UK's flexible office workspace

The UK's office culture is transforming, with the traditional concept of 'office space' evolving into a more fluid and adaptable model. Once characterised by the fixed leases of Central London and major regional cities, the office sector is now embracing flexibility. This metamorphosis, accelerated by the pandemic, has seen the office market adapt

to the demands of a modern workforce.

Central London

UK's urban hubs

Central London and key regional cities

This report delves into flexible workspaces across the UK, examining key drivers such as cost per desk, deals per desk, lease lengths and supply in Central London and other significant urban hubs. The report has been written in collaboration with Office Freedom, the world’s first flexible office broker and a renowned name in the industry, enabling deeper insight and analysis into the sector.

Central London

Average rents

Average desks

Click to switch

between averages

2020

£735

2023

£926

2020

£715

2023

£834

2020

£628

2023

£725

2020

£646

2023

£696

2020

£371

2023

£664

2020

£371

2023

£664

2020

£615

2023

£596

2020

£544

2023

£571

2020

£635

2023

£546

2020

£589

2023

£530

2020

£453

2023

£519

2020

£674

2023

£514

2020

£419

2023

£469

2020

£411

2023

£448

2020

£570

2023

£427

2020

£614

2023

£546

2020

£729

2023

£411

2020

£630

2023

£480

Hover over area

to view figures

As imposed by the 2021 Environment Act, developments in England from early 2024 will be required to deliver a mandatory 10% Biodiversity Net Gain (BNG), maintained for a period of at least 30 years. BNG is an approach to development and/or land management that seeks to leave the natural environment in a measurably better state. Habitat creation or enhancement can be delivered on-site, off-site or via statutory biodiversity credits, and is calculated using an approved Biodiversity Metric.

What is Bio Diversity Net Gain?

Central London's sub-markets, such as

the West End and Midtown, have been at the forefront in terms of desk pricing and tenant mix in recent years. The traditional industry boundaries have blurred, evidenced by some hedge funds migrating from Mayfair and St James’s to Covent Garden and some tech firms establishing themselves in Fitzrovia rather

than the Clerkenwell / Old Street / Shoreditch “tech-belt”.

Desk cost dynamics

Premium areas

In 2023, the West End districts of St James's, Mayfair, and Kensington & Fulham, stood out, with the average cost per desk amounting to £926, £834, and £725, respectively.

Range of costs

However, average costs per desk per month vary between locations. SE1, Liverpool Street and Aldgate were among the most affordable Central London areas in 2023, recording average rents of £448, £427 and £411, respectively. Outside the West End, areas such as Euston & Kings Cross, Shoreditch and Bank have witnessed among the highest costs per desk this year, achieving an average of £696, £664 and £620, respectively.

Growth trajectory

Some Central London submarkets, such as the West End and Midtown, recorded positive growth in recent years, while others, such as Southbank and the City, have seen average cost per desk going in a downward trajectory of late.

Certain districts, notably St James's and Shoreditch/Old Street, have seen a surge in desk prices from 2020 to 2023, reflecting the growing demand in both districts and the premium nature of the former.

St James's

saw a 26% increase from £735 in 2020 to £926 in 2023, while Mayfair experienced a rise of 16.6% from £715 in 2020 to £834 in 2023. Both areas have witnessed strong demand amid limited availability, especially for larger floorspace.

Shoreditch/Old Street

experienced a remarkable 79% surge in rental prices, rising from £371 in 2020 to £664 in 2023. The initial struggle faced by the City Fringe area during Covid-impacted 2020 has been superseded by a wave of high-calibre building openings, fuelling an upswing in demand. Furthermore, the Old Street area's market dynamics have been significantly influenced by WeWork's strategic rent increases since 2020. While WeWork's recent filing for administration has cast a shadow over the sector, the flexible office industry remains well-positioned for growth, with businesses seeking adaptable workspaces that can cater to their evolving needs.

