Big-Box

Market Report

U.S. Research Report | 2022 Midyear Review & Outlook

North America

A variety of factors across North America have impacted demand for big-box industrial facilities. The surge of online shopping throughout the global COVID-19 pandemic increased demand for bulk industrial facilities, while economic uncertainty hindered consumer spending to some degree. Core markets including the Inland Empire, Dallas-Fort Worth, Atlanta, Chicago, Northern-Central New Jersey, Southern New Jersey-Eastern Pennsylvania and Toronto continue to be the destinations of choice for many occupiers, while emerging secondary markets that are near the fastest-growing population centers — and in close proximity to the most utilized logistics hubs in the region — continue to grow.

In this unique interactive report, we examine the North American big-box industrial market through the first half of 2022, which includes the seven core North American big-box markets and nine emerging secondary markets. We will highlight the fundamentals and look at demand factors, including demographics and logistics capabilities, and assess what lies ahead in the quarters ahead.

Introduction

Unless otherwise specified, all report data is through midyear 2022.

Download a PDF

Download a PDF

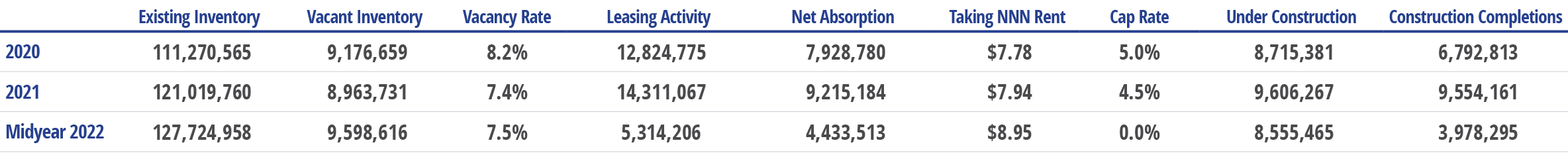

Supply chain delays and disruptions continued to impact the industrial sector and sparked immense change for occupiers of bulk product throughout North America. E-commerce growth has abated, but third-party logistics and manufacturing activity have surged, offsetting the dip in online retailers’ transactions. In fact, third-party logistics increased its market share of bulk transactions in the U.S. to 31.4% at midyear, up from 29.9% one year ago. A resurgence in U.S. manufacturing is also benefitting the industrial sector. This shift in occupancy resulted in more than 231.8 million square feet of occupancy gains at midyear, and nearly 92.5 million square feet of occupancy gains were recorded in the big-box market. This positive momentum in third-party logistics related to occupancy gains, is largely aided by more occupiers opting to outsource fulfillment and distribution.

Overview

North American

Building Inventory

Historical Data

200,000 - 499,999 SF

4,206

Big-box buildings

102

Fully vacant

1,105

Big-box buildings

36

Fully vacant

500,000 - 749,999 SF

976

Big-box buildings

23

Fully vacant

750,000+ SF

Northern California

Toronto

Northern-Central New Jersey

I-4 Corridor

Atlanta

Kansas City

Greater Phoenix

Dallas

Columbus

Cincinnati

Chicago

Indianapolis

Houston

Southern New Jersey

Inland Empire

Memphis

Robust demand for big-box product remained, however, bulk vacancy increased nominally to 0.7%, up from 0.4% year-over-year. The GTA maintains the second tightest big-box market with historically low vacancy and just three big-box facilities in the region that were fully vacant at midyear. Despite the slight rise in vacancy, industrial big-box average asking net rents in the GTA have set a new high mark, reaching $13.68 per square foot at the end of the first half of the year, a 12.5% increase year-over-year. While large blocks have historically attained pricing discounts, strong demand for all size ranges is leading to more unvaried lease rates. Tenants with immediate space requirements or who are nearing the end of their terms have no choice but to pay the current high-level rates.

