Taking Stock:

The UK's Office Sustainability Challenge

The UK office market has continued to evolve under the combined pressures of tightening regulation and rising tenant expectations. The push toward net zero, largely driven by the UK Government’s Minimum Energy Efficiency Standards (MEES), is now intersecting with structural changes in demand, including hybrid working, changing space utilisation, and increased scrutiny of ESG performance by both occupiers and investors.

Our report provides a comprehensive update on the sustainability profile of the UK office stock, focusing on four core metrics: age, quality, EPC ratings, and BREEAM certifications.

Jump straight to a section:

Methodology

Get in touch

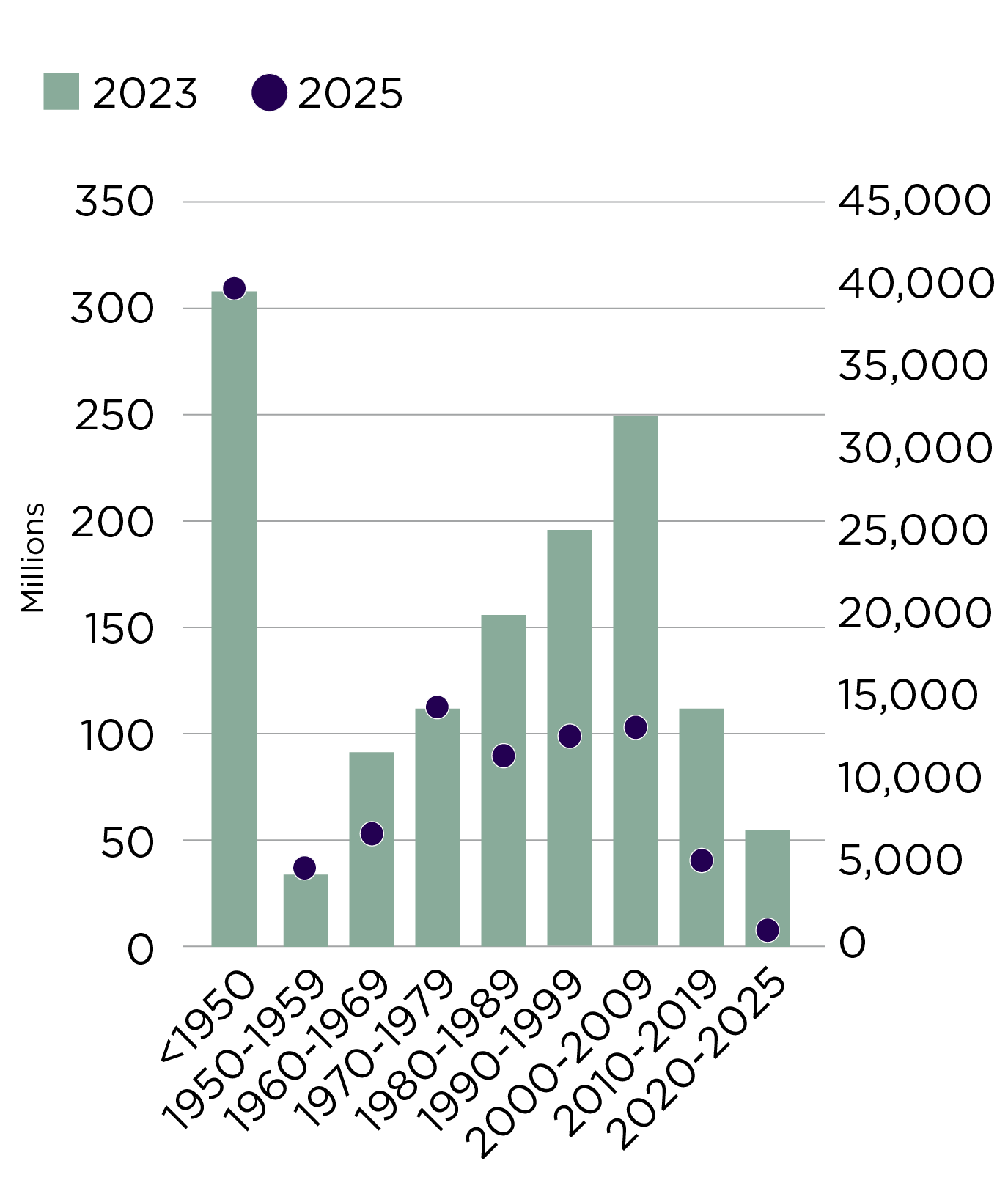

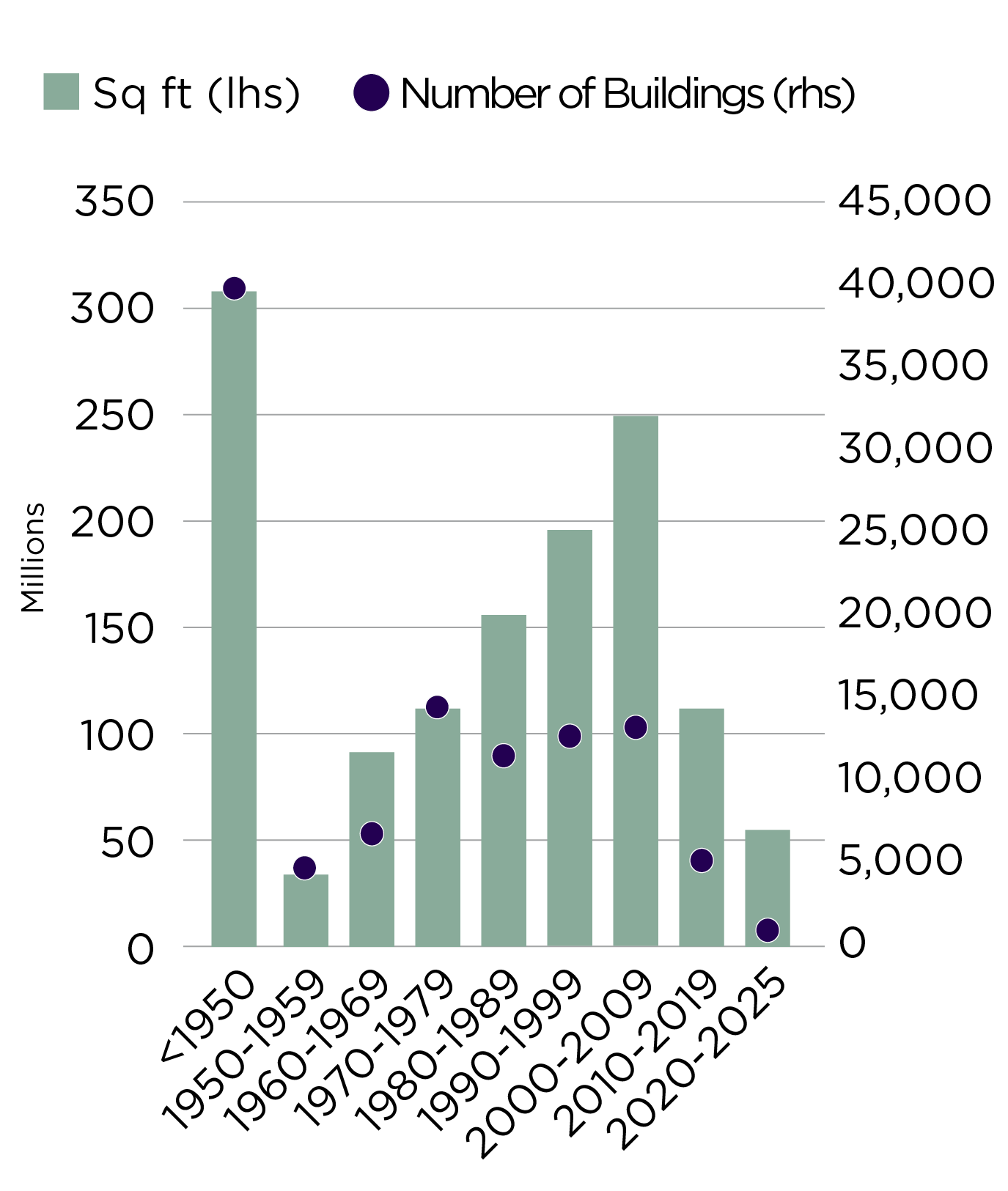

Age

Quality

EPC rating

BREEAM Certifications

Conclusion

The 2025 dataset enables a richer understanding of how sustainability characteristics are evolving. Our dataset now includes over 120,000 unique office buildings across the UK, covering both national stock and twelve major city office markets.

