Telecom customers are quick to make a change in a constantly �changing industry. New research from Amazon Ads and Kantar conducted in May 2025 shows that between 28% and 49% of U.S. consumers across prepaid and post-paid wireless, broadband internet, cable TV, and satellite TV have either switched providers in the past year or are actively considering it.

But churn isn’t random. Customers leave because of outages, poor service, price hikes, or contract expirations—all moments when competitors step in. But those same triggers offer providers openings to reinforce loyalty.

By understanding why customers switch, why they stay, and how advertising can influence decisions at these critical moments, telecom marketers can pinpoint when to engage with their most valuable audiences and what messaging will be most impactful. With ad-supported reach to more than 300 million U.S. consumers a month—and trillions of streaming and commerce signals—Amazon Ads offers the tools to help providers shift from managing churn to unlocking durable loyalty.

For many telecom customers, switching isn’t impulsive—it’s the result of frustration building over time. Disappointing outages, unsatisfying customer service, or repeated price hikes give competitors an opening to convince these frustrated consumers.

Switching can be a hassle for consumers, with new equipment, billing headaches, and service disruptions. For providers, the takeaway is clear: Most customers want reasons to stay loyal.

Reliability is table stakes. Between 31% and 48% of telecom consumers say it’s their No. 1 reason for sticking with a provider, per the research. That means marketers can’t just promote flashy offers; they need to consistently reinforce reliability to reassure customers they’re making the safe choice.

But value builds loyalty, too. Bundling, loyalty programs, and tailored product offers instill trust and turn satisfied customers into advocates.

For many, bundling is the top reason to stay: prepaid wireless (55%), post-paid wireless (53%), cable TV (59%), satellite TV (67%), and broadband (58%).

Loyalty programs also help: 25% of satellite TV customers, 24% of prepaid wireless, and 20% of broadband TV said rewards were a top three reason to stay.

Marketers should promote bundles not just as savings, but as added value that deepens the relationship and encourages advocacy.

Advertising is a powerful tool for providers that both influences acquisitions and shapes loyalty, through precise messaging, impactful ad channels, and demographic data. Among loyal consumers (41%) and recent switchers (49%), advertising reinforced their decision to stay with a provider, according to Amazon Ads. But advertising also prompts consumers to switch, especially those actively considering switching (33%) and those passively retained (28%).

With trillions of signals, ad-supported reach to more than 300 million U.S. consumers a month, and solutions like Amazon DSP, Prime Video ads, and Amazon Marketing Cloud (AMC), Amazon Ads helps telecom providers protect their customer base and turn churn risk into loyalty growth.

BROUGHT TO YOU BY

Amazon Ads offers full-funnel advertising solutions to help businesses of all sizes achieve their marketing goals at scale. Amazon Ads connects advertisers to highly relevant audiences through first-party insights; extensive reach across premium content like Prime Video, Twitch, and third-party publishers; the ability to connect and directly measure campaign tactics across awareness, consideration, and conversion; and generative AI to deliver appropriate creative at each step. Amazon Ads helps advertisers reach an average monthly ad-supported audience of more than 300 million in the U.S. across Amazon's owned and operated properties and third-party publishers.

This immersive experience was produced for Amazon Ads by EMARKETER Studio, an in-house creative studio within research company EMARKETER. EMARKETER is the leading provider of research, data, and insights for marketing, advertising, and commerce professionals. Our data-driven forecasts and rigorous analysis empower revenue-driving teams to make strategic decisions with confidence. Through expert context from our analysts, carefully vetted data sources, and a proprietary research methodology, EMARKETER delivers forecasts, reports, and benchmarks that help companies anticipate tomorrow’s market trends today. EMARKETER is a division of Axel Springer S.E.

Satellite TV churn has more than doubled since 2023, showing that tolerance for service issues is falling and the willingness to switch �is rising.

Meanwhile, cable TV customers want to know their providers are ready to listen and react when their viewing needs aren't met—47% �of cable TV consumers say lack �of customer support spurs them �to weigh the options.