View Properties

Download a PDF of the Report

A continued period of tightening and improving fundamentals is being exhibited across the greater Toronto area market. Larger buildings continue to be in limited supply and are hotly sought-after when they do become available for lease via new construction or backfill. E-commerce fulfillment companies are expanding their footprints at a rapid pace, along with the third-party logistics, food service, industrial supply and technology/pharmaceutical sectors, all seeing strong activity levels. Rapidly rising land and entitlement charges are pushing rents to higher and previously unrealized levels. Vacancy levels have remained low through 2021 into 2022 and are poised to remain low well into 2023."

"

Click each market for more information

Toronto

Canada

David Colley, SIOR

Senior Vice President,

Toronto West

Demand continues to outpace availability

View Properties

Download a PDF of the Report

547

Big-box buildings

2

Fully vacant

200,000 - 499,999 SF

51

Big-box buildings

1

Fully vacant

500,000 - 749,999 SF

55

Big-box buildings

0

Fully vacant

750,000+ SF

Building inventory

Historical data

For more U.S. research and analysis from Colliers International, visit U.S. Research.

Other Industrial Research Reports

- Q2 2022 U.S. Industrial Report

This document/email has been prepared by Colliers for advertising and general information only. Colliers makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. This publication is the copyrighted property of Colliers and /or its licensor(s). © 2022. All rights reserved. This communication is not intended to cause or induce breach of an existing listing agreement.

Historical data

Download a PDF

Download a PDF

Toronto

Canada

Southern New Jersey

Eastern Pennsylvania

New Jersey

Northern-Central

California

Northern

Memphis

Tennessee

Kansas City

Missouri

Inland Empire

California

Indianapolis

Indiana

I-4 Corridor

Florida

Houston

Texas

Phoenix

Arizona

Dallas

Texas

Columbus

Ohio

Cincinnati

Ohio

Chicago

Illinois

Atlanta

Georgia

Click on each market for more information

Historical data

On the heels of unprecedented absorption of 40 million square feet in 2021, Atlanta continues its heaping helping of big-box transactions with over 10.5 million square feet absorbed through Q2 2022. Atlanta’s vacancy is at historic lows, average rents are at all-time highs and climbing, and overall new construction is at record levels at more than 50 million square feet as tenant demand continues to outpace supply. Atlanta is poised for an epic year in 2022 with unrivaled growth, tenant demand, and asset valuation.

Ben Logue, SIOR

Senior Vice President & Principal,

Atlanta

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Atlanta's bulk market bolstered its first quarter numbers by ending the first half of the year with more than five million square feet absorbed. Considering 2021 was a record year for occupancy gains, occupier demand remains high as year-to-date absorption still indicates a strong market in Atlanta. Transaction volume remains persistent as the first half of the year saw seven tenants move into space greater than 500,000 square feet. This has kept the overall vacancy rate for bulk product in Atlanta relatively low, at 4.4%, 190 basis points lower than the previous year.

Atlanta’s bulk market remains strong at midyear

Georgia

Atlanta

367

Big-box buildings

12

Fully vacant

200,000 - 499,999 SF

137

Big-box buildings

8

Fully vacant

500,000 - 749,999 SF

148

Big-box buildings

3

Fully vacant

750,000+ SF

Building inventory

Historical data

While demand for big-box product in Chicago dropped off during the first half of 2022 compared to the hyperactive demand witnessed during 2021, it was due to a lack of supply of available big-box buildings and record low vacancy. Over the coming quarters, developers will be making a big push to meet this demand, with a record amount of space breaking ground."

Jack Rosenberg, SIOR

National Director, Logistics and Transportation Group Principal,

Chicago

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Through the first half of 2022, demand for Chicago’s big box industrial product persisted, as occupancy gains totaled 11.8 million square feet. A total of 5.1 million square feet was recorded during the second quarter and, while still strongly positive, it also represented the lowest quarterly total since the fourth quarter of 2020 and was nearly half of the record 9.7 million square feet recorded during the fourth quarter of 2021. The market, however, remains incredibly tight.