Twelve key UK office markets are included in the comparison, alongside the national total.

Methodology

Download the full report

The key variables analysed are:

Building Age

By decade of construction, unadjusted for refurbishment.

Stock Quality

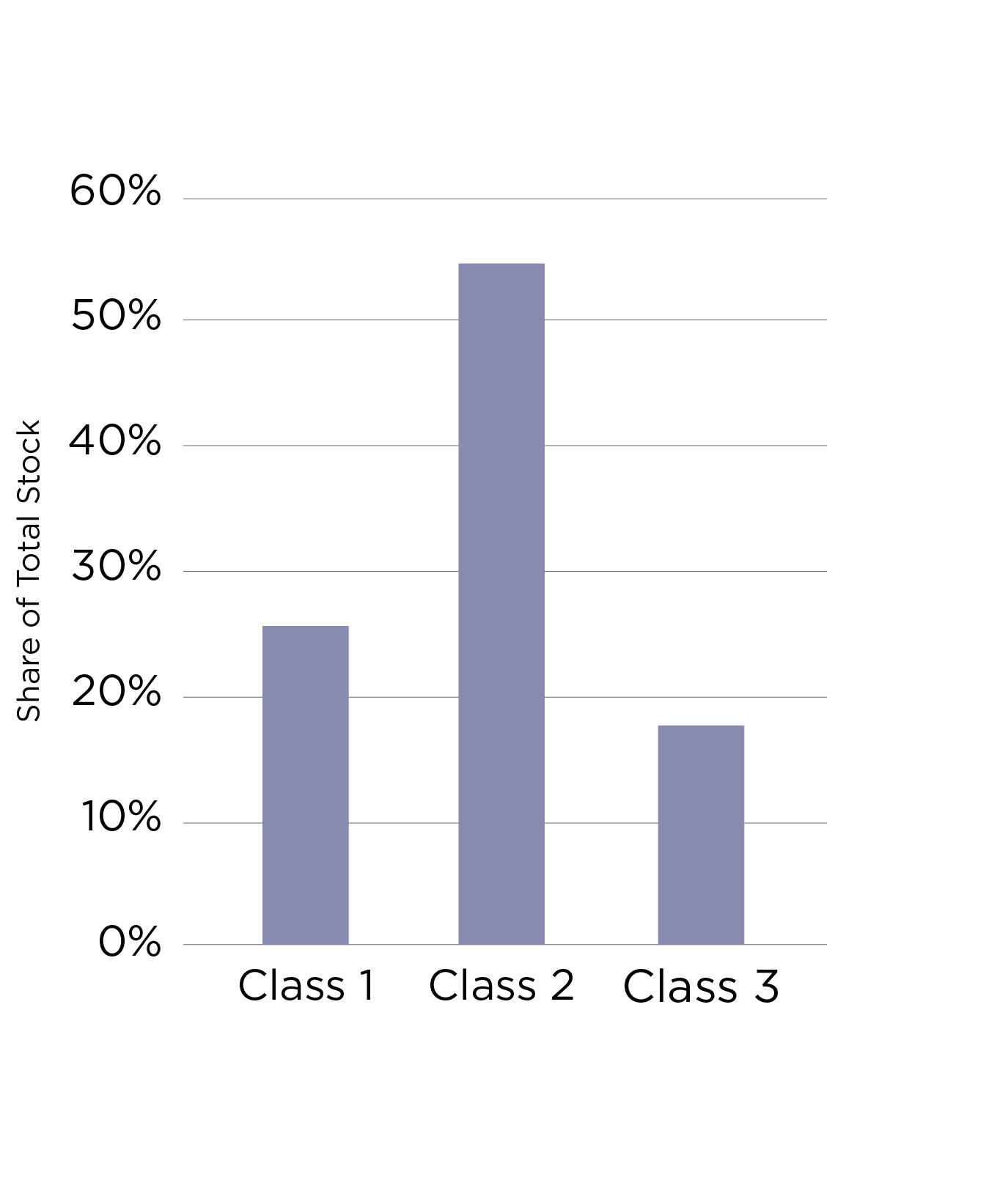

Grouped into Class 1 (best-in-class), Class 2 (secondary), and Class 3 (functional).

