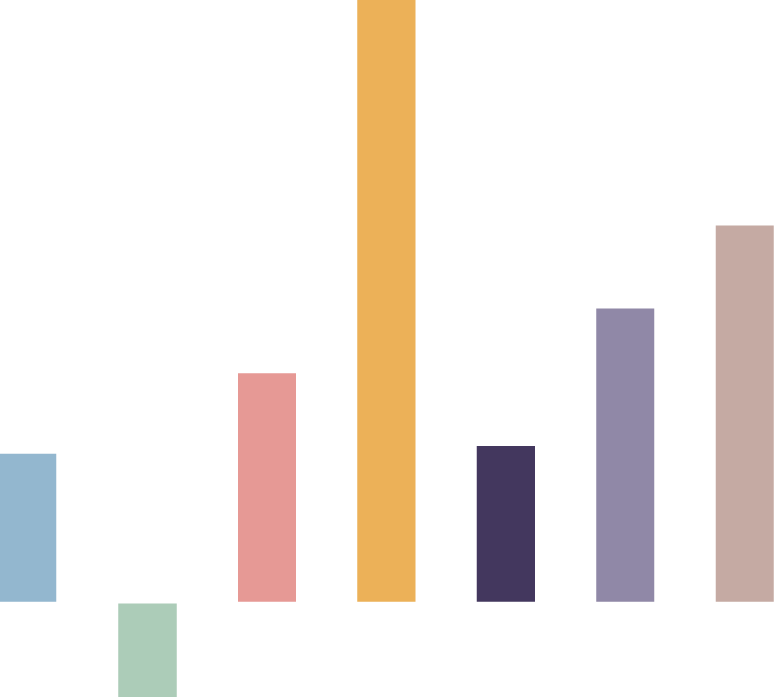

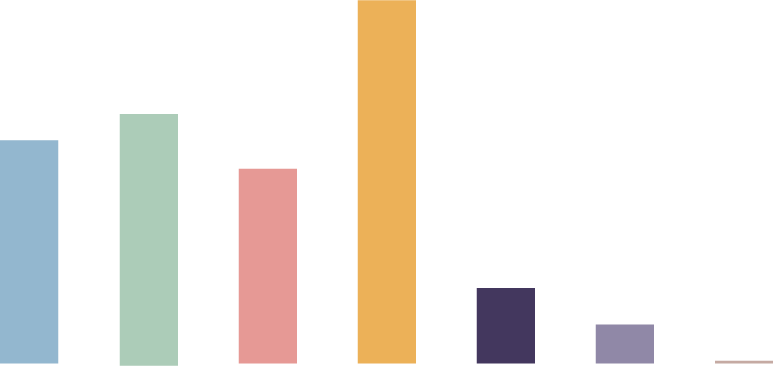

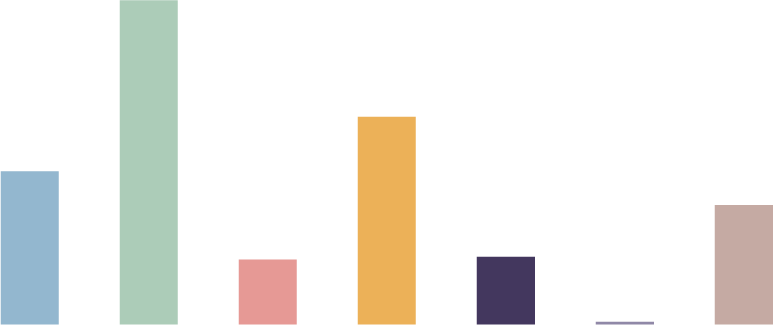

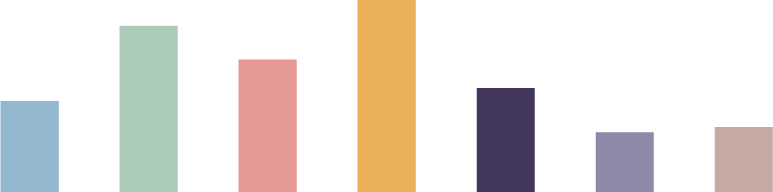

When ranked against the basket of alternative assets, the Model Estate ranked sixth out of seven this year. Gold was the only asset class that ranked lower, with all other indices experiencing major rebounds. Regardless, this is still a positive performance, considering inflation rose by 4.8% in 2021, 0.9% lower than the overall growth of the Model Estate. Over a 2- and 3-year period, the Estate ranks a modest third. The 10-year annualised growth stands at 4.6%, also putting the Estate in third place, suggesting a consistent performance over the longer term. The fine wine index was the standout performer of 2021, with growth at historic levels. Commercial property (based on the MSCI Annual Index) also delivered a strong result, bolstered by the successes of the industrial market.

Read more on the Model Estate...

In response to widespread encouragement from trust advisors, the Estate has started considering its Natural Capital assets...

Natural Capital:

A New Asset Class

Scroll to explore

The Model Estate is a hypothetical agricultural estate created by Carter Jonas in 2010. The Estate has evolved over the years...

Model Estate components & performance

Figure 3 Long-term alternative asset class performance

Source: Carter Jonas, Lix-ex, MSCI, HAGI, London Stock Exchange

Growth % pa

20

15

10

5

0

-5

2021

2-year

annualised

3-year

annualised

Model Estate

Classic Cars

Fine Wine

MSCI All Property

Gold

MSCI Residential

Equities

Fine Wine: 23.2%

Last year saw the fine wine market break records, with the level of growth in capital values not seen since 2017 and reaching the highest ever industry benchmark. Whereas the price of luxury asset classes faced significant reductions in 2019 and modest growth in 2020, 2021 saw a huge increase of 23.2%. The boost can be partly accredited to low interest rates, which has led people to seek alternative ways to invest. Although prices rose across all regions, Burgundy and Champagne’s performance within the Liv-Ex 100 index was remarkably positive. US wines are on the rise too. Australia, on the other hand, has suffered the effects of China’s trade tariffs, with collectors’ cellars continuing to imitate worldwide political narratives.

Equities: 14.5%

