Model Estate

2025

Welcome to the 2025 Model Estate research report, the fifteenth annual publication produced by Carter Jonas, which documents the changing nature of a rural estate and its diverse range of income streams.

Image: caption goes here

Traditional rural estates have, historically, been attractive to investors and high-net-worth buyers as they provide secure and consistent assets, whilst often affording exceptional family homes and other amenity interests. Read our report to gain insight into how multi-let estates can offer opportunities for capital growth and partial protection from commodity price volatility.

The Model Estate's Performance at a glance

Click on a tile to find out more about the component

Get in touch for more information

About the Model Estate

Why was the estate created?

Overall Performance

Renewable energy 113%

The Estate's renewable energy assets, comprising a solar farm and a Battery Energy Storage System (BESS), achieved a standout 113.1% year-on-year value increase, reaffirming their status as the Estate's top performers.

Electricity export prices have continued to decline over the past year. However, they are now reaching a relatively stable position which is above the longer term historical average. Despite this stabilisation, the solar farm's rent has reverted to the base rate, rather than being calculated based on revenue. Fortunately, the solar farm operator has recently secured a private wire agreement with a nearby cold storage facility. This facility has signed a Power Purchase Agreement to buy all the electricity generated by the solar farm at a rate 50% higher than the current export price, meaning the landlord will now receive the top-up revenue rent going forward.

Last year, the Estate removed 5 acres from in-hand arable farmland and reallocated it to develop a 100MW Battery Energy Storage System (BESS). Due to the intermittent nature of renewable energy sources, there is a growing demand for BESS. An Option to Lease agreement was signed with a BESS developer. It has now received planning permission and the lease has been triggered. Construction commenced immediately for the BESS to meet its 2025 connection date. The full value of the BESS lease won’t be realised until the site is operational with a track record. However, the hope value has increased significantly, indicating strong prospects for future gains.

113%

year-on-year value change

Get in touch for more information

Renewable Energy

Quarry

Residential

Let farms

In-hand farmland

Manor House

Other

Commercial

Quarry 5.0%

While market sentiment remains optimistic, sales levels at the quarry during the year remained flat, falling short of productivity forecasts. Expectations for a surge in production were unmet as market demand, driven by housebuilding, commercial, and infrastructure projects, did not fully materialise. Although lease revenues saw an inflationary increase of approximately 8%, productivity falls counteracted the expected headline lease revenue increases for the year.

In addition to previous years, efforts to restore previously worked land at the quarry through infilling with inert waste materials have commenced, albeit at modest initial levels. It is expected that a 12-month period will be required to capture further market share for available inert waste materials. During this period, it is hoped that waste arisings will increase as bulk fill and soil materials generated by regional muck-away projects grow. Such growth depends on increased startups in housebuilding and commercial development projects over the coming 12-24 months.

Progress has also been made this year in preparing the planning application for a lateral extension to the quarry in the coming years. Recognising that lead-in times for planning decisions continue to lengthen, Quarry Co deemed it prudent to make early progress in preparing and finalising the application and Environmental Statement for submission within the coming year.

As in previous years, the asset value of the quarry has performed relatively well, maintaining an increase in reported annual growth. However, this growth is starting to plateau due to underperforming markets and sales. A positive lease structure and annual rent review mechanism are helping to counter downward production impacts by bolstering key rental factors that support value. Nonetheless, the true benefits of such arrangements will not be realised until there is a recovery in market demand for mineral products.

5.0%

year-on-year value change

Residential 4.0%

The Estate’s let residential assets appreciated by 4.0% year-on-year, accelerating from 1.4% the year before. While growth has moderated from the elevated levels of 2022 (when values increased by 15.8%), it remains robust, mirroring wider market dynamics.

At a national level, the housing market largely recovered from its downturn and had regained the losses seen by April 2024 after falling from July 2023. HM Land Registry reports that house prices ended 2024 up 4.6% on 2023 and have since continued to rise. Meanwhile, tenant demand in the private rented sector is unprecedentedly high, illustrated in elevated levels of rental growth. In December, annual rental growth stood at 9.0% (ONS), representing a slight acceleration from 8.4% a year ago. Rent reviews on the Estate have resulted in rental uplifts of 9.0%, reflecting this increase.

Looking forward, downward pressure on pricing could arise from new and anticipated policy changes, impacting investor appetite and the viability of holding older assets. The Renters' Rights Bill is progressing through Parliament, proposing several key changes, such as the abolition of no-fault evictions and fixed-term tenancies, and the introduction of rent control measures. The government is also proposing to increase the minimum EPC rating for rental properties from E to C for new tenancies from 2028, and all existing tenancies from 2030. Rural estate cottages are categorised by their traditional construction and often present energy efficiency challenges. Addressing these may incur significant capital expenditure and outweigh the financial benefits of holding the property. Estate owners may therefore consider the disposal of off-lying properties.

4.0%

year-on-year value change

Let farms 3.2%

The value of the let farmland increased by 3.2% over the year, picking up pace from 2.1% growth the year before. This is largely due to a stark supply and demand imbalance in land to rent, and despite uncertainties in the wider farmland market and more subdued growth in commercial arable and pasture land values. The accompanying cottages also saw an uplift in value, reflecting an improvement in the housing market.

The latest data from Defra shows that land rented on AHA tenancies has continued its downward trend. In the 12 months to June 2024, the area of land rented on AHAs fell by 2.1% (or c. 60,050 acres), following a 3.6% decline the year before. The area of land rented on FBT tenancies also fell, but by a more moderate 0.3% (or c. 9,970 acres), following a 1.0% drop the previous year. This suggests that land on AHA tenancies that ended with no successor was not necessarily re-let on a new FBT.

Driven by the potential financial returns of non-agricultural uses, landowners are increasingly removing land from the rental market for purposes like tree planting, rewilding, and renewable energy projects. While the impact of evolving policies and schemes (notably the environmental land management schemes and biodiversity net gain) on the sector unfolds, land management patterns will likely continue to shift as landowners evaluate their economic benefits (both in income and capital gains).

Changes to APR and BPR present further potential for a decline in the let farm sector. The Tenant Farmers Association expressed concerns that tenant farms will be brought in-hand to increase the proportion of trading assets (relative to investment assets, as per the Balfour principle) to maximise BPR and reduce tax liabilities. It may also be the case that tenanted land will be sold to cover tax bills.

As such, it is no surprise that rents continue to push upwards. Nationally, rents on FBTs increased by 2.7% in the year to March 2024 (Defra). Regionally, in Southern England, our own dataset suggests that openly marketed FBT rents tend to exceed national averages. On the Estate, the FBTs average £156/acre.

3.2%

year-on-year value change

In-hand farmland 3.0%

The Estate's in-hand farmland portfolio saw a 3.0% year-on-year uplift, continuing its four-year upward trend. This performance, while slightly below last year's 3.4% growth, indicates the ongoing resilience of the land market in the face of structural change and economic volatility. Given farmland's substantial portion of the Estate's total value, its gains were a key driver of the year's overall growth.

The value of the in-hand arable land has risen from £10,250/acre to £10,500/acre, representing a 2.4% increase, while the in-hand pasture land increased from £8,732/acre to £9,000/acre, a 3.2% increase. Alongside the agricultural land, the in-hand portfolio includes a farmhouse and 60 acres of woodland. The farmhouse saw its value increase by 5.2%, broadly in line with national house price growth for detached houses (5.0% as per HM Land Registry), and the woodland increased in value by 4.9% overall.

The in-hand farmland outpaces national trends for average arable and pasture land, which saw their value increase by 1.4% and 1.8%, respectively. However, these values remain consistent with average values in the southern regions (where the Estate is located). Land values are becoming increasingly polarised, with higher-quality land in desirable locations increasing at a faster rate. This trend accelerated in 2024, with uncertainties arising from the change in government and the potential of shifting political priorities creating sensitivity in pricing in some parts of the market. Conversely, there is sustained demand for well-positioned assets from an array of buyers, notably rollover funds benefiting from Business Asset Rollover Relief (particularly in the southern regions).

3.0%

year-on-year value change

Manor House 0.0%

The market for large country houses in the UK has been cautious, with some buyers who require finance still hesitant to invest more capital while borrowing costs remain high. Recent changes to the ‘non-dom’ regime and other changes to tax policy (including increases to the rates of Capital Gains Tax and Agricultural and Business Property Relief) have tempered sentiment at the upper end of the market.

While those houses that have come to the market have been met with sufficient interest, primarily from cash-rich buyers, they have generally sold at their guide prices, resulting in stable values. As such, the value of the Estate’s manor house and accompanying gardens has held firm at £7.85m for the third year in a row.

0.0%

year-on-year value change

Other 0.0%

The value of the sporting rights, telecoms mast and fishing rights have also held firm over the last year. These assets continue to generate a steady income, with an overall yield of 13.0%.

Commercial -0.1%

The Estate's commercial assets saw a slight dip in value this year, continuing a trend of marginal decreases for the third consecutive year (recording -0.8% for both 2022 and 2023). This fractional decrease underlines the relative stability of the UK commercial property sector compared to recent years, which has been facing varying degrees of structural change and subsequent price adjustments.

The decline in value stemmed from the rooftop solar assets, which depreciated by 3.9% as they move one year closer to their expiry. Nevertheless, they remain a valuable source of electricity for the commercial units and generate income through the Feed-in Tariff.

Formerly agricultural buildings, the Estate’s commercial portfolio comprises fully let office and industrial assets. Rents stand at £14.50/sq ft for the office assets, while rents for the industrial assets vary from £3.72/sq ft for a former aircraft hangar to £6.25/sq ft for a workshop unit, all unchanged from 2023.

In the office market, vacancy rates have been increasing since the second half of 2020 as tenants downsized or consolidated space. However, office vacancy rates now look close to peaking, and office occupancy rates have also shown a modest improvement over the last year after broadly levelling off the year before (Remit Consulting). Office attendance has now risen to the highest levels since the pandemic began and net demand has been positive (as more space has been leased than vacated) for the first time in five years (CoStar). Further enhanced by the cost-effectiveness and appeal of the natural surroundings that rural offices offer, this recovery should have a positive effect for investor sentiment and could help maintain the capital value of the Estate’s office assets.

Yet, downside risks remain, particularly as the shift to prime, city-centre space continues. Occupiers and investors are increasingly prioritising sustainable, energy-efficient buildings that provide advanced amenities and are situated in desirable locations. This trend is being accelerated by the next round of tightening to minimum energy efficiency standards (MEES) regulations, with a minimum EPC rating of C due to take effect from April 2027. These buildings are leading the office market recovery, with out-of-town and secondary stock (such as on the Estate) struggling to keep up. Many rural properties will need upgrades to meet compliance standards, and some estates may choose to repurpose or sell off assets where capital expenditure cannot be justified by the expected rent.

Although industrial vacancy rates have been rising over recent quarters, attributable to a combination of slowing demand and rising supply of available space, vacancy at the national level now appears to be levelling off. With a robust outlook for demand and relatively little new supply coming through, we think vacancy will peak this year and begin to decline, which is encouraging for those with an industrial portfolio.

That said, like offices, demand for industrial units is also focused on prime, energy-efficient space, particularly as many operators are promoting their ability to maximise their clients’ sustainability credentials within the supply chain. Given the strong underlying demand conditions, we expect continued rental growth for industrial space over the next 12 months, depending on the type, quality and location of the property.

Capital growth performance across the commercial property market is back on an upward trajectory, illustrated by the MSCI All-Property Index. All-property capital values increased by 0.5% in 2024, compared with -5.2% in 2023 (MSCI Annual Index). However, industrial is outperforming the average, with capital growth of 3.2% in 2024, whilst office values fell by -3.9% (although office performance has seen significant improvement and values have now broadly levelled off).

-0.1%

year-on-year value change

Find out more about MEES

For more information on how any of the findings in this report might affect your holding, please contact a member of the team:

01223 346609

Tim Jones

Head of Rural

Email

01865 404484

Email

Christopher Rhodes

Head of Rural Valuations

020 7493 0685

Email

Sophie Davidson

Rural Research

020 7518 3285

Email

Harry Robertson

Energy

01743 213269

Email

Paul Clarke

Minerals & Waste Management

0117 403 9946

Email

Anna Hicks

IHT

01423 707835

Email

Tom Hind

IHT

"Due to the intermittent nature of renewable energy sources, there is a growing demand for BESS."

"As underlying supply problems are likely to persist in the rental market, landlords who retain their rental assets are likely to see ongoing competition and should benefit from rising rents."

The Model Estate is a hypothetical agricultural estate created by Carter Jonas in 2010. The Estate has evolved over the years and comprises over 3,000 acres. It includes a combination of let and in-hand farms, a commercial and residential portfolio, a telecoms mast, fishing rights, a syndicate shoot, a solar farm, a 100MW Battery Energy Storage System (BESS), and a quarry. It is located within the geographical triangle bounded by the M4, M40 and M5 motorways.

In using the example of a hypothetical mixed rural estate, similar in structure to many under the management of Carter Jonas, we gain an interesting and helpful insight into the performance of a rural estate and the dynamics at play. This enables us to make strategic recommendations for the future.

Please note that all findings in this report are based on valuations undertaken on 31 December 2024.

The overall valuation of the Model Estate totalled £53.92m in December 2024, representing an annual increase of 4.6% against a value of £51.54m in 2023. An acceleration in growth (up from 2.8% in 2023) offers a reassuring signal, suggesting underlying resilience as rural estates prepare for forthcoming policy changes. Changes to Agricultural Property Relief (APR) and Business Property Relief (BPR) from Inheritance Tax are set to take place in April 2026, which have created a pressing need for a proactive approach to estate planning, likely including an assessment of the estate’s value and structure. Nonetheless, the data presented underscores buoyant investor sentiment, with an evolving value proposition that leverages the adaptable character of rural estates.

Jump straight to a component:

Read our exploration on how the Model Estate would be impacted by changes to IHT

The 2024 growth surpasses the CPI inflation rate of 2.5% at the end of the year. Despite substantial growth in recent years, the last time the Model Estate’s annual growth outstripped inflation was in 2019, when CPI inflation stood at 1.3% and the Estate increased in value by 2.4%.

Over the longer term, 10-year capital growth decelerated slightly but still returned an impressive 3.9% annualised growth rate, or 46.2% cumulatively. When adjusting for inflation, the Model Estate achieved a positive annualised growth rate of 0.8%, translating to an admirable overall increase of 8.4%.

While there was the expected variation in performance across the different assets, only the commercial portfolio ended the year in negative territory, albeit by a negligible -0.1%. The Estate’s renewable energy assets were the top performer by year-on-year increase. As a result, their share of the Estate’s overall value doubled from 1.8% to 3.6%. The quarry, which accounts for 11.5% of the Estate’s value, also performed well, albeit more subdued than the previous two years.

Agricultural land remains a key component of the Estate's valuation, accounting for 55.8%, and so is a key determinant of value change. That said, this marks a significant change from the 68.7% recorded ten years prior, attesting to the growing trend of diversification on traditional estates. Both the in-hand and let farmland experienced notable growth over the year, reflecting the continued appeal of farmland assets. Driven by ongoing shortages in the rental sector (putting upward pressure on rents) and a recovering housing market, the let residential assets also delivered healthy gains. However, the value of the manor house and the ‘other’ assets maintained their value.

"When adjusting for inflation, the Model Estate achieved a positive annualised return of 0.8%, translating to an admirable overall increase of 8.4%"

"Agricultural land remains a key component of the Estate's valuation, accounting for 55.8%"

£53.92m

Total value

4.6%

Annual change

Hover over a component to view it's assets

Let Farms

1,494 acres of arable

land and 371 acres

of pasture land

Six farms

Four let on FBTs

Two let on AHAs

Three farmhouses

One let on an FBT

Two let within the AHA

Four sub-let cottages

One let on an Ag Protected tenancy

Three let on ASTs

In-hand farmland

1,073 acres of arable land,�71 acres of pasture land �and 60 acres of woodland

One four-bedroom farmhouse

Manor House

A Grade II listed Manor House and 23 acres of gardens, grounds and amenity woodland

Click on a component to jump to it's analysis

Let residential

Seven houses

Five let on ASTs

One let on Ag Protected tenancy

one occupied in-hand �by a family member

Let commercial

13 properties

all let on L&T tenancies�one with roof mounted solar

Other

A telecoms mast, let syndicate shoot and fishing rights

Renewable energy

25-acre solar farm and a 100MW Battery Energy Storage System

Quarry

65-acre quarry

Telecoms mast

Fishing rights

Syndicate shoot

Commercial properties

Residential properties

Manor House

Quarry

Solar Farm

Farmhouse

FBT

FBT

FBT

FBT

AHA

AHA

AHA

AHA

FBT

AST

AST

AST

Ag Protected

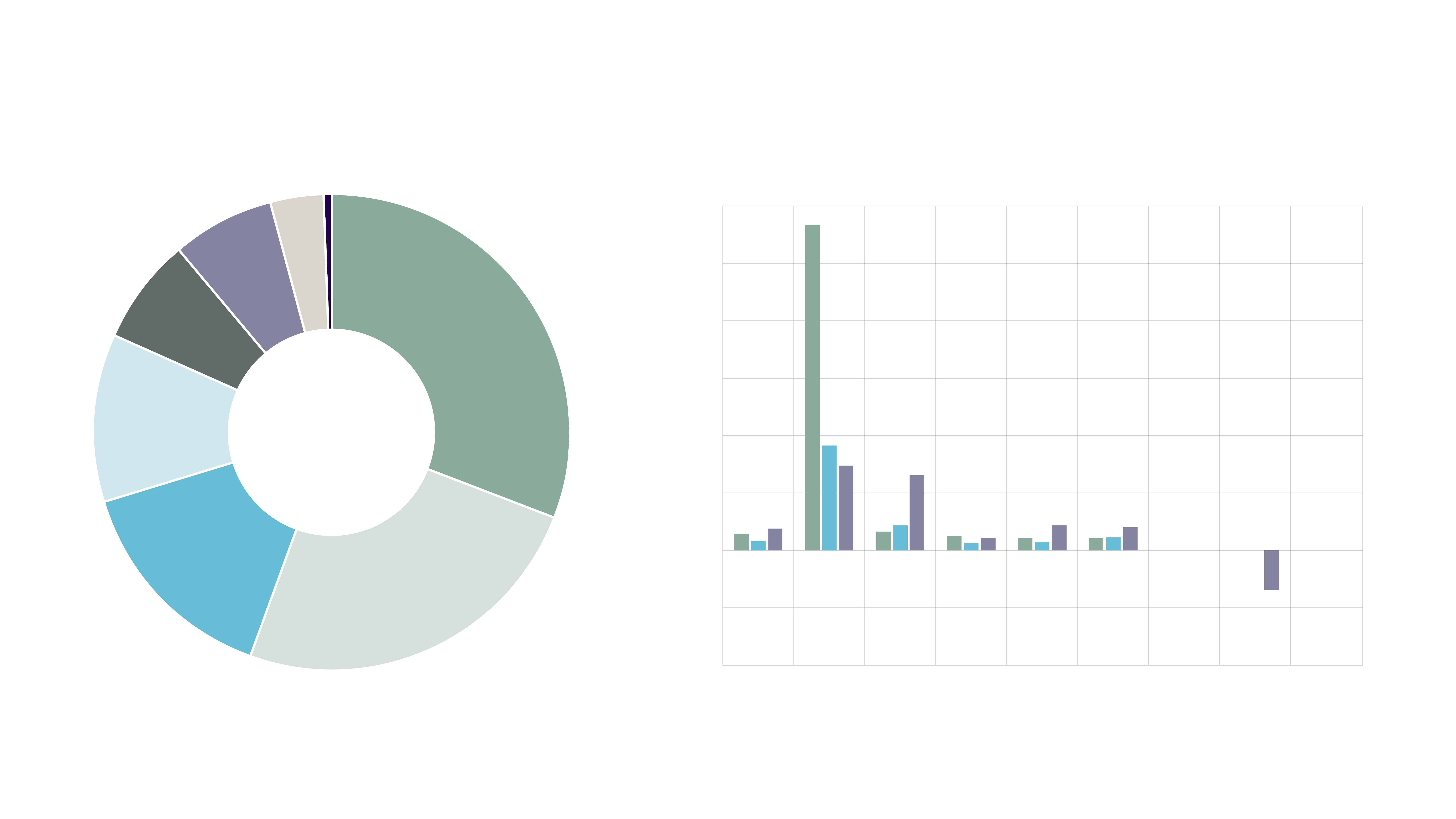

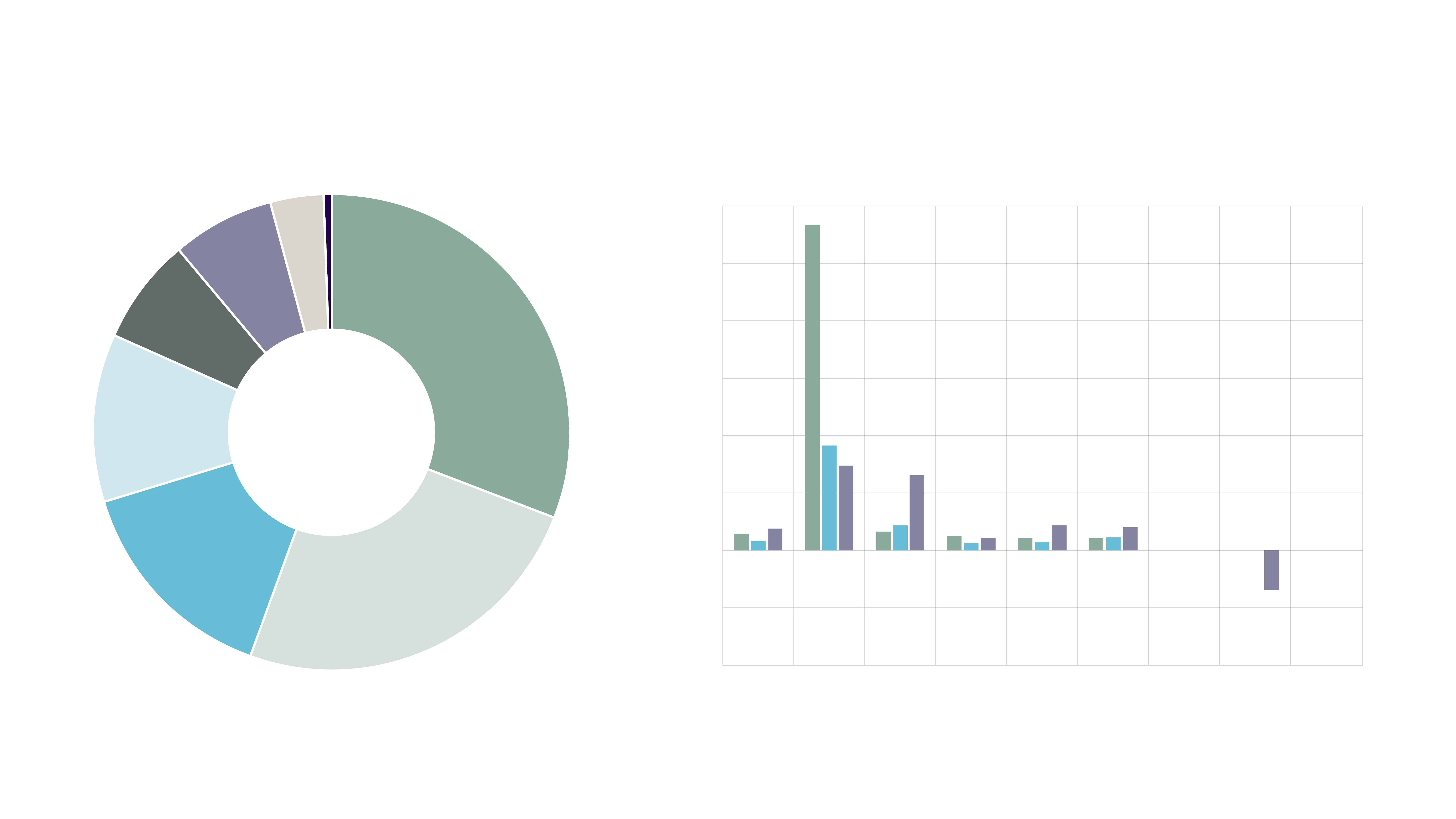

Figure 1

Components of the Model Estate (by capital value)

Source: Carter Jonas

Let commercial

Let residential

Renewable energy

Other

Let farms

In-hand farmland

Manor house

Quarry

31.0%

24.7%

14.5%

11.5%

7.1%

7.1%

3.6%

0.3%

Figure 2�Model Estate Performance, 31 December 2024

Source: Carter Jonas

120.0%

100.0%

80.0%

60.0%

40.0%

20.0%

0.0%

-20.0%

-40.0%

Growth %

Total Estate

Renewable Energy

Quarry

Residential

Let Farms

In-hand Farmland

Manor House

Other

Commercial

4.6%

2.8%

6.9 %

113.1%

35.6%

28.8%

5.0%

7.5%

25.0%

Component Performance

4.0%

1.4%

3.6%

3.2%

2.1%

7.4%

3.0%

3.4%

7.1%

-0.1%

-0.8%

-0.8%

0.0%

0.0%

-14.8%

"Land values are becoming increasingly polarised, with higher-quality land in desirable locations increasing �at a faster rate."