Aldgate/Whitechapel

In contrast, areas such as Aldgate/Whitechapel and Liverpool Street witnessed a significant drop in pricing from 2020 to 2023 and recorded a decrease of 43.6% and 25.1%, respectively. These areas have grappled with an oversupply, partly due to the influx of larger managed spaces as several new buildings have opened their doors recently. Furthermore, intense competition among landlords has escalated incentives, prompting considerable rent concessions for tenants.

Leasing trends

Lease Terms and Time from Initial Enquiry to Move-in

Duration dynamics

The lease term for flexible space has been on an upward curve in Central London, moving from 347 days in 2020 to a recent peak of 438 days in 2023. In contrast, the traditional office lease term in Central London has decreased in the same period, with an average term of 2,409 days in 2020 falling to 2,044 in 2023. However, the lease length for both types appears to be levelling off in recent months.

Transition efficiency

Concurrently, the time from lead to move-in in the capital has decreased from 100 days in 2020 to 61 days in 2023, suggesting faster decision-making and possibly a streamlined administrative process. Smaller requirements and fewer options in the market have also contributed to the decrease in the time from lead to move-in.

Desk per deal analysis

Growth pockets

Canary Wharf and Shoreditch/Old Street have experienced a notable increase in the average number of desks per deal from 2020 to 2023. This trend points towards a growing preference among larger companies for these areas, likely driven by the greater availability of spacious premises.

2020

8.5

2023

8

2020

7.1

2023

7.1

2020

6

2023

6

2020

8.8

2023

4

2020

12

2023

16.3

2020

15.3

2023

9.3

2020

24.2

2023

3.5

2020

4.6

2023

17

2020

8.8

2023

13.6

2020

16.7

2023

11.8

2020

29.5

2023

9.3

2020

8.1

2023

6.2

2020

6.8

2023

9.2

2020

10.4

2023

14.7

2020

12.3

2023

10.5

2020

5.1

2023

4.5

2020

24.4

2023

15.3

2020

5.7

2023

10

Click to view research

Hover over area

to view figures

Central London

2020

£735

2023

£926

2020

£715

2023

£834

2020

£628

2023

£725

2020

£646

2023

£696

2020

£371

2023

£664

2020

£371

2023

£664

2020

£615

2023

£596

2020

£544

2023

£571

2020

£635

2023

£546

2020

£589

2023

£530

2020

£453

2023

£519

2020

£674

2023

£514

2020

£419

2023

£469

2020

£411

2023

£448

2020

£570

2023

£427

2020

£614

2023

£546

2020

£729

2023

£411

2020

£630

2023

£480

2020

8.5

2023

8

2020

7.1

2023

7.1

2020

6

2023

6

2020

8.8

2023

4

2020

12

2023

16.3

2020

15.3

2023

9.3

2020

24.2

2023

3.5

2020

4.6

2023

17

2020

8.8

2023

13.6

2020

16.7

2023

11.8

2020

29.5

2023

9.3

2020

8.1

2023

6.2

2020

6.8

2023

9.2

2020

10.4

2023

14.7

2020

12.3

2023

10.5

2020

5.1

2023

4.5

2020

24.4

2023

15.3

2020

5.7

2023

10

Average desks

Average rents

*per desk per month

*desks per deal

*per desk per month

The average number of desks per deal in Central London varied across areas:

Canary Wharf showed a significant increase from 4.6 desks in 2020 to 17 desks in 2023. Companies including WeWork, The Office Group and SQB have all opened new flexible centres in Canary Wharf in that period, providing much-needed high-quality space in the area.

Shoreditch/Old Street maintained steady growth, with 12 desks in 2020 and 16.3 desks in 2023, supported by larger tech companies looking for space in the area.

