HOUSING MARKET OUTLOOK

The outlook for the housing market: COVID-19 restrictions, the changing labour market, the stamp duty holiday, and of course, Brexit.

The UK economy and the housing market specifically face several upside and downside risk factors now and over the coming months. There are four major items which could put pressure on both: new or extended pandemic restrictions, the end of the government furlough scheme, Brexit trade negotiations, and wider global issues (including a rise in global COVID-19 cases and the US election). Here we discuss a few of these items and how the effects might play out over the coming months.

Scroll to explore

Email me

Head of Residential

Lisa Simon

We closely monitor the market so that we can achieve the best possible price for your property. If you’re considering selling or letting, or simply curious to know what your property is worth in these changing times, book a complimentary market appraisal.

Email me

Head of Residential Research

Leslie Schroeder

WINTER 2020/21

What would happen if there are increased lockdown restrictions or another full lockdown?

2020

We have seen that the path of COVID-19 is highly unpredictable, and the rate of infection can accelerate rapidly. Given this, we can’t discount another full or partial lockdown as a possibility, particularly as the Government has already imposed various local restrictions now that COVID-19 cases have begun to rise again, with many more areas on the ‘watchlist’. Furthermore, local restrictions that have been re-imposed appear to be somewhat random and arbitrary, meaning it is even harder to predict what the government will do next.

What we can see for definite though are the areas of society and the economy that the Government are clearly prioritising, namely: schooling, higher education and anything which keeps the wider economy going (i.e. work from home if you can). So although it does remain an option to restrict housing market activity (as it did during April and part of May earlier this year) what we do know is that it was also one of the first things that reopened in mid-May, while the stamp duty (SDLT) tax break shows that maintaining momentum in the market is a high priority. In addition, activity is now being undertaken in a ‘COVID-secure’ way, so the risk of keeping the market open is lower than it was in the spring. We can therefore be optimistic that it won’t be one of the first sectors to be restricted again, should further and wider lockdown measures be needed.

