Gen X

The Overlooked Generation With Outsized Impact

Compared to Baby Boomers and Millennials, Generation X flies under the radar as a valued financial force. This influential group of prime earners, born roughly between 1965 and 1980, is smaller in size than the Boomer and Millennial generations but carries a surprisingly large footprint. They are decisionmakers and influencers, guiding spending not just for themselves, but for aging parents as well as children who rely on them. This cohort carries considerable economic sway in so many ways, and yet it is routinely overlooked by marketers and brands that are chasing other buyers.

The Quiet Power of the Gen X Consumer

Introduction:

The member organization for industry advancement, ICSC promotes and elevates the marketplaces and spaces where people shop, dine, work, play and gather as foundational and vital ingredients of communities and economies. ICSC produces experiences that create connections and catalyze deals; aggressively advocates

to shape public policy; develops high-impact marketing and public relations that influence opinion; provides an enduring platform for professional success; and

creates forward-thinking content with actionable insights – all of which drive industry innovation and growth. For more information, please visit www.ICSC.com.

Connect.

Industry Insights • Events • Membership

Explore our website for more information.

1.

2.

3.

4.

5.

6.

7.

8.

9.

Sources

Gen X, the Overlooked Marketing Powerhouse

Distribution of Household Wealth in the U.S. Since 1989

Generation X Represents the Most Immediate Opportunity for Wealth Managers

Forgotten Gen X Now Quietly Fuels Trillions in Consumer Spending

Which Generation Spends More?

Earnings call: e.l.f. Beauty Posts Strong Q1 Growth, Raises Fiscal 2025 Outlook

Gen X Is The Most Stressed Generation Alive And Studies Reveal Why

PulteGroup (PHM) Q2 2025 Earnings Call Transcript

Gen X is Beauty’s Fastest-growing Spender: Here’s How to Engage Them

, Axies, October 31, 2023.

, The Federal Reserve System, Q1 2025.

, Cerulli Associates, June 30, 2025.

, USA Today, August 22, 2025.

, U.S. Bureau of Labor Statistics, April 18, 2025.

, Investing.com, August 9, 2024.

, Benzinga, July 19, 2024.

, The Motley Fool, August 5, 2025.

, Global Cosmetic Industry, August 15, 2024.

Gen X consumers are discerning shoppers who value their time and seek authentic, no-fuss solutions that fit their demanding lives. Consider the positioning of one beauty-focused brand whose founder acknowledges that Gen X consumers want multifunctional products that simplify their routines.⁹ It helps illustrate what so many Gen Xers told us they appreciate: minimalist products that strip away the unnecessary without sacrificing results.

Here are some strategic moves retailers can make to reach this valuable consumer with a strong preference for in-store shopping and an openness to omnichannel retail:

Winning Over Gen X

Conclusion:

Optimize the in-store experience for clear navigation, short lines, comfortable layouts and well-trained staff.

Consider demographics and refine the tenant mix as needed to speak to Gen X, including fitness, elevated quick-service restaurants and home goods.

Use local demographic and spending data to target Gen X-dense ZIP codes and invest marketing dollars precisely where they count.

Position your brand for the inheritance wave to capture spending on retail and lifestyle spending: home upgrades, wellness and luxury.

Build marketing campaigns that speak to Gen X directly—through email, reviews, informative posts and high-quality service.

•

•

•

•

•

The lack of attention on Gen X consumers is even more notable given the generation’s growing financial clout. With $42 trillion in wealth at the start of 2025,² and a collective $1.4 trillion a year projected to come their way in inherited assets over the next decade,³ Gen X is a powerhouse consumer sector that retailers should be prioritizing.

The takeaway is clear: Generation X wields the kind of purchasing power brands should be fighting for.

