Contact Us

Enter your details and we'll connect you with the right Computershare Corporate Trust team member.

Learn More

Mortgage-Backed Securities

Asset-Backed Securities

CLO & Loan Services

ABL Facilities

Delaware Statutory Trust

Structured Finance

Learn More

Corporate Finance

Business Escrow

Municipal Debt

Successor Trustee

Collateral Agent

Conventional Debt

Learn More

Business Escrow

1031 Exchange

Collateral Trust

Loan Administration

Securities Custody

Trust & Agency Services

Learn More

Our TrustConnect

platform is a single online source that provides a streamlined experience for accessing your corporate trust account data

TrustConnect™

We offer a wide range of services that fulfill our clients’ unique and emerging needs.

Find Your Solution

Why Computershare

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™ Technology

Contact Us

Global Banking Model

Structured Finance

TrustConnect™

Why Computershare

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™ Technology

Contact Us

Learn More

Mortgage-Backed Securities

Asset-Backed Securities

CLO & Loan Services

ABL Facilities

Delaware Statutory Trust

Structured Finance

Learn More

Corporate Finance

Business Escrow

Municipal Debt

Successor Trustee

Collateral Agent

Conventional Debt

Learn More

Business Escrow

1031 Exchange

Collateral Trust

Loan Administration

Securities Custody

Trust & Agency Services

Learn More

Our TrustConnect

platform is a single online source that provides a streamlined experience for accessing your corporate trust account data

TrustConnect™

We offer a wide range of services that fulfill our clients’ unique needs.

Find Your Solution

Enter your details and we'll connect you with the right team member.

Contact Us

Computershare �CLO & Loan Services

Expert servicing of loan financing structures

Computershare specializes in collateralized debt obligation and leveraged loan finance facilities. When you work with us, you will have a single point of contact who is cross-trained in a broad set of asset classes, including credit default swaps, total return swaps, structured products, bank loans, and indexed products.

As a nationwide leading capital markets player, we offer a wide variety of services in connection with debt securities issued by public and private corporations, government entities, and banking and securities industries.

Introducing our CLO Blog Series

In a constantly evolving market, we monitor key trends and listen to customer feedback to deliver solutions that truly make an impact. Our blog series offers actionable insights and encourage conversations that drive the market forward.

CONTINUE >>

The Evolution of Private Credit and Its Impact on CLO

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

Additional resources and news from Computershare Corporate Trust.

Latest Insights

CONTINUE >>

How a CLO Trustee Can Free You Up to Focus on Strategy

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

As the private credit market expands, financing structures are becoming more complex, requiring careful management and expertise.

It is more important than ever to work with a collateral agent and trustee who can keep pace with these complexities and help you achieve your financial objectives.

To avoid miscommunication, inefficiencies, and compliance risks, seek a collateral agent or trustee with a dedicated point of contact, proven expertise, fast onboarding, and seamless loan administration.

As a client, the last thing you need is to be left in a tangled web of communication, where simple inquiries require endless back-and-forth. A lack of personalized attention can lead to miscommunication, delays, and mistakes. A dedicated single point of contact who resolves inquiries in a single conversation saves time and frees you up to focus on strategic decisions...

CONTINUE >>

Navigating the Growing Corporate Loan Market

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

Collateral agents and trustees can function as strategic partners in the expanding CLO and ABL market, offering tailored and high-touch services.

Computershare is investing in modern technology and tools to deliver information to clients faster than ever before and continue its excellent customer service.

These capabilities also enable us to scale our CLO and ABL Facility business and become even more efficient.

In the growing corporate loan market, collateral agents and trustees can play a pivotal role as strategic partners to drive success. Our clients know Computershare Corporate Trust as their trusted partner who understands the need for high-touch, specialized CLO and loan administration services. Our 20+ year tenure in the corporate loan market has given us the insight to tailor custom workflows for complex structures that meet the unique needs of each asset manager...

Free Checklist

Questions to Ask When Choosing a Trustee to Facilitate Your CLO Deals

Download Now

Download Now

As the private credit market continues to grow, asset managers financing loan originations through CLOs and leveraged loan facilities must contend with the complexities of portfolio management and credit oversight.

Increased exposure to various types of financing structures with concentration and portfolio coverage tests creates a heightened need for more frequent and detailed monitoring of loan data and portfolio performance.

In today’s market, transparency, automation, and efficiency in data reporting are essential in maintaining a competitive advantage.

As more asset managers’ loan origination volumes continue to grow through the private credit market, the lines between middle market and broadly syndicated loans (BSL) can no longer be viewed in the same manner as they have been in years past...

Computershare specializes in collateralized debt obligation and leveraged loan finance facilities. When you work with us, you will have a single point of contact who is cross-trained in a broad set of asset classes, including credit default swaps, total return swaps, structured products, bank loans, and indexed products.

Expert servicing of loan financing structures

Computershare CLO & Loan Services

Introducing Our CLO Blog Series

In a constantly evolving market, we monitor key trends and listen to customer feedback to deliver solutions that truly make an impact. Our blog series offer actionable insights and encourage conversations that drive the market forward.

Free Download

Questions to Ask When Choosing a Trustee to Facilitate Your CLO Deals

Download Now

Introducing Our CLO Blog Series

In a constantly evolving market, we monitor key trends and listen to customer feedback to deliver solutions that truly make an impact. Our blog series offer actionable insights and encourage conversations that drive the market forward.

As a nationwide leading capital markets player, we offer a wide variety of services in connection with debt securities issued by public and private corporations, government entities, and banking and securities industries. See Full List

The Evolution of Private Credit and Its Impact on CLO

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

As the private credit market continues to grow, asset managers financing loan originations through CLOs and leveraged loan facilities must contend with the complexities of portfolio management and credit oversight.

Increased exposure to various types of financing structures with concentration and portfolio coverage tests creates a heightened need for more frequent and detailed monitoring of loan data and portfolio performance.

In today’s market, transparency, automation, and efficiency in data reporting are essential in maintaining a competitive advantage.

