AXA Investment

Managers

Scroll

Creating the perfect blend with

How do you like your coffee in the morning? Cappuccino, flat white, latte or a strong espresso?

Whatever you prefer, all coffees contain a small number of key ingredients - beans, water, milk, sugar –

which are combined in different ways to match your preference. But a good coffee also requires

judgment and skill in sourcing, roasting and grinding the beans, adding the right amount of water,

blending with the right type and amount of milk before adding sugar, or not…

Keeping this in mind might help when it comes to thinking about factor investing.

Factor investing may sound complex, but in essence, it’s nothing new. For decades, investors have tried to look for common characteristics in companies that are associated with identifiable and persistent return patterns.

Faced with a vast number of stocks to choose from, factor investing allows investors to build a diverse portfolio of securities that have the right characteristics to help them meet their investment goals.

What is factor investing?

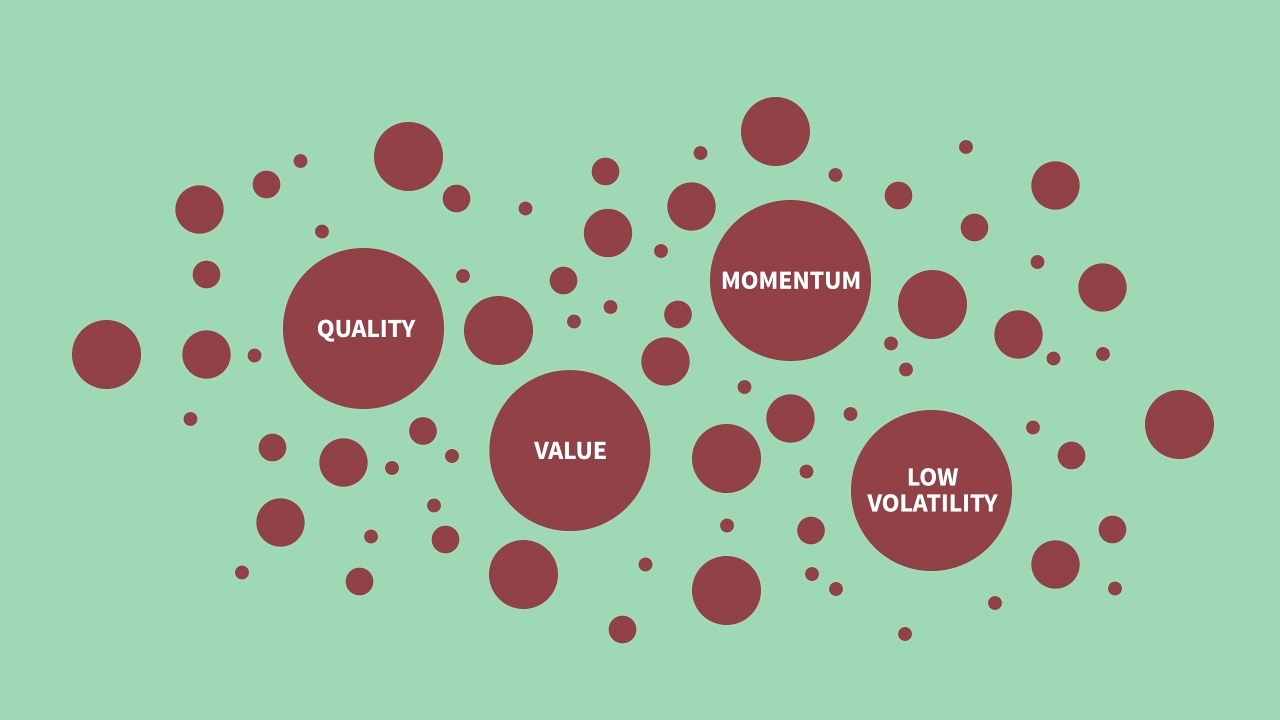

Researchers have identified hundreds of different factors, but most fall into some well-known groupings: value, momentum, quality and low volatility.

In the same way a good barista selects the best ingredients to create your perfect drink, factor investing blends the right factors to create an investment that can potentially deliver your desired risk/return outcome, often at a lower cost than traditional investing.

The big change: How ESG is becoming vital to companies’ future prospects

The scientific consensus is that climate change is real-and society’s attitude is changing in line with the growing threat. Changes in regulation and consumer attitudes cannot be ignored – nor can long term trends such as scarcity of resources, shifting weather patterns and global demographic trends.

Because of this, we believe companies can no longer be viewed just through the lens of financial data. We therefore use ESG data alongside financial data to better understand how companies are positioned to navigate these changes.

