Biodiversity Net Gain:

February 2025

How has the biodiversity net gain (BNG) market developed in the year since requirements were introduced? And how will supply and demand continue to evolve over the next couple of years?

Download the full report

Introduction

Mandatory biodiversity net gain (BNG) has now been in place for a year, driving investment in nature-based solutions and contributing to the UK’s wider environmental goals.

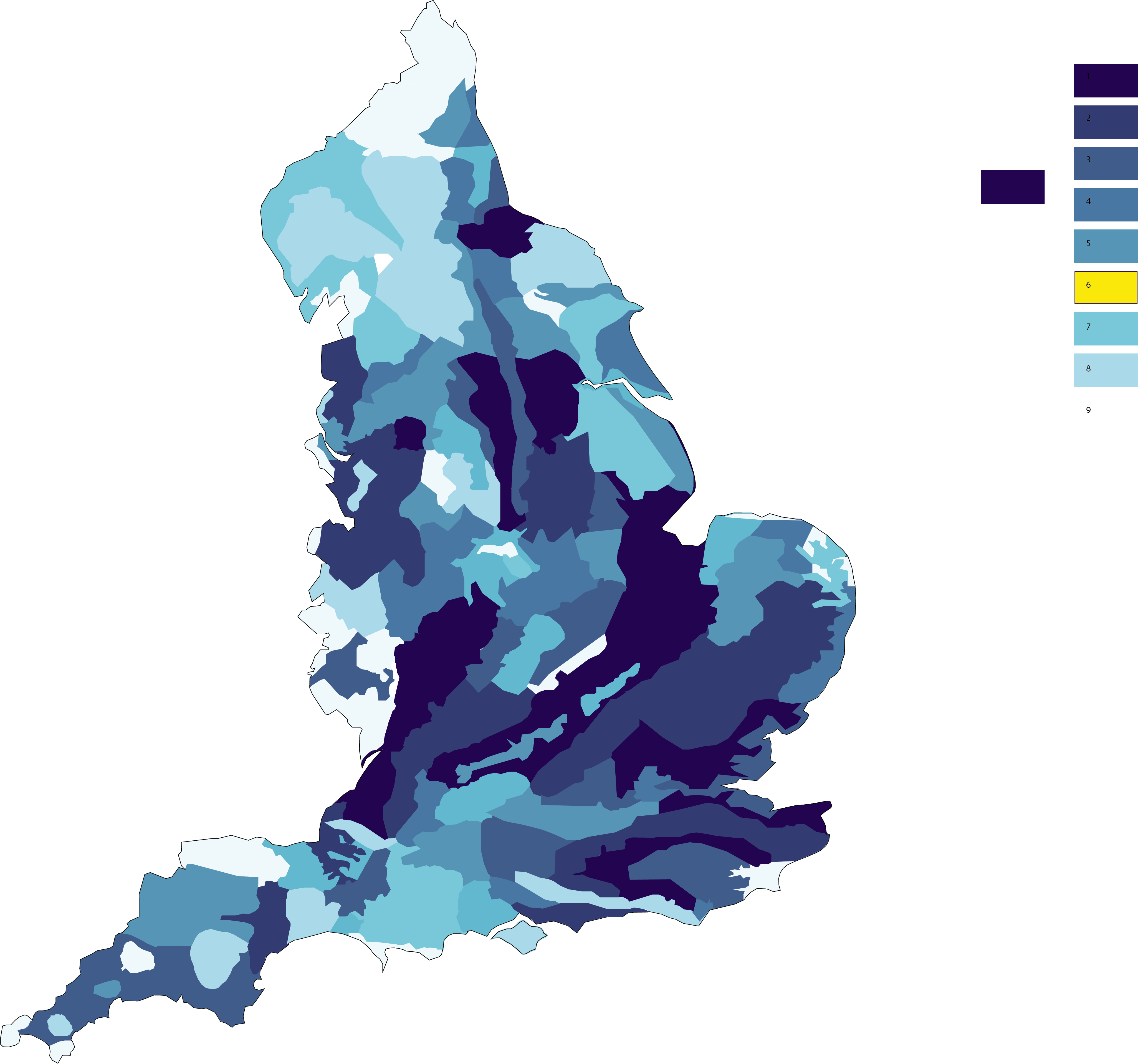

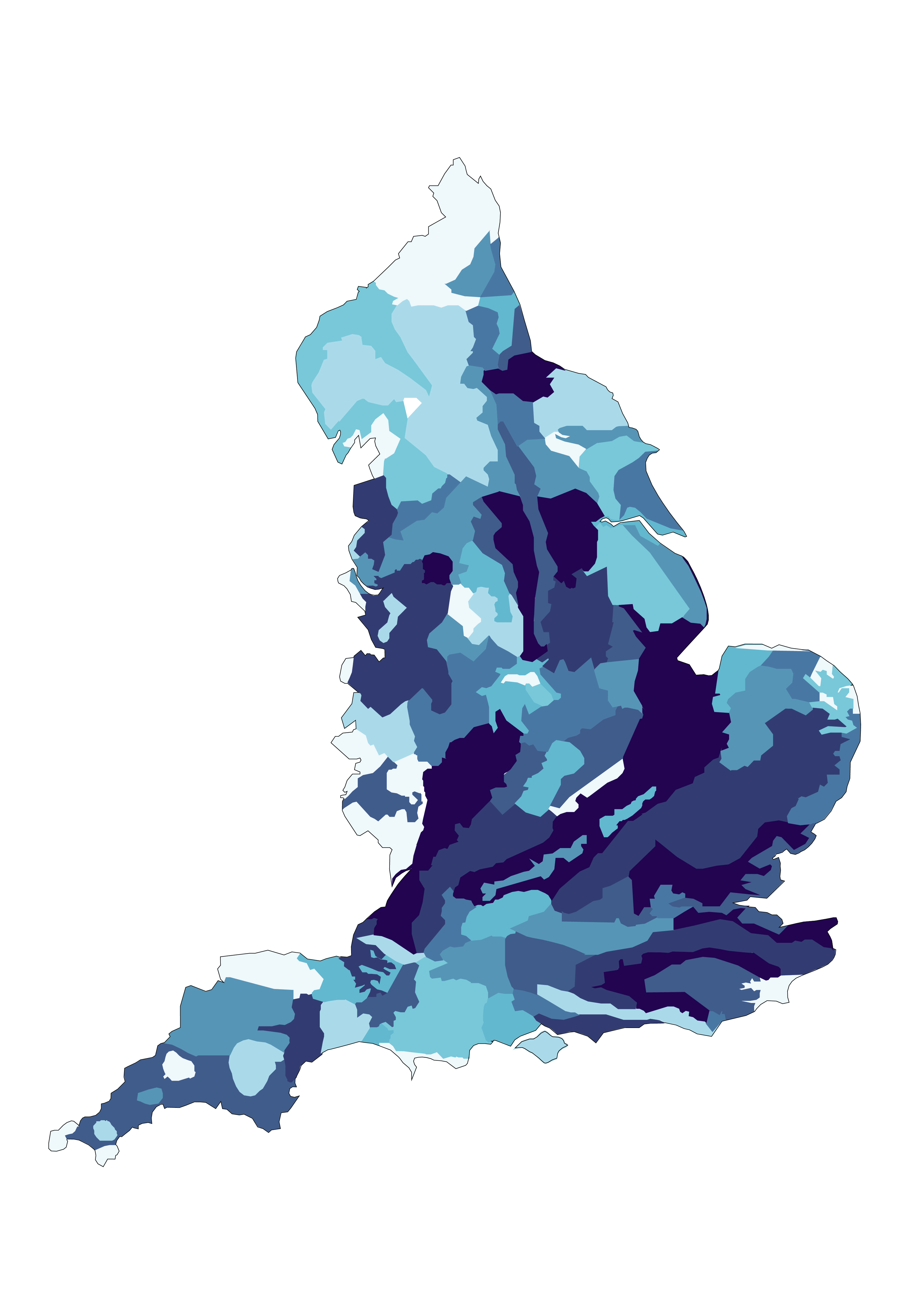

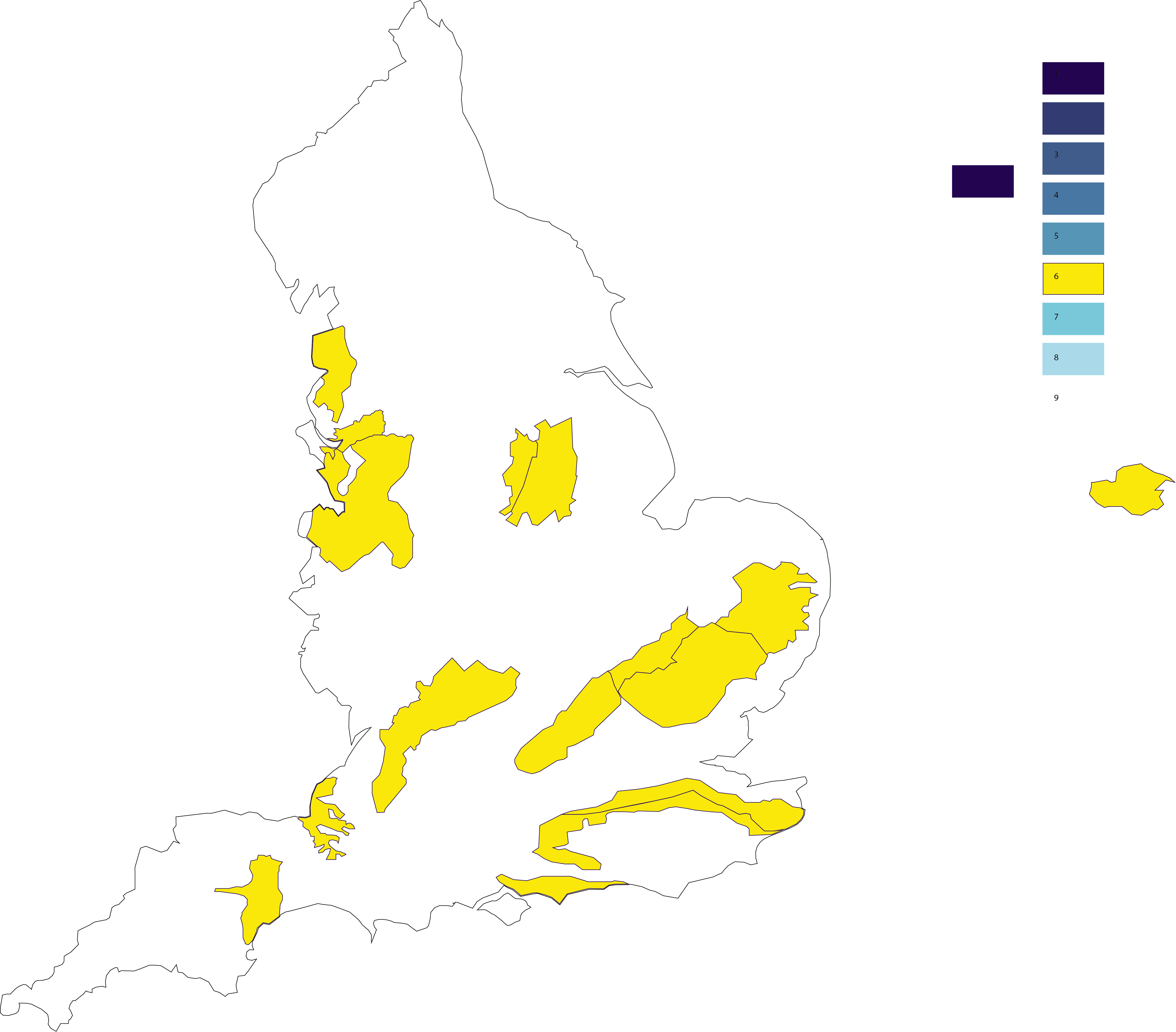

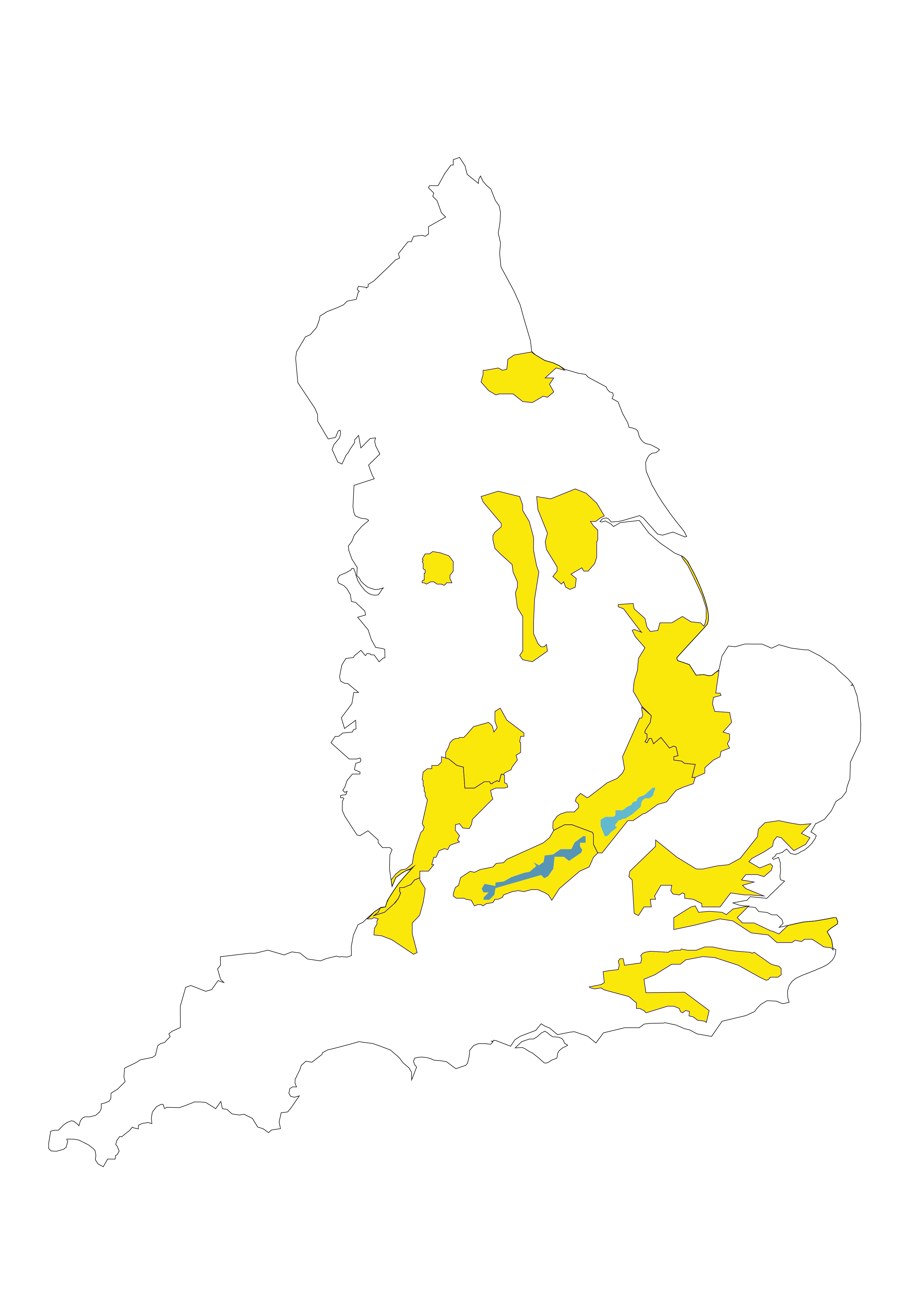

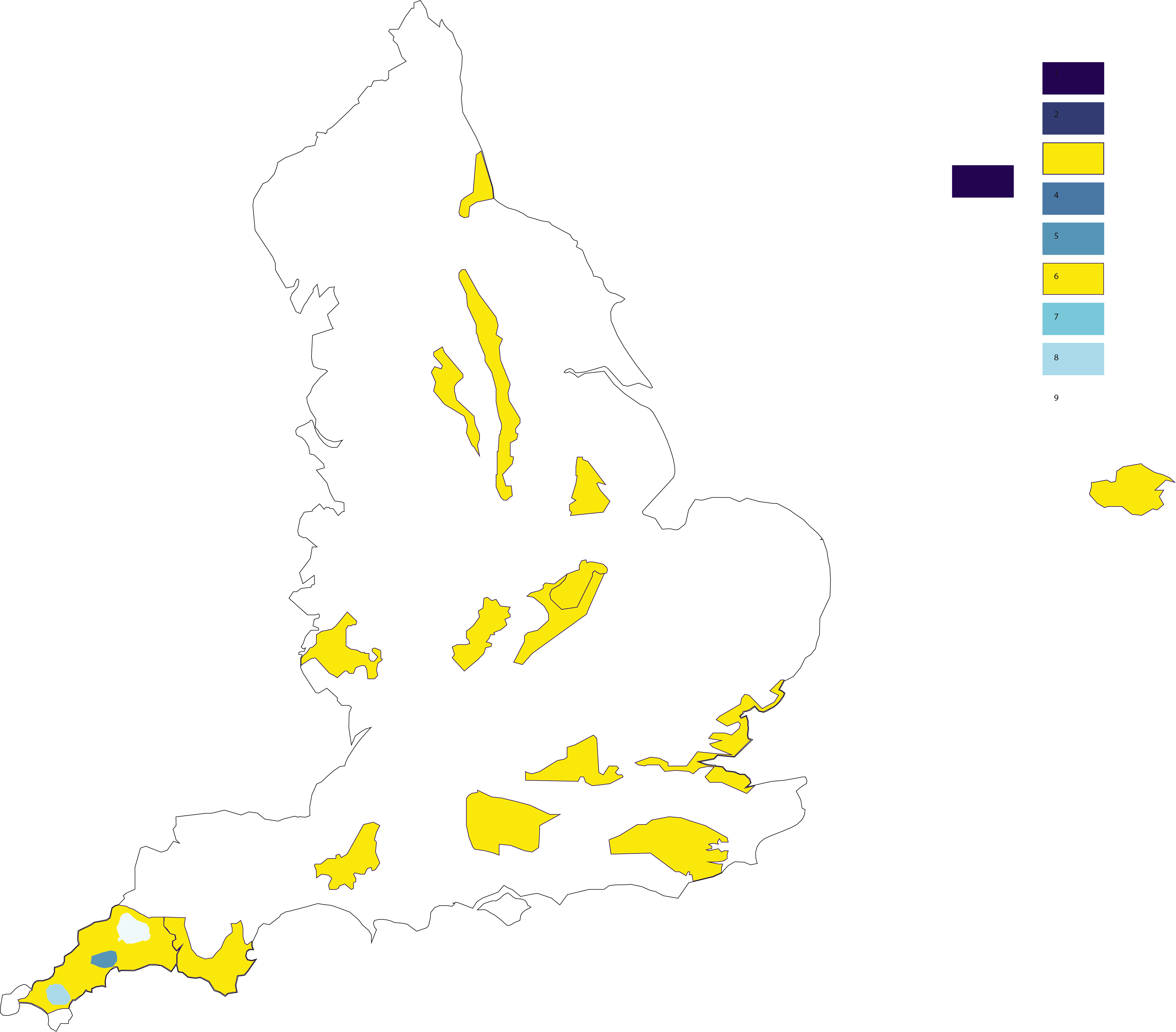

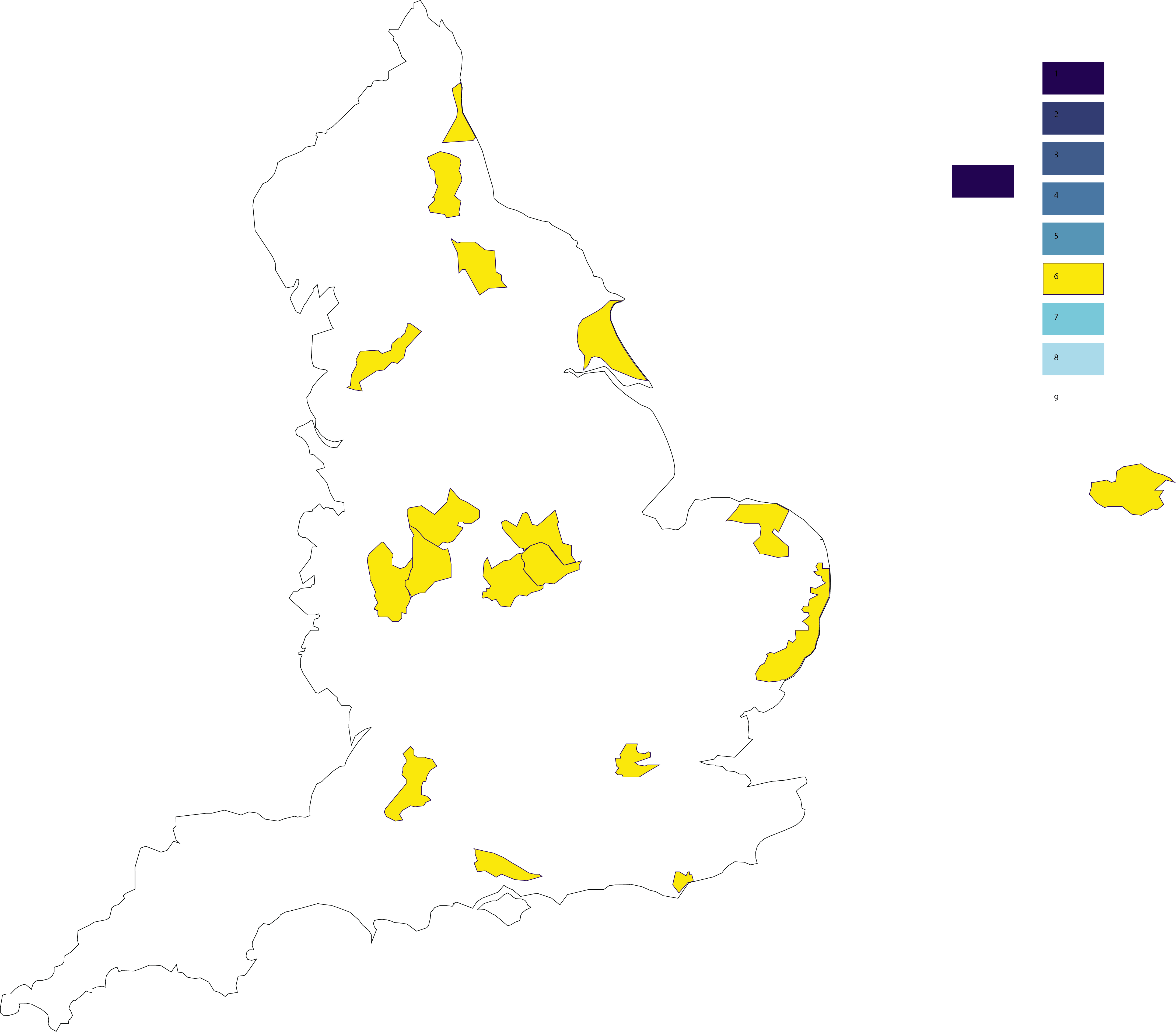

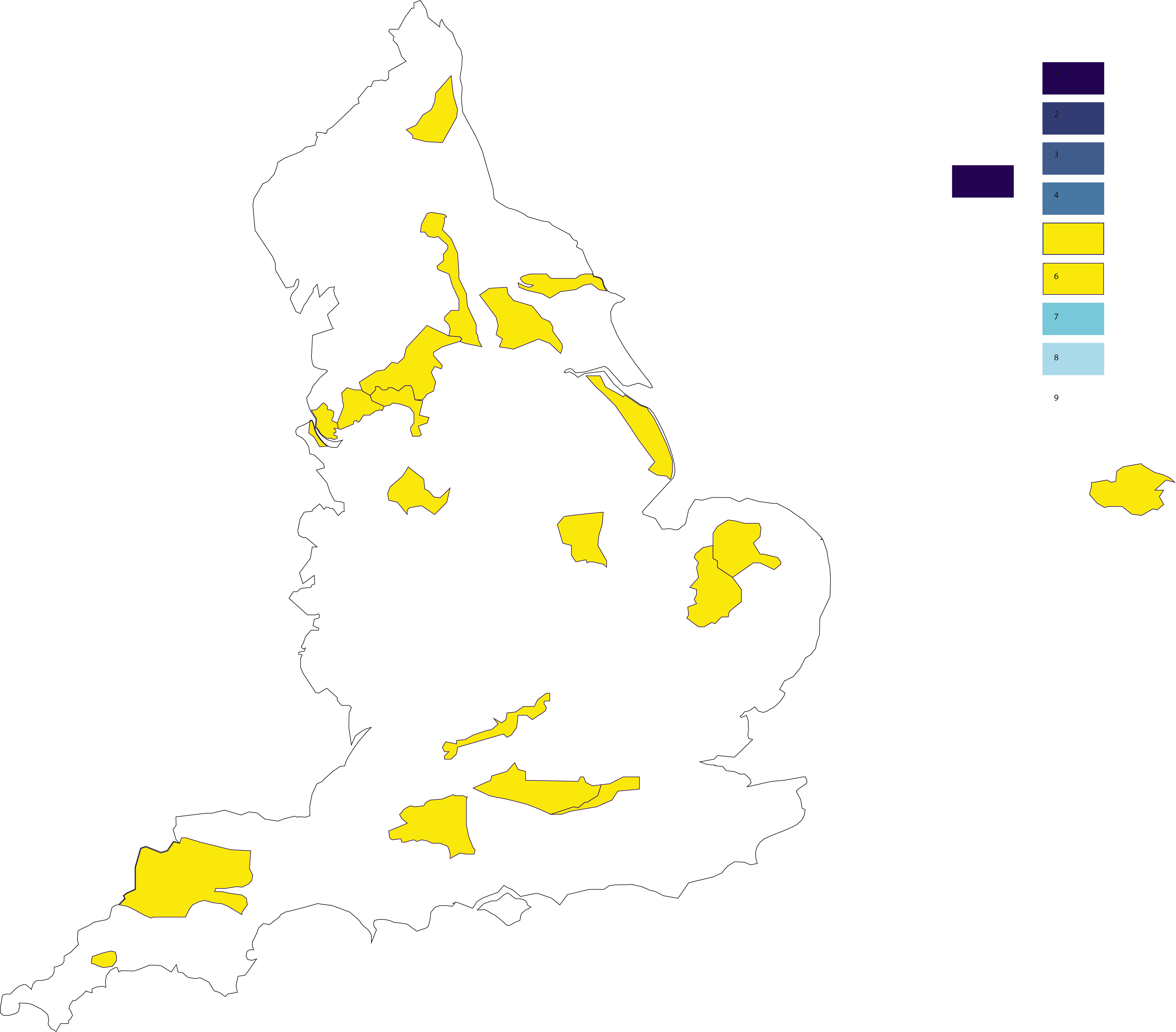

Where achieving net gain on-site is not feasible or strategically optimal, the private BNG market is essential for providing off-site solutions. In some areas, several habitat banks are already registered and more are in the pipeline, resulting in considerable competition. In others, demand for biodiversity units is outpacing the supply of units (some with no supply at all so far), leaving substantial room for growth of the market.

Our research aims to answer questions on the requirements of the average development, how net gain is being delivered to date, and the potential demand over the next two years, to gain an understanding of how the market is developing and any barriers to growth.

Download the full report

Navigating the Evolving Market

Key findings

54.7%

1

While there is a wide variation in the average baseline value of developments, a typical range has become evident. There is also variation between greenfield and brownfield sites, although not as large as may be expected.

2

54.7% of the developments are providing all BNG on-site.

3

For both those delivering all BNG on-site and those opting for off-site solutions, we are seeing net gain percentages much higher than 10%.

