Hover over a region to view the latest prime rent and land value figures

INDUSTRIAL

OVERVIEW

Autumn 2023

To discuss the industrial market in further detail, contact our sector specialists

View MORE Carter Jonas research

Andrew Smith SIOR

National

Partner

07919 326085

Email me

Email me

William Rooke

East

Partner

07899 081027

Email me

Alison Williams

South West and South Wales

Partner

07917 041109

Email me

Chris Hartnell

North

Partner

07800 572007

Email me

Jon Silversides

South Midlands / M40

Partner

07720 537141

Email me

Frederic Schneider SIOR

International

Partner

07733 124489

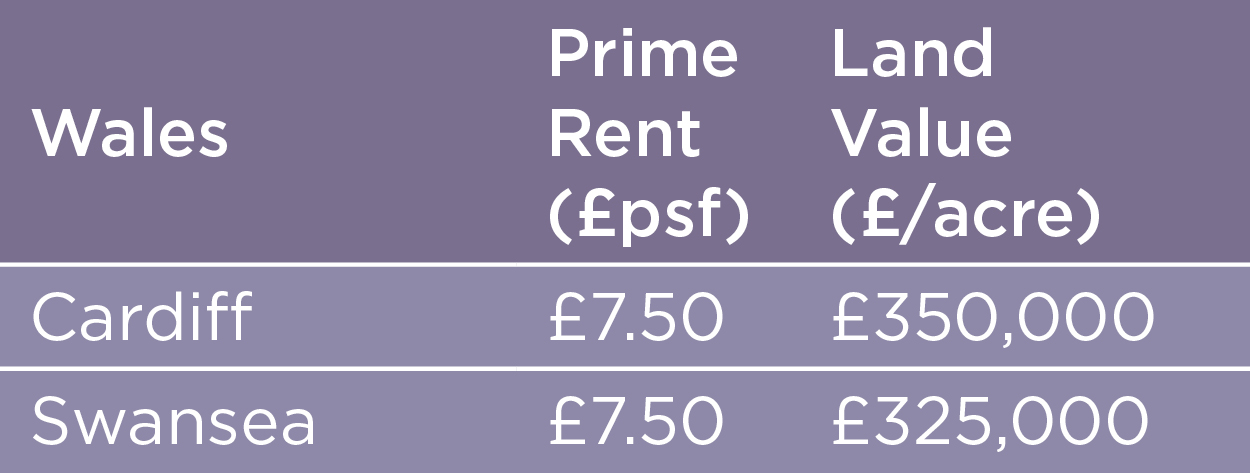

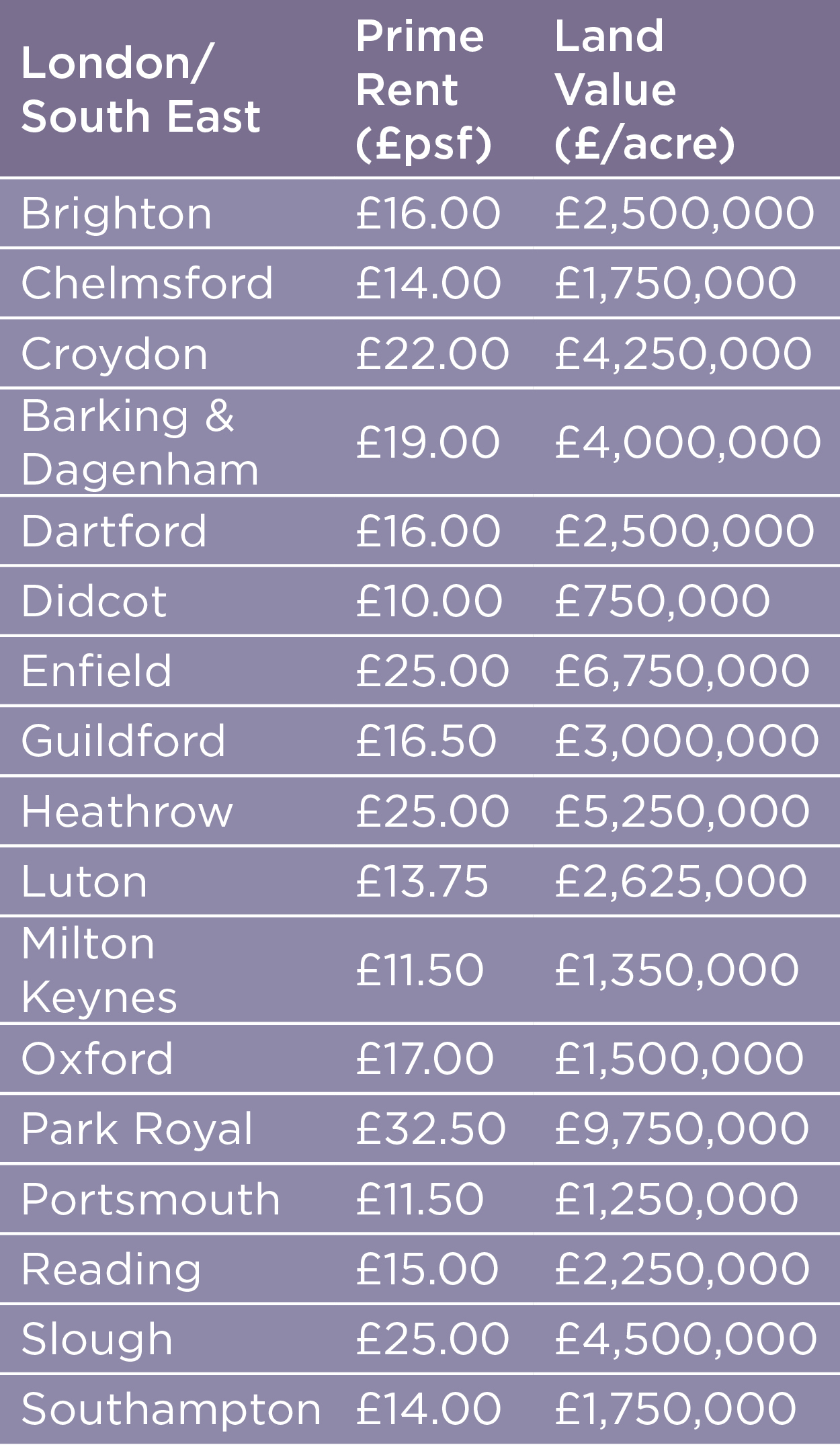

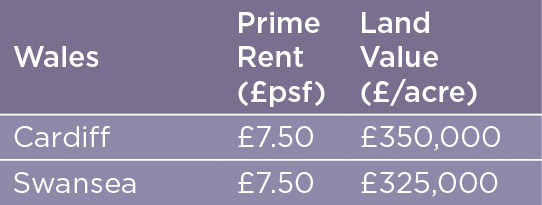

Our Industrial Overview report monitors prime headline rents and land values in 50 key industrial locations across the UK. It also highlights the Carter Jonas Industrial Index, which tracks the overall trend in values.

Email me

Darren Letherby

Bristol

Partner

07393 259956

Headline rental growth,

6 months to September 2023

+3.7%

Occupier demand and supply

Land value growth,

6 months to September 2023

+0.4%

Prime rent: Based on 10,000 (GIA) sq ft brand new unit in a prime location, with 45-50% site cover and 10% office content, and a lease term of 5-10 years.

Land value: Based on land with an unrestricted B1(c), B2, & B8 planning consent with a 45-50% site cover and in a prime location. Also based on no abnormal cost for any environmental issues, site levelling or s.106 (CIL) commitments etc. All data estimated as of September 2023.

Amazon has formed a substantial proportion of big shed take-up in recent years, but the online retailer has been scaling back its requirements and disposing of surplus space in some locations. Given this, it is not surprising that overall take-up has reduced, with fewer transactions at the larger end of the spectrum in particular. The heavy reliance of the market on one occupier was never ideal, and demand is now spread more evenly across a diverse range of firms and sectors.