Around a third of prepaid wireless (35%), post-paid wireless (29%), satellite TV (35%), and broadband (35%) consumers say that frequent outages or service disruptions are the biggest reasons they consider switching providers, per data from Amazon Ads.

Beyond the switch: How telecom brands build loyalty

�

How loyal customers are made

The message matters as much as the medium. Across categories, cost-savings is the biggest motivator. Up to 60% of telecom consumers say ads showcasing discounts and savings are the top reason to switch.

For those considering switching: 62% of prepaid, 67% of post-paid, 66% of cable, 52% of satellite, and 65% of broadband consumers point to discounts as the most persuasive driver.

Customer service messaging also resonates, especially with prepaid (27%) and satellite (33%) customers.

The challenge for marketers is delivering the right message �at the right moment. Signals from Amazon Ads can help �show when customers are most receptive, whether they are �a recently switcher or actively loyal. These indicators allow advertisers to reach and engage their target audiences with AI-powered timing and messaging. Additionally, Amazon DSP enables telecom marketers to reach customers across multiple touchpoints, from Amazon-owned properties to premium third-party publishers. With 1 in 3 actively considering switching and nearly half of recent switchers making connectivity purchases on Amazon, Amazon DSP is ideal for serving high-intent offers that close the deal during purchase consideration.

Though building telecom loyalty can be complicated for marketers, it's a solvable problem. The data shows:

Reliability and price

are table stakes.

Streaming drives�the strongest recall�and follow-up actions.

Advertising influences both loyalty and churn.

Spanish-preferred customers are a high-value growth segment.

Demographics matter as well. Spanish-preferred US audiences report significantly higher loyalty than the general population.

For example, 64% are actively loyal to their cable provider and would promote them to others (vs. 47% overall).�

Nearly half (49%) are loyal advocates for their satellite provider (vs. 35% overall), per Amazon Ads. �

For marketers, this represents both a defensive challenge as competitors will try to poach this base and a growth opportunity to deepen trust with culturally relevant, language-specific campaigns.

Inflation adds another layer. Rising costs are a top reason for switching among broadband (17%), prepaid wireless (24%), and satellite (30%) customers. And when contracts expire—especially for post-paid wireless (26%) and broadband (17%)—many take the chance to comparison shop.

Telecom's U.S. Spanish speaker opportunity

Messaging that motivates

Telecom marketers can find particular success on streaming services, where consumers are more likely to internalize their messaging. At least 57% telecom customers recall ads while watching shows or films—far higher than recall for podcasts (under 20%) or music streaming (under 10%).

Streaming TV, including Prime Video Ads, offers reach across the loyalty spectrum—reinforcing brand value among actively loyal customers and influencing those at the edge of switching. And through Amazon Ads partnering with Roku, they can reach 80% of addressable CTV users, according to data from Amazon Ads. Pairing this with Amazon DSP remarketing ensures a connected customer journey from awareness to conversion.

Amazon Marketing Cloud (AMC) takes this further, allowing telecom marketers to measure how impressions on Prime Video translate into website visits, remarketing engagements, and ultimately conversions. With AMC, providers can see which combinations of channels and messages work best for loyal customers versus switchers, enabling data-driven optimization.

This matters because recall drives action, usually visiting a provider’s website or asking a friend for advice.

Prepaid wireless (38%), post-paid wireless (29%), cable TV (31%), and broadband (32%) consumers visited the provider's website to learn more. �

For consumers who are actively considering switching, over 2 in 5 (43%) asked a friend or colleague about the provider after seeing a telecom ad.

Reaching consumers when they shop online also creates lasting connections. Over a quarter of prepaid wireless (29%), cable TV (26%), and broadband (26%) consumers recalled telecom ads while online shopping, and 40% of satellite TV consumers said the same thing.

