YOY

6.5%

Forecast

YOY

-882.3K

SF

Forecast

Under

Construction

YOY

603.3K

SF

Forecast

Overall Asking

Lease Rates (FSG)

YOY

$6.60

/ SF

Forecast

Read on for an overview of the industrial market.

- Q3 2025 sales totaled $81.8 million, bringing year-to-date sales volume to $117.5 million.

- Speculative development is limited, mainly in the Northeast submarket. Build-to-suit demand is rising as developers wait on tenants before breaking ground. Recent and expected rate cuts may unlock delayed projects.

- Vacancies rose from 5.6% to 6.5% quarter-over-quarter, though year-over-year rates held nearly steady (6.4% to 6.5%).

- Small bay demand is strengthening, but deals have been drawn out as tenants push for favorable terms. Second-gen spaces led demand, while first-gen buildings are less viable for small to mid-sized users.

SF

Net Absorption

Vacancy

Industrial Report

Q3 2025 Interactive

Des Moines, Iowa

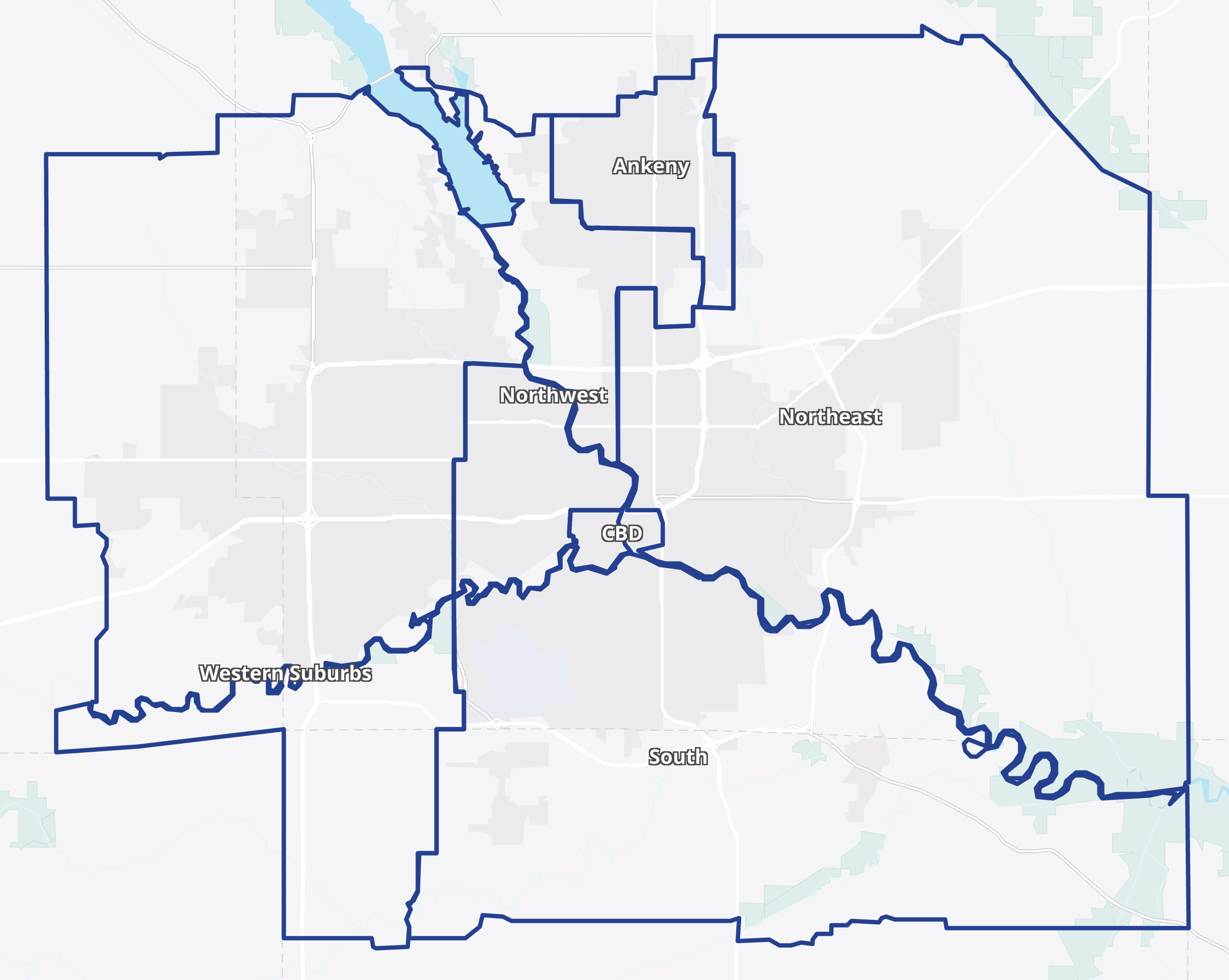

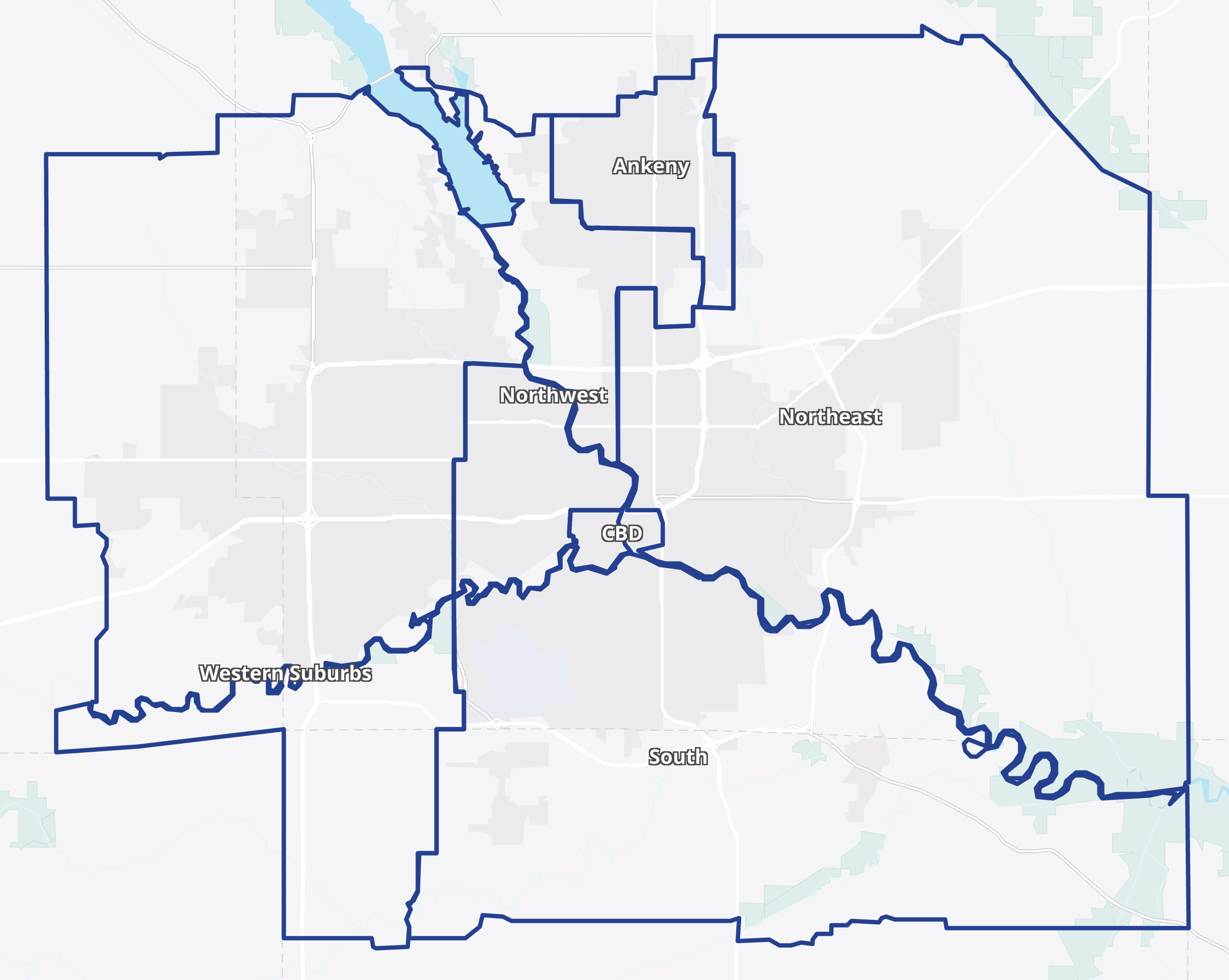

Colliers' statistical tracked set for Des Moines includes all single and multi-tenant industrial properties above 10,000 square feet. Heavy manufacturing and data center facilities are excluded from the total tracked inventory. Classifications are based on building clear heights, where Office Services (OS) is below 18 ft., Manufacturing is greater than or equal to 18 ft. and less than 24 ft., and Warehouse-Distribution (WD) is 24 ft. and greater. Market statistics are subject to historical revisions.