We believe thoughtful use of this data helps us capture better fundamentals, for example, our research shows that more diverse boards are better able to protect future profitability, so we include diversity when we assess the quality of a company; by integrating ESG we aim to reduce risk and improve investment outcomes. To us, it’s the right way to invest.

While we use technology to process enormous amounts of data, it’s our people that make the difference. Whether its actively researching new data, developing more advanced models or engaging with companies, our team of investment experts are focussed on building the bridge between today and our client’s tomorrow.

The AXA IM Blend

What factors does the Sustainable Equity strategy focus on?

A basic tenet of investing is that fundamentals drive stock prices over the long term. The factors we use, therefore, need to be linked to fundamentals. Our quantitative investment team, Rosenberg Equities, has over 30 years of experience in working with data and technology innovatively to build proprietary factors, based on detailed financial and non-financial data for over 20,000 companies worldwide.*

Our primary factor focus is QUALITY. We seek out high-quality companies with a track record of sustaining profitability and delivering stable earnings growth.

High-quality companies tend to experience less share price volatility, and may help dampen downside risk in falling markets. As earnings growth is also considered, this helps the strategy to participate in rising markets.

As in your coffee- whatever your individual taste, if the beans aren’t high quality, you’ll notice the difference!

We combine this with another factor: LOW VOLATILITY.

People often think you need to take a risk to improve the chance of better returns. That does not have to be the case.

Stocks with low levels of historic share price volatility have over time delivered better returns than stocks with higher volatility.* Having exposure to low volatility companies can lower the overall risk profile of a portfolio, and provide mitigation during market falls.

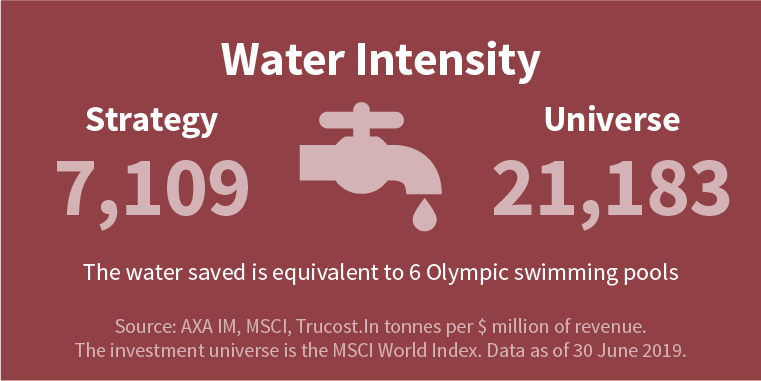

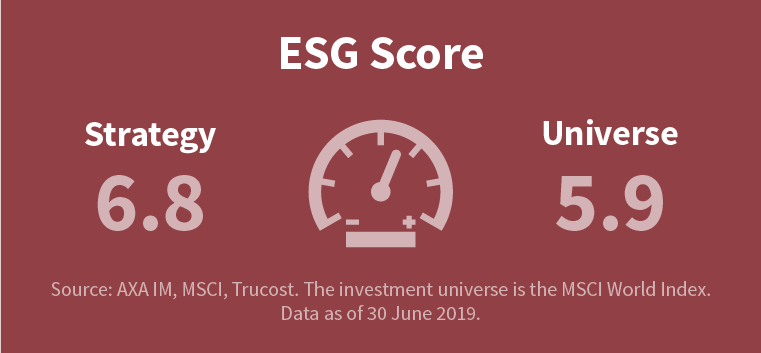

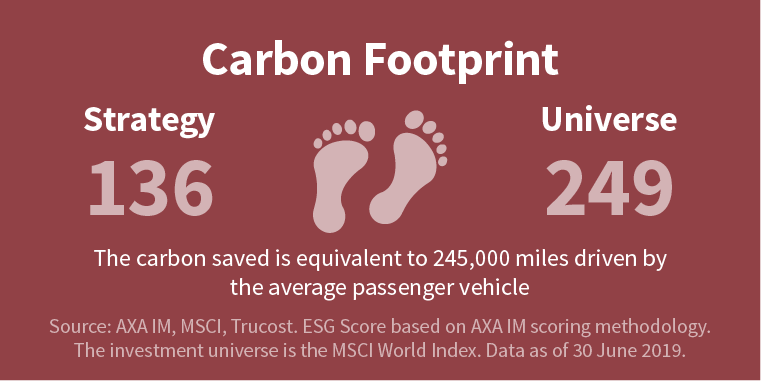

We further improve the fundamentals of the portfolio by incorporating ESG information for every stock we cover. We believe that ESG information is vital to understanding a company’s future prospects, and is therefore important to be considered alongside its quality and volatility characteristics. We ensure that the strategy meets the AXA IM ESG Standards, and delivers a better-than-benchmark ESG score and improved carbon/water intensity. As active stewards of your assets, AXA IM also actively engages with the companies we invest in.*

* No representation is made as to the outcome of engagement activities.