The FTSE All Share index saw a significant rebound in 2021, with levels exceeding, albeit marginally, pre-pandemic levels. The market was up by 14.5%, following a substantial drop of 12.5% in 2020. In a year where a successful vaccine rollout rallied consumer confidence, businesses curtailed in 2020 were able to transition to the ‘new normal’. The year-on-year performance jumped by 926 points, representing an increase of 14.5%. Such growth has had a positive impact on annualised performances, with the 3-year and 5-year annualised growth at 4.6% and

1.7% respectively.

MSCI All Property: 11.3%

The overall UK property market also witnessed a remarkable increase in 2021. It cannot be ignored, however, that there is a large variance in performance in the asset types that make up this index. Notably, although it experienced a slight year-on-year uplift, the retail market is on a longer-term downward trajectory that was already in momentum pre-pandemic. On the contrary, immense growth of warehousing and logistics fuelled by the growth of e-commerce has further pushed up industrial capital values, bolstering the total index. MSCI Industrial has seen a year-on-year increase of 31.2%, with the 5-year annualised figure at a strong 12.3%. Office performance was comparatively stagnant at 1.3% for 2021.

Classic Cars: 8.8%

Classic car prices flourished during the pandemic, attributed to the proliferation of online auctions, pent-up demand as people exited lockdown restrictions and the rise in many people’s disposable wealth. Despite a setback in 2019, growth has been otherwise positive. The 8.8% increase in 2021 suggests a return to confidence in this sentiment, which is also seen in the market’s longer-term performance trends.

MSCI Residential: 6.0%

UK residential property values grew by 6.0% in 2021, up from a slight negative performance in 2020. Demand was initially driven by the stamp duty holiday and homeworkers moving from the city but did not subside as expected when the tax break ended in June or when pandemic restrictions eased. According to HMRC data, almost 1.5 million residential property transactions took place in 2021, up by 41% on the previous year. Although it is anticipated that the positive story will continue into 2022, rising house and energy prices and the subsequent impact on affordability look likely to soften growth in this sector. Rising inflation rates also pose a challenge to household incomes, which look likely to further impact sales volumes.