Demand is becoming more location specific. In some places, take-up is being boosted well above normal levels by infrastructure projects such as High Speed 2 and Sizewell C nuclear power station. Labour market conditions are also affecting demand, with a constrained labour supply now impacting the practicality of operating in certain markets.

The manufacturing sector appears to have stabilised, particularly at the hi-tech end of the spectrum, despite criticism of the government’s lack of any real coherent strategy. Indeed, we are witnessing this positivity in the form of investment and relocation decisions, with several such enquires remaining active.

Source: Carter Jonas

In many locations, prime rents have been flat over the last six months, but this is not uniformly the case. Indeed, some markets have seen exceptionally strong rental performance, particularly those where a healthy local economy has fostered demand and there is little standing stock or development. A good example of this is Norwich, where the prime rent has risen from £8.00 to £10.00 per sq ft.

Prime rental trends

The overall prime rent for the UK has increased by 3.7% over the last six months, marking a return to growth following no change over the previous six months. This represents a more sustainable rate of growth following the rapid rise seen over the previous two years. Over the three years to September 2023, prime UK industrial rents have increased by a remarkable 38%, an average growth rate of 11.5% per annum.

Source: Carter Jonas Industrial Index

6

months

12

months

3

years

5

years

3.7%

11.7%

7.8%

3.7%

"Emerging policy such as MEES and mandatory Biodiversity Net Gain, as well as developers and funders wishing to raise their ESG credentials, are steering the market towards ever more sustainable practices."

