Navigating the New Rules of

New research reveals how digital transformation is impacting the status quo of marketing

Consumers today expect more in exchange for their loyalty, but many consumer product (CP) brands are feeling the pressure to adapt to shifting behaviors and demographics that stem from inflation, supply chain disruptions, market saturation, and more.

That’s why the latest joint study from SAP Emarsys, and Deloitte, titled “The Consumer Products Engagement Report,” explores how digital transformation is impacting the status quo of marketing, both for consumers and brands, especially considering:

of all CP marketers believe they must ADAPT TO CHANGE faster than ever before

The research suggests that transformation is already underway:

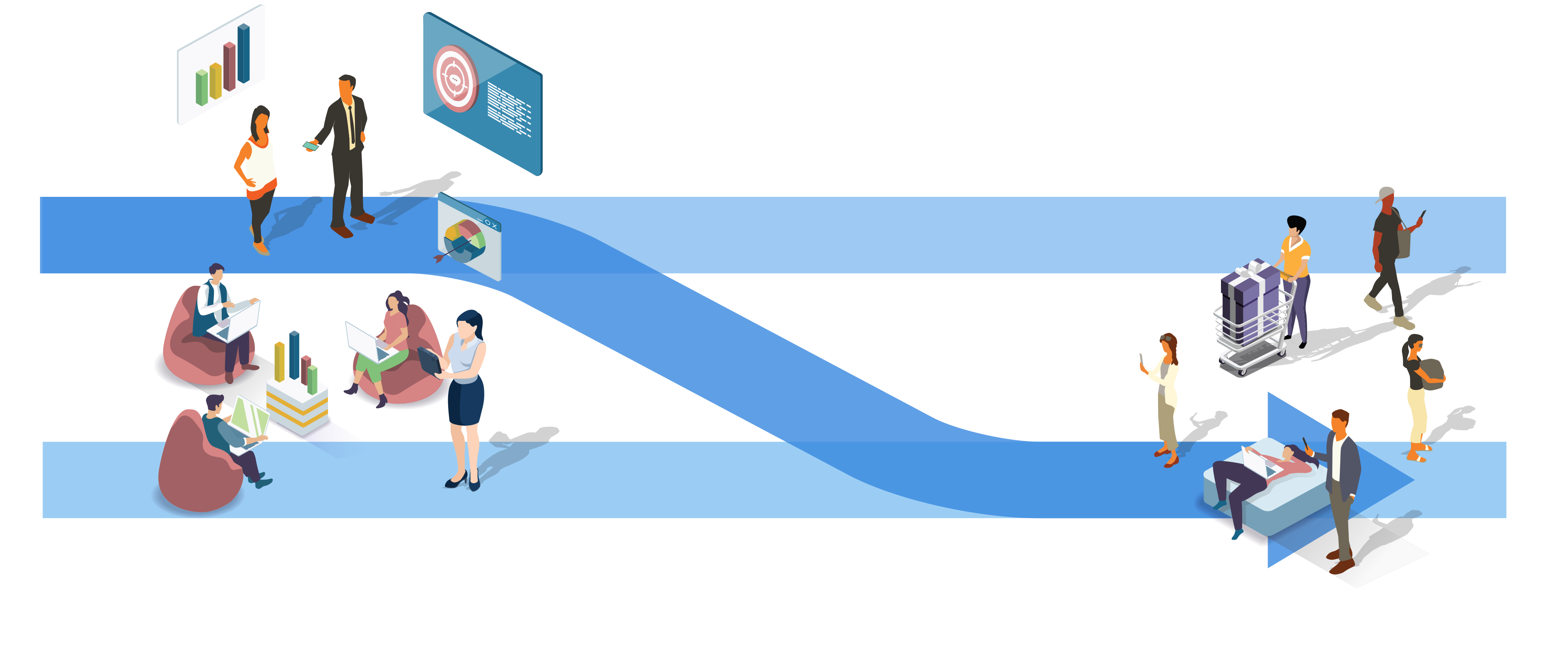

Marketing has entered the Engagement Era.�

In this era, it is critical for brands to differentiate themselves by creating a dialogue with consumers, taking an omnichannel approach across the entire consumer lifecycle—complete with a foundation of connected data across every touchpoint of the business.

Read on to find out...