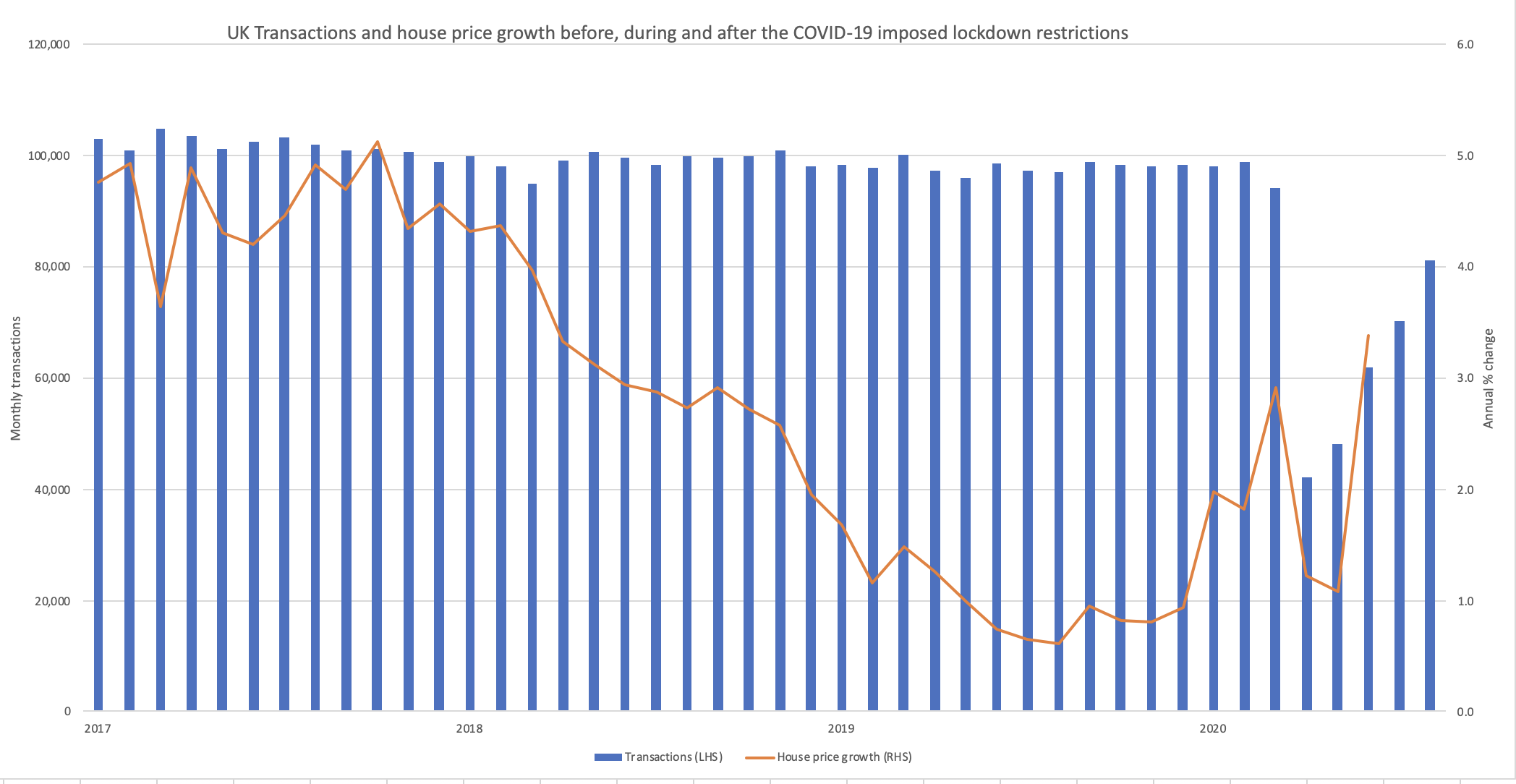

However, if another restriction on the buying and selling of homes is imposed, we can see what the impact might be because it happened during the initial lockdown. The good news is that once restrictions were lifted there was a clear bounce back as pent-up demand during the lockdown encouraged people back to the market quickly. And it wasn’t just pent-up demand that buoyed the situation, but the restrictions themselves brought new purchasers to the market as they discovered during weeks and months of lockdown that they now have different priorities and changing preferences.

"... the restrictions themselves brought new purchasers to the market as they discovered during weeks and months of lockdown that they now have different priorities and changing preferences."

UK Transactions and house price growth before, during and after the COVID-19 imposed lockdown restrictions

100,000

80,000

60,000

40,000

20,000

0

2017

2018

2019

2020

Source: HMRC, HM Land Registry

Transactions (LHS)

House price growth (RHS)

Monthly transactions

Annual % change

5.0

4.0

3.0

2.0

1.0

0

Restrictions on buying & selling homes

Additionally, the temporary tax break has also clearly had the desired effect of helping to boost the market as by August transactions had doubled over where they were in April and May, and price growth has begun to climb rapidly. Finally, as mentioned above, the government is clearly keen to see the housing market recover as part of the economic recovery and this was made clear with the introduction of the stamp duty holiday.

Having said all the above, another lockdown or further restrictions on the economy and socialising would undoubtedly dampen buyer confidence. Even without further restrictions, uncertainty over economic and employment prospects is clearly going to put downward pressure on the (limited) recovery that we are currently experiencing.

Invariably it is hard to disentangle the effects of the recent stamp duty tax break from everything else that is going on surrounding the pandemic. There is clearly a cohort of purchasers who may not have been serious about looking to buy a home who were drawn to the market in order to take advantage of the tax savings. However, there was also pent-up demand due to nearly two months of not being allowed to buy or sell a home so there will have been a surge in demand from those purchasers too.