EPC Ratings

A+ to G, used to assess alignment with current and future regulatory standards.

BREEAM Certification

Used selectively where data exists to identify �exemplar buildings.

Figure 1

Office stock by age

Source: CoStar, Carter Jonas Research

Office Stock by Age

Office Stock by Quality

Figure 2

Office Stock by Quality Class

Source: CoStar, Carter Jonas Research

Key Takeaways:

1

2

3

Regional markets carry a higher burden of obsolete or marginal stock, with limited investment appetite and weaker occupier demand. This divergence could lead to higher vacancies and write-downs unless targeted funding or incentives are introduced.

Class 1 space, representing just over a quarter of stock, remains highly sought after, particularly in core urban markets, due to its alignment with tenant ESG goals and space efficiency preferences.

The UK’s office stock remains heavily weighted toward Class 2 (mid-quality) space, which accounts for over half of the total supply. This reflects the persistence of legacy stock that continues functioning but may struggle to meet future occupier or regulatory standards.

Class 3 space remains a significant minority, typically associated with secondary locations, limited amenity provision, and outdated specifications. This segment faces the highest risk of functional obsolescence and value decline without intervention.

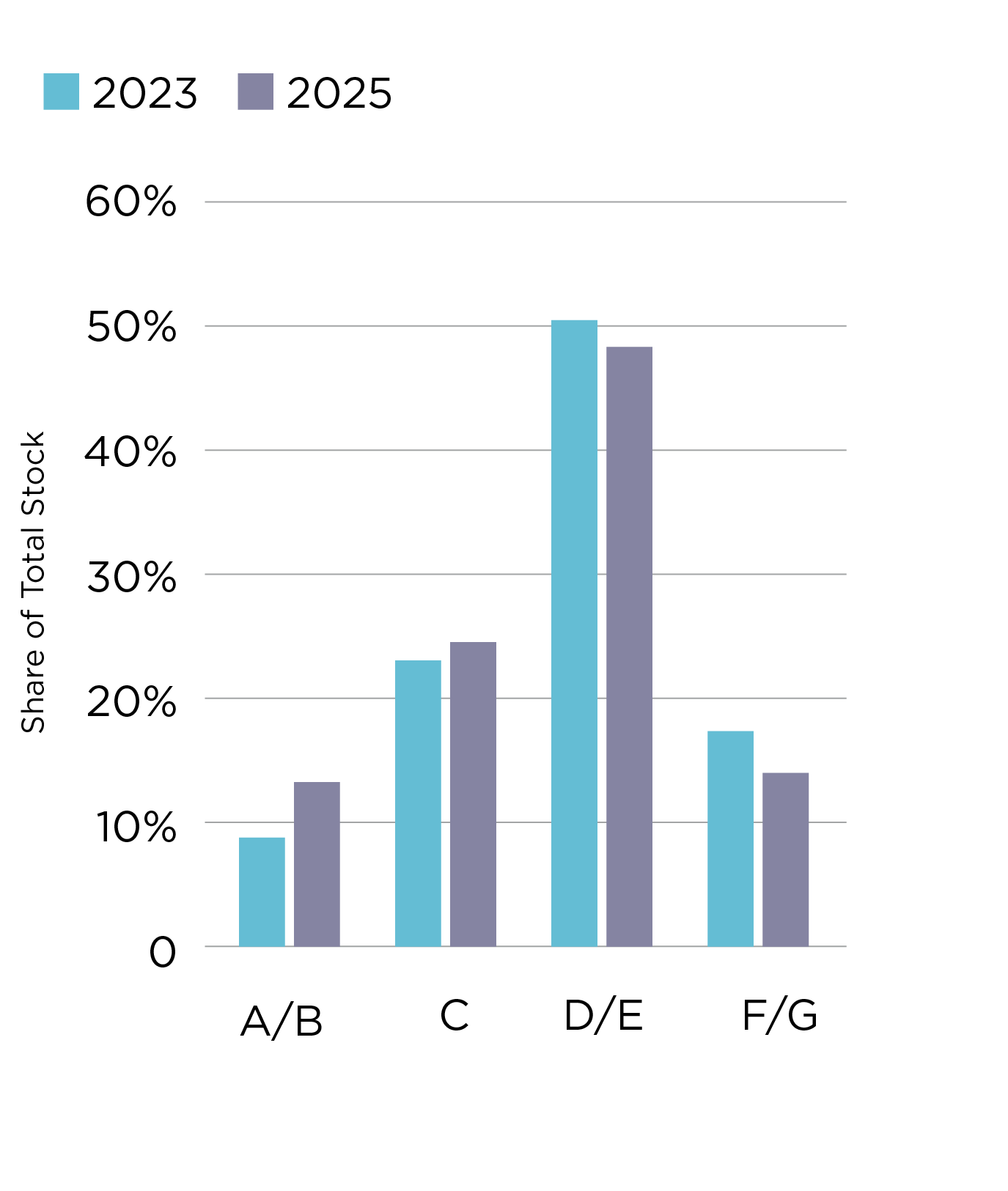

Figure 3

EPC Rating Distribution (2023 vs 2025)

