YOY

17.5%

Forecast

YOY

-41.8K

SF

Forecast

Under

Construction

YOY

17.9K

SF

Forecast

Overall Asking

Lease Rates (FSG)

YOY

$18.96

/ SF

Forecast

Read on for an overview of the office market.

– Over 1 million sq. ft. sold in Q3, led by the $32 million Wells Fargo portfolio deal, while leasing demand concentrated on premier assets with in-demand amenities and modern finishes.

- Vacancy stabilized at 17.5% with sublease availability down sharply, reflecting improved outlook despite challenges in leasing large second-gen spaces.

- Asking lease rates held steady at $18.96 / SF for the third straight quarter.

- Expansion interest rose, but deals slowed as tenants shopped for the best terms; high-demand spaces leased “as is” while older stock required concessions.

SF

Net Absorption

Vacancy

Office Report

Q3 2025 Interactive

Des Moines, Iowa

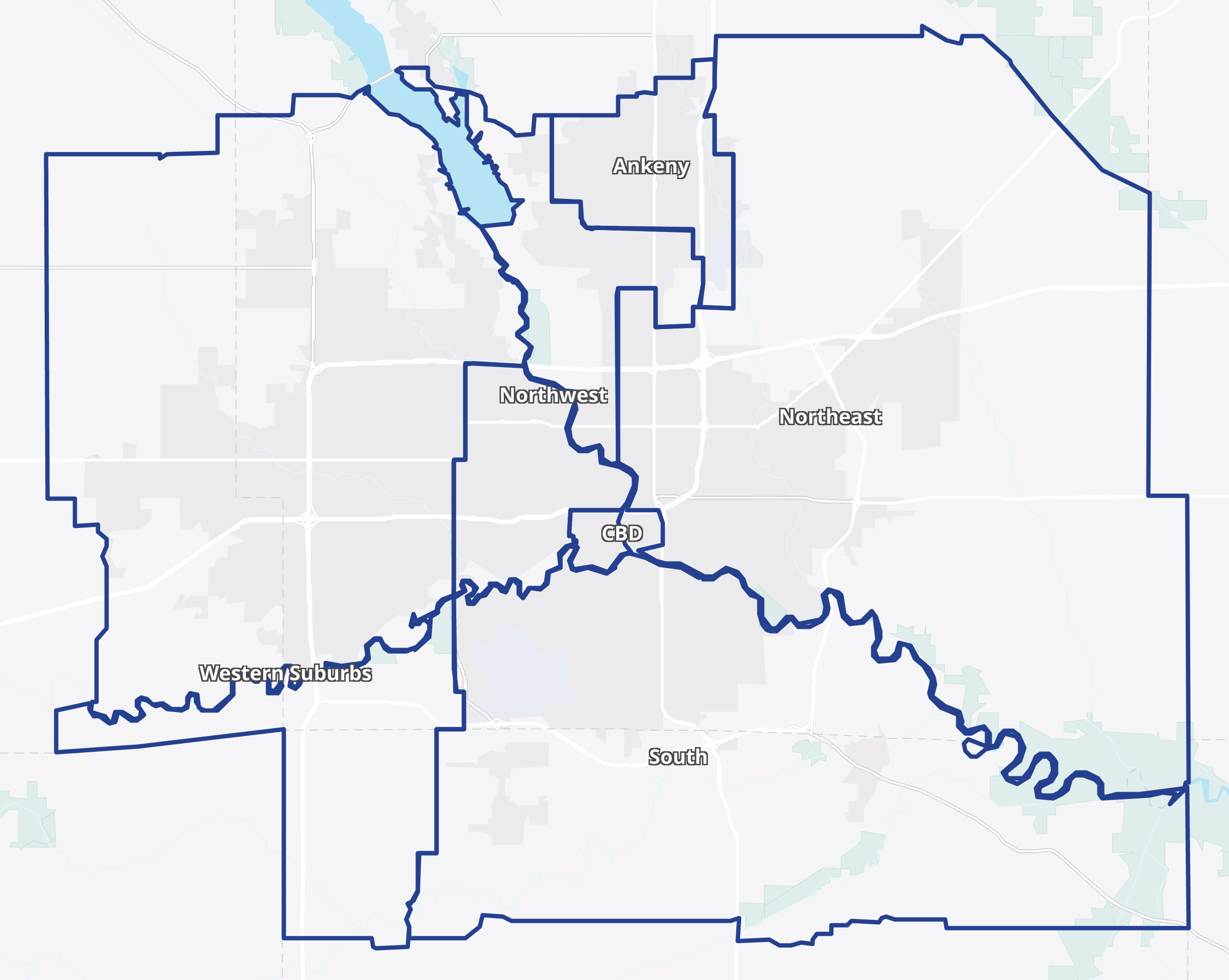

Colliers’ statistical tracked set for Des Moines includes single and multi-tenant office properties above 10,000 square feet. Banks, medical, religious and government buildings, as well as owner-occupied properties where owners occupy 75 percent or more of the building, are excluded from the total tracked inventory. Market statistics are subject to historical revisions.

This site is not maintained by Colliers or its affiliates (“Colliers”). Any use of this site, and any information you provide to this site, willbe governed by the terms and conditions of this site, including those relating to confidentiality, data privacy and security. Colliers is not responsible for the information and content on this site. You are encouraged to review the privacy and security policies of this site, which may be different than those maintained by Colliers.

This document/email has been prepared by Colliers for advertising and general information only. Colliers makes no guarantees, representations, or warranties of any kind, expressed or implied, regarding the information, including but not limited to, warranties of content, accuracy, and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers excludes unequivocally all inferred or implied terms, conditions, and warranties arising out of this document and excludes all liability for loss and damages arising therefrom. This publication is the copyrighted property of Colliers and/or its licensor(s). © 2025. All rights reserved. This communication is not intended to cause or induce breach of an existing listing agreement. Colliers International MN LLC.

