AN FTI CONSULTING REPORT

The December 2024 Activism Vulnerability Report

The FTI Activism Vulnerability Screener is a proprietary model that measures the vulnerability of public companies in the U.S. and Canada to shareholder activism by collecting criteria relevant to activist investors and benchmarking to sector peers.

An anticipated change toward a less restrictive regulatory environment following the U.S. elections fuels a growing sense of optimism for M&A activity. If this optimism proves correct, we expect a friendlier M&A backdrop to underpin an uptick in the number of activist campaigns in 2025.

ABOUT THE REPORT

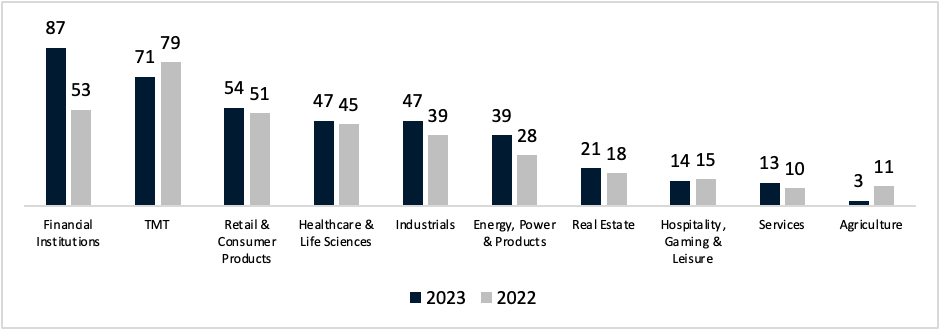

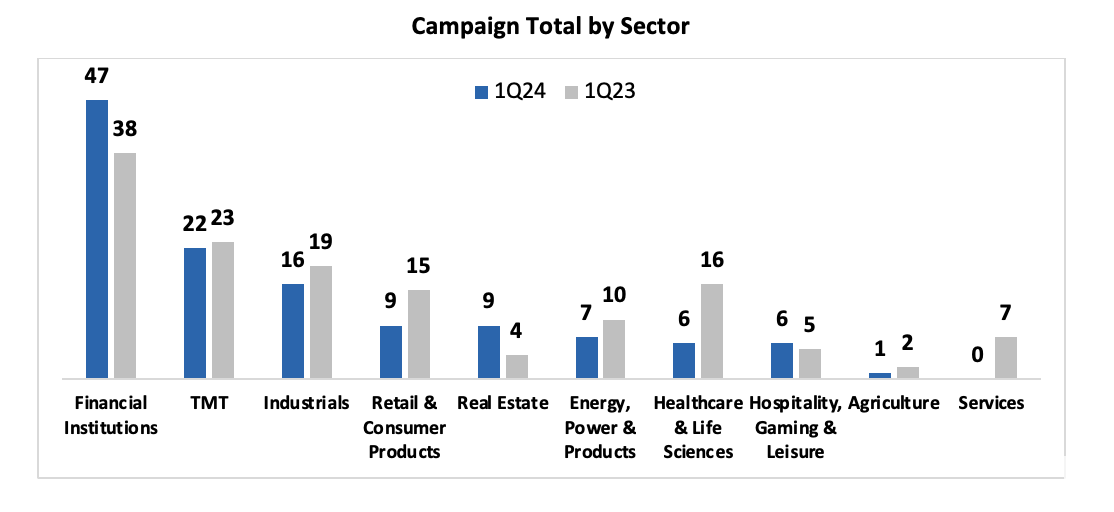

Financial Institutions, Technology, Media & Telecommunications (“TMT”) and Retail & Consumer Products experienced heightened activist activity in 2023.

Notable Campaigns

Southwest Airlines — Last quarter, Elliott Investment Management had nominated a 10-person slate to overhaul Southwest’s Board and called for a special meeting before the end of the year. In a multi-step process, Southwest agreed that seven directors (out of 14 from the 2024 annual meeting) would depart, being replaced by seven new directors, including five Elliott nominees, Executive Chairman and former CEO Gary Kelly. The late October settlement led Elliott to express confidence that the changes agreed to by Southwest would boost operational performance, resulting in a withdraw of its special meeting request.

