Model Estate v

The Asset Classes

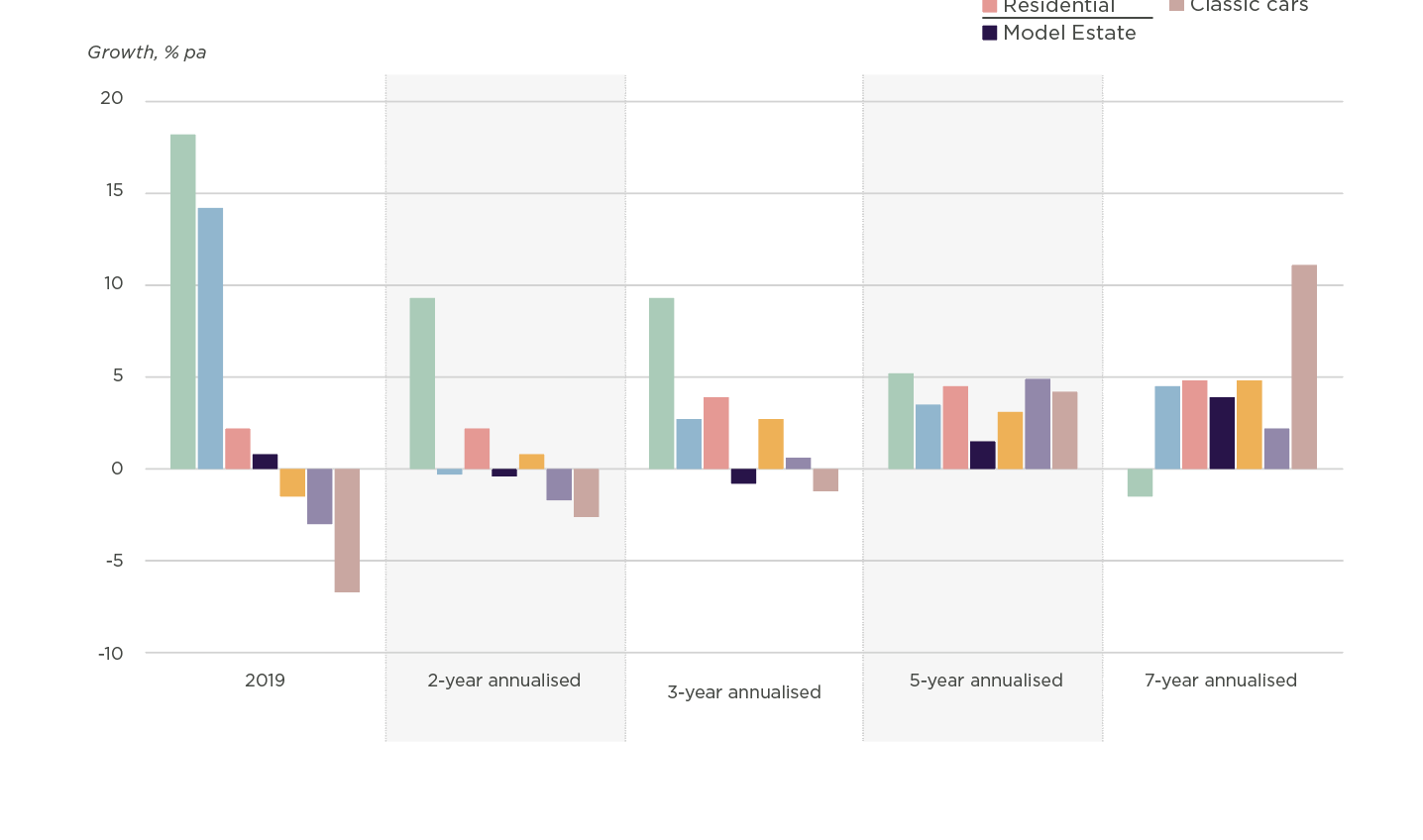

The Model Estate ranked fourth in this year’s alternative asset class rankings, with its one-year performance outstripped by gold, equities and residential property. Over the longer-term, annualised growth remained strong, at 1.5% on a five-year basis and 3.9% over a seven-year period.

