A network that delivers

Surest uses the national UnitedHealthcare network, giving members access to 1.8+ million physicians and health care professionals and 5,600+ hospitals. Surest also offers a host of virtual care options, so members can connect with providers at their convenience for a wide range of needs, including urgent, preventive, and specialty—often at low or no cost.

SPONSORED BY SUREST

Balancing employee health and rising costs with a transparent health plan.

Meet Surest—the health plan of choice for nearly 1 million members and growing.

By Monica Vanover on July 25, 2025

What if you could offer a health plan that actually supports employee well-being while potentially saving employers money compared to traditional plans? One that prioritizes transparency and provides access to a large, national network.

Surest is an employer-sponsored health plan that offers comprehensive medical coverage employees expect and provides access to information to help them make decisions about their care. It removes the usual barriers—like deductibles and coinsurance—and replaces them with the simplicity of a digital-first design, upfront copays, and a national network of physicians and health care professionals. It’s a benefit that supports employee well-being while offering opportunities for both the member and employer to save money.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusa ntium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo nemo enim ipsam.

statistic from the organization

XX

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusa ntium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo nemo enim ipsam.

statistic from the organization

XX

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusa ntium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo nemo enim ipsam.

statistic from the organization

XX

Are you ready to break away from the status quo?

See how a Surest health plan can bring a better benefit to your business.

SCROLL DOWN

QUICK FACTS

50%

Surest members, on average, had

lower out-of-pocket costs.

15%

Employers may save up to

What makes Surest different?

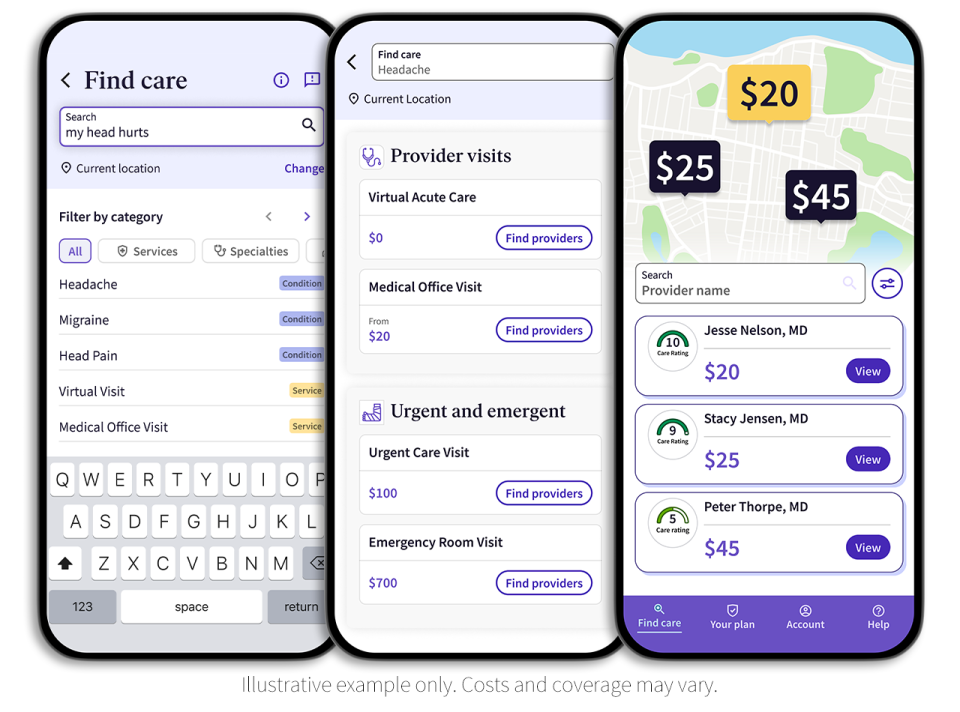

Surest is a no-deductible health plan that uses a digital-first experience, so members can shop and compare care options at their convenience. From the Surest app or website, members can search for care to see near-instant copay, provider, and treatment options. This real-time access to information helps members choose care that fits their health needs, budget, and lifestyle.

Today, fewer than 1 in 5 Americans say they know the cost of care before receiving it. At the same time, 95% believe health care organizations should make those costs clear in advance. Surest was built with that expectation in mind. Unlike traditional plans that often leave people guessing about costs, Surest shows copays (not estimates) in advance to help avoid surprise bills and confusion.

Providers, services, and locations are all clearly marked with a copay that members can see prior to getting care. Surest also incorporates filters and features to help members find and compare care options. Features like Care Ratings help explain to members, in the Surest experience, how Surest evaluates providers on services they offer based on their historical effectiveness and cost-efficiency performance. Then we assign higher Care Ratings—and lower copays—for higher-performing providers.

Surest also simplifies the complexities of figuring out what’s included in a visit and a copay by bundling services that typically occur together. For example, labs and tests related to a procedure may be grouped into one copay and noted within the description. This gives members a more complete picture of what they’ll pay—before they even step into a provider’s office.

Removing barriers to care

Cost is one of the biggest reasons people delay or skip care. In fact, a record number of Americans say they’ve put off medical treatment due to cost concerns.

But delaying care can lead to bigger health issues—and higher costs down the road. Surest removes barriers like deductibles and coinsurance so members are more likely to get the care they need, when they need it. They don’t have to wait for coverage to kick in after reaching a high deductible or try to figure out how providers and insurance charge for services. They know the copay up front, so they can plan ahead and get the care they need—possibly leading to better health outcomes for them and more predictable costs for employers.

Digital design, personal touch

While Surest is built for on-the-go ease and convenience, it also offers human support when it matters most. The Surest Member Services team is available by phone, email, or chat to help members navigate care—from understanding treatment options to finding in-network providers—and offer support they need along the way.

Surest isn’t just good for employees—it’s good for business too.

Designed to meet people where they are, the Surest health plan is transparent, accessible, and simple. It offers a rich benefit that supports both the mental and physical well-being of employees—to help attract and retain top talent—while offering a smarter way to manage health care spending.

It’s no wonder Surest is the fastest-growing commercial offering at UnitedHealthcare.

Learn More

1

2

3

Steve Cain, CEO of UnitedHealthcare of California, breaks down Surest—a healthcare plan that ditches deductibles and co-insurance for simple, transparent copays.

In this episode, Steve shares how Surest empowers members with real-time cost and quality data, reduces ER visits and unnecessary surgeries, and makes navigating healthcare as easy as tapping your phone.

1

2

Members who migrated from a non-Surest plan into a Surest plan in 2022, compared to those who stayed with a non-Surest plan. 141_V04.

Surest actuarial results through 2024.

UnitedHealthcare Employer and Individual network statistics, ending Q1 2025.

3

1

2

3

Members who migrated from a non-Surest plan into a Surest plan in 2022, compared to those who stayed with a non-Surest plan. 141_V04.

Surest actuarial results through 2024.

UnitedHealthcare Employer and Individual network statistics, ending Q1 2025.

SPONSORED BY SUREST