4

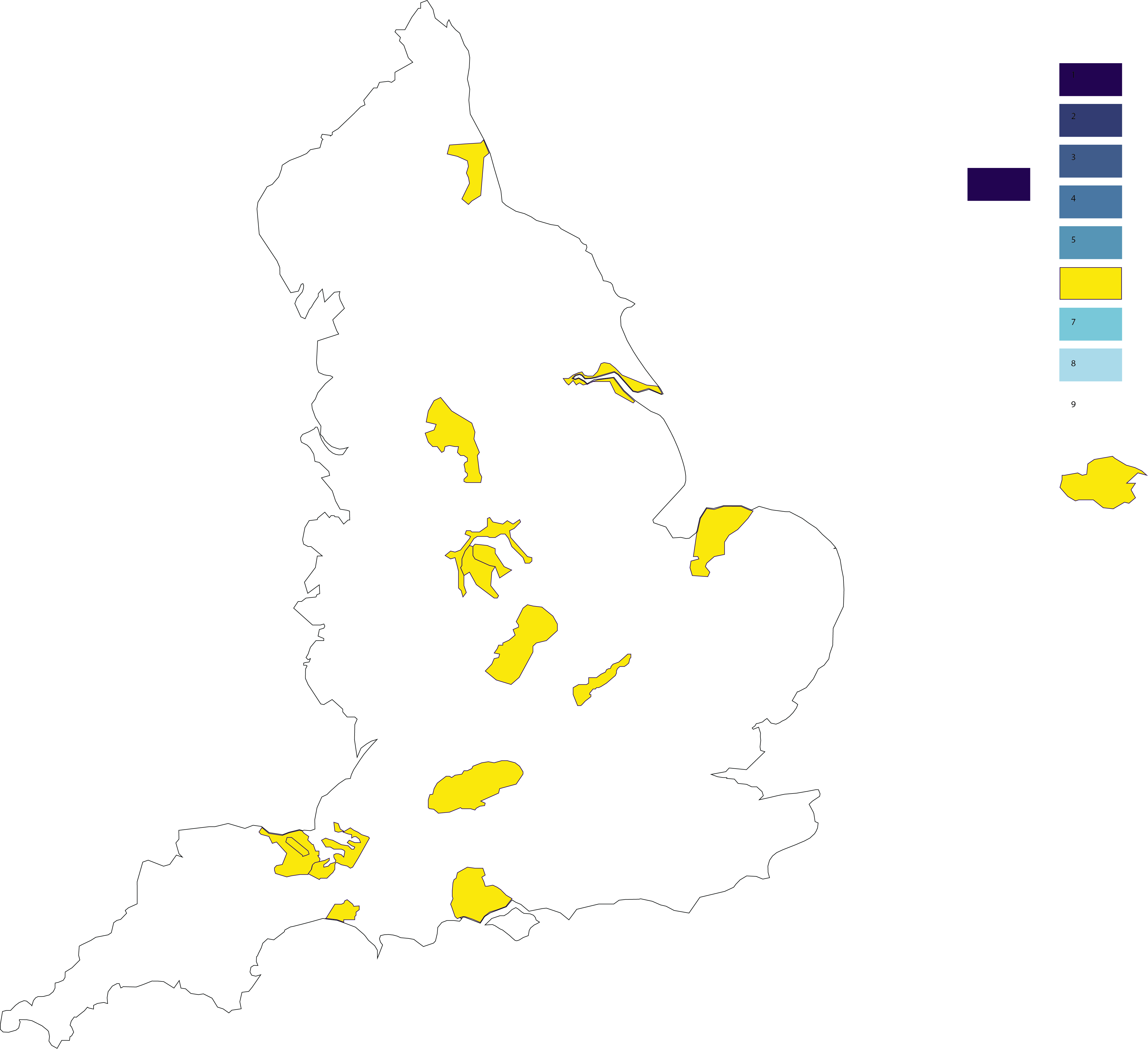

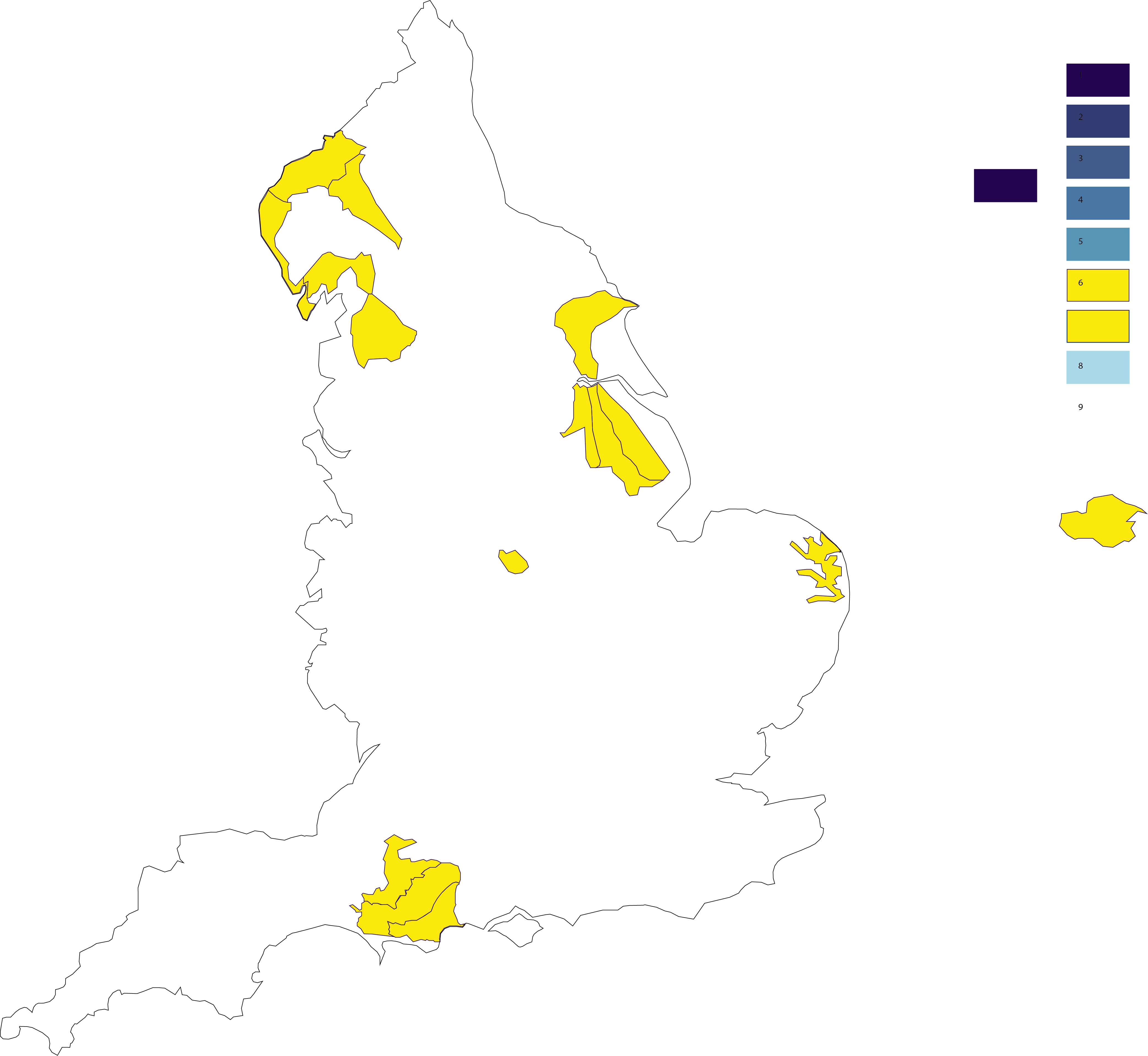

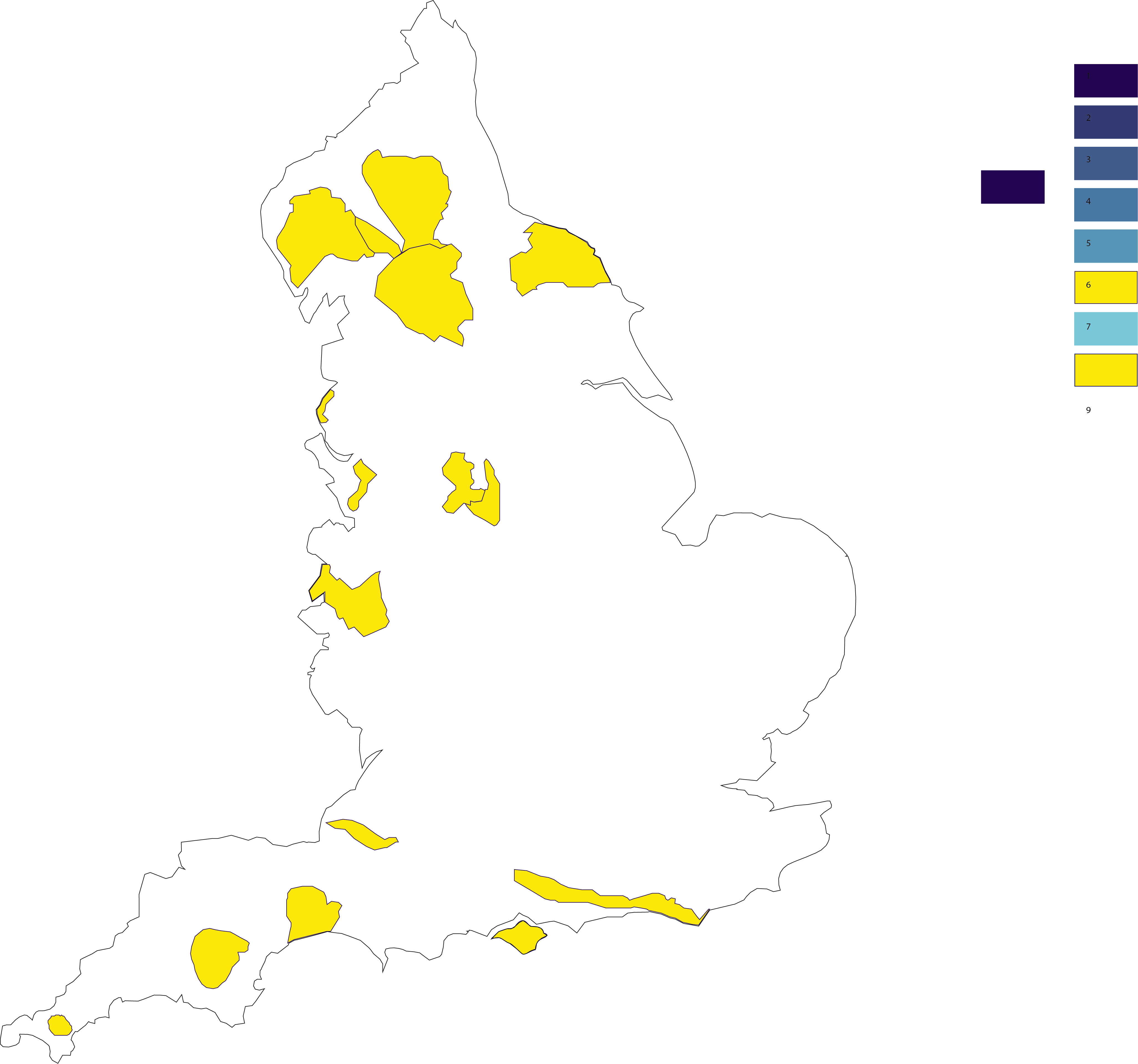

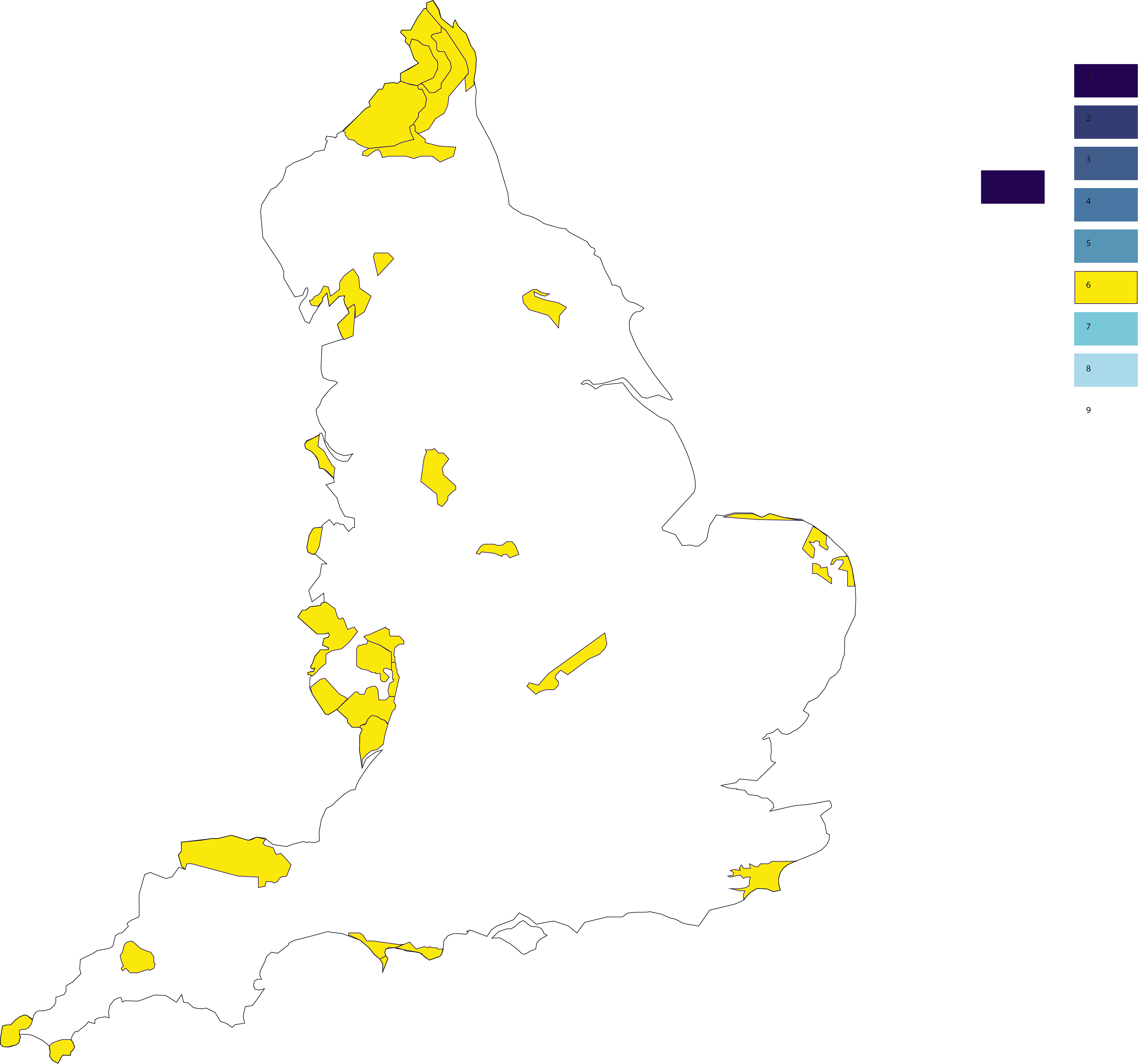

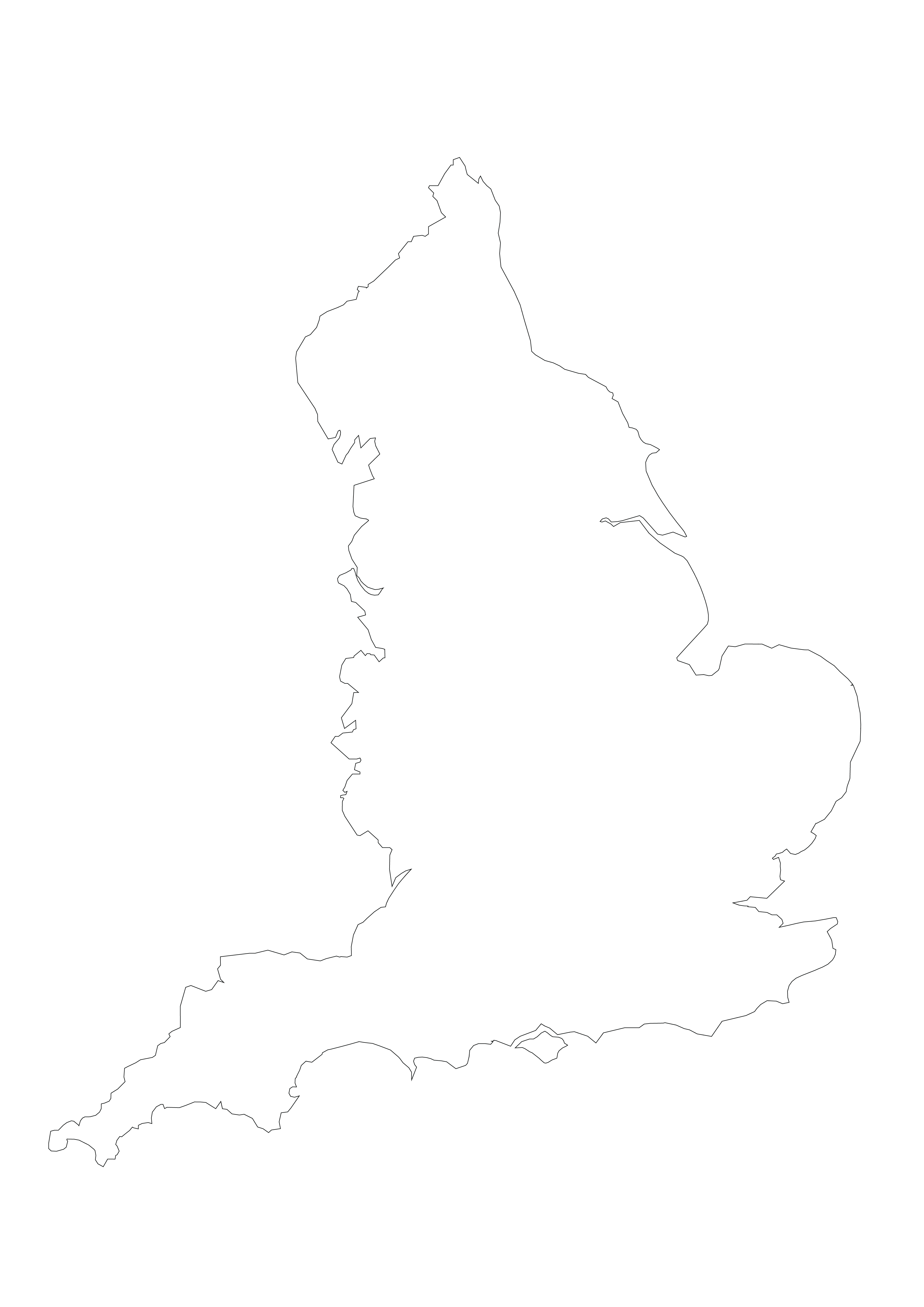

The BNG market is largely operating at National Character Area (NCA) level for now. There are hotspots for development (see map), which indicates where competition for BNG units may arise and, in turn, where opportunity for supply lies.

Download the full report

Demand for BNG

Download the full report

Canterbury

Southampton

Bristol

Plymouth

Newcastle-upon-Tyne

Scarborough

Whitehaven

Leeds

Manchester

Lincoln

Nottingham

Birmingham

Cambridge

Norwich

London

Oxford

Key

Highest

Lowest

Key locations

Key locations

Local planning authorities

Local planning authorities

Rate of development (by land area) across National Character Areas�

Get in touch

Jump straight to a section:

Introduction

Key findings

Demand for BNG

Get in touch

David Alborough

Joint National Lead, Natural Capital Services Team

Email

01223 751107

01904 558205

Lucy George

Senior Natural Capital Advisor

Email

0113 824 2379

Richard Holliday

Associate, Planning �& Development

Email

020 7493 0685

Sophie Davidson

Associate, Research

Email