To get a comprehensive understanding of this pivotal but often-overlooked consumer segment, ICSC took a close look at what motivates these midlife consumers. In this study, we examined $5 trillion in U.S. retail spending to show why Gen X plays a disproportionately powerful role in driving both in-store and online growth. The findings contribute to

a growing body of research

by ICSC that explores how different

In many respects, Gen X ranks as retail’s most potent yet underestimated consumer group, as this new research reveals:

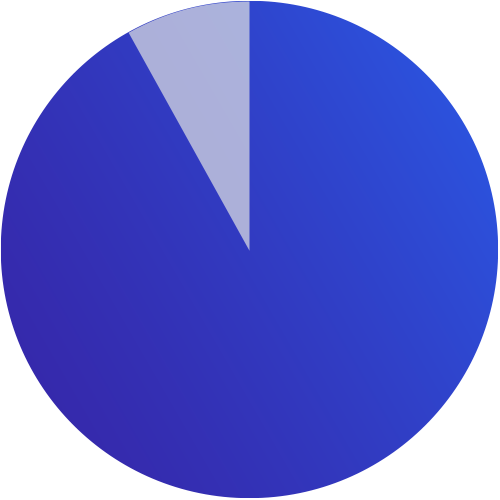

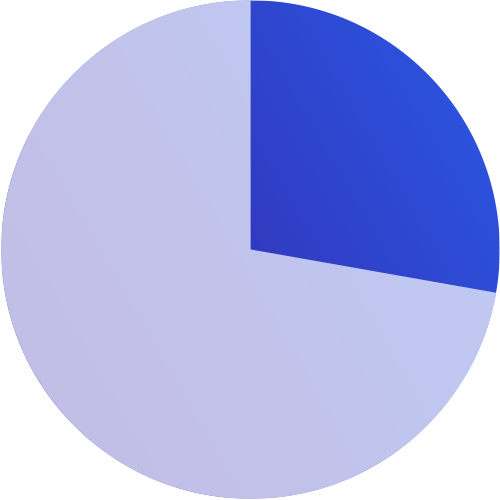

Despite being one of the smallest demographics by size, 45- to 60-year-olds drive the highest value per shopper of any cohort: Gen X consumers represent just 19% of the population, yet account for 31% of

in-store and online spending, and outpace all other generations in revenue per shopper (RPS).

34% of Gen X consumers have or expect to receive an inheritance.

While Gen X is financially powerful, they are also being stretched to the limit. Three in four are caregivers

for children and/or parents and more than half are stressed about rising costs, retirement savings, and healthcare.

•

•

•

From June 27, 2025, through July 1, 2025, ICSC and the analytics firm Alexander Babbage conducted a national survey of 1,086 adults. In addition to consumer research, ICSC and Alexander Babbage conducted a retail behavioral study encompassing $5 trillion in total retail spending, covering five total years of transactions (2020–2024), allowing for trend analysis and year-over-year comparisons. The analysis includes a total of $3.1 trillion in-store spending and a total of $1.9 trillion in online spending. It covers 426 total retailers across 11 major retail categories and 43 unique retail subcategories. Revenue per shopper (RPS) reflects the total dollars spent per transaction, calculated as the total observed sales divided by the total observed number of transactions. It is also referred to as average purchase or average basket.

About this study

To better understand how Gen X compares to other generations in spending, we analyzed average transaction receipts across a broad array of retail categories. For instance, when buying home furnishings, Gen X leads by a wide margin—outspending Baby Boomers by nearly 80% and more than double what Gen Z spends per purchase (Figure 3).

One Gen X In-Store and Online Home Furnishings Transaction Is Worth

Gen Z: 2.4

Millennial: 1.0

Baby Boomer: 1.8

Silent Generation: 3.1

Friendly staff who

offer quick checkout

options and maybe

some comfy spots to

sit and relax.

Gen X shoppers are retail’s most lucrative customers, especially in-store. This comes with high expectations, including consistent service and inventory reliability. Earn Gen X loyalty by minimizing friction in their shopping experiences, catering to their need for efficiency and consistently delivering reliable service and inventory.

Retailers, take note

Revenue per shopper (RPS) across all generations rises in ZIP codes with a larger percentage of Gen X residents.

Gen X contributes nearly

one-third of all full-service restaurant spending.

Gen X RPS is two times that of Boomers in restaurants.

Where Gen X resides—and spends

Did You Know?

Where They Are:

Why It Matters:

•

•

•

•

•

•

More than one-third of the nation’s Gen X population resides in just five states, California, Texas, Florida, New York and Pennsylvania.

Gen X over-indexes in population in Illinois, Georgia and North Carolina.

Gen X resides in high-performing restaurant and lifestyle retail ZIP codes.

•

•

•

Millennials and Gen Z are

under-indexed in RPS.

Many retailers still are prioritizing younger demographics, ignoring

Gen X’s impact.

Gen X’s spending power

is a location-based

advantage.