Mark Mills

Vice President

+1 515 803 8101

For information and inquiries, please contact us:

Back to the top

Colliers’ statistical tracked set for Des Moines includes single and multi-tenant office properties above 10,000 square feet. Banks, medical, religious and government buildings, as well as owner-occupied properties where owners occupy 75 percent or more of the building, are excluded from the total tracked inventory. Market statistics are subject to historical revisions.

This site is not maintained by Colliers or its affiliates (“Colliers”). Any use of this site, and any information you provide to this site, willbe governed by the terms and conditions of this site, including those relating to confidentiality, data privacy and security. Colliers is not responsible for the information and content on this site. You are encouraged to review the privacy and security policies of this site, which may be different than those maintained by Colliers.

This document/email has been prepared by Colliers for advertising and general information only. Colliers makes no guarantees, representations, or warranties of any kind, expressed or implied, regarding the information, including but not limited to, warranties of content, accuracy, and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers excludes unequivocally all inferred or implied terms, conditions, and warranties arising out of this document and excludes all liability for loss and damages arising therefrom. This publication is the copyrighted property of Colliers and/or its licensor(s). © 2025. All rights reserved. This communication is not intended to cause or induce breach of an existing listing agreement. Colliers International MN LLC.

Jeremy Jacobs

Executive Managing Director

+1 952 897 7778

For information and inquiries, please contact us:

Back to the top

Vacancy

YOY

17.5%

Forecast

Net Absorption

YOY

-41.8K

SF

Forecast

Under

Construction

YOY

17.9K

SF

Forecast

YOY

Overall Asking

Lease Rates (FSG)

$18.96

/ SF

Forecast

Read on for an overview of the office market.

– Over 1 million sq. ft. sold in Q3, led by the $32 million Wells Fargo portfolio deal, while leasing demand concentrated on premier assets with in-demand amenities and modern finishes.

- Vacancy stabilized at 17.5% with sublease availability down sharply, reflecting improved outlook despite challenges in leasing large second-gen spaces.