How are CPs navigating this new era?�

of all CP marketers believe they need to “significantly transform” their company's customer engagement approach in 2025.

of Gen Z say they don’t care about “brands” as long as a CP meets their needs—more than any previous generation.�

How Ferrara Sweetened Its �Direct Consumer Engagement

Ferrara is a sweet snacking manufacturer making well-known brands including NERDS, Jelly Belly, Trolli, SweeTARTS, and more.

John Frieda Masters the Art of Product Launches

The John Frieda brand was founded on the idea of disrupting the haircare industry with salon-quality products tailored to specific hair concerns.

�

Engagement

of Gen Z say they DON'T CARE ABOUT "BRANDS" as long as a consumer product meets their needs—more than any previous generation�

Ferrara needed a way to modernize its consumer engagement platforms and data management systems to address evolving market demands and consumer preferences effectively, but was limited by legacy technologies.

�

By partnering with SAP Emarsys and Deloitte and pivoting to a more data-informed and consumer-centric approach, Ferrara uncovered insights into its fan base, such as the fact that many enjoy Ferrara candies while gaming.

�

59% increase in contactable customers

20% above industry average open rates for email campaigns

300% fan growth of Trolli brand

�

“Our marketing teams are really looking to engage directly with consumers to provide them with content and campaigns, because we want happy brand fans.”

Dan Bartelsen, Director of Information Technology, Business Partners for E-Commerce and Digital, Ferrara�

With a presence in 24 countries and over 88 products, the company found it difficult to effectively connect with consumers. The marketing team needed the ability to identify its audience and increase conversion rates for new products.�

�

By partnering with SAP Emarsys and BlueWheel, John Frieda was able to develop and execute a comprehensive omnichannel launch strategy for the ULTRAfiller+ across email, social media, paid social ads, web, and online and physical stores.

�

#1 most popular product in the John Frieda catalogue

4X conversion rate compared with average CVR

88% of users purchased two or more products

�

“For lifecycle marketing, we wanted to provide personalized experiences for increased conversion rate, develop segmentation strategies for improved retention and conversion, implement automation triggers to nurture current and future customers, and educate our existing audience and identify customer needs for this new product line.”

�Lyla Holt, Global Digital Marketing Manager, Consumer Care

at John Frieda�

85%

56%

88%

85%

89%

35%

53%

56%

85%

57%

71%

of all CP marketers believe they must adapt to change “faster than ever before”.

of all CP marketers believe AI will be essential for engaging new customers.

of all CP marketers share customer engagement data with their financial and operational processes and systems (e.g. Enterprise Resource Planning or ERPs).

plan to improve this in the future.�

of consumers say they’ve made spending cutbacks, but with notable generational differences in where they make those cuts.

of consumers have switched to own-label alternatives because they are more affordable.

of consumers are put off by brands asking for data but not explaining how it will be used.�

E

N

G

A

G

E

M

E

N

T

A

N

A

G

M

T

N

-

Z

E

M

Q

A

Q

U

E

Z

-

N

T

M

G

A

N

A

Q

M

E

L

-

N

T

M

G

R

N

B

Q

M

E

Z

-

N

T

M

G

A

N

A

Q

M

E

Z

-

N

T

M

G

A

1

C

Q

M

E

Z

-

N

T

M

G

A

Y

A

H

M

E

0

-

N

T

M

G

A

7

A

Q

M

P

Z

-

N

T

M

G

A

X

A

Q

M

E

Z

-

N

T

M

G

A

N

A

Q

M

E

Z

-

N

T

M

G

A

N

N

-

M

E

T

A

N

Q

M

A

G

-

M

E

T

A

N

Q

M

A

G

N

What are the priorities enabling data strategies?

What role does Artificial Intelligence play?�

Which channels are brands using to connect with consumers?

How do consumers feel about brands?

How are Gen Z shoppers impacting consumption?�

Adjust your focus to see the transformation

Brought to you by

UNLOCK

HIGH-�LIGHTS

?

of Gen Z say they DON'T CARE ABOUT "BRANDS" as long as a consumer product meets their needs—more than any previous generation�

?

of Gen Z say they DON'T CARE ABOUT "BRANDS" as long as a consumer product meets their needs—more than any previous generation�

SOLUTION

�

CHALLENGE

�

RESULTS

�

SOLUTION

�

RESULTS

�

CHALLENGE

�

SEE THE FULL CASE STUDY

SEE THE FULL CASE STUDY