Streaming's advantage

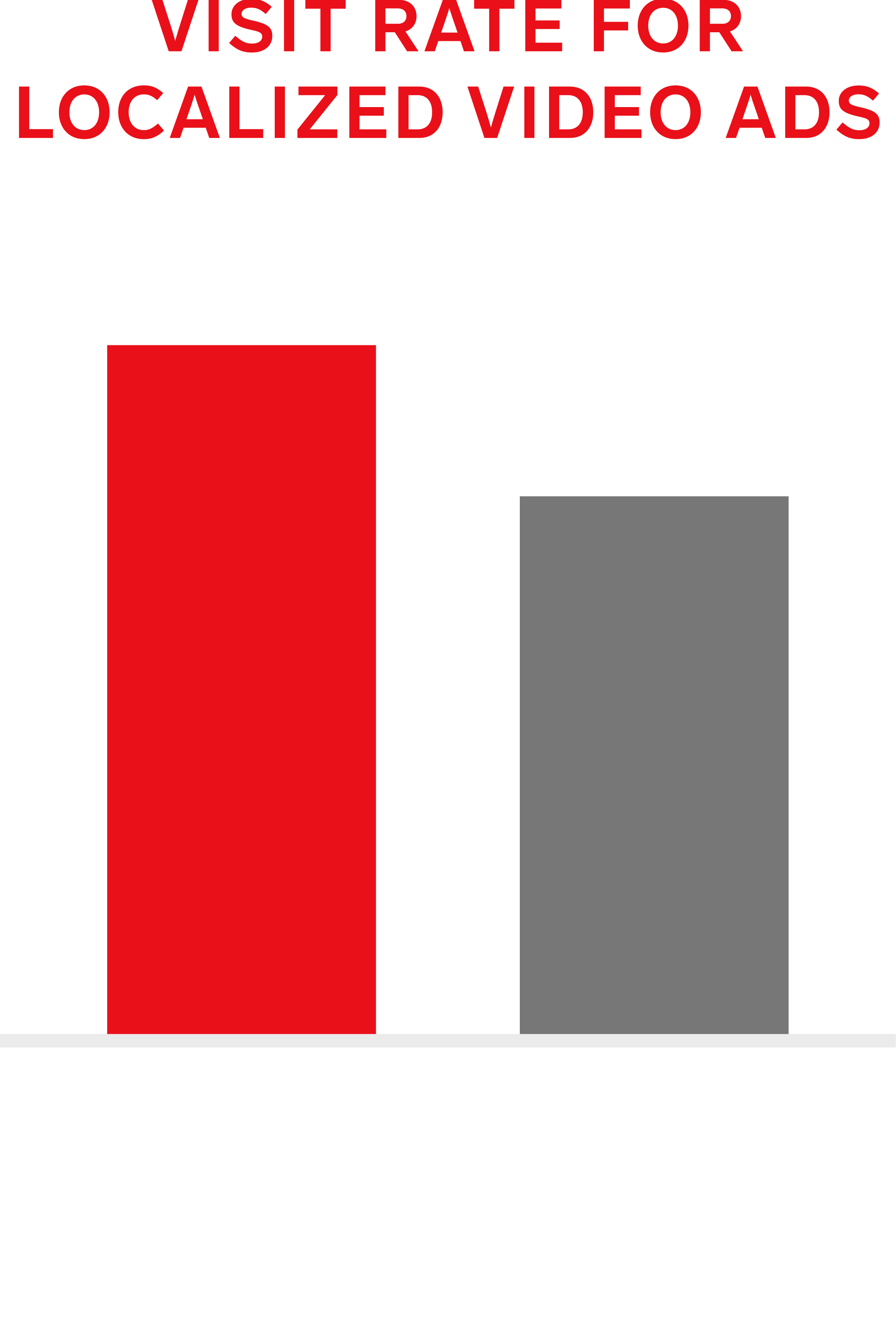

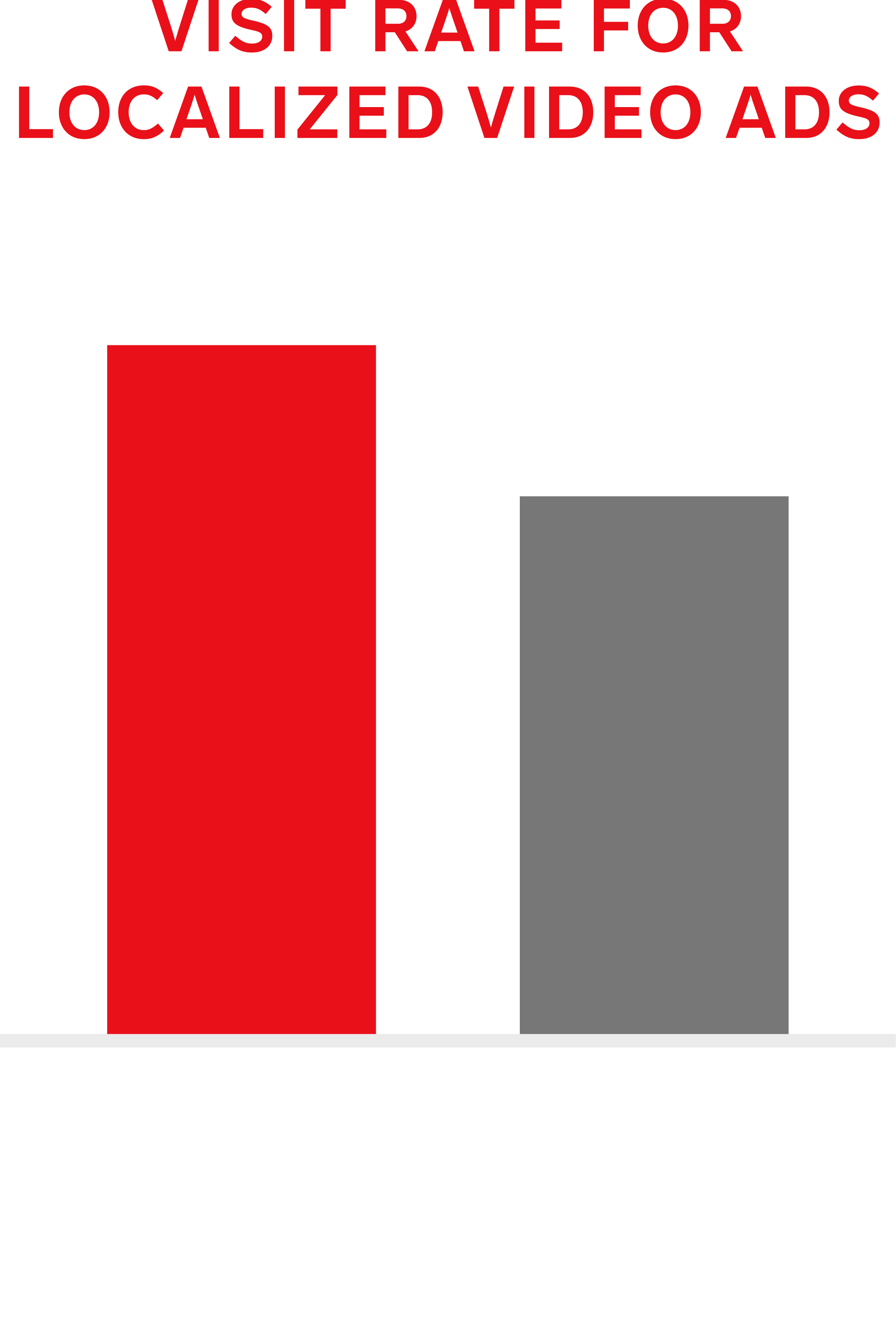

