Development Outlook

Autumn 2025

We explore the latest trends and outlook for development activity and cost inflation. Beyond the commercial and residential markets, this edition features the Build-to-Rent, Minerals, and Energy sectors.

Jump straight to a section:

Development trends and costs outlook

Commercial market trends

Residential market trends and living sectors

Get in touch

Download the full report

Infrastructure and minerals

Development trends and costs outlook

Download the full report

Download this section

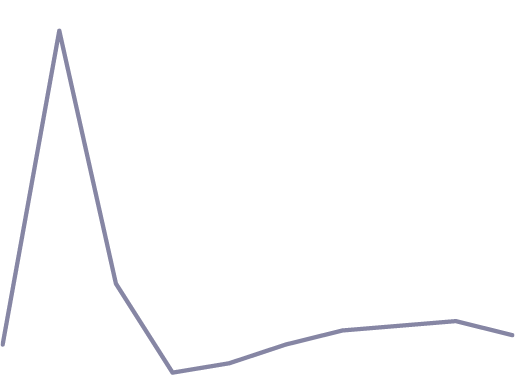

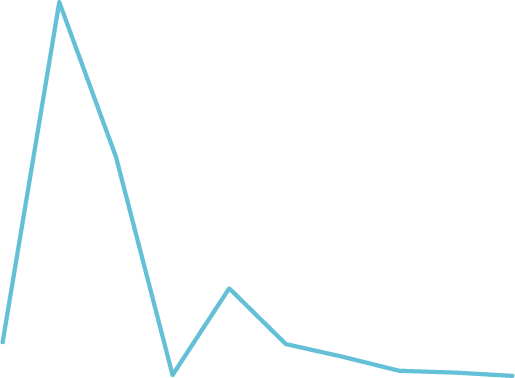

Construction output for new work declined from late 2022 until early 2024, but has been on a broadly rising trend over the last year, and is now back to the same level as autumn 2023. However, current construction PMI readings are well below the long-term average, and indeed are the lowest since the early phases of the Covid pandemic in 2020.

Tender price inflation is expected to accelerate modestly, from an estimated 2.3% per annum over the last 12 months to a little over 3% per annum by Q3 2027. As CPI begins to moderate towards its 2% target rate, tender prices will start to rise faster than general inflation.

This section features:

