How has a real estate sector which is “basically fresh air” grown to be worth, at conservative estimates, $200bn in the US and between £5-7bn in the UK?

Subscribe to Commercial Journal to receive content like this directly to your inbox

ISSUE 03 | may 2023

“The investor market has grasped open storage as a sector that’s probably been undervalued from a rental point of view for a very long time.”

UP NEXT:

Flexible offices

Aerated concrete

Residential valuations

Options for short-term space

What is it and why is it a problem

The unusual and the wonderful

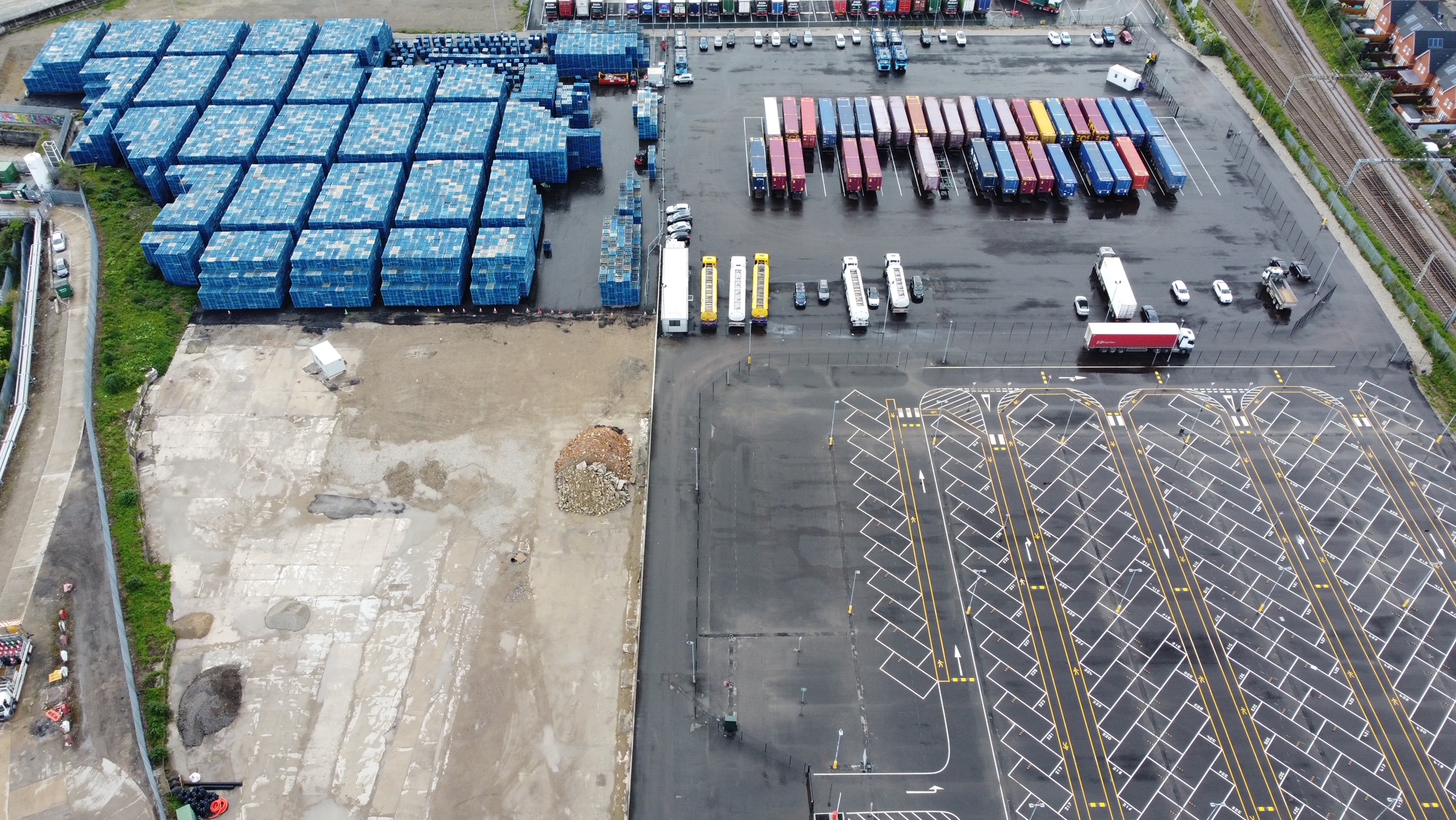

The ‘fresh air’ sector, as described by Carter Jonas Partner Andy Smith, is open storage, land on which trailers, equipment, pallets, vehicles, or containers can be stored – anything that doesn’t need to be indoors.

