open storage UPDATE

Autumn 2022

Enquiries for open storage land totalling 671 acres were recorded in the first eight months of 2022. This equates to the equivalent of just over 1,000 acres over one year. On this basis, total demand in 2022 would be lower than the 1,300 acres of demand registered in 2021, but still nearly double the 2020 level, as Figure 1 illustrates.

outlook

The open storage market is characterised by the scarcity of high-quality Class 1 product, and occupier demand will remain elevated compared with the level of supply for sites in the right location and of the right specification. Quality is increasingly important, reflecting the broader trend across the commercial property sector.

For investors, there will be only limited opportunities to purchase either high-quality existing sites, or sites that can be upgraded. However, the restricted quantity of stock will help to maintain upward pressure on rental values and will mean increasing potential returns from upgrading lower-quality sites.

Given the defensive qualities of open storage, continued strong rates of rental growth, and demand uncertainty in many traditional property sectors, we expect investor interest to remain extremely strong.

Market transparency will continue to improve gradually as the sector matures and investors increasingly see it as a distinct asset class.

For further information, please contact:

Email me

Andrew Smith

Partner, Head of Industrial Agency

+44 (0)7919 326085

Email me

Daniel Francis

Head of research

+44 (0)7801 666137

FRICS SIOR

Occupier demand

Section one

Classifying open storage sites

Section two

Supply

Section three

Pricing and tenure

Section four

Drivers, opportunities and growth potential

Section Five

Welcome to our Autumn 2022 update on the latest demand and rental value trends in the open storage market. With elevated levels of interest from occupiers and investors, we consider the outlook for this important and growing sector.

Figure 1 also shows that the average size of open storage land requirements has fallen from a peak of 5.2 acres in 2021 to 4.0 acres during the first eight months of 2022. In part, this is due to several enquiries for very large sites in 2021 (greater than 20 acres), which have not recurred in 2022.

We continue to see a high level of enquiries from a wide variety of open storage users. Demand is particularly strong from logistics and parcel operators for the parking and storage of van fleets, including electrical vehicles which require high-specification sites.