Developers pick up the pace in a tight big-box industrial market

Illinois

Chicago

505

Big-box buildings

7

Fully vacant

200,000 - 499,999 SF

106

Big-box buildings

2

Fully vacant

500,000 - 749,999 SF

95

Big-box buildings

2

Fully vacant

750,000+ SF

Building inventory

Historical data

The greater Cincinnati Industrial market has never experienced the level of demand seen during the first half of 2022. Year-to-date absorption figures set a record with 6.9 million square feet of total net absorption, a 109% increase year-over-year. The overall vacancy rate surpassed the first quarters record and fell to 2.3%. The last time the market experienced demand this strong during the first half of the year, was 2017 when demand was nearly 50% less. With the sixth-largest cargo airport in North America, an unparalleled geographic location, and limited supply of land, demand for bulk warehouse space is the driving force behind the exponential growth. Bulk warehouse space accounts for the majority of total net absorption and saw the sharpest decline in vacancy rates. With such strong demand, speculative construction activity is at an all-time high as well with more than eight million square feet of space currently under construction. A significant portion of which has already been pre-leased or sold. As strong demand continues to be sustained, the second half of 2022 will test the bulk industrial market. Millions of square feet of new supply will hit the market and it remains to be seen whether demand will remain at record levels into 2023. However, with over 1.5 million square feet of speculative supply being accounted for already, elevated activity will likely persist."

John B. Gartner III, SIOR

Senior Vice President & Principal, Cincinnati

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

The Cincinnati big-box market is particularly well-suited to meet the growing demand for faster delivery and the accompanying demand for warehousing and transportation. The year started off incredibly strong for the Greater Cincinnati industrial market as demand pushed the market past new heights. Cincinnati’s bulk market continued to post elevated occupancy levels as 5.1 million square feet of net absorption were recorded during the first half of 2022. This is nearly double the 2.6 million square feet recorded a year ago.

Bulk demand shatters

previous records

Ohio

Cincinnati

132

Big-box buildings

2

Fully vacant

200,000 - 499,999 SF

40

Big-box buildings

0

Fully vacant

500,000 - 749,999 SF

20

Big-box buildings

0

Fully vacant

750,000+ SF

Building inventory

Historical data

The Columbus market continues to see strong activity in warehouse space. However, we are at a point where new development, although record-breaking, cannot keep up with the demand that we're seeing. Moving forward, the region's strategic location will continue to attract top tenants and contribute to activity. Construction will also remain steady in coming years as developers try to keep up with demand from e-commerce and retailing companies."

Michael Linder, SIOR

Senior Executive Vice President,

Columbus

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Strong momentum for the industrial big-box market continued at midyear for the Columbus market. Significant growth in third-party logistics has benefitted the Columbus big-box market as leasing activity increased 27% year-over-year. The largest leases of the year were signed by prominent retailers and third-party logistics companies, which continue to fuel activity in Central Ohio.

Columbus big-box activity continues to rise as strongdemand fuels the industrial sector

Ohio

Columbus

136

Big-box buildings

1

Fully vacant

200,000 - 499,999 SF

29

Big-box buildings

0

Fully vacant

500,000 - 749,999 SF

39

Big-box buildings

0

Fully vacant

750,000+ SF

Building inventory

Historical data

Dallas-Fort Worth continues to prove we can handle 45 million square feet of industrial development under construction, as we continue to be one of the leading cities in net absorption. As the fourth largest metropolitan area in the U.S., we are continuing to make strides to keep up with the continued growth. Across the entire country, we are only approximately 3.6% of total industrial inventory. With prime port markets facing supply shortages, the Dallas-Fort Worth market has benefited from being a prime e-commerce location. It’s a hot market and a hot city, but a great place to live."

Allyson Yost

Vice President,

Dallas

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

The Dallas-Fort Worth big-box market posted records in all major categories in 2021 which will be incredibly difficult to follow in 2022. Occupancy gains, while not as strong as a year ago, are still on pace to achieve an above-average year. However, with the continuation of the area’s population boom, there is no shortage of labor and developable land sites are abundant throughout the metroplex. Infill development sites, however, are in short supply as companies aim to relocate closer to the end customer and these coveted locations are difficult to acquire.