As more asset managers’ loan origination volumes continue to grow through the private credit market, the lines between middle market and broadly syndicated loans (BSL) can no longer be viewed in the same manner as they have been in years past. Once dominated by large banks and a small population of lenders, loan originations by nonbank lenders without broad syndication is becoming increasingly popular. This shift is driven by growing demand for private credit solutions amid increased bank regulation and market dislocation, with investors searching for higher yields. However, as this trend continues, asset managers issuing CLOs in this space must contend with a host of new complexities.

The private credit market has grown from roughly $725 billion in 2018 to roughly $1.7 trillion in 2023, with asset managers in the upper middle market segment finding different ways to finance their origination. Larger loans may represent a greater share of their portfolio, thereby increasing exposure to a single borrower or sector. To mitigate this risk, managers are finding diverse ways to finance their origination platform which requires more frequent and more detailed monitoring of their financing vehicles. Failing to manage various financing structures, each with their own unique tests, across an increased number of borrower names they are tracking could lead to market dislocation and portfolio instability.

Furthermore, private credit managers need support for more complex loan terms, extensive deal negotiations with syndicate members, and accompanying legal documentation. In the initial stages of a deal, a trusted third party is needed for understanding deal mechanics and portfolio tests while conducting the calculations outlined in governing agreements.

Finally, as test requirements for credit facilities and CLOs evolve, there is greater demand for more robust data, analytics, and reporting support. Asset managers need to be able to track, analyze, and report on more complex loan portfolios while ensuring the data is reconciled against their counterparties. Inaccuracies and delays in data could impact portfolio performance, trigger compliance violations, and delay CLO waterfall calculations—not to mention erode investor confidence. In today’s market, transparency, automation, and efficiency in data reporting are no longer optional—they are critical to one’s competitive edge.

As the corporate loan market evolves, asset managers must consider how these changes will affect not only their financial objectives, but also engage trusted partners dedicated to the administration of their CLOs and leveraged loan facilities.

What are you seeing in the market and how is it affecting your portfolio?

Send me a note at Alison.Roth@Computershare.com.

How a CLO Trustee Can Free You Up to Focus on Strategy

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

As the private credit market expands, financing structures are becoming more complex, requiring careful management and expertise.

It is more important than ever to work with a collateral agent and trustee who can keep pace with these complexities and help you achieve your financial objectives.

To avoid miscommunication, inefficiencies, and compliance risks, seek a collateral agent or trustee with a dedicated point of contact, proven expertise, fast onboarding, and seamless loan administration.

As a collateral agent and trustee, the Computershare team constantly anticipates challenges and ensures milestones are met under pressure. In fact, a client of ours recently thanked us for completing multiple transactions that “had a ton of moving pieces on an expedited timeline,” for which our “speed, accuracy, flexibility, expertise, and partnership mentality…[was] greatly appreciated and [didn’t] go unnoticed.”

�It is kind words like these that remind me of what is at stake for asset managers and issuers. Indeed, the growth in size and complexity of the private credit market underscores the need to choose a collateral agent or trustee of the right caliber, no matter the market segment. To ensure smooth operations and stakeholder confidence throughout your deal’s lifecycle, here are four common pitfalls to avoid when evaluating a CLO trustee and loan administrator in today’s market.

�Does the provider have a single point of contact?

�As a client, the last thing you need is to be left in a tangled web of communication, where simple inquiries require endless back-and-forth. A lack of personalized attention can lead to miscommunication, delays, and mistakes.

�A dedicated single point of contact who resolves inquiries in a single conversation saves time and frees you up to focus on strategic decisions. Precise and accurate responses also minimize the risk of misinformation, safeguarding your peace of mind and the interests of your investors and lenders. Additionally, having a team of experts coordinating closely across sales, relationship management and account management ensures that you are always informed of important developments and supported fully.

�Does the collateral agent/trustee have sufficient ABL Facility and CLO experience?

�A less experienced collateral agent or trustee may lack the insights needed to tailor workflows that account for the unique ways you process and track loans. Consider their track record. How many ABL Facilities and CLOs have they administered? Evaluating both the team’s individual expertise and combined years of experience can provide a clearer picture of their capabilities and experience with a transaction’s life cycle. Additionally, a provider experienced in a broader offering of structured finance services has more experience with which to address unusual circumstances should they arise.

�Can the collateral agent/trustee onboard and set up the account quickly?

�In a fast-paced environment, deal timelines can be aggressive, and you need a collateral agent and trustee that can close multiple transactions quickly. Mismanaged timelines may delay the pre-closing stage.

�A dedicated business negotiations team with full control over the pre-close and closing process may be able to move faster than one that relies on multiple teams. A consultative, agile approach that helps you solve for any unique circumstances is critical to a successful closing. Additionally, robust collaboration is paramount to an effective transition from closing to the relationship management team. This streamlines compliance and reporting set-up and gets your transaction onboarded in the collateral agent/trustee’s systems efficiently and accurately.

�Is the collateral agent/trustee’s loan administration and client service model efficient?

�Once a deal closes, an inefficient and disconnected client service model can create unnecessary headaches. Strong organizational structure is needed to ensure your ABL Facility or CLO runs like clockwork. It’s important to ensure your provider’s loan administration, relationship management and client service teams work closely to ensure seamless administration of your CLO or ABL facility.

�The corporate loan market is a complex, high-stakes arena. To succeed, you need a collateral agent or trustee that goes beyond templates to create tailored solutions. By keeping these potential pitfalls in mind, you can ensure CLO compliance and protect investor confidence.

What are you seeing in the market and how is it affecting your portfolio? �Send me a note at Alison.Roth@Computershare.com.

Navigating the Growing Corporate Loan Market

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

Collateral agents and trustees can function as strategic partners in the expanding CLO and ABL market, offering tailored and high-touch services.

Computershare is investing in modern technology and tools to deliver information to clients faster than ever before and continue its excellent customer service.

These capabilities also enable us to scale our CLO and ABL Facility business and become even more efficient.�

In the growing corporate loan market, collateral agents and trustees can play a pivotal role as strategic partners to drive success. Our clients know Computershare Corporate Trust as their trusted partner who understands the need for high-touch, specialized CLO and loan administration services. Our 20+ year tenure in the corporate loan market has given us the insight to tailor custom workflows for complex structures that meet the unique needs of each asset manager.

