Lookbook

The ground keeps shifting beneath marketers. The economic and regulatory backdrop is anything but settled. Marketers are watching renewed tariff battles, antitrust court cases against major platforms, and a possible nationwide TikTok ban.

In this Lookbook, we unpack those three headline issues—tariffs, antitrust, �and a TikTok ban—and show how each is reshaping advertising, media, and commerce. Use these insights to stay nimble and turn uncertainty into an advantage.

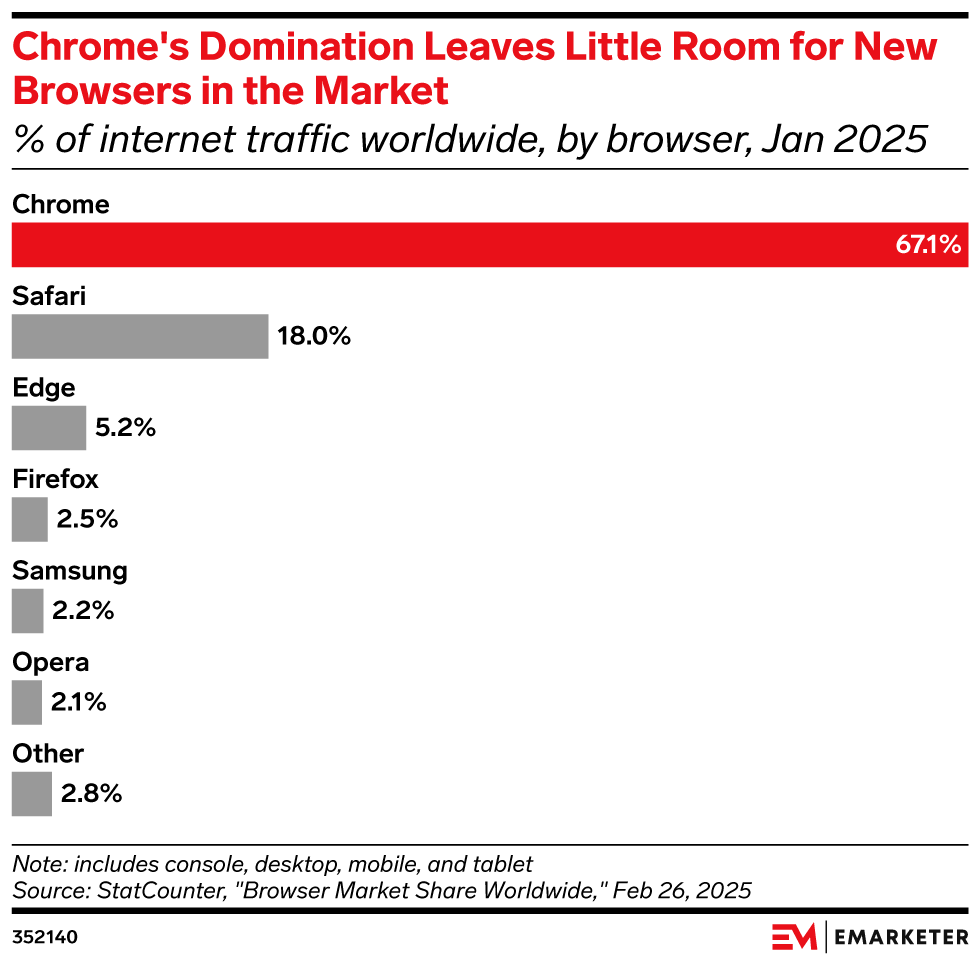

% of internet traffic worldwide, by browser, Jan 2025

Chrome's Domination Leaves Little Room for New Browsers in the Market

Big Tech faces regulatory scrutiny

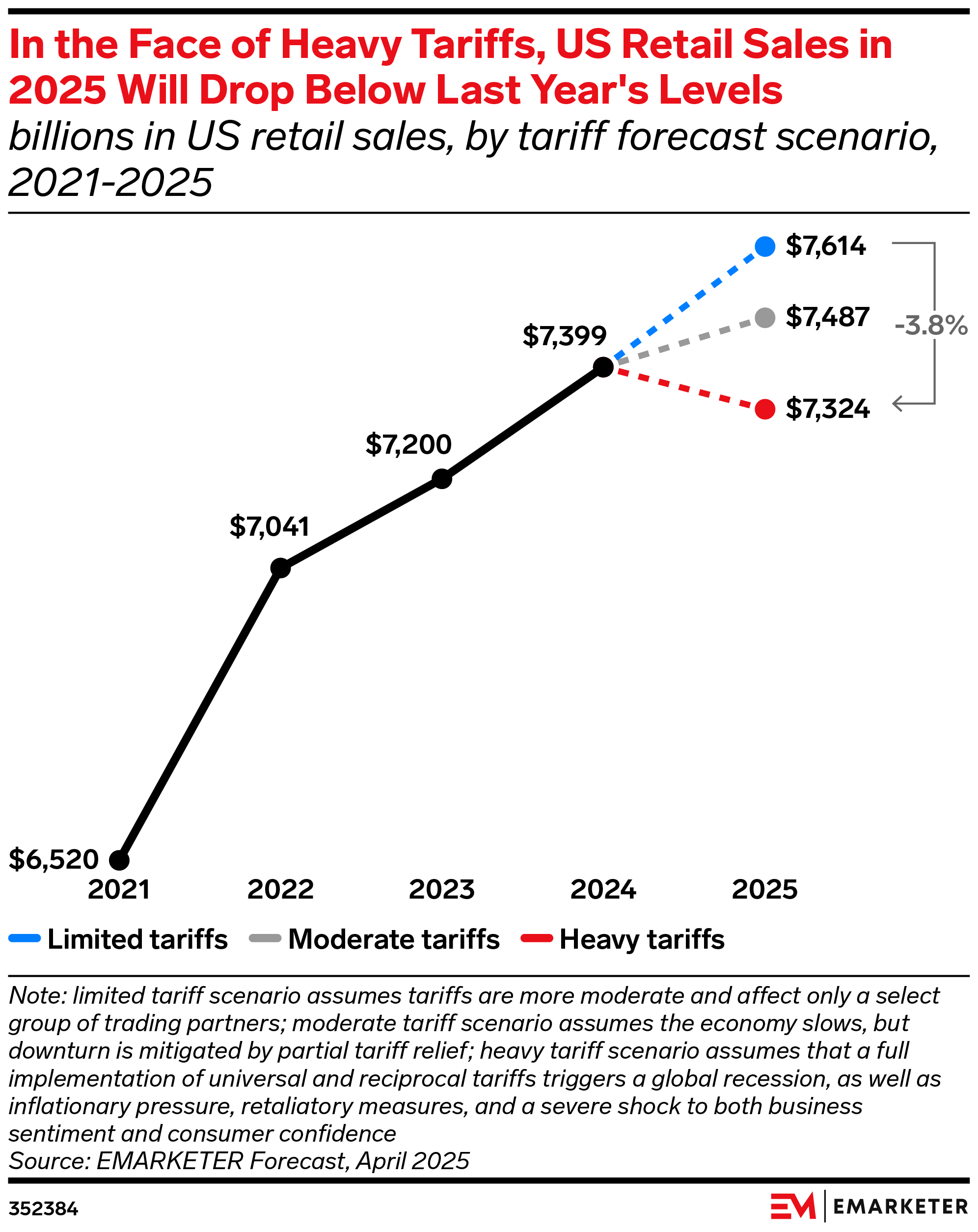

billions in US retail sales, by tariff forecast scenario,

2021-2025

In the Face of Heavy Tariffs, US Retail Sales �in 2025 Will Drop Below Last Year's

Tariff headwinds impact retail and marketers’ budgets

“Any forced divestiture of Instagram will likely take years to play out, so marketers won’t need to confront this challenge in the near term. However, even a preliminary ruling against Meta would send a seismic shock through the digital advertising industry. Particularly in conjunction with the still-very-real possibility that TikTok is eventually banned in the US, marketers could be facing an almost unrecognizable social media ecosystem over the medium term.”

Higher tariffs ripple through the supply chain, dent demand, and ultimately impact marketing budgets. As costs climb, retailers must either raise prices and risk losing shoppers or absorb the tariffs and scale back on advertising. The constant uncertainty slows deliveries, so marketers need flexible plans to easily shift ad dollars around �mid-campaign.

Sky Canaves

Principal Analyst, EMARKETER

“Tariffs aren’t just a line-item—they’re a disruptive force across pricing, inventory, and demand. As costs rise and consumer confidence dips, agility becomes essential. Retailers must rethink promotions, shift marketing spend to high-performing digital channels, and double down on value messaging to keep customers engaged. Those who adapt quickly will be best positioned to protect both margin and market share in a volatile environment.”

Cindy Liu

Forecasting Director, EMARKETER

With the moderate tariffs scenario as our baseline, we forecast that 2025 US retail sales will reach $7.513 trillion. While it appears less likely for now, a slide into a heavy‑tariff environment would pull total retail sales down to $7.324 trillion—nearly $190 billion below the baseline. Higher shelf prices will steer spending toward essentials and private label bargains, squeezing discretionary categories and thinning ad budgets.