Construction activity

is still red hot

Texas

Dallas

465

Big-box buildings

17

Fully vacant

200,000 - 499,999 SF

128

Big-box buildings

9

Fully vacant

500,000 - 749,999 SF

92

Big-box buildings

4

Fully vacant

750,000+ SF

Building inventory

Historical data

Houston’s big-box market has seen continued positive absorption and new construction growth in 2021 and early 2022. Houston’s port saw its busiest year ever in 2021. Year-over-year, the port surpassed its previous high-water mark for total loaded twenty-foot equivalent unit volume increased 7%. Material shortages, increased consumer demand and labor shortages in other port markets are all contributing factors to the record growth. The massive e-commerce growth we saw in 2021 has seemed to temper a bit, but that has not stopped the absorption in the port market. Home Depot and Walmart have continued the rapid expansion of their distribution networks in the Houston MSA and across the U.S. 2021 retail sales were estimated at roughly $4.5 trillion. Within that total is e-commerce (non-store) sales, which have grown nearly 20% to a range of $1.09 to $1.13 trillion. Developers continue to deliver new product and seek viable land positions in Houston’s east and southeast submarkets to service this ever-expanding port activity. What remains to be seen is if land sellers and developers can find common ground in this rapidly changing market. The 100 basis point swing in cap rates will not allow a developer to pay the same amount for land that they could have just four months ago. In certain instances, developers are seeking up to a 30% price reduction in order to make their underwriting pencil."

Robert Alinger, SIOR

Principal & Director, Houston

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Following a record year of construction deliveries, new supply took a noticeable dip at the start of 2022 as just 2.9 million square feet was delivered in the Houston area at midyear. This is in stark contrast to the 7.4 million square feet delivered last year at this time. The largest facility built in Houston thus far is an 800,000-square-foot distribution center for California-based plastics resin logistics company, Plastics Express, in Baytown. With fewer deliveries and increased occupancy, Houston’s big-box vacancy plummeted to 5.5%, down from 14.0% last year at this time.

Houston's industrial big-box market continues to grow in 2022

Texas

Houston

256

Big-box buildings

15

Fully vacant

200,000 - 499,999 SF

45

Big-box buildings

2

Fully vacant

500,000 - 749,999 SF

28

Big-box buildings

0

Fully vacant

750,000+ SF

Building inventory

Historical data

The record year we achieved in 2021 on the I-4 Corridor continues in 2022. National tenant demand remains robust, vacancy rates are at all time lows and the development pipeline has surpassed 10 million square feet. As the populations of Orlando and Tampa continue to merge into a megatropolis, the I-4 Corridor will be the beneficiary of this unprecedented growth."

David Wilson

Managing Director,

Orlando

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

The availability of big-box facilities remains low in the I-4 Corridor as there are only five existing facilities fully available in the region. The lack of 500,000-plus-square-foot product, especially, combined with growing demand for this size range from e-commerce and 3PL tenants, has created a significant opportunity for speculative development. A total of 5.5 million square feet remained under construction at midyear, including a 1.2-million-square-foot distribution center for Lowe’s (scheduled to be delivered by year-end), and a 1.2-million-square-foot speculative warehouse in the Orlando market.

Record activity continues

in Central Florida

Florida

I-4 Corridor

72

Big-box buildings

3

Fully vacant

200,000 - 499,999 SF

13

Big-box buildings

0

Fully vacant

500,000 - 749,999 SF

16

Big-box buildings

1

Fully vacant

750,000+ SF

Building inventory

Historical data

The Indianapolis Motor Speedway isn’t the only place where records are being shattered. The Indianapolis big-box market is on track to break last year’s historic leasing activity and construction levels. Even with all that new product hitting the market, tenants are finding it challenging to secure a space for any immediate needs. Developers are clamoring to keep up and stake their positions. We expect tenant demand in central Indiana to stay on pace through the back half of 2022."