�Yet excellence isn’t the finish line, it’s just the first step. Thanks to innovative technology enhancements that make us faster, more efficient, and even more attuned customer needs, the service our clients rely on is being redefined. In the first quarter of 2025, we are streamlining our internal tools and processes to meet the evolving needs of the market.

�Data Consumption and Tie-Out

�The increase in volume of CLOs and ABL facilities that we are seeing in the market may imply greater exposure to more borrower names to track, and different compliance attributes for asset managers, creating the need for frequent and more detailed monitoring of loans attributes and compliance tests.

�We are proud to offer reporting solutions that are tailored to the unique needs of the manager, now integrated with data consumption tools for client data ingestion and data tie-out tools and feeds to ensure date transparency and accuracy.

�Automating Calculations

�Our commitment goes beyond basic reporting. We’re also meeting the need for more detailed analysis of performance metrics and cash flows by automating calculations and reporting for portfolio managers, created specifically for ABL/Borrowing Base lenders based on their requirements as well as their lender’s requirements.

�Here is the exciting part: These advancements aren’t just improving how we service private credit—we’re extending these capabilities into the broadly syndicated loan space as well, bringing our signature focus to an even larger stage.

�Be it CLOs, ABL facilities, credit facilities, BDCs, or private credit funds, we’re excited to bring a superior client experience through enhanced internal processes. With strides into a wider array of loan markets at scale, the Computershare team is here to ensure our clients succeed in every corner of the corporate loan landscape.

What are you seeing in the market and how is it affecting your portfolio? �Send me a note at Alison.Roth@Computershare.com.

Alison Roth

SVP, Division Manager, �CLO & Leveraged Loan Services

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

CONTINUE >>

The Evolution of Private Credit and Its Impact on CLO Management

By Alison Roth

SVP, Division Manager, �CLO and Leveraged Loan Services

As more asset managers’ loan origination volumes continue to grow through the private credit market, the lines between middle market and broadly syndicated loans (BSL) can no longer be viewed in the same manner as they have been in years past...

CONTINUE >>

The Evolution of Private Credit and Its Impact on CLO Management

By Alison Roth

SVP, Division Manager, �CLO and Leveraged Loan Services

As more asset managers’ loan origination volumes continue to grow through the private credit market, the lines between middle market and broadly syndicated loans (BSL) can no longer be viewed in the same manner as they have been in years past. Once dominated by large banks and a small population of lenders, loan originations by nonbank lenders without broad syndication is becoming increasingly popular. This shift is driven by growing demand for private credit solutions amid increased bank regulation and market dislocation, with investors searching for higher yields. However, as this trend continues, asset managers issuing CLOs in this space must contend with a host of new complexities.

The private credit market has grown from roughly $725 billion in 2018 to roughly $1.7 trillion in 2023, with asset managers in the upper middle market segment finding different ways to finance their origination. Larger loans may represent a greater share of their portfolio, thereby increasing exposure to a single borrower or sector. To mitigate this risk, managers are finding diverse ways to finance their origination platform which requires more frequent and more detailed monitoring of their financing vehicles. Failing to manage various financing structures, each with their own unique tests, across an increased number of borrower names they are tracking could lead to market dislocation and portfolio instability.

Furthermore, private credit managers need support for more complex loan terms, extensive deal negotiations with syndicate members, and accompanying legal documentation. In the initial stages of a deal, a trusted third party is needed for understanding deal mechanics and portfolio tests while conducting the calculations outlined in governing agreements.

Finally, as test requirements for credit facilities and CLOs evolve, there is greater demand for more robust data, analytics, and reporting support. Asset managers need to be able to track, analyze, and report on more complex loan portfolios while ensuring the data is reconciled against their counterparties. Inaccuracies and delays in data could impact portfolio performance, trigger compliance violations, and delay CLO waterfall calculations—not to mention erode investor confidence. In today’s market, transparency, automation, and efficiency in data reporting are no longer optional—they are critical to one’s competitive edge.

As the corporate loan market evolves, asset managers must consider how these changes will affect not only their financial objectives, but also engage trusted partners dedicated to the administration of their CLOs and leveraged loan facilities.

What are you seeing in the market and how is it affecting your portfolio? �Send a note to me and my team below.

CONTINUE >>

The Evolution of Private Credit and Its Impact on CLO Management

By Alison Roth

SVP, Division Manager, �CLO and Leveraged Loan Services

As more asset managers’ loan origination volumes continue to grow through the private credit market, the lines between middle market and broadly syndicated loans (BSL) can no longer be viewed in the same manner as they have been in years past...

CONTINUE >>

The Evolution of Private Credit and Its Impact on CLO Management

By Alison Roth

SVP, Division Manager, �CLO and Leveraged Loan Services

As more asset managers’ loan origination volumes continue to grow through the private credit market, the lines between middle market and broadly syndicated loans (BSL) can no longer be viewed in the same manner as they have been in years past...

CONTINUE >>

How a CLO Trustee Can Free You Up to Focus on Strategy

By Alison Roth

SVP, Division Manager, �CLO and Leveraged Loan Services

As a collateral agent or trustee, the Computershare team constantly anticipates challenges and ensures milestones are met under pressure. In fact, a client of ours recently thanked us for completing multiple transactions that “had a ton of moving pieces on an expedited timeline,” for which our “speed, accuracy, flexibility, expertise, and partnership mentality…[was] greatly appreciated and [didn’t] go unnoticed.”

�It is kind words like these that remind me of what is at stake for asset managers and issuers. Indeed, the growth in size and complexity of the private credit market underscores the need to choose a collateral agent or trustee of the right caliber, no matter the market segment. To ensure smooth operations and stakeholder confidence throughout your deal’s lifecycle, here are four common pitfalls to avoid when evaluating a CLO trustee and loan administrator in today’s market.

�Does the provider have a single point of contact?

�As a client, the last thing you need is to be left in a tangled web of communication, where simple inquiries require endless back-and-forth. A lack of personalized attention can lead to miscommunication, delays, and mistakes.

�A dedicated single point of contact who resolves inquiries in a single conversation saves time and frees you up to focus on strategic decisions. Precise and accurate responses also minimize the risk of misinformation, safeguarding your peace of mind and the interests of your investors and lenders. Additionally, having a team of experts coordinating closely across sales, relationship management and account management ensures that you are always informed of important developments and supported fully.