Source: EPC Register, Carter Jonas Research

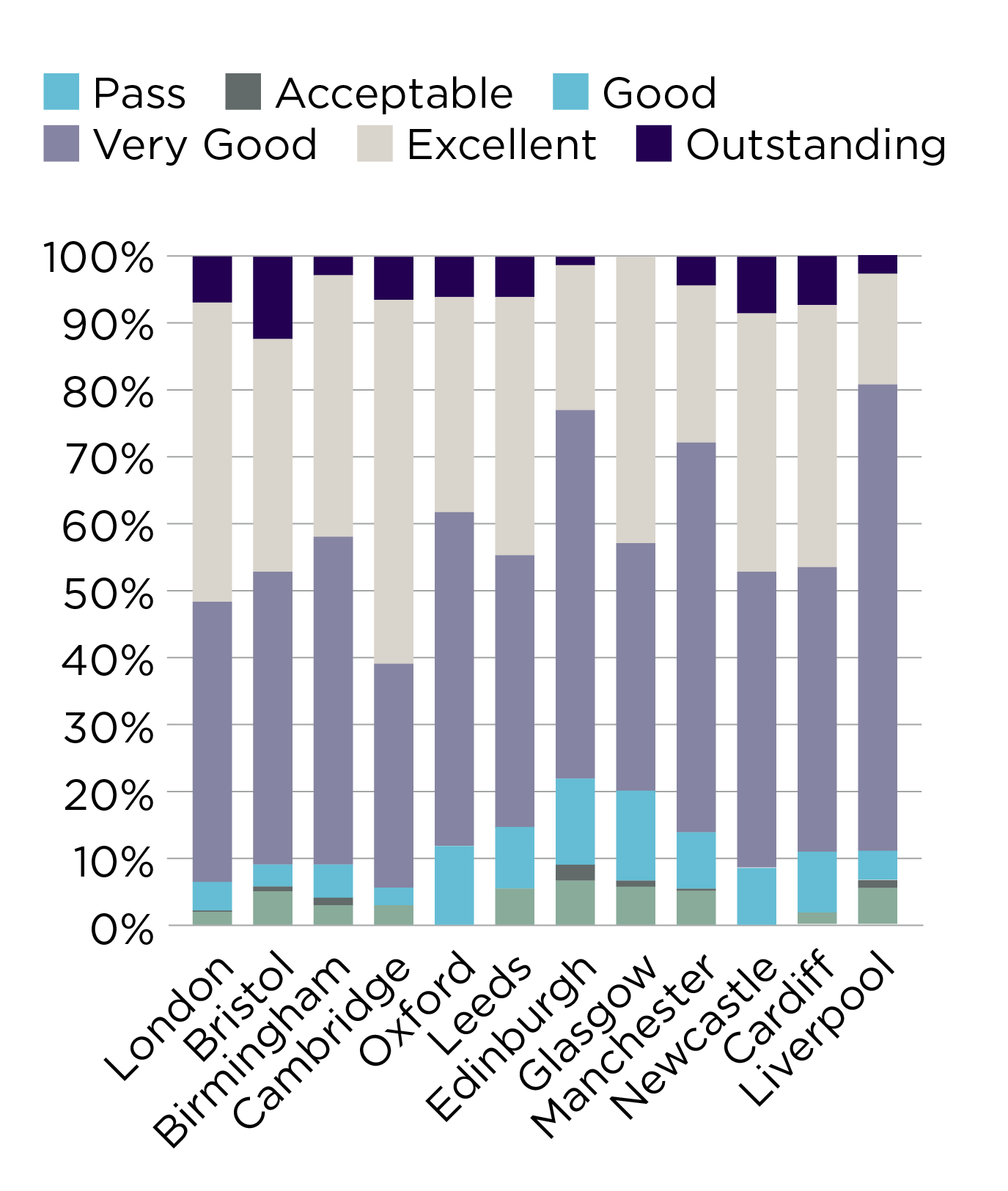

Office Stock by

BREEAM Certifications

Figure 4

Share of BREEAM Ratings by City

Source: BREEAM, Carter Jonas Research

Conclusion

Get in touch

The UK office market is clearly becoming more sustainable, but at a pace that will fall short of policy timelines. While improvements in EPC performance of the existing stock and the addition of new prime stock (albeit gradually) are welcome, the bulk of UK office space would be non-compliant by 2030.

Download the full report, where we look at the strategic implication, examine these factors in more detail and compare 12 key UK office markets alongside the national picture.

07780 667010

Email

Richard Love

Head of Commercial Consultancy

020 7518 3270

Email

Rad Radev

Associate Research Analyst

Download the full report

Download the full report

Download the full report

Download the full report

Download the full report

A large majority of stock is over 30 years old, pointing to high retrofit demand. These buildings are likely to face increasing tenant resistance, rising maintenance costs, and falling valuations unless significant upgrades are made.

Key Takeaway:

Progress is visible but slow; compliance risk remains high. The marginal gains seen over the past two years are unlikely to keep pace with the 2027 and 2030 deadlines without broader market mobilisation.

Key Takeaways:

While some cities have shown significant reductions in F and G-rated stock, the reasons are likely multifactorial—ranging from new development and refurbishment activity to changes of use, occupancy shifts, or differing enforcement levels. In others, slower progress may reflect structural economic limitations, a lower churn in office stock, or a lack of incentive to act.

