Land values:

the national view

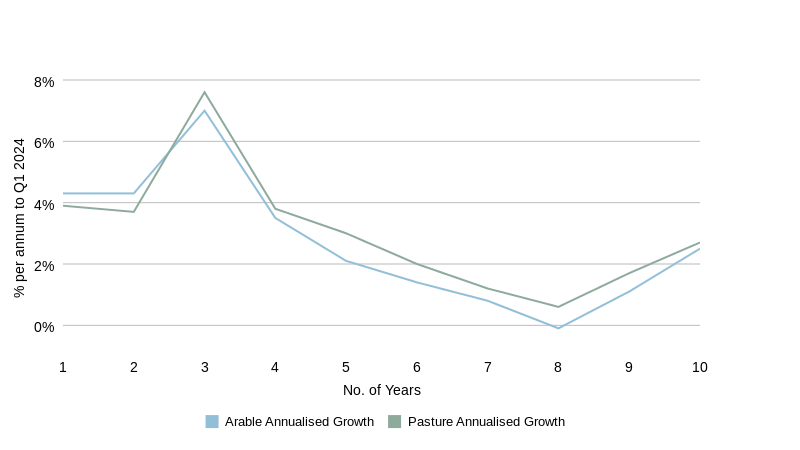

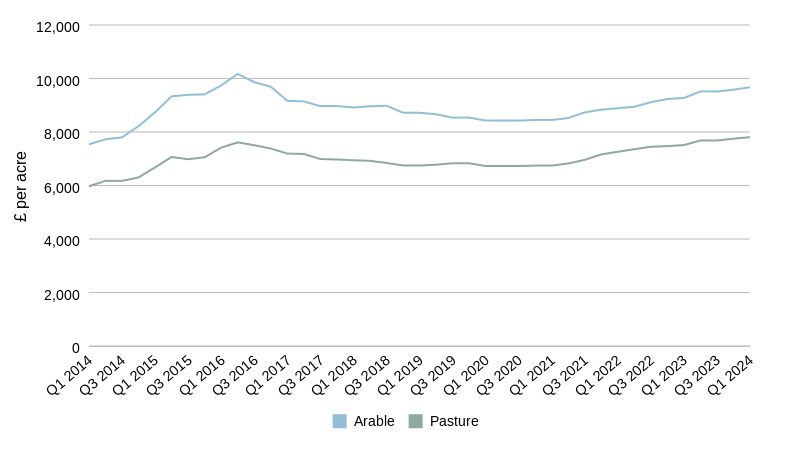

Average farmland values in England and Wales continued their upwards climb in Q1 2024.

With annual growth picking up pace a little and CPI inflation falling sharply, both arable and pasture land values are now rising faster than inflation.

Easing inflationary pressures and the prospect of interest rate cuts offer welcome relief for farmers. Fuelled by these factors, along with a significant cash presence and a growing natural capital market, market sentiment remains high.

While historically low supply has limited activity in recent, a noticeable increase in Q1 with further anticipated growth in Q2 could significantly boost transaction volumes. With robust demand and rising availability, farmland values are likely to continue their upward trajectory.

£9,667

per acre

Average arable land value in Q1

from

Q4 2023

+0.9%

+4.3%

from

Q1 2023

£7,806

per acre

from

Q4 2023

+0.7%

+3.9%

from

Q1 2023

Farmland

Market Update

Agricultural land values continued to rise steadily in the first quarter of the year. An influx in supply over the coming months is likely to be met with robust demand, boosting market activity.

“Land value growth has not entered negative

territory in over three years.”