Gold -3.6%

The global macro-economic picture destabilised the gold market’s momentum in 2021. Significant fluctuations were reflective of worldwide uncertainties due to the pandemic, and the market saw a low of $1,681.24 in March and a high of $1,907.94 in June. The market faced headwinds at the end of November and December, with the rise of interest rates and subsequent tightening of monetary policies resulting in price reductions. However, this weakening in the market has not caused prices to unravel significantly. While the short-term performance is negative, medium- and long-term trends are particularly strong in relation to the other alternative asset classes. 3-year and 5-year annual growth stands at 12.5% and 9.5% respectively, suggesting that gold may remain a popular choice for investors and a safe haven in times of uncertainty.

MSCI Industrial has seen a year-on-year increase of 31.2%, with the 5-year annualised figure at a strong 12.3%.

Read more on the Model Estate...

2021 was not a year of significant change for the Estate. Although opportunities and threats have been considered across all sectors of the Estate...

Natural Capital: A New Asset Class

The Model Estate is a hypothetical agricultural estate created by Carter Jonas in 2010. The Estate has evolved over the years...

Model Estate components & performance

Alternative Asset Class Rankings

When ranked against the basket of alternative assets, the Model Estate ranked sixth out of seven this year. Gold was the only asset class that ranked lower, with all other indices experiencing major rebounds. Regardless, this is still a positive performance, considering inflation rose by 4.8% in 2021, 0.9% lower than the overall growth of the Model Estate. Over a 2- and 3-year period, the Estate ranks a modest third.

25

Contact us for more information

EMAIL TIM

01223 346609

Head of Rural

Tim Jones

EMAIL TIM

01223 346609

Head of Rural Division

Tim Jones

Contact us for

more information

Gold -3.6%

The global macro-economic picture destabilised the gold market’s momentum in 2021. Significant fluctuations were reflective of worldwide uncertainties due to the pandemic, and the market saw a low of $1,681.24 in March and a high of $1,907.94 in June. The market faced headwinds at the end of November and December, with the rise of interest rates and subsequent tightening of monetary policies resulting in price reductions. However, this weakening in the market has not caused prices to unravel significantly. While the short-term performance is negative, medium- and long-term trends are particularly strong in relation to the other alternative asset classes. 3-year and 5-year annual growth stands at 12.5% and 9.5% respectively, suggesting that gold may remain a popular choice for investors and a safe haven in times of uncertainty.