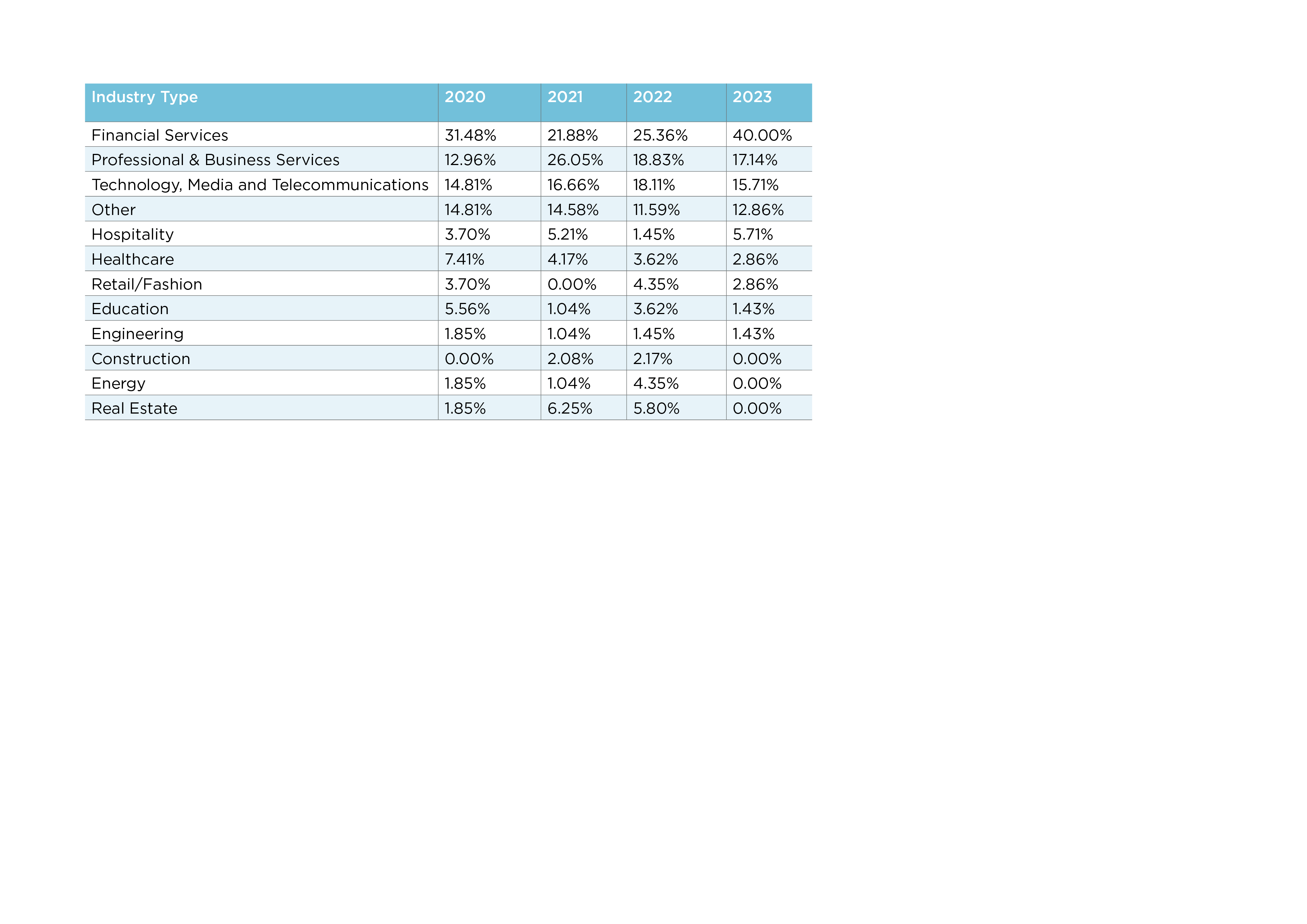

The data paints a vivid picture of the occupier landscape in Central London:

Financial Services

Dominating the scene, their presence has grown from 31.48% share of the total in 2020 to a commanding 40.00% in 2023, although

it shrank significantly in 2021.