Cam Kucic, SIOR

Senior Vice President, Indianapolis

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

The Indianapolis big-box market continued its rapid rate of growth at midyear. The market achieved 11.0 million square feet of leasing activity and is on-track to surpass the record-high 12.7 million square feet reached in 2021. Third-party logistics providers and packing companies are dominating this activity. In the last 24 months, they accounted for more than half of all new modern bulk transactions, including the largest five deals of Q2 2022. Investors and occupiers will continue to choose Indianapolis at a greater pace than other Midwest markets because of its strong labor force, pro-business environment and a plethora of logistics advantages. All of this translates to robust leasing, positive absorption, increased development and more investor interest in the region for the foreseeable future.

Record-high leasing volume

leading to new development

Indiana

Indianapolis

137

Big-box buildings

8

Fully vacant

200,000 - 499,999 SF

69

Big-box buildings

3

Fully vacant

500,000 - 749,999 SF

46

Big-box buildings

4

Fully vacant

750,000+ SF

Building inventory

Historical data

In the face of rising inflation and the rise in cost of energy, the Fed has been raising interest rates to put the brakes on what most fear, which is stagflation and a looming recession. If you view any type of media outlet, this is being pumped in your face daily. There have been some definite changes to the industrial real estate markets, most notably on the front of valuations. The cost of debt, volatility of the cost of debt and what that’s done to valuation underwriting has definitely impacted the markets. Cap rates, exit cap rates and backing down on rental rate escalation trends have adjusted the soaring valuations of assets and land. All that said, the sheer fundamentals of the Inland Empire industrial real estate market have been solid. Overall vacancy is 0.3% and buildings over 500,000 square feet is 0%. Buildings currently under construction are at an all-time high of 29.9 million square feet with 5.3 million square feet of completions year-to-date which is still not providing enough inventory to hold up the Inland Empire’s prior absorption levels. Currently, gross absorption is 15.6 million square feet and net absorption is 4.3 million square feet. We’ve now achieved our 52nd straight quarter of positive net absorption. With these fundamentals in place and tenant demand remaining strong, rental rates have increased 35% year-over-year on average. Overall predictions for the remainder of the year is that absorption will remain constant, vacancy will remain low and rental rates will still continue to increase beyond what most investors are underwriting."

Mark Zorn, SIOR

Vice Chair,

Inland Empire

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Leasing activity in the Inland Empire totaled 10.2 million square feet, while net absorption plummeted year-over-year to 4.3 million square feet due to the lack of vacant existing space. Construction completions totaled 5.4 million square feet with most buildings leased prior to completion. These totals, while nowhere near record-level activity, remain impressive given the lack of available big-box options in the Inland Empire. This lack of available space caused overall vacancy to plummet to a historic low of 0.3%, making the Inland Empire the only bulk market in the U.S. with vacancy lower than 1.0%. There are no fully-vacant buildings above 500,000 square feet available in the Inland Empire.

Vacancy hits historic low as rents continue to soar

California

Inland Empire

486

Big-box buildings

2

Fully vacant

200,000 - 499,999 SF

143

Big-box buildings

0

Fully vacant

500,000 - 749,999 SF

126

Big-box buildings

0

Fully vacant

750,000+ SF

Building inventory

Historical data

The Kansas City market continues to be a thriving industrial market with robust activity. E-commerce activity continues to push new industrial development to previously unseen levels throughout the metro. Kansas City’s low vacancy rates and strong market fundamentals continue to be the driving force for future speculative construction. Industrial users look to place their operations in Kansas City as a result of ideal geography, established infrastructure and steady supply of speculative development."

Ed Elder

President,

Kansas City

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Bulk industrial activity in Kansas City remains active as more occupiers look to place operations within the market. By midyear, the overall vacancy rate for big-box facilities increased to 9.4%, up over the 8.0% recorded one year ago, largely due to the number of speculative projects that delivered vacant. Occupancy gains totaled 4.5 million square feet, up 17.6% over midyear 2021. Absorption totals are expected to increase further in the second half of the year based on the timing of several new industrial buildings slated to be delivered in Q3 and Q4 2022. Current industrial real estate demand is a direct result of distribution growth and expanding e-commerce traffic. Occupiers are striving to modernize and expand existing supply chains to accommodate the accelerating pace of the market.

