Model Estate 2021

Welcome to the 2021 Model Estate research report, the eleventh annual publication produced by Carter Jonas, which documents the frequently changing nature of a rural estate and its diverse range of income streams.

About the Model Estate

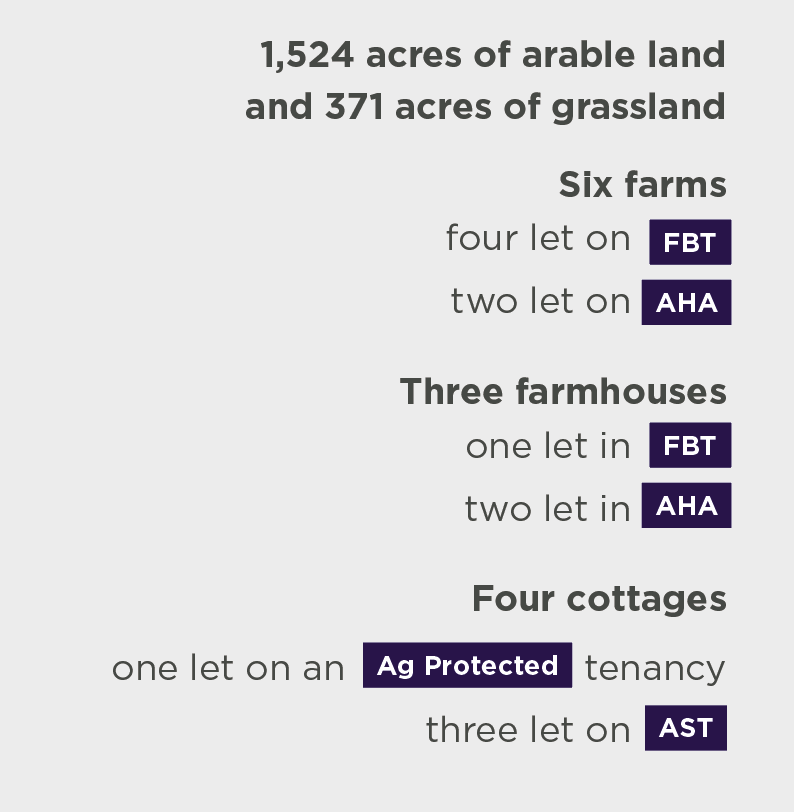

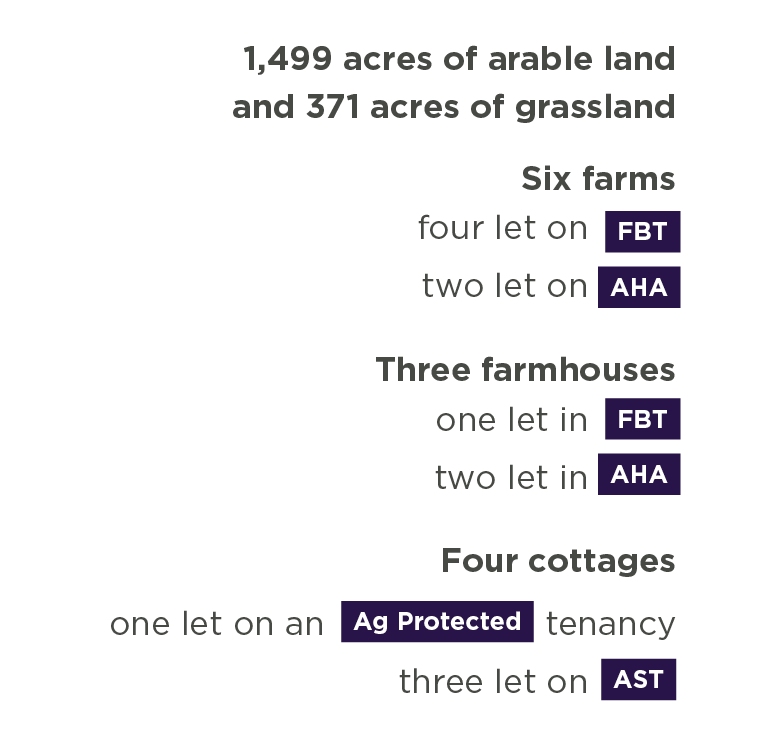

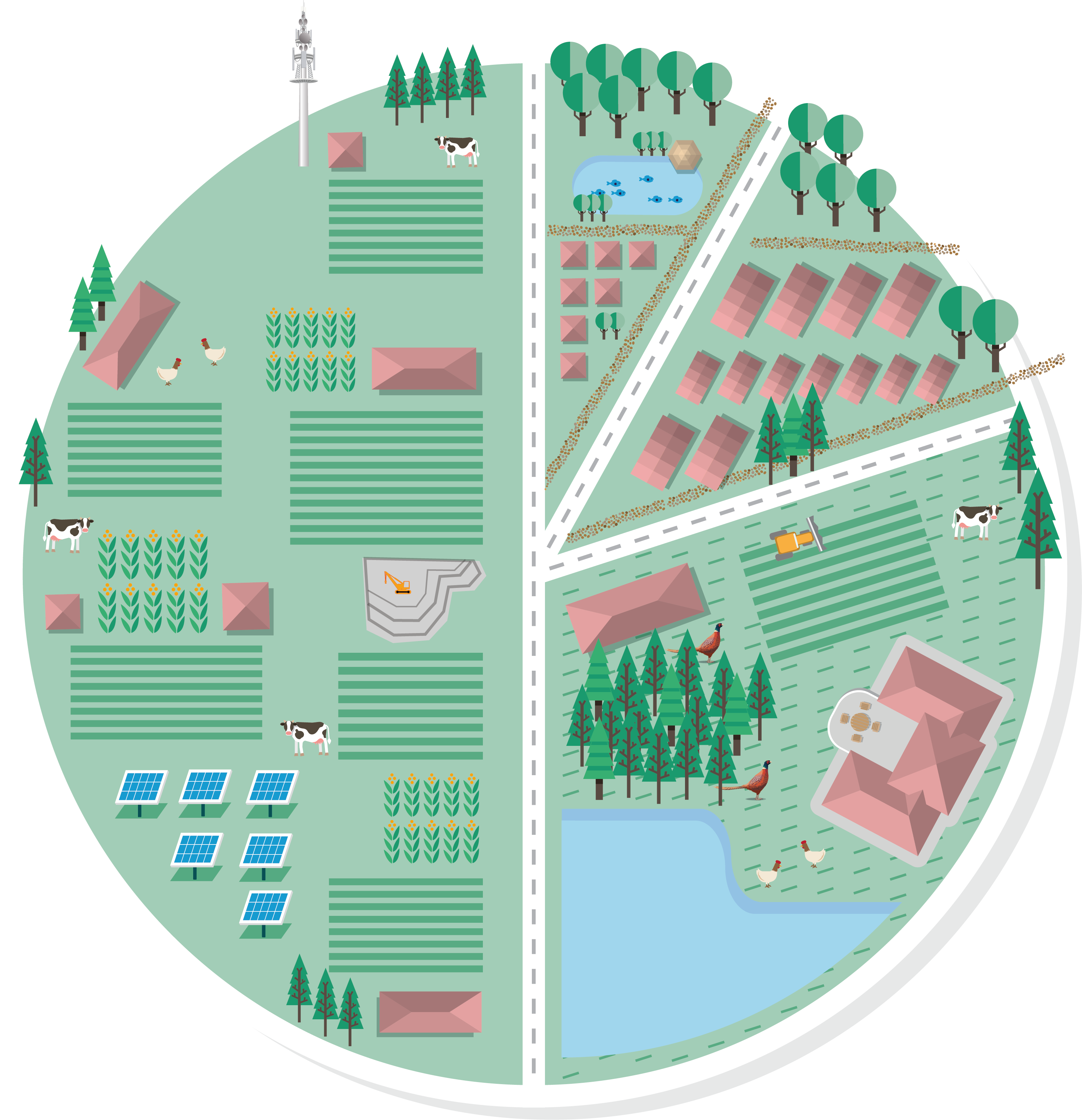

The Model Estate is a notional agricultural estate created by Carter Jonas in 2010. The Estate has evolved over the years and currently comprises 3,168 acres and includes a combination of let and in-hand farms, a commercial and residential portfolio, a telecoms mast, fishing rights, a syndicate shoot, a solar farm, and a quarry. It is located within the geographical triangle bounded by the M4, M40 and M5 motorways.

Why was the Model Estate created?

Analysing the Estate’s data each year enables us to give a balanced view of

all the assets and make strategic recommendations for the coming months, similar to the annual reviews produced by Carter Jonas for estates under our management.