Only 22% of TMT campaigns so far this year have resulted in activist victories, far lower than the 42% success rate in 2023’s TMT campaigns.�

The TMT sector is marked by evolving market dynamics, regulatory scrutiny, and volatile financial results, all of which underpin its persistent vulnerability to activists.

"Geopolitical tensions, including Middle Eastern conflicts, U.S. and European elections, and heightened 3Q24 market volatility, created uncertainty that slowed dealmaking."

2024 OUTLOOK

Number of times activists publicly sought board seats during the first three quarters of 2024 (up from 112 over the same period in 2023).

147

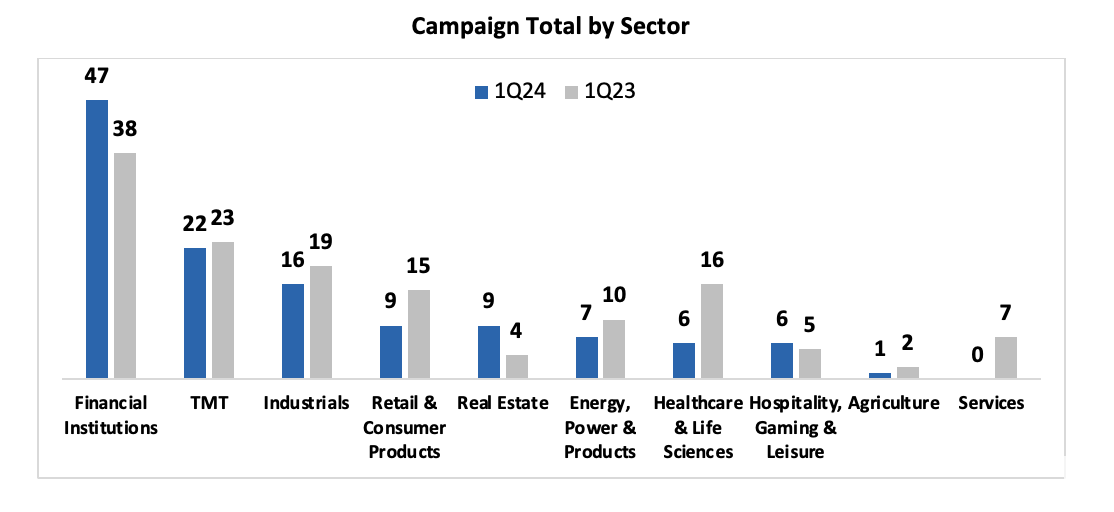

Campaign Total by Sector

Activism Vulnerability Screener Methodology

The Activism Vulnerability Screener is FTI Consulting’s proprietary model that measures the vulnerability of public companies in the U.S. and Canada to shareholder activism by collecting criteria relevant to activist investors and benchmarking to sector peers.

The criteria are sorted into four categories, scored on a scale of 0-25, (1) Governance, (2) Total Shareholder Return, (3) Balance Sheet and (4) Operating Performance, which are aggregated to a final Composite Vulnerability Score, scored on a scale of 0-100.

FTI Consulting’s Activism and M&A Solutions team determined these criteria through research of historical activist campaigns in order to locate themes and characteristics frequently targeted by activist investors.