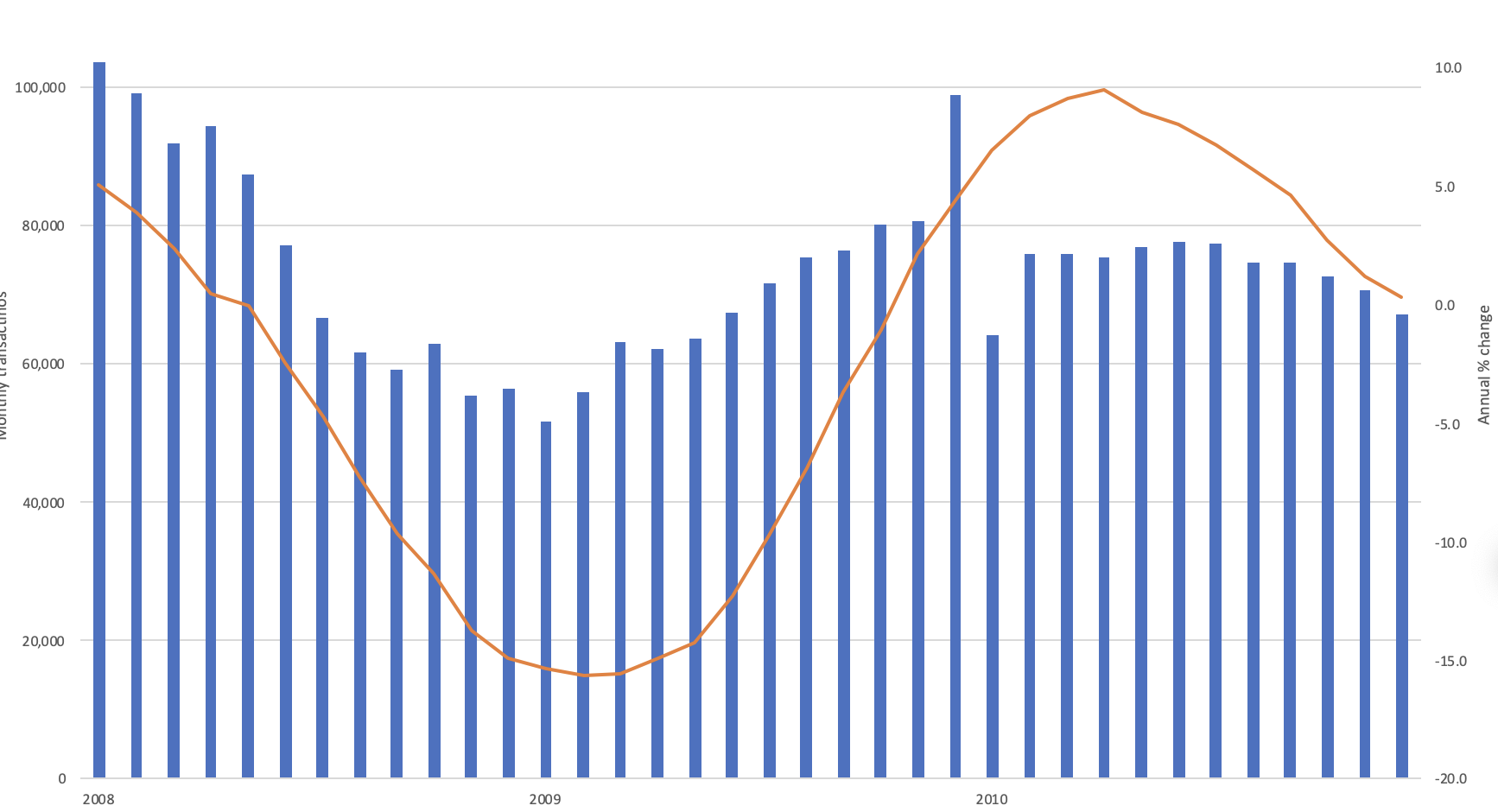

What are the fundamental effects during and after the Stamp Duty holiday?

What we can pretty much guarantee from any government interventionist scheme is more volatility in the market – in other words those people who might have bought next year will have brought things forward so that this year there will be a spike in activity and price growth where next year there will probably be a lull in both. Indeed, we saw this happen during the 2008/2009 SDLT holiday where the tax break did have the desired effect of halting the very obvious monthly decline in transactional activity prior to September 2008. Very clearly though transaction activity rose during every month of 2009 before the scheme completed in December of that year. Meanwhile average price growth during 2008 showed a decline of nearly 15% while the rise in demand and subsequent transactional activity during 2009 lead to 4.4% house price growth that year. The following year transaction activity stabilised, and house price growth subdued but remained just slightly positive for the year at just below 1% growth.

"There is clearly a cohort of purchasers who may not have been serious about looking to buy a home who were drawn to the market in order to take advantage of the tax savings."

Stamp duty holiday period

Sept 2008 - Dec 2009

100,000

10.0

Monthly transactions

Annual % change

80,000

5.0

60,000

0

40,000

-5.0

20,000

2008

2009

2010

0

-10.0

Transactions (LHS)

House price growth (RHS)

-20.0

Source: HMRC, HM Land Registry

UK Transactions and house price growth before, during and after the Stamp Duty holiday, 2008/2009

-15.0

What about Brexit?