The Model Estate is also used to compare the short- and long-term capital value performance of agricultural land and assets against

a basket of alternative asset classes: residential and commercial property, equities, gold, fine wine and classic cars.

Please note that all findings in this report are based on valuations undertaken on 31 December 2020.

Components

Total value:

£44.36 million

Annual change:

+11.6%

The Model Estate was valued at £44.36 million in December 2020, representing an annual increase of 11.6%. This substantial rise was driven by the introduction of a quarry (sand and gravel), which replaced 25 acres of let farms, consequently impacting on the sub-sector’s performance. Positive performance across both the in-hand farms and the residential assets were also contributors, while the value of the commercial portfolio remained unchanged.

Let farms 32%

Let commercial 9%

In-hand farms 41%

Let residential 7%

Other 11%

Figure 1 Components of the Model Estate (by capital value)

Source: Carter Jonas

Let residential

Let commercial

In-hand farm

Other

Let farms

Explore the Model Estate

SOLAR FARM

TELECOMS MAST

FISHING RIGHTS

SYNDICATE SHOOT

Other

SOLAR FARM

SYNDICATE SHOOT

FISHING RIGHTS

TELECOMS MAST

MANOR HOUSE

FARMHOUSE

In-hand farm

FARMHOUSE

MANOR HOUSE

Let commercial

Let residential

AST

AST

FBT

FBT

FBT

FBT

Let farms

Show all components

Performance

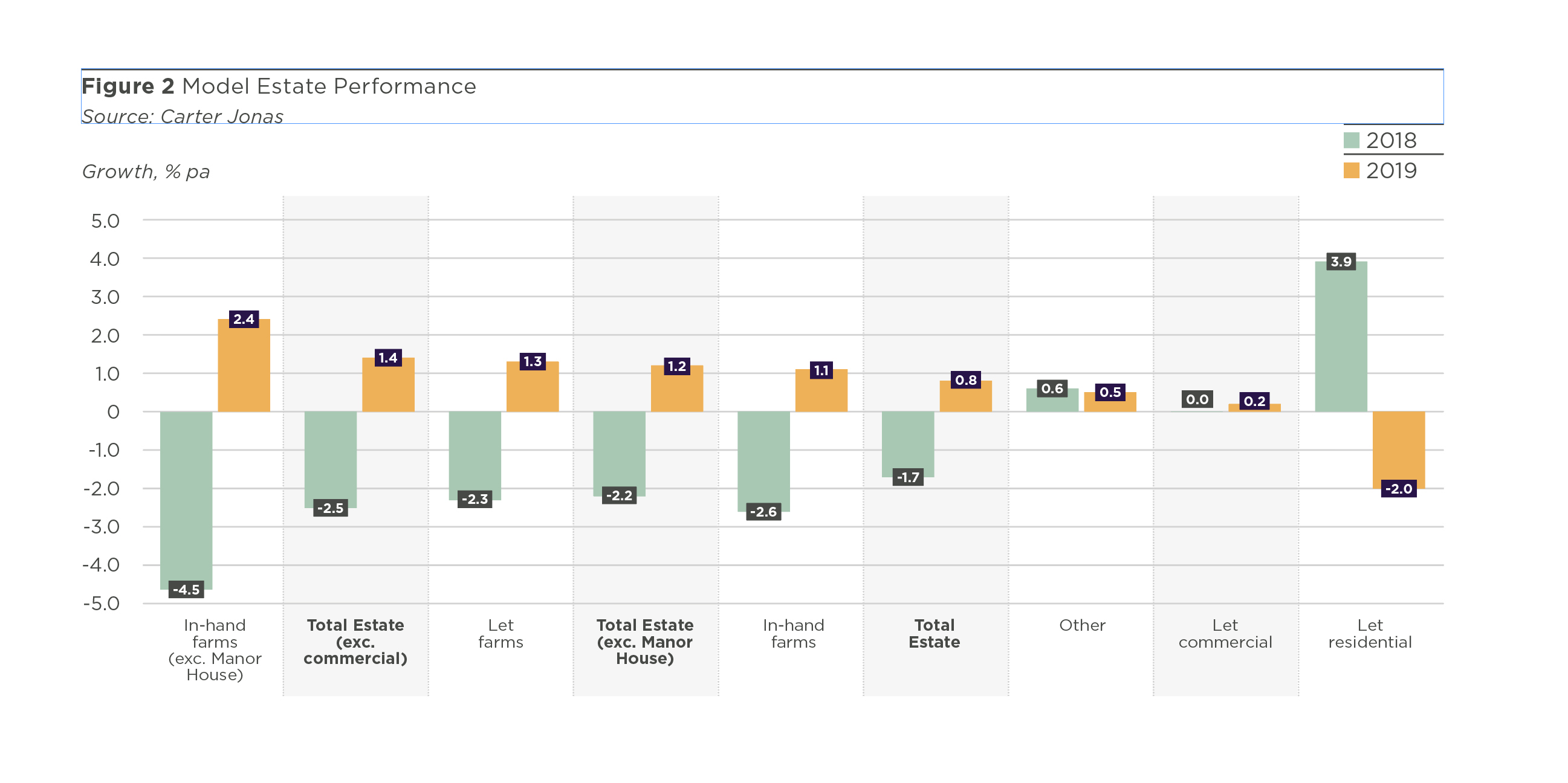

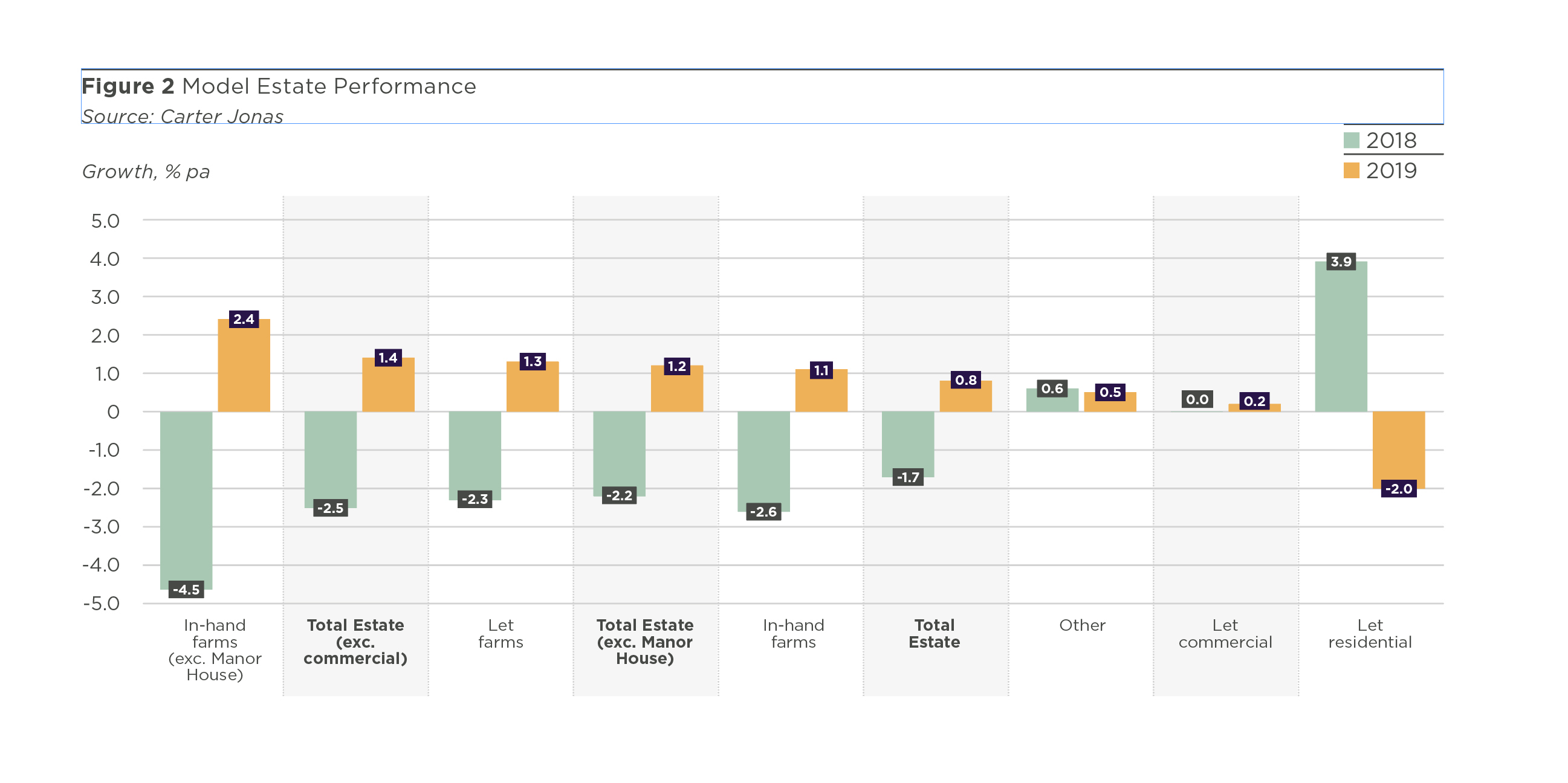

Despite the turbulent economic climate created by the Covid-19 pandemic, the Model Estate yet again proved its resilience with its value increasing to £44.4 million at December 2020 from £39.8 million in 2019, an 11.6% increase during the year.

Figure 2 Model Estate Performance

Source: Carter Jonas

Growth % pa

5.0

4.0

3.0

2.0

1.0

0.0

-1.0

-2.0

-3.0

-4.0

-5.0

In-hand

farms (exc. Manor

House)

Total

Estate

(exc. commercial

Let

farms

Total

Estate

(exc. Manor House)

In-hand

farms

Total

Estate

Other

