Global Enforcement of

While anti-money laundering (AML) continues to dominate global financial crime regulation, enforcement activity is slowing as attention turns from banks to other financial institutions.

An Overview of Financial Crime Fines

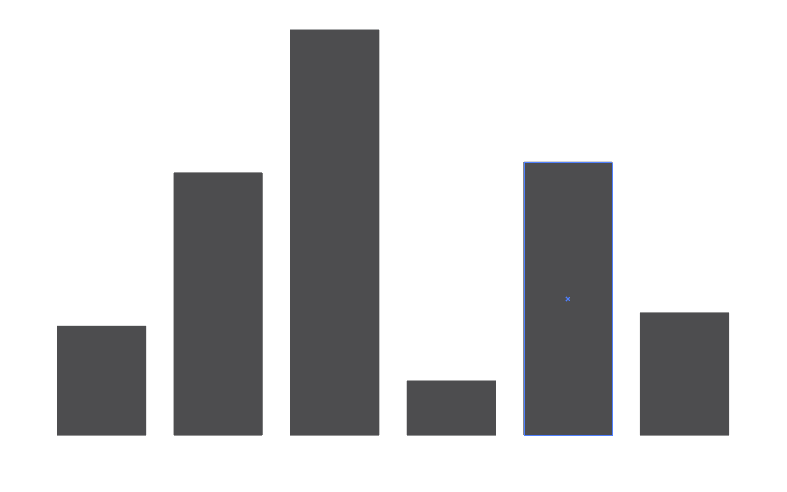

The value of fines issued to financial services firms for AML failings reached a new recent low in 2021 compared to 2020 and represents just half of the peak figure achieved in 2018.

Number of fines issued

56 Total

5

Sanctions

6

Bribery

45

Money Laundering

61 Total

13

Sanctions

3

Bribery

45

Money Laundering

2018

2017

2019

65 Total

7

Sanctions

6

Bribery

52

Money Laundering

2020

2019

64 Total

7

Sanctions

23

Bribery

34

Money Laundering

2018

69 Total

11

Sanctions

34

Bribery

24

Money Laundering

2020

2019

2019

2018

2020

2017

2016

2018

2016

2017

Value of fines levied*

2020

2019

$4,675 mn Total

$27 mn

Sanctions

$2,427 mn

Bribery

$2,222 mn

Money Laundering

2019

2018

2020

$3,259 mn

Sanctions

$48 mn

Bribery

$444 mn

Money Laundering

2018

2017

2019

2020

$538 mn

Sanctions

$220 mn

Bribery

$3,297 mn

Money Laundering

2017

2016

2018

2019

2016

2017

2018

$31 mn

Sanctions

$7,497 mn

Bribery

$889 mn

Money Laundering

$3,751 mn Total

$4,054 mn Total

$3,947 mn Total

$102 mn

Sanctions

$1,709 mn

Bribery

$2,136 mn

Money Laundering

$8,417 mn Total

An Increase in Number of Fines

Globally, the number of fines issued in 2020 was

at the same level as those in 2019, however the

total value of AML enforcement fines is five times higher in 2020 following numerous substantial fines by Nordic regulators. Moreover, fine amounts

in 2021 may reach similarly high levels as previous years, with the total value of AML fines as of June 2021 nearly half of the 2020 and 2017 totals.

Hover over the chart to learn more.