The one thing we do know is that Brexit is definitely happening – the UK left the EU in January and we are now in the transition period which end on 31 December 2020. The most likely outcomes are that no trade deal is reached, or a limited trade deal is agreed. There is certainly not enough time to organise a comprehensive trade deal the Government’s self-imposed deadline of 15 October so we should know by then which way it will go. Unfortunately, the government (and those of other EU nations) are clearly currently preoccupied with the immediate health and economic implications and threats associated with the COVID-19 pandemic. So, with that in mind, there is still a small possibility that Brexit negotiations could be delayed yet further and they may use COVID-19 as an excuse to kick the can down the road once again.

In general, it will be very hard to disentangle the effects of Brexit from the effects of the COVID-19 pandemic, on the economy or the housing market. The pandemic is much more on people’s mind than Brexit because its effects are currently being felt but if things go very wrong with Brexit negotiations there is the potential for practical difficulties such as shortages of food and medicines to emerge. If no deal is reached the housing market may begin to see another fall in demand as consumer confidence is likely to fall in reaction to a wider economic fallout. If things get too bumpy then there is a possibility that the Chancellor might decide to bring in further supporting measures, in a similar way to what he has done for the end of the furlough scheme.

"In general, it will be very hard to disentangle the effects of Brexit from the effects of the COVID-19 pandemic, on the economy or the housing market."

Although we are still seeing historically low interest rates and competitive mortgage availability for home movers, this has not been the case for first time buyers (FTB). The pandemic and its associated restrictions and lockdown led many mortgage lenders to pull higher LTV mortgages over the last few months. In March there were nearly 1,700 mortgages available with a 10% deposit but by July this had shrunk to less than 100. First time buyers are of course the ones who will be hit hardest by this as they will need to spend longer to scrape together yet larger deposits. This is clearly going to put a dampener on this cohort of buyers and transaction volumes may decline as a result. The Chancellor may combat this by introducing another interventionist scheme whether it be temporary or permanent, aimed at FTB’s, and this has been done in the past (2010).

Other downside and upside consequences

There are of course other, broader elements to look at when discussing the outlook for the housing market. Employment, for example is forecast to rise over the coming months as layoffs and redundancies begin to take hold and businesses find they are unable to survive. The end of the government’s Coronavirus Job Retention Scheme (furlough) in just a few weeks will deeply impact many and although the Chancellor has initiated a new programme (Job Support Scheme) he has said himself that he cannot save every job. Any rise in unemployment (HM Treasury forecast 8.0% by the end of 2020 and 6.5% during 2021) will decrease consumer confidence, even for those who remain in employment.

There is an overriding consensus that the significant increase in government borrowing resulting from the COVID crisis will lead to higher taxes in the future. The Chancellor cancelled this year’s Autumn statement, so any announcement on tax rises looks to be on hold until well into next year. Just where the tax burden might fall is of course anyone’s guess although there has been talk of a ‘wealth tax’ or an increase in capital gains tax. The impact of these will naturally filter down to the property market although the housing market has often shown resilience in the past, from previous tax rises (i.e.: the additional 3% stamp duty introduced in 2016, the higher rate tax on £2 million properties).

Lastly, there is also the hope of a COVID-19 vaccine rollout sometime in 2021. Not only would a vaccine change the course of the current human health catastrophe but it would allow a sense of normality to return to everyday life and instil a much needed and renewed sense of assurance and confidence about the future. Undoubtedly, such a positive and optimistic change in the current situation will spark a boom in the economy, jobs, spending, and house buying and selling. So even though (as recent reports suggest) it may take up to 12 months for a complete immunisation programme to happen, simply the knowledge that there is a vaccine will probably be enough for consumer confidence levels to increase enormously.

Factors impacting the UK housing market

Second

national lockdown

Increased

social distancing

Brexit

trade disruption

End

of SDLT holiday

Further

job

losses

Tax

rises

More LTV mortgages

available

Rollout

of

vaccine

Hover over a factor to see the risks

What’s more, we have also seen that the government is not afraid to intervene in the housing market, whether it be through a temporary stamp duty tax break or more permanent measures such as abolishing it altogether on homes under £250,000 for first time buyers in 2010, and increasing it to 7% on homes over £2 million in 2012. While we don’t anticipate any permanent changes to the stamp duty tax, there is a chance that the current holiday could be extended if the Chancellor felt it was needed, or indeed there are other measures which the Chancellor may trigger to act across the whole of the economy, should he feel it necessary.