E-commerce activity continues to drive new industrial development

Missouri

Kansas City

90

Big-box buildings

2

Fully vacant

200,000 - 499,999 SF

34

Big-box buildings

2

Fully vacant

500,000 - 749,999 SF

15

Big-box buildings

1

Fully vacant

750,000+ SF

Building inventory

Historical data

Building on momentum from 2021, Memphis has continued to see new development activity across all submarkets. Record setting big-box absorption of 5.9 million square feet at the mid-year point has set the tone for this year and driven continued new specualtive development. In the first half of 2022, there have been eleven new deals over 100,000 square feet, totaling 6.7 million square feet. This velocity has spurred new development of 12.9 million square feet under construction. The second half of 2022 will continue to see positive absorption and robust rate growth due to the continued demand of big-box uers across mulitple sectors, including medical, e-commerce and 3PLs."

Tim Mashburn

Senior Vice President & Principal, Memphis

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Memphis’ big-box industrial market continued its healthy pace of growth at midyear. Significant growth in distribution and third-party logistics firms has benefitted the Memphis bulk market as occupancy gains increased 21.4% over this time last year and totaled 5.9 million square feet. Third-party logistics firms supporting the retail and e-commerce industries accounted for more than half of all big-box absorption, with companies including Medtronic Logistics, K Power Logistics, FedEx and Advanced Warehouse all taking bulk space during the first half of the year. Leasing activity also remained elevated and totaled 14.2 million square feet. 11 transactions greater than 100,000 square feet were signed by midyear, totaling 6.7 million square feet.

Big-box momentum soars to new highs

Tennessee

Memphis

108

Big-box buildings

7

Fully vacant

200,000 - 499,999 SF

52

Big-box buildings

0

Fully vacant

500,000 - 749,999 SF

64

Big-box buildings

3

Fully vacant

750,000+ SF

Building inventory

Historical data

Northern California continues to prosper at a sustainable rate despite speculation of a looming recession. Headwinds created by increased construction costs, supply chain disruption, interest rate hikes, lack of labor, and runaway inflation have softened pre-leasing activity and construction starts from last year’s record pace, however, market fundamentals remain strong. Demand for big-box space continues to outpace supply, keeping vacancy rates low and putting continued upward pressure on rental rents. The momentum in Northern California shows very few signs of slowing with no drastic changes expected in the foreseeable quarters, but market activity will likely moderate from the record run of the last two years."

Tommy Ponder, SIOR

Executive Vice President, Sacramento

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Strong demand across Northern California continued with 4.4 million square feet of year-to-date net absorption only 5% below 2021’s record pace. As demand still outpaces supply, asking rents continue to rise across all markets. The regional vacancy rate ticked up 20 basis points from year-end 2021 to 7.5% but is still 120 basis points below Q4 2020’s vacancy rate. Williams Sonoma leased 1.1 million square feet in Tracy at Prologis’ International Park of Commerce in a Colliers-brokered transaction. The state-of-the-art cross-docked building located 46 miles from the Port of Oakland features a 50-foot clear height with 194 dock-high doors. Modular homebuilder Veev subleased 507,000 square feet from Amazon in the East Bay submarket of Hayward. In addition, future demand in the Central Valley could come from companies in the Inland Empire, where vacancy sits at 0.5% and rents have doubled in the last two years.

Market fundamentals remain strong despite economic headwinds

California

Northern California

204

Big-box buildings

9

Fully vacant

200,000 - 499,999 SF

57

Big-box buildings

2

Fully vacant

500,000 - 749,999 SF

32

Big-box buildings

1

Fully vacant

750,000+ SF

Building inventory

Historical data

With a dearth of availability in New Jersey, developers continue to break ground on industrial projects as the state currently has 13.9 million square feet under construction, a 17.5% increase year-over-year, as 3.2 million square feet was delivered through the first half of 2022. The addition of the new inventory where just 1.6% of the inventory is available for lease, provides opportunities for occupiers that did not previously exist. New Jersey though has experienced a slowdown in pre-leasing as developers have held off on leasing buildings under construction to achieve higher rents upon completion. Pricing for new construction in the Port and Meadowlands submarkets continue to achieve taking rents above $20 per square foot, while pricing guidance in the Exit 8A and 7A submarkets are north of $13 per square foot."

