Model Estate 2020

Welcome to the 2020 Model Estate research report, the tenth annual publication produced by Carter Jonas, which documents the frequently changing nature of a rural estate and its various income streams.

About the Model Estate

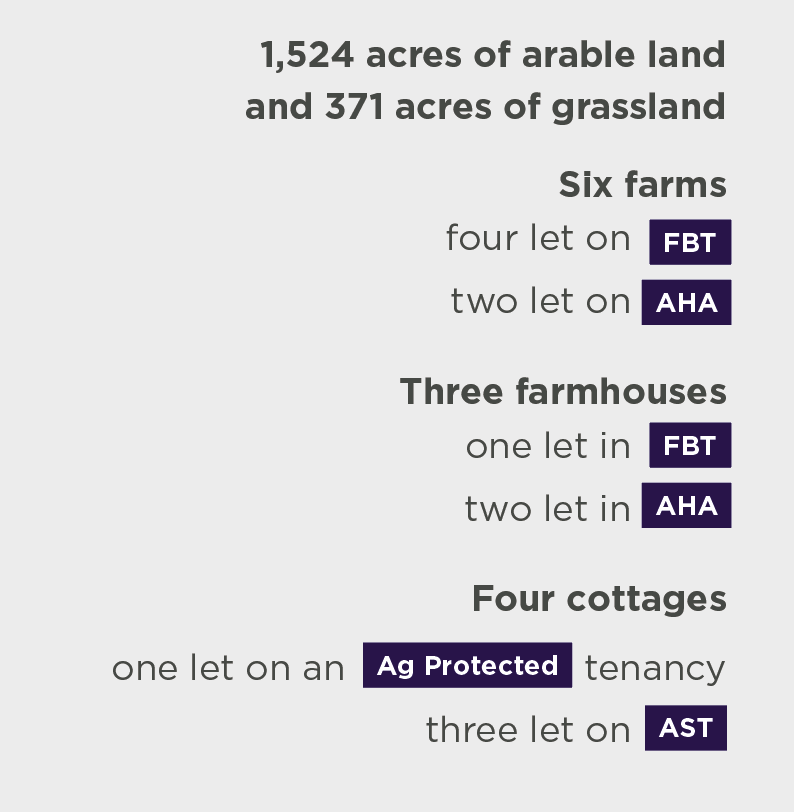

The Model Estate is a notional agricultural estate created by Carter Jonas in 2010. The Estate has evolved over the years and currently comprises 3,168 acres and includes a combination of let and in-hand farms, a commercial and residential portfolio, a telecoms mast, fishing rights, a syndicate shoot and a solar farm. It is located within the geographical triangle bounded by the M4, M40 and M5 motorways.

Why was the Model Estate created?

Analysing the Estate’s data each year enables us to give a balanced view of all the assets and make strategic recommendations for the coming months, similar to the annual reviews produced by Carter Jonas for estates under our management.

Furthermore, the Model Estate is also used to compare the short- and long-term capital value performance of agricultural land and assets against a basket of alternative asset classes: residential and commercial property, equities, gold, fine wine and classic cars.

Please note that all findings in this report are based on valuations undertaken on 31 December 2019.

Components

Total value:

£39.75 million

Annual change:

+0.8%

The Model Estate was valued at £39.75 million in December 2019, representing a modest but respectable annual increase of 0.8%. This rise was driven by a positive performance across all components, with the exception of the residential portfolio, and was in contrast to the 1.7% annual decrease witnessed in 2018.

Let farms 36%

Let commercial 10%

In-hand farms 45%

Let residential 7%

Other 2%

Figure 1 Components of the Model Estate (by capital value)

