Land values:

the national view

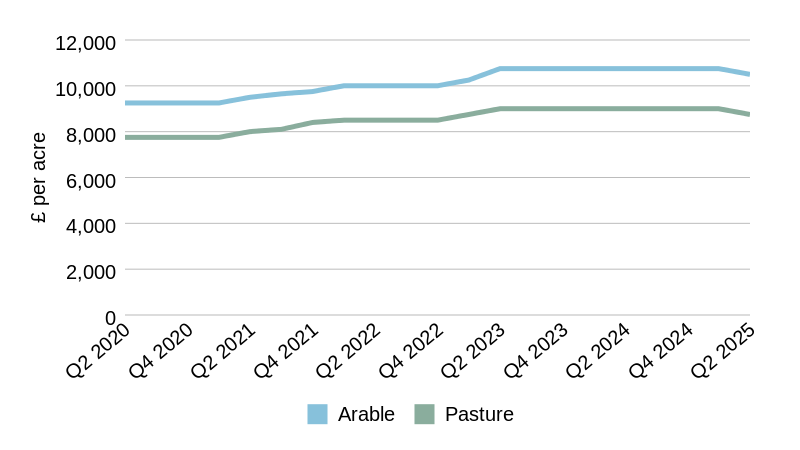

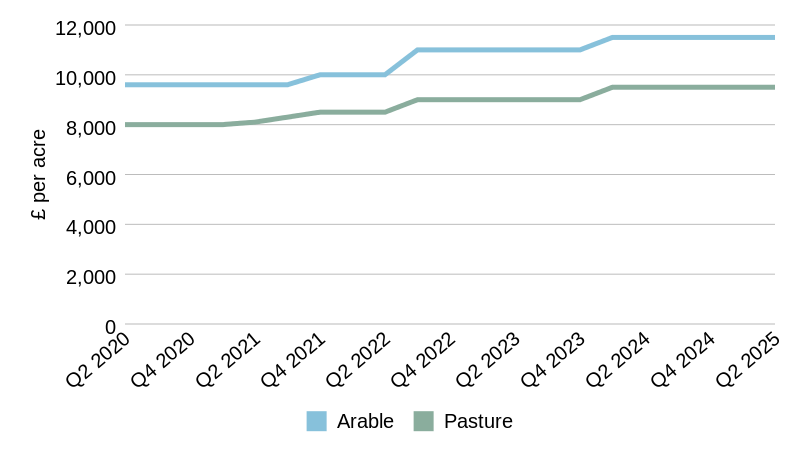

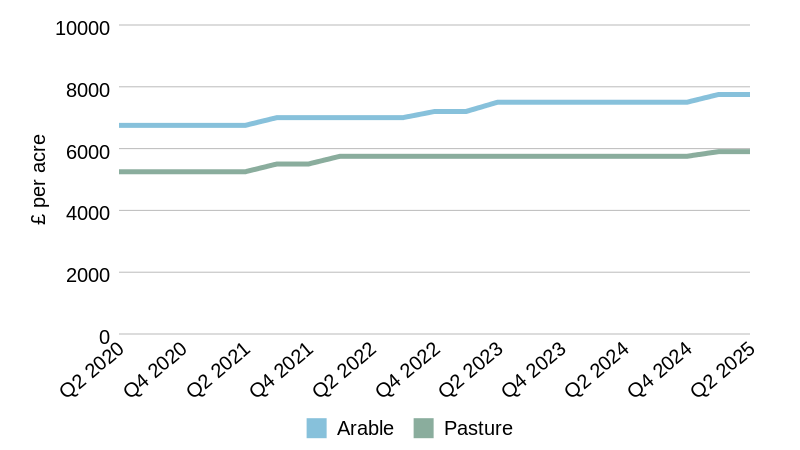

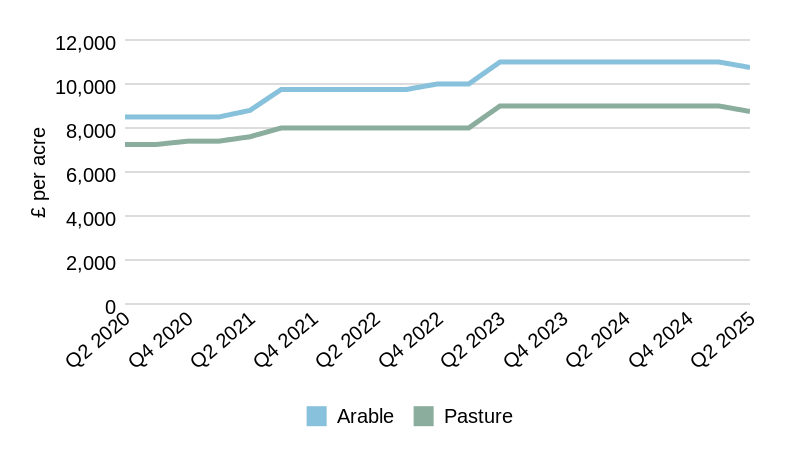

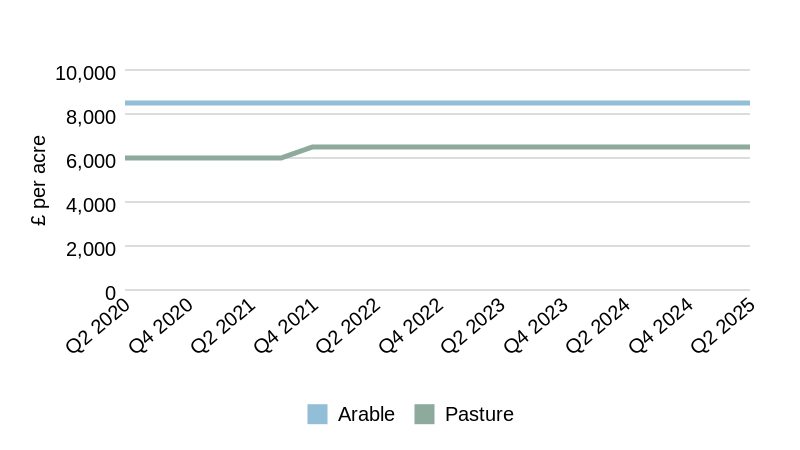

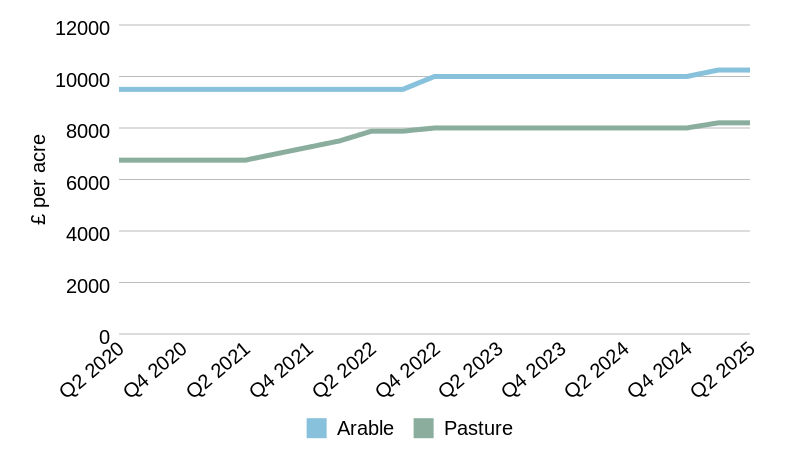

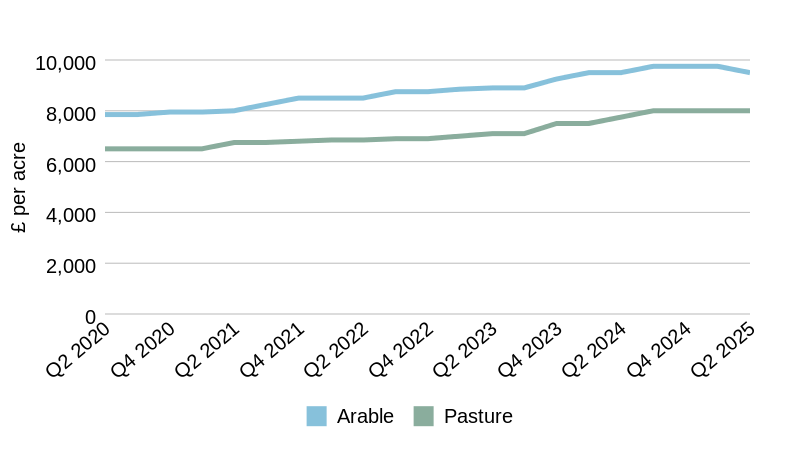

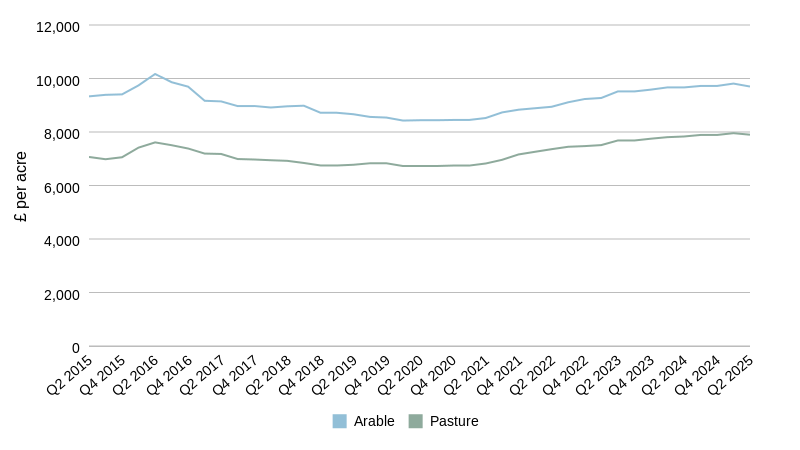

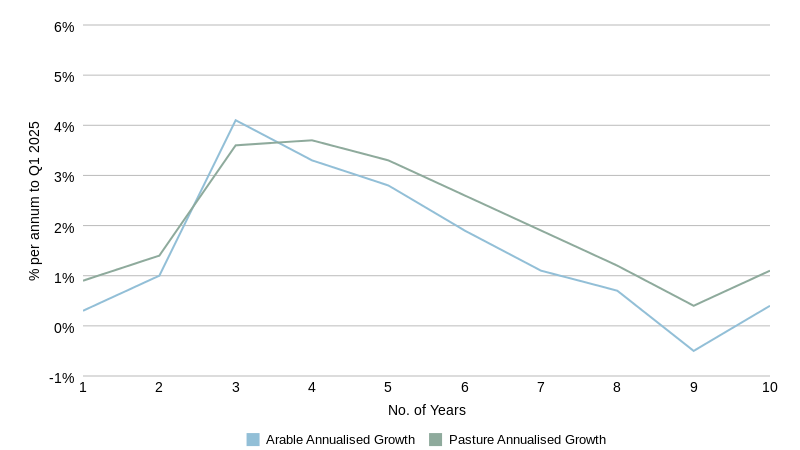

Farmland values in England and Wales eased in Q2 2025 amid cautious buyer sentiment.

That said, values are still up on this time last year. Over the longer term, long-term growth is

robust and significantly outstrips CPI inflation.

There remains a healthy level of demand for prime assets, particularly when there is interest from local farmers looking to expand their operations and in locations with a strong rollover buyer presence. Secondary and tertiary assets, on the other hand, are being approached with hesitancy, widening the price gap.

£9,700

per acre

Average arable land value in Q2

from

Q1 2025

-1.1%

+0.3%

from

Q2 2024

£7,900

per acre

from

Q1 2025

-0.7%

+0.9%

from

Q2 2024

Farmland

Market Update

Average farmland values across England and Wales softened in the second quarter of the year amid increased caution in parts of the market.

An adjustment in values reflects easing buyer appetite for some

assets, as market polarisation intensifies.