Let commercial

Let residential

2.4

-4.5

-2.5

-2.3

-2.2

-2.6

0.6

0.0

-1.7

3.9

1.4

1.3

1.2

1.1

0.8

0.5

0.2

-2.0

2018

2019

Other: 650%

The Estate’s impressive growth was primarily driven by the introduction of a quarry, following a successful planning process, which was the sole reason for this sub-sector’s exceptional increase. The quarry had a 2020 year-end value of £4.4 million and an annual income of £542,500; a detailed description of this component and its financial contribution is contained in the next section.

In terms of the other elements of the sub-sector; the solar farm’s capital value increased by 8.8% over the last year while the value of the telecoms mast, commercial shoot and fishing rights all remained stable.

Residential: 4.0%

The residential element of the Estate had a 4.0% increase in capital value over the year. All seven properties which comprise the portfolio remained occupied with rental levels holding firm. This positive trend is in line with the national picture which has seen demand strengthen for good quality, well located residential property with good internet connection remaining a key driver. This strengthening in demand is forecast to continue after restrictions

have been lifted from the Covid-19 pandemic, as flexible working combined with improved quality of life will remain key factors in the decision to relocate.

In-hand Farms: 1.3%

The in-hand element of the Estate saw values rise by 1.3% in 2020, slightly above the 1.1% recorded in the previous year. The increase was entirely due to the Manor House and the one farmhouse included within this sub-sector. The value of the arable land remained stable, although pasture land values fell by just over 3% over the last twelve months.

In contrast to previous years, the value of the Manor House materially improved the performance of the in-hand farms in 2020, with a return of 1.3% when included, and no change being recorded when excluded. This demonstrates the strengthening in demand and values of the national country house market as an increasing number of people consider relocating to more rural locations for an improvement in quality of life, due to the impact of the global pandemic and the consequent change in working patterns.

