Insurance in step with AI

�At a recent Insurance Post webinar held in association with Hyland, experts from Axa UK and Covéa explored how agentic AI could transform underwriting, claims and fraud. �With AI now able to reason, plan and act autonomously, the discussion focused on how insurers are balancing innovation with governance, trust and the need to keep humans and machines moving in step.

Watch the webinar

Five ways insurers are shaping the path for agentic AI

1. From assistants to agents

Insurers are shifting �from AI that supports decisions to AI

that can plan and

act independently.

2. Building proof through claims

Axa is piloting agentic AI in claims, testing scalability and value across complex settlement processes.

4. Governance drives sustainable transformation

�Clear ownership, aligned teams and defined data standards make tech change stick�

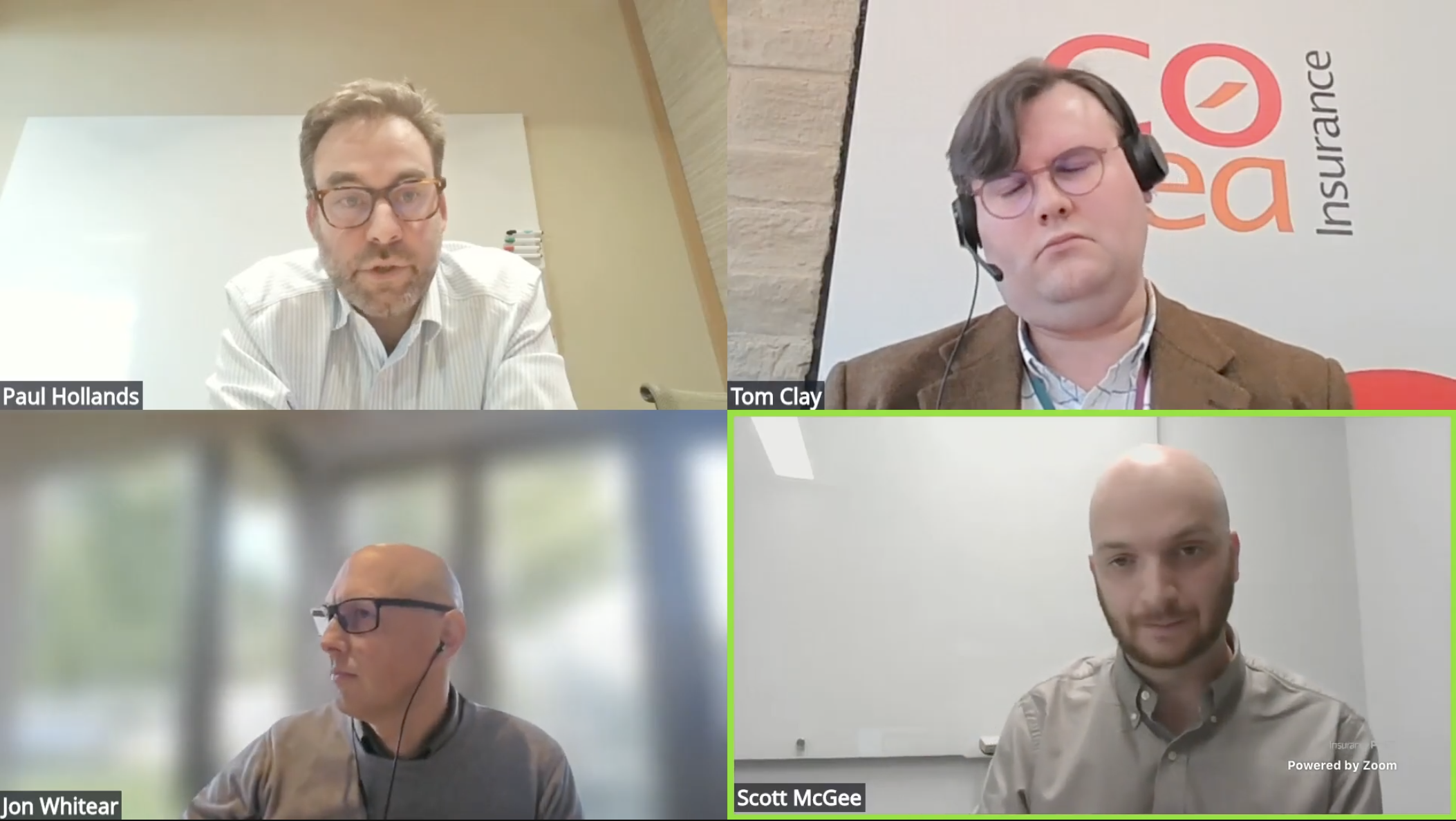

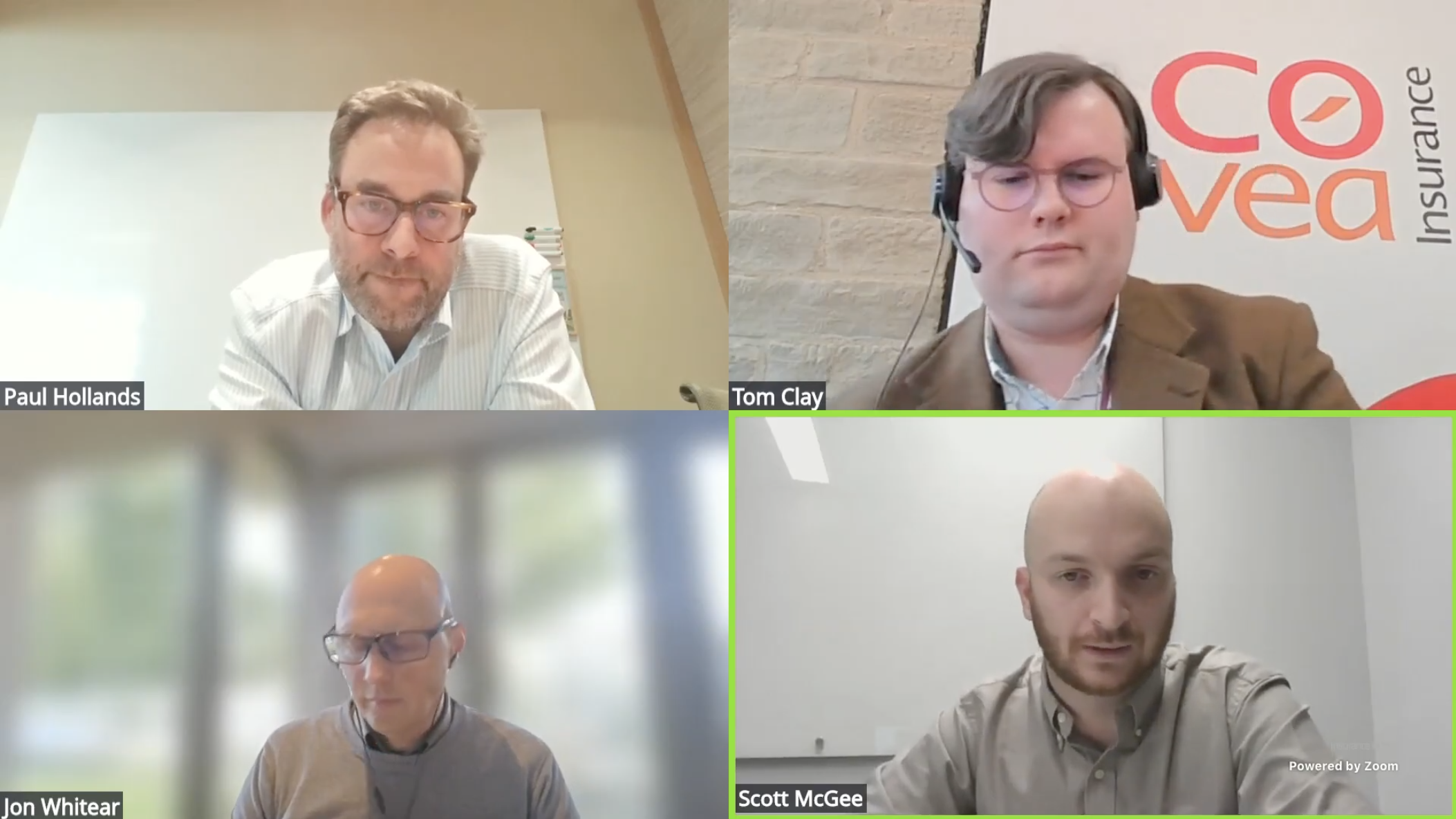

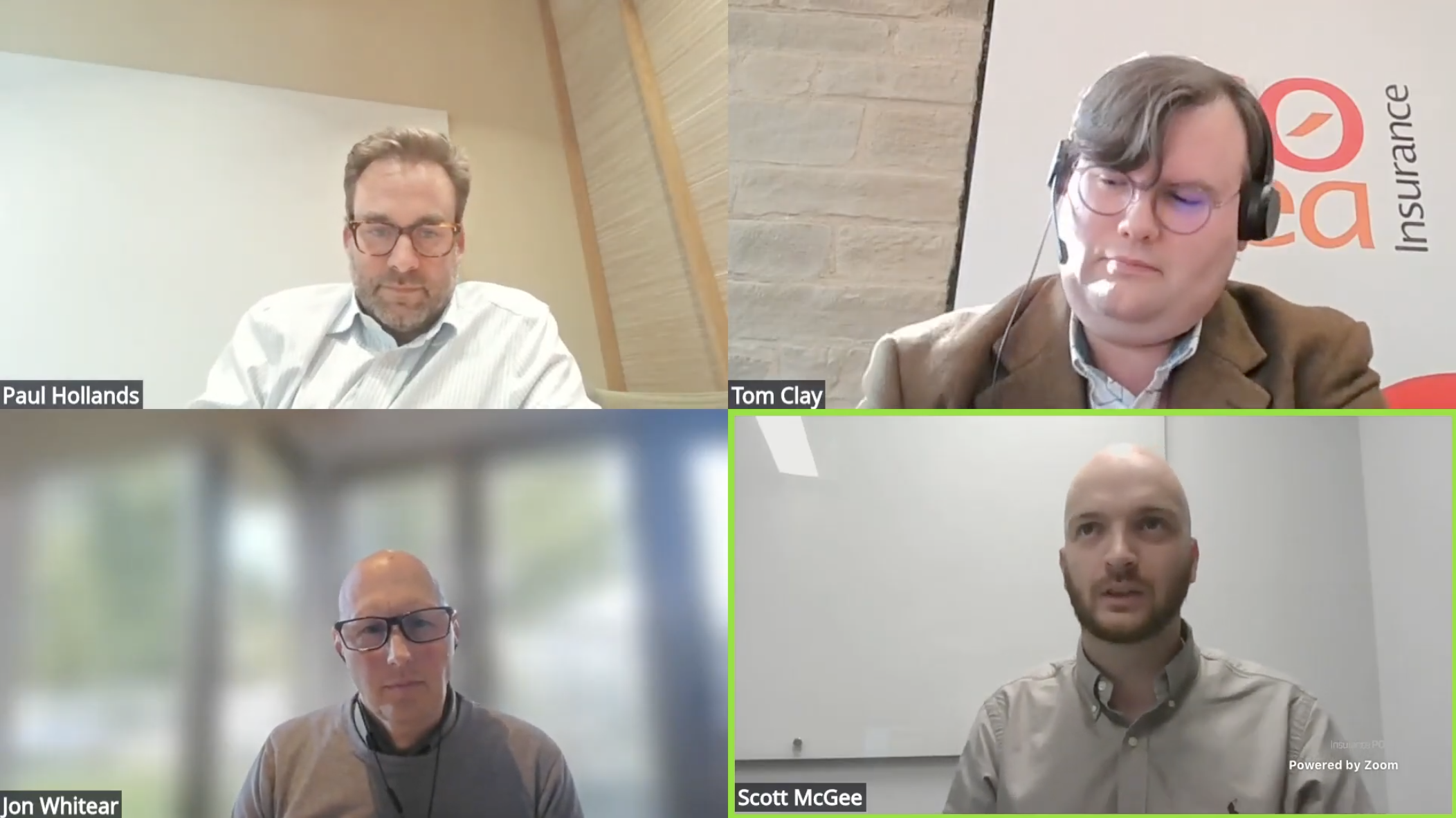

The panel

Paul Hollands�Chief data and AI officer

Axa UK�

Tom Clay�hief data scientist

Covéa Insurance�

Jon Whitear�Speciality sales, EMEA and APAC Hyland

Watch the webinar

1. Defining what makes AI “agentic”

Chapters

2. From pilots to proof of value

3. Balancing efficiency and augmentation

4. Building guardrails for autonomy

5. Balancing governance and resilience

What’s the biggest opportunity – or risk –

in adopting agentic AI for your organisation?

Q

Embedding explainability�Integrating with core systems�Building trust and oversight�Upskilling the workforce�Scaling successful pilots

Submit

OK

Thank you

Defining what

makes AI “agentic”

Chapter 1:

From pilots

to proof of value

Chapter 2:

Balancing efficiency and augmentation

Chapter 3:

Building guardrails for autonomy

Chapter 4:

Balancing

governance

and resilience

Chapter 5:

3. Augmentation over automation

�Agentic AI enhances people and processes, driving better �outcomes instead of simply cutting costs.�

1. Guardrails, not guesswork

Clear governance, explainability and training keep autonomous systems transparent, consistent �and accountable.

2. Education is everything

AI adoption succeeds when insurers invest

in skills, culture and confidence across

their workforce.

Culture and

confidence

Chapter 6:

6. Culture and confidence