Governance

Proxy voting standard

Board composition

Proxy access

Total Shareholder Return

Capital gains

Dividend and share repurchase policy

Relative valuation

Balance Sheet

Capital allocation

Leverage ratios

Liquidity

Operating Performance

Revenue and earnings growth

Profitability margins

Merger integration

Read the full insights from the December 2024 report

Key Contacts

Jason Frankl�Senior Managing Director

+1 202 312 9216� jason.frankl@fticonsulting.com

Brian Kushner�Senior Managing Director

+1 214 397 1764� brian.kushner@fticonsulting.com

Ryan Chiang�Managing Director

+1 240 968 8776� ryan.chiang@fticonsulting.com

Tom Kim

Managing Director

+1 917 545 9223

thomas.kim@fticonsulting.com

DOWNLOAD THE FULL REPORT

2020

6.0%

2021

8.1%

2022

9.1%

2023

7.8%

2020

8.7%

2021

11.1%

2022

6.7%

2023

6.3%

2020

29.3%

2021

28.8%

2022

27.7%

2023

31.4%

Large Cap (>$10B)

Mid Cap ($2B-$10B)

Small Cap (<$2B)

ACTIVISM VULNERABILITY SCREENER RESULTS: 3Q24

The latest rankings reveal significant volatility, with seven industries shifting by seven or more positions, including three that moved more than ten spots.

The top three most vulnerable industries are Utilities, Media & Publishing and Real Estate, with Utilities jumping seven places to top the list. �

We observed the greatest vulnerability increases in Financial Conglomerates, REITs, and Consumer Non-Durables, moving up 17, 11, and 9 spots, respectively.�

The Restaurants industry experienced the most significant improvement, dropping 13 slots to land at 22, a remarkable turnaround from its 10-spot climb in the previous quarter.�

The Financial Institutions and Industrials sectors dominate the least vulnerable industries on the ranking, occupying slots 28 through 36 at the bottom of the list.