The hot, dry weather in the spring significantly reduced harvest yields in 2020. However, commodity prices witnessed a notable increase as a result of Brexit, and have continued to remain high offsetting, in part, the impact of a low yielding harvest. The downward tapering of BPS has continued to squeeze farm income across the board, placing pressure

to diversify, find alternative income streams, and

reduce costs.

Commercial: 0.0%

The commercial element of the Estate remained fully occupied and values held stable over the last year. In light of the pandemic, this is a very positive outcome, with all tenants remaining able to pay full rent despite the increasingly difficult economic conditions.

Letting activity has proved restrained across the major UK cities relative to previous years, although not at the catastrophic levels which were feared at the beginning of the pandemic. Good quality space in rural locations with good internet connections continue to be in demand with rental increase forecast for the remainder of 2021.

Let Farms: -1.4%

The let farms portfolio was the only element of the Estate which recorded a decline in values in 2020. However, this drop was due to a reduction in area of 25 acres, as a result of the quarry being opened up and subsequently being taken out of agricultural production.

The value of the residential element of the let farms increased by just over 3% in the last 12 months, with arable land values holding stable in contrast to pasture land values declining by 3.3%.

Read more on the Model Estate...

Find out more from our experts about mineral extraction on the Model Estate, and how to maximise the value of subsequent leisure opportunities.

Mining for minerals

Performance

How did the Model Estate rank amongst the alternative asset classes?