Under the moderate‑tariffs baseline, US digital ad spending is projected to reach $335 billion in 2025—about 8.0% higher than the $310 billion spent in 2024, according to an April 2025 EMARKETER forecast. As the threat of tariffs squeeze budgets, brands are likely to redirect dollars toward �lower-funnel digital channels that deliver quick, provable ROI.

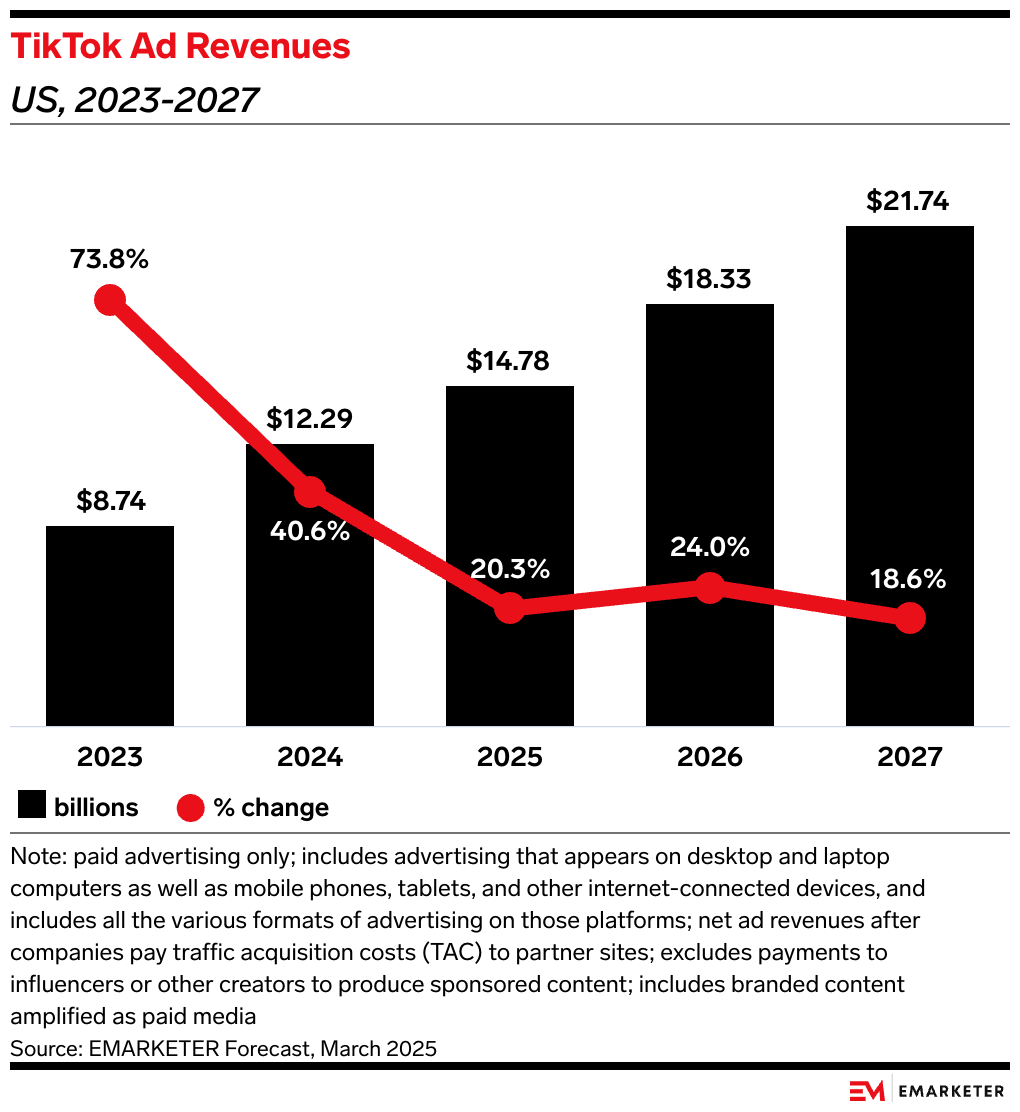

US, 2023-2027

TikTok Ad Revenues

If TikTok’s clock runs out

Note: includes console, desktop, mobile, and tablet

Source: StatCounter, "Browser Market Share Worldwide," Feb 26, 2025

352140

Note: limited tariff scenario assumes tariffs are more moderate and affect only a select group of trading partners; moderate tariff scenario assumes the economy slows, but downturn is mitigated by partial tariff relief; heavy tariff scenario assumes that a full implementation of universal and reciprocal tariffs triggers a global recession, as well as inflationary pressure, retaliatory measures, and a severe shock to both business sentiment and consumer confidence