Kurt Moeller

Managing Director

+1 214 397 1724� kurt.moeller@fticonsulting.com

Robert Kueppers

Senior Advisor

+1 202 312 9100� robert.kueppers@fticonsulting.com

Carl Jenkins

Managing Director

+1 303 689 8877� carl.jenkins@fticonsulting.com

Glenn Tyranski

Managing Director

+1 212 651 7120� glenn.tyranski@fticonsulting.com

DOWNLOAD THE FULL REPORT

DOWNLOAD THE FULL REPORT

DOWNLOAD THE FULL REPORT

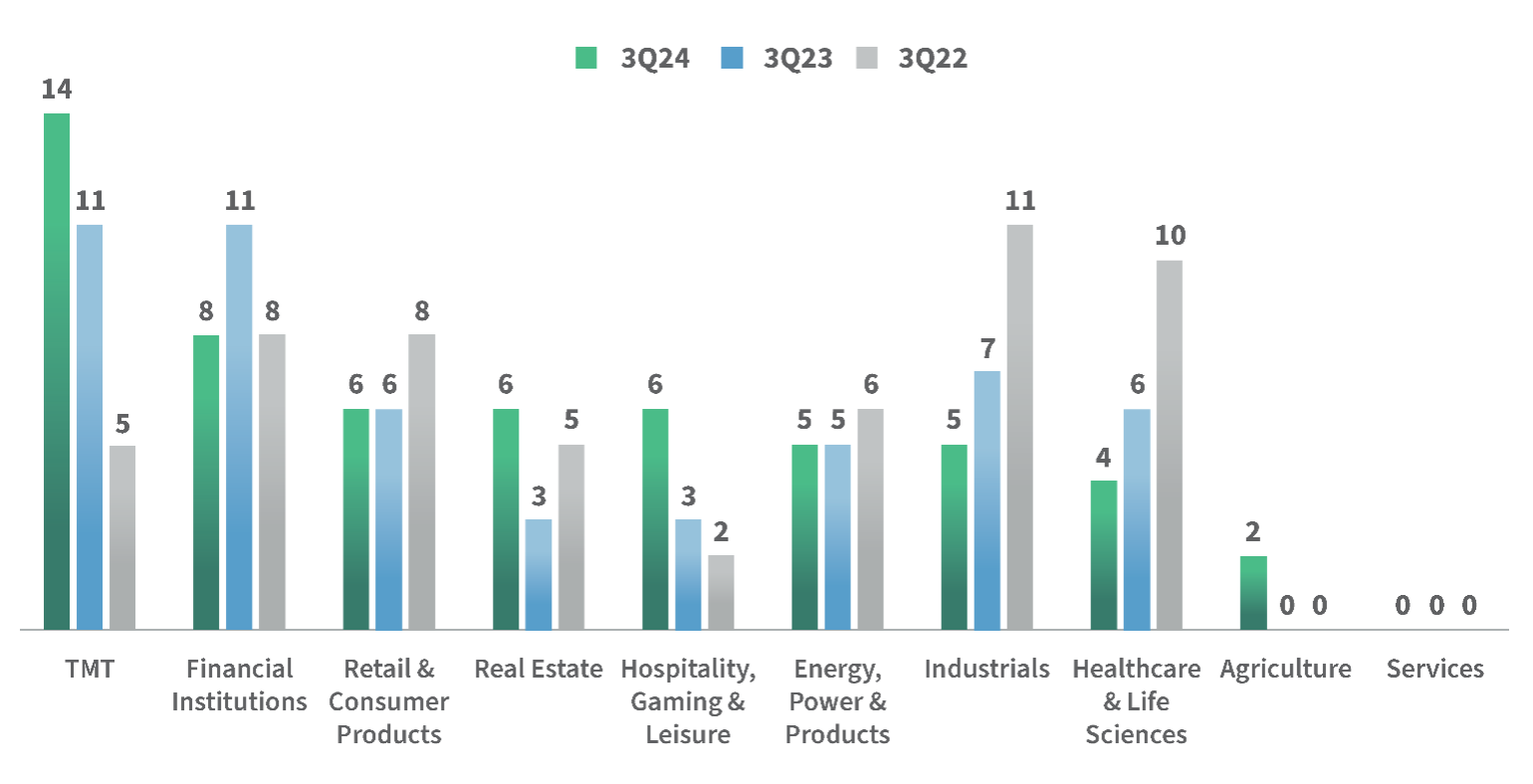

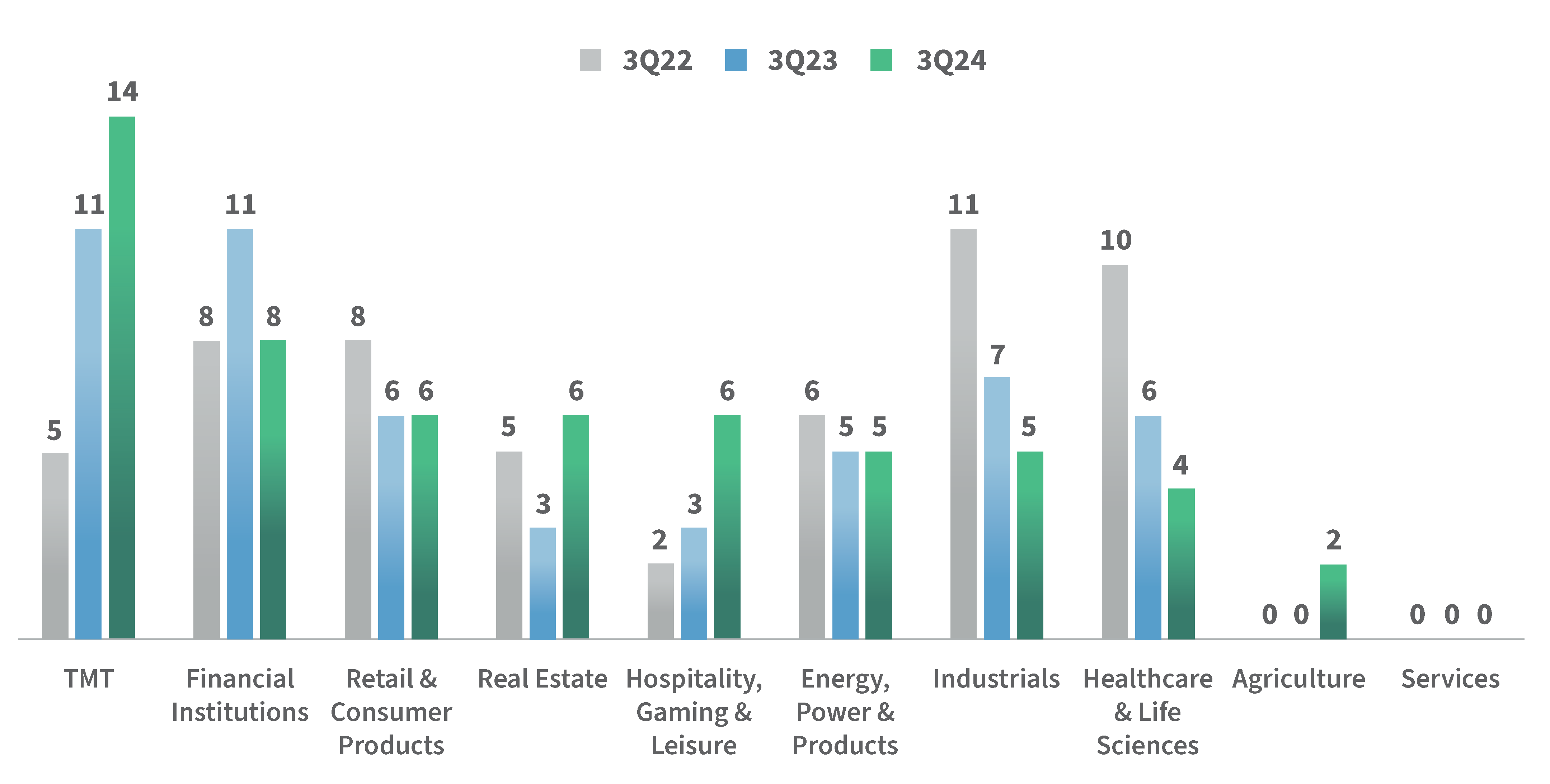

Activist investor activity experienced a seasonal dip after a very active first half of 2024. There were 56 campaigns initiated in 3Q24, closely mirroring previous years' activity levels for the same period. The Technology, Media and Telecommunications (“TMT”) and Financial Institutions sectors continue to lead as the most frequently targeted, with 14 and eight campaigns, respectively, and continue to face activist pressure in the fourth quarter, with nine and six new campaigns, respectively, launched between October 1 and November 1, 2024. Notable recent campaigns in these sectors highlight activists’ focus on areas such as digital transformation, restructuring efforts and cost-reduction initiatives.

Q3 2024 IN REVIEW

Pfizer — Starboard Value built a $1 billion stake in Pfizer to push for strategic changes, as Pfizer struggled with declining demand for its COVID-19 vaccines. Starboard approached former Pfizer executives Ian Read and Frank D’Amelio, who reportedly initially expressed interest in working with Starboard, but later withdrew their support in favor of CEO Albert Bourla. Starboard criticized Pfizer for poor shareholder returns and weak innovation since 2019. In response, Pfizer appointed former Vanguard CEO Tim Buckley to its Board.

Cheesecake Factory — JCP Investment Management built a 2% stake in Cheesecake Factory and is pressuring the restaurant chain to spin off its North Italia, Flower Child, and Culinary Dropout brands into a separate, growth-focused company. The activist believes separate management teams would better drive financial performance and has called for a strategic review of other, smaller assets. However, during an October 29 earnings call, Cheesecake Factory rejected JCP’s demands, expressing confidence in the current strategy.

TMT

14

11

3Q23

3Q22

Campaign Total by Sector

An Ancora-led investor group nominated a majority slate of directors, looking to oust Norfolk’s CEO. Norfolk added two new directors and hired a new COO. At the AGM, shareholders voted for three of Ancora’s seven proposed directors.

