Hover over a region to view the latest prime rent and land value figures

INDUSTRIAL

OVERVIEW

Spring 2023

To discuss the industrial market in further detail, contact our sector specialists

View MORE Carter Jonas research

Andrew Smith SIOR

National

Partner

07919 326085

Email me

Email me

William Rooke

East

Partner

07899 081027

Email me

Alison Williams

South West and South Wales

Partner

07917 041109

Email me

Chris Hartnell

North

Partner

07800 572007

Email me

Jon Silversides

South Midlands / M40

Partner

07720 537141

Email me

Frederic Schneider SIOR

International

Partner

07733 124489

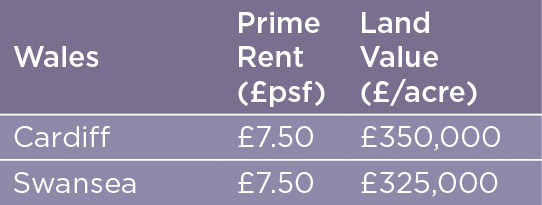

Our Spring 2023 Industrial Overview monitors prime headline rents and land values in 50 key industrial locations across the UK. It also highlights the Carter Jonas Industrial Index, which tracks the change in rents and land values across the market.

Email me

Darren Letherby

Bristol

Partner

07393 259956

Headline rental growth

during H2 2022

0%

High inflation and construction costs together with rising interest rates and the start of an economic recession have combined to create an uncertain and, in some ways, dysfunctional market. Given the speed of the recent correction in land values, the lower than usual level of transactions, and the anomalies we are seeing in rents for design and build product versus standing stock, it should be emphasised that our figures for prime rents and land values are based on our view of the prevailing values and not necessarily actual transactions.

Occupier demand & supply

Land value growth

during H2 2022

-29.3%

Prime rent: Based on 10,000 (GIA) sq ft brand new unit in a prime location, with 45-50% site cover and 10% office content, and a lease term of 5-10 years.

Land value: Based on land with an unrestricted B1(c), B2, & B8 planning consent with a 45-50% site cover and in a prime location. Also based on no abnormal cost for any environmental issues, site levelling or s.106 (CIL) commitments etc. All data estimated as of January 2023.

Despite the current economic uncertainty, the occupier market has remained robust. Ongoing long-term shifts in distribution chains continue to drive the market, including the trend towards reshoring and creating more robust supply chains, most notably for non-perishable goods.

Across many of the locations we monitor, take-up was somewhat subdued in the second half of 2022, but this was largely due to the absence of available stock, rather than weaker underlying demand. Quality stock is now in short supply and the market will remain tight in 2023, given the ongoing healthy occupier demand and limited development coming on stream during the year.

As the recession impacts further in 2023, we think that some second-hand stock will be offered back to the market as sub-leases. There could also be a rise in insolvencies, meaning more space coming back directly to landlords. Whilst this could begin to distort some areas of the market, the overall impact is likely to be modest.

Source: Carter Jonas

Following very strong growth in prime headline rents of 22% in 2021, 2022 has been a year of two halves. We reported a further strong, above-inflation increase of 9% during the first half of the year, but in contrast we have seen broadly static rental levels since the summer.

Prime rental trends

There is still strong competition amongst occupiers for existing and new build product, which has helped to maintain rental values despite the deteriorating economic conditions.

Source: Carter Jonas Industrial Index

6

months

12

months

3

years

5

years

9%

36%

42.3%

0%

Despite the positive occupier story and resilience of rental values, there has been a significant fall in industrial capital values during the last quarter of 2022, as investors have reassessed their risk assumptions following the rapid rise in long and short-term interest rates. The industrial sector has seen a sharper correction in values than the commercial market as a whole, reflecting the exuberant rise in values seen during the second half of 2021 and the first half of 2022.

Investment market trends

We are now seeing a ‘normalisation’ of yields and interest rates. However, we are not likely to see commercial property yields rise to the levels seen in the global financial crisis. In addition, the industrial and distribution sector has undergone a transformational change over the last 15 years, and the downward readjustment of yields relative to the rest of the commercial property market should be a permanent feature.

