To verify the predictive nature of the Intralinks Deal Flow Predictor, we compared the data underlying the Intralinks Deal Flow Predictor with subsequent announced deal volume data reported by Thomson Reuters to build an econometric model (using standard statistical techniques appropriate for estimating a linear regression model) to predict the future reported volume of announced M&A transactions two quarters ahead, as recorded by Thomson Reuters. We engaged Analysis & Inference (“A&I”), an independent statistical consulting and data science research firm, to assess, replicate and evaluate this model. A&I’s analysis showed that our prediction model has a very high level of statistical significance, with a more than 99.9 percent probability that the Intralinks Deal Flow Predictor is a statistically significant six-month predictive indicator of announced deal data, as subsequently reported by Thomson Reuters.

We plan to periodically update

the independent statistical

analysis to confirm the Intralinks Deal Flow Predictor’s continuing validity as a predictor of future M&A activity.

The Intralinks Deal Flow Predictor report is provided “as is”

for informational purposes only. Intralinks makes no guarantee regarding the timeliness, accuracy or completeness of the content of this report. This report is based on Intralinks’ observations and subjective interpretations of due diligence activity taking place, or proposed to take place, on Intralinks’

and other providers’ VDR platforms for a limited set of transaction types. This report is not intended to be an indicator of Intralinks’ business performance or operating results for any prior or future period. This report is not intended to convey investment advice or solicit investments of any kind whatsoever.

The Intralinks Deal Flow Predictor provides Intralinks’ perspective on the level of early-stage M&A activity taking place worldwide during any given period. The statistics contained in this report reflect the volume of VDRs opened, or proposed to be opened, through Intralinks and other providers for conducting due diligence on proposed transactions, including asset sales, divestitures, equity private placements, financings, capital raises, joint ventures, alliances and partnerships. These statistics are not adjusted for changes in Intralinks’ share of the VDR market or changes in market demand for VDR services.

These statistics may not

correlate to the volume of completed transactions reported by market data providers and should not be construed to represent the volume of transactions that will ultimately be consummated during any period nor of the revenue or M&A deal volume that Intralinks may generate for any financial period. Indications of future completed deal activity derived from the Intralinks Deal Flow Predictor are based on assumed rates of deals going from due diligence stage to completion. In addition, the statistics provided by market data providers regarding announced M&A transactions may be compiled with a different set of transaction types than those set forth above.

Read more

About the Intralinks Deal Flow Predictor

Be the first to share this information:

Another reason is the way in which many acquirers are now approaching the post-merger integration (PMI) process. While in the past the PMI process and those involved with it used to be distinctly separate from those involved in deal origination and execution, more and more corporates are now favoring an approach that allows these teams to work together much earlier in the lifetime of a transaction.

Bringing in the integration team at the beginning of the process can not only help the deal team get a much stronger understanding of the strategic and operational fit of a deal, it can also have an impact on valuation due to deeper discussions around synergies and cost cutting potential. This in turn can result in a higher offer price.

So, what are our expectations for the future? The consensus is that while M&A continues to boom, with corporates under pressure to grow and adapt to changing markets and PE firms needing to deploy capital, valuations will remain high. The challenge in the years to come will be to make transactions done at today’s high valuation levels generate the expected returns on investment. Given the high valuations in today’s environment it is inevitable that many deals will fail to deliver the anticipated shareholder value – which may cause both strategic acquirers and financial sponsors to pull back the reins on some of the more aggressive dealmaking and revert to a more pragmatic approach to M&A. With that in mind, thorough due diligence processes and well-planned and

well-executed post-merger integrations will distinguish successful acquirers from those who may ultimately suffer from buyer’s remorse.

References:

Back

These reasons, along with increasing competition from financial sponsors for attractive assets coming to market, are factors in driving up valuations.

Flush with cash, and with no signs of fund-raising slowing down, private equity (PE) firms are making bolder and bolder moves, scooping up assets that “by right” should be under corporate ownership. The perceived notion that strategic acquirers can pay a higher price for assets due to the synergies, cost savings and overall strategic benefits ensuing from a deal no longer holds true. The overall valuation gap between strategic acquirers and PE firms has fallen to zero in H1 2018. In some sectors, such as Financials, Energy & Power and Materials, strategic acquirers are even being outbid by PE firms prepared to pay even higher valuations.

That said, deals like the formerly-mentioned Takeda/Shire acquisition show that corporates too are not shy about digging deep into their pockets to pay for “must-have” targets that have the potential to transform their businesses. So why are buyers – strategic and financial alike – so confident when it comes to paying top dollar for deals?

One of the biggest game changers is the increasing sophistication of the due diligence process, leading to greater confidence when it comes to the price that is being offered for an asset. One example is the use of artificial intelligence (AI) technology by acquirers during due diligence to look at a wider range of issues, dig deeper in key areas but also move much faster. Chris Perram, CEO of FileFacets and Noah Waisberg, CEO and co-founder of Kira Systems, two pioneers of applying artificial intelligence and machine learning to M&A deals, were interviewed in a previous edition of the Intralinks Deal Flow Predictor about the support their technologies can lend to the M&A process. AI technologies supporting the dealmaking process are undergoing rapid adoption by legal advisors and larger corporates and are set to become as widely used as VDRs which began to replace physical data rooms for due diligence 20 years ago.

Read more

However, many also felt that the high valuations targets are currently demanding could also be the undoing of the current period of strong deal activity.

Before taking a closer look at some of the reasons for the high valuations we are seeing and how they might end up slowing down deal activity, let’s examine some recent M&A data.

According to Thomson Reuters, worldwide announced M&A activity totaled US$2.5 trillion during the first half of 2018, an increase of 61 percent compared to the first half of 2017, and the strongest first half for global M&A since their records began in 1980. Eighty-one mega-deals (ones with a value greater than US$5 billion) accounted for 50 percent of the total value of announced M&A during the period. The value of worldwide M&A deals greater than US$5 billion totaled US$1.3 trillion during the first half of 2018, more than three times the levels seen a year ago, marking an all-time high for the number, value and overall percentage of mega deals in any first half on record.

The US $77 billion acquisition of Irish-domiciled pharmaceutical manufacturer Shire by Japan’s Takeda, as well as the US$100+ billion bidding war between Disney and Comcast for the media and entertainment companies Sky and Twenty-First Century Fox are just two examples of deals that have raised eyebrows over the amounts of money involved. Takeda is even reported to be considering selling its iconic former head office in Osaka, the site on which the company was founded more than two centuries ago, to raise funds to support the deal and stave off criticism that it is too expensive and will load Takeda with too much debt.

The reasons for the booming M&A market have been well-documented in previous editions of this report: cheap financing, shareholder pressure to seek alternative forms of growth and streamline operations by selling non-core assets, a way to deal with digital disruptors and the remorseless advance of “platform” companies such as Facebook, Amazon, Google and Netflix to name but a few.

Read more

Can you tell us about your experience of working with virtual data rooms on IPOs?

Philip Whitchelo: The IPO market had a huge year in 2017 with the number of issues overall growing by 45 percent worldwide. The APAC region is particularly active for IPOs, with 1,123 issues in 2017 comprising 72 percent of the worldwide total. India had the second largest number of IPOs after China . Can you tell us why IPOs are so popular in India and give us your perspectives on the dynamics and growth of the market?

Rupesh Khant,

vice president,

ICICI Securities Limited

For this edition of the Intralinks Deal Flow Predictor, we spoke to Rupesh Khant, vice president with Indian financial services provider ICICI Securities, about recent trends in the initial public offering (IPO) market, the reasons behind them and his expectations for the coming months.

See Q&A

Q&A

The Indian IPO Market

Ben Collins,

director, strategy & product marketing, Intralinks

Read More

According to data from Thomson Reuters, valuation levels for worldwide announced acquisitions in H1 2018 were the highest in over 30 years. At a recent corporate development forum held in London, the resounding verdict from M&A practitioners was that the ongoing boom in global M&A activity coupled with valuations reaching such multi-decade highs means that it’s a seller’s market: almost anything can be sold and usually for very good money.

M&A Valuations

Spotlight

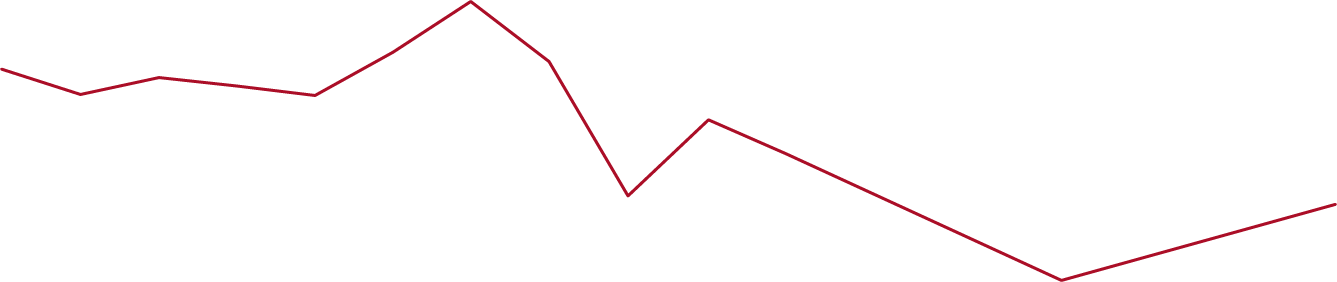

The Real Estate sector is predicted to be the only one to see growth in LATAM M&A announcements over the next six months.

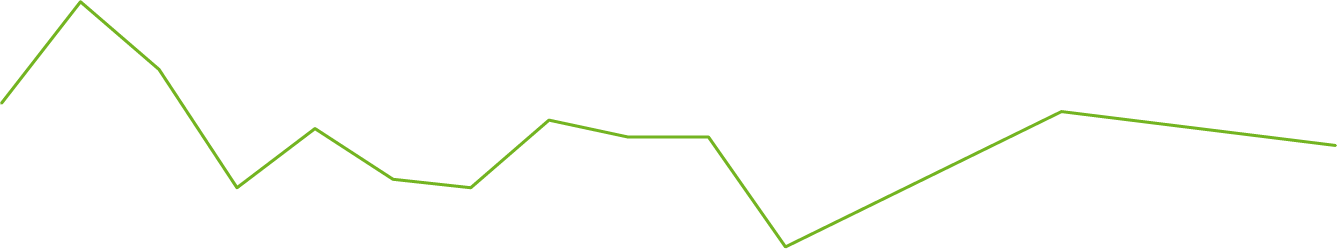

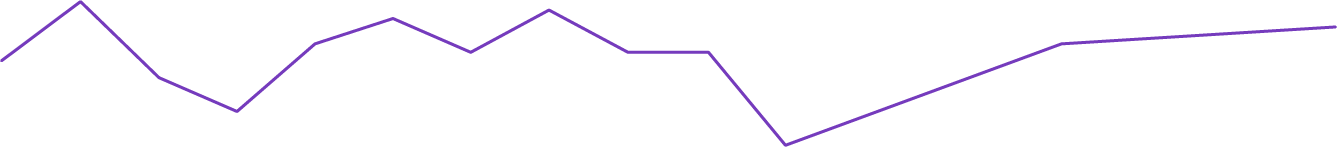

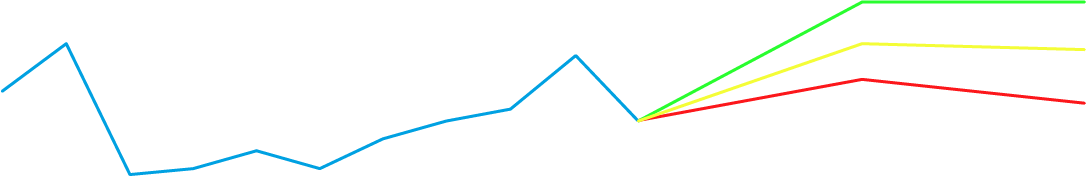

The Real Estate, Materials and Industrials sectors are predicted to lead the growth in EMEA M&A announcements over the next six months.