This site is not maintained by Colliers or its affiliates (“Colliers”). Any use of this site, and any information you provide to this site, willbe governed by the terms and conditions of this site, including those relating to confidentiality, data privacy and security. Colliers is not responsible for the information and content on this site. You are encouraged to review the privacy and security policies of this site, which may be different than those maintained by Colliers.

This document/email has been prepared by Colliers for advertising and general information only. Colliers makes no guarantees, representations, or warranties of any kind, expressed or implied, regarding the information, including but not limited to, warranties of content, accuracy, and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers excludes unequivocally all inferred or implied terms, conditions, and warranties arising out of this document and excludes all liability for loss and damages arising therefrom. This publication is the copyrighted property of Colliers and/or its licensor(s). © 2025. All rights reserved. This communication is not intended to cause or induce breach of an existing listing agreement. Colliers International MN LLC.

Mark Mills

Vice President

+1 515 803 8101

For information and inquiries, please contact us:

Back to the top

Colliers' statistical tracked set for Des Moines includes all single and multi-tenant industrial properties above 10,000 square feet. Heavy manufacturing and data center facilities are excluded from the total tracked inventory. Classifications are based on building clear heights, where Office Services (OS) is below 18 ft., Manufacturing is greater than or equal to 18 ft. and less than 24 ft., and Warehouse-Distribution (WD) is 24 ft. and greater. Market statistics are subject to historical revisions.