Discover the epic battles behind the scenes at Disney as CEO Bob Iger navigates shareholder activism and media scrutiny to secure his position in a recent article published by FTI Consulting.

Despite facing challenges that have unseated previous CEOs, Iger's persuasive leadership and strategic moves have kept him at the helm of the iconic company. Read more about how Iger's journey could redefine Disney's legacy.

Special Report: Inside Disney’s Star CEO Wars

Choice Hotels International Inc. vs. Wyndham Hotels and Resorts, Inc.

Ancora Advisors vs.

Norfolk Southern Corp.

Arkhouse Management and Brigade Capital vs. Macy’s Inc.

After Choice made an unsolicited takeover offer for Wyndham in October 2023, Choice’s share price substantially underperformed peers Hilton and Hyatt. When Choice withdrew its bid in March 2024, its share price rose meaningfully.

Macy’s directors seemed unwilling to engage in meaningful dialogue to negotiate a sale, prior to Arkhouse proposing a slate of directors. Though proxy contests often are not necessary to create change, the threat of one can expedite the process.

Recent Reports

April 2024 Report

December 2023 Report

September 2023 Report

June 2023 Report

Squarespace — After agreeing to a sale to private equity firm Permira Advisors LLP in May, Squarespace faced opposition from Glazer Capital, which argued that the $44 per share deal undervalued the company. In response to investor pushback and a recommendation from ISS against the deal, Permira raised its offer to $46.50 per share. The revised agreement also eliminated the ability of shareholders to vote on the deal, as it was structured as a tender offer. The tender offer received support from 97.5% of shares, and it became effective in October.

JUNE 2024 Report

JUNE 2024 Report

READ THE ARTICLE

After Choice made an unsolicited takeover offer for Wyndham in October 2023, Choice’s share price substantially underperformed peers Hilton and Hyatt. When Choice withdrew its bid in March 2024, its share price rose meaningfully.

Choice Hotels International Inc. vs. Wyndham Hotels and Resorts, Inc.

Macy’s directors seemed unwilling to engage in meaningful dialogue to negotiate a sale, prior to Arkhouse proposing a slate of directors. Though proxy contests often are not necessary to create change, the threat of one can expedite the process.

Arkhouse Management and Brigade Capital vs. Macy’s Inc.

An Ancora-led investor group nominated a majority slate of directors, looking to oust Norfolk’s CEO. Norfolk added two new directors and hired a new COO. At the AGM, shareholders voted for three of Ancora’s seven proposed directors.

Ancora Advisors vs.

Norfolk Southern Corp.

Discover the epic battles behind the scenes at Disney as CEO Bob Iger navigates shareholder activism and media scrutiny to secure his position in a recent article published by FTI Consulting.

Despite facing challenges that have unseated previous CEOs, Iger's persuasive leadership and strategic moves have kept him at the helm of the iconic company. Read more about how Iger's journey could redefine Disney's legacy.