Alternative Asset

Class Rankings

Scroll to explore

Scroll to explore

Scroll to explore

For an interactive map showing all of the components of the Model Estate 2021 visit this page on desktop

Annual change:

+11.6%

700

Other

Total

Estate

(exc. commercial

Total

Estate

(exc. Manor

House)

Total

Estate

Let Residential

In-hand Farm

In-hand Farm

(exc. Manor House)

Let commercial

Let Farms

600

500

400

300

200

100

0

-100

649.6

15.0

13.2

11.6

4.0

1.3

0.0

-1.4

0.0

16

Total

Estate

(exc. commercial

Total

Estate

(exc. Manor

House)

Total

Estate

Let Residential

In-hand Farm

In-hand Farm

(exc. Manor House)

Let commercial

Let Farms

14

12

8

6

4

0

-2

-4

2

10

15.0

13.2

11.6

4.0

1.3

0.0

0.0

-1.4

Other: 650%

The Estate’s impressive growth was primarily driven by the introduction of a quarry, following a successful planning process, which was the sole reason for this sub-sector’s exceptional increase. The quarry had a 2020 year-end value of £4.4 million and an annual income of £542,500; a detailed description of this component and its financial contribution is contained in the next section.

In terms of the other elements of the sub-sector; the solar farm’s capital value increased by 8.8% over the last year while the value of the telecoms mast, commercial shoot and fishing rights all remained stable.

Residential: 4.0%

The residential element of the Estate had a 4.0% increase in capital value over the year. All seven properties which comprise the portfolio remained occupied with rental levels holding firm. This positive trend is in line with the national picture which has seen demand strengthen for good quality, well located residential property with good internet connection remaining a key driver. This strengthening in demand is forecast to continue after restrictions have been lifted from the Covid-19 pandemic, as flexible working combined with improved quality of life will remain key factors in the decision to relocate.

Commercial: 0.0%

The commercial element of the Estate remained fully occupied and values held stable over the last year. In light of the pandemic, this is a very positive outcome, with all tenants remaining able to pay full rent despite the increasingly difficult economic conditions.

Letting activity has proved restrained across the major UK cities relative to previous years, although not at the catastrophic levels which were feared at the beginning of the pandemic. Good quality space in rural locations with good internet connections continue to be in demand with rental increase forecast for the remainder of 2021.

Let Farms: -1.4%

The let farms portfolio was the only element of the Estate which recorded a decline in values in 2020. However, this drop was due to a reduction in area of 25 acres, as a result of the quarry being opened up and subsequently being taken out of agricultural production.

The value of the residential element of the let farms increased by just over 3% in the last 12 months, with arable land values holding stable in contrast to pasture land values declining by 3.3%.

Figure 2 Model Estate Performance

Source: Carter Jonas

Growth % pa

2020

Figure 2 Model Estate Performance

Source: Carter Jonas

Growth % pa

2020

In-hand Farms: 1.3%

The in-hand element of the Estate saw values rise by 1.3% in 2020, slightly above the 1.1% recorded in the previous year. The increase was entirely due to the Manor House and the one farmhouse included within this sub-sector. The value of the arable land remained stable, although pasture land values fell by just over 3% over the last twelve months.

In contrast to previous years, the value of the Manor House materially improved the performance of the in-hand farms in 2020, with a return of 1.3% when included, and 0.0% being recorded when excluded. This demonstrates the strengthening in demand and values of the national country house market as an increasing number of people consider relocating to more rural locations for an improvement in quality of life, due to the impact of the global pandemic and the consequent change in working patterns.

The hot, dry weather in the spring significantly reduced harvest yields in 2020. However, commodity prices witnessed a notable increase as a result of Brexit, and have continued to remain high offsetting, in part, the impact of a low yielding harvest. The downward tapering of BPS has continued to squeeze farm income across the board, placing pressure to diversify, find alternative income streams, and reduce costs.

QUARRY

QUARRY

Contact us for more information

EMAIL HEENA

020 7518 3270

Research Analyst

Heena Gadhavi

EMAIL CATHERINE

01604 608203

Rural Consultant

Catherine Penman

EMAIL TIM

01223 346609

Head of Rural Division

Tim Jones

EMAIL HEENA

020 7518 3270

Research Analyst

Heena Gadhavi

EMAIL CATHERINE

01604 608203

Rural Consultant

Catherine Penman

EMAIL TIM

01223 346609

Head of Rural Division

Tim Jones

Contact us for

more information