�Does the collateral agent/trustee have sufficient ABL Facility and CLO experience?

�A less experienced collateral agent or trustee may lack the insights needed to tailor workflows that account for the unique ways you process and track loans. Consider their track record. How many ABL Facilities and CLOs have they administered? Evaluating both the team’s individual expertise and combined years of experience can provide a clearer picture of their capabilities and experience with a transaction’s life cycle. Additionally, a provider experienced in a broader offering of structured finance services has more experience with which to address unusual circumstances should they arise.

�Can the collateral agent/trustee onboard and set up the account quickly?

�In a fast-paced environment, deal timelines can be aggressive, and you need a collateral agent and trustee that can close multiple transactions quickly. Mismanged timelines may delay the pre-closing stage.

�A dedicated business negotiations team with full control over the pre-close and closing process may be able to move faster than one that relies on multiple teams. A consultative, agile approach helps you solve for any unique circumstances is critical to a successful closing. Additionally, robust collaboration is paramount to an effective transition from closing to the relationship management team. This streamlines compliance and reporting set-up and gets your transaction onboarded in the collateral agent/trustee’s systems efficiently and accurately.

�Is the collateral agent/trustee’s loan administration and client service model efficient?

�Once a deal closes, an inefficient and disconnected client service model can create unnecessary headaches. Strong organizational structure is needed to ensure your ABL Facility or CLO runs like clockwork. It’s important to ensure your provider’s loan administration, relationship management and client service teams work closely to ensure seamless administration of your CLO or ABL facility.

�The corporate loan market is a complex, high-stakes arena. To succeed, you need a collateral agent or trustee that goes beyond templates to create tailored solutions. By keeping these potential pitfalls in mind, you can ensure CLO compliance and protect investor confidence.

What are you seeing in the market and how is it affecting your portfolio? �Send a note to me and my team below.

Download Now

CONTINUE >>

COMING SOON

© Computershare Limited 1996 - 2025.

All rights reserved.

Comprehensive solutions for your most complex corporate trust needs.

Conventional Debt

Corporate Finance | Business Escrow

Municipal Debt | Successor Trustee�Collateral Agent and more

LEARN MORE

Trust & Agency Services

Business Escrow | 1031 Exchange �Collateral Trust | Loan Administration

Securities Custody and more

LEARN MORE

Structured Finance

Mortgage-Backed & Asset-Backed Securities CLO & Loan Services | Delaware Statutory Trust

Longevity Services and more

LEARN MORE

TrustConnectTM

Our TrustConnect platform is a single online source that provides a streamlined experience for accessing your corporate trust data

LEARN MORE

Cat Bond Offering

Choose your new cat bond partner with confidence. With dedicated experts, personalized service, and easy onboarding, Computershare is well suited to support your cat bond needs.

LEARN MORE

Enter your details and we'll connect you with the right team member.

Enter your details and we'll connect you with the right team member.

Contact Us

Request a personalized demo of our CLO-ABL Direct online portal today.

Discover more

© Computershare Limited 1996 - 2025.

All rights reserved.

Comprehensive solutions for your most �complex corporate trust needs.

Conventional Debt

Corporate Finance | Business Escrow

Municipal Debt | Successor Trustee�Collateral Agent and more

LEARN MORE

Trust & Agency Services

Business Escrow | 1031 Exchange �Collateral Trust | Loan Administration

Securities Custody and more

LEARN MORE

Structured Finance

Mortgage-Backed & Asset-Backed Securities CLO & Loan Services | Delaware Statutory Trust

Longevity Services and more

LEARN MORE

TrustConnectTM

Our TrustConnect platform is a single online source that provides a streamlined experience for accessing your corporate trust data

LEARN MORE

Cat Bond Offering

Choose your new cat bond partner with confidence. With dedicated experts, personalized service, and easy onboarding, Computershare is well suited to support your cat bond needs.

LEARN MORE

Enter your details and we'll connect you with the right team member.

Contact Us

Enter your details and we'll connect you with the right team member.

Why Computershare

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™ Technology

About Us

Contact Us

CONTACT

CONTACT

Why Computershare

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™ Technology

About Us

Contact Us

CONTINUE >>

Delivering Speed, Accuracy, and Automation to Asset-Based Lending Facilities

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

The Computershare Corporate Trust team now uses automated borrowing base calculations for faster processing and easier tracking of liabilities and key events.

Our transparent waterfall reporting provides line-by-line distributions aligned with deal terms.

Automated concentration tests streamline compliance oversight and scale across complex portfolios.

In a world of increasingly complex private debt structures, today’s loan facilities demand faster insights, precise compliance, and tools that scale. One of the most persistent challenges in this space has been the tension between Excel’s modeling power and its lack of scalability or consistent data governance. Computershare Corporate Trust is addressing that challenge with a suite of new internal capabilities designed to support faster, smarter...

Delivering Speed, Accuracy, and Automation to Asset-Based Lending Facilities

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

The Computershare Corporate Trust team now uses automated borrowing base calculations for faster processing and easier tracking of liabilities and key events.

Our transparent waterfall reporting provides line-by-line distributions aligned with deal terms.

Automated concentration tests streamline compliance oversight and scale across complex portfolios.

In a world of increasingly complex private debt structures, today’s loan facilities demand faster insights, precise compliance, and tools that scale. One of the most persistent challenges in this space has been the tension between Excel’s modeling power and its lack of scalability or consistent data governance. Computershare Corporate Trust is addressing that challenge with a suite of new internal capabilities designed to support faster, smarter administration of complex credit facilities.

By automating borrowing base calculations, streamlining waterfall management, and enabling high-precision concentration testing, we’re helping our clients reduce friction, increase transparency, and unlock greater operational efficiency.

�Power Without Scale

�Collateral administrators have long relied on spreadsheets to manage borrowing bases, waterfall distributions, and compliance checks. But as portfolios grow, the manual burden of building and maintaining these models becomes unsustainable. With no centralized structure, analysts must rebuild models for each deal, introducing delays, inconsistencies, and operational risk.