FIGURE 5

Commodity prices

Source: Carter Jonas, AHDB, Farmers Weekly, Defra, ONS, OPEC

Input

Outputs

CRUDE OIL

Unit

Latest data

Date

Quarterly change

Annual change

£/barrel

51.5

June '25

-10.2%

-21.4%

Fertiliser

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

376.4

June '25

-0.2%

14.2%

Red Diesel

Unit

Latest data

Date

Quarterly change

Annual change

pence/litre

71.8

June '25

-8.0%

-13.2%

Feed Wheat

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

180.2

June '25

-3.9%

-11.6%

oilseed rape

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

429.3

June' 25

1.0%

7.8%

MILK

Unit

Latest data

Date

Quarterly change

Annual change

pence/litre

43.1

May '25

-6.0%

13.4%

BEEF

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

641.3

June '25

-4.2%

34.2%

Pork

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

203.7

June '25

1.4%

-1.5%

Click a location for

a local overview

East of England

Arable

Pasture

£8,000

£7,000

£12,000

£9,500

£9,500

£8,000

-2.6%

0.0%

0.0%

3.2%

Low

£ / acre

Prime

£ / acre

Average

£ / acre

Quarterly %

Annual %

East of England land values

North West

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£8,200

£6,750

£12,300

£10,250

£10,250

£8,200

0.0%

0.0%

2.5%

2.5%

Pasture

North West land values

Wales

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£8,250

£4,250

£10,000

£10,000

£8,500

£6,500

0.0%

0.0%

0.0%

0.0%

Pasture

EMAIL Hugh

01248 360417

Partner

Hugh O’Donnell

Wales land values

North East

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£6,650

£4,400

£9,000

£6,650

£7,750

£5,900

0.0%

0.0%

3.3%

2.6%

Pasture

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

North East land values

Yorkshire and the Humber

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£8,200

£5,700

£11,275

£7,500

£9,300

£7,250

0.0%

0.0%

3.3%

3.6%

Pasture

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

Yorkshire and the

Humber land values

East Midlands

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£8,250