Development �trends

Costs and inflation outlook

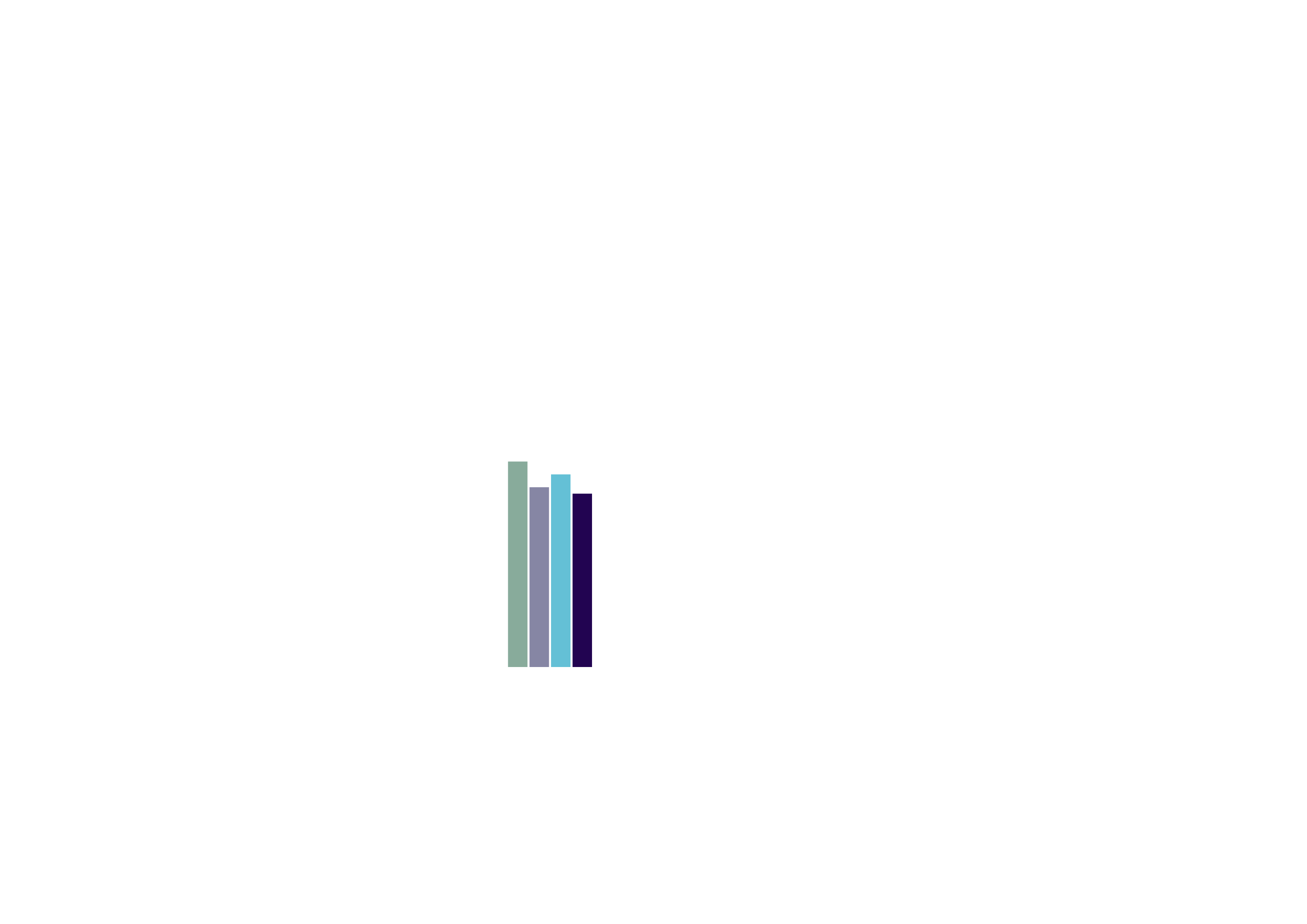

Tender price and CPI inflation forecasts

Source: BCIS, Oxford Economics, Carter Jonas Research

Tender price inflation CPI

10.0

9.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0

Q3 2021

Q3 2022

Q3 2023

Q3 2024

Q3 2025

Q3 2026

Q3 2027

Q3 2028

Q3 2029

Q3 2030

% per anum

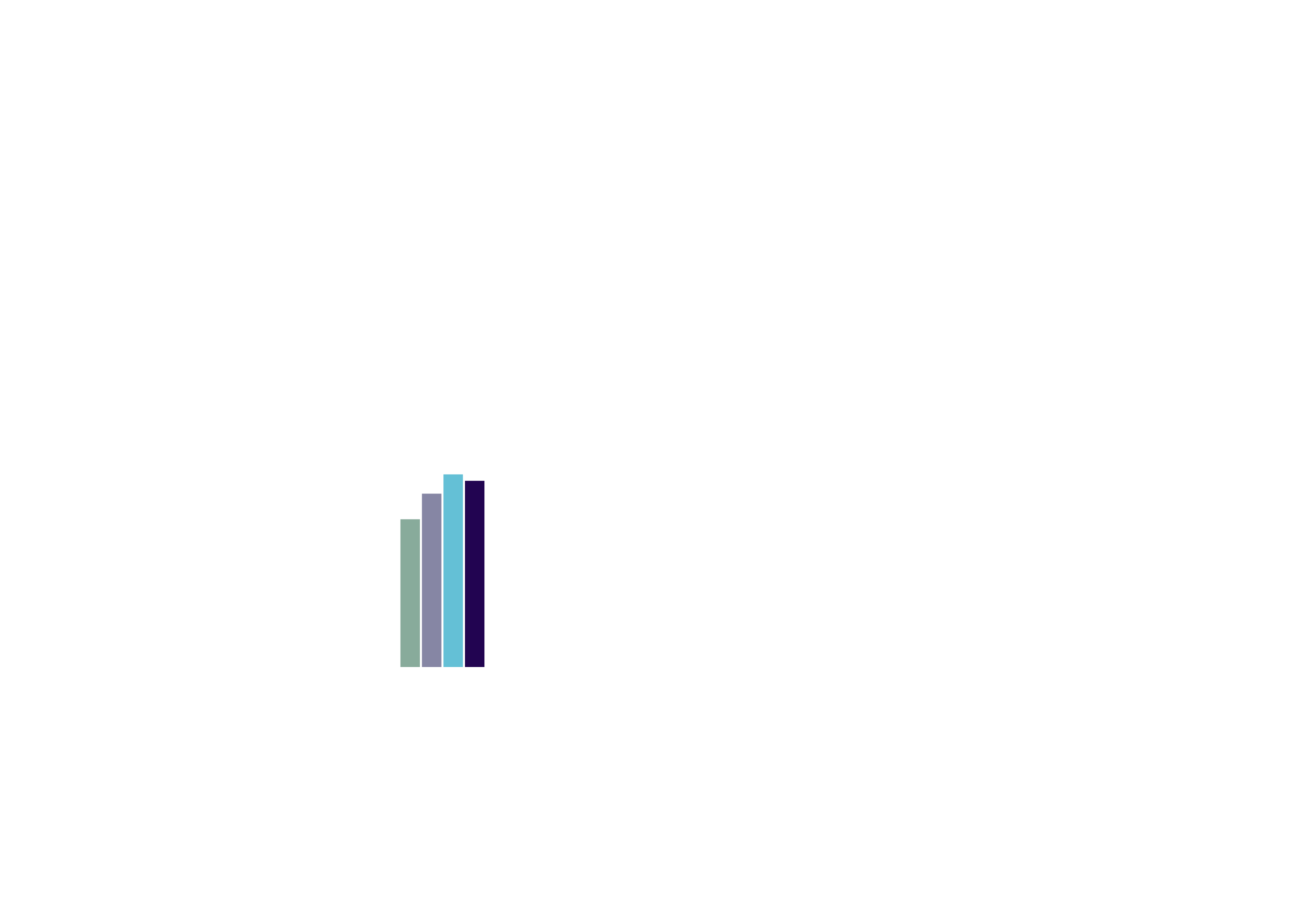

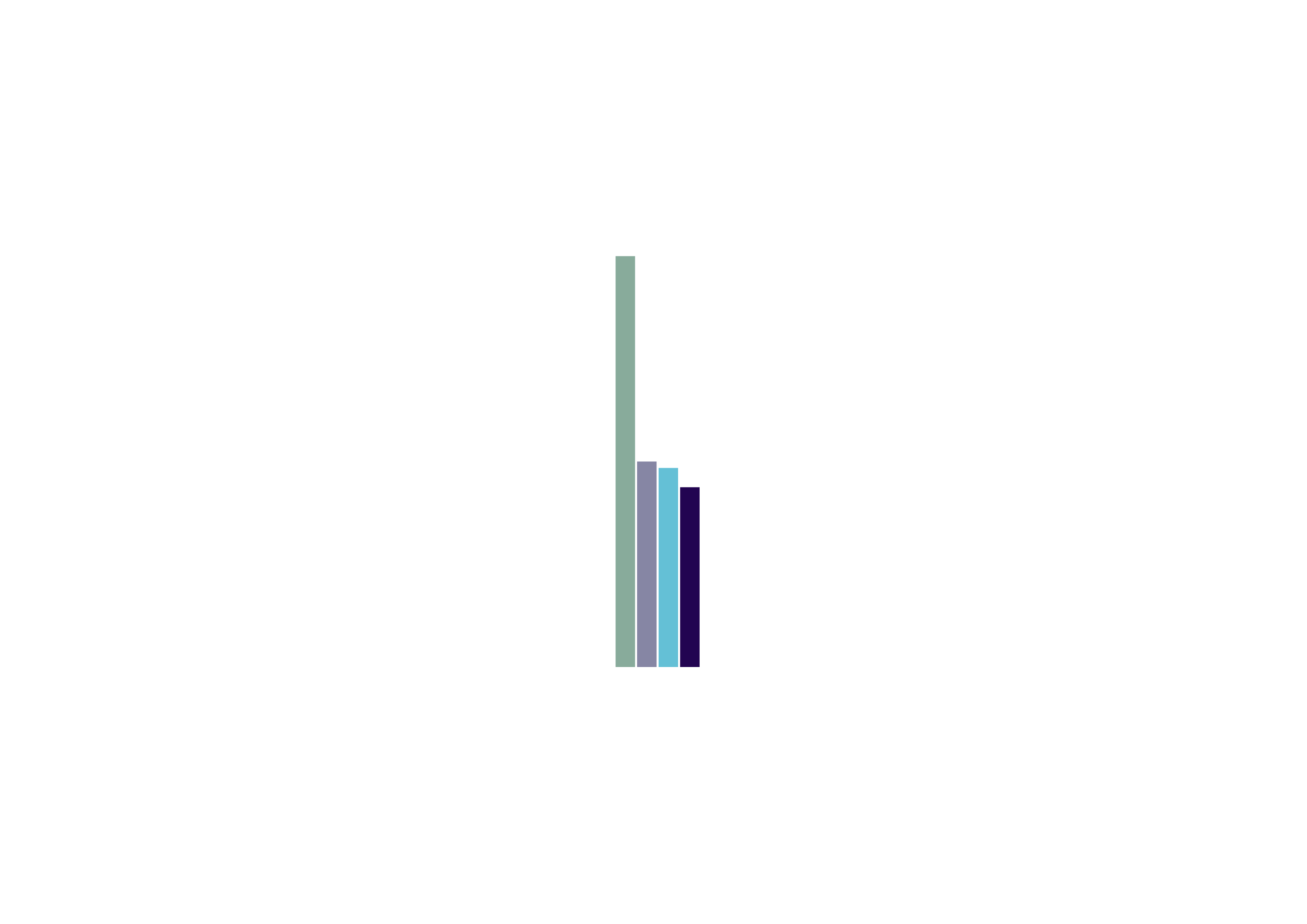

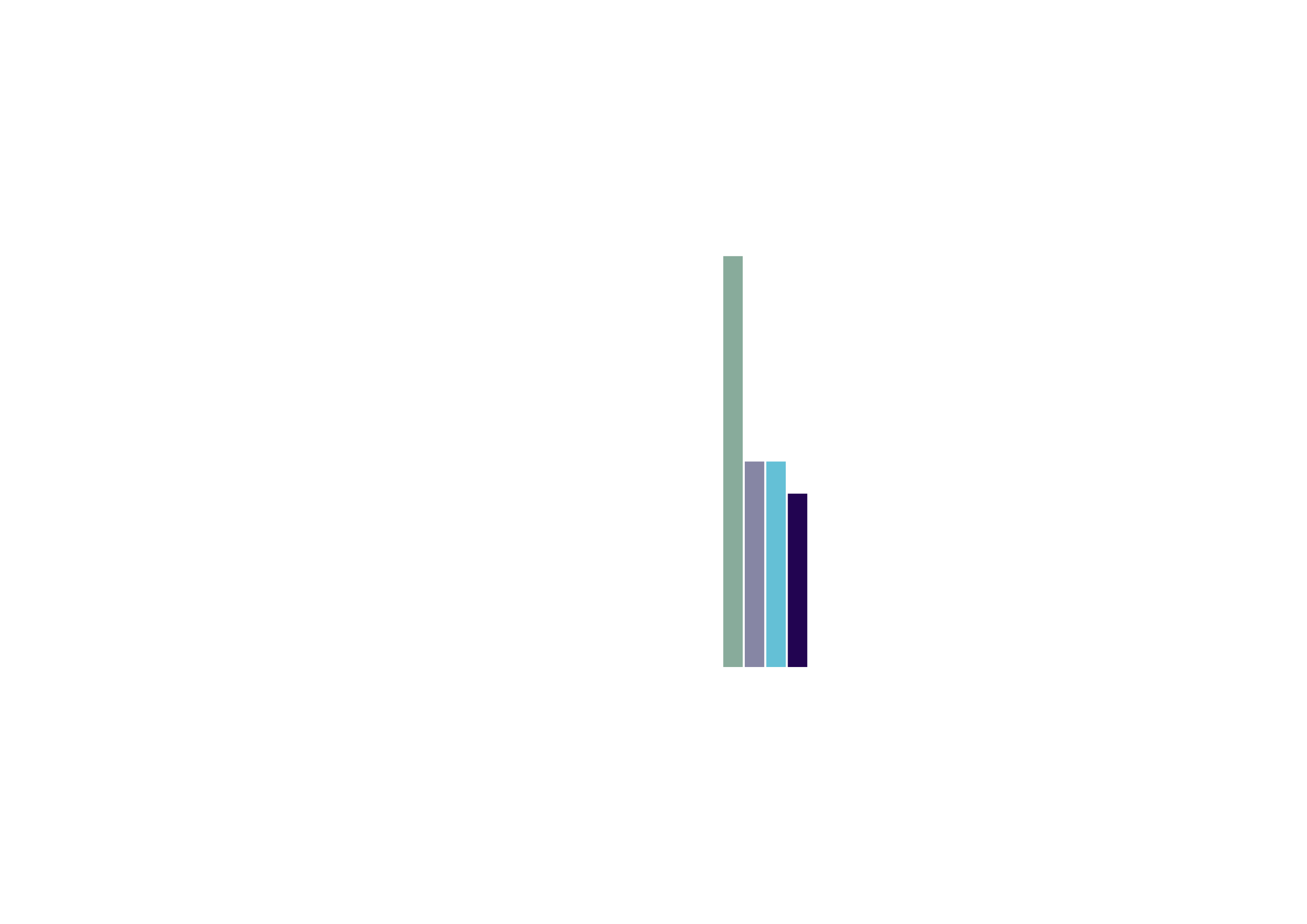

Annual inflation projections

Source: BCIS, Oxford Economics, ONS, Carter Jonas Research

Q3 2025 (est) Q3 2026 Q3 2027 � Q3 2027-Q3 2030 (% per annum)

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0

Tender�prices

Building �costs

Material

costs

Labour�costs

Download the full report

Download this section

Commercial market trends

We expect a slowdown in commercial rental growth across the office, industrial and retail sectors, but growth should remain positive and average circa 2% per annum at the all-property level over the next three years. Industrials should continue to outperform, but the variation in performance between sectors should continue to narrow. Assuming a stable profile for commercial property yields, commercial capital value growth should also remain in positive territory.