Power Shoppers With High Expectations

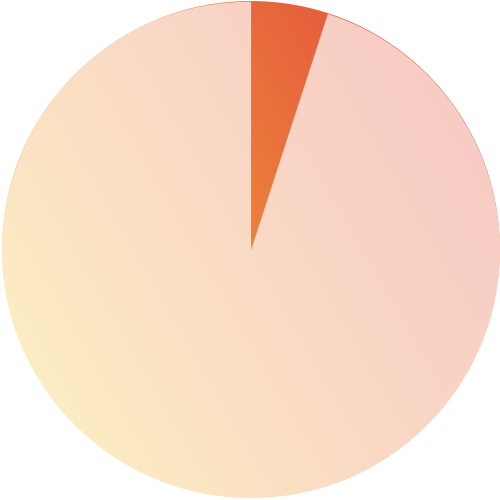

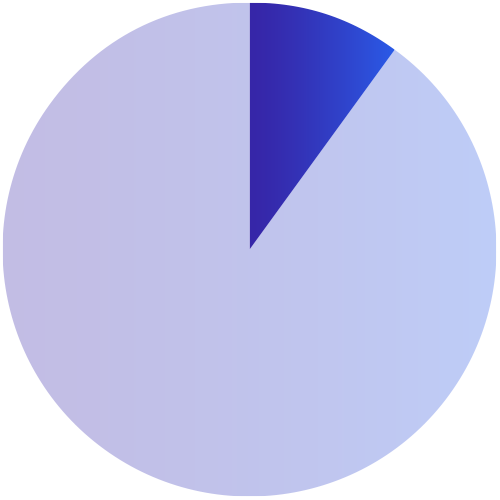

Gen X consumers can get lost in a retail environment teeming with messages that seldom seem to reflect their needs and wants. While marketers posit that younger consumers are primarily the ones they need to attract to build loyalty,⁴ our research suggests the opposite. Though Gen X may not be the noisiest segment in retail, they are making their presence felt where it counts: at the checkout. Gen X represents only 19% of the population but drives 31% of in-store and online spending (Figure 1). That share of total spending is even higher within categories like apparel (Figure 2).

Section 1:

Financially Strong, Emotionally Stretched

For businesses where people shop, dine, work, play and gather, Gen X consumers occupy the sweet spot of consumption. They are managing households and the attendant expenses, making spending decisions that affect their loved ones. No other generational cohort surpasses this group’s average annual household spending, which totaled nearly $96,000, according to the latest figures from the U.S. Bureau of Labor Statistics (Figure 6).⁵ Since 2020, Gen X has boosted annual expenditures by 25%, exceeding every other adult cohort in spending growth.

Section 2:

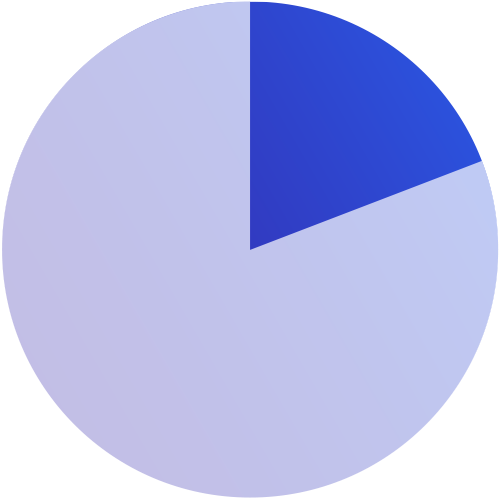

Responses from our survey suggest that midlife consumers have a largely favorable view of their financial circumstances. Consider that 56% of Gen X respondents report a positive life outlook—more than any other generation (Figure 7). In nearly every category in our survey except luxury goods, Gen X consumers say they expect to increase their spending over the next 12 months. This mindset suggests a cohort that is ready to spend—not impulsively, but intentionally—on comfort, wellness and quality of life.

We’re not only the number one brand amongst Gen Z and

Gen Alpha, but we’re increasingly picking up many more millennials

and Gen X as well. So, we love what our marketing is doing, both in

the top line from awareness standpoint, equity and new audiences.

Tarang Amin, CEO, e.l.f. Cosmetics

Inheritances are likely to influence how those dollars are spent—for years to come. Nationally, nearly half of the total wealth that is expected to be transferred over the next 25 years is projected to be left to Gen Xers. That includes, on average, a projected $1.4 trillion every year over the next decade.