£7,250

£11,250

£9,250

£9,250

£8,250

-2.6%

0.0%

0.0%

3.1%

Pasture

East Midlands land values

West Midlands

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£9,500

£7,000

£14,000

£12,000

£11,500

0.0%

0.0%

0.0%

0.0%

Pasture

EMAIL EDWARD

0121 3060386

Associate Partner

Edward Beale

West Midlands land values

South East

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£9,000

£8,000

£12,250

£9,500

£10,500

£8,750

-2.3%

-2.8%

-2.3%

-2.8%

Pasture

EMAIL Andrew

07880 084633

Partner

Andrew Chandler

Wales

West Midlands

East Midlands

South west

South east

East of england

Yorkshire & the humber

North east

North west

Get in touch

Hover over a trend for more info

South West

Arable

Low

£ / acre

Prime

£ / acre

£ / acre

Quarterly %

Annual %

Average

£9,500

£6,500

£12,000

£11,000

£10,750

£8,750

-2.3%

-2.8%

-2.3%

-2.8%

Pasture

EMAIL JACK

01823 428593

Partner

Jack Mitchell

South West land values

EMAIL Andrew

07880 084633

Head of Rural Agency

Andrew Chandler

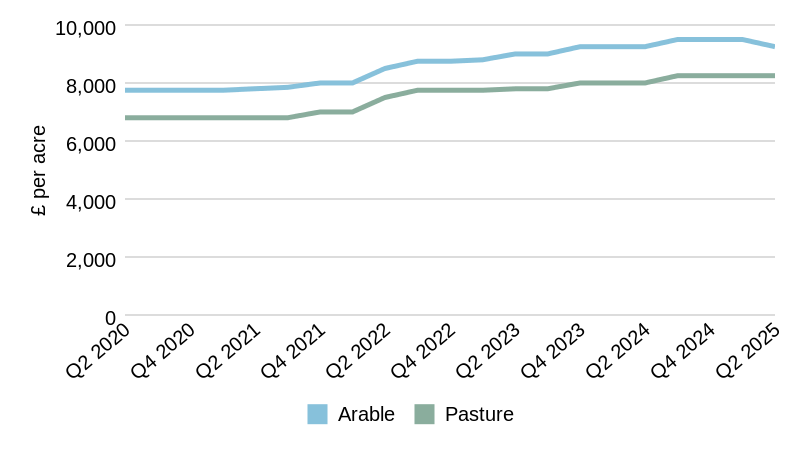

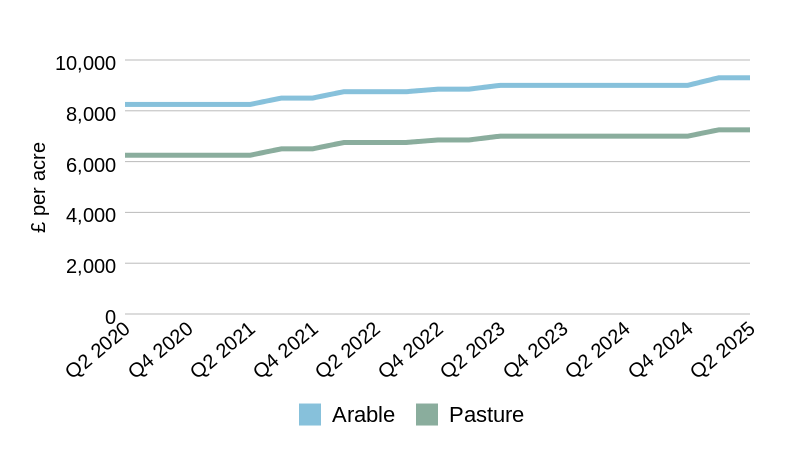

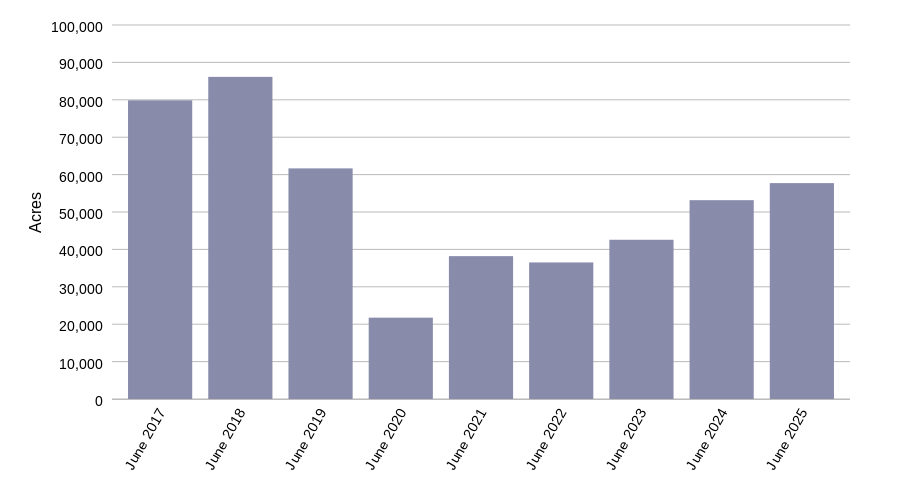

After a slow start to the year, the volume of new, publicly marketed supply saw a significant increase in the second quarter, making the first half of the year considerably higher than the same period last year. While supply levels now exceed recent averages, they remain below historical highs.

Rather than one main factor driving the increase in supply, a combination of mounting pressures is prompting some farmers and landowners to review their business strategies and financial position, sometimes leading to a decision to sell (in whole or in part).

A number of policy changes took effect this quarter, with potential profit implications. Firstly, there were increases in employers’ National Insurance Contributions (NIC), the National Living Wage and National Minimum Wage. The beneficial tax treatment of furnished holiday lets was also removed, and the transitional period for changes to Class Q and R planning rules ended.