This site is not maintained by Colliers or its affiliates (“Colliers”). Any use of this site, and any information you provide to this site, will be governed by the terms and conditions of this site, including those relating to confidentiality, data privacy and security. Colliers is not responsible for the information and content on this site. You are encouraged to review the privacy and security policies of this site, which may be different than those maintained by Colliers.

This document/email has been prepared by Colliers for advertising and general information only. Colliers makes no guarantees, representations, or warranties of any kind, expressed or implied, regarding the information, including but not limited to, warranties of content, accuracy, and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers excludes unequivocally all inferred or implied terms, conditions, and warranties arising out of this document and excludes all liability for loss and damages arising therefrom. This publication is the copyrighted property of Colliers and/or its licensor(s). © 2025. All rights reserved. This communication is not intended to cause or induce breach of an existing listing agreement. Colliers International MN LLC.

Jeremy Jacobs

Executive Managing Director

+1 952 987 7778

For information and inquiries, please contact us:

Back to the top

Vacancy

YOY

6.5%

Forecast

Net Absorption

YOY

-882.3K

SF

Forecast

Under

Construction

YOY

603.3K

SF

Forecast

YOY

Overall Asking

Lease Rates (FSG)

$6.60

/ SF

Forecast

Read on for an overview of the industrial market.