Andy Smith, Partner

SUBSCRIBE

Andrew Smith

020 7518 3242

EMAIL ANDREW

SUBSCRIBE

Open storage:

CONTACT:

Overlooked and undervalued

Read more:

Flexible offices

Residential valuations

Aerated concrete

Options for short-term space

The unusual and the wonderful

What is it and why is it a problem

SUBSCRIBE

SUBSCRIBE

"The trajectory of rents has been quite steep, and in some cases, they have doubled or tripled in the last 2-3 years,”

“Open storage has always been at the unloved and unattractive end of the industrial market spectrum. Twenty-five years ago, the industrial sector as a whole was in a similar position: low value, with little mainstream attention,” says Smith.

Industrial and distribution have since “blossomed”, and open storage is starting to get similar attention.

Smith stumbled upon open storage about 10 years ago while working with utility companies looking to dispose of assets such as redundant gas holders. He was tasked with finding meanwhile use to reduce the risk of vandalism and trespassers while they were awaiting demolition.

He looked at short-term lets and noticed a market for open storage. “I was always surprised by how much interest there was,” he says.

Attempts by Smith to highlight the potential of this niche sector fell on deaf ears – “people would look at me like I was mad”. But as he thought he might be wrong about open storage, the market was taking off in the US.

He heard about a fund for ‘industrial outside storage’ (IOS), as it was referred to in the States, set up in response to demand.

Meanwhile, occupiers in the UK were struggling to find suitable sites: “I've known occupiers that have taken on bigger warehouses than they need to get extra parking space or have ended up parking inside for lack of space outside,” he says.

During COVID, the sector started to get more attention in the UK. As demand for online retail and home delivery boomed, corporates such as Amazon and DPD were leasing sites to park trailers/vans.

“The investor market has grasped open storage as a sector that’s probably been undervalued from a rental point of view for a very long time.”

Current economic and market conditions may also favour open storage over building out a site. Debt has become more expensive, and construction costs are still high, which has made development riskier.

For landowners, the capital expenditure and ongoing costs of an open storage site are much lower than developing and maintaining a building. And as open storage charges per sq ft for the entire site rather than just the indoor space, in some instances, it could be more lucrative.

“It’s an opportunity for companies to re-evaluate whether open storage perhaps works longer term now in the higher value locations,” says Smith.

Which is good news for occupiers. Typically, open storage has been used as an interim use, but many occupiers want the certainty of knowing they have space for longer than 18 months or two years.

It’s particularly important if they need to invest in the site to make it suitable, perhaps upgrading security or installing infrastructure for charging electric vehicles.

And taking a longer-term view can mean better returns for investors. Smith says: “These companies have pretty strong covenants and will potentially pay a premium for a longer lease. It’s a good income flow.”

These household names were a far cry from the low-value, ‘dirty’ businesses routinely associated with open storage. Smith recruited a team of five in response to the emergence of the demand, and values started to rise.

But not all open storage sites are equal. Different occupiers have different requirements. Location and road access are obvious factors, although some open storage sites operate successfully in

remote locations.

To help navigate this landscape, Carter Jonas has built an Open Storage index, which classifies sites based on the variety of occupier requirements. The index also helps landlords identify demand levels based on factors such as security levels, services and facilities, as well as planning use.

The surface of the site is also key. Concrete can bear heavier loads, such as stacks of containers and large equipment. It can also withstand the turning pressure of tyres on heavy vehicles and machinery, which would damage other surfaces.

Tarmac, which is slightly cheaper to lay than concrete, works well with lighter vehicles. Then there are temporary surfaces like hardcore or mesh, which are adequate for storage that doesn’t generate a lot of heavy traffic movements.

Rental returns will vary depending on the type of site and what it can be used for, but as so few people work with open storage, it can be tricky to value. To help investors, Smith has drawn up a scale for grading sites based on a variety of metrics.

Other challenges include competition, planning and sustainability.

Sites suitable for long-term open storage use often compete with other uses involving a build. Although sites with a development constraint such as overhead cables, easements or gas pipes underneath can work well.

If planning is required, planners won’t necessarily have come across open storage before. Throw in an application for EV charging points, and it’s another new area for planners to navigate.

Then there is sustainability, particularly if using concrete. This can particularly be a problem for institutional investors looking to meet ESG targets.

But all sectors have challenges and have started from a low base.

ISSUE 03 | MAY 2023

SUBSCRIBE

Read more:

Flexible offices

Residential valuations

Aerated concrete

Options for short-term space

The unusual and the wonderful

What is it and why is it a problem

SUBSCRIBE

SUBSCRIBE

UP NEXT:

SUBSCRIBE

Subscribe to Commercial Journal to receive content like this directly to your inbox