- Asking lease rates held steady at $18.96 / SF for the third straight quarter.

- Expansion interest rose, but deals slowed as tenants shopped for the best terms; high-demand spaces leased “as is” while older stock required concessions.

Interactive Office

Q3 2025

Des Moines, Iowa

Capital Markets

Over one million sq. ft. of office space was sold in Q3, totaling $42.62 million. The downtown Wells Fargo Office portfolio accounted for $32 million over a four-building portfolio in Downtown Des Moines. One of the most significant acquisitions in recent memory for downtown Des Moines. DMCRE1 and DMCRE2 acquired the Wells Fargo portfolio. Gordon Glade, partner of DMCRE1, stated that his team admires the steady growth and transformation Des Moines has undertaken. DMCRE2 comprises a duo of local developers, Jonathan Koester and Michael Stressman. The portfolio was assessed at $56.2 million, selling at a $24.2 million discount.

Beyond the Wells Fargo portfolio acquisition, the central theme of Office dispositions has occurred within the owner-user segmentation. Merchants Bonding Co. has started construction on its 34,000 sq. ft. expansion project at their headquarters at 6700 Westown Parkway, West Des Moines. As the Downtown Des Moines Market is bouncing off historic lows, the value proposition of the Downtown market is very appealing to companies looking to expand their footprint while maintaining financial feasibility. With more interest rate cuts likely, financing headwinds pose less of a challenge.

Vacancy and Subleasing

Market Fundamentals

Market Report

Market Graph

Vacancy across the Des Moines Metro has stabilized at around 17.5% for four straight quarters. Vacant sq. ft. steadied at 4.5 million sq. ft. Vacancy in the upper teens is here to stay with the post-pandemic economy. Des Moines has a lower vacancy rate than neighboring capital cities and metro areas. Large, second-generation spaces have been challenging to lease. Activity from small users focused on spaces allowing for immediate occupancy with little to no necessary tenant improvements. National users in the market showed more interest in shell space requiring build-out. The Atlas Building in West Des Moines absorbed much demand as tenants were drawn to the building's unique amenities package and modernization.

From Q3 2024 to Q3 2025, sublease availability decreased 31% from 230,000 to 158,000 sq. ft. across the Des Moines Metro. Downtown Des Moines sublease availability decreased 77% year-over-year from 31,000 sq. ft. to 7,000 sq. ft. Western Suburbs sublease availability decreased 40% in the past year from 150,000 sq. ft. to 90,000 sq. ft. The substantial decrease in sublease availability is correlated with a growing positive outlook.

Subleasing / Development

Over one million sq. ft. of office space was sold in Q3, totaling $42.62 million. The downtown Wells Fargo Office portfolio accounted for $32 million over a four-building portfolio in Downtown Des Moines. One of the most significant acquisitions in recent memory for downtown Des Moines. DMCRE1 and DMCRE2 acquired the Wells Fargo portfolio. Gordon Glade, partner of DMCRE1, stated that his team admires the steady growth and transformation Des Moines has undertaken. DMCRE2 comprises a duo of local developers, Jonathan Koester and Michael Stressman. The portfolio was assessed at $56.2 million, selling at a $24.2 million discount.

Beyond the Wells Fargo portfolio acquisition, the central theme of Office dispositions has occurred within the owner-user segmentation. Merchants Bonding Co. has started construction on its 34,000 sq. ft. expansion project at their headquarters at 6700 Westown Parkway, West Des Moines. As the Downtown Des Moines Market is bouncing off historic lows, the value proposition of the Downtown market is very appealing to companies looking to expand their footprint while maintaining financial feasibility. With more interest rate cuts likely, financing headwinds pose less of a challenge.