- Q3 2025 sales totaled $81.8 million, bringing year-to-date sales volume to $117.5 million.

- Speculative development is limited, mainly in the Northeast submarket. Build-to-suit demand is rising as developers wait on tenants before breaking ground. Recent and expected rate cuts may unlock delayed projects.

- Vacancies rose from 5.6% to 6.5% quarter-over-quarter, though year-over-year rates held nearly steady (6.4% to 6.5%).

- Small bay demand is strengthening, but deals have been drawn out as tenants push for favorable terms. Second-gen spaces led demand, while first-gen buildings are less viable for small to mid-sized users.

Interactive

Q3 2025

Des Moines, Iowa

Capital Markets

Sales activity increased substantially this quarter. Q3 2025 sales totaled $81.8 million, bringing year-to-date sales voume to $117.5 million and signaling strong investor interest in the Des Moines industrial market. Year-to-date sales volume is $41.9 million more than Q3 last year.

PW Fund B LP, managed by California-based Buzz Oates, acquired the I-80 Distribution Center at 555 Ninth St. NE in Altoona for $25 million. The 302,604 sq. ft. warehouse, built in 2022 on 16 acres, is valued at $27.2 million. The purchase is Buzz Oates' third Central Iowa acquisition since August 2024. This building was fully leased to John Deere in Q2 of 2025.

JBS acquired Hy-Vee's 220,000 sq. ft. warehouse in Ankeny at 4150 SE Delaware Ave for $40 Million. Maxwell Street Capital Partners, operating as PDM SLB LLC, purchased two adjoining properties near North High School's Grubb Stadium. The firm paid $955,070 for 2730 Sixth Ave, a 15,245 sq. ft. office/warehouse property built in 1974 and valued at $1.2 million, and $3.4 million for 2701 Onthank Drive, a 2.3-acre site with an 81,808 sq. ft. warehouse built in 1963, valued at $2.58 million.

Vacancy and Development

Market Fundamentals

Industrial Report

Market Graph

Metro-wide vacancy rose 1.6% in Q3 2025 to 6.5%. The newly vacant spaces are concentrated in the Western Suburbs and Northeast submarkets. These submarkets experienced a combined negative 699,500 sq. ft. of negative absorption. New developments broke ground in Q3, bringing the total construction pipeline just above 600,000 sq. ft.

Robinson, Inc., a Wisconsin metal fabrication company with 50 years in operation, will lease an 800,000 sq. ft. facility in Altoona, IA, and New Horizon Cuisine, a producer of premium sauces and flavor extracts, plans a $14.5 million, 30,000 sq. ft. expansion production facility in Ankeny, IA, to support growth.

With the increase in vacancy rates across the metro, proposed sites are waiting on tenants to commence construction. Speculative development is limited to only a few occurring in the Northeast submarket. Build-to-suit options are abundant as developers are eager to begin building. Much demand has been pent-up this year due to economic uncertainty. With the recent rate cuts, the market may see some construction commence with further rate cuts before the year's end.

Subleasing / Development

Sales activity increased substantially this quarter. Q3 2025 sales totaled $81.8 million, bringing year-to-date sales voume to $117.5 million and signaling strong investor interest in the Des Moines industrial market. Year-to-date sales volume is $41.9 million more than Q3 last year.

PW Fund B LP, managed by California-based Buzz Oates, acquired the I-80 Distribution Center at 555 Ninth St. NE in Altoona for $25 million. The 302,604 sq. ft. warehouse, built in 2022 on 16 acres, is valued at $27.2 million. The purchase is Buzz Oates' third Central Iowa acquisition since August 2024. This building was fully leased to John Deere in Q2 of 2025.

JBS acquired Hy-Vee's 220,000 sq. ft. warehouse in Ankeny at 4150 SE Delaware Ave for $40 Million. Maxwell Street Capital Partners, operating as PDM SLB LLC, purchased two adjoining properties near North High School's Grubb Stadium. The firm paid $955,070 for 2730 Sixth Ave, a 15,245 sq. ft. office/warehouse property built in 1974 and valued at $1.2 million, and $3.4 million for 2701 Onthank Drive, a 2.3-acre site with an 81,808 sq. ft. warehouse built in 1963, valued at $2.58 million.