A HISTORY OF AML FINES GLOBALLY

Number of fines

Fine values*

2016

2017

2018

2019

2020

2021

$2,222 mn

$444 mn

$3,297 mn

$2,136 mn

$889 mn

$1,626.6 mn

55

24

34

52

45

45

Jan 1- June 30

Key AML Findings

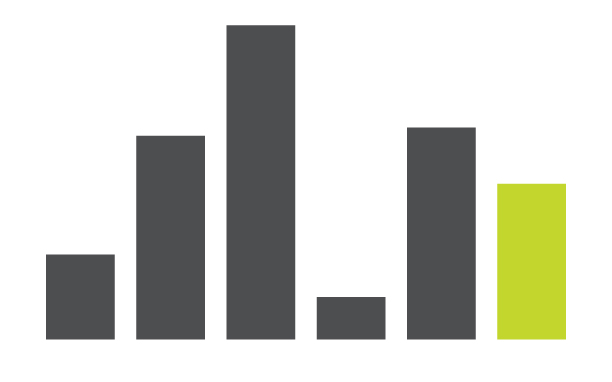

AML management, suspicious activity monitoring, customer due diligence, and compliance oversight are the most frequently cited failings, a trend that

is consistent across all regions globally. Firms should continue investing in these areas to minimize their financial crime risk and potential exposure to regulatory enforcement action.

U.S.

AML Management

Customer Standard Due Diligence/Monitoring

Suspicious Activity Monitoring

Compliance Monitoring and Oversight

Record Keeping

Systems and Controls

Regulatory Reporting

Customer Enhanced Due Diligence/Monitoring

Staff Training and Competency

Risk Management

Client Onboarding

Internal Audit

Sanctions Management

Supervision of Relevant Persons

Management Information

Staff Recruitment

27

72

57

31

18

19

18

15

11

10

6

6

4

8

1

1

Customer Standard Due Diligence/Monitoring

AML Management

Suspicious Activity Monitoring

Compliance Monitoring and Oversight

Customer Enhanced Due Diligence/Monitoring

Regulatory Reporting

Risk Management

Systems and Controls

Staff Training and Competency

Client Onboarding

Record Keeping

Management Information

Staff Recruitment

Third-Party Oversight

Internal Audit

IT Governance

51

43

28

18

19

13

13

14

9

8

8

4

4

3

3

2

APAC

1

2

Sanctions Management

Supervision of Relevant Persons

Customer Standard Due Diligence/Monitoring

AML Management

Suspicious Activity Monitoring

Compliance Monitoring and Oversight

Risk Management

Record Keeping

Systems and Controls

Customer Enhanced Due Diligence/Monitoring

Supervision of Relevant Persons

Staff Training and Competency

Client Onboarding

Management Information

Third-Party Oversight

Regulatory Reporting

27

20

16

11

7

7

7

4

3

4

3

2

2

3

Where regulations are hitting hardest

2016

2017

2018

2019

2020

2021

Jan 1- June 30

2020

2019

2018

2017

2016

Global Regulators: Blockbuster fine in

the Netherlands underlines that the U.S.

no longer dominates AML penalty activity

Since the 2008 financial crisis, regulatory enforcement — particularly of AML activities — was at a high, with the U.S. historically leading the way in issuing fines. More recently, however, the Nordics and Australia have led the way and imposed record levels of enforcement penalties.

Forthcoming changes in EU AML/Countering

the Financing of Terrorism (CFT) legislation

(as proposed by the European Commission in July 2021), including the creation of a new EU AML/CFT supervisory authority, may lead to increased enforcement action and larger fines issued within the EU in the coming years.

U.S. as %

41%

$7.27 mn

France

$441.09 mn

United Kingdom

$3.74 mn

Ireland

$592.69 mn

U.S.

97%

U.S. as %

$19.32 mn

Singapore

$2.73 mn

France

$4.76 mn

United Kingdom

$3.74 mn

Ireland

$858.25 mn

U.S.

72%

U.S. as %

$1.12 mn

Singapore

$346.76 mn

France

$204.22 mn

United Kingdom

$7.45 mn

Ireland

$1,545 mn

U.S.

$2.59 mn

Hong Kong

$28.48 mn

Australia

58%

U.S. as %

$4.50 mn

Singapore

$74.80 mn

France

$1.22 mn

United Kingdom

$0.48 mn

Ireland

$1,909 mn

U.S.

