Retail Pulse Check

A summary of insights identified as part of the Retail Pulse Check Survey conducted by RISnews, Intel and SAP.

A New World of Retail

GET STARTED

Q2: Additional Safety Measures

Q3: Reopening Workspaces

Q8: Shifts in Consumer Demand

Q9: Balancing Supply & Demand

Q4: Changes in Go-To-Market

Q5: Consumer Interaction Changes

Q6: E-commerce Acceleration

Q7: Trade Spend Changes

Q10:Top Supplier Relationships

Q11: Raw/Packaging Materials

Q12: Visibility to At-Risk Suppliers

Q13: Alternate Sourcing

An Industry Fundamentally Impacted

Findings include:

Growing Talent While Helping to Ensure Their Safety

Balancing Personalization and Privacy

Complementing Physical and Digital Experiences with Each Other

Staying Focused on the Supply Chain As a Critical Asset

The goal of this survey is to better understand the opportunities, risks, and transformational shifts that retailers are experiencing as they look toward the future of post-pandemic customer engagement. And our data-based findings did not disappoint.

The survey revealed an interesting new challenge for retail in this next wave of operations – striking the right balance across competing priorities that have now become the expected retail experience. For example, retailers are now faced with customers who want better control over their personal information and innovate new ways to personalize the shopping experience.

At the same time, the pandemic changed the store landscape for good, giving customers the option to buy everything online, even if they don’t want to. In addition, employee health and safety have become fast-emerging priorities, while new roles are being introduced to help ensure excellence in store fulfillment and personalization.

Despite the challenges of managing the uncertainty of a pandemic that brought a series of government-mandated lockdowns and changes in customer behavior and expectations, retailers have found many bright spots along the way. RISnews, Intel and SAP surveyed the retail industry to explore those opportunities and how retailers pivoted their strategies to benefit from them.