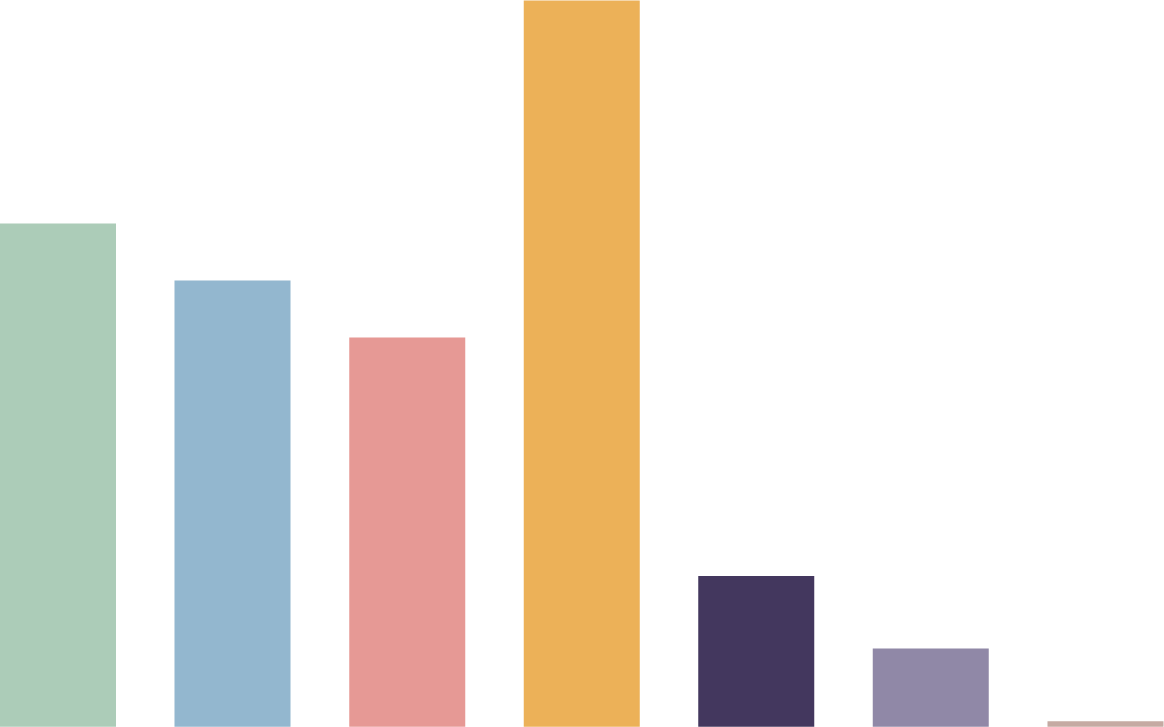

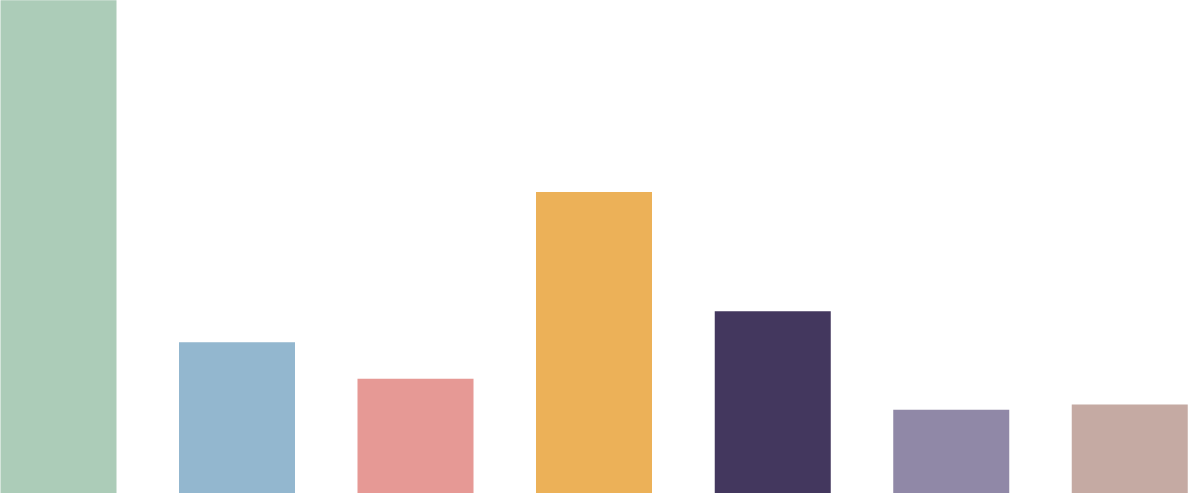

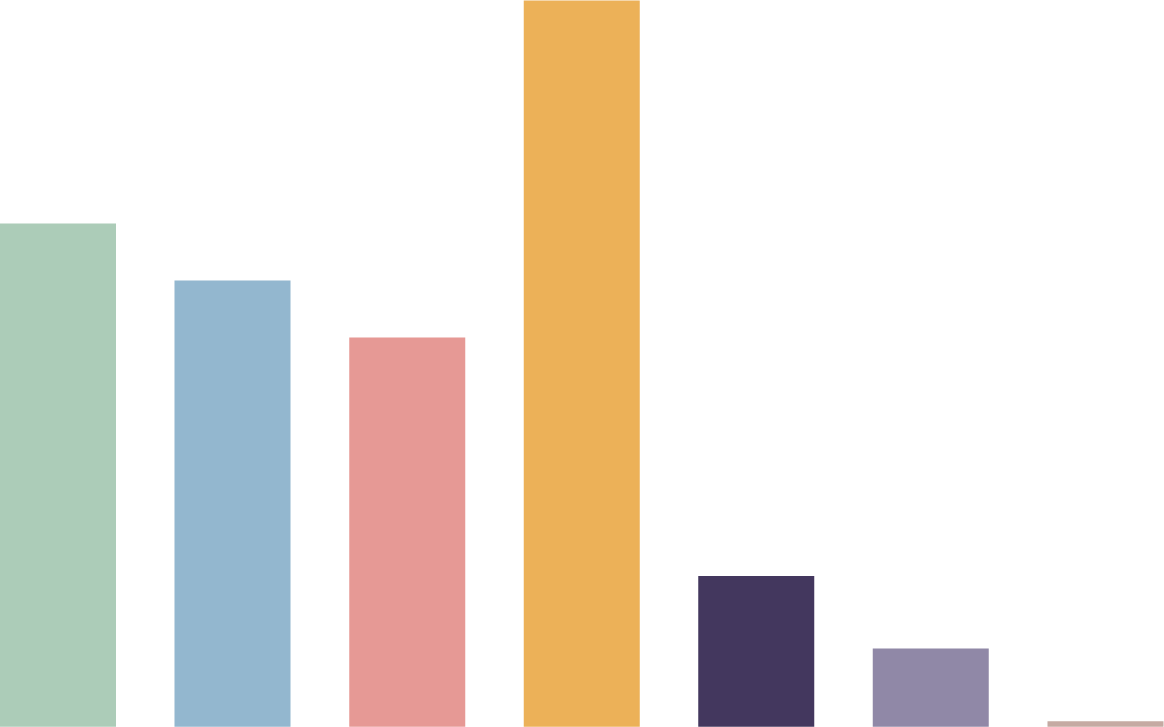

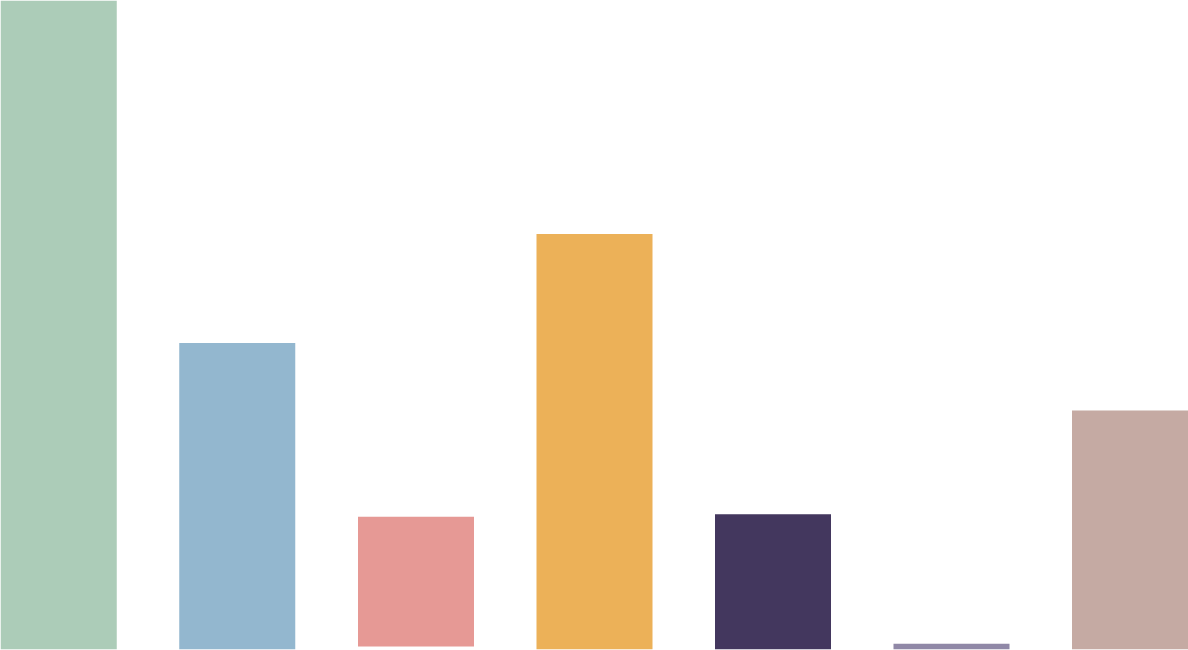

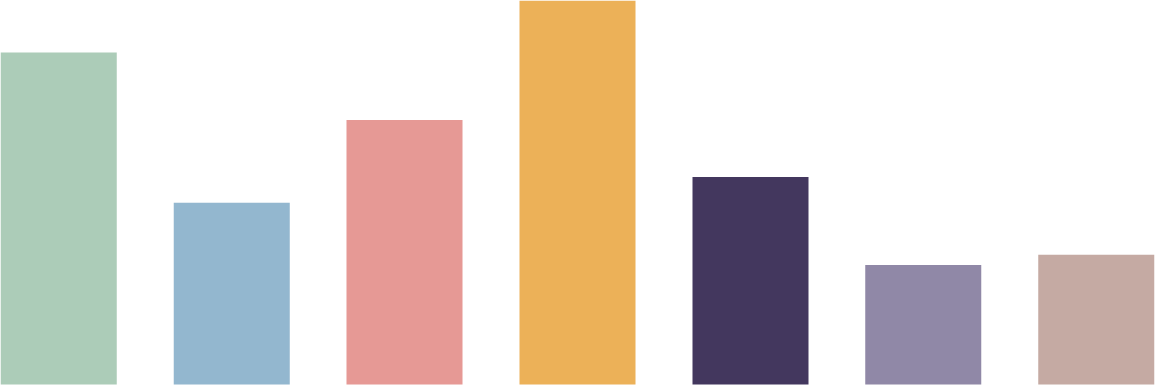

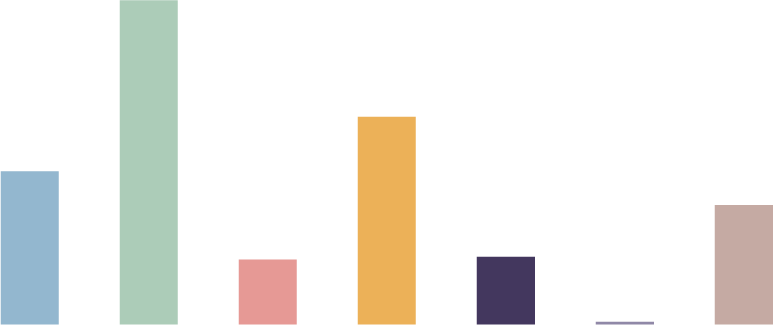

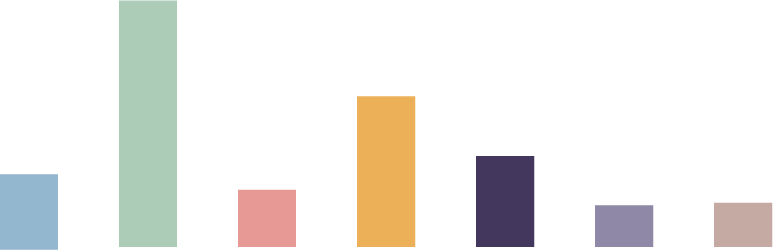

