© Computershare Limited 1996 - 2025.

All rights reserved.

Contact Us

Enter your details and we'll connect you with the right team member.

Read More

Computershare wins certificate administrator race for second straight year

NEWS ARTICLE

Read More

PRESS RELEASE

Read More

INFOGRAPHIC

Read More

INFOGRAPHIC

Computershare redefines traditional depository model with suite of deposit options

Questions to Ask When Choosing a Trustee to Facilitate Your ABS Deals

Questions to Ask When Choosing a Collateral Trust Provider

Additional resources and news from Computershare Corporate Trust.

Latest Insights

Learn More

Mortgage-Backed Securities

Asset-Backed Securities

CLO & Loan Services

ABL Facilities

Delaware Statutory Trust

Structured Finance

Learn More

Corporate Finance

Business Escrow

Municipal Debt

Successor Trustee

Collateral Agent

Conventional Debt

Learn More

Business Escrow

1031 Exchange

Collateral Trust

Loan Administration

Securities Custody

Trust & Agency Services

Learn More

Our TrustConnect

platform is a single online source that provides a streamlined experience for accessing your corporate trust account data

TrustConnect™

We offer a wide range of services that fulfill our clients’ unique and emerging needs.

Find Your Solution

Structured Finance | Conventional Debt | Trust & Agency Services | TrustConnect™

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™

|

|

|

CONTACT US

Why Computershare

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™ Technology

Contact Us

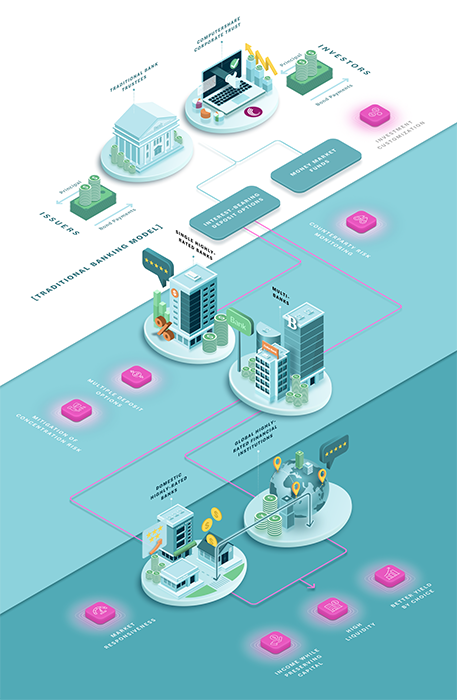

Global Banking Model

With an extensive network of resources

and long-standing relationships across

the globe, Computershare is a financial

and administrative partner who is able

to innovate and grow along with you.

Computershare Corporate Trust (CCT) offers a wider array of deposit products through our global network of approximately 20 different banking partners.

Our Global Banking Model allows us to offer a wider variety of investment yield options and is likely to decrease the concentration risk that arises from having balances at a single financial institution.

Free Download

Comparing the Benefits of a Global Banking Model vs. Traditional Model

Download Now

Download Now

CONTACT US >>

<< PREVIOUS

Yield: Is the trustee able to help me leverage the rate environment?

Computershare Corporate Trust’s network of banking partners is uniquely situated to provide customers the greatest flexibility in this regard, and we are excited to see how this approach can continue to add

value for our clients.

Our range of banking partners gives clients the ability to tailor preferences or design personalized deposit options to better meet their financial needs. Our global banking model is a positive change that provides flexibility and value for our clients.

For more information on how Computershare Corporate Trust can help you meet the needs of your most complex transactions, contact us using the form below.

Yield:

Is the trustee able to help me leverage the rate environment?

CONTINUE >>

<< PREVIOUS

Risk management: How does the trustee monitor client counterparty risk?

The Computershare Treasury team regularly assesses all of our banking partners for any adverse ratings activity or information that could impact any balances. Addressing concentration risk is inherent to Computershare Corporate Trust’s new global banking model, providing sound risk management practices and peace of mind to our clients.

Customization: To what degree can the trustee cater to my deposit and return preferences?

Computershare Corporate Trust’s global banking network ensures that you will be able to choose from a wide array of deposit products that meet the credit rating and liquidity requirements for your transaction as required by the governing documents.

Customization:

To what degree can the trustee cater to my deposit and return preferences?

Risk management:

How does the trustee monitor client counterparty risk?

CONTINUE >>

<< PREVIOUS

Not only does this allow Computershare to offer a wider variety of investment yield options, but it also is likely to decrease the concentration risk that arises from having balances at a single financial institution.

When selecting a service provider for your structured finance, conventional debt, and trust & agency needs, you should always consider these four attributes:

Stability: Can I rely on the trustee to perform over the entire life of the deal?

With decades of industry experience and over $5 trillion of debt under administration*, Computershare Corporate Trust has proven itself to be a reliable industry leader to a wide variety of clients. We continue to fulfill our clients’ unique and changing transactional needs as we leverage our global banking network.

Stability:

Can I rely on the trustee to perform over the entire life of the deal?