Doug Bansbach

Executive Managing Director, Woodbridge

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

New Jersey's industrial market continued to show remarkable market fundamentals amid supply constraints which resulted in a reduction of the square footage leased during the first half of the year. Leasing activity totaled 6.8 million square feet through the first two quarters of 2022, a 51.4% decrease year-over-year. Despite a slowdown in leasing activity, positive net absorption continued in New Jersey at 2.4 million square feet, as occupancy gains continued to be driven by occupied new deliveries. Bulk occupiers contributing to absorption at midyear included Volkswagen, Keurig, FedEx and List Logistics.

Leasing volume falls amid supply constraints

New Jersey

Northern-Central

206

Big-box buildings

3

Fully vacant

200,000 - 499,999 SF

49

Big-box buildings

1

Fully vacant

500,000 - 749,999 SF

43

Big-box buildings

2

Fully vacant

750,000+ SF

Building inventory

Historical data

Historical data

"

The Phoenix big-box industrial market is setting records and continues to impress investors and developers alike. 2021 was another banner year for absorption and 2022 is shaping up to be even more impressive. Phoenix rents continue to escalate and new construction starts will exceed 36 million square feet in 2022. The Loop 303 corridor in the Southwest Valley offers regional users the logistics necessary to serve the entire Southwest with larger footprints exceeding one million square feet.

We expect 2022 occupancy gains to exceed 25 million square feet, and that is up almost 10% over last year’s record of 23 million square feet. We may have headwinds in capital market transactions, but so long as rents continue to accelerate, Phoenix industrial will stay on everyone’s radar."

Don MacWilliam

Executive Vice President, Phoenix

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Phoenix's industrial activity remains strong as more occupiers relocate to the market. At midyear, the overall vacancy rate for big-box facilities plummeted to just 3.3%, down from 12.1% one year ago. This marks the lowest recorded vacancy rate for bulk product in Phoenix. The big-box market in Phoenix was largely fueled by retailers and third-party logistics companies, with companies including Amazon, Funko, Best Buy, and Cornerstone Shared Services all occupying more than 700,000 square feet each in the first half of the year. As a result, occupancy gains totaled 8.3 million square feet, a 64% increase over the previous year and the market has already absorbed more inventory than all of 2021.

Construction is not stopping

Arizona

Phoenix

129

Big-box buildings

3

Fully vacant

200,000 - 499,999 SF

31

Big-box buildings

1

Fully vacant

500,000 - 749,999 SF

21

Big-box buildings

1

Fully vacant

750,000+ SF

Building inventory

As occupiers work to resolve global supply chain issues, demand will likely continue at its record-setting pace. Demand continues to outpace supply despite the high level of new construction. This imbalance will exert upward pressure on rental rates for the foreseeable future. Large amounts of capital chasing fewer sale offerings have resulted in record-high building sale prices and low capitalization rates. Strong competition for infill land sites along the I-95 corridor has caused FAR prices to skyrocket."

Mark V. Chubb

Senior Managing Director & Principal, Conshohocken

"

View Properties

View Properties

Download a PDF of the Report

Download a PDF of the Report

Bulk vacancy levels plummeted year-over-year to 2.1%, down from 6.9% the previous year as increased occupancies and new pre-leased speculative product continues to be delivered. 11.6 million square feet of new supply added 1.8 million square feet of vacant product. Robust occupier demand and limited availability also fuel construction activity in this market. A total of 39.8 million square feet remained under development at the end of the second quarter. Occupier demand persists in this region and companies continue to modernize their omnichannel approach. As such, a lack of large-format vacancies (greater than 750,000 square feet) is driving the development boom in this market.

Record high occupier demand has driven vacancy to the lowest level in a decade

Eastern Pennsylvania

Southern New Jersey

366

Big-box buildings

9

Fully vacant

200,000 - 499,999 SF

121

Big-box buildings

1

Fully vacant

500,000 - 749,999 SF

136

Big-box buildings

1

Fully vacant

750,000+ SF

Building inventory