EMEA

Healthcare

Real Estate

Financials

Consumer & Retail

Materials

TMT

Energy & Power

Industrials

+27%

+10%

+19%

+27%

+14%

+20%

+7%

+18%

+9%

+7%

+4%

-1%

2%

-1%

-2%

+20%

+12%

Intralinks six month forecast

Q3

Q2

Q1

Q4

2017

Q3

Q2

2017

Q1

Q4

2016

Q3

Q2

2016

Q1

50%

40%

30%

20%

10%

0%

-10%

-20%

2018

2018

2018

2017

2017

2016

2016

2015

Q4

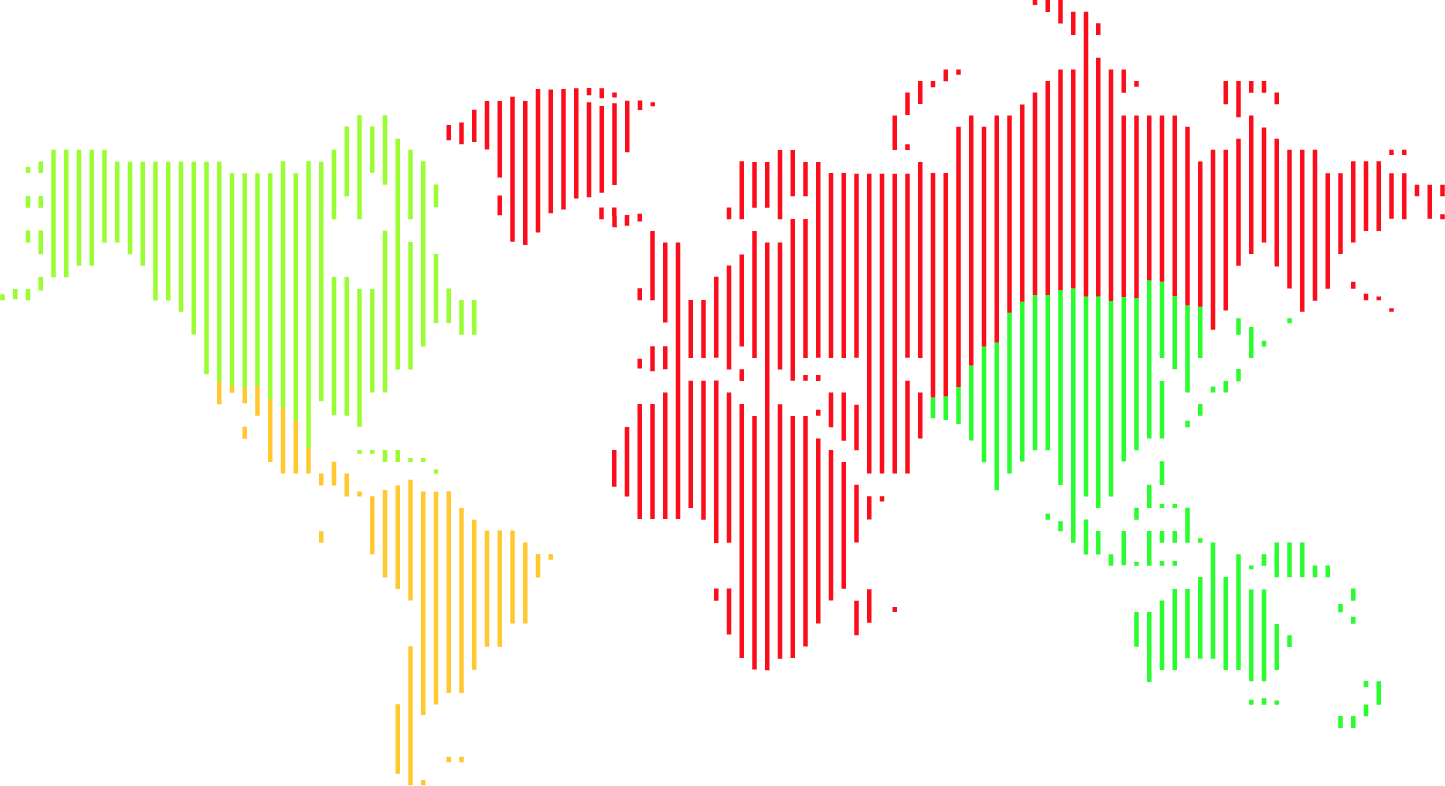

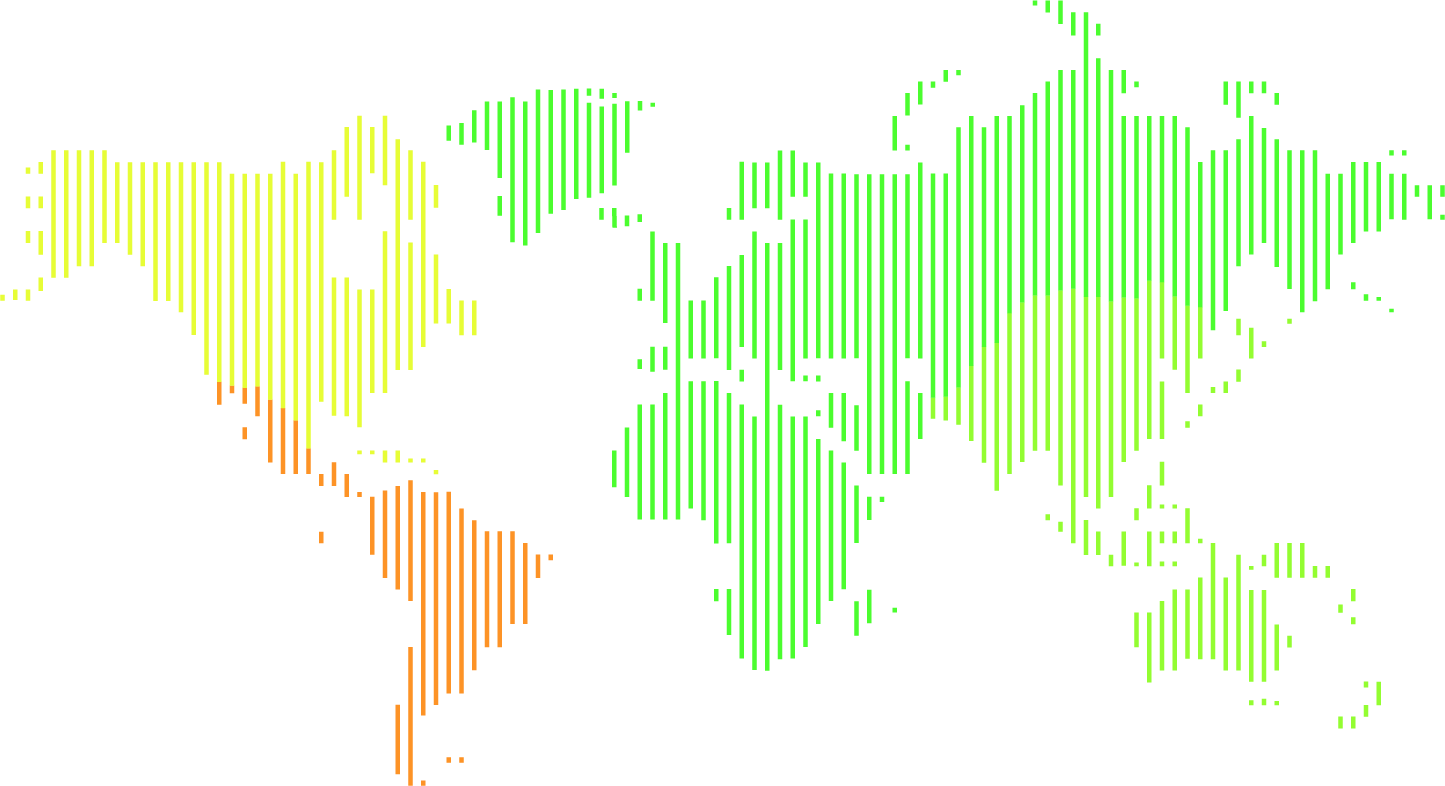

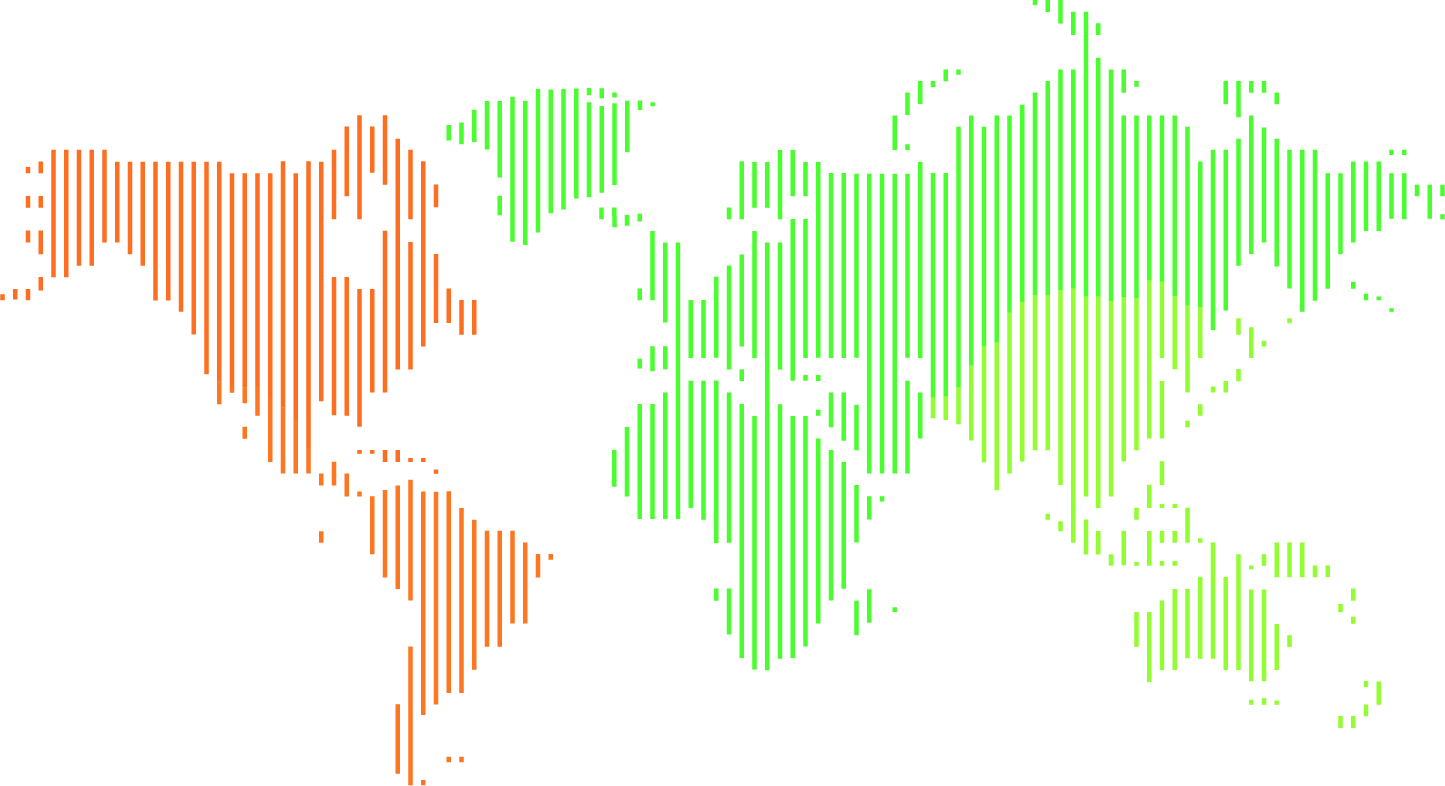

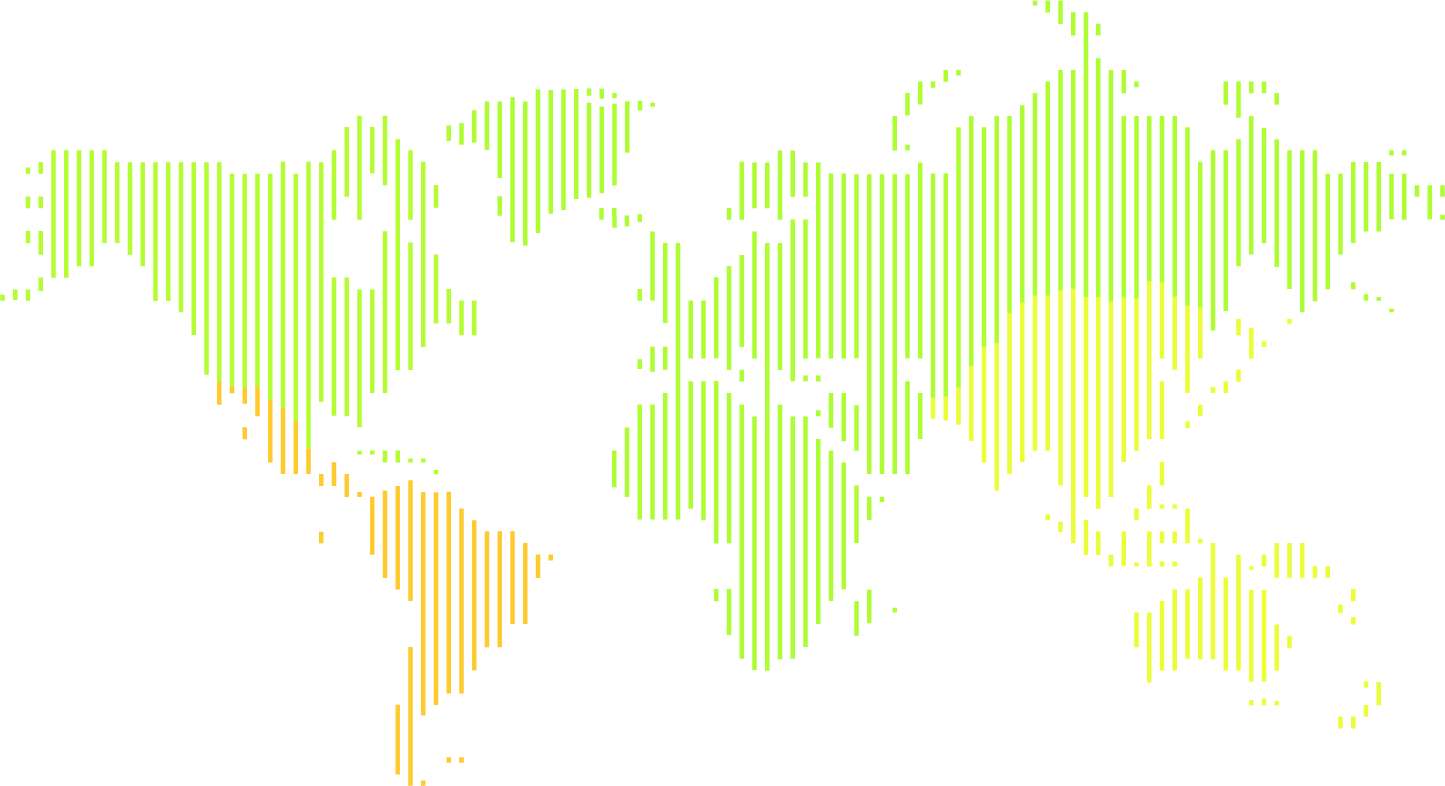

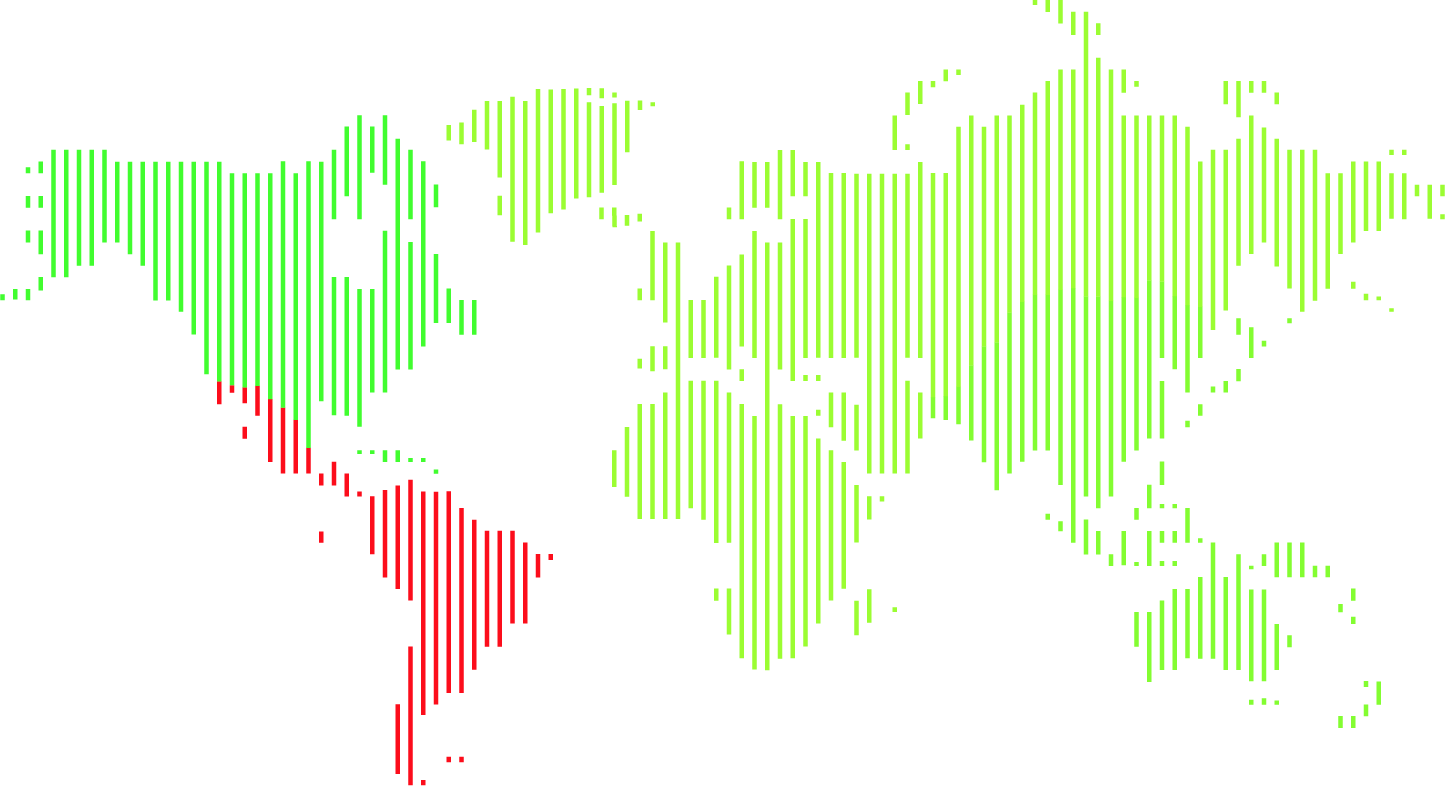

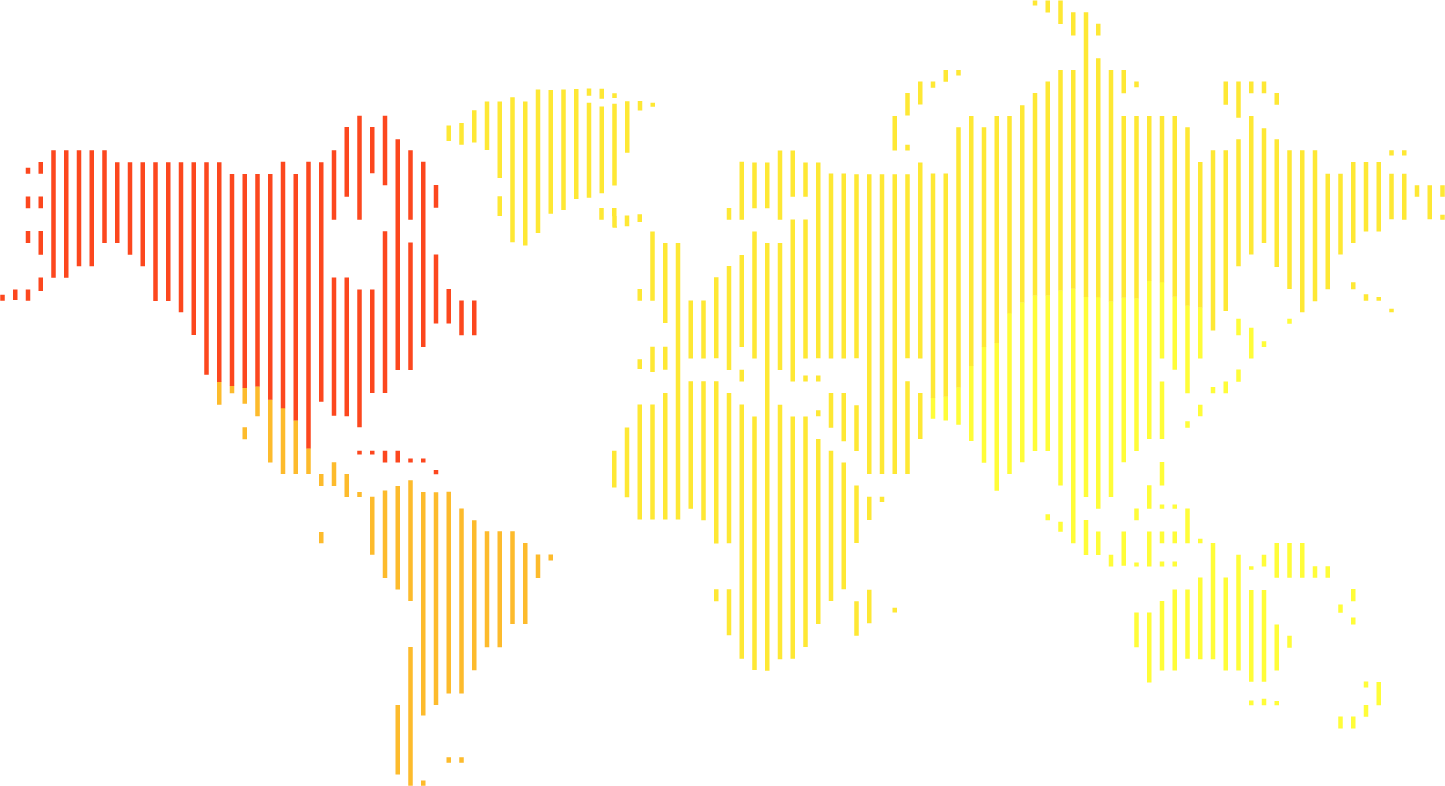

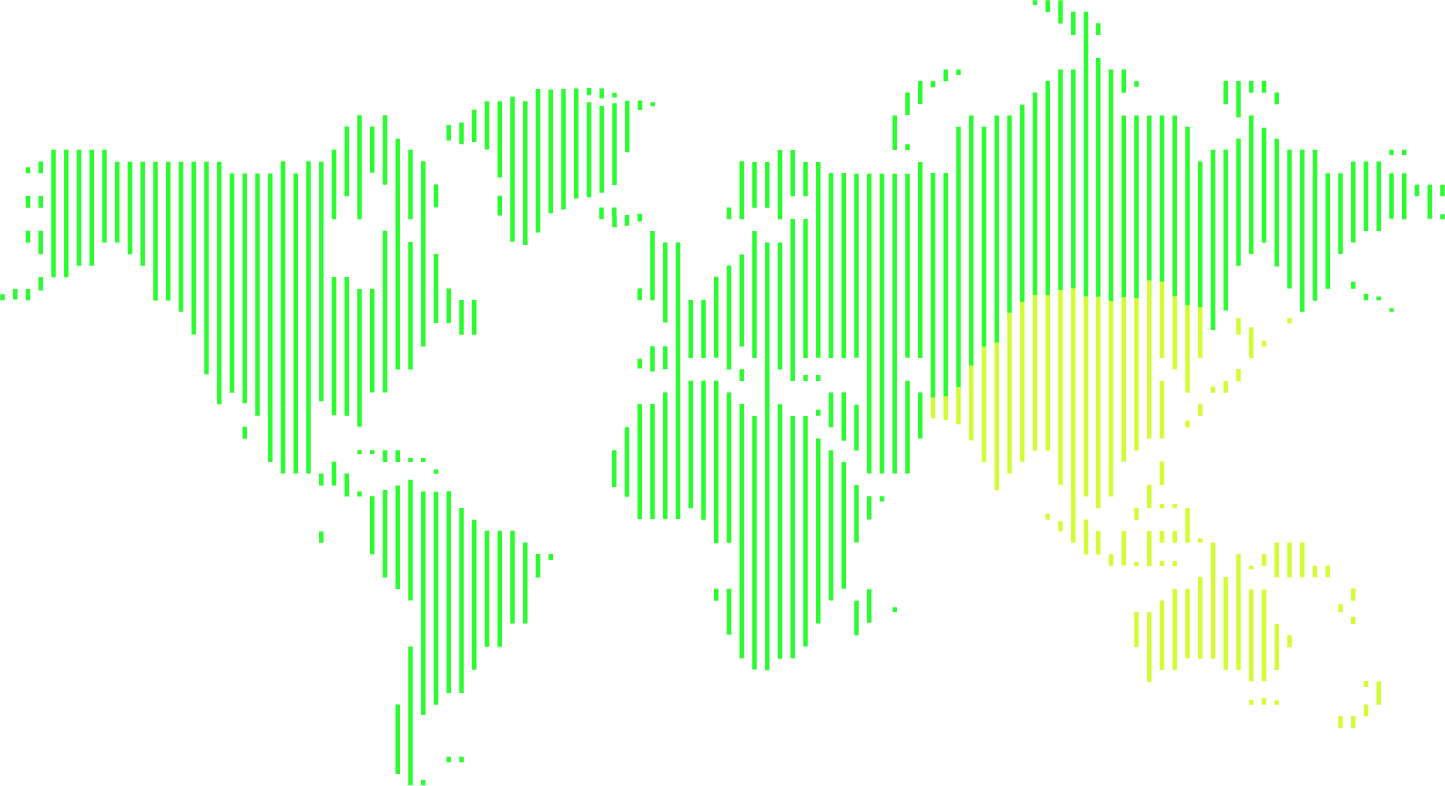

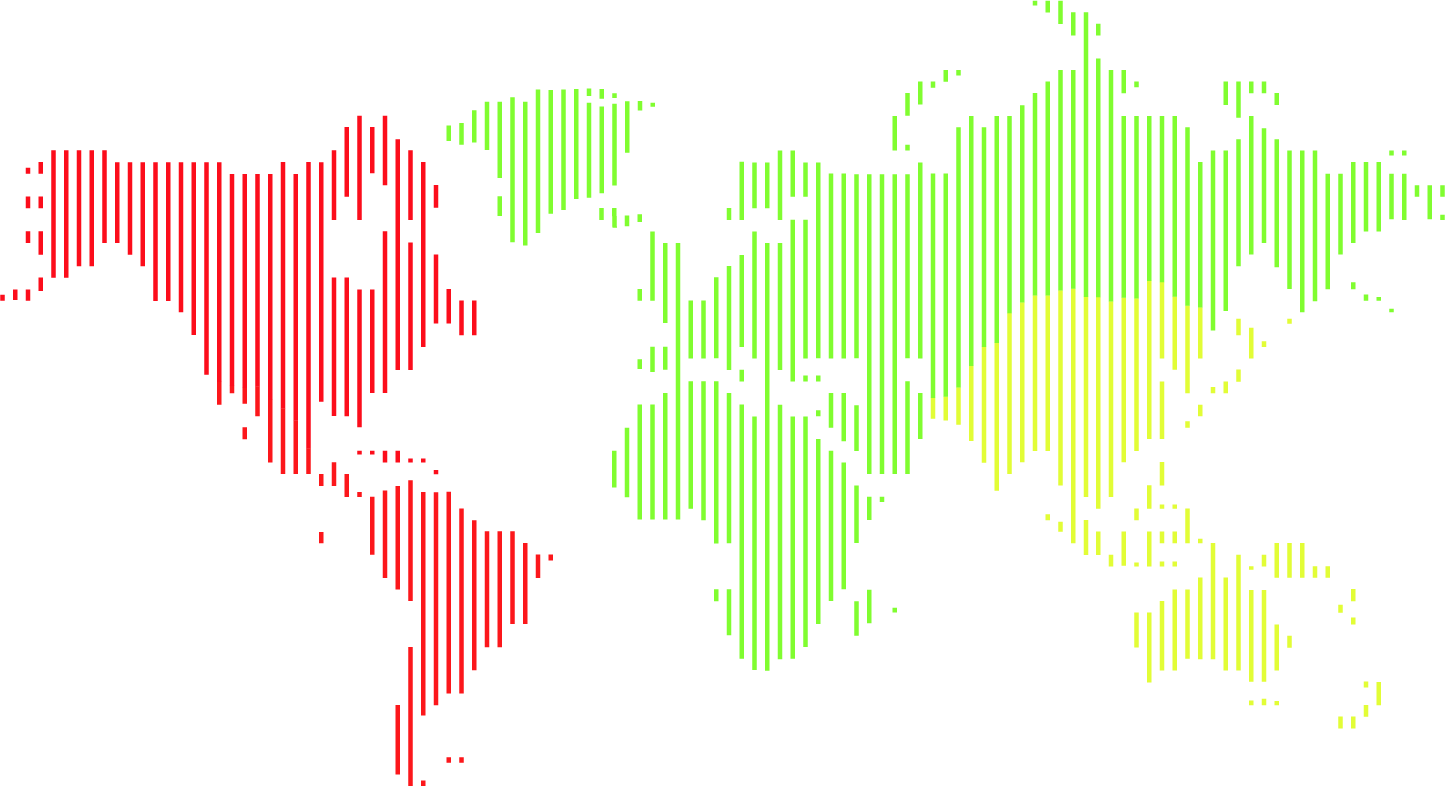