TMT

Despite a decrease from 18% in 2022 to 15.7% share in 2023, the technology, communication and media sector remains among the

largest occupiers in London.

Professional & Business Services

This sector has remained among the most active having 17% of the share in 2023.

In Central London, the Financial Services industry also occupied the largest share of traditional office space leased in 2023, accounting for over 30% of the total. Other sectors taking a significant share of the traditional offices' take-up were Technology, Communication and Media (16.3%), Professional & Business Services (14.2%) and Real Estate (10.3%).

Notably, most Real Estate occupiers who took traditional leases in 2023 were flexible space providers and accounted for 7% of the total office take-up in that period, showing the current demand for flexible space in the market.

Diverse occupier landscape in Central London

"Central London's iconic sub-markets, such as the West End and Midtown, have evolved into flexible workspace hubs, reflecting a dynamic work ethos"

Supply

Growth of new flex centres since 2021

Central London led the growth in flex space, with 586 new flex centres opening in the period 2021 – September 2023, accounting for 80% of the new openings across the UK. Core markets in the capital accounted for 70% of the new spaces, while the fringe locations accounted for the remainder.

Central London new centres by

area year on year

The City of London saw the most significant growth, with six new centres in 2021,

26 in 2022, and 82 in 2023. Shoreditch/Old Street and SE1 also witnessed a substantial increase in the same period.

Central London new centres by area 2023

Central London led the growth in flex space, with 586 new centres opening in the period 2021 – September 2023, accounting for 80% of the new openings across the UK in that period. Core markets in the capital accounted for 70% of the new spaces, while the fringe locations accounted for the remainder.

Conclusions

Central London has witnessed growth in flexible workspace pricing, with areas like St James's, Mayfair, and Shoreditch leading the charge. The significant price surges in these districts from 2020 to 2023 highlight the increasing demand for premium, flexible workspaces.

However, it's essential to note the challenges. While some areas have seen a surge in demand and pricing, others, like Aldgate/Whitechapel and Liverpool Street, have experienced a decline. These fluctuations emphasise the importance of understanding local market dynamics and the factors influencing demand.

The occupier landscape in Central London has remained similar to three years ago, with Financial Services taking a dominant position. The continued demand from those occupiers suggests that businesses across sectors recognise the benefits of flexible workspaces.

Beyond the capital, other significant cities in the UK are also seeing a marked interest in flexible workspaces. The data indicates that while Central London remains a dominant player given its overall size relative to the regional markets, cities/towns such as Reading, Aberdeen, and Cambridge are carving out their own significant niches in the flexible workspace sector. This suggests a broadening of demand, with regional hubs increasingly becoming focal points for businesses seeking adaptable office solutions.

In the broader context, the pandemic has undeniably acted as a catalyst, accelerating the transition towards flexible workspaces. As businesses prioritise adaptability, cost-efficiency, and employee well-being, the demand for flexible workspaces is poised to grow further.

Definitions

Definitions

All the data is based on transactional evidence.

Flexible office deals are all private office deals and not coworking or memberships. All three months plus up to 3 years. Size ranges from 1-70 desks.

New centres for serviced means brand new serviced floors or buildings that opened. For managed, they are leased floors that have been turned into managed offerings. Sizes range from 500 sq ft + for managed to 100k plus for serviced buildings.

The Occupier Type analysis is based on around 1000 deals.

Flexible office space providers offer a variety of different types of workspaces, including:

Coworking spaces: Shared workspaces where individuals and small teams can rent desks or private offices on a flexible basis.

Serviced offices: Fully furnished and equipped offices that can be rented short-term or long-term.

Hybrid offices: A combination of coworking spaces and serviced offices, offering businesses the best of both worlds.