Email me

Nick Waddington

National

Partner

0121 824 0771

Email me

Adam McGuinness

National

Partner

0121 824 0770

Prime rent and

land value figures

Prime rent: Based on 10,000 (GIA) sqft brand new unit in a prime location, with 45-50% site cover and 10% office content, and a lease term of 5-10 years.

Land value: Based on land with an unrestricted B1(c), B2, & B8 planning consent with a 45-50% site cover and in a prime location. Also based on no abnormal cost for any environmental issues, site levelling or s.106 (CIL) commitments etc. All data estimated as of January 2023.

As well as variations by local market, there have been strong differences in regional performance. The South East and East has seen the largest rise over the last six months, at 8.6%. The north of England (encompassing the North West, Yorkshire and the Humber, and North East regions) saw prime rents rise by 2.9%, whilst the South West / Wales saw a rise of 2.5% over the last six months. The Midlands saw little change at +0.6% whilst the London/M25 market recorded -2.7%, with some locations seeing a modest downwards correction in rents as recent exuberant take-up returned to more normal levels. Growth by region is illustrated in Figure 1.

UK prime industrial rental growth to September 2023

Figure 1: Change in prime rents, last 6 months

The rate of material price inflation has now decelerated from the extremely high rates seen last year, and tender price inflation has reduced as cost pressures have eased. However, we have seen several companies in the construction sector run into financial difficulties with a number of insolvencies, and this is now impacting ongoing development in some cases. This situation will play out further over the next six months.

Emerging policy such as MEES and mandatory Biodiversity Net Gain, as well as developers and funders wishing to raise their ESG credentials, are steering the market towards ever more sustainable practices. This is increasing the complexity and cost of development. Therefore, even though overall build cost inflation is now falling, additional sustainability elements must increasingly be factored in, adding potentially 5-10% to the overall cost.

The industrial land market has now largely adjusted to the new build cost and interest rate / inflationary environment. Industrial land values rose by 0.4% in the six months to September, compared with the significant correction of -29.3% over the previous six months. Strong demand from industrial occupiers and open storage site operators is helping to support land values in some locations where developers are struggling to achieve viability.

As Figure 2 illustrates, the long-term trend for industrial land values remains upwards, and land values are nearly 11% higher than two years ago, 18.6% higher than three years ago and 45% higher than five years ago (the latter figure representing an average annual growth rate of 7.7%).

Beyond the overall UK figure, the industrial land market has seen a mixed picture, although land has remained in strong demand in many locations. This is particularly the case in those markets where open storage investors are helping to drive pricing as some traditional developers have fallen away. The same is true for locations where data centre demand has returned strongly, most notably in the South East, which has driven some exceptional pricing levels, assisted by owner-occupiers who remain well financed.

Land values and development outlook

Figure 2: UK industrial prime rents and land values

Source: Carter Jonas

Source: Carter Jonas Industrial Index

6

months

12

months

3

years

5

years

-29.0%

5.9%

per annum

7.7%

per annum

+0.4%

UK prime industrial land value growth to September 2023

Investment market

At £6.8 billion, the total value of industrial property purchased during the first three quarters of 2023 was 22% below the Q1-3 average over the previous five years. This reflects subdued trading volumes and pricing uncertainty across the commercial investment market, amid a backdrop of subdued economic growth and the rapid rise in interest rates and gilt yields. However, the industrial sector has fared more favourably than the broader commercial property sector, and accounted for 31% of the total value traded during Q1-3 2023, above the average of 24% recorded over the previous five years.

These figures reflect the resilient nature of the sector, and there is still an enormous weight of money looking to target industrial property from a broad range of investors. With robust occupier demand, constrained supply and good prospects for continued rental growth, investor sentiment remains highly positive towards the industrial sector against a challenging economic backdrop.

The supply of new units is very limited across most key markets, and the development pipeline will remain restricted, given the constraints on developers, including higher funding costs and elevated building costs. On the positive side for supply, more good quality ‘grey’ space is coming onto the market as a sublease.

The accelerated evolution of the open storage sector has provided additional impetus to the broader industrial market. Several funds have gained entry to the sector over the last six months, which in some cases has compressed yields to a point where they are almost on par with traditional industrial yields (although this is only in exceptional circumstances and for prime assets).

The very strong industrial and logistics take-up experienced during 2020-2022 can be regarded as exceptional, driven by pandemic-specific requirements as well as accelerated change in global supply chains. This year has seen the market for logistics space (and online requirements in particular) cool noticeably, but the overall level of requirements remains robust, and take-up is strong relative to the average over the decade prior to 2020.

UK average