Source: Carter Jonas

Let residential

Let commercial

In-hand farm

Other

Let farms

Explore the Model Estate

SOLAR FARM

TELECOMS MAST

FISHING RIGHTS

SYNDICATE SHOOT

Other

SOLAR FARM

SYNDICATE SHOOT

FISHING RIGHTS

TELECOMS MAST

MANOR HOUSE

FARMHOUSE

In-hand farm

FARMHOUSE

MANOR HOUSE

Let commercial

Let residential

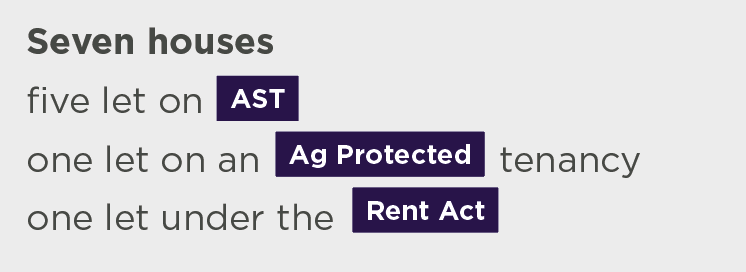

AST

AST

FBT

FBT

FBT

FBT

Let farms

Show all components

Performance

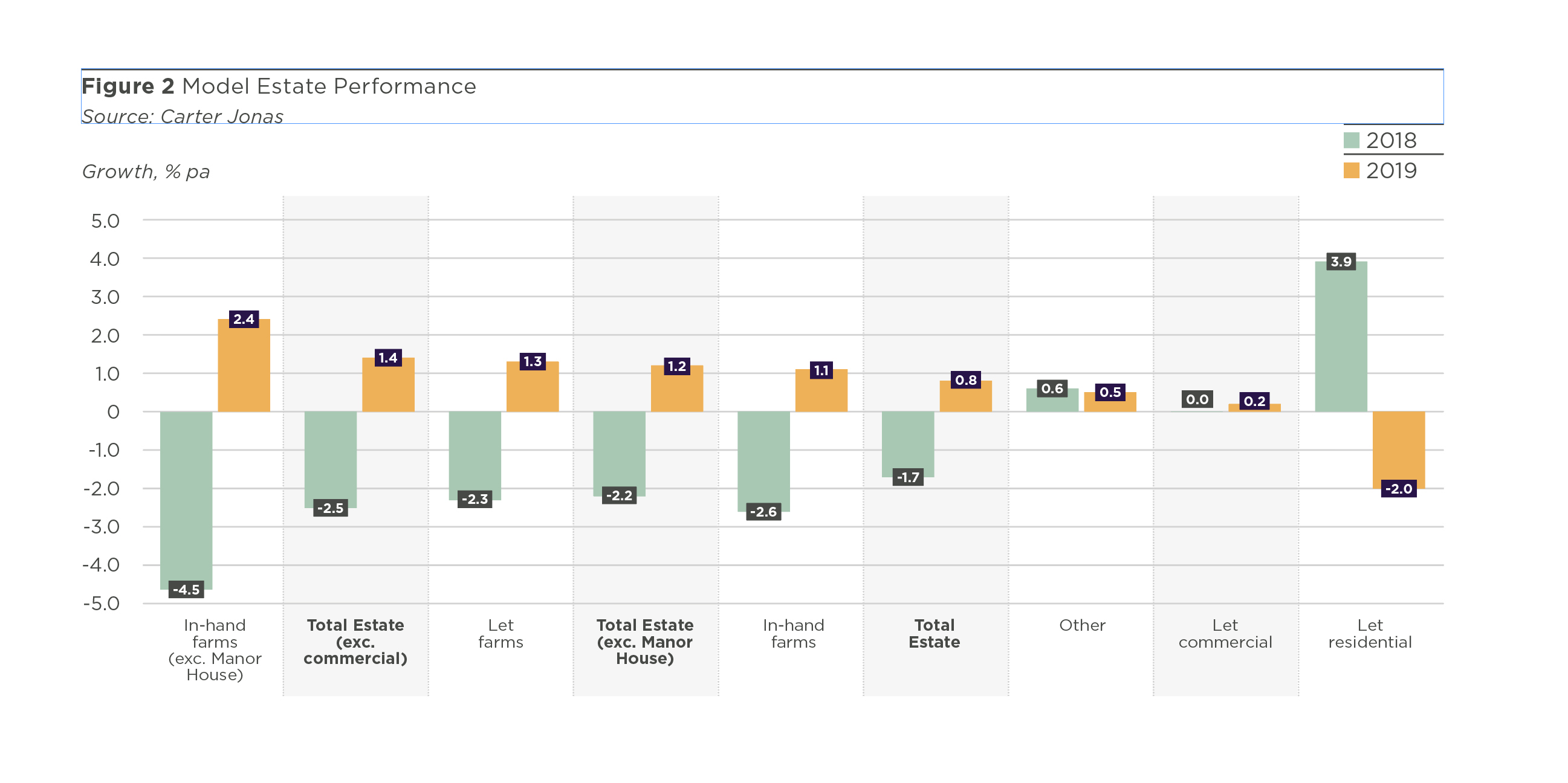

Despite the economic and political turbulence during 2019, the value of the Model Estate increased by a respectable 0.8% in 2019, illustrating the resilient performance of a multi-sector asset.