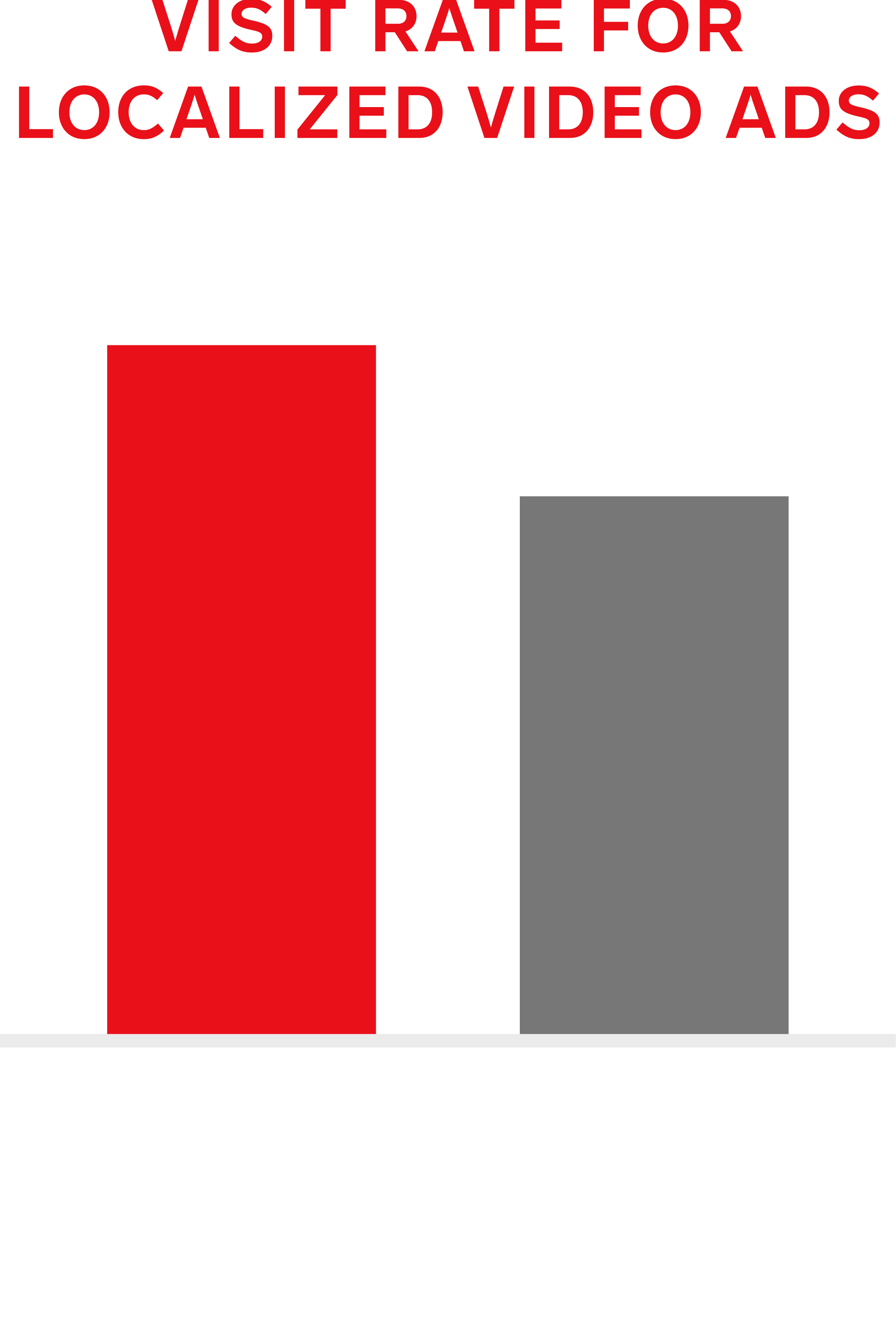

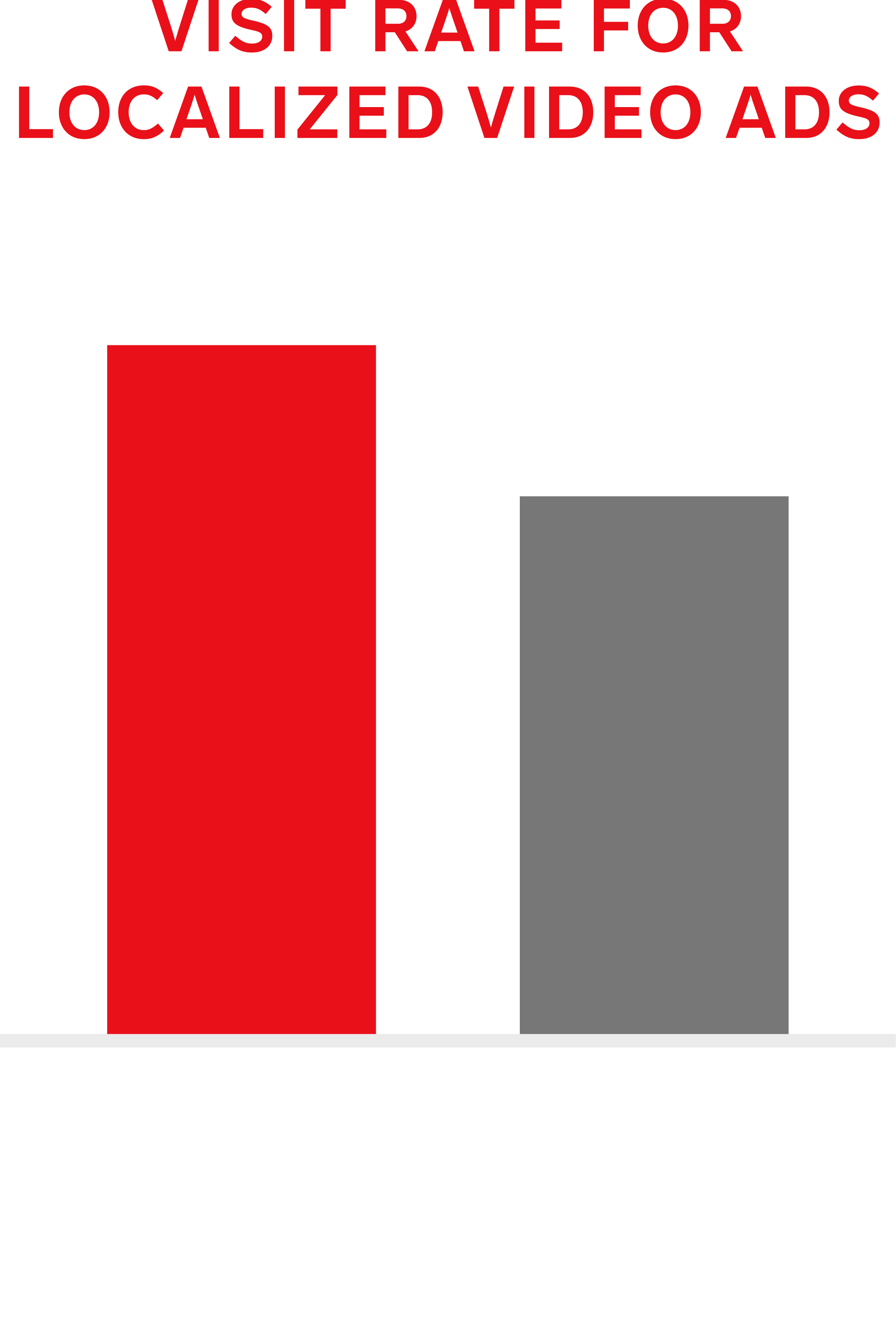

Spanish-preferred U.S. consumers over-index on loyalty and advocacy. Localized video ads drive above-average engagement (41% visit rates vs. 32% for the general population). Pairing Spanish-first creative with Amazon DSP reach and AMC measurement helps marketers deepen loyalty while driving new acquisition.