�Borrowing Base Automation: Faster Processing, Smarter Oversight

�With new investments in technology, Computershare now automates borrowing base calculations and customizes them to each facility’s structure. We also automate internal modeling and reporting of the available capacity, liabilities, and key events, unencumbered by manual processes that slow things down. Historical data views and built-in back-testing functions allow for clear traceability of how each figure was derived. Plus, our Excel plugin enables us to pull data directly for our clients, combining flexibility with structure.

�Waterfall Management: Know Where Every Dollar Goes

�Our waterfall reporting capabilities deliver automated, line-by-line distribution reports down to the tranche and expense level. Our clients get clear outputs that mirror the governing terms of each deal, eliminating guesswork and reducing reconciliation delays.

�Concentration Tests: Precision at Scale

�Our automated concentration testing flags exposures and thresholds across evolving portfolios with speed and accuracy. This streamlines compliance monitoring and supports reporting.

�Behind the Scenes: The Best of Both Worlds

�Excel, although a powerful calculation tool, is difficult to govern or scale. Our new operational capabilities bring existing Excel models into a centralized environment where calculation models are contained in a library, data flows are standardized, and reporting logic is consistent across multiple deals.

�Built-in reconciliation tools help us identify breaks and tie out calculations faster. Custom reporting frameworks ensure we can adapt to unique deal structures, while maintaining consistency across the broader portfolio.

�The Bottom Line

�You don’t need to adopt a new system to benefit from ours. By investing in automation, Computershare delivers faster turnarounds, higher accuracy, and stronger governance—so you can spend less time reconciling and more time managing your portfolio.

�Send me an email and let’s talk about how these tools can support your next facility.

Alison.Roth@Computershare.com.

CONTINUE >>

Navigating the Growing Corporate Loan Market

By Alison Roth

SVP, Division Manager, �CLO and Leveraged Loan Services

In the growing corporate loan market, collateral agents and trustees can play a pivotal role as strategic partners to drive success. Our clients know Computershare Corporate Trust as their trusted partner who understands the need for high-touch, specialized CLO and loan administration...

CONTINUE >>

Navigating the Growing Corporate Loan Market

By Alison Roth

SVP, Division Manager, �CLO and Leveraged Loan Services

In the growing corporate loan market, collateral agents and trustees can play a pivotal role as strategic partners to drive success. Our clients know Computershare Corporate Trust as their trusted partner who understands the need for high-touch, specialized CLO and loan administration services. Our 20+ year tenure in the corporate loan market has given us the insight to tailor custom workflows for complex structures that meet the unique needs of each asset manager.

�Yet excellence isn’t the finish line, it’s just the first step. Thanks to innovative technology enhancements that make us faster, more efficient, and even more attuned customer needs, the service our clients rely on is being redefined. In the first quarter of 2025, we are streamlining our internal tools and processes to meet the evolving needs of the market.

�Data Consumption and Tie-Out

�The increase in volume of CLOs and ABL facilities that we are seeing in the market may imply greater exposure to more borrower names to track, and different compliance attributes for asset managers, creating the need for frequent and more detailed monitoring of loans attributes and compliance tests.

�We are proud to offer reporting solutions that are tailored to the unique needs of the manager, now integrated with data consumption tools for client data ingestion and data tie-out tools and feeds to ensure date transparency and accuracy.

�Automating Calculations

�Our commitment goes beyond basic reporting. We’re also meeting the need for more detailed analysis of performance metrics and cash flows by automating calculations and reporting for portfolio managers, created specifically for ABL/Borrowing Base lenders based on their requirements as well as their lender’s requirements.

�Here is the exciting part: These advancements aren’t just improving how we service private credit—we’re extending these capabilities into the broadly syndicated loan space as well, bringing our signature focus to an even larger stage.

�Be it CLOs, ABL facilities, credit facilities, BDCs, or private credit funds, we’re excited to bring a superior client experience through enhanced internal processes. With strides into a wider array of loan markets at scale, the Computershare team is here to ensure our clients succeed in every corner of the corporate loan landscape.

What are you seeing in the market and how is it affecting your portfolio? �Send me a note at Alison.Roth@Computershare.com.

Delivering Speed, Accuracy, and Automation to Asset-Based Lending Facilities�

Read More

CLO Series:�Navigating the Growing Corporate Loan Market

BLOG POST

NEWS ARTICLE

Read More

CLO Series:

How a CLO Trustee Can Free You Up to Focus on Strategy

BLOG POST

PRESS RELEASE

Read More

CLO Series:

The Evolution of Private Credit and Its Impact on CLO

BLOG POST

INFOGRAPHIC

Delivering Speed, Accuracy, and Automation to Asset-Based Lending Facilities

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

The Computershare Corporate Trust team now uses automated borrowing base calculations for faster processing and easier tracking of liabilities and key events.

Our transparent waterfall reporting provides line-by-line distributions aligned with deal terms.

Automated concentration tests streamline compliance oversight and scale across complex portfolios.

In a world of increasingly complex private debt structures, today’s loan facilities demand faster insights, precise compliance, and tools that scale. One of the most persistent challenges in this space has been the tension between Excel’s modeling power and its lack of scalability or consistent data governance. Computershare Corporate Trust is addressing that challenge with a suite of new internal capabilities designed to support faster, smarter administration of complex credit facilities.

By automating borrowing base calculations, streamlining waterfall management, and enabling high-precision concentration testing, we’re helping our clients reduce friction, increase transparency, and unlock greater operational efficiency.

�Power Without Scale

�Collateral administrators have long relied on spreadsheets to manage borrowing bases, waterfall distributions, and compliance checks. But as portfolios grow, the manual burden of building and maintaining these models becomes unsustainable. With no centralized structure, analysts must rebuild models for each deal, introducing delays, inconsistencies, and operational risk.

�Borrowing Base Automation: Faster Processing, Smarter Oversight

�With new investments in technology, Computershare now automates borrowing base calculations and customizes them to each facility’s structure. We also automate internal modeling and reporting of the available capacity, liabilities, and key events, unencumbered by manual processes that slow things down. Historical data views and built-in back-testing functions allow for clear traceability of how each figure was derived. Plus, our Excel plugin enables us to pull data directly for our clients, combining flexibility with structure.