$12.71 mn

Hong Kong

$442.99 mn

Australia

$1.35 mn

Switzerland

$4.36 mn

Luxembourg

$845.68 mn

Netherlands

45%

U.S. as %

$4.50 mn

Singapore

$4.36 mn

France

$127.94 mn

United Kingdom

$0.31 mn

Ireland

$199.09 mn

U.S.

$107.59 mn

Hong Kong

$0.27 mn

Luxembourg

$3.85 mn

Italy

$1.23 mn

Netherlands

$0.12 mn

Canada

15%

U.S. as %

$1.07 mn

Singapore

$0.21 mn

France

$47.45 mn

United Kingdom

$592.69 mn

U.S.

$356.9 mn

Hong Kong

$6.2 mn

Italy

$0.02 mn

Canada

$559.33 mn

Sweden

Hover over the map to view the total fine amounts in each jurisdiction

Focused on Financial Services

Kroll is a global advisor with extensive expertise in a wide range of financial crime prevention areas. Our global team of financial crime specialists assists a wide range of regulated firms to improve their frameworks and arrangements to mitigate risks, meet regulatory requirements, and minimize reputational damage and enforcement action.

About the Global Enforcement Review

Kroll’s Global Enforcement Review 2021 provides insights on global enforcement trends with a focus on the financial services industry. Combining our regulatory experience with analysis of enforcement penalties issued by key regulators around the globe, our aim is to assist firms in understanding the key risks to inform strategic, governance, risk and compliance programs.

In compiling this research and analysis, we have drawn on Corlytics’ extensive RiskFusion Global Enforcement database for the period January 1, 2016, to December 31, 2021. Corlytics is a world leader in determining of regulatory risk impact.

For more information, visit here

Corlytics prioritizes and selects penalties for inclusion

in the database based on the following criteria:

Enforcement penalties are from high priority financial services regulators and cover enforcement actions

against both firms and individuals.

Enforcement penalties greater than

$1 million (mn) or equivalent across all selected regulators. For individuals, the $1 mn threshold does not apply.

All enforcement penalties (including those below

$1 mn) for financial services firms and associated individuals with assets greater than $25 billion.

Anti-Money Laundering Regulation:

Shift in Focus

BREAKDOWN OF FAILINGS

2016

2017

2018

2019

2020

2021

Jan 1- June 30

2021

2020

2019

2017

2016

Total Number of Failings 2016-2021

Total Number of Failings 2016-2021

2018

Jan 1- June 30

12

5

6

1

1

3

3

1

0

1

0

0

0

4

0

0

7

5

6

4

5

1

2

3

2

2

2

2

2

1

0

14

3

12

9

3

1

4

6

4

4

2

2

0

1

1

0

24

9

19

14

6

6

7

3

4

3

1

2

1

1

0

1

5

3

3

1

2

8

1

1

1

0

0

0

1

1

0

0

10

11

2

1

2

1

0

0

1

0

0

0

0

0

Global Total 2016-2021

UK + EU

U.S.