FIGURE 5

Commodity prices

Source: Carter Jonas, AHDB, Farmers Weekly, Defra, ONS, OPEC

Input

Outputs

CRUDE OIL

Unit

Latest data

Date

Quarterly change

Annual change

£/barrel

66.3

March '24

6.1%

2.5%

Fertiliser

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

342.0

March '24

-3.4%

-26.5%

Red Diesel

Unit

Latest data

Date

Quarterly change

Annual change

pence/litres

85.3

March '24

1.8%

-11.4%

Feed Wheat

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

177.5

March '24

-9.1%

-18.7%

oilseed rape

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

373.2

March '24

0.7%

-11.8%

MILK

Unit

Latest data

Date

Quarterly change

Annual change

pence/litre

37.3

Feb '24

-1.2%

-22.3%

BEEF

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

493.9

March '24

16.0%

1.4%

Pork

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

208.3

March '24

-1.1%

-1.8%

Click a location for

a local overview

East of England

Arable

Pasture

£7,250

£6,500

£11,250

£9,250

£9.500

£7,500

2.7%

0.0%

7.3%

7.1%

Low

£ / acre

Prime

£ / acre

Average

£ / acre

Quarterly %

Annual %

East of England land values

North West

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£8,000

£6,500

£12,000

£10,000

£10,000

£8,000

0.0%

0.0%

0.0%

0.0%

Pasture

North West land values

Wales

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£8,250

£4,250

£10,000

£8,500

£8,500

£6,500

0.0%

0.0%

0.0%

0.0%

Pasture

EMAIL Hugh

01248 360417

Partner

Hugh O’Donnell

Wales land values

North East

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£6,500

£4,250

£8,750

£6,500

£7,500

£5,750

0.0%

0.0%

4.2%

0.0%

Pasture

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

North East land values

Yorkshire and the Humber

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£8,000

£5,500

£11,000

£7,250

£9,000

£7,000

0.0%

0.0%

1.7%

2.2%

Pasture

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

Yorkshire and the

Humber land values

East Midlands

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£8,250

£6,750

£11,000

£9,000

£9,250

£8,000

0.0%

0.0%

5.1%

3.2%

Pasture

East Midlands land values

West Midlands

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£9,500

£7,000

£14,000

£12,000

£11,500

4.5%

5.6%

4.5%

5.6%

Pasture

EMAIL EDWARD

0121 3060386

Associate Partner

Edward Beale

West Midlands land values

South East

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£9,250

£8,000

£12,250

£9,500

£10,750

£9,000

0.0%

0.0%

4.9%

2.9%

Pasture

EMAIL Andrew

07880 084633

Partner

Andrew Chandler

Wales

West Midlands

East Midlands

South west

South east

East of england

Yorkshire & the humber

North east

North west

Get in touch

Hover over a trend for more info

South West

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£10,000

£7,000

£12,000

£11,000

£11,000

£9,000

0.0%

0.0%

10.0%

12.5%

Pasture

EMAIL David

01823 428591

Partner

David Hebditch

South West land values

EMAIL Andrew

07880 084633

Head of Rural Agency

Andrew Chandler

New, publicly marketed farmland supply was 49.3% higher than the level of supply in the first quarter of 2023. Yet, the wet weather has delayed numerous launches, indicating the usual surge of supply in the spring will be greater than in recent years. Nonetheless, an increase in availability this by no means represents an oversupply, with demand persisting from a range of buyers.

There have been recent developments for the new Environmental Land Management (ELM) schemes with important implications for the land market. In particular, the government confirmed that land managed under an environmental agreement will fall within the scope of agricultural property relief (APR) from inheritance tax (starting April 2025). A cap on the proportion of land than can be taken out of production for the Sustainable Farming Incentive (SFI) was also announced. This helps to address food security concerns by mitigating significant shifts in land use.

Supply and

demand

Commodity price trends

£1,000

£2,250

£1,700

0.0%

7.9%

Hill

£500

£1,500

£1,000

0.0%

0.0%

Hill

£1,800

£2,900

£2,250

0.0%

4.7%

Hill

£11,000

£14,000

£12,500

0.0%

2.0%

Lifestyle

£1,800

£3,850

£2,750

0.0%

5.8%

Hill

£10,750

£15,750

£13,250

0.0%

1.9%

Lifestyle

£11,000

£13,000

£12,000

0.0%

0.0%

Yorkshire Wolds

£13,250

£25,000

£16,750

0.0%

0.0%

Lifestyle

£8,250

£14,000

£10,250

2.5%

13.9%

Silts and Fen

£25,000

£16,000

0.0%

0.0%

Lifestyle

£13,500

£25,000

£17,000

0.0%

1.5%

Lifestyle

£8,250

£14,000

£10,500

2.4%

13.5%

Silts and Fen

£16,000

£35,000

£22,500

0.0%

12.5%

Lifestyle

SHEEP

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

797.8

March '24

35.9%

47.3%

CHICKEN

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

376.0

Feb '24

-3.3%

1.6%

EMAIL SOPHIE

020 7493 0685

Research Associate

Sophie Davidson

FIGURE 2: Annualised Growth of Average Land Values in England and Wales

FIGURE 1: Average Land Values in England and Wales

South East land values

FIGURE 4: Cumulative publicly marketed farmland supply

FIGURE 3: Year-to-date publicly marketed farmland supply

£12,500

£9,500

Carter Jonas continues to monitor the changing nature of the farmland market and the influences on land values in England and Wales.

Please note that values vary depending on the quality of the land and local dynamics, among many other factors. Speak to your regional expert (at the bottom of this page) for location-specific advice.

Land values:

the regional view

Q1 2024

Download the full report

Download the full report

Download the full report

Download the full report

For more commentary, download the full report as a PDF.

For more commentary, download the full report as a PDF.

Download the full report

For more commentary, download the full report as a PDF.

Average pasture land value in Q1

Explore the report

Land values: the national view | Land values: the regional view | Supply and demand | Commodity prices

For more commentary, download the full report as a PDF.

Chyverton Estate, Truro / extending to 233 acres / Coming soon

WEST MIDLANDS

NORTH EAST

SOUTH WEST

WALES

NORTH WEST

YORKSHIRE & HUMBER

EAST MIDLANDS

EAST OF ENGLAND

SOUTH EAST

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

Download the full report

For more commentary, download the full report as a PDF.

Inputs

Outputs

Crude Oil

Fertiliser

Red Diesel

Milk

Beef

Feed Wheat

Oilseed Rape

Pork

Sheep

Chicken

Download the full report

For more commentary, download the full report as a PDF.

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

EMAIL Jamie

01223 346592

Senior Surveyor

Jamie Elbourn

EMAIL Jamie

01223 346592

Senior Surveyor

Jamie Elbourn

EMAIL Jamie

01223 346592

Senior Surveyor

Jamie Elbourn

EMAIL Jamie

01223 346592

Senior Surveyor

Jamie Elbourn

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson