open storage UPDATE

Spring 2024

outlook

Occupier demand for open storage sites will remain strong throughout 2024 despite the overall subdued outlook for economic growth, buoyed by its broad occupier base and concentration in expanding sectors of the economy. We expect requirements for EV charging sites to be particularly strong, together with the establishment of the battery storage sector as a major open storage user.

Please contact our specialist team:

Email me

Andrew Smith

Partner, Open Storage Lead

+44 (0)7919 326085

Email me

Daniel Francis

Head of Research

+44 (0)20 7518 3301

Welcome to our spring 2024 Open Storage Update. Since we first published research on this market in 2021, activity levels and values have accelerated significantly. We have also witnessed a continued broadening of the occupier base, and this edition features the battery storage sector, which is emerging as a major future source of demand.

There has also been a step change in investor sentiment, and open storage is now attracting huge interest from a broad range of purchasers. This is in sharp contrast to the situation three years ago, when the sector was almost entirely absent from property investment portfolios.

The number of enquiries for open storage land has continued to rise, totalling 537 in 2023, compared with 417 in 2022, and representing a near-quadrupling of demand since 2020 (see Figure 1). The total amount of land required in 2023 was 2,277 acres (taking an average of the minimum and maximum size requirement for each enquiry). The sector’s growth in terms of acres required is illustrated in Figure 2. It is important to note that overall demand will be much higher than these figures suggest, as some enquirers will be considering multiple sites, and not all enquiries will be formally registered.