"Occupiers and investors are increasingly prioritising sustainable, energy-efficient buildings that provide advanced amenities and are situated in desirable locations."

"With a robust outlook for demand and relatively little new supply coming through, we think vacancy will peak this year and begin to decline, which is encouraging for those with an industrial portfolio."

0.0%

0.0%

0.0%

Get in touch for more information

Renewable Energy

Quarry

Residential

Let farms

In-hand farmland

Manor House

Other

Commercial

Get in touch for more information

Renewable Energy

Quarry

Residential

Let farms

In-hand farmland

Manor House

Other

Commercial

Get in touch for more information

Renewable Energy

Quarry

Residential

Let farms

In-hand farmland

Manor House

Other

Commercial

Get in touch for more information

Renewable Energy

Quarry

Residential

Let farms

In-hand farmland

Manor House

Other

Commercial

Get in touch for more information

Renewable Energy

Quarry

Residential

Let farms

In-hand farmland

Manor House

Other

Commercial

Get in touch for more information

Renewable Energy

Quarry

Residential

Let farms

In-hand farmland

Manor House

Other

Commercial

Renewable Energy

Quarry

Residential

Let farms

In-hand farmland

Manor House

Other

Commercial

The overall valuation of the Model Estate totalled £53.92m in December 2024, representing an annual increase of 4.6% against a value of £51.54m in 2023.

+4.6%

Annual change

The Model Estate

The solar farm and Battery Energy Storage System (BESS) reaffirmed their status as the Estate’s top performer.

+113%

Renewable Energy

Annual change

Quarry sales remained flat despite optimistic market sentiment, hindering expected revenue growth and causing asset value growth to plateau.

+5.0%

Quarry

Annual change

The residential assets value growth accelerated from the previous year, mirroring wider dynamics in the housing market and rental sector.

+4.0%

Residential

Annual change

The continued robust performance of the let farmland is largely driven by a worsening imbalance between the supply of and demand for rental land.

+3.2%

Let farms

Annual change

The Estate's in-hand farmland portfolio continued its upward trajectory, demonstrating the land market's resilience despite structural shifts and economic fluctuations.

+3.0%

In-hand farmland

Annual change

The Estate's manor house value has remained stable for three consecutive years.

0.0%

Manor House

Annual change

The value of the sporting rights, telecoms mast and fishing rights have held firm over the last year. These assets continue to generate a steady income, with an overall yield of 13.0%.

0.0%

Other

Annual change

The Estate's commercial assets dipped slightly in value for the third consecutive year. While rooftop solar depreciated, office and industrial unit values were flat.

-0.1%

Annual change

Commercial

"The asset value of the quarry has performed relatively well... However, this growth is starting to plateau due to underperforming markets and sales."

"It is expected that a 12-month period will be required to capture further market share for available inert waste materials."

"Driven by the potential financial returns of non-agricultural uses, landowners are increasingly removing land from the rental market for purposes like tree planting, rewilding, and renewable energy projects."

"Formerly agricultural buildings, the Estate’s commercial portfolio comprises fully let office and industrial assets."

2024 % change

2023 % change

2022 % change

The overall valuation of the Model Estate totalled £53.92m in December 2024, representing an annual increase of 4.6% against a value of £51.54m in 2023. An acceleration in growth (up from 2.8% in 2023) offers a reassuring signal, suggesting underlying resilience as rural estates prepare for forthcoming policy changes. This growth surpasses the CPI inflation rate of 2.5% at the end of the year, and outpaces inflation over the longer term.

Read the full analysis

Read the full analysis

Read the full analysis

Read the full analysis

Read the full analysis

Read the full analysis

Read the full analysis

Read the full analysis

Read the full analysis

The Estate's commercial assets dipped slightly in value for the third consecutive year. While rooftop solar depreciated, office and industrial unit values were flat.