Sections 48 and 48E

Low-Income Communities

Sections 45, 48, 45Y and 48E

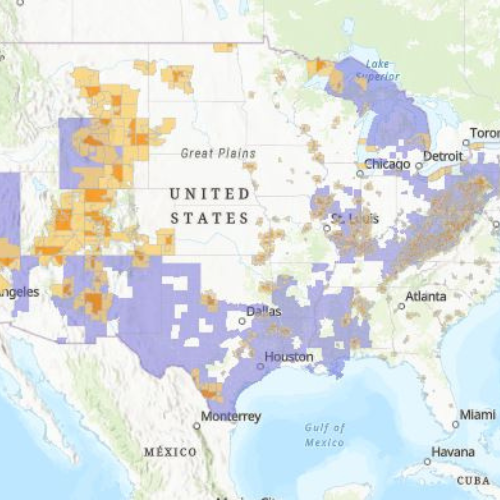

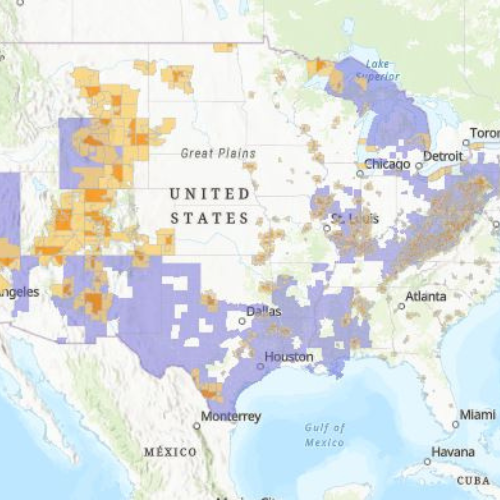

Energy Communities

Sections 45, 48, 45Y and 48E

Domestic Content

Prevailing Wage and Apprenticeship (PWA)

Sections 6417 and 6418

Monetization

Sections 45U and 45J

Nuclear Energy

Sections 25C, 25D and 179D

Residential & Energy Efficiency

Sections 45Q

Carbon Capture & Sequestration

Sections 30D, 25E, 45W and 30C

Clean Vehicle Tax Credits & Charging Infrastructure

Sections 48C and 45X

Manufacturing

Sections 40B, 45V, 45Z and 6426

Alternative & Clean Fuels

Sections 45, 45Y, 48 and 48E

Energy Generation, Storage & Qualified Biogas Property

General Energy Tax Information and Resources

Attend live events to hear from our attorneys regarding specific tax incentives.

Holland & Knight Events

Read insight from our attorneys regarding specific tax incentives.

Holland & Knight Insights

Sections 48 and 48E

Low-Income Communities

Sections 45, 48, 45Y and 48E

Energy Communities

Sections 45, 48, 45Y and 48E

Domestic Content

Prevailing Wage and Apprenticeship (PWA)

Sections 6417 and 6418

Monetization

Sections 45U and 45J

Nuclear Energy

Sections 25C, 25D and 179D

Residential & Energy Efficiency

Section 45Q

Carbon Capture & Sequestration

Sections 30D, 25E, 45W

and 30C

Clean Vehicle Tax Credits & Charging Infrastructure

Sections 48C and 45X

Manufacturing

Sections 40B, 45V, 45Z and 6426

Alternative & Clean Fuels

Sections 45, 45Y, 48 and 48E

Energy Generation, Storage & Qualified Biogas Property

General Energy Tax Information and Resources

One Big Beautiful Bill Act to Scale Back Clean Energy Tax Credits.

Did You Know?

Energy Tax Topics