Alternative Asset

Class Rankings

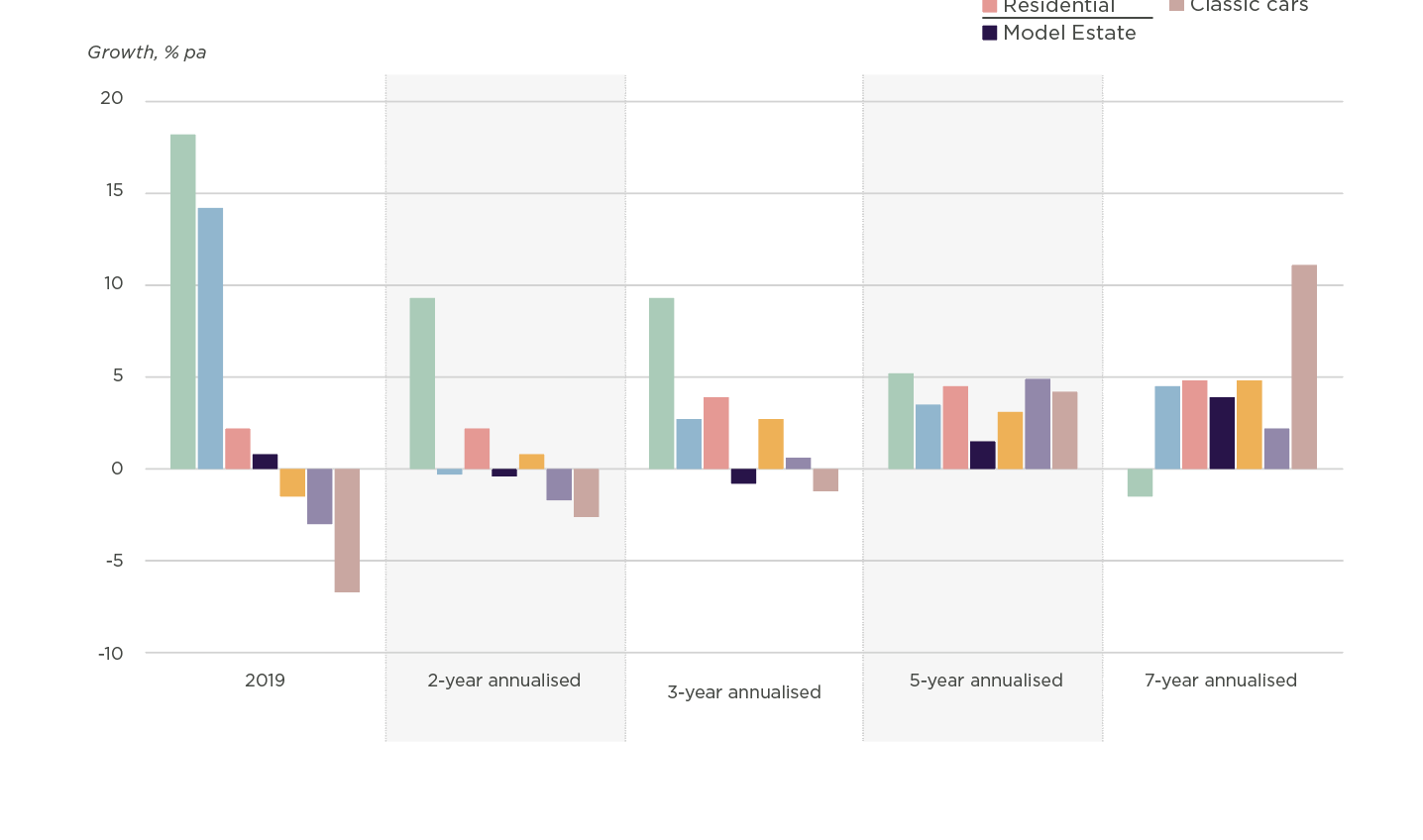

The improved performance of 2020, as highlighted in the component performance section, has resulted in the Model Estate taking second place in this year’s alternative asset class rankings. Over a 2- and 3-year annualised period, the Estate also ranked second, however over the longer term, performance has been slower. Over a 5-year annualised period, the Estate’s value increased by 2.8% per annum, ranking fourth, and grew by 4.4% when annualised over the last 7 years.

Read more on the Model Estate...

Find out more from our experts about mineral extraction on the Model Estate, and how to maximise the value of subsequent leisure opportunities.

Mining for Minerals

Scroll to explore

The Model Estate was valued at £39.75 million in December 2019, representing a modest but respectable annual increase of 0.8%...