Rental trends

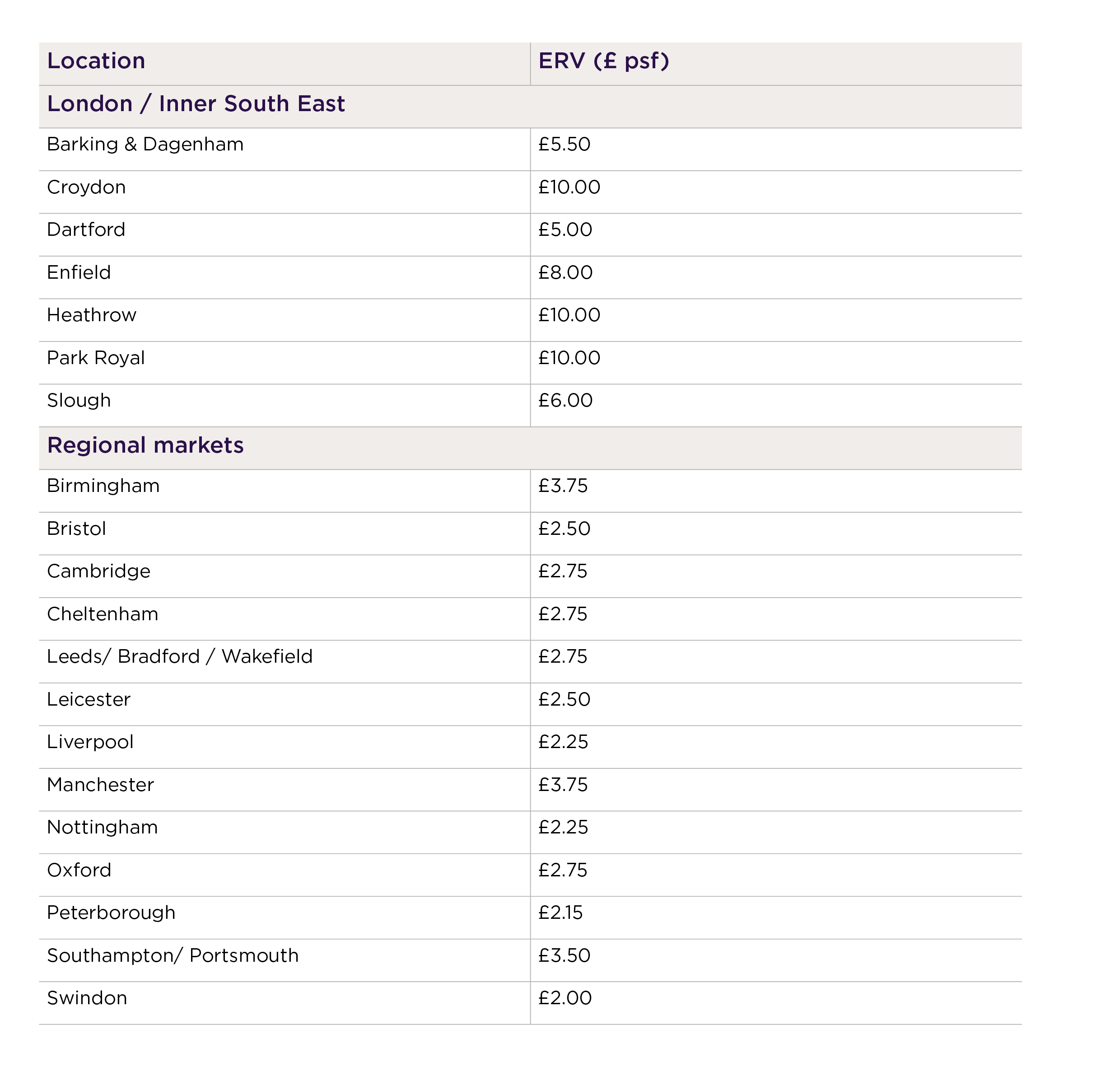

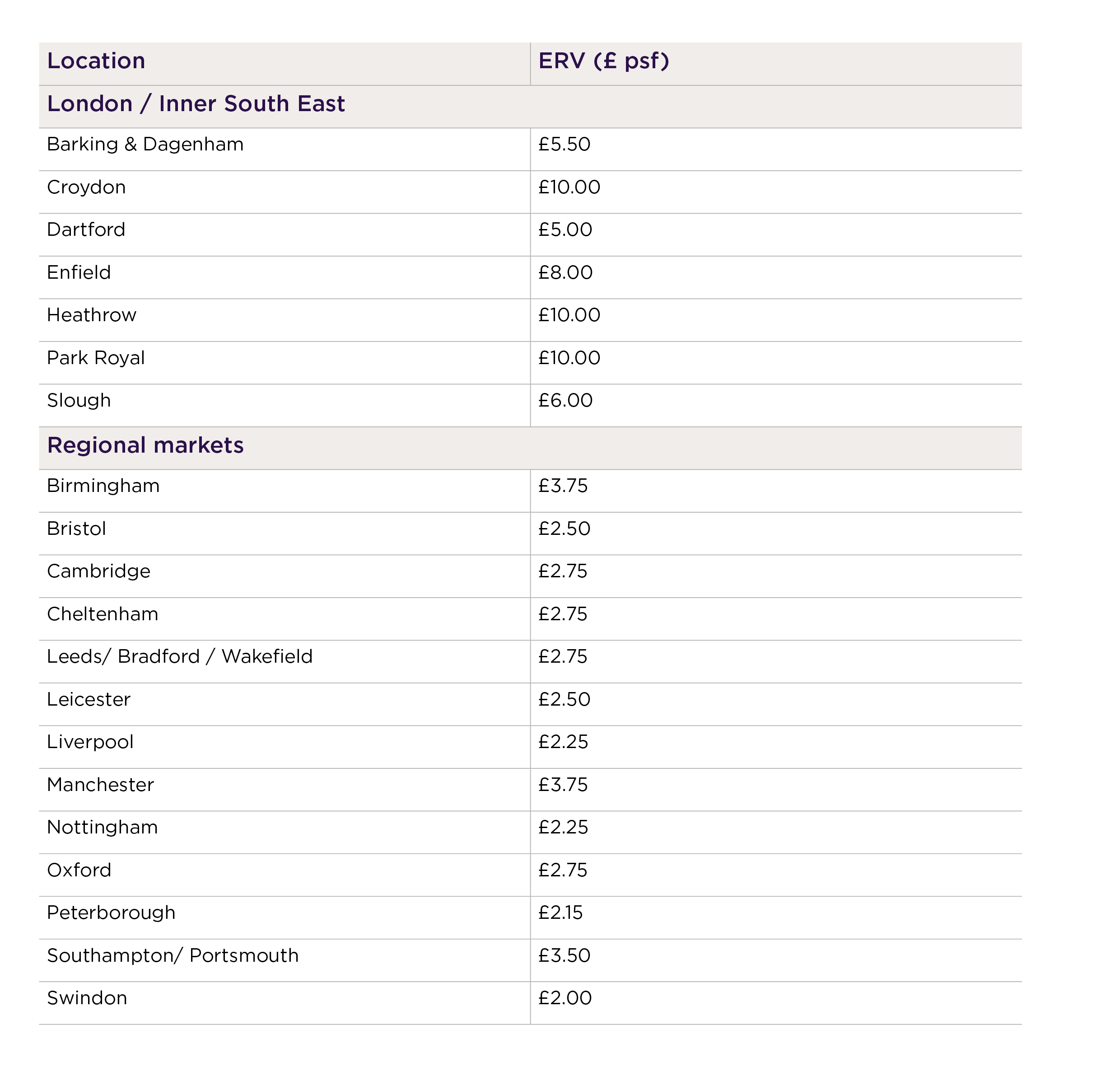

Rents for Class 1 sites have continued to increase over the last 12 months, although the rate of growth has slowed. Growth has been led by London and the inner south east, at 3.3% over the six months to spring 2024, and by 9.5% over the last year. Meanwhile, growth across the regional locations has been more restrained, averaging 0.7% over the last six months and 2.1% over the last year. Since 2016, Class 1 rents in London and the inner south east have risen by an average of 18.9% per annum, whilst the regional markets have seen a broadly similar rate of growth of 18.1% per annum (see Figure 5).

Source: Carter Jonas

Stated ERVs assume a 1.5 acre Class 1 site which is serviced and fenced, with a concrete surface, broadly unrestricted B8 use and available on a lease length of 3-5 years.

Read more about our research on how open storage is the new asset class in the industrial sector

Read more

Number of enquiries

•

•

Figure 1: Number of enquiries

Source: Carter Jonas, Agency Pilot, IAS

Figure 2: Open Storage Demand (acres)

Total demand (no. of enquiries)

Figure 3: Proportion of enquiries by size band

Source: Carter Jonas

•

Stated ERVs assume a 1.5 acre (net useable) average Class 1 site scoring a minimum of 85 on the Carter Jonas classification scoring system. The site is assumed to be serviced and fenced, with a concrete surface, broadly unrestricted B8 use and available on a lease length of 3-5 years.

Table 2: Class 1 rents, spring 2024

London/Inner South East

Rest of UK

Figure 5: Rental growth to Spring 2024

Price per sq ft (£)

6 months

1 year

Figure 6: Annual rental growth, Class 1 sites

•

Investment trends

We continue to see a substantial level of interest in open storage opportunities from a broad variety of investors, and there is a significant weight of money looking to invest in the UK and more broadly across Europe (where the sector is more nascent). This is unsurprising given the sector’s healthy occupier market drivers, including strong rental growth potential, a broad occupier base, and favourable sustainability characteristics, set against a backdrop of an uncertain outlook for many of the more ‘mainstream’ property sectors. Investors also continue to assess the potential to upgrade low quality sites to Class 1 or 2.

•

Occupational demand levels for open storage

Source: Carter Jonas, Agency Pilot, IAS

Source: Carter Jonas

Source: Carter Jonas

•

Enquiries vary considerably in terms of size, from small urban micro-sites to large non-urban storage facilities.

Total demand (acres)

The majority of renewable energy sources such as solar photovoltaics and wind farms require large areas of land to be viable. However, few technologies are as compact and take up as little space as Battery Energy Storage System (BESS).

•

BESS projects are a critical part of the UK’s electrical infrastructure and will be integral for maximising the implementation of intermittent renewable energy sources in the future, such as solar photovoltaics and wind turbines. BESS can import and store large amounts of energy from the electricity network for a short period of time before exporting it back to the grid. These systems are being developed to support and reduce the need for Peak Power Gas (PPG) power stations which are the UK’s current method of supplying demand electricity.

•

For a BESS to be financially viable, it must be located in close proximity to a substation to minimise connection costs and keep electrical losses to a minimum. Due to these costs a BESS will ideally be located within 3km of a 33kV substation and 2km of a 132kV substation. Projects that have been constructed further away from substations will usually attract lower rents and may not be financially viable.

•

BESS is well suited to being installed on small parcels of brownfield land, especially in industrial areas, as there will be less of a concern around the visual impact of the development. This is an area where open storage can provide an opportunity for smaller BESS installations. We see the potential for sites of anywhere from 1 to 2 acres, but sites that will have a good power connection will be particularly attractive.

•

Battery storage - a growing demand channel for open storage sites

Figure 6 illustrates the slowdown in the rate of growth from the extraordinary levels seen in 2022 and the first half of 2023. This deceleration has been particularly marked in the regional markets, where high growth rates represented an element of catch-up with the London / inner south east and were starting from very low base rents.

•

•

Source: Carter Jonas

Figure 7: Class 1 open storage rents, spring 2024,

London / inner south east

Price per sq ft (£)

Source: Carter Jonas

In 2023 we saw a marked increase in the number of open storage investment transactions. This is a clear indicator that the market is maturing as an institutional asset class, and it has also allowed us to start tracking the investment market in terms of deal volumes and pricing levels. We hope this will help to increase transparency further.

•

Figure 9 illustrates market yields for open storage, based on actual transactions, comparing 2022 and 2023 for two different geographies. This shows a clear differential between London/inner south east and the rest of the UK, with yields for the latter being circa 150 basis points higher in both years.

•

The data also shows that the open storage sector reflected the upward yield movement seen across the broader industrial market (and commercial property sector more generally) in 2023. Whilst open storage yields have moved out, the data is relatively limited and demand for good quality open storage sites remains strong. Our data is based on averages from a broad range of achieved yields which reflect significant variation according to the quality of site (Class 1-4) and the location (Primary-Tertiary), as well as the usual range of other investment metrics. Indeed, prime Class 1 sites are likely to trade at a yield of 100-200 basis points sharper than lower quality sites.

Many occupiers are seeking the certainty of leasing space for longer than 18 months to two years, particularly on larger sites of three acres plus where CAPEX may be higher on set up. Importantly, longer-term lettings work for investors too, particularly if they decide to invest in a site to increase its grade, attracting tenants with a stronger covenant who will potentially pay a premium for a longer lease.

•

Open storage has traditionally been seen as an interim use for a site prior to development, and many sites suitable for long-term open storage compete with other uses (although this is less applicable to sites with a development constraint such as overhead cables, easements or gas pipes underneath).

•

Many developers have been concluding that schemes will be built eventually rather than the site remaining in open storage use, even if development is delayed due to current market conditions. There has understandably been a reluctance to spend capital to create an interim open storage site, as investment over less than 5-8 years tends only to be viable where there is an existing slab / surface (even here, expenditure would still be required on items such as security for good quality sites).

•

However, current economic and market conditions are increasingly favouring longer-term open storage over developing an alternative use on a site. Debt has become more expensive, construction costs remain high, commercial property yields have shifted upwards, and residential values are falling, with added uncertainty due to rising interest rates. All of this has made development riskier. Conversely, the metrics of the open storage market have become more favourable.

•

For landowners, the capital expenditure and ongoing costs of an open storage site are much lower than developing and maintaining a building. Depending on the efficiency of a site and the gross to net ratio, it is conceivable that the overall value / return could be better for an open storage solution rather than for a new build. We think there is now an opportunity for investors and developers to re-evaluate whether open storage could work in the longer term in some higher value locations.

