The evolution of multi-storey warehousing

The multi-storey warehouse concept is well established in a number of major Asian cities, including Hong Kong, Singapore, and Tokyo, where high population densities have exerted strong pressure on land values.

Multi-storey warehousing

in London

Multiple floors with lorry access to all floors

Multiple floors with goods lift

Single storey Mezzanine floors

In the established Asian markets, multi-storey warehouses are typically up to three storeys, but they can be 10 floors or more and the tallest is more than 20 floors.

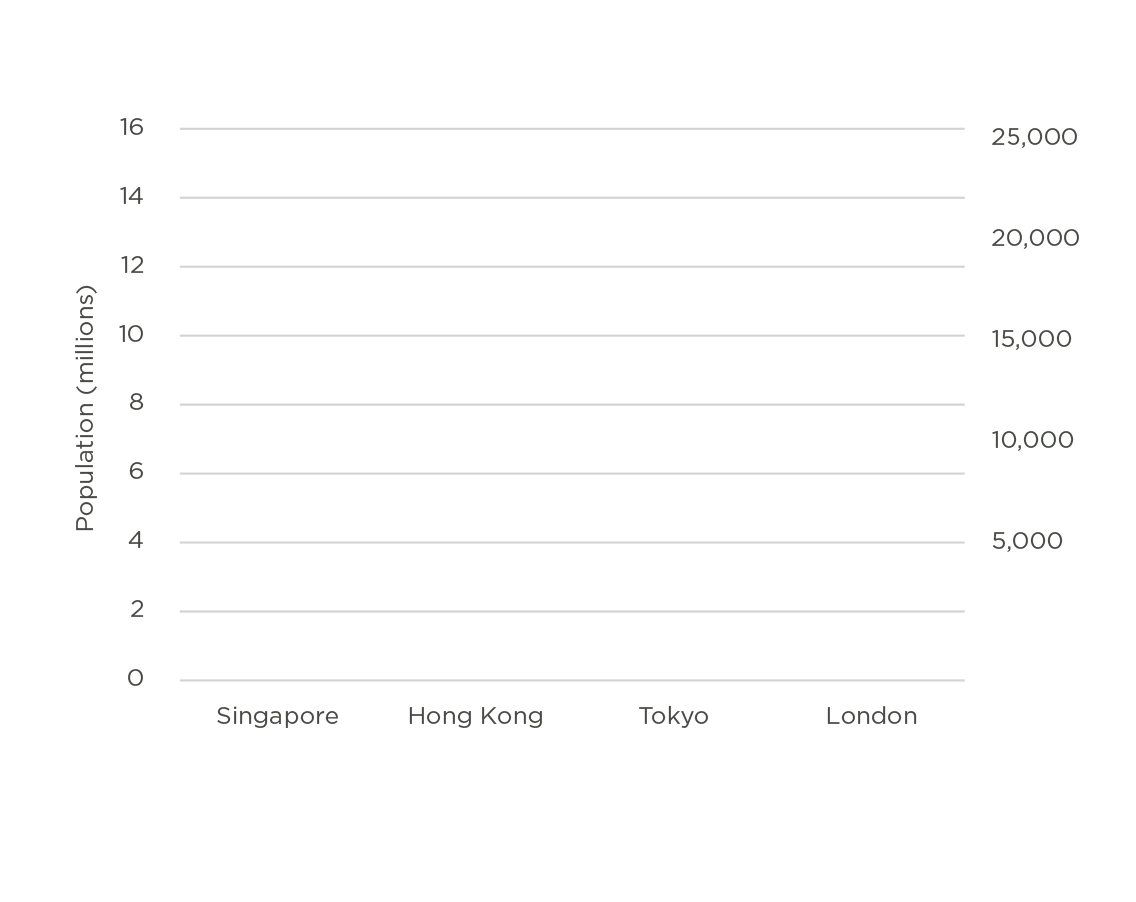

Figure 1

population and density - selEcted global cities

RIGHT ON SO MANY LEVELS

Rapid growth in ‘last mile’ delivery requirements means rising demand for urban warehousing across the globe. With urban space at a premium, multi-storey warehousing is now gaining traction in some major centres across North America

and Europe.

In the UK, a number of schemes have been proposed in recent years, but only one ‘true’ multi-storey warehouse has been developed to date: 234,000 sq ft X2 at Heathrow, developed by Brixton / SEGRO.

what is MULTI-STOREY WAREHOUSING?

Access to the upper levels can be via a goods lift (some of which can lift goods vehicles), or direct lorry access via ramps. For processing goods, direct lorry access is important, and goods lifts with no lorry access may restrict the upper floors to purely storage use.