Survey respondents say they plan to dedicate the bulk of those inherited dollars to paying down debt, as well as on other key goals like retirement or starting a business. However, 35% of what they’re inheriting is likely to be spent on retail and experiences (Figure 8). In total numbers, Gen Xers are planning to spend around $308 billion annually on home upgrades or personal splurges.

Historic transfer of wealth

of Gen Xers Use

Social Media Every Day

of TikTok’s User

Base Is Gen X

of Brand Influencer

Spending Is Targeted to Gen X

%

92

%

28

%

5

Omnichannel on Their Terms

When the oldest Gen Xers hit working age in the 1980s, catalog shopping and mall showrooms were commonplace in retail. As younger members of the cohort joined the workforce around the year 2000, e-commerce had begun to transform the ways people consume. These distinct eras capture the complexity of Gen X: They weren’t raised on tablets or with mobile shopping at their fingertips like today’s digital natives. Nevertheless, Gen X has evolved alongside some of the biggest transformations in technology, and they have become tech-fluent along the way.

This is a generation that expects intuitive, low-friction digital experiences. Overwhelmingly, our research shows digital tools for product discovery and purchase should enhance convenience, not create new hurdles for Gen X consumers. Among shopping features, 76% of respondents in our survey say they use self-checkout kiosks either occasionally or frequently. Meanwhile, 68% of respondents say they use mobile apps for shopping or payments with similar regularity.

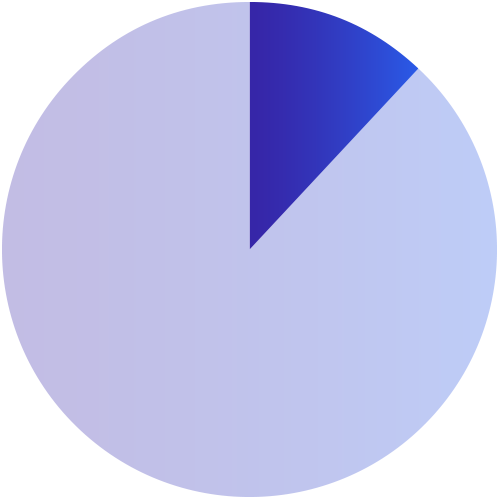

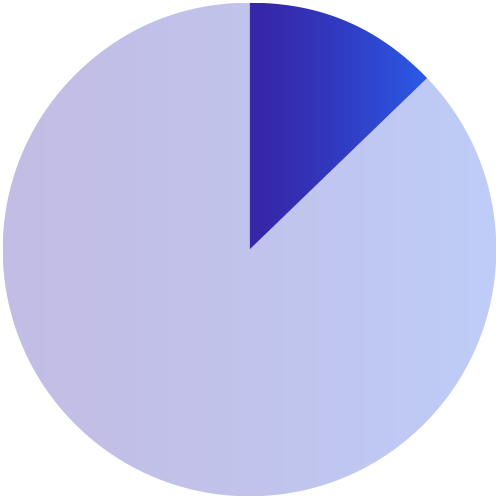

More than two-thirds of Gen Xers (68%) say they have occasionally or frequently used social media to purchase a product or service (Figure 10). Facebook was the most common channel, followed by TikTok and Instagram. These channels also provide a means of virtual window-shopping, as 62% of respondents say they use YouTube to browse. This tracks with our 2025 social commerce survey, which showed that members of Gen X are most likely to purchase a product in-store immediately after seeing a product that interested them on social media.

We also learned that trusted connections matter. Members of Gen X say they rely on recommendations from family and friends more than any other sources when making purchasing decisions.

Section 3:

BUT

ONLY

generations interact with—and reshape—the marketplaces and spaces where people shop, dine, work, play, and gather.

Gen X consumers bring financial clout, brand loyalty and multigenerational influence to every transaction. Their tastes are rewriting the rules of loyalty and service and the future of brick-and-mortar. While brands battle for Boomer loyalty and Millennial mindshare, Gen X is powering the bottom line.

Some brands—including Gen Z- and Alpha-focused lifestyle brands—are publicly making overtures to the Gen X demographic. In a 2024 earnings call, for instance, the beauty company e.l.f. Cosmetics signaled that it would be broadening its promotional messaging.⁶

In our survey, 74% of Gen Xers say they are caregivers often for both older and younger generations. The life-stage pressures of caring for aging parents and children are transforming both Gen Xers’ finances and their literal sense of place. As a result, 39% have moved or are planning to move—often for affordability or caregiving needs.