Vacancy and Absorption

mark.mills@colliers.com

Jeremy.jacobs@colliers.com

Key Takeaways

Key Takeaways

A growing number of tenants over the third quarter of 2025 were contemplating expansion of footprints across the metro. Significant user demand slowed as year-end approached. This slowdown correlates with tenants actively seeking the best deal terms. These deals are taking more time to finalize as tenants explore every feasible option in the market due to the amount of volume. High-demand office space was marketed as-is with little to no free rent or tenant improvement allowances. Low demand and second-generation spaces called for more TI allowances, negotiated rent, and free rent options as landlords were eager to lease up space.

Year-to-date, the Des Moines office market experienced 122,450 sq. ft. of negative absorption as tenants rightsize. However, some large users signed deals that come as significant expansions from their previous footprints. American Equity left Westown Parkway for the former Nationwide building downtown. Telligen, a company situated between University Ave and Westown Parkway, leased up the former American Equity building downtown, leaving a vacant space to be filled by their previous landlord. These tenant movements showcase the trend of flight to quality and tenants looking for the best concession packages in the market.

Market asking rates held steady in the 2025, coming in at $18.96 PSF/Yr gross at the close of Q3. Year-over-year gross rates jumped 24.8%, which signals owners have invested capital into building improvements that allowed them to attract tenants and push rates in the post-pandemic market.

A growing number of tenants over the third quarter of 2025 were contemplating expansion of footprints across the metro. Significant user demand slowed as year-end approached. This slowdown correlates with tenants actively seeking the best deal terms. These deals are taking more time to finalize as tenants explore every feasible option in the market due to the amount of volume. High-demand office space was marketed as-is with little to no free rent or tenant improvement allowances. Low demand and second-generation spaces called for more TI allowances, negotiated rent, and free rent options as landlords were eager to lease up space.

Year-to-date, the Des Moines office market experienced 122,450 sq. ft. of negative absorption as tenants rightsize. However, some large users signed deals that come as significant expansions from their previous footprints. American Equity left Westown Parkway for the former Nationwide building downtown. Telligen, a company situated between University Ave and Westown Parkway, leased up the former American Equity building downtown, leaving a vacant space to be filled by their previous landlord. These tenant movements showcase the trend of flight to quality and tenants looking for the best concession packages in the market.

Market asking rates held steady in the 2025, coming in at $18.96 PSF/Yr gross at the close of Q3. Year-over-year gross rates jumped 24.8%, which signals owners have invested capital into building improvements that allowed them to attract tenants and push rates in the post-pandemic market.

Vacancy

Sublease Availability

Vacancy and Absorption

Vacancy

Jesse Tollison

Research Analyst

+1 952 225 4201

jesse.tollison@colliers.com

Jeremy Jacobs

Executive Managing Director

+1 952 897 7778

jeremy.jacobs@colliers.com

Vacancy and Absorption

Asking Rates

Vacancy across the Des Moines Metro has stabilized at around 17.5% for four straight quarters. Vacant sq. ft. steadied at 4.5 million sq. ft. Vacancy in the upper teens is here to stay with the post-pandemic economy. Des Moines has a lower vacancy rate than neighboring capital cities and metro areas. Large, second-generation spaces have been challenging to lease. Activity from small users focused on spaces allowing for immediate occupancy with little to no necessary tenant improvements. National users in the market showed more interest in shell space requiring build-out. The Atlas Building in West Des Moines absorbed much demand as tenants were drawn to the building's unique amenities package and modernization.

From Q3 2024 to Q3 2025, sublease availability decreased 31% from 230,000 to 158,000 sq. ft. across the Des Moines Metro. Downtown Des Moines sublease availability decreased 77% year-over-year from 31,000 sq. ft. to 7,000 sq. ft. Western Suburbs sublease availability decreased 40% in the past year from 150,000 sq. ft. to 90,000 sq. ft. The substantial decrease in sublease availability is correlated with a growing positive outlook.

Vacancy

Rental Rates

Mark Mills

Vice President

+1 515 803 8101

mark.mills@colliers.com

Jesse Tollison

Research Analyst

+1 952 225 4201

jesse.tollison@colliers.com

Inventory Summary

Capital Markets