Final thoughts

Despite all the above, the resilience of the UK housing market has been shown time and time again. After the 2009 financial crisis and the ensuing transaction declines and price falls the market rebounded reasonably quickly. Sales volumes found a natural level and although pricing has behaved with more volatility than transactions, on the whole this too has found a more sustainable level of growth, particularly over the last five years, and this is despite the uncertainty of Brexit for over four years now.

Let us also not forget that where we are now is a lot less uncertain than where we were in late March when everything was new and the situation had never happened before. Now at least we are in a position where we’ve been through it and the housing market has, so far, come out the other side ‘okay’. In fact the market is better prepared if anything like this were to happen again; the first set of restrictions meant the industry has become much more adept at virtual viewings and video calls, and the legal, mortgage and conveyancing processes have been made less cumbersome as a reaction to the strict social distancing measures introduced.

"Now at least we are in a position where we’ve been through it and the housing market has, so far, come out the other side ‘okay’. In fact the market is better prepared if anything like this were to happen again."

DISCLAIMER:

© Carter Jonas 2020. The information given in this publication is believed to be correct at the time of going to press. We do not however accept any liability for any decisions taken following this report. We always recommend that professional advice is taken.

BOOK a market appraisal

View properties

talk to an expert

BOOK a market appraisal

View properties

talk to an expert

Second

national lockdown

While we do not expect a full national lockdown or indeed a lockdown for as long as the one earlier this year, if one were to happen it would impact the economy significantly however the housing market is now far more prepared. The government has shown that it considers the housing market a priority so house moving may be exempt from a full lockdown.

Downside risk

Low probability, high impact

Increased

social distancing

Highly likely to happen, probably on a more localised level however there may be nation-wide restrictions. Some industries will still be able to operate as normal however it will certainly slow production. The housing industry is now far better prepared to deal with increased restrictions and the government clearly considers the housing market a priority.

Downside risk

High probability, moderate impact

Brexit

trade disruption

Government will likely try to do everything they can to avoid trade disruption. However, with the focus on the pandemic this could get delayed again however it will be hard to untangle the overall effects of Brexit and the pandemic.

Downside risk

Moderate probability, moderate impact

End

of SDLT holiday

As was experienced when the previous SDLT holiday ended in 2009 we expect some volatility but overall stabilisation of both transactions and price growth is anticipated, once the holiday ends.

Downside risk

High probability, moderate impact

Further

job

losses

Rising unemployment clearly means fewer people contributing to the economy and this impacts overall growth, consumer spending, etc. Consumer confidence will be impacted, and the housing market may feel the pinch as a result.

Downside risk

High probability, moderate impact

Extension of SDLT holiday

Extension of SDLT holiday

The government has clearly shown the housing market is a priority in keeping the economy and confidence strong. An extension of the stamp duty holiday (beyond March 2021) may be another way of helping to boost the wider market. Extensions of government interventionist schemes have been done in the past so this would not be too unusual.

Upside risk

Low probability, high impact

Tax

rises

The significant increase in government borrowing resulting from the COVID-19 crisis will likely lead to higher taxes in the future. It’s difficult to say where the burden will land but less disposable income will mean less spending for those who are affected. The housing market has weathered tax rises in the past so we are hopeful that the impact will not be too great.

Downside risk

Moderate probability, moderate impact

More LTV mortgages

available

The pandemic and its associated restrictions and lockdown led many mortgage lenders to pull higher LTV mortgages over the last few months and first-time buyers are most at risk of losing out as a result. If these were to be reintroduced at greater levels, this cohort of buyers would be enticed back to the market leading to even greater transaction levels.

Upside risk

Low probability, high impact

Rollout

of

vaccine

Not only would a vaccine change the course of the current human health catastrophe, but it would allow a sense of normality to return to everyday life and instil much needed confidence about the future. Vaccine trials are looking promising, particularly the one at Oxford University however a full vaccination program may take up to 12 months to complete once a vaccine is formally approved.

Upside risk

Moderate probability, high impact