These financial pressures influence a host of personal choices: 76% of respondents in our survey say caregiving has significantly affected their spending, while 53% have had to cut back on discretionary expenditures on items like dining, shopping or entertainment. More than a quarter of respondents (27%) say they have had to take on additional debt or use savings to cover caregiving responsibilities.

The Strain of Caregiving

While many Gen Xers are hopeful about the future, they are also shouldering some of the heaviest financial and emotional burdens that come with midlife. Multiple studies over the course of a decade or longer have characterized Gen X as the most stressed generation.⁷

More than half of Gen Xers surveyed say they feel financial pressure related to retirement and healthcare. As members of the “sandwich generation,” many are supporting both children and aging parents. They are balancing external pressures such as inflation, the cost of healthcare and housing transitions. In our survey, 90% of respondents say they experience at least one of

the following sources of stress: feeling stretched in multiple directions, having limited personal time and undergoing strain in personal relationships (Figure 9).

Resilient, but realistic

Figure 1

Silent Generation

Baby Boomer

Gen X

Millennial

Gen Z

Share of Spending

Share of Population

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Gen X Share of Population vs. Share of In-Store and Online Spending

Gen X Share of In-Store and Online Apparel & Accessories Spending

Share of Population

%

19.4

Share of In-Store and

Online Spending

%

33.2

Figure 2

Figure 3

To get an even fuller picture of Gen X's spending behavior, we looked at the channels where the generation directs its dollars. Seventy-seven percent of the respondents we surveyed say they feel confident purchasing at physical locations due to its tactile advantages and human connections, both of which are elements digital channels can’t fully match. Their spending habits underscore this preference, demonstrating that they have a preference for brick-and-mortar. Gen X spends more in-store than online across nearly every category—and leads the pack with the highest in-store revenue per shopper (RPS) in most sectors (Figure 4). At fitness centers, for instance, Gen X spends $93 on average per in-store transaction. That’s around 64% higher than the amount Baby Boomers spend on average per in-store transaction, and more than four times the amount Gen Z consumers typically spend on average at the point of sale at fitness centers (Figure 5).

The enduring appeal of brick-and-mortar

Provide more

benches to sit for

us older folks who

sometimes need

to take a rest.

More open

checkouts, more

ADA accessibility,

wider spaces

between racks.

For a generation that’s balancing careers, caregiving responsibilities and household demands, it’s no surprise that Gen X consumers seek ways to make their lives easier. Our research shows they demand seamless shopping environments and express little tolerance for common, in-store pain points.

Nearly two-thirds (62%) of respondents cite long checkout lines as their top frustration. Nearly half (48%) are put off by inventory shortages. The expectations of Gen X consumers are clear: Stores must offer real-time inventory accuracy, consistent staffing and clear communication to win and retain their business.

While the numbers tell one part of the story, Gen X consumers also made their needs known, and their comments, gathered as part of our consumer research, reveal just how much the in-store experience matters:

Meeting Gen X’s expectations for service and speed

Convenience may bring Gen X in the door, but trust is what keeps them coming back. This generation is highly loyal once a brand earns its confidence. Eighty-one percent of respondents told us they’re loyal to brands they trust, and 51% say that loyalty has only grown over the past five years

(See Brand Trust Runs

Figure 8

Home and Personal Property Upgrades

Travel and Personal Experiences

Gen X Plans to Spend 35% of What They’re

Inheriting on Retail and Experiences

Splurge on Myself

and Family

%

13

%

12

%

10

In our survey, Gen X stood out for its strong focus on property investment and home enhancements. Members of this generation were most likely to say they’re investing in a second or additional home. In addition, 54% of Gen Xers said they’re prioritizing making their homes more comfortable or functional, surpassed only by Baby Boomers.

Uncertainty about the economy

Managing household expenses

Health concerns

Feeling stretched in multiple directions

Retirement

1

2

3

4

5

Top Five Stressors for Gen X

Source: Axies Digital¹

Figure 9

Enter a U.S. ZIP code (e.g., 11201) in the search box.

Press return or click on a result from the drop-down list to zoom to that location.