Source: EMARKETER Forecast, April 2025

352384

Note: paid advertising only; includes advertising that appears on desktop and laptop computers as well as mobile phones, tablets, and other internet-connected devices, and includes all the various formats of advertising on those platforms; net ad revenues after companies pay traffic acquisition costs (TAC) to partner sites; excludes payments to influencers or other creators to produce sponsored content; includes branded content amplified as paid media

Source: EMARKETER Forecast, March 2025

What’s happening?

Tariff impact on commerce will trickle down to ad budgets.

Ad budgets may shift �to lower-funnel efforts.

Google’s Chrome commands 67.1% of global browser traffic, per StatCounter, and a federal court labeled its advertising engine an illegal monopoly. At a minimum, the Department of Justice wants Google �to sell Ad Exchange and DoubleClick for Publishers. The judge still has to hold a separate remedies trial—and Google’s search-monopoly case�is awaiting a remedy decision—so any breakup plan is still in flux.

Ad tech faces an overhaul �due to monopoly claims.

A Federal Trade Commision’s suit could force Meta to spin off Instagram and WhatsApp. Instagram alone represents 37.4% of Meta’s global ad revenue, according to EMARKETER’s March 2025 forecast. Removing Instagram from Meta would fragment audiences, expand the number of ad buying paths, and make cross-platform measurement tougher.

Meta faces a social media shake-up.

Regulators aren’t bluffing. Breakups, sell-offs, and billion‑dollar fines are now realistic outcomes, not hypotheticals for Big Tech. If it happens, audience reach may fracture, platform fees could spike, and attribution turns into a maze of new data silos. Marketers who diversify their spend across more platforms now and beef up their own IDs will be best insulated from sudden shifts in scale and budget.

What’s happening?

Resilience becomes key amidst �legal uncertainty.

Remedy trials and appeals will drag on, but marketers can’t wait for rulings to future‑proof plans. Combat uncertainty by spreading budgets across multiple walled gardens and testing ID‑agnostic measurement in anticipation of a Google breakup.

The US delivers over 40% of TikTok’s global ad revenue, and spending here is set to climb 20.3% to $14.78 billion in 2025. If a ban occurred, Meta and YouTube would capture about 50% of reallocated US TikTok ad spending this year. Yet TikTok trails in creator budgets. US marketers are expected to spend $3.45 billion on YouTube influencers and $3.17 billion on Instagram in 2025, versus $2.35 billion for TikTok, EMARKETER forecasts.

Ad dollars are up for grabs.

TikTok creators are prioritizing cross-platform strategies, and competitors like YouTube Shorts, Instagram Reels, and Snapchat Spotlight are welcoming them with open arms. YouTube and Instagram are the top platforms US TikTok creators say they’d turn to if TikTok disappears, according to Fohr and CivicScience surveys.

Creators diversify due �to legislative limbo.

TikTok secured a 75‑day extension to finalize a sale of its US operations after President Donald Trump vowed to “keep TikTok up and running.” The new deadline falls in mid‑June 2025, but ByteDance says key issues remain unresolved and Chinese approvals are required. A forced sale or nationwide ban would upend creator livelihoods and brand advertising and commerce strategies, impacting a platform that drives cultural trends and captures 14.4% of US social ad spending, per EMARKETER. A change in TikTok’s operations due to new ownership could push brands to redeploy budgets and retool creative and influencer strategies.

What’s happening?

“Big Tech breakups, divestments, and other realignments are just some of the uncertainties marketers and publishers face—alongside macroeconomic volatility, AI disruptions, and cookie whiplash. In this turbulent environment, digital players may fall into decision paralysis. Instead, they should leverage generative AI and agentic AI, prepare for a cookieless future, and avoid panicking over what they can’t control. The future market will likely look different, but businesses that stay grounded in their value and seek opportunity amid change will emerge stronger.”

“Consumer behavior can change dramatically in response to uneven and shifting tariff policies. Rising prices and potential product shortages will put loyalty to the test, so brands and retailers have to continually monitor sentiment and pull together a holistic view of their customers across channels and in real time to respond appropriately. With the right tools, brands and retailers can maximize the impact of targeted promotions and incentives to support revenue and profitability goals.”