Supply and

demand

Commodity price trends

£1,100

£2,500

£1,800

0.0%

5.9%

Hill

£500

£1,500

£1,000

0.0%

0.0%

Hill

£1,900

£3,000

£2,300

0.0%

2.2%

Hill

£11,275

£14,350

£12,800

0.0%

2.4%

Lifestyle

£1,900

£4,000

£2,850

0.0%

3.6%

Hill

£11,000

£16,000

£13,500

0.0%

1.9%

Lifestyle

£11,250

£13,250

£12,300

0.0%

2.5%

Yorkshire Wolds

£13,250

£25,000

£16,750

0.0%

0.0%

Lifestyle

£9,500

£17,000

£13,000

4.0%

18.2%

Silts and Fen

£25,000

£16,000

0.0%

0.0%

Lifestyle

£13,500

£25,000

£17,000

0.0%

0.0%

Lifestyle

£9,500

£17,000

£13,000

4.0%

18.2%

Silts and Fen

£15,000

£34,000

£22,500

0.0%

0.0%

Lifestyle

SHEEP

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

743.5

June '25

1.3%

-5.0%

CHICKEN

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

378.0

Jan' 25

-1.6%

-1.6%

EMAIL SOPHIE

020 7493 0685

Research Associate

Sophie Davidson

FIGURE 2: Annualised Growth of Average Land Values in England and Wales

FIGURE 1: Average Land Values in England and Wales

South East land values

£12,500

£9,500

Land values:

the regional view

Q2 2025

Download the full report

Download the full report

Download the full report

Download the full report

For more commentary, download the full report as a PDF.

For more commentary, download the full report as a PDF.

Download the full report

For more commentary, download the full report as a PDF.

Average pasture land value in Q2

Explore the report

Land values: the national view | Land values: the regional view | Supply and demand | Commodity prices

For more commentary, download the full report as a PDF.

Ruses Farm & Hempstead Hall Farm, Hempstead CB10 / 392.4 acres / For sale

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

EMAIL Jamie

01223 346592

Associate

Jamie Elbourn

EMAIL Jamie

01223 346592

Associate

Jamie Elbourn

Overview and spotlight on the East

Rowbury Farm, Leckhampstead, Berkshire / 260 acres / For sale / £6,000,000

Source: Carter Jonas

Source: Carter Jonas

Download the full report

+0.9%

from

Q2 2024

-0.7%

from

Q1 2025

per acre

£7,900

+0.3%

from

Q2 2024

-1.1%

from

Q1 2025

Average pasture land value in Q2

per acre

£9,700

Average arable land value in Q2

Land values:

the national view

Farmland values in England and Wales eased in Q2 2025 amid cautious buyer sentiment.

That said, values are still up on this time last year. Over the longer term, long-term growth is

robust and significantly outstrips CPI inflation.

There remains a healthy level of demand for prime assets, particularly when there is interest from local farmers looking to expand their operations and in locations with a strong rollover buyer presence. Secondary and tertiary assets, on the other hand, are being approached with hesitancy, widening the price gap.

Download the full report

For more commentary, download the full report as a PDF.

Land values:

the regional view

Click a location for

a local overview

WEST MIDLANDS

NORTH EAST

SOUTH WEST

WALES

NORTH WEST

YORKSHIRE & HUMBER

EAST MIDLANDS

EAST OF ENGLAND

SOUTH EAST

East of England land values

EMAIL Jamie

01223 346592

Associate

Jamie Elbourn

CLOSE

View on desktop for a full overview

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

North West land values

CLOSE

View on desktop for a full overview

EMAIL Hugh

01248 360417

Partner

Hugh O’Donnell

Wales land values

CLOSE

View on desktop for a full overview

CLOSE

View on desktop for a full overview

EMAIL David

01823 428593

Partner

Jack Mitchell

South West land values

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

North East land values

CLOSE

View on desktop for a full overview

EMAIL Sam

01423 707801

Associate Partner

Sam Johnson

Yorkshire and the

Humber land values

CLOSE

View on desktop for a full overview

East Midlands land values

CLOSE

View on desktop for a full overview

EMAIL Jamie

01223 346592

Associate

Jamie Elbourn

EMAIL EDWARD

0121 3060386

Associate Partner

Edward Beale

West Midlands land values

CLOSE

View on desktop for a full overview

EMAIL Andrew

07880 084633

Partner

Andrew Chandler

View on desktop for a full overview

South East land values

CLOSE

Download the full report

For more commentary, download the full report as a PDF.