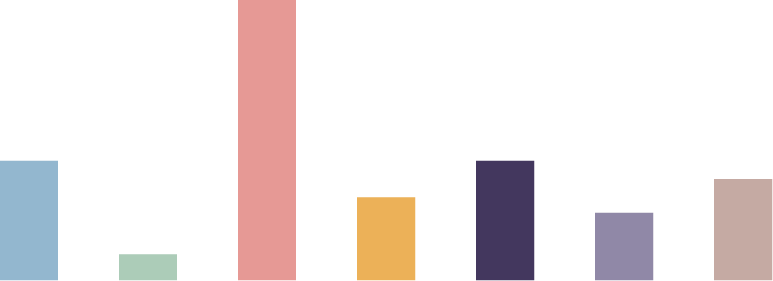

Growth % pa

7-year

annualised

10-year

annualised

20

25

15

10

5

0

-5

5-year

annualised

EMAIL SOPHIE

020 7493 0685

Senior Research Analyst

Sophie Davidson

EMAIL CHRIS

01865 404484

Rural Partner

Christopher Rhodes

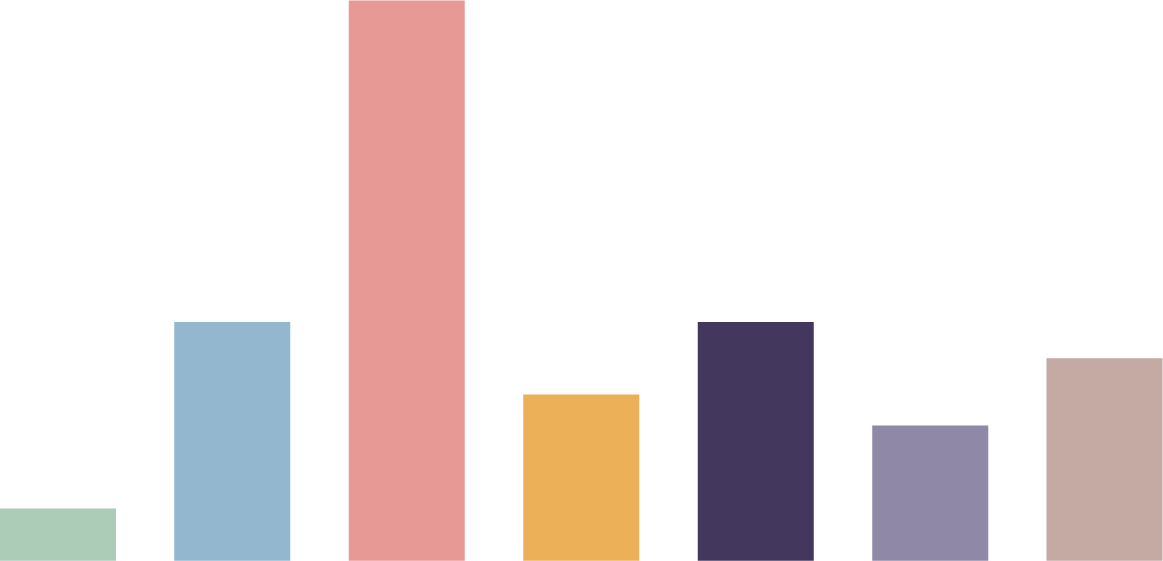