�Waterfall Management: Know Where Every Dollar Goes

�Our waterfall reporting capabilities deliver automated, line-by-line distribution reports down to the tranche and expense level. Our clients get clear outputs that mirror the governing terms of each deal, eliminating guesswork and reducing reconciliation delays.

�Concentration Tests: Precision at Scale

�Our automated concentration testing flags exposures and thresholds across evolving portfolios with speed and accuracy. This streamlines compliance monitoring and supports reporting.

�Behind the Scenes: The Best of Both Worlds

�Excel, although a powerful calculation tool, is difficult to govern or scale. Our new operational capabilities bring existing Excel models into a centralized environment where calculation models are contained in a library, data flows are standardized, and reporting logic is consistent across multiple deals.

�Built-in reconciliation tools help us identify breaks and tie out calculations faster. Custom reporting frameworks ensure we can adapt to unique deal structures, while maintaining consistency across the broader portfolio.

�The Bottom Line

�You don’t need to adopt a new system to benefit from ours. By investing in automation, Computershare delivers faster turnarounds, higher accuracy, and stronger governance—so you can spend less time reconciling and more time managing your portfolio.

�Send me an email and let’s talk about how these tools can support your next facility.

Alison.Roth@Computershare.com.

Navigating the Growing Corporate Loan Market

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

Collateral agents and trustees can function as strategic partners in the expanding CLO and ABL market, offering tailored and high-touch services.

Computershare is investing in modern technology and tools to deliver information to clients faster than ever before and continue its excellent customer service.

These capabilities also enable us to scale our CLO and ABL Facility business and become even more efficient.�

In the growing corporate loan market, collateral agents and trustees can play a pivotal role as strategic partners to drive success. Our clients know Computershare Corporate Trust as their trusted partner who understands the need for high-touch, specialized CLO and loan administration services. Our 20+ year tenure in the corporate loan market has given us the insight to tailor custom workflows for complex structures that meet the unique needs of each asset manager.

�Yet excellence isn’t the finish line, it’s just the first step. Thanks to innovative technology enhancements that make us faster, more efficient, and even more attuned customer needs, the service our clients rely on is being redefined. In the first quarter of 2025, we are streamlining our internal tools and processes to meet the evolving needs of the market.

�Data Consumption and Tie-Out

�The increase in volume of CLOs and ABL facilities that we are seeing in the market may imply greater exposure to more borrower names to track, and different compliance attributes for asset managers, creating the need for frequent and more detailed monitoring of loans attributes and compliance tests.

�We are proud to offer reporting solutions that are tailored to the unique needs of the manager, now integrated with data consumption tools for client data ingestion and data tie-out tools and feeds to ensure date transparency and accuracy.

�Automating Calculations

�Our commitment goes beyond basic reporting. We’re also meeting the need for more detailed analysis of performance metrics and cash flows by automating calculations and reporting for portfolio managers, created specifically for ABL/Borrowing Base lenders based on their requirements as well as their lender’s requirements.

�Here is the exciting part: These advancements aren’t just improving how we service private credit—we’re extending these capabilities into the broadly syndicated loan space as well, bringing our signature focus to an even larger stage.

�Be it CLOs, ABL facilities, credit facilities, BDCs, or private credit funds, we’re excited to bring a superior client experience through enhanced internal processes. With strides into a wider array of loan markets at scale, the Computershare team is here to ensure our clients succeed in every corner of the corporate loan landscape.

What are you seeing in the market and how is it affecting your portfolio? �Send me a note at Alison.Roth@Computershare.com.

How a CLO Trustee Can Free You Up to Focus on Strategy

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

As the private credit market expands, financing structures are becoming more complex, requiring careful management and expertise.

It is more important than ever to work with a collateral agent and trustee who can keep pace with these complexities and help you achieve your financial objectives.

To avoid miscommunication, inefficiencies, and compliance risks, seek a collateral agent or trustee with a dedicated point of contact, proven expertise, fast onboarding, and seamless loan administration.

As a collateral agent and trustee, the Computershare team constantly anticipates challenges and ensures milestones are met under pressure. In fact, a client of ours recently thanked us for completing multiple transactions that “had a ton of moving pieces on an expedited timeline,” for which our “speed, accuracy, flexibility, expertise, and partnership mentality…[was] greatly appreciated and [didn’t] go unnoticed.”

�It is kind words like these that remind me of what is at stake for asset managers and issuers. Indeed, the growth in size and complexity of the private credit market underscores the need to choose a collateral agent or trustee of the right caliber, no matter the market segment. To ensure smooth operations and stakeholder confidence throughout your deal’s lifecycle, here are four common pitfalls to avoid when evaluating a CLO trustee and loan administrator in today’s market.

�Does the provider have a single point of contact?

�As a client, the last thing you need is to be left in a tangled web of communication, where simple inquiries require endless back-and-forth. A lack of personalized attention can lead to miscommunication, delays, and mistakes.

�A dedicated single point of contact who resolves inquiries in a single conversation saves time and frees you up to focus on strategic decisions. Precise and accurate responses also minimize the risk of misinformation, safeguarding your peace of mind and the interests of your investors and lenders. Additionally, having a team of experts coordinating closely across sales, relationship management and account management ensures that you are always informed of important developments and supported fully.

�Does the collateral agent/trustee have sufficient ABL Facility and CLO experience?

�A less experienced collateral agent or trustee may lack the insights needed to tailor workflows that account for the unique ways you process and track loans. Consider their track record. How many ABL Facilities and CLOs have they administered? Evaluating both the team’s individual expertise and combined years of experience can provide a clearer picture of their capabilities and experience with a transaction’s life cycle. Additionally, a provider experienced in a broader offering of structured finance services has more experience with which to address unusual circumstances should they arise.

�Can the collateral agent/trustee onboard and set up the account quickly?

�In a fast-paced environment, deal timelines can be aggressive, and you need a collateral agent and trustee that can close multiple transactions quickly. Mismanaged timelines may delay the pre-closing stage.