Rental Trends

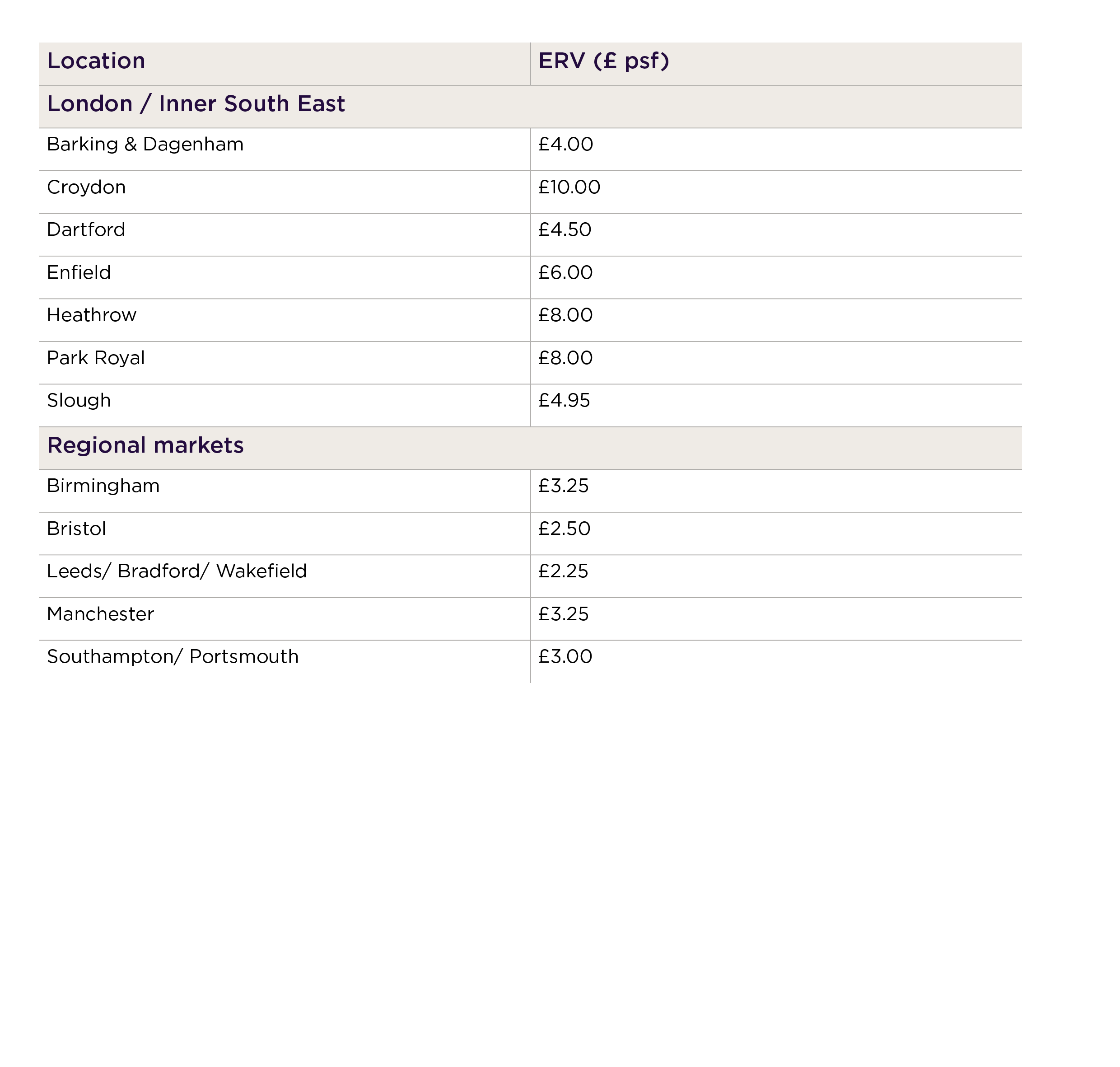

There has been significant rental growth in the open storage sector over the last year, and a key trend has been a narrowing of the gap between the regional markets and London / the Inner South East. In September 2021, the average rent across our monitored locations in London / the Inner South East was £4.39 psf, 3.4 times the £1.30 psf average in the regional markets. Currently, the average prime rent across our London / Inner South East monitored locations is £6.49 psf, compared with £2.85 psf in the regional markets, representing a lower multiple of 2.3.

These increases represent a growth rate over the last year of 48% in London/ the Inner South East, and 119% in the regional markets. The growth rate in London and the Inner South East was considerably slower over the last six months (6.3%) compared with the previous six (39%). The regional markets saw only a modest slowdown, from 52% during September 2021 to March 2022, to 44% in the six months to September 2022.

Source: Carter Jonas

Stated ERVs assume a 1.5 acre Class 1 site which is serviced and fenced, with a concrete surface, broadly unrestricted B8 use and available on a lease length of 3-5 years.

Read more about our research on how Open Storage is the new asset class in the industrial sector

Read more

Total Demand (acres)

Total demand (acres)

The proportion of enquiries for small sites (less than 1.5 acres) has increased noticeably. In 2021, this segment accounted for 28% of enquiries, compared with 42% of enquiries in 2022 to date. Enquiries by size band are shown in Figure 2.

In terms of the number of enquiries, 2022 is broadly in line with the 2021 level, and is significantly elevated compared with previous years, as Figure 3 illustrates.

•

•

•

•

•

Average size required (acres)

Figure 1: Open Storage Demand (acres)

2022 (projected)

Average size required

Source: Carter Jonas, Agency Pilot, IAS

2021

Jan-Aug 2022

Figure 2: Open Storage Demand (no. of enquiries)

Number of enquiries

2022 (projected)

Total demand (no. of enquiries)

Figure 3: Open Storage Demand

Source: Carter Jonas, Agency Pilot, IAS

We have also assessed the relative importance of the open storage sector within the overall industrial market by analysing industrial enquiries in 2022 to date. The findings show that 12% of all industrial enquiries specifically related to open storage land, with a further 15% requiring land more broadly (which could be for a range of uses from open storage to development). Therefore, more than a quarter (27%) of industrial enquiries relate to land (note that some enquiries related to both land and buildings and were therefore included under both categories).

•

Figure 4: Breakdown Of All Industrial Market Enquiries

Land

Open Storage

Trade Counter

Industrial and Logistics

Land Only

Land and Buildings

Current rents for prime class 1 sites are shown in Table 1, and the change over the last 12 months is shown in Figures 5 and 6.

Table 1: Prime rents – Class 1 sites

September 2021

September 2022

Figure 5: Open Storage Rents By Location

Price per sq ft (£)

6 months

1 year

Figure 6: Growth In Open Storage Rents To September 2022

Price per sq ft (£)

•

•

•

•

Investment trends

Many investment funds now have a much greater awareness of the sector. Interest is incredibly strong, ranging from those who are currently making acquisitions, to those actively looking to enter the market, and others who are considering the potential opportunities for the first time. We are aware of five key funds that are looking to invest in the sector with capital of £100 million plus (each), as well as other smaller ones currently seeking product. However, there could be as much as £1 billion coming into the sector.

Market transparency is slowly increasing, but lags well behind more mature commercial property sectors. A sign of this is the increasing number of investment brochures we are seeing.

With a significant weight of money behind it, the market for open storage land is holding up well. This contrasts with industrial development land, where construction costs have risen significantly, due to increasing materials prices and labour costs, together with higher interest rates. Therefore, open storage funds have a better prospect of successfully competing against vacant development plots. Indeed, they have been some of the stronger bidders of late, especially outside of London.

Given the ongoing strong underlying demand, the sector remains defensive against short-term economic uncertainty.

•

•

•

•

Demand

Source: Carter Jonas, Agency Pilot, IAS

Source: Carter Jonas, Agency Pilot, IAS

Source: Carter Jonas

Source: Carter Jonas