CONTINUE >>

Four benefits of a global banking model

By Joseph McMahon

Change can be disruptive, but it is often a blessing in disguise that leads to a better way of doing things. This certainly is the case when it comes to the cash and investment activities of trust and agency accounts administered by Computershare Corporate Trust. For nearly two decades leading Corporate Trust Investment Solutions at Wells Fargo Corporate Trust Services, I engaged solely with Wells Fargo’s internal investment partners when it came to administering deposit balances.

As the Head of Treasury at Computershare Corporate Trust, I have witnessed a remarkable change that is expected to benefit our clients in numerous ways. Instead of engaging with only a single depository institution, Computershare is now able to offer a wider array of deposit products through our global network of approximately 20 different banking partners.

Additional resources and news from Computershare Corporate Trust.

Latest Insights

Understand the benefits of a global banking model versus a traditional one.

Click on the diagram to learn more

While single-bank corporate trust providers may offer a range of investment offerings, cash deposit options are typically limited to the single banking institution and its credit ratings.

With a greater number of available deposit options among a group of investment grade banks, or potential combinations thereof, the distribution of cash deposits can be tailored to potentially generate higher yields.

◕ Traditional Banking Model

◕ Global Banking Model

Better Yield by Choice

Liquidity levels are generally the same, as the underlying money market funds and interest-bearing deposits are not materially different.

Offers choice to clients based upon the product that best suits their requirements, including maintaining high levels of liquidity.

● Traditional Banking Model

● Global Banking Model

High Liquidity

Traditional model is rated as the same in this regard.

In both models, clients earn interest income on their balances. Due to potentially higher yields by choice, income has the potential to increase.

● Traditional Banking Model

● Global Banking Model

Income While Preserving Capital

A corporate trust provider limited to a single bank can move funds into investment product offerings but does not have access to an external network of banking partners.

The CCT team can react quickly, working with clients to reallocate funds in response to changes in the market, and clients can move or change investment platforms in accordance with their preferences.

◑ Traditional Banking Model

◕ Global Banking Model

Market Responsiveness

When limited to a single deposit bank, cash balances are subject to greater concentration risk.

CCT provides clients the ability to mitigate concentration risk that arises from having balances at a single institution in the event of a failure of the deposit institution. By offering clients access to the Computershare global network of highly-rated financial institutions, CCT has developed an array of deposit options that meet client demands, as well as the credit rating and liquidity requirements of governing agreements.

◔ Traditional Banking Model

● Global Banking Model

Concentration Risk Mitigation

The traditional banking model in corporate trust is limited to a single institution that could be subjected to downgrades.

The Computershare global banking model allows clients to choose from multiple interest-bearing deposit options spanning both domestic FDIC-insured banks and global institutions. Clients can choose a single or multi-bank approach and can select deposit options according to bank ratings as well.

◔ Traditional Banking Model

● Global Banking Model

Multiple Deposit Options

The safety of the client deposit is tied to the credit risk of that single institution, potentially placing cash balances at risk.

CCT actively monitors both market risk and the rating downgrades of our banking partners to comply with the major metrics allowed in our deal documents. CCT partners with financial institutions, such as domestic FDIC-insured and international banks, that are highly-rated by S&P, Moody’s or Fitch to administer the deposit and investment activities of trust and agency clients.

◔ Traditional Banking Model

● Global Banking Model

Counterparty Risk Monitoring

The traditional banking model in corporate trust is limited to a single institution that could be subjected to downgrades.

Computershare Corporate Trust (CCT) offers curated investment options including money market funds and interest-bearing deposit options, with different return targets for conventional debt, structured finance, as well as trust and agency clients. Deposit options can be selected according to the client’s investment preferences, as well as minimum credit rating and liquidity requirements.

◑ Traditional Banking Model

◕ Global Banking Model

Curated Investment Options

Structured Finance

TrustConnect™

Why Computershare

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™ Technology

Contact Us

Additional resources and news from Computershare Corporate Trust.

Tap the diagram buttons to learn more

Free Download

Questions to Ask When Choosing a Trustee to Facilitate Your ABS Deals

Download Now

© Computershare Limited 1996 - 2024.

All rights reserved.

Learn More

Mortgage-Backed Securities

Asset-Backed Securities

CLO & Loan Services

ABL Facilities

Delaware Statutory Trust

Structured Finance

Learn More

Corporate Finance

Business Escrow

Municipal Debt

Successor Trustee

Collateral Agent

Conventional Debt

Learn More

Business Escrow

1031 Exchange

Collateral Trust

Loan Administration

Securities Custody

Trust & Agency Services

Learn More

Our TrustConnect

platform is a single online source that provides a streamlined experience for accessing your corporate trust account data

TrustConnect™

We offer a wide range of services that fulfill our clients’ unique needs.

Find Your Solution

Enter your details and we'll connect you with the right team member.

Contact Us

Global Banking Model

Computershare offers an array of deposit products through our global network of different

(More...)

Four benefits of a global banking model

by Joseph McMahon

Change can be disruptive, but it is often a blessing in disguise that leads to a better way of doing things. This certainly is the case when it comes to the cash and investment activities of trust and agency accounts administered by Computershare Corporate Trust. For nearly two decades leading Corporate Trust Investment Solutions at Wells Fargo Corporate Trust Services, I engaged solely with Wells Fargo’s internal investment partners when it came to administering deposit balances.