Flexible office space providers also offer a range of amenities and services, such as:

High-speed internet

Meeting rooms and event spaces

Printing and photocopying

Business support services

On-site cafés and restaurants

Central London

UK's urban hubs

Office Freedom

Email me

Rad Radev

Associate Research Analyst

+44 (0)20 7518 3270

Source: Office Freedom, Carter Jonas

Source: Office Freedom, Carter Jonas

Source: Office Freedom, Carter Jonas, CoStar

Source: Office Freedom, Carter Jonas

Source: Office Freedom, Carter Jonas

Source: Office Freedom, Carter Jonas

% share of Occupier Type in Central London

Email me

Ollie Lee

Associate

+44 (0)20 3940 9463

Email me

Ed Caines

Head of Landlord Representation

+44 (0)20 7016 0724

Email me

Bob Toor

Senior Account Director

+44 (0)7507 554 521

Email me

Julian Wogman

Senior Account Director

+44 (0)7904337664

Carter Jonas

Scroll up to view map data

Average desks per deal in

central London

Average rents

Rental trends have been influenced by factors such as supply dynamics and property quality. Limited availability in the West End and Kings Cross contrasts with oversupply in the City and South Bank sub-markets. Moreover, the emergence of high-spec, energy-efficient buildings around the City Fringe is enhancing the quality of offerings and pushing rental values upwards, thanks to strong demand for the best space in the market.

Email me

Jon Posener

Chief Operating Officer

+44 (0)20 3872 7134

Definitions

Definitions

All the data is based on transactional evidence.

The flexible office deals are all private office deals and not coworking or memberships. All deals are for three months plus up to 3 years. Size ranges from 1-70 desks.

New flex centres mean brand new serviced floors or buildings that opened. Managed centres are leased floors that have been turned into managed offerings. Sizes range from 500 sq ft + for managed to 100k plus for serviced buildings.

The Occupier Type analysis is based on around 1000 deals.

Flexible office space providers offer a variety of different types of workspaces, including:

Coworking spaces: Shared workspaces where individuals and small teams can rent desks or private offices on a flexible basis.

Serviced offices: Fully furnished and equipped offices that can be rented short-term or long-term.

Hybrid offices: A combination of coworking spaces and serviced offices, offering businesses the best of both worlds.

Flexible office space providers also offer a range of amenities and services, such as:

High-speed internet

Meeting rooms and event spaces

Printing and photocopying

Business support services

On-site cafés and restaurants

It feels that the flex market has now recovered from Covid. Regardless of what happens with WeWork, there is now a large amount of established flex office operators who continue to grow. There is still some hesitancy from certain companies in terms of coming back to the office, but we are finding that the majority of our clients have been embracing a more hybrid working policy and are taking permanent office space.

Richard Smith, COO of Office Freedom

"

"

Blackfriars, Fitzrovia, Holborn/Chancery Lane and Soho recorded a notable decrease in average desk per deal in 2023 compared to 2020. A lack of available high-quality larger floorspace in Soho and Fitzrovia, is likely to be one of the reasons behind the fall in those areas. In contrast, Holborn/Chancery Land has seen a number of large buildings opening in 2023.

18

16

14

12

10

8

6

4

2

0

Demand for London office accommodation is being driven, in part, by the operators of serviced and co-working office space that are seeking accommodation for conversion,

reflecting the robustness of occupier demand in that market sector.

While there has been a steady growth in new serviced office buildings, a large part of the growth in flex space has been due to managed office spaces. Many landlords are now offering fitted, all-inclusive, self-contained spaces, on shorter-term deals. This part of the flex market will continue to grow at pace throughout 2024.

Jon Posener, COO of Office Freedom

"

"

Ollie Lee, Carter Jonas

"

"

An increasing number of landlords of non-serviced office suites, typically below 5,000 sq ft, are fitting out available accommodation and offering it to let on a “plug-in-and-go” basis to compete with the serviced office market.

Ollie Lee, Carter Jonas

"

"

Continue reading our report on UK’s flexible office workspace