Vacancy and Absorption

mark.mills@colliers.com

jeremy.jacobs@colliers.com

Key Takeaways

Key Takeaways

In Q3 of 2025, the Des Moines industrial market saw negative absorption of 882,000 sq. ft. The Northeast, South, Northwest, and Western Suburbs submarkets faced the most negative absorption in Q3. The primary contributor was JT Logistics vacating over 400,000 sq. ft. in the northeast submarket. Asking rates fell from $6.90 PSF/Yr to $6.60. Vacancy has held steady in the past year at 6.5%.

The most significant lease signings for Q3 2025 were 177,000 sq. ft. at 4121 Dixon Street to BradyPLUS. 118,000 sq. ft. were leased at 6600 Merle Hay Road to an unnamed distribution tenant. Lastly, 56,000 sq. ft. was leased at 1550 E Washington to a book printing manufacturer named LBS.

The demand for small bay footprints has strengthened throughout the year. Deals are taking longer as users want the best deal, and the number of availabilities was substantial. Second-gen rates have softened; however, landlords offer little to no concessions. Demand was dominated by small users in need of second-gen spaces.

In Q3 of 2025, the Des Moines industrial market saw negative absorption of 882,000 sq. ft. The Northeast, South, Northwest, and Western Suburbs submarkets faced the most negative absorption in Q3. The primary contributor was JT Logistics vacating over 400,000 sq. ft. in the northeast submarket. Asking rates fell from $6.90 PSF/Yr to $6.60. Vacancy has held steady in the past year at 6.5%.

The most significant lease signings for Q3 2025 were 177,000 sq. ft. at 4121 Dixon Street to BradyPLUS. 118,000 sq. ft. were leased at 6600 Merle Hay Road to an unnamed distribution tenant. Lastly, 56,000 sq. ft. was leased at 1550 E Washington to a book printing manufacturer named LBS.

The demand for small bay footprints has strengthened throughout the year. Deals are taking longer as users want the best deal, and the number of availabilities was substantial. Second-gen rates have softened; however, landlords offer little to no concessions. Demand was dominated by small users in need of second-gen spaces.

Vacancy

Development

Vacancy and Absorption

Vacancy

Jesse Tollison

Research Analyst

+1 952 225 4201

jesse.tollison@colliers.com

Jeremy Jacobs

Executive Managing Director

+1 952 897 7778

jeremy.jacobs@colliers.com

Vacancy and Absorption

Asking Rates

Metro-wide vacancy rose 1.6% in Q3 2025 to 6.5%. The newly vacant spaces are concentrated in the Western Suburbs and Northeast submarkets. These submarkets experienced a combined negative 699,500 sq. ft. of negative absorption. New developments broke ground in Q3, bringing the total construction pipeline just above 600,000 sq. ft.

Robinson, Inc., a Wisconsin metal fabrication company with 50 years in operation, will lease an 800,000 sq. ft. facility in Altoona, IA, and New Horizon Cuisine, a producer of premium sauces and flavor extracts, plans a $14.5 million, 30,000 sq. ft. expansion production facility in Ankeny, IA, to support growth.

With the increase in vacancy rates across the metro, proposed sites are waiting on tenants to commence construction. Speculative development is limited to only a few occurring in the Northeast submarket. Build-to-suit options are abundant as developers are eager to begin building. Much demand has been pent-up this year due to economic uncertainty. With the recent rate cuts, the market may see some construction commence with further rate cuts before the year's end.

Vacancy

Rental Rates

Mark Mills

Vice President

+1 515 803 8101

mark.mills@colliers.com

Jesse Tollison

Research Analyst

+1 952 225 4201

jesse.tollison@colliers.com

Inventory Summary

Capital Markets