Deeper green = increasing

early-stage M&A activity (YOY)

Yellow = stable early-stage M&A activity (YOY)

Deeper red = decreasing

early-stage M&A activity (YOY)

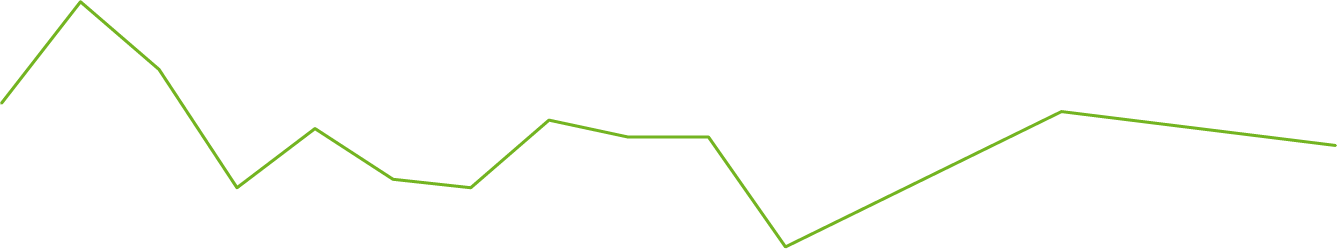

The Energy & Power, TMT and Materials sectors are predicted to lead the growth in APAC M&A announcements over the next six months.