more >

About the Study

NEXT

PREVIOUS

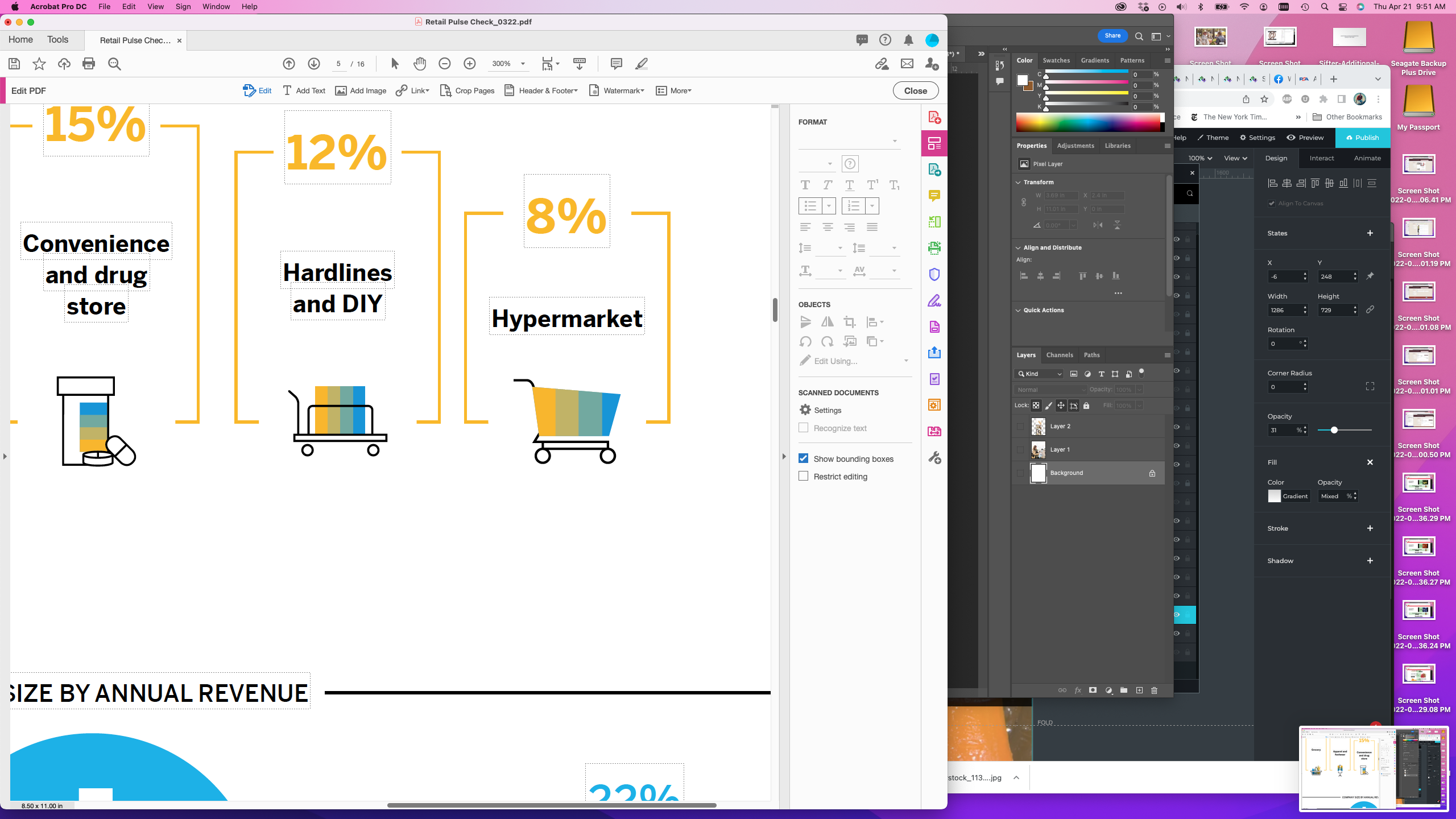

42%

23%

15%

12%

8%

Survey Methodology

Survey responses represent executives from global and regional retail organizations across five major segments, varying in annual revenue and employee numbers. All findings are based on the results of the pulse check conducted in 2021.

Grocery

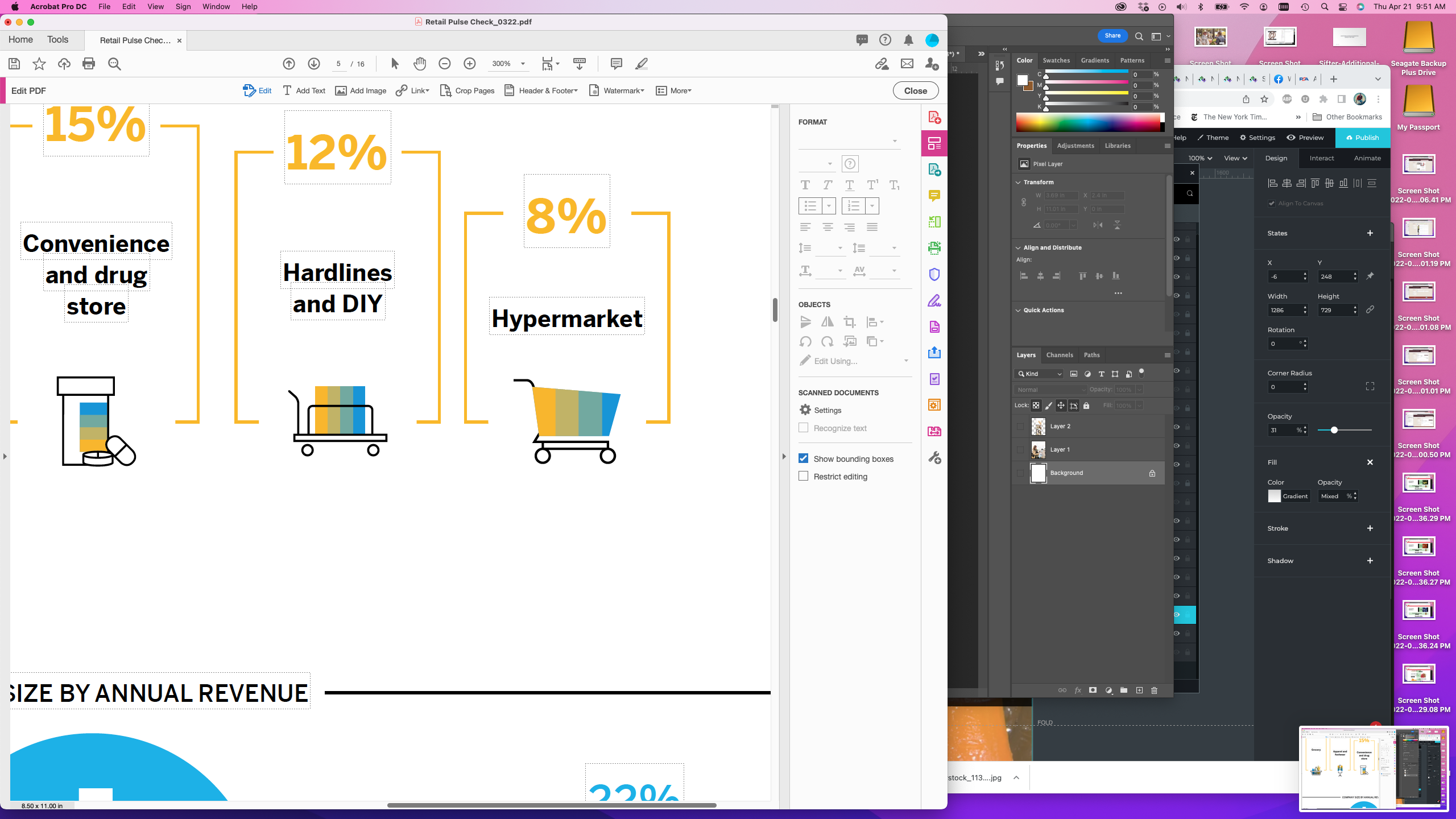

22%

Small and Midsize (

Large ($1 billion - $9.98 billion)

Enterprise (>$10 billion)

41%

37%

Apparel and footwear

Convenience and drug store

Hardlines and DIY

Hypermarket

RETAIL Categories Represented

Company Size By Annual Revenue

more >

NEXT

PREVIOUS

$

Click Here to Continue Reading the Survey Results and to Download the Full Report as a PDF

scroll

scroll

Continue Reading + Download PDF

(page will reload with full report)