"There are still buyers with plenty of cash in the system for industrial property..."

Email me

Nick Waddington

National

Partner

0121 824 0771

Email me

Adam McGuinness

National

Partner

0121 824 0770

Prime rent and

land value figures

Prime rent: Based on 10,000 (GIA) sqft brand new unit in a prime location, with 45-50% site cover and 10% office content, and a lease term of 5-10 years.

Land value: Based on land with an unrestricted B1(c), B2, & B8 planning consent with a 45-50% site cover and in a prime location. Also based on no abnormal cost for any environmental issues, site levelling or s.106 (CIL) commitments etc. All data estimated as of January 2023.

Throughout 2023, and supply constraints will exert some upward pressure on rents. However, many industrial occupiers face an uncertain economic environment, together with significant cost pressures ranging from wages to energy, as well the likelihood of a marked increase in business rates from April. We therefore expect to see only subdued, sub-inflation rental growth. But the mere fact that we do not expect rents to fall, given the challenging economic outlook, illustrates the resilience of the sector.

UK prime industrial rental growth to January 2023

Figure 1: Rental and land value growth rates to January 2023

In our June 2022 publication we commented that, in our view, the industrial land market had reached a peak. Since then, developers have been challenged by sharply rising build costs and supply chain problems, together with the rising cost of debt, and broader economic and political uncertainty. All of this is dampening development activity.

As developers have retreated, the development land market has struggled, precipitating a surprisingly sharp readjustment in industrial land values in the second half of 2022, accentuated by the seizure of the capital markets and uncertainty surrounding the cost of debt.

Land values have fallen by more than 10% in almost all of our monitored locations – although there have been some exceptions where values have held steady. However, many locations have seen falls of more than 25%, with much greater declines of up to 50% in some markets.

The average fall in land values across our 50 monitored locations in the second half of 2022 was 29.3%. However, values are still nearly 24% higher than their level three years ago.

The extent to which construction activity recovers will partly depend on how quicky the rate of build cost inflation eases. With contractors less busy, and assuming an easing of global supply chain disruptions and falling general inflation, build cost inflation should decelerate during 2023. But continued labour shortages and upward pressure on wages will limit the rate at which this occurs.

Those starting on site in 2023 should face only limited competition and be in a strong position to capitalise on lower land values, ongoing robust occupier demand, and the benign outlook for the occupier market.

Indeed, the market for prime sites is currently holding up well, and some sites within the M25 have recently shown an increased bidding tension which may help the recovery of land values when the debt capital markets stabilise.

There are still buyers with plenty of cash in the system for industrial property including land at a much more adjusted price which vendors will also need to adjust accordingly if they want to see through any conviction of a sale.

Where land values have fallen significantly, open storage investors and occupiers have seen the opportunity to acquire sites – most notably those with existing surfaces (for example demolished former factories that have kept the slab). This market therefore presents an opportunity as stop gap use, especially where vendors are looking to release land.

Land values and development outlook

Figure 2: Prime rent and land value index

Source: Carter Jonas

Source: Carter Jonas Industrial Index

6

months

12

months

3

years

5

years

-14.9%

23.6%

50.6%

-29.3%

UK prime industrial land value growth to January 2023

Investment market trends

Despite the positive occupier story and resilience of rental values, there has been a significant fall in industrial capital values during the last quarter of 2022, as investors have reassessed their risk assumptions following the rapid rise in long and short-term interest rates. The industrial sector has seen a sharper correction in values than the commercial market as a whole, reflecting the exuberant rise in values seen during the second half of 2021 and the first half of 2022.

We are now seeing a ‘normalisation’ of yields and interest rates. However, we are not likely to see commercial property yields rise to the levels seen in the global financial crisis. In addition, the industrial and distribution sector has undergone a transformational change over the last 15 years, and the downward readjustment of yields relative to the rest of the commercial property market should be a permanent feature.