APAC

NA

LATAM

EMEA

APAC

Click on the icons to find out more

Worldwide M&A activity predicted to hit new high in 2018, but imbalances grow

*Thomson Reuters’ data on announced deal volumes for the past four quarters has been adjusted by Intralinks for expected subsequent changes in reported announced deal volumes in Thomson Reuters’ database.

Click on the regions to find out more

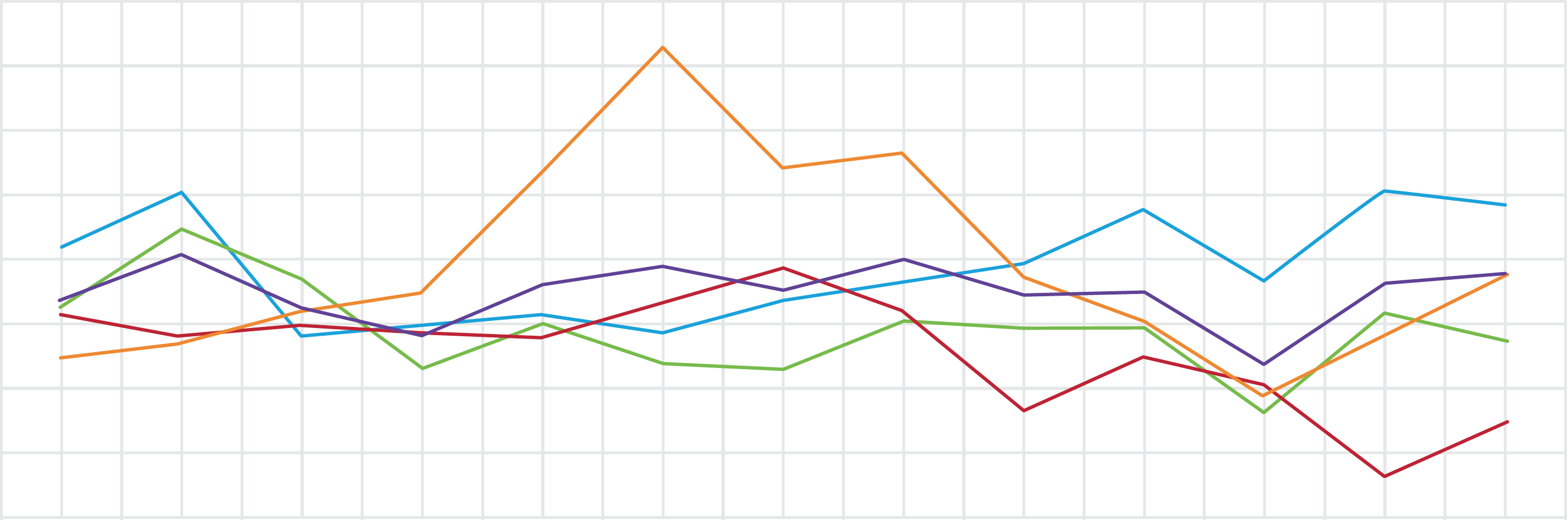

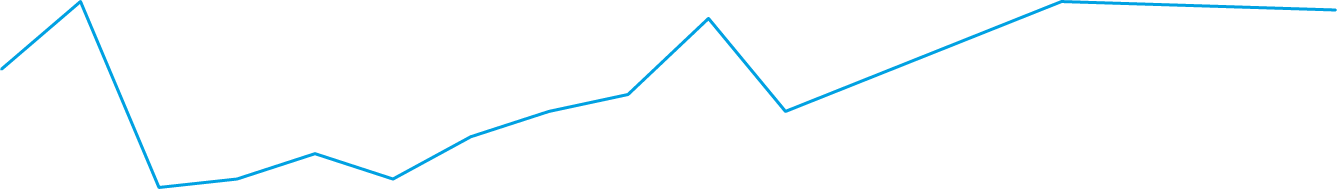

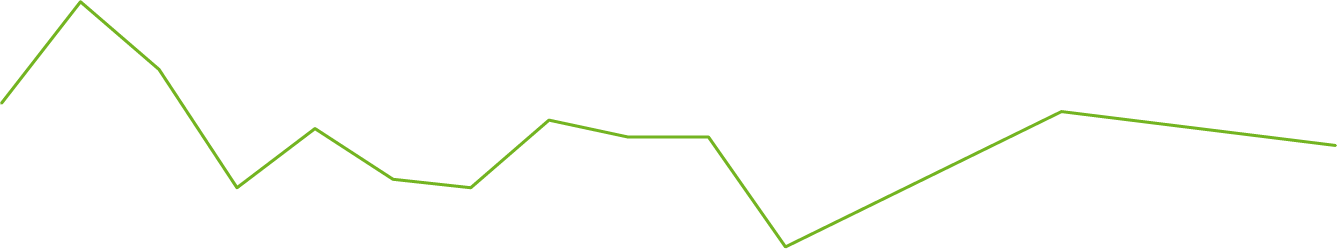

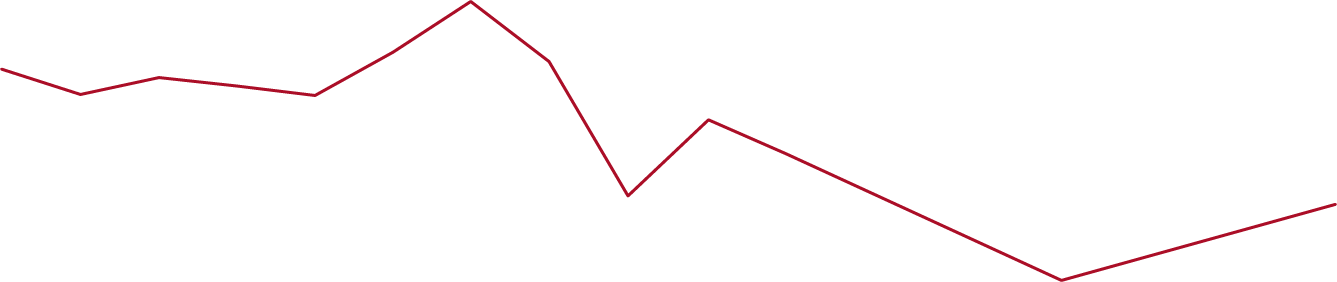

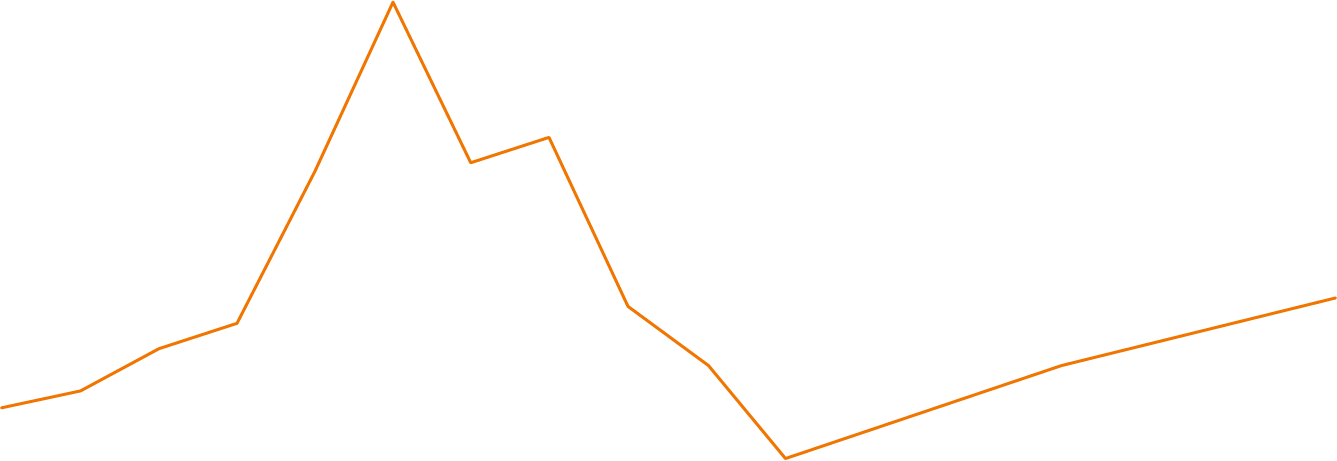

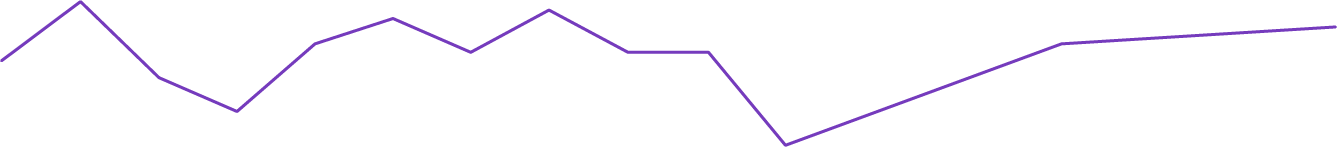

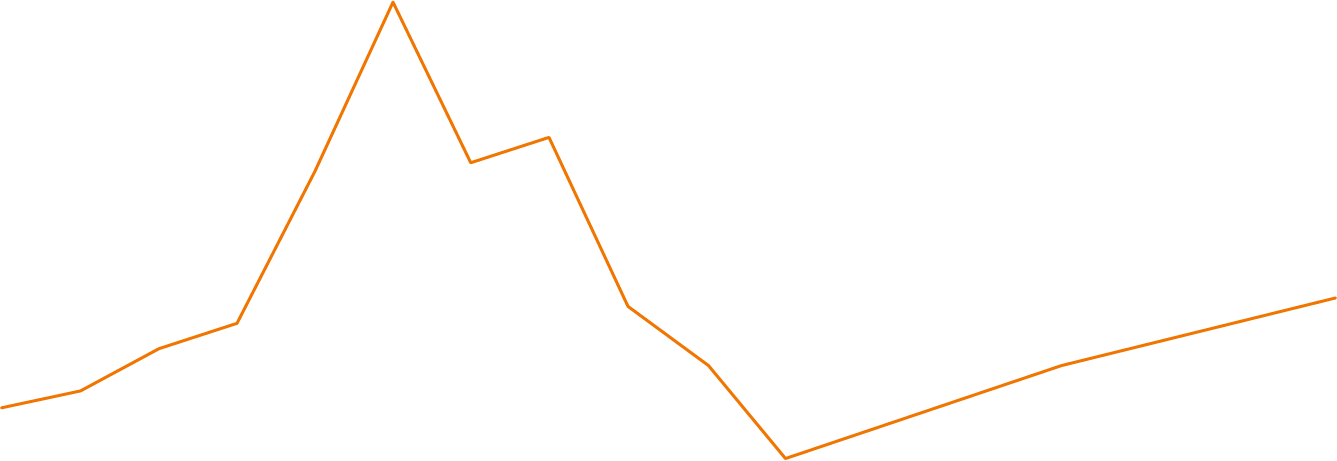

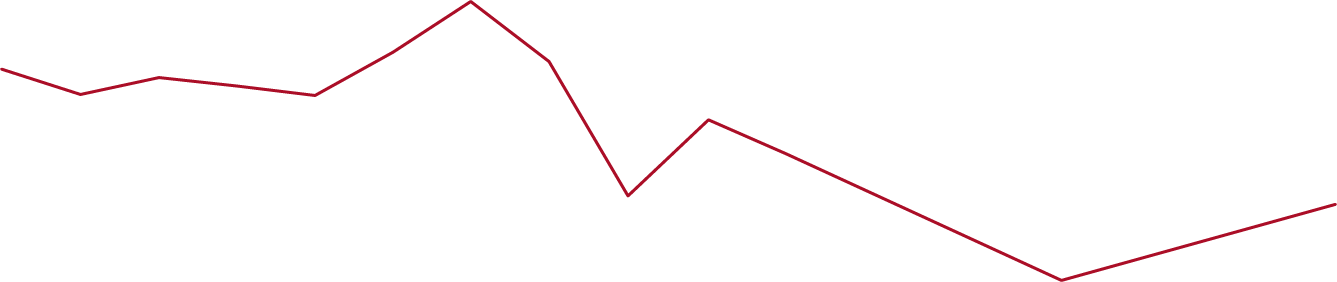

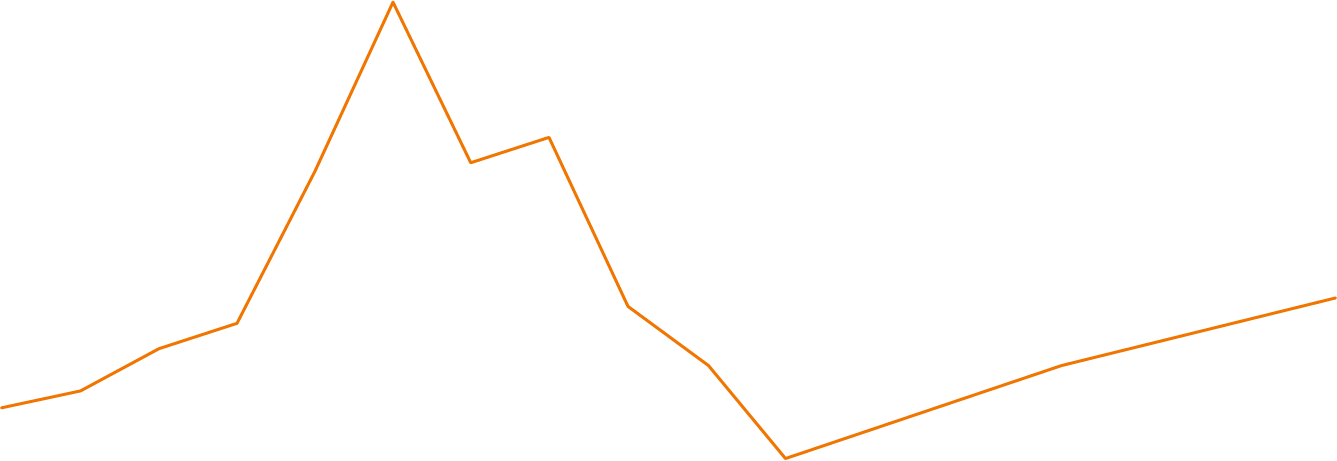

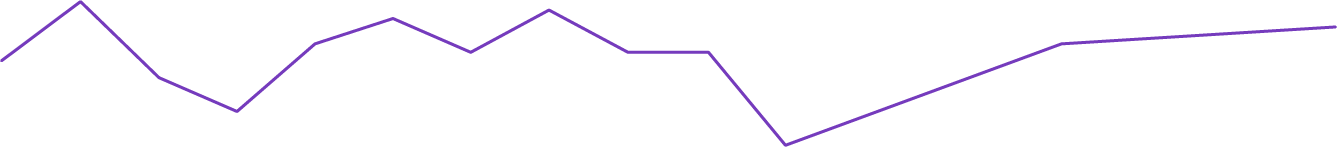

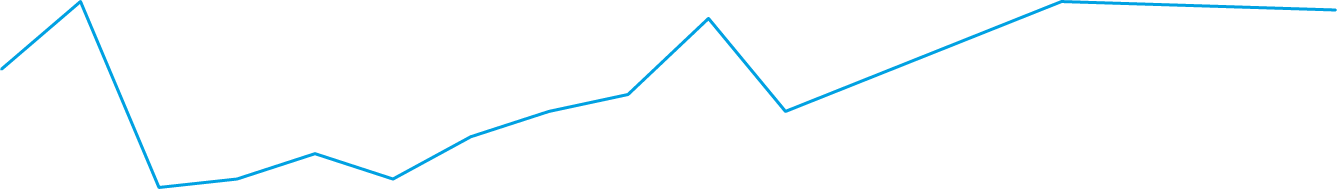