•

Development potential

The focus of occupier demand will continue to be on high-quality sites of Class 1 and 2, driven by electric fleet and logistics operators. Class 2 tarmac surface sites may become more dominant in the market, due to their suitability for EV charging in particular and lower rents compared with Class 1 sites.

•

We anticipate further rental growth in 2024. Southampton/Portsmouth and Leeds are emerging as strong regional rental growth leaders, whilst other secondary and tertiary markets are also likely to see catch-up growth.

•

Interim open storage use will be an increasing consideration for developers, with some commercial developments on hold due to market conditions. This may lead to an increase in the stock available for a period of 1-3 years. However, sites offering longer leases will continue to attract a rental premium.

•

Strong investor appetite will persist in 2024 with more than £6 billion chasing opportunities in the sector, and a continued stream of potential new entrants. There is a premium for open storage portfolios, particularly those with reversionary rent and asset management opportunities.

•

However, investors may undertake some strategic re-evaluation of open storage sites, reassessing those in high-value locations due to favourable rental shifts.

•

Current Carter Jonas instructions

Taplow

Taplow

Contact us

Email me

Archie Dupree

Lettings & Market Reports

+44 (0)7393 259922

Email me

Darren Shaw

Site & Development Acquisitions

+44 (0)7816 120706

Email me

Andrew Mitchell

Investment

Email me

Tom Bradley

Reviews & Renewals

+44 (0)7393 259 913

Email me

Ruobei Ding

Database Management & Assistant

+44 (0)7890 943482

Rental trends

Investment trends

Back to top

Back to top

Back to top

•

•

Figure 8: Prime open storage rents, regional market

Source: Carter Jonas

Email me

Andrew Mitchell

Investment

Email me

Darren Shaw

Site and Development Acquisitions

+44 (0)20 3940 9462

Email me

Tom Bradley

Reviews and Renewals

+44 (0)20 7062 3112

Email me

Archie Dupree

Lettings & Market Reports

+44 (0)20 7518 3306

Email me

Ruobei Ding

Database Management & Assistant

+44 (0)20 7298 1814

Explore each section of this report

Click on the images to find out more

•

5

4

3

2

1

0

Email me

Abigail Jones

Surveyor

+44 (0) 7776 490 276

Email me

Daniel Francis

Head of Research

+44 (0)20 7518 3301

Classifying Open storage

Demand levels

Acres

Rapid growth in e-commerce, last mile delivery requirements, and parcel deliveries has continued to drive demand for HGV and van parking and storage. This trend is also being accelerated by the introduction of local policies to restrict vehicle access in some urban areas, for example low emission zones.

The drivers of demand for open storage continue to evolve. Some sectors have waned, for example ‘dark kitchen’ requirements which boomed during the pandemic. Others are growing rapidly, particularly those around electrification, and we are seeing a sharp rise in demand for EV charging facilities. We think the next growth sector is likely to be battery storage, which the following section examines in detail.

Philippe Rottner, Energy Specialist at Carter Jonas, gives his views on the battery storage sector.

The typical route to market for landowners is to secure Option & Lease agreements with a developer. The developer will undertake the process of securing a grid connection and planning permission, at which point they may call for the lease and build out the project. Rents will vary depending on the project viability but typically they range from £1,500 - £2,500 / MW of installed capacity. It may be possible to negotiate enhanced rents / revenue share if longer duration batteries are being installed (i.e. 4-hour batteries).

•

BESS can be installed with a density of 30-60MW / acre and yield potential rental income of £45,000-£150,000 per acre per annum. The higher density is only likely to be possible when the batteries have been vertically stacked.

•

Typical BESS leases will include an index linked base rent and a potential revenue rent, depending on the developer. Leases are usually 25-40 years in duration depending on the length of the planning permission and will usually be contracted out of the Landlord and Tenant Act 1954 security of tenure provisions.