Download the full report

Download this section

Residential market trends and living sectors

Despite a recent increase in market activity, house price growth has been slowing. Although prices have seen a slight increase, they are lagging behind the rate of inflation at 2.8% in the 12 months to July 2025 (HM Land Registry), with considerable regional variation (ranging from 0.7% in the London to 7.9% in the North East). We expect growth to slow in 2026 (1.4%), then gather momentum in 2027 (2.7%), 2028 (3.6%) and 2029 (4.0%).

This section features:

Residential market trends

In focus: �the living sectors

"There are mixed signals in the housing market."

In the 20 years to the end of 2024/25, �housing starts in England averaged 142,000 per annum, but 2024/25 saw a particular low with just 113,200 starts, the fewest since 2012/13. Starts in Q1 2025 were 29,600, up from 25,600 in Q4 2024, but still equivalent to less than 120,000 per annum. This underlines the challenge of meeting the government’s target of 300,000 net additional dwellings. As of August 2025, planning data shows almost 370,000 units in the pipeline in England for 2026, but only 58,800 units actually have planning permission in place.

The private residential rental market continues to perform well, mostly supported by strong levels of tenant demand and constraints on supply. Investor confidence in the UK’s �Build-to-Rent sector is improving, although the planning and regulatory process is delaying construction starts and acting as a deterrent to private investment. Debt financing is key, with an increase in alternative lenders leading to growth in available capital, as well as traditional funding models cautiously returning to the market, and a rise in forward funding deals.

Download the full report

Download this section

Infrastructure and minerals

In June, the government published its 10 Year Infrastructure Strategy, announcing funding of £725 billion over the next decade. This covers a very broad definition of infrastructure, from transport and energy, through to schools, hospitals, prisons, and defence, and includes maintenance programmes as well as new projects. A new UK Government Body – NISTA - has been launched to oversee its delivery, and an Infrastructure Pipeline digital portal has been launched to provide greater certainty on upcoming projects.

Minerals: Although operational output levels at the UK’s quarries is subdued, the UK’s mineral reserves are still being consumed more quickly than they are being replenished, and development work linked to new mineral prospects remains highly active, driven by the typical lead time needed to get new schemes through the planning pipeline.

Landfill tax: under new government proposals, all landfill will be charged at the standard rate, meaning an additional cost of £122.10 per tonne by 2030 for sending less polluting inert excavation material to landfill. This could significantly impact viability, and / or reduce land values, potentially leading to considerable market disruption.

Get in touch

020 7529 1519

David Wood

Head of Quantity �Surveying

Email

020 7518 3301

Dan Francis

Head of Research

Email

020 7298 1827

Jon Pinkerton

Head of Development Consultancy

Email

01865 404478

James Cordery

Head of Development Agency

Email

020 7518 3335

Ben Le Coq

Partner, Commercial Development

Email

020 7493 0685

Sophie Davidson

Associate, Research

Email

For more detail on all topics covered in Development Outlook, Autumn 2025, �download the full research report.

Download the full report

CPI �inflation

Download the full report

Download this section

Download the full report

Download this section

Download the full report

Download this section

Download the full report