As the Head of Treasury at Computershare Corporate Trust, I have witnessed a remarkable change that is expected to benefit our clients in numerous ways. Instead of engaging with only a single depository institution, Computershare is now able to offer a wider array of deposit products through our global network of approximately 20 different banking partners.

Not only does this allow Computershare to offer a wider variety of investment yield options, but it also is likely to decrease the concentration risk that arises from having balances at a single financial institution.

Computershare Corporate Trust’s range of banking partners gives clients the ability to tailor preferences or design personalized deposit options to better meet their financial needs. Our global banking model is a positive change that provides flexibility and value for our clients.

When selecting a service provider for your structured finance, conventional debt, and trust & agency needs, you should always consider these four attributes:

Stability:

Can I rely on the trustee to perform over the entire life of the deal?

With decades of industry experience and over $5 trillion of debt under administration*, Computershare Corporate Trust has proven itself to be a reliable industry leader to a wide variety of clients. We continue to fulfill our clients’ unique and changing transactional needs as we leverage our global banking network.

Risk Management:

How does the trustee monitor client counterparty risk?

The Computershare Treasury team regularly assesses all of our banking partners for any adverse ratings activity or information that could impact any balances. Addressing concentration risk is inherent to Computershare Corporate Trust’s new global banking model, providing sound risk management practices and peace of mind to our clients.

Customization:

To what degree can the trustee cater to my deposit and return preferences?

Computershare Corporate Trust’s global banking network ensures that you will be able to choose from a wide array of deposit products that meet the credit rating and liquidity requirements for your transaction as required by the governing documents.

Yield:

Is the trustee able to help me leverage the rate environment?

Computershare Corporate Trust’s network of banking partners is uniquely situated to provide customers the greatest flexibility in this regard, and we are excited to see how this approach can continue to add value for our clients.

For more information on how Computershare Corporate Trust can help you meet the needs of your most complex transactions, contact us using the form below.

*Data for the 12-months ending 06/30/2022. DUA includes all issues within the paying agency system of record. All totals are in USD. CAD to USD exchange rate .78 on 06/30/2022.

Additional resources and news from Computershare Corporate Trust.

Latest Insights

Four benefits of a global banking model

Change can be disruptive, but it is often a blessing in disguise that leads to a better way of doing things. This certainly is the case when it comes to the cash and investment activities of trust and agency accounts administered by Computershare Corporate Trust.

(More...)

Additional resources and news from Computershare Corporate Trust.

Latest Insights

By Joseph McMahon

Comprehensive solutions for your most complex corporate trust needs.

Conventional Debt

Corporate Finance | Business Escrow

Municipal Debt | Successor Trustee�Collateral Agent and more

LEARN MORE

Trust & Agency Services

Business Escrow | 1031 Exchange �Collateral Trust | Loan Administration

Securities Custody and more

LEARN MORE

Structured Finance

Mortgage-Backed & Asset-Backed Securities CLO & Loan Services | Delaware Statutory Trust

Longevity Services and more

LEARN MORE

TrustConnectTM

Our TrustConnect platform is a single online source that provides a streamlined experience for accessing your corporate trust data

LEARN MORE

Cat Bond Offering

Choose your new cat bond partner with confidence. With dedicated experts, personalized service, and easy onboarding, Computershare is well suited to support your cat bond needs.

LEARN MORE

Enter your details and we'll connect you with the right team member.

Enter your details and we'll connect you with the right team member.

Contact Us

Contact us to know the feeling

Comprehensive solutions for your most �complex corporate trust needs.

Conventional Debt

Corporate Finance | Business Escrow Municipal Debt | Successor Trustee�Collateral Agent and more

LEARN MORE

Trust & Agency Services

Business Escrow | 1031 Exchange �Collateral Trust | Loan Administration

Securities Custody and more

LEARN MORE

Structured Finance

Mortgage-Backed & Asset-Backed Securities CLO & Loan Services | Delaware Statutory Trust | Longevity Services and more

LEARN MORE

TrustConnectTM

Our TrustConnect platform is a single online source that provides a streamlined experience for accessing your corporate trust data

LEARN MORE

Cat Bond Offering

Choose your new cat bond partner with confidence. With dedicated experts, personalized service, and easy onboarding, Computershare is well suited to support your cat bond needs.

LEARN MORE

Enter your details and we'll connect you with the right team member.

Contact Us

Enter your details and we'll connect you with the right team member.

Contact us to know the feeling

Trust feels like peace of mind.

Trust feels like peace of mind.

Contact us to know the feeling

Contact us to know the feeling

Trust feels like peace of mind.

Trust feels like peace of mind.

Contact us to know the feeling

Contact us to know the feeling

Why Computershare

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™ Technology

About Us

Contact Us

CONTACT

CONTACT

Why Computershare

Structured Finance

Conventional Debt

Trust & Agency Services

TrustConnect™ Technology

About Us

Contact Us