UK + EU

Click to explore the total number of failings by type, year, or region

Global Total 2016-2021

Total Number of Failings 2016-2021

2021*

*Jan 1- June 30

13

8

6

2

3

0

0

0

0

2

2

0

0

0

0

2020

12

6

4

0

3

2

2

1

1

1

2

0

0

1

0

0

2019

6

8

5

6

3

4

3

4

3

3

0

1

1

0

2

0

2018

6

4

5

6

5

4

4

4

3

2

1

2

2

1

1

1

2017

6

3

4

3

3

2

2

2

2

0

1

1

1

1

0

1

2016

8

14

4

2

1

3

1

0

0

0

0

0

0

1

0

0

1

1

0

0

0

0

0

Total Number of Failings 2016-2021

2021

Jan 1- June 30

8

1

3

0

2

1

0

0

0

0

0

0

0

1

2020

2019

5

5

4

3

1

1

2018

8

8

5

3

2

2

1

1

1

0

1

1

2017

3

4

4

3

1

2

2

1

3

2016

4

0

1

3

0

1

4

1

0

1

0

0

0

0

0

0

0

0

0

0

0

1

0

0

0

0

0

1

1

4

1

3

1

0

0

1

0

2

2

1

2

1

1

Customer Standard Due Diligence/Monitoring

AML Management

Suspicious Activity Monitoring

Compliance Monitoring and Oversight

Customer Enhanced Due Diligence/Monitoring

Systems and Controls

Record Keeping

Risk Management

Staff Training and Competency

Client Onboarding

Internal Audit

Sanctions Management

Supervision of Relevant Persons

Management Information

Staff Recruitment

Third-Party Oversight

IT Governance

98

142

101

60

38

40

33

30

24

17

9

5

13

7

5

5

2

*Rounded to the nearest million

*Rounded to the nearest million

Jan 1- June 30

Jan 1- June 30

U.S.

Jan 1- June 30

Jan 1- June 30

Jan 1- June 30

UK + EU

APAC

Global Total 2016-2021

Jan 1- June 30

APAC

Jan 1- June 30

Regulatory Reporting

34

1

2021

2020

2019

2018

2017

2016

Jan 1- June 30

Total Number of Failings 2016-2021

Total Number of Failings 2016-2021

Total Number of Failings 2016-2021

2021

2020

2019

2018

2017

2016

Total Number of Failings 2016-2021

2021

2020

2019

2018

2017

2016

Third-Party Oversight

IT Governance

0

0

0

0

0

0

0

0

0

0

0

0

Third-Party Oversight

IT Governance

Jan 1- June 30

2021

2020

$2,253.5 mn Total

$18.9 mn

Sanctions

$608 mn

Bribery

$1,626.6 mn

Money Laundering

2021

2021

$5.13 mn

Luxembourg

$917.15 mn

Australia

£0.01 mn

Germany

$3.80 mn

Hong Kong

$0.75 mn

Singapore

$1.41 mn

Italy

$578 mn

Netherlands

1

0

0

0

0

2

0

0

0

0

2

Jan 1- June 30

Jan 1- June 30

Jan 1- June 30

Number of fines issued

Jan 1- June 30

2021

2020

67 Total

8

Sanctions

4

Bribery

55

Money Laundering

2020

2019

2021

56 Total

5

Sanctions

6

Bribery

45

Money Laundering

2019

2018

2020

2021

61 Total

13

Sanctions

3

Bribery

45

Money Laundering

2018

2017

2019

2020

65 Total

7

Sanctions

6

Bribery

52

Money Laundering

2017

2016

2018

2019

64 Total

7

Sanctions

23

Bribery

34

Money Laundering

2016

2017

2018

69 Total

11

Sanctions

34

Bribery

24

Money Laundering

2021

2021

Jan 1- June 30

2021

2020

67 Total

8

Sanctions

4

Bribery

55

Money Laundering

Value of fines levied*

*Rounded to the nearest million

2020

2019

$4,675 mn Total

$27 mn

Sanctions

$2,427 mn

Bribery

$2,222 mn

Money Laundering

2019

2018

2020

$3,751 mn Total

$3,259 mn

Sanctions

$48 mn

Bribery

$444 mn

Money Laundering

2018

2017

2019

2020

$4,054 mn Total

$538 mn

Sanctions

$220 mn

Bribery

$3,297 mn

Money Laundering

2017

2016

2018

2019

$3,947 mn Total

$102 mn

Sanctions

$1,709 mn

Bribery

$2,136 mn

Money Laundering

2016

2017

2018

$8,417 mn Total

$31 mn

Sanctions

$7,497 mn

Bribery

$889 mn

Money Laundering

2021

2021

Jan 1- June 30

2021

2020

$2,253.5 mn Total

$18.9 mn

Sanctions

$608 mn

Bribery

$1,626.6 mn

Money Laundering

A HISTORY OF AML FINES GLOBALLY

2016

2017

2018

2019

2020

2021

Jan 1- June 30

24

34

52

45

45

55

*Rounded to the nearest million

$889 mn

$2,136 mn

$3,297 mn

$444 mn

$2,222 mn

$1,626.6 mn

Number of fines

Fine values*

$4.76 mn

United Kingdom

$19.32 mn

Singapore

$2.73 mn

France

$1.12 mn

Singapore

$2.59 mn

Hong Kong

$28.48 mn

Australia

$346.76 mn

France

$7.45 mn

Ireland

$204.22 mn

United Kingdom

$1,545 mn

U.S.