Model Estate components & performance

Figure 3 Long-term alternative asset class performance

Source: Carter Jonas, Lix-ex, MSCI, HAGI, London Stock Exchange

Growth % pa

25

15

10

5

0

-5

-10

2020

2-year

annualised

3-year

annualised

5-year

annualised

7-year

annualised

Equities

Residential

Commercial

Fine wine

Gold

Model Estate

Classic cars

Gold: 24.9%

The price of gold, in US Dollar terms, increased by almost 25% during 2020 and proved the best performing asset of the year. This price increase was driven by a combination of factors including low interest rates and strong investor demand. The Covid-19 pandemic and uncertainties surrounding the result of the US presidential election did not deter demand or growth. Looking across the longer term, annualised growth of gold remained the top performer over a 2-, 3- and 5-year period, and ranked seventh over a 7-year period.

Classic Cars: 6.2%

The classic cars market bounced back in 2020, with the HAGI Top Index increasing by 6.2%. This took the asset into third place in the rankings, up from the -6.7% growth and last place ranking in 2019. This rise may surprise many, although it has come from a relatively low base at the start of 2020. The index did rise during the first six months of the year, a shock given the lockdowns in places across many major global markets, before dipping slightly, and then once again increasing during the final three months of 2020. Despite the market in Europe effectively closing in the spring months, many consumers and car enthusiasts were still active online, but without being able to view or test drive, activity was not necessarily translated into sales until much later in the year.

Fine Wine: 5.4%

Despite the headwinds faced by the market in 2020, the Liv-ex 100 index ended the year up by 5.4%, placing fourth in this year’s alternative asset class rankings. The index fell throughout the first half of the year but did increase significantly in the autumn and winter months, ending the year in a strong position. The price and volume of wines were sold at strong prices in November and December, providing a strong indication that demand continues to be healthy. While 2020 ended on a high, 2021 will be a telling year for the market, as both Brexit-related and US imposed tariffs came into force in January. Over the longer term, growth has remained robust, increasing by 5.9% and 3.1% per annum over a 5- and 7-year time period, respectively.

MSCI Residential: -0.2%

The UK’s residential property market held up remarkably well throughout 2020, due to the rapid easing of restrictions in the sector and the stamp duty holiday, which was set up to encourage buyers to return to the market and resulted in strong demand. This was after the market experienced one of its lowest points ever during the second quarter of 2020, when the national lockdown was in place. The impact of the pandemic on consumer earnings hit pricing levels, and as the result the value of the MSCI Residential index fell by 0.2% throughout the year. However, the changing priorities and preferences of consumers due to the lockdown also led to a surge in sales activity and price growth during the second half of the year, although the latter tapered off towards the end of the year.

MSCI Commercial: -4.3%

The commercial property market in the UK has been a big casualty of the pandemic. The 4.3% decline in capital values throughout 2020 was primarily led by the retail sector, whose struggles over the last few years were amplified by the effects of the pandemic, when national lockdowns required all non-essential shops to close their doors, with many unsure whether they would reopen. This, together with a collapse of major national brands including the Arcadia Group and Debenhams, has seen retail property values reach all-time lows. The shift to online retailing surged during 2020, as was to be expected while physical retail stores remained close, and, as a result, demand for distribution warehouses has continued to grow, offsetting some of the declines of the retail sector. In the office market, the working from home revolution of 2020 has seen capital values reduce, however the full effect of this is likely to be realised in 2021. Many firms will be making decisions on whether employees will be returning to the office full time, and whether office footprints can be reduced as working from home patterns are made permanent.

Equities: -12.5%

The FTSE All Share Index suffered one of its biggest annual losses in 2020, down by 12.5% throughout the year (based on month end figures). The stock market saw the fastest crash in history in the four weeks to the end of March, although a rebound was seen through the middle and latter months of the year. However, given the nature of investors for equities, it is more pertinent to look at medium to longer term trends. The annualised growth of the FTSE All Share index increased by 1.3% per annum over a 5-year period, and by 0.3% over 7 years.

The price of gold,

in US Dollar terms, increased by almost 25% during 2020

Read more on the Model Estate...

Find out more from our experts about mineral extraction on the Model Estate, and how to maximise the value of subsequent leisure opportunities.

Mining for Minerals

The Model Estate was valued at £39.75 million in December 2019, representing a modest but respectable annual increase of 0.8%...

Model Estate components & performance

Alternative Asset Class Rankings

The improved performance of 2020, as highlighted in the component performance section, has resulted in the Model Estate taking second place in this year’s alternative asset class rankings. Over a 2- and 3-year annualised period, the Estate also ranked second, however over the longer term, performance has been slower. Over a 5-year annualised period, the Estate’s value increased by 2.8% per annum, ranking fourth, and grew by 4.4% when annualised over the last 7 years.

25

-15

Contact us for more information

EMAIL HEENA

020 7518 3270

Research Analyst

Heena Gadhavi

EMAIL CATHERINE

01604 608203

Rural Consultant

Catherine Penman

EMAIL TIM

01223 346609

Head of Rural Division

Tim Jones

20

-15

EMAIL HEENA

020 7518 3270

Research Analyst

Heena Gadhavi

EMAIL CATHERINE

01604 608203

Rural Consultant

Catherine Penman

EMAIL TIM

01223 346609

Head of Rural Division

Tim Jones

Contact us for

more information