Special Report: Inside Disney’s Star CEO Wars

5

Financial

Institutions

8

11

8

Retail & Consumer Products

6

6

8

Real Estate

6

3

5

Hospitality, Gaming & Leisure

6

3

2

Energy, �Power & Products

5

5

6

Industrials

5

7

11

Healthcare �& Life �Sciences

4

6

10

Agriculture

2

0

0

Services

0

0

0

3Q24

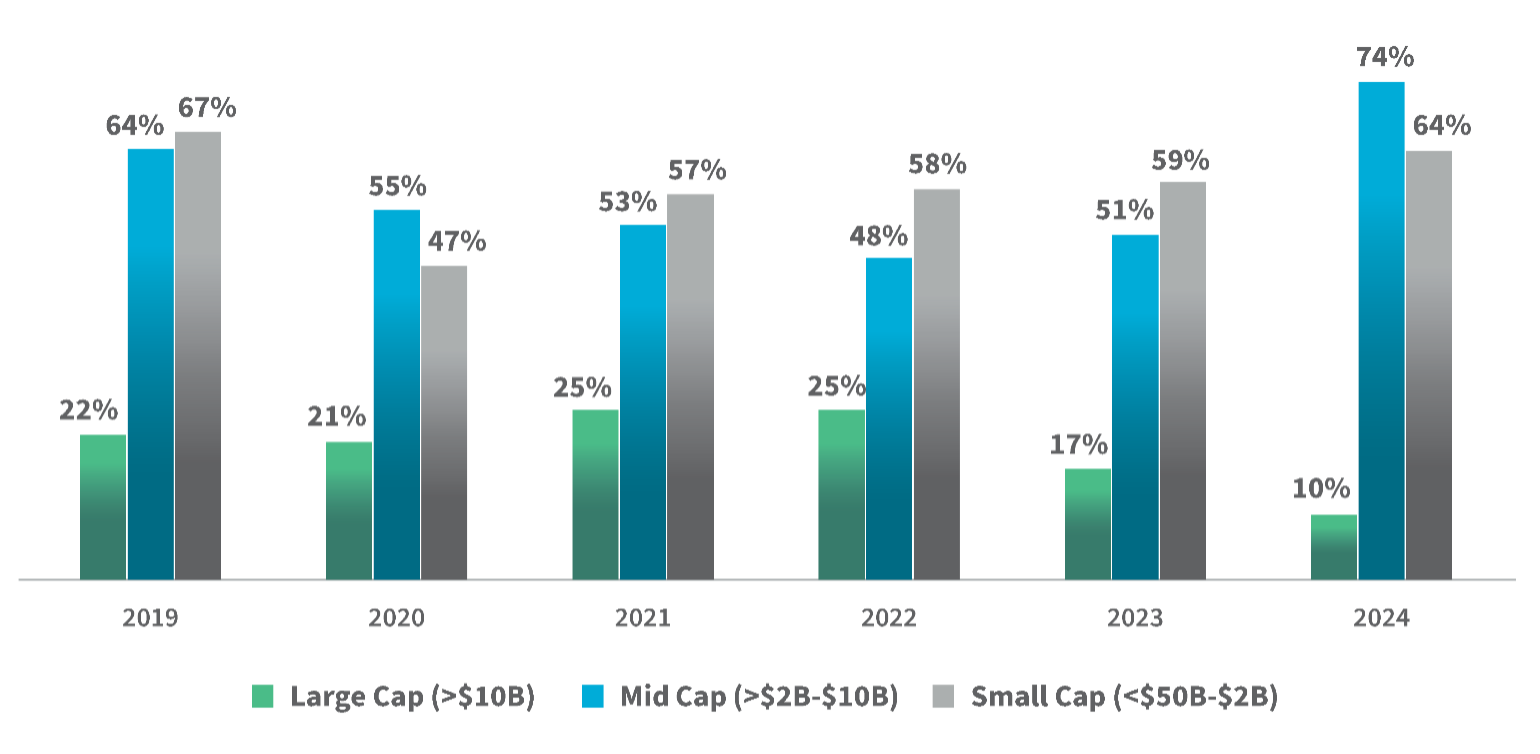

2019

67%

64%

22%

Large Cap (>$10B)

Mid Cap (>$2B-10$B)

Small Cap (<$50B-2$B)

Activist Success Rate when Targeting Mid-Cap Companies

(YTD through November 1, 2024)

2020

47%

55%

21%

2021

57%

53%

25%

2022

58%

48%

25%

2023

59%

51%

17%

2024

64%

74%

10%

MID-CAP COMPANIES CAPTURE ACTIVIST ATTENTION

Mid-cap companies have seen a surge in activist interest, accounting for 25% of total campaigns in 3Q24, compared to just 10% a year earlier. One possible reason: Activists are achieving higher success rates in the mid-cap segment, with an impressive 74% of concluded mid-cap campaigns delivering favorable outcomes for activists in 2024 through November 1, up from 51% during the same period last year.

September 2024 Report

JUNE 2024 Report