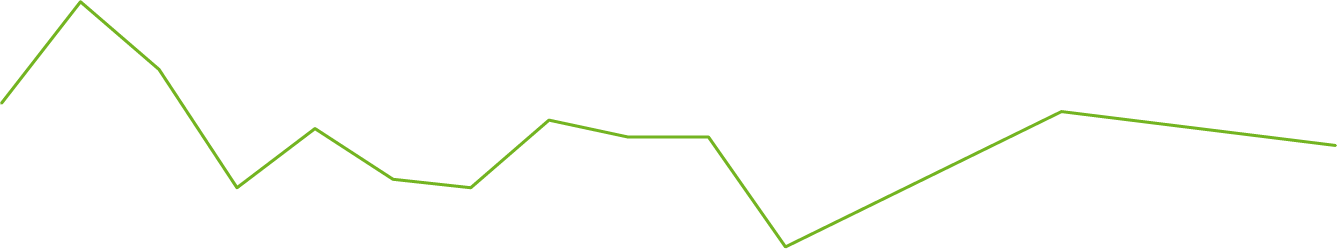

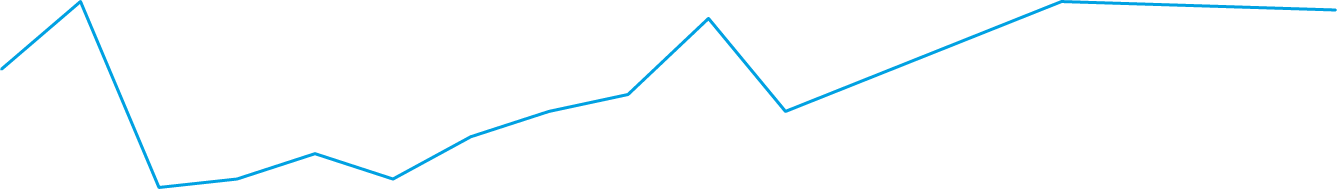

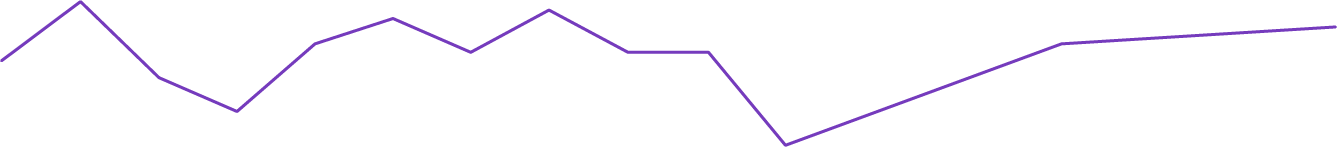

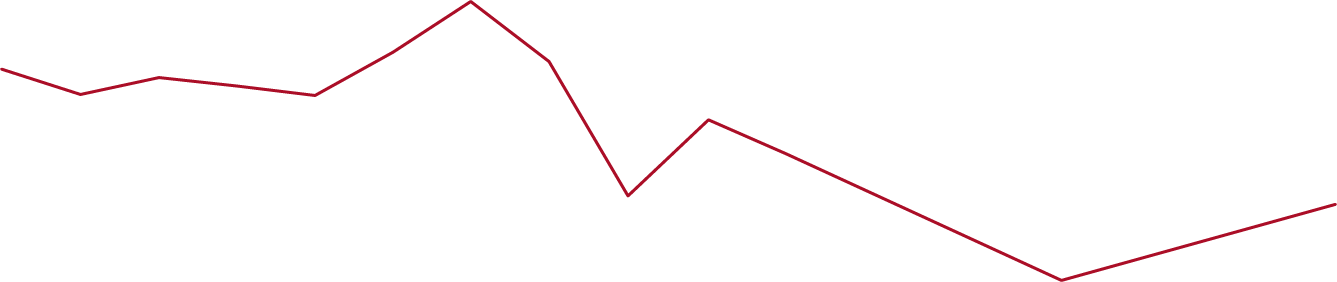

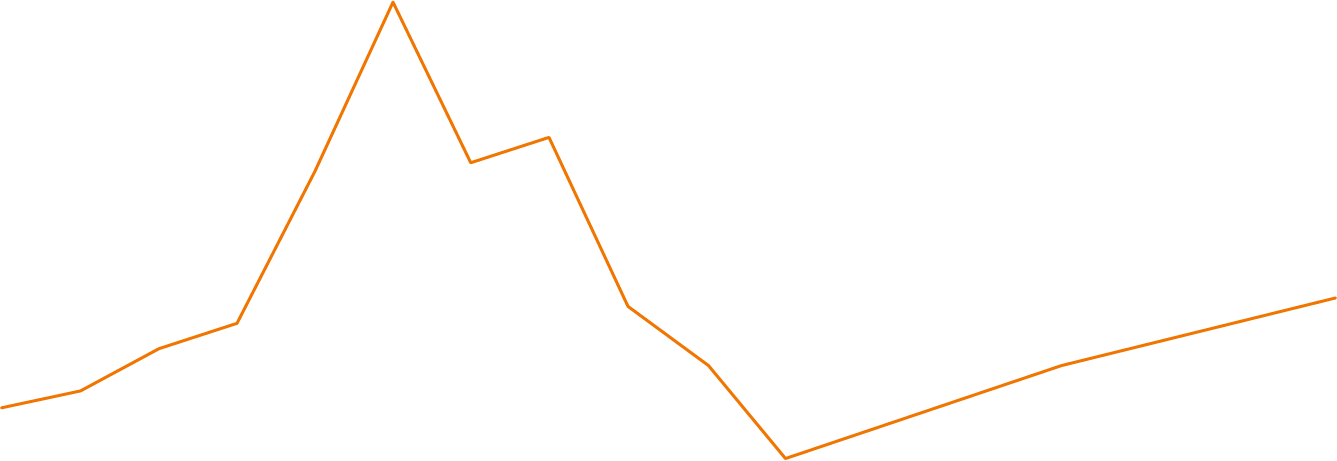

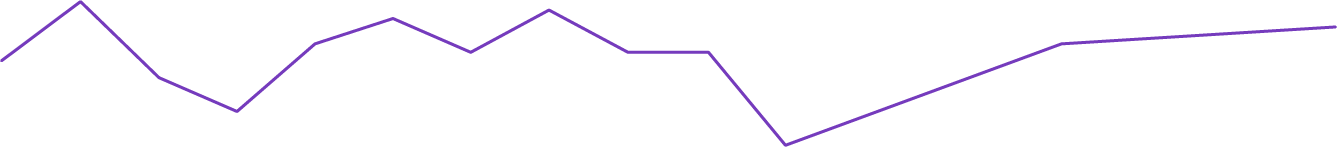

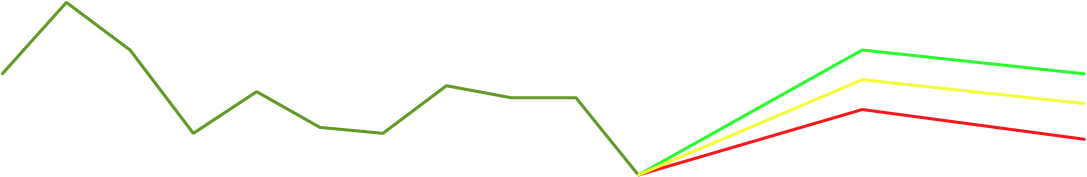

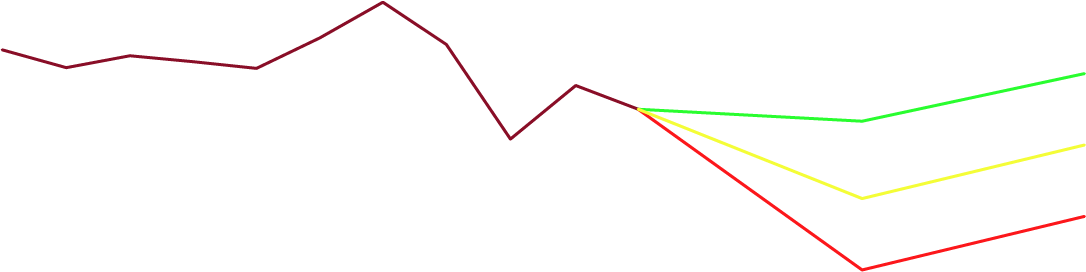

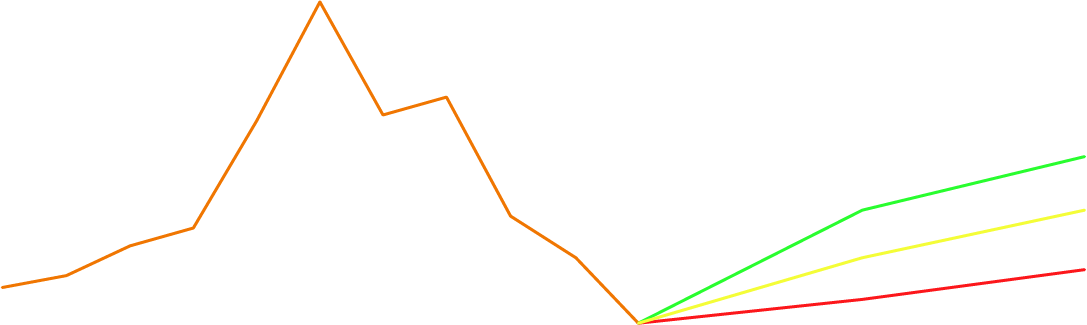

This graph shows the year-over-year (YOY) % change in the number of announced M&A deals, as reported by Thomson Reuters, with our regional and worldwide mid-point growth forecasts for the next two quarters*.

Our Deal Flow Predictions Through Q4 2018

We forecast that in H2 2018 growth in the worldwide number of announced deals will resume at 7 percent YOY (within a range of 0 to 14 percent). Over the next six months, the strongest growth in worldwide deal announcements is expected to come from the