This suburban corridor offers a clear advantage for premium and durable-goods retailers targeting Gen X. With population shares topping 21%, and average incomes between $105,000 and $145,000, ZIPs like 06424 and 06798 demonstrate both the capacity and willingness to spend—with RPS between $73 and $81. The spatial clustering of Gen X households along NYC commuter belts positions this MSA as an ideal testbed for targeted offerings and long-term loyalty strategies.

Northeast: Bridgeport-Stamford-Danbury, CT MSA

Capitalizing on the Gen X location-based advantage through high potential metropolitan statistical areas (MSA)

While Miami’s submarkets vary—urban, suburban, and beachside—Gen X households show consistent behaviors across ZIPs, particularly in high-performing areas like 33178 and 33187. With strong retail spend and stable incomes, these consumers present scalable potential for retailers offering multi-category solutions. This allows retailers to execute tailored, submarket-specific campaigns while building around a unified strategy—one grounded in the lifestyle needs and spending habits of a mature, engaged consumer base.

Southeast: Miami-Fort Lauderdale-West Palm Beach, FL MSA

Gen X households dominate the suburban edges of this region. The commuter-rich zones of Frankfort and Spring Grove aren’t just affluent—with average household incomes approaching $195,000 and steady retail spend across both urban and suburban ZIPs—this region represents a predictable, high-value market for retailers. The family orientation and commuting routines of Gen X households make them strong adopters of retail hubs that offer convenience, multi-category assortments, and time-saving value.

Midwest: Chicago-Naperville-Elgin, IL-IN MSA

This market stands out for its population scale, income strength, and varied consumer needs. High RPS, affluent suburban communities including The Woodlands, as well as large suburban communities like Pearland, enable retailers to serve different audience needs within the same MSA. Luxury, mid-tier, and value models can find footholds here. With Gen X numbering over 1.5 million and average incomes ranging from $114,000 to $194,000, there’s sustained buying power across demographics—offering retailers room to innovate, localize, and scale.

West: Houston-Pasadena-The Woodlands, TX MSA

Figure 4

Gen Z

Millennial

Gen X

Baby Boomer

Silent Generation

$37.61

$70.16

$71.92

$43.03

$25.92

In-Store Revenue Per Shopper: Total Retail

Figure 5

Gen Z

Millennial

Gen X

Baby Boomer

Silent Generation

$22.31

$68.82

$93.21

$56.88

$34.00

In-Store Revenue Per Shopper: Fitness Centers

Gen Z

Millennial

Gen X

Baby Boomer

Silent Generation

$649.93

$1,630.45

$996.97

$589.29

In-Store Revenue Per Shopper: Luxury

$1,683.46

Figure 6

2023

2022

2021

2020

2019

$95,692

$91,382

$83,357

$75,095

$76,788

Gen X Average Annual Expenditures

Figure 7

Negative

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Overall Lookout on Life

Neutral

Optimistic

Gen Z

Millennial

Gen X

Silent Generation/

Baby Boomer

Figure 10

Gen Z

Millennial

Gen X

Silent Generation/

Baby Boomer

Doesn't Use

Social Media

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Has Social Media Led You to Purchase a Product/Service?

Never

Rarely

Yes, Occasionally

Yes, Many Times

As the last pre-digital generation, Gen X embraces online retail but still

prefers shopping in-store—where they spend the most and expect a high standard of service.

Retailers, take note

Gen X is spending more per consumer than any other generation—but every dollar is hard-earned. If your brand meets their needs for quality, ease or relief, they’ll reward you.

Retailers, take note

Ryan Marshall, President and CEO, PulteGroup

The target consumer... is the Gen X buyer. So think about buyers that are

over the age of 45.... They’ve got wealth… They may be looking to

start to make that semi-retirement-type transition, but they still consider themselves to be very young and active.

This is retail’s most loyal generation. But loyalty has limits—especially when stores miss the mark on service, keeping items in stock or maintaining products that are relevant to their needs.

Retailers, take note

Retailers and restaurants should prioritize Gen X-heavy ZIP codes, as these areas deliver higher spend per shopper and stronger near-term ROI.

Retailers, take note

Download the PDF

Retailers often take Gen X for granted—despite their loyalty

•

Why It Matters:

•

•

•

Accurate inventory

Well-staffed stores

Clear, respectful communication

What They Expect:

81% of Gen X shoppers say they’re loyal to brands they trust

•

Did You Know?