Figure 2 Model Estate Performance

Source: Carter Jonas

Growth % pa

5.0

4.0

3.0

2.0

1.0

0.0

-1.0

-2.0

-3.0

-4.0

-5.0

In-hand

farms (exc. Manor

House)

Total

Estate

(exc. commercial

Let

farms

Total

Estate

(exc. Manor House)

In-hand

farms

Total

Estate

Other

Let commercial

Let residential

2.4

-4.5

-2.5

-2.3

-2.2

-2.6

0.6

0.0

-1.7

3.9

1.4

1.3

1.2

1.1

0.8

0.5

0.2

-2.0

2018

2019

Let farms: 1.3%

The Estate’s growth was supported by the value of its let farms, which increased by 1.3% in 2019, in contrast to the previous two years’ negative growth rate. While the cottages saw a small decrease in value over the year, arable land increased by just under 3%, bolstering the sub-sector’s performance.

In-hand farms: 1.1%

The performance of the in-hand farming component rose by 1.1% during 2019, in comparison to the previous year’s 2.6% decline. This rise was entirely due to the increase in arable land values over the course of the year, with pasture and woodland values remaining static. The value of the Manor House reduced by 1.1%, in contrast to the previous year’s improvement, although in line with the wider country house market. This had a negative impact on the sub-sector’s performance; in-hand farms excluding the Manor House showed growth of 2.4%.

As a result of the unprecedented wet weather conditions over the last year, the cropping rotation has been impacted, with a higher acreage of spring produce incorporated. The oilseed rape crop has also been subject to cabbage stem flea beetle, and the combination of these factors has significantly reduced the projected income for 2020. There may be further impacts to this due to changing commodity prices following the coronavirus outbreak. Furthermore, with the extraction of minerals resource scheduled for 2020, 25 acres of land was removed from the cropping rotation.

Other: 0.5%

The “other” category of the Estate saw capital values increase by 0.5% in 2019, which was entirely due to the annualised increase in revenue of the solar farm. Both the capital value and rental income from the telecoms mast, commercial shoot and fishing rights all remained static over the same time period.

Commercial: 0.2%

The commercial element of the Estate remains fully occupied and increased by 0.2% in 2019, due to a small uplift in the rental values of both the workshop/ storage and office, while yields remained constant. Occupier demand throughout the UK’s regional office markets remained robust throughout 2019. Low volumes of speculative development continue to fuel rents. This will have a positive impact on rural office locations, with occupiers increasingly demanding a good quality working environment with crucial internet connectivity.

Residential: -2.0%

The residential portfolio was the only component which saw values fall in 2019, by 2.0%. Despite this reduction in capital values, rental levels remained stable during the year and demand for good quality, well-located rental accommodation in rural locations remains strong. This decline contrasts with trends witnessed in the national housing market, where pricing levels during the year, particularly after the December general election. In Oxfordshire however, where the Model Estate is located, price growth was relatively muted.

Read more on the Model Estate...

Find out more from our experts about mineral extraction on the Model Estate, and how to maximise the value of subsequent leisure opportunities.

Extracting Minerals

& Leisure opportunities

Performance

How did the Model Estate rank amongst the alternative asset classes?

Model Estate v

The Asset Classes

Scroll to explore

Scroll to explore

Scroll to explore

While the Estate performed well in 2019, as outlined within the report, our plans for 2020 will be impacted by wider political and economic disruptions, namely Brexit and the Covid-19 pandemic, although the former is likely to be put on the back burner as the UK recovers from the economic shock of Covid-19. The virus, and the subsequent lockdown measures implemented by the UK Government, have severely impacted the economy and most forecasting houses have now downgraded GDP growth for 2020, although growth for 2021 has been upgraded.

In the context of the Model Estate, this slowdown will delay the extraction of mineral resource and the subsequent leisure development planned for this year. For the purpose of this publication, we have worked on the best case scenario that both proposals commenced later in the summer months, after lockdown measures were eased.

For an interactive map showing all of the components of the Model Estate 2020 visit this page on desktop