The telecom industry is expected to spend $29.07 billion on media advertising this year, including $22.26 billion on digital advertising, according to an EMARKETER forecast, a 9.8% growth YoY. With advertising acquisition and boosting retention, success in a crowded industry depends on identifying the most effective messaging and where consumers are most receptive. Unique targeting capabilities and measurement data from Amazon Ads can assist telecom marketers in launching campaigns that excel in advertising's dual role.

Design

Miri Kramer - Creative Director, Content Studio, EMARKETER

Anthony Wuillaume - Art Director, Content Studio, EMARKETER

�

But value builds loyalty, too. Bundling, loyalty programs, and tailored product offers instill trust and turn satisfied customers into advocates.

For many, bundling is the top reason to stay: prepaid wireless (55%), post-paid wireless (53%), cable TV (59%), satellite TV (67%), and broadband (58%).

Loyalty programs also help: 25% of satellite TV customers, 24% of prepaid wireless, and 20% of broadband TV said rewards were a top three reason to stay.

Marketers should promote bundles not just as savings, but as added value that deepens the relationship and encourages advocacy.

Demographics matter as well. Amazon Ads and Kantar’s study included a sample of 300 self-identified U.S. Spanish speakers. These respondents reported significantly higher loyalty than the general population.

Nearly half (49%) are loyal advocates for their satellite provider (vs. 35% overall), per Amazon Ads. �

For example, 64% are actively loyal to their cable provider and would promote them to others (vs. 47% overall).

For marketers, this represents both a defensive challenge as competitors will try to poach this base and a growth opportunity to deepen trust with culturally relevant, language-specific campaigns.

The challenge for marketers is delivering the right message �at the right moment. Signals from Amazon Ads can help �show when customers are most receptive, whether they are �a recently switcher or actively loyal. These indicators allow advertisers to reach and engage their target audiences with AI-powered timing and messaging. Additionally, Amazon DSP enables telecom marketers to reach customers across multiple touchpoints, from Amazon-owned properties to premium third-party publishers. With 1 in 3 actively considering switching and nearly half of recent switchers making connectivity purchases on Amazon, Amazon DSP is ideal for serving high-intent offers that close the deal during purchase consideration.

The message matters as much as the medium. Across categories, cost-savings is the biggest motivator. Up to 60% of telecom consumers say ads showcasing discounts and savings are the top reason to switch.

For those considering switching: 62% of prepaid, 67% of post-paid, 66% of cable, 52% of satellite, and 65% of broadband consumers point to discounts as the most persuasive driver.

Customer service messaging also resonates, especially with prepaid (27%) and satellite (33%) customers.

Telecom marketers can find particular success on streaming services, where consumers are more likely to internalize their messaging. At least 57% telecom customers recall ads while watching shows or films—far higher than recall for podcasts (under 20%) or music streaming (under 10%).

Streaming TV, including Prime Video Ads, offers reach across the loyalty spectrum—reinforcing brand value among actively loyal customers and influencing those at the edge of switching. And through Amazon Ads partnering with Roku, they can reach 80% of addressable CTV users, according to data from Amazon Ads. Pairing this with Amazon DSP remarketing ensures a connected customer journey from awareness to conversion.

Amazon Marketing Cloud (AMC) takes this further, allowing telecom marketers to measure how impressions on Prime Video translate into website visits, remarketing engagements, and ultimately conversions. With AMC, providers can see which combinations of channels and messages work best for loyal customers versus switchers, enabling data-driven optimization.

This matters because recall drives action, usually visiting a provider’s website or asking a friend for advice.

For consumers who are actively considering switching, over 2 in 5 (43%) asked a friend or colleague about the provider after seeing a telecom ad.

Prepaid wireless (38%), post-paid wireless (29%), cable TV (31%), and broadband (32%) consumers visited the provider's website to learn more. �

Reaching consumers when they shop online also creates lasting connections. Over a quarter of prepaid wireless (29%), cable TV (26%), and broadband (26%) consumers recalled telecom ads while online shopping, and 40% of satellite TV consumers said the same thing.

Source: Amazon Ads and Kantar, May 2025, U.S., n=300.