The proposed 2027 and 2030 MEES milestones represent potential cliff-edge moments for Class 2 and 3 buildings with EPC ratings of C or below. While timelines may shift, the direction of policy is clear. The financial and logistical demands of upgrading these assets, especially in secondary markets, could trigger a wave of capital reallocation, disposals, or even demolition in cases where retrofit is unviable.

EPC Rating

The number of BREEAM-certified office buildings in the UK continues to grow, reflecting increased regulatory pressure and shifting occupier preferences. However, this growth is heavily weighted toward buildings completed in the past 15 years. Our 2025 data shows that a significant majority of BREEAM-rated stock was constructed post-2010, reinforcing the strong correlation between new development and formal sustainability credentials.

Class 1

2025

"It’s worth noting that a large portion of the ageing stock is pre-war, meaning a reasonable proportion may, from a compliance perspective at least, fall under alternative governance measures, such as exemptions for Listed Buildings."

Richard Love�Head of Commercial Consultancy

"The key to making this Class 2 stock relevant and attractive to tenants will be a redevelopment strategy that balances prudent spending with the creation of exemplary or distinctive space."

Richard Love�Head of Commercial Consultancy

"Government legislation is only one lever that will drive the growth of sustainable office stock. Informed occupiers and the expectations of a new generation of workers will also significantly influence the pace of change, provided developers can make it economically viable."

Richard Love�Head of Commercial Consultancy

Download the full report

Richard Love�Head of Commercial Consultancy

Download the full report

Download the full report

Download the full report

Richard Love�Head of Commercial Consultancy

Download the full report