$1,909 mn

U.S.

$199.09 mn

U.S.

$328.91 mn

U.S.

$1.07 mn

Singapore

$356.9 mn

Hong Kong

$6.2 mn

Italy

$559.33 mn

Sweden

$0.21 mn

France

$47.45 mn

United Kingdom

$0.02 mn

Canada

$917.15 mn

Australia

$5.13 mn

Luxembourg

£0.01 mn Germany

$578 mn

Netherlands

$441.09 mn

United Kingdom

$1.23 mn

Luxembourg

$1.41 mn

Italy

$7.27 mn

France

$0.75 mn

Singapore

2021

Jan 1- June 30

7

5

6

4

5

1

2

3

2

2

2

2

2

1

0

0

0

0

14

3

12

9

3

1

4

6

4

4

2

2

0

1

1

0

0

0

24

9

19

14

6

6

7

3

4

3

1

2

1

1

0

1

0

0

5

3

3

1

2

8

1

1

1

0

0

0

1

1

0

0

0

0

10

11

2

1

2

1

0

1

0

1

0

0

0

0

0

0

0

0

12

5

6

1

1

3

3

1

0

1

0

0

0

4

0

0

0

0

Jan 1- June 30

27

72

57

31

18

19

18

15

11

10

6

6

4

8

1

1

0

0

AML Management

Customer Standard Due Diligence/Monitoring

Suspicious Activity Monitoring

Compliance Monitoring

and Oversight

Record Keeping

Systems and Controls

Regulatory Reporting

Customer Enhanced Due Diligence/Monitoring

Staff Training and Competency

Risk Management

Third-Party Oversight

IT Governance

Client Onboarding

Internal Audit

Sanctions Management

Supervision of Relevant Persons

Management Information

Staff Recruitment

2021

2020

2019

2018

2017

2016

Jan 1- June 30

Total Number of Failings 2016-2021

6

3

4

3

3

2

2

2

2

0

1

1

1

1

0

1

0

1

6

4

5

6

5

4

4

4

3

2

1

2

2

1

1

1

0

0

6

8

5

6

3

4

3

4

3

3

0

1

1

0

2

0

1

1

12

6

4

0

3

2

2

1

1

1

2

0

0

1

0

0

0

0

13

8

6

2

3

0

0

0

0

2

2

0

0

0

0

0

0

0

8

14

4

2

1

2

3

1

0

0

0

2

0

0

0

0

0

0

Jan 1- June 30

51

43

28

18

19

13

13

14

9

8

8

4

4

3

3

2

1

2

AML Management

Customer Standard Due Diligence/Monitoring

Suspicious Activity Monitoring

Compliance Monitoring

and Oversight

Record Keeping

Systems and Controls

Regulatory Reporting

Customer Enhanced Due Diligence/Monitoring

Staff Training and Competency

Risk Management

Third-Party Oversight

Client Onboarding

Supervision of Relevant Persons

2021

2020

2019

2018

2017

2016

Jan 1- June 30

Total Number of Failings 2016-2021

Management Information

3

4

4

3

1

2

2

1

3

0

0

0

0

0

8

8

5

3

2

2

1

1

1

0

1

1

0

0

5

5

4

1

3

1

1

0

1

0

0

0

0

1

1

4

1

3

1

0

0

1

0

2

2

1

1

2

8

1

3

0

2

1

0

0

0

0

0

0

0

1

4

0

1

3

0

1

4

1

0

1

0

0

0

0

Jan 1- June 30

27

20

16

11

7

7

7

4

3

4

3

2

2

3

AML Management

Customer Standard Due Diligence/Monitoring

Suspicious Activity Monitoring

Compliance Monitoring

and Oversight

Record Keeping

Systems and Controls

Regulatory Reporting

Customer Enhanced Due Diligence/Monitoring

Staff Training and Competency

Risk Management

Third-Party Oversight

IT Governance

Client Onboarding

Internal Audit

Sanctions Management

Supervision of Relevant Persons

Management Information

Staff Recruitment

98

142

101

60

38

40

34

33

30

24

17

9

5

13

7

5

5

2

2021

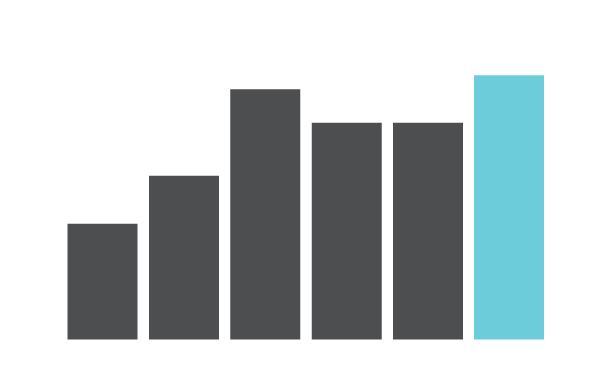