Jasmine Enberg

Vice President and Principal Analyst, EMARKETER

“As the Trump administration continues to punt the deadline for a sale, it’s mostly business as usual for TikTok creators, brands, and consumers. But cracks have started to form, and tariffs are adding another layer of complexity for creators and brands that sell on TikTok. Contingency planning and platform diversification are now the name of the game for TikTok creators and advertisers as the situation could change at a moment’s notice, upending strategies.”

“Instagram and YouTube are circling TikTok like sharks, best positioned to gain engagement and boost monetization if a ban materializes. But don’t count out three dark horses—Snapchat, LinkedIn, and Pinterest—all quietly ramping up efforts to grab market share. Snapchat saw Snap Star Spotlight posts jump 125% YoY in Q1, while LinkedIn rebranded its video arm as BrandLink to attract more B2B content creators and advertisers. Meanwhile, Pinterest is focused on driving sales as it positions itself as a shopping hub.”

TARIFFS

xx

Forecasting Director,�EMARKETER

Cindy Liu

Principal Analyst, �EMARKETER

Sky Canaves

Ethan Cramer-Flood

Principal Forecasting Writer, EMARKETER

Vice President, Content, EMARKETER

Paul Verna

Principal Forecasting Writer, EMARKETER

Ethan Cramer-Flood

Vice President, Content, EMARKETER

Paul Verna

Top

01

02

03

end

ANTITRUST

TIKTOK BAN

Senior Analyst, �EMARKETER

Oscar Orozco

Senior Director, Forecasting, EMARKETER

Oscar Orozco

Jasmine Enberg

Vice President and Principal Analyst, EMARKETER

How Policy Shifts—from Tariffs to TikTok—Will Reshape Commerce and Advertising

Consumer sentiment fell to its second-lowest reading on record, according to the University of Michigan’s index, with year-ahead inflation expectations rising from 5.0% in March to 6.7% in April—the biggest jump since 1981. Tariff turmoil is reshaping spending habits. Over one-fifth (17%) of US adults bought big-ticket items sooner to dodge price hikes, and 40% plan to cut back on nonessential spending, a CNET survey found. Marketers should time promotions around tariff dates and keep value messaging front and center to capture cautious shoppers.

Consumer confidence is on the decline.

Nearly 50 million US shoppers are expected to buy on TikTok in 2025, and the app saw $100 million in Black Friday sales. If a ban is imposed, there’s no exact replacement for TikTok for shopping. Shoppers and merchants would likely move to Meta and YouTube, upstarts like WhatNot and LTK, or Chinese retailers such as Temu and Shein.

Where TikTok shoppers might go.

Policy pivots can overturn a media plan overnight—but they don’t have to derail yours.

�With EMARKETER’s forecasts, analyst reports, and daily insights, you’ll see the next tariff hike, court ruling, or platform shake-up before it impacts your bottom line. Use our data to adapt your current marketing, media, and commerce strategies, and turn volatility into opportunity.

Stay Ahead of the Shifts

GET A DEMO

Supporting the critical decisions that drive your business forward�

Develop Media & Commerce Strategies

Optimize �Campaign Budget

Benchmark Marketing �& Commerce Performance

Determine �Market Sizing

Develop Go-to-Market Strategy

Demonstrate Thought Leadership

Win New Business

“EMARKETER provides a multifaceted view of market trends through rich, insightful narratives. These detailed forecasts have enabled me to accurately anticipate market shifts, ensuring that our advertising recommendations are both strategic and impactful.”

— Todd Elbrink, strategist, Veritone One

AI Search, exclusively on PRO+, is a faster, smarter way to navigate EMARKETER research. Cut your research time from hours to minutes, �and get reliable, context-driven answers tailored to your specific questions.

Cut through the noise with vetted, transparent, �and reliable research.

How Policy Shifts—�from Tariffs to TikTok—

Will Reshape Commerce and Advertising

What decision-makers need to know, backed by data and expert insight.

Design

Miri Kramer - Creative Director, Content Studio, EMARKETER

Anthony Wuillaume - Art Director, Content Studio, EMARKETER

�

Author

Jennifer King, Content Manager, �Content Marketing, EMARKETER

Editing

Henry Powderly - Senior Vice President, �Media Content and Strategy, EMARKETER

Becky Schilling - Senior Director, �Media Content, EMARKETER

Kyna Xu - Associate Product Marketing �Manager, EMARKETER

Contact Our Team

Sales Inquiries: sales@emarketer.com

Advertising and Sponsorships: advertising@emarketer.com

�

The following people �contributed to this Lookbook:

Jonathan Tam - SVP, Marketing, EMARKETER

Michelle Lakov - Director, �Product Marketing, EMARKETER