Real Estate, TMT (Technology, Media and Telecoms) and Industrials sectors. For the full year 2018, we are forecasting 3 percent YOY growth in the worldwide number of announced M&A deals (within a range of 0 to 7 percent). At the mid-point of our forecast, this would lead to over 53,000 announced deals in 2018, a new record.

+8%

+6%

-6%

+5%

+5%

+10%

+5%

+9%

+6%

-2%

+2%

+11%

+4%

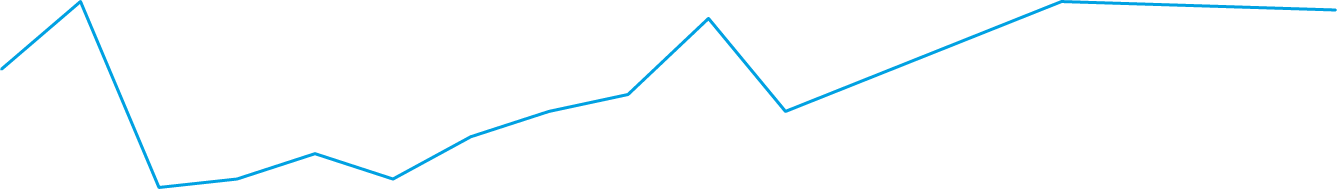

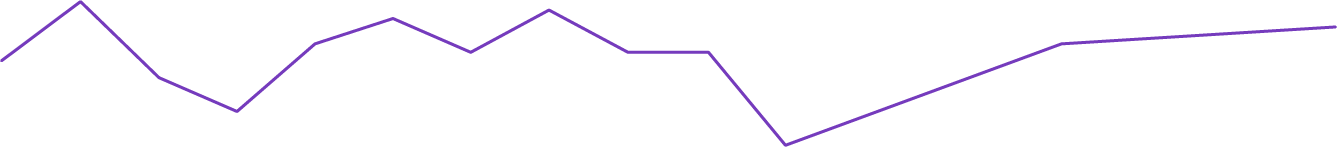

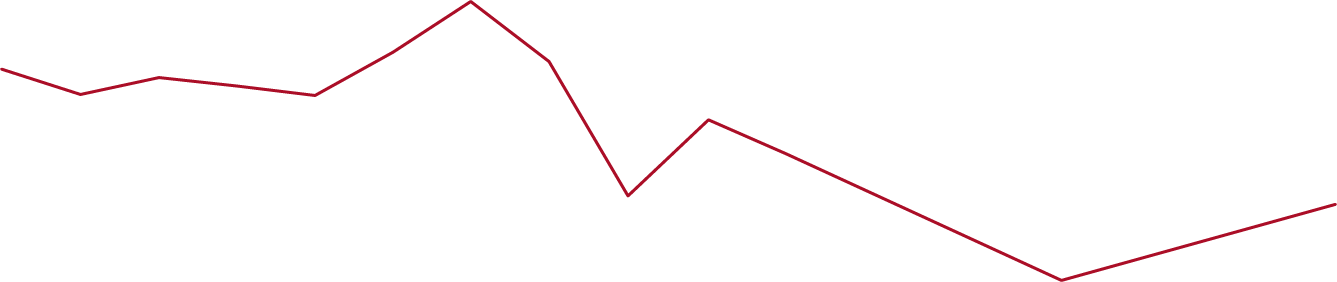

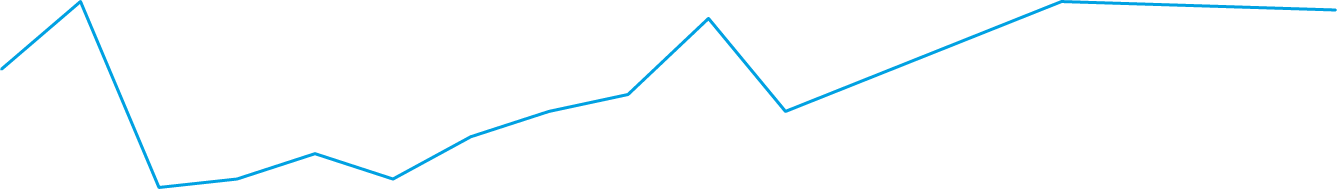

We forecast that the number of announced M&A deals in H2 2018 is expected to increase by around 4 percent YOY, within a range of -4 to 13 percent. This growth is being driven by the U.S., with Canada expected to see declining levels of M&A announcements in 2H 2018 compared to the same period in 2017.