Although there has been an increase in the number

of fines, the total volume of fines is less. The overwhelming historical dominance of the U.S.

in AML-related fines now seems to be a thing of

the past, with the U.S. fines accounting for just

36% of the global total in 2021.

The latest data also highlights the four key AML failings from 2016-2021, which regulators across the world have consistently identified through the fines they imposed, including AML management, suspicious activity monitoring, customer due diligence, and compliance monitoring and oversight.

It is almost impossible to find a major global bank that has not been sanctioned for AML or other financial crime failing in recent years. This is reflective of the predominant focus global regulators have placed on ensuring AML measures

are functioning robustly at the world’s major financial services institutions. Now regulators are increasingly turning their enforcement attention to other financial services companies such as asset managers or cryptocurrency exchanges.

In a further shift of trends, 2021 also saw a new jurisdiction join the “top table”

of countries imposing major fines for AML failings—the Netherlands. Indeed,

in 2021, the Dutch regulator fined one of its major banks $578 million (mn), which alone represented 35% of the total value of AML fines globally.

Meanwhile, 2021 was another busy year for the UK, with AML failings accounting for over half the total value of UK fines issued by the Financial Conduct Authority (FCA) in 2021. In fact, 2021 saw AML fines as the

highest proportion of total fines by the FCA since 2017.

Kroll is a global advisor with extensive expertise

in a wide range of financial crime prevention areas. Our global team of financial crime specialists assists a wide range of regulated firms to improve their frameworks and arrangements to mitigate risks, meet regulatory requirements, and minimize reputational damage and enforcement action.

Enforcement penalties greater than $1 mn or equivalent across all selected regulators. For individuals, the $1 mn threshold does not apply.

All enforcement penalties (including those below $1 mn)

for financial services firms and associated individuals

with assets greater than $25 bn.

$0.24 mn

Belgium

$1.23 mn

Luxembourg

The latest data also highlights the four key AML failings from 2016-2021, which regulators across the world have consistently identified through the fines they imposed, including AML management, suspicious activity monitoring, customer due diligence, and compliance monitoring and oversight.

It is almost impossible to find a major global bank that has not been sanctioned for AML or other financial crime failing in recent years. This is reflective of the predominant focus global regulators have placed on ensuring AML measures are functioning robustly at the world’s major financial services institutions. Now regulators are increasingly turning their enforcement attention to other financial services companies such as asset managers or cryptocurrency exchanges.

$3.80 mn

Hong Kong

$0.24 mn

Belgium