Supply and

demand

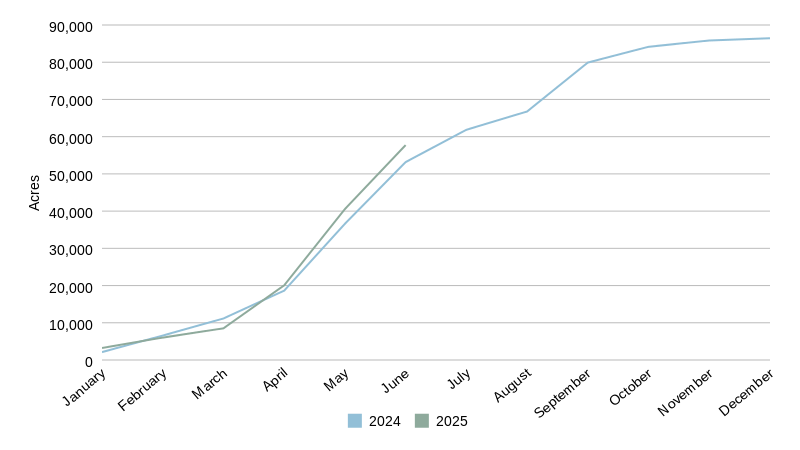

FIGURE 4: Cumulative publicly marketed farmland supply

FIGURE 3: Year-to-date publicly marketed farmland supply

Source: Farmers Weekly

Source: Farmers Weekly

After a slow start to the year, the volume of new, publicly marketed supply saw a significant increase in the second quarter, making the first half of the year considerably higher than the same period last year. While supply levels now exceed recent averages, they remain below historical highs.

Rather than one main factor driving the increase in supply, a combination of mounting pressures is prompting some farmers and landowners to review their business strategies and financial position, sometimes leading to a decision to sell (in whole or in part).

A number of policy changes took effect this quarter, with potential profit implications. Firstly, there were increases in employers’ National Insurance Contributions (NIC), the National Living Wage and National Minimum Wage. The beneficial tax treatment of furnished holiday lets was also removed, and the transitional period for changes to Class Q and R planning rules ended.

Download the full report

For more commentary, download the full report as a PDF.

Source: Carter Jonas, AHDB, Farmers Weekly, Defra, ONS, OPEC

Commodity price trends

Click a trend for more info

FIGURE 5

Commodity prices

Inputs

Outputs

Crude Oil

Fertiliser

Red Diesel

Milk

Beef

Feed Wheat

Oilseed Rape

Pork

Sheep

Chicken

CRUDE OIL

Unit

Latest data

Date

Quarterly change

Annual change

£/barrel

51.5

June' 25

-10.2%

-21.4%

Fertiliser

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

376.4

June' 25

-0.2%

14.2%

Red Diesel

Unit

Latest data

Date

Quarterly change

Annual change

pence/litre

71.8

June' 25

-0.8%

-13.2%

Feed Wheat

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

180.2

June' 25

-3.9%

-11.6%

oilseed rape

Unit

Latest data

Date

Quarterly change

Annual change

£/tonne

429.3

June' 25

1.0%

7.8%

MILK

Unit

Latest data

Date

Quarterly change

Annual change

pence/litre

43.1

May' 25

-6.0%

13.4%

BEEF

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

641.3

June' 25

-4.2%

34.2%

Pork

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

203.7

June' 25

1.4%

-1.5%

SHEEP

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

743.5

June' 25

1.3%

-5.0%

CHICKEN

Unit

Latest data

Date

Quarterly change

Annual change

pence/kg dw

378.0

Jan' 24

-1.6%

-1.6%

Download the full report

For more commentary, download the full report as a PDF.

EMAIL Andrew

07880 084633

Head of Rural Agency

Andrew Chandler

Get in touch

EMAIL SOPHIE

020 7493 0685

Research Associate

Sophie Davidson

FIGURE 2: Annualised Growth of Average Land Values in England and Wales

Source: Carter Jonas

FIGURE 1: Average Land Values in England and Wales

Source: Carter Jonas

FIGURE 4: Cumulative publicly marketed farmland supply

FIGURE 3: Year-to-date publicly marketed farmland supply

Source: Farmers Weekly

Source: Farmers Weekly

Ruses Farm & Hempstead Hall Farm, Hempstead CB10 / 392.4 acres / For sale

Overview and spotlight on the West Midlands

Overview and spotlight on the West Midlands