As a supplement to our regular quarterly newsletter, we are providing an overview of developing marketplace trends in light of recent economic and claims activity.

Keeping You Informed on Events Impacting the Industry

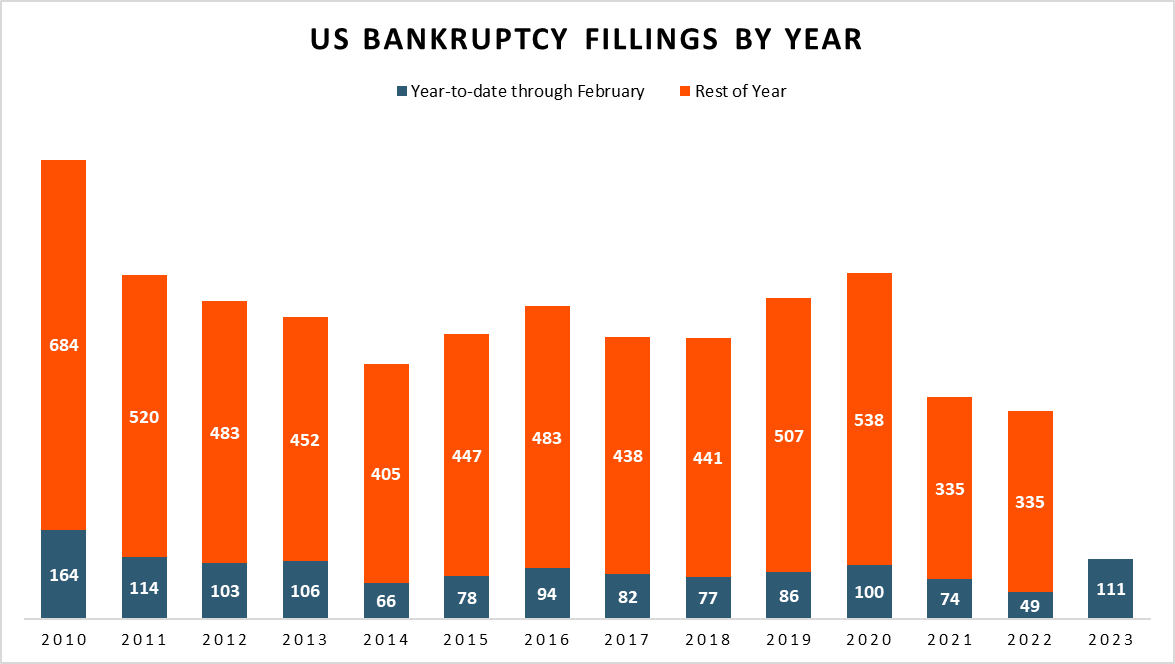

As of March 3, 2023, S&P Global’s Market Intelligence, indicates filings hit a 12-year high in the first 2 months of 2023 (consistent with notice activity).

Firms reporting declining profit margins outnumbered firms reporting rising margins by 27 percentage points (Ken Simonson-Data Digest, AGC 5.12.23).

According to the American Bankruptcy Institute, commercial chapter 11 filings increased 79% in March 2023 over the prior year.

Hudson has observed a significant increase in lien activity and bankruptcies on enrolled projects (consistent with the above marketplace data). These notices and the subsequent file investigation found these common items:

79%

12

27

June | 2023

A fully extended or significant use of line of credit

Poor payment history/significant unpaid lower tiers (30-60-90 days in arrears)

©2023 Hudson Insurance Group. The information contained in this newsletter is for general information only and shall not modify the terms of any insurance policy.

Scroll down

Marketplace Update

SUBCONTRACTOR DEFAULT INSURANCE

Parent company/organizational structures to protect/insulate subcontracted entity

Source Data: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-corporate-bankruptcy-filings-hit-12-year-high-in-first-2-months-of-2023-74567693

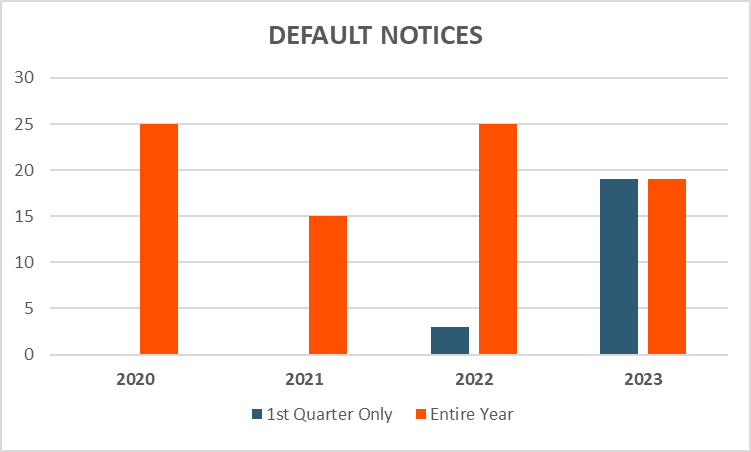

Notice of Default are up over 500% YoY

Prevailing issues in 2020-2022 were primarily lack of qualified manpower/inability to staff projects, but more recently have been shifting to failure as a result of financial pressures/distress

Wood framing, electrical and drywall subcontractors have had the highest default rate in the Hudson book from 2018-2023

While not mature and on a small number of claims, the severity of claims is also increasing

Below are some key metrics we have observed YTD:

This is a missed opportunity to identify via lower tier lien release process. Hudson suggests some threshold criteria be utilized to address the larger lower-tier exposures for those not regularly collecting these lower-tier releases.

This is a missed opportunity to collect PCG or contract directly with the parent. Subcontractors are becoming increasingly more sophisticated, along with the market going through a significant amount of mergers and acquisition.

Both have led to subcontractors that are performing the work being a subsidiary or affiliate of that Holdco or Parent.

The Parent likely holds all the financial health or ability to control the finances of the subsidiary. It’s not uncommon for the parent to be financially well-healed, while the subsidiary has no financial positions.

For this reason, we’d advocate that going forward, when a parent or cross company's financials are used, a guarantee be deployed when matched with the risk.

The above reinforces the importance of continual qualification throughout the lifecycle of a subcontract, AFTER prequalification (collect interim statements, WIP, etc.), as many of the notices were prequalified with older, less reliable financial information.

This is a missed opportunity to identify via lower tier lien release process. Hudson suggests some threshold criteria be utilized to address the larger lower tier exposures for those not regularly collecting these lower-tier releases.