•

Another less common route to market is for a landowner to secure planning permission and a grid connection themselves. This will come at a cost and will vary depending on the project size and location. However, there can be a significant upside, with ‘shovel ready’ sites trading in excess of £70,000 / MW (approximately £2,000,000 - £4,000,000 per acre). Importantly, the risk of not obtaining a viable grid connection is significant.

•

Large-scale BESSs (i.e. sites of 15 acres plus) are likely to lean towards more greenfield/agricultural land or low grade (Class 4) open storage sites in which the rents will be likely closer to the typical rate an operator will pay. With BESS generally the price that is paid is not dependent on location, but very much depends on grid connections.

•

In summary, BESS is a technology that will continue to be a requirement as more renewable energy sources become operational.

•

•

•

Back to top

Figure 4: Classifcation system

Limited data and expertise will continue to pose challenges for valuers, but this should ease as the market continues to mature, with more knowledge-sharing and a greater understanding of the sector’s nuances.

•

•

Price per sq ft (£)

Figure 8: Class 1 open storage rents, spring 2024,

regional markets

Source: Carter Jonas

We have continued to evolve our unique open storage classification index. This allows us to grade sites from Class 1 to 4 (with 1 being a ‘prime’ site), based on 16 parameters across four broad categories (surfacing, services & security, accessibility, and planning). The classification is illustrated in Figure 4.

Classifying open storage sites

•

We have separated the quality of the location from this classification (for example the proximity to a motorway or urban market), as this is highly occupier specific. The broad location quality of each site is classified as Primary, Secondary, or Tertiary.

•

Quality of site versus type of occupier – finding the perfect match

The rising importance of sustainability

•

Although open storage does not have many of the sustainability challenges inherent in the built environment, we believe it is a key factor to consider. An obvious challenge is the concrete surfacing associated with Class 1 sites.

•

For investors, open storage provides an opportunity to add assets with relatively low environmental impact to their portfolios. Sustainability impacts can be further mitigated through specific actions such as undertaking a BREEAM Infrastructure Assessment, Embodied Carbon Assessment, or enhancing a site by providing a Sustainable Urban Drainage System.

•

•

2024 has seen Biodiversity Net Gain (BNG) become a central part of the planning process, with most new developments in England now required to demonstrate and deliver a mandatory 10% net gain in biodiversity. This can be achieved either onsite or by purchasing BNG units offsite from third parties.

•

Our classification index will continue to evolve to incorporate sustainability metrics.

•

A rising proportion of occupiers require Class 1 sites, and many are prepared to pay a premium to achieve this. However, there is a structural shortage of open storage sites, which is most acute for these higher quality sites, and the higher rental values for Class 1 open storage mean occupiers are being priced out in some locations. In addition, occupiers should consider whether they want the dilapidation and sustainability implications associated with the concrete surfacing of a Class 1 site.

•

Opting for a higher specification than necessary could result in higher rents and a narrower choice of location, but opting for a lower specification than necessary may result in problems at the operational level. It is therefore important for occupiers to consider carefully what specification of site they really need.

Surfacing - for certain occupier types, notably crane storage and those stacking containers more than two containers high, concrete (and therefore a Class 1 site) is essential. However, for most uses, hardcore surfacing is usually sufficient. In the regional markets, especially in areas that have low rental values, occupiers are less willing to pay higher rents for concrete and tarmac surfacing.

•

Services - almost all occupiers require power and water, for example to service a portable cabin used as a welfare/office unit.

•

Fencing - is essential for most occupiers, with a minimum of Class 2 (paladin) needed. Alternatively, if the site is not fully fenced then a natural barrier such as a river would be acceptable.

•

Unrestricted B8 - use is required for many occupier types. Haulage companies will generally need this as they operate outside of normal business hours.

•

•

We have assessed the typical site quality required for key types of open storage user, summarised in Table 1.