�A dedicated business negotiations team with full control over the pre-close and closing process may be able to move faster than one that relies on multiple teams. A consultative, agile approach that helps you solve for any unique circumstances is critical to a successful closing. Additionally, robust collaboration is paramount to an effective transition from closing to the relationship management team. This streamlines compliance and reporting set-up and gets your transaction onboarded in the collateral agent/trustee’s systems efficiently and accurately.

�Is the collateral agent/trustee’s loan administration and client service model efficient?

�Once a deal closes, an inefficient and disconnected client service model can create unnecessary headaches. Strong organizational structure is needed to ensure your ABL Facility or CLO runs like clockwork. It’s important to ensure your provider’s loan administration, relationship management and client service teams work closely to ensure seamless administration of your CLO or ABL facility.

�The corporate loan market is a complex, high-stakes arena. To succeed, you need a collateral agent or trustee that goes beyond templates to create tailored solutions. By keeping these potential pitfalls in mind, you can ensure CLO compliance and protect investor confidence.

What are you seeing in the market and how is it affecting your portfolio? �Send me a note at Alison.Roth@Computershare.com.

The Evolution of Private Credit and Its Impact on CLO

By Alison Roth – SVP, Division Manager, CLO and Leveraged Loan Services

As the private credit market continues to grow, asset managers financing loan originations through CLOs and leveraged loan facilities must contend with the complexities of portfolio management and credit oversight.

Increased exposure to various types of financing structures with concentration and portfolio coverage tests creates a heightened need for more frequent and detailed monitoring of loan data and portfolio performance.

In today’s market, transparency, automation, and efficiency in data reporting are essential in maintaining a competitive advantage.

As more asset managers’ loan origination volumes continue to grow through the private credit market, the lines between middle market and broadly syndicated loans (BSL) can no longer be viewed in the same manner as they have been in years past. Once dominated by large banks and a small population of lenders, loan originations by nonbank lenders without broad syndication is becoming increasingly popular. This shift is driven by growing demand for private credit solutions amid increased bank regulation and market dislocation, with investors searching for higher yields. However, as this trend continues, asset managers issuing CLOs in this space must contend with a host of new complexities.

The private credit market has grown from roughly $725 billion in 2018 to roughly $1.7 trillion in 2023, with asset managers in the upper middle market segment finding different ways to finance their origination. Larger loans may represent a greater share of their portfolio, thereby increasing exposure to a single borrower or sector. To mitigate this risk, managers are finding diverse ways to finance their origination platform which requires more frequent and more detailed monitoring of their financing vehicles. Failing to manage various financing structures, each with their own unique tests, across an increased number of borrower names they are tracking could lead to market dislocation and portfolio instability.

Furthermore, private credit managers need support for more complex loan terms, extensive deal negotiations with syndicate members, and accompanying legal documentation. In the initial stages of a deal, a trusted third party is needed for understanding deal mechanics and portfolio tests while conducting the calculations outlined in governing agreements.

Finally, as test requirements for credit facilities and CLOs evolve, there is greater demand for more robust data, analytics, and reporting support. Asset managers need to be able to track, analyze, and report on more complex loan portfolios while ensuring the data is reconciled against their counterparties. Inaccuracies and delays in data could impact portfolio performance, trigger compliance violations, and delay CLO waterfall calculations—not to mention erode investor confidence. In today’s market, transparency, automation, and efficiency in data reporting are no longer optional—they are critical to one’s competitive edge.

As the corporate loan market evolves, asset managers must consider how these changes will affect not only their financial objectives, but also engage trusted partners dedicated to the administration of their CLOs and leveraged loan facilities.

What are you seeing in the market and how is it affecting your portfolio?

Send me a note at Alison.Roth@Computershare.com.

Read More

CLO Series:�Delivering Speed, Accuracy, and Automation to ABL

BLOG POST

NEWS ARTICLE

LEARN MORE

Interested in learning more?

Go to our awesome demo video library page

Standardized reporting, and downloadable portfolio and transaction data strengthen oversight for managers.

Transparent data governance

Internal capabilities and calculation libraries to onboard multiple transactions with speed and accuracy.

Fast transaction onboarding

Reconciliation tools to ensure data integrity between deal parties.

Transparency of data and calculations through client portals.

Automation for borrowing base, compliance testing, and asset-based lending (ABL) waterfall reporting reduces manual work and lowers operational risk.

Technology that reduces risk of errors

The Computershare CLO advantage?

There isn’t just one.

Scale your CLOs and ABL facilities with precision

Scale your CLOs and ABL facilities with precision

Computershare Corporate Trust provides the tools, clarity, and support to guide their clients toward successful CLO and ABL management.

We pair experienced service teams with TrustConnect™ �CLO-ABL Direct — a modern client portal that delivers transparent data, test calculations, and custom reporting. When so many paths can lead to confusion, Computershare puts you on the path of simplicity.

Scale your CLOs and ABL facilities with precision

Scale your CLOs and ABL facilities with precision

Computershare Corporate Trust provides the tools, clarity, and support to guide our clients toward successful CLO and ABL management.

We pair experienced service teams with TrustConnect™ CLO-ABL Direct — a modern client portal that delivers transparent data, test calculations, and custom reporting. When so many paths can lead to confusion, Computershare puts you on the path of simplicity.