In the UK, there are many examples of very high single-storey warehouses with mezzanine floors, but we do not regard these as true multi-storey buildings (for reasons including their potentially temporary nature, limited floor loadings and access issues).

Why the rapid rise in ‘last mile’ space?

Occupier demand for ‘last mile’ logistics has been accelerating due to a potent combination of:

the rising popularity of city centre living and strong employment growth means more deliveries are required in central London.

The supply challenge

London’s industrial land supply is in long term decline, and given the city’s structural housing shortage plus continued rapid population growth, pressures will become ever more acute.

The constrained nature of London, surrounded by the Green Belt, points towards the need to do more with less space, and planning policy is responding with an increased focus on intensification.

For the warehousing sector, this points towards building higher (or underground); increasing the level of site coverage; and providing more industrial within mixed-use schemes.

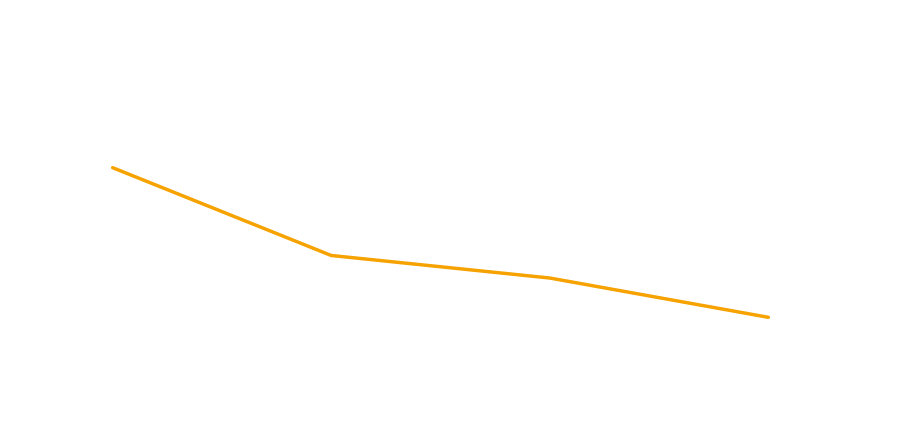

Severe supply pressures have resulted in strong rental and land value growth. Over the last two years prime rental values in London and the inner South East have risen by nearly 9% and land values have increased by more than a third.

Change in London

& Inner South East, last two years

PRIME RENTS

LAND VALUES

+8.6%

+34.3%

How does London compare with established multi-storey markets?