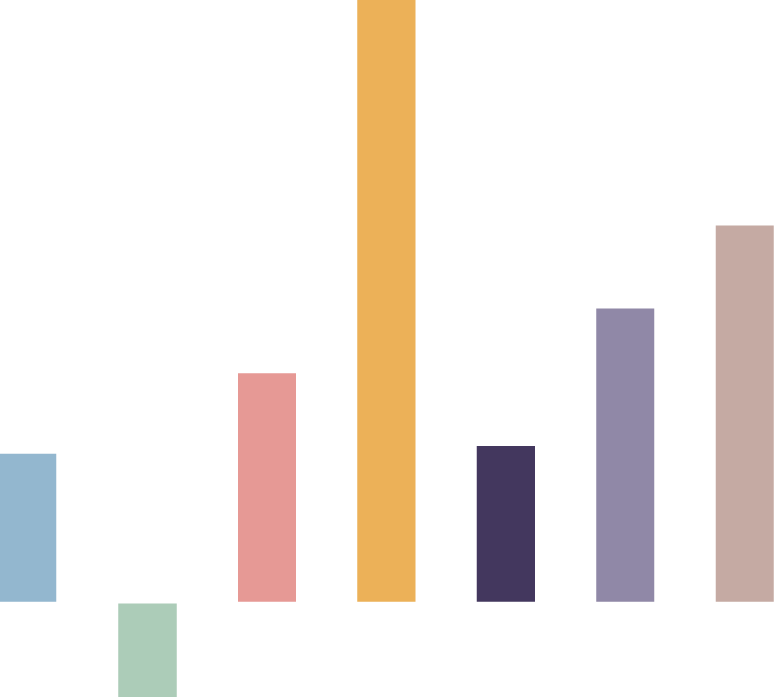

Gold: 24.9%

The price of gold, in US Dollar terms, increased by almost 25% during 2020 and proved the best performing asset of the year. This price increase was driven by a combination of factors including low interest rates and strong investor demand. The Covid-19 