•

•

•

Table 1: Site quality by sector*

*The class specified is the one most appropriate for each occupier type. Most occupiers will want Class 1 if they can but are often priced out.

**Class 1 is required if stacking more than two containers high

***Class 1 is required for crane storage and exceptionally heavy HGVs

London/Inner South East

Rest of UK

Figure 9: Market yields, open storage

Source: Carter Jonas

2022

2023

•

•

•

•

•

•

•

•

•

•

•

London/Inner South East

Rest of UK

Get in touch

Click here to get in touch for more information on any of the listed open storage units

Class (Matrix Score)

Class 2 (72)

Details

• Available freehold or leasehold

• Taplow Elizabeth Line station is within 150 metres

• B8 use

Size

2.6 acres

Bath Road, Taplow, Berkshire, SL6 0NL

Class (Matrix Score)

Class 1 (76)

Details

• The North West’s largest dedicated open storage site

• Strategic south west Manchester location

• Only c.6 miles to the M6 motorway

• Excellent road network connectivity

• Suitable for a variety of open storage users

• Range of plot sizes available

Size

32.5 acres

Quoting

£3.00 psf

Manchester Road, Carrington,

M31 4AY

Class (Matrix Score)

Class 1 (81)

Details

• Fully secure and fenced site

• Three-phase power

• Mains water supply and drainage

• 46,874 sq ft 3-sided warehouse with 6m clear eaves rising to 11m at the apex

• On site security

Size

2.12 acres

Quoting

£11.50 psf p.a.

Plot 2,

Link Park Road, Heathrow,

UB7 7EZ

Class (Matrix Score)

Class 1 (89)

Details

• Prime distribution site/ facility

• Low site cover (22.5%) cross dock parcel depot of 27,680 sq ft

• Concrete surface throughout

• Excellent access to A10/ M25

Size

2.17 acres

Quoting

£925,000 p.a.

19 Millmarsh Lane,

Enfield

Class (Matrix Score)

Class 2 – Class 3

Details

• Well established commercial park

• Range of open storage plots available

• Concrete, tarmac and soft surface available

• Good HGV access to the A46 at Six Hills

Size

0.63 – 6.87 acres

Quoting

£47,500 p.a - £505,000 p.a

Melton Commercial Park, Melton Mowbray, Leicestershire, LE14 3JL

Class (Matrix Score)

Class 2 (59)

Details

• Suitable for a range of commercial, industrial and waste management related uses (subject to achieving the necessary planning consents)

• Strategic Location serving A10 and North London

Size

6.53 acres

Quoting

POA

Rye House

Hoddesdon, EN11 0RF

Class (Matrix Score)

Class 1 (85)

Details

• Buildings to be cleared

• 3 phase electricity

• Mains water & drainage

• Excellent access to the A14

Size

7.41 acres

Quoting

£2.75 psf

Former Islip Furnace Site,

Kettering Road Islip, Kettering,

Northamptonshire NN14 3JW

Class (Matrix Score)

Class 1 (80)

Details

• Concrete surface

• Secure and fenced.

• Electricity, water and drainage

• Established B2/B8 use

• Excellent access to the M25 and A3

Size

1.15 acres

Quoting

£375,000 p.a.

1 Brooklands Road,

Weybridge,

KT13 0TJ

Class (Matrix Score)

Class 2 (68)

Details

• Superb location

• Highly visible site

• Close proximity to the A1

• Fully secure site with power

• 46,000 vehicle movements per day

• Excellent accessibility

Size

2.03 acres

Quoting

£170,000 p.a.

Markham Moor, Retford, Nottinghamshire, DN22 0TE

View full property listing

View full property listing

View full property listing

View full property listing

View full property listing

View full property listing

Carrington

Link Park Heathrow

Enfield

Melton Mowbray

Hoddesdon

Kettering

Weybridge

Markham Moor

Carrington

Link Park Heathrow

Enfield

Melton Mowbray

Hoddesdon

Kettering

Weybridge

Markham Moor