Brand Trust Runs Deep

Gen Alpha

The Quiet Power of

a growing body of research

Power Shoppers With

Figure 4

Gen Z

Millennial

Gen X

Baby Boomer

Silent Generation

$37.61

$70.16

$71.92

$43.03

$25.92

In-Store Revenue Per Shopper:

Total Retail

Gen Z

Millennial

Gen X

Baby Boomer

Silent Generation

$22.31

$68.82

$93.21

$56.88

$34.00

In-Store Revenue Per Shopper:

Fitness Centers

Revenue per shopper (RPS) across all generations rises in ZIP codes with a larger percentage of Gen X residents.

Gen X contributes nearly one-third of all

full-service restaurant spending.

Gen X RPS is two times that of Boomers in restaurants.

•

•

•

Did You Know?

More than one-third of the nation’s Gen X population resides in just five states, California, Texas, Florida, New York and Pennsylvania.

Gen X over-indexes in population in Illinois, Georgia and North Carolina.

Gen X resides in high-performing restaurant and lifestyle retail ZIP codes.

•

•

•

Where They Are:

This suburban corridor offers a clear advantage for premium and durable-goods retailers targeting Gen X. With population shares topping 21%, and average incomes between $105,000 and $145,000, ZIPs like 06424 and 06798 demonstrate both the capacity and willingness to spend—with RPS between $73 and $81. The spatial clustering of Gen X households along NYC commuter belts positions this MSA as an ideal testbed for targeted offerings and long-term loyalty strategies.

Northeast: Bridgeport-Stamford-Danbury, CT MSA

While Miami’s submarkets vary—urban, suburban, and beachside—Gen X households show consistent behaviors across ZIPs, particularly in high-performing areas like 33178 and 33187. With strong retail spend and stable incomes, these consumers present scalable potential for retailers offering multi-category solutions. This allows retailers to execute tailored, submarket-specific campaigns while building around a unified strategy—one grounded in the lifestyle needs and spending habits of a mature, engaged consumer base.

Southeast: Miami-Fort Lauderdale-West Palm Beach, FL MSA

Gen X households dominate the suburban edges of this region. The commuter-rich zones of Frankfort and Spring Grove aren’t just affluent—with average household incomes approaching $195,000 and steady retail spend across both urban and suburban ZIPs—this region represents a predictable, high-value market for retailers. The family orientation and commuting routines of Gen X households make them strong adopters of retail hubs that offer convenience, multi-category assortments, and time-saving value.

Midwest: Chicago-Naperville-Elgin, IL-IN MSA

Gen X shoppers are retail’s most lucrative customers, especially in-store. This comes with high expectations, including consistent service and inventory reliability. Earn Gen X loyalty by minimizing friction in their shopping experiences, catering to their need for efficiency and consistently delivering reliable service and inventory.

Retailers, take note

Retailers and restaurants should prioritize Gen X-heavy ZIP codes, as these areas deliver higher spendper shopper and stronger near-term ROI.

Retailers, take note

Omnichannel on Their

Figure 10

Silent Generation

Baby Boomer

Millennials

Gen Z

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Share of Spending

Share of Population

Gen X Share of Population vs. Share of In-Store and Online Spending

Never

Share of Spending

Share of Population

As the last pre-digital generation, Gen X embraces online retail but still prefers shopping in-store—where they spend the most and expect a high standard of service.

Retailers, take note

Gen X is spending more per consumer than any other generation—but every dollar is hard-earned. If your brand meets their needs for quality, ease or relief, they’ll reward you.

Retailers, take note

Financially Strong,

Figure 5

Gen Z

Millennial

Gen X

Baby Boomer

Silent Generation

$22.31

$68.82

$93.21

$56.88

$34.00

In-Store Revenue Per Shopper:

Fitness Centers

Figure 7

Doesn't Use Social Media

Never

Rarely

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Gen Z

Millennial

Gen X

Silent Generation/Baby Boomer

Has Social Media Led You to

Purchase a Product/Service?

In our survey, Gen X stood out for its strong focus on property investment and home enhancements. Members of this generation were most likely to say they’re investing in a second or additional home. In addition, 54% of Gen Xers said they’re prioritizing making their homes more comfortable or functional, surpassed only by Baby Boomers.

Some brands see an opening as Gen Xers navigate these midlife transitions. During one of the company’s earnings calls, Ryan Marshall, President and CEO of residential builder PulteGroup, discussed the appeal of the company’s resort-style communities.⁸

Source: Axies Digital¹

Deep).