Watch Soon

Borrowing Base�Calculations�

DEMO VIDEO

INFOGRAPHIC

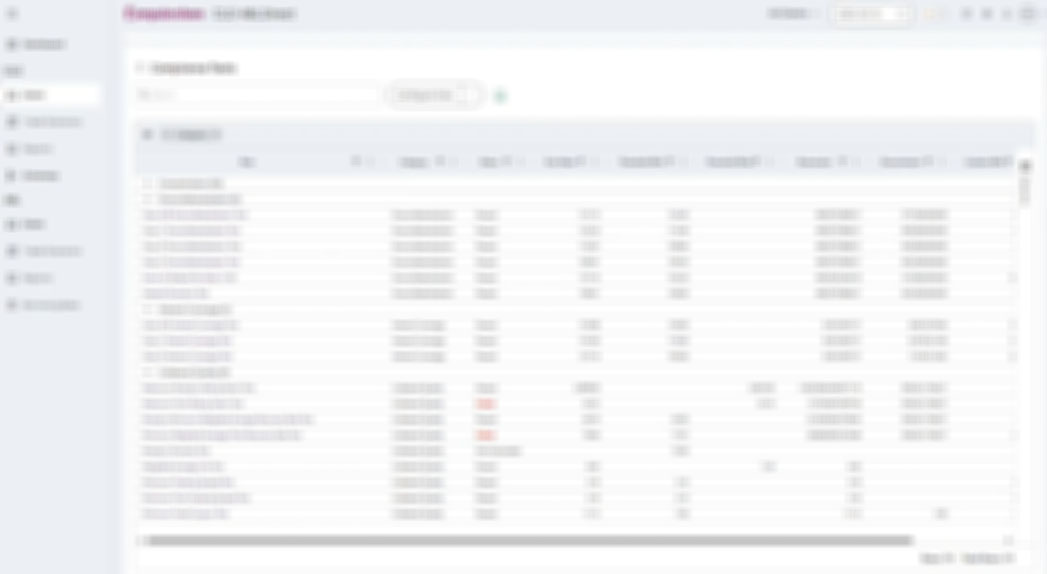

Watch Now

Compliance�Testing�(1:12)

DEMO VIDEO

PRESS RELEASE

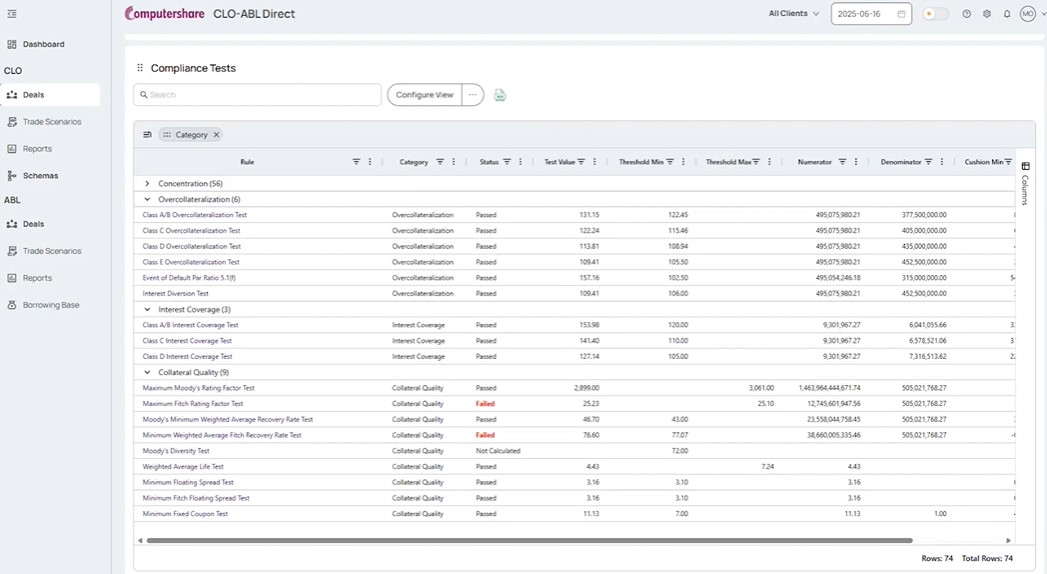

Watch Now

Collateral �Distributions�(1:26)

DEMO VIDEO

NEWS ARTICLE

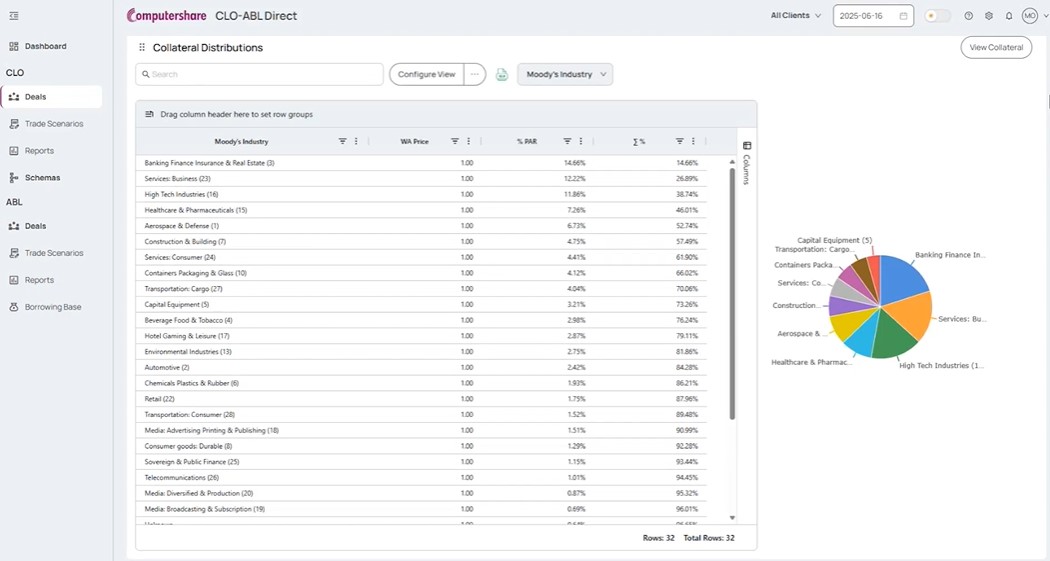

Watch Now

Portal�Overview�(1:47)

DEMO VIDEO

NEWS ARTICLE

COMING SOON

COMING SOON

Portal Overview

Collateral Distributions

Compliance Testing

Borrowing Base Calculations

Daily reconciliations and customized calculations keep portfolios current and reporting dependable as your deal count grows.

Accuracy at scale

A dedicated team that knows your deals coordinates your needs across different transaction types.

High-touch service

Seasoned teams with broad structured finance experience bring proactive problem solving to CLOs, ABLs, BDCs, and private credit funds.

Cross-trained expertise

Get a custom demo

The Computershare CLO advantage?

There isn’t just one.

REQUEST YOUR DEMO

REQUEST YOUR DEMO

Demo Video Library

Free eBook

A Blueprint for CLOs, Private Credit, and Asset-Based Lending

Download Now

Download Now

Operating at Scale

Free Download

Questions to Ask When Choosing a Trustee to Facilitate Your CLO Deals

Download Now

ebook