pandemic and uncertainties surrounding the result of the US presidential election did not deter demand or growth. Looking across the longer term, annualised growth of gold remained the top performer over a 2-,

3- and 5-year period, and ranked seventh over a 7-year period.

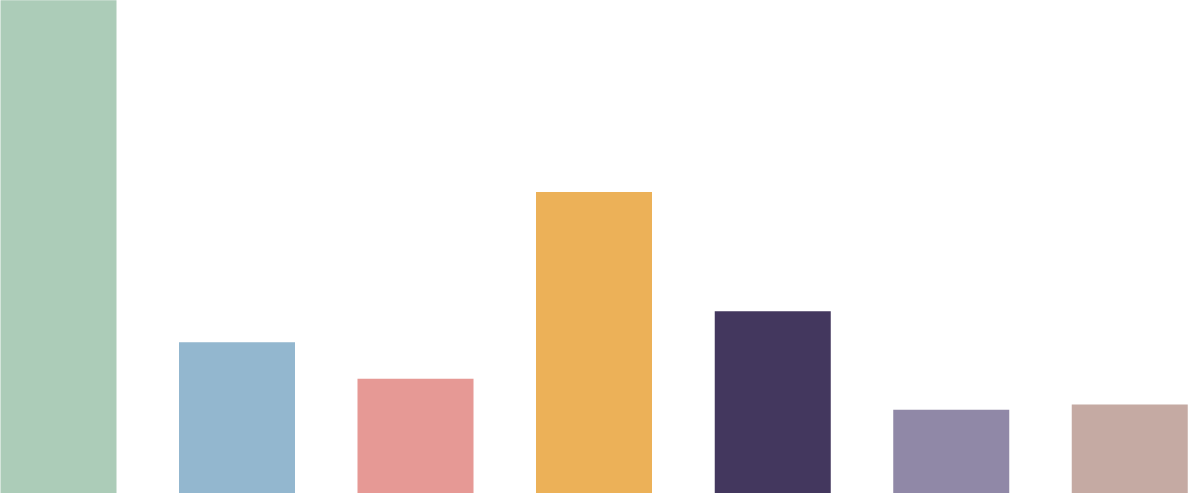

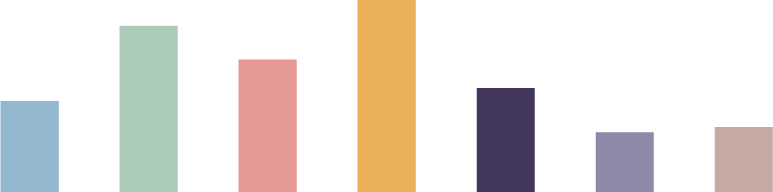

Growth % pa

7-year

annualised

10-year

annualised

20

25

15

10

5

0

-5

5-year

annualised

Equities

EMAIL SOPHIE

020 7493 0685

Senior Research Analyst

Sophie Davidson

EMAIL CHRIS

01865 404484

Rural Partner

Christopher Rhodes

5-year

annualised