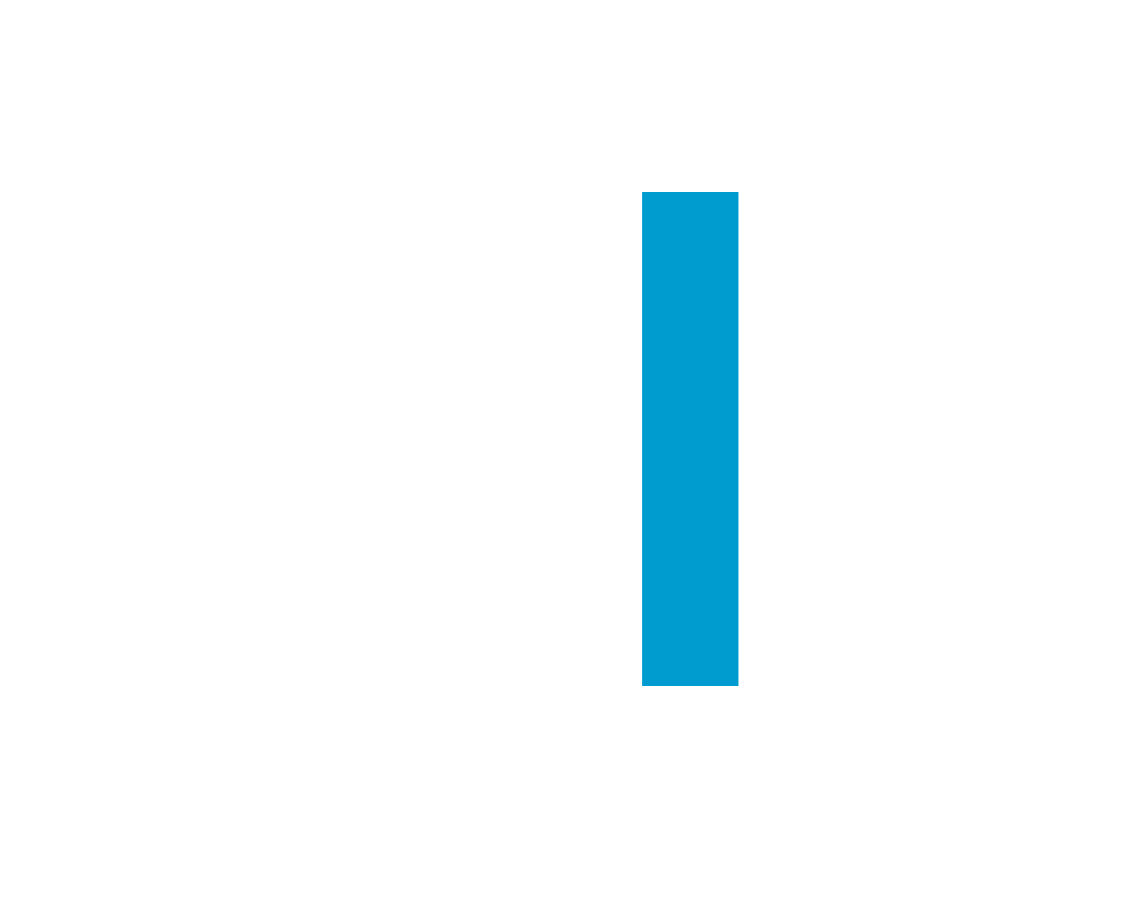

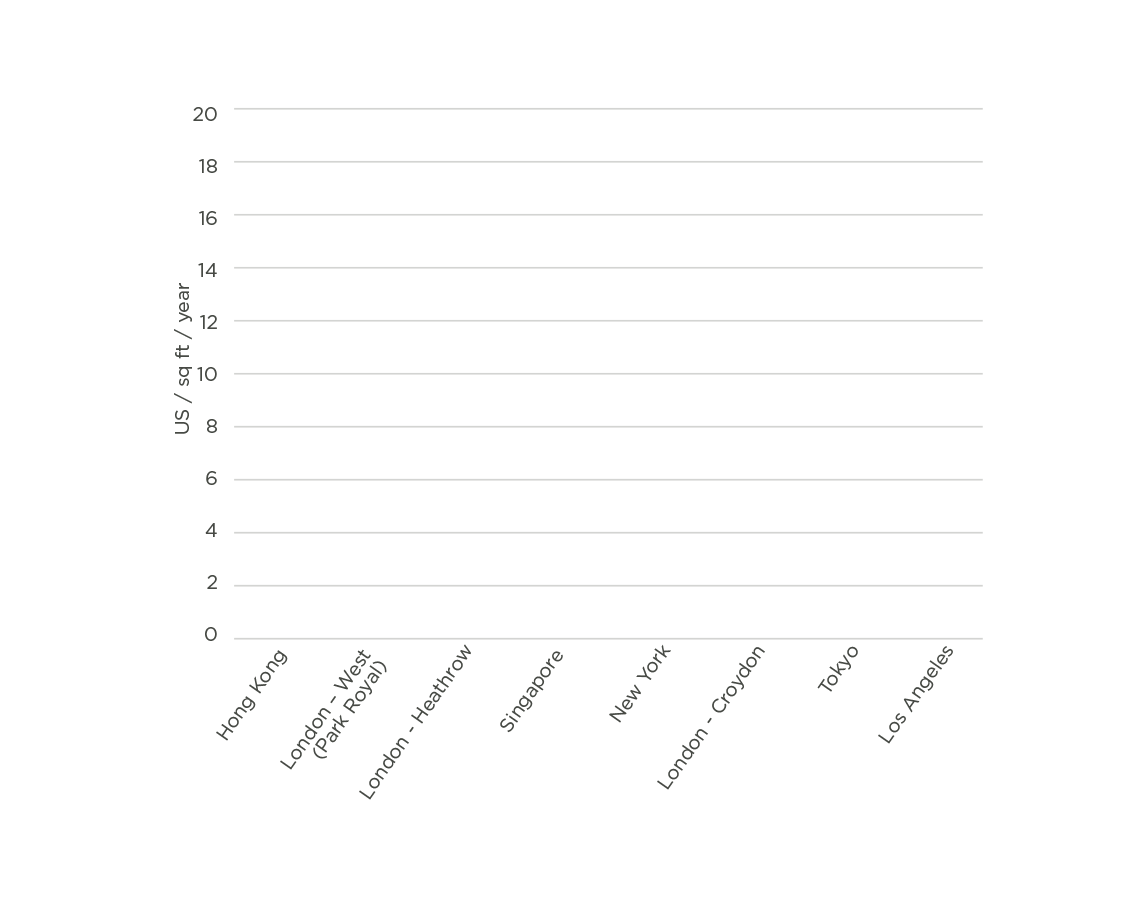

We have compared London’s population and prime rents with the successful Asian multi-storey industrial markets of Singapore, Hong Kong and Tokyo.