Read more on the Model Estate...

Find out more from our experts about mineral extraction on the Model Estate, and how to maximise the value of subsequent leisure opportunities.

Extracting Minerals

& Leisure opportunities

Scroll to explore

The Model Estate was valued at £39.75 million in December 2019, representing a modest but respectable annual increase of 0.8%...

Model Estate components & performance

Figure 3 Long-term alternative asset class performance

Source: Carter Jonas, Lix-ex, MSCI, HAGI, London Stock Exchange

Growth % pa

20

15

10

5

0

-5

-10

2019

2-year

annualised

3-year

annualised

5-year

annualised

7-year

annualised

Equities

Residential

Commercial

Fine wine

Gold

Model Estate

Classic cars

Gold 18.2%

The price of gold surged in 2019, increasing by 18.2% during the year, compared with 1.2% in 2018. In actual terms, this equated to $1,512/oz at the end of 2019, the highest year-end figure since 2012. Demand for gold was strong throughout the year and, in US dollars, price growth increased most during the summer months, as a result of the 75 basis points fall in the US Federal Reserve bank rate to 1.5% in October.

Equities 14.2%

In the equities market, the FTSE All Share index ended the year up by 14.2% annually at 4,196 points. This was the highest month-end result for the year and was inflated by the Conservative party majority in the December general election, which pointed to more certainty in the UK Government as we move into a post-Brexit period.

Residential 2.2%

Annual house price growth in the UK increased by 2.2% during 2019, however regional variances were apparent. Wales recorded the largest annual increase of 7.8%, while the South East and London saw slower, but positive, rises of 1.0% and 0.2% respectively. Price increases are forecast for 2020, buoyed by the clear general election result and by the anticipated stamp duty increase from 15% to 18% for overseas buyers in the Spring Budget. These purchasers are expected to rush to acquire before the Budget, which may temporarily strengthen the market.

Commercial -1.5%

The fall in commercial capital values in 2019 was once again driven by significant reductions in the retail sector, where values declined by 7.7%. This was in comparison to a relatively stagnant performance in the office sector of 0.1% during 2019. While the industrial sector has experienced double-digit growth over the last two years, a lower but positive increase of 1.7% has again resulted in the sector performing most strongly.

Fine wine -3.0%

Pricing of luxury asset classes was restrained in 2019, facing various headwinds, including Brexit uncertainty and new US tariffs on European wines. As a result, the fine wine index ended the year on 302.6 points, down by 3% annually. During the year, the index dipped slightly before it peaked in August, and then declined rapidly each month until December. While the short-term trends are negative, over a five- and seven-year period, the index increased by 4.9% per annum and 2.2% per annum respectively.

Classic cars -6.7%

Uncertainty surrounding Brexit and the US-China trade conflict has also affected the classic car market. A decline of 6.7% was recorded in 2019, however such assets are thought of as being longer-term investments. Over a five-year period, annualised growth of 4.2% was recorded, and this increased to 11.1% over seven years, showing the asset’s strong long-term investment potential.

The price of gold surged in 2019, increasing by 18.2% during the year, compared with 1.2% in 2018

Read more on the Model Estate...

Find out more from our experts about mineral extraction on the Model Estate, and how to maximise the value of subsequent leisure opportunities.

Extracting Minerals

& Leisure opportunities

The Model Estate was valued at £39.75 million in December 2019, representing a modest but respectable annual increase of 0.8%...

Model Estate components & performance

Model Estate v

The Asset Classes

The Model Estate ranked fourth in this year’s alternative asset class rankings, with its one-year performance outstripped by gold, equities and residential property. Over the longer-term, annualised growth remained strong, at 1.5% on a five-year basis and 3.9% over a seven-year period.