* ESG data is not available for the entire universe.

ASSOCIATED RISKS WITH THE STRATEGY

The capital is not guaranteed. The strategy is invested in financial markets and uses techniques and instruments which are subject to some levels of variation, which may result in gains or losses.

Counterparty Risk: Risk of bankruptcy, insolvency, or payment or delivery failure of any of the strategy's counterparties, leading to a payment or delivery default.

Risk linked to Method and Model: attention is drawn to the fact that the strategy is based on the utilisation of a proprietary share selection model. The effectiveness of the model is not guaranteed and the utilisation of the model may not result in the investment objective being met.

Operational Risk: Risk that operational processes, including those related to the safekeeping of assets may fail, resulting in losses.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. Past performance is not a guide to current or future performance. Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision. All investments involve risk. The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested. Exchange-rate fluctuations may also affect the value of the investment.

The firm seeks to achieve its clients’ investment objectives primarily through reliance on the modelling of proprietary and 3rd party financial and non-financial data, information, and considerations, the sources, weights, and implementation of which may be subject to change and/or the discretion of the firm regardless of whether described herein or elsewhere. Although many of its investment approaches are driven by bottom-up stock selection akin to that of a traditional fundamental investor, the firm seeks to achieve its clients’ investment objectives primarily in reliance on analytical models. The goal of the firm’s systematic approach is not to replicate a perfect “model” portfolio; instead, like other long-term, fundamentally oriented investors, it seeks to create portfolios possessing ex ante those fundamental and statistically important characteristics reflecting our investment beliefs. The firm’s ability to implement its investment objectives depends on various considerations such as the models’ economic, analytical and mathematical underpinnings, the accurate encapsulation of those principles in a complex computational (including software code) environment, the quality of the models’ data inputs, changes in market conditions, and the successful expression of the models' views into the investment portfolio construction process. Many of these have subjective elements that present the possibility of human error. While the investment process principally relies on models, the firm’s process also incorporates the investment judgment of its portfolio managers who may exercise discretion in attempting to capture the intent of the models, particularly in changing market conditions. The firm’s success in implementing its investment objectives may depend on the ability of portfolio managers and others to interpret and implement the signals generated by the models. The firm has established certain systematic rules and processes for monitoring client portfolios to ensure that they are managed in accordance with their investment objectives, but there is no guarantee that these rules or processes will effectively manage the risks associated with its investment process under all market conditions. While the firm employs controls designed to assure that our models are sound in their development and appropriately adapted, calibrated and configured, analytical error, software development errors, and implementation errors are an inherent risk of complex analytical models and quantitative investment management processes. These errors may be extremely hard to detect, and some may go undetected for long periods of time or indefinitely. The firm’s controls, including our escalation policies, are designed to ensure that certain types of errors are subject to review once discovered. However, the effect of errors on our investment process and, where relevant, performance (which can be either positive or negative) may not be fully apparent even when discovered. When the firm discovers an investment process error in one of its models, it may in good faith and in accordance with its obligations, decide not to correct the error, to delay correction of an error, or develop other methodology to address the error, if not inconsistent with the client’s interests. Also, the firm generally will not disclose to affected clients investment process errors that are not the result of a contractual or regulatory breach, or that are non-compensable, unless it otherwise determines that information regarding the error is material to its clients.

If MSCI information appears herein, it may only be used for your internal use, it may not be reproduced or re-disseminated in any form, and it may not be used as a basis for, or a component of, any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com).

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 7 Newgate Street, London EC1A 7NX. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

* AXA IM Rosenberg Equities, December 2018. Volatility is based on a proprietary Rosenberg measure that combines beta and stock specific risk. Quality is based on a proprietary Rosenberg Equities measure of earnings quality. Low = bottom 30%, Middle = next 40%, High = top 30% according to a square-root-of-market cap (SRMC) weighting scheme within each region on a monthly basis. Universe is MSCI World. Returns do not include transaction costs and are gross of fees.

People often think you need to take a risk to improve the chance of better returns. That does not have to be the case. Stocks with low levels of historic share price volatility have over time delivered better returns than stocks with higher volatility.* Having exposure to low volatility companies can lower the overall risk profile of a portfolio, and provide mitigation during market falls.