Although Greater London has a lower population density than all of these markets, at nearly 15,000 people per sq mile it is not that far behind Tokyo (16,400). Greater London’s total population of 9 million makes it 1.5 times larger than Singapore, and 1.25 times Hong Kong, although only two thirds the size of Tokyo. Overall, this suggests that London’s size and density are not too dissimilar to these successful multi-storey markets.

In addition, industrial rents in prime areas of London are higher than those in Singapore and Tokyo, and only a little way behind Hong Kong (although care needs to be taken in comparing rents without taking into account other occupancy costs, especially the UK’s very high level of Business Rates). This suggests that cost pressures are also broadly comparable.

Population (m)

Population density (people/sq mile)

Figure 2

Prime industrial rent comparison

Good in theory – so what are the barriers?

The fundamentals appear to support multi-storey warehousing in London, but there are some key differences to comparable markets in Asia.

Conclusions

does multi-storey stack up?

The rapid growth in ecommerce is driving demand for urban logistics across the globe. In London, high population density, strong economic and population growth, rising city centre living and regulation on vehicle usage are all fuelling this demand.

Given the constrained geography of London and a long-term housing shortage, the pressure on land supply is increasing. This is causing strong rental and land value growth. Planning policy is responding to the pressures of growth with a greater focus on intensification.

All this points towards multi-storey warehousing as part of the solution, but many developers currently appear to view the concept as simply too risky.

Ultimately, retailers and their logistics partners need large, efficient distribution facilities near to their customers. If they can gain competitive advantage from using multi-storey warehousing, they will be prepared to pay the necessary higher rents. However, it may need some pioneers who are prepared to prove that the concept works.

Summary of key drivers, enablers and barriers

• The rapid growth inecommerce

• Increasing consumer

• expectations

• Strong population growth

• City centre resurgence

• London’s growth constraints

• Long-term decline in

industrial land supply

• CSR agenda

• Several schemes already proposed

• Planning policy increasingly

supportive of intensification

• Above-inflation rental growth

• Opportunities for other

income / mixed-use

• Overseas capital from markets

familiar with multi-storey

warehousing

• The need to achieve viability

• The lack of an establish rental

pricing model

• The lack of valuation certainty

• The lack of developer experience

in the UK market

• Risk aversion to repeat of

perceived failure of X2

• Higher running costs

• Higher Business Rates

• Traffic congestion issues

And direct delivery to consumers – the value of UK internet retail sales now accounts for more than 18% of total retail sales and on its current trajectory could represent over 30% of sales in five years’ time.

Rapid growth in ecommerce

Not only are consumers buying more online, but they are also demanding an increasingly rapid and efficient delivery service.

RISING CONSUMER EXPECTATIONS

Greater London’s population is projected to grow by 7.7% over the next decade. As London can’t expand outwards due to planning and geographic constraints, this inevitably means a rising population density.

POPULATION GROWTH

London’s Congestion Charge has been followed by the Ultra Low Emission Zone (an additional charge for vehicles that don’t meet emissions standards). Regulation is likely to become progressively more restrictive.

SUSTAINABILITY

The rising popularity of city centre living and strong employment growth means more deliveries are required in central London.

CITY CENTRE LIVING

Occupational taxes are considerably higher in the UK than most other global markets - Business Rates can be 40-50% of rent, compared with typically 3-5% in many global markets.

London’s constrained road layouts could render many sites unsuitable for the necessary volume of lorry traffic.

Smaller trucks in some Asian markets make for easier vehicle access to upper levels.

Multi-storey industrial is nascent in the UK, and market norms need to develop across issues ranging from how to price rents on different floors, to valuation principles.

SEGRO’s X2 scheme took many years to fully let and although this was largely down to its launch in 2008 at the start of the recession, it has perhaps created the wrong impression.

download full ARTICLE

This research outlines the rise of one of the fastest expanding markets in the London industrial landscape.

The following insights are provided by our national property experts who specialise in industrial agency.

Andrew Smith FRICS SIOR

Partner

T: + 44 (0)20 7518 3242

M: +44 (0)79 1932 6085

E: andrew.smith@carterjonas.co.uk

Looking for experts in multi-

storey warehousing in London?

Contact a member of our team:

Andrew Smith FRICS SIOR

Partner

T: +44 (0)20 7518 3242

M: +44 (0)79 1932 6085

E: andrew.smith@carterjonas.co.uk

Looking for experts in multi-

storey warehousing in London?

Contact a member of our team:

Population density (people/sq mile)

US$ / sq ft / year

DOWNLOAD FULL ARTICLE

• Several schemes already proposed

• Planning policy increasingly

supportive of intensification

• Above-inflation rental growth