+8%

0%

-11%

0%

+7%

+27%

+24%

+43%

+23%

+5%

+2%

-3%

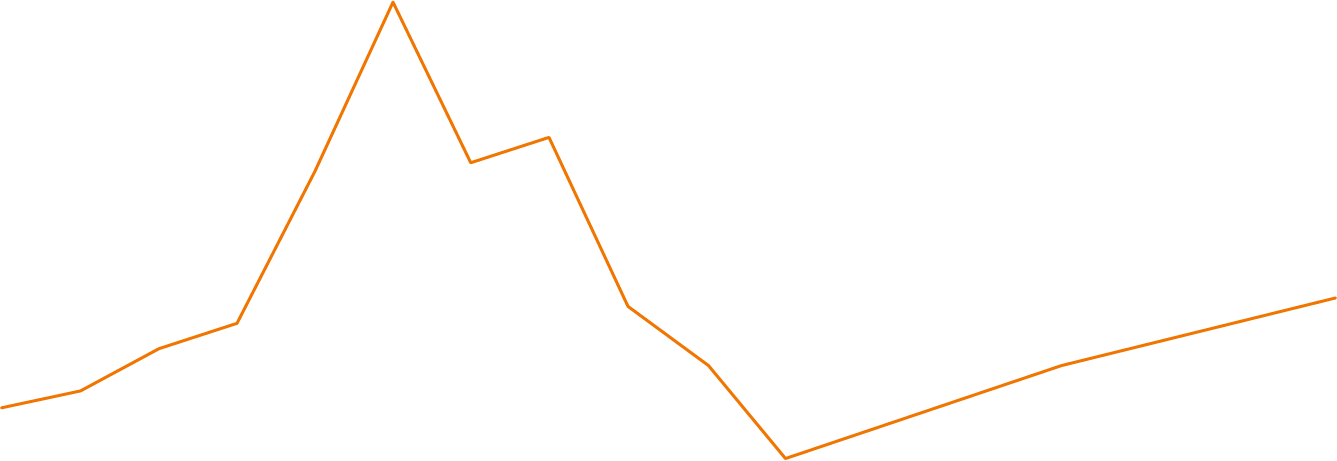

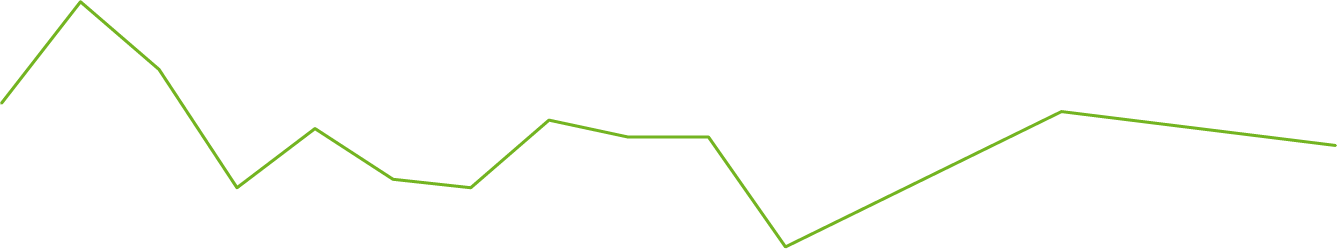

-5%

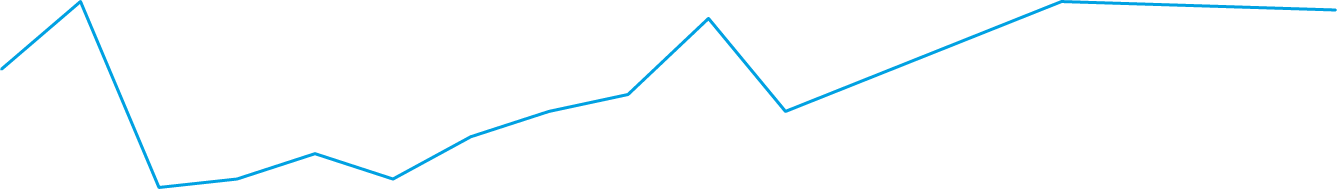

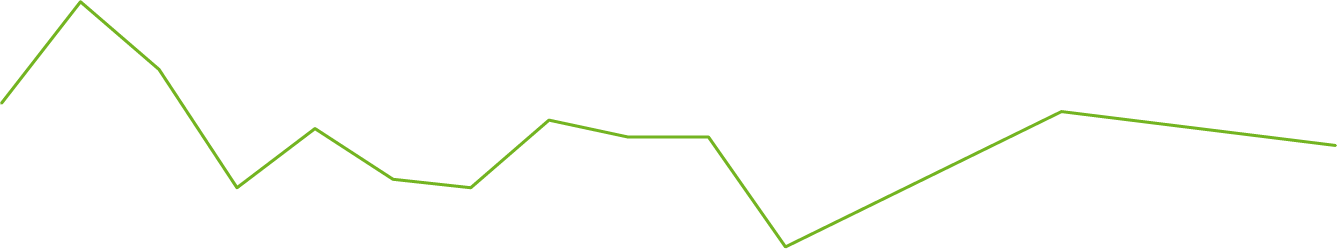

We forecast that the number of announced M&A deals in H2 2018 is expected to decrease by around 20 percent YOY, within a range of -32 to -7 percent. The Real Estate sector is predicted to be the only one to see growth in LATAM M&A announcements over the next six months.

-15%

-24%

-9%

-5%

-14%

+2%

+9%

+4%

-2%

-1%

0%

-2%

+1%

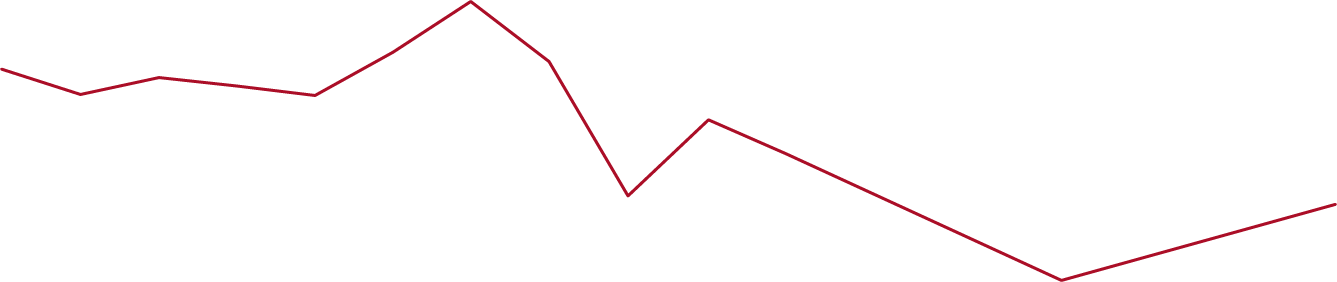

We forecast that the number of announced M&A deals in H2 2018 is expected to remain flat YOY, within a range of -5 to 5 percent, with the strongest contributions to EMEA’s growth expected to come from sub-Saharan, Northern Europe and Eastern Europe. The Real Estate, Materials and Industrials sectors are predicted to lead the growth in EMEA M&A announcements over the next six months.

-2%

+2%

+14%

-1%

-1%

+1%

-7%

-6%

0%

-7%

+7%

+15%

+3%

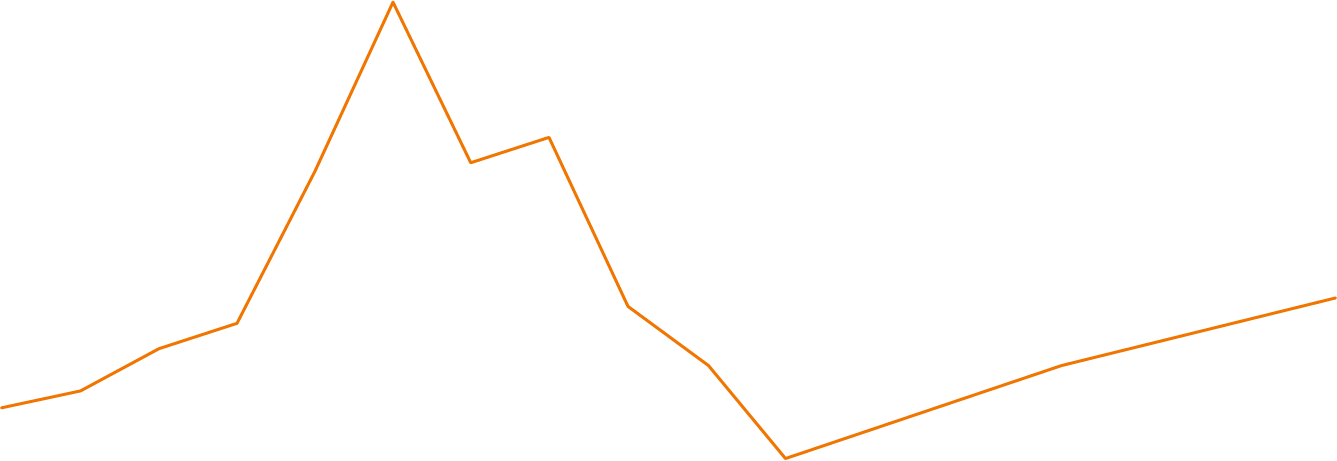

We forecast that the number of announced M&A deals in H2 2018 is expected to increase by around 19 percent YOY, within a range of 12 to 27 percent. The Energy & Power, TMT and Materials sectors are predicted to lead the growth in APAC M&A announcements over the next six months.

+19%

+20%

+7%

+18%

+9%

+7%

+4%

-1%

+2%

-1%

-2%

+20%

+12%

Q4

Intralinks Six-Month Forecast

Q3

Q2

Quarters

Q1

2018

Q4

Q3

2017

Q2

Q1

2017

Q4

Q3

2016

Q2

50%

40%

30%

YOY % growth in the number of announced M&A deals

20%

10%

0%

-10%

-20%

-30%

2018

2018

2018

2017

2017

2016

2016

2016

Q1

2015

Q4

Global

NA

LATAM

EMEA

APAC

Scroll down

Our quarterly prediction of future trends in the global M&A market

Intralinks® Deal Flow Predictor

APAC

EMEA

LATAM

NA

Global

Q4

2018

-30%

-40%

Intralinks

Six Month

Forecast

Mid-point forecast

High forecast

Low forecast

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2015

2016

2016

2017

2017

2018

2018

2018

2018

2016

2016

2017

2017

-20%

-30%

-40%

-10%

0%

10%

20%

30%

40%

50%

+3%

+15%

+7%

-7%

0%

-6%

-7%

+1%

-1%

-1%

-14%

+2%

-3%

+7%

-2%

-8%

+3%

High forecast

Low forecast

Intralinks

Six Month

Forecast

Mid-point forecast

Intralinks six month forecast

Deeper green = increasing

early-stage M&A activity (YOY)

Yellow = stable early-stage M&A activity (YOY)

Deeper red = decreasing

early-stage M&A activity (YOY)

Industrials

Energy & Power

TMT

Materials

Consumer & Retail

Financials

Real Estate

Healthcare

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2015

2016

2016

2017

2017

2018

2018

2018

2018

2016

2016

2017

2017

-20%

-30%

-40%

-10%

0%

10%

20%

30%

40%

50%

+1%

-2%

-1%

-2%

+9%

+2%

-14%

-5%

-9%

-24%

-36%

-11%

-15%

-27%

-3%

High forecast

Low forecast

Intralinks

Six Month

Forecast

Mid-point forecast

Intralinks six month forecast

Deeper green = increasing

early-stage M&A activity (YOY)

Yellow = stable early-stage M&A activity (YOY)

Deeper red = decreasing

early-stage M&A activity (YOY)

Industrials

Energy & Power

TMT

Materials

Consumer & Retail

Financials

Real Estate

Healthcare

LATAM

0%

+4%

NA

The Real Estate, TMT and Energy & Power sectors are predicted to lead the growth in NA M&A announcements over the next six months.

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2015

2016

2016

2017

2017

2018

2018

2018

2018

2016

2016

2017

2017

-20%

-30%

-40%

-10%

0%

10%

20%

30%

40%

50%

-5%

-3%

+2%

+5%

+23%

+43%

+24%

+27%

+7%

0%

-11%

0%

-7%

+8%

+8%

-2%

+17%

High forecast

Low forecast

Intralinks

Six Month

Forecast

Mid-point forecast

Intralinks six month forecast

Deeper green = increasing

early-stage M&A activity (YOY)

Yellow = stable early-stage M&A activity (YOY)

Deeper red = decreasing

early-stage M&A activity (YOY)

Industrials

Energy & Power

TMT

Materials

Consumer & Retail

Financials

Real Estate

Healthcare

Energy & Power

Industrials

Materials

Consumer

& Retail

TMT

Financials

Real Estate

Healthcare

Click the icons to find out more

Deeper red = decreasing early-stage M&A activity (YOY)

Ben Collins

Director, Strategy & Product Marketing Intralinks

Back

3

4

5

[4] http://dmi.thomsonreuters.com/Content/Files/MA%2

0Review%20Financial%20Advisors_1H2018.pdf

[5] https://www.intralinks.com/resources/publications/

deal-flow-predictor-2018q1

[3] Data from https://www.thomsonone.com

Rupesh Khant: The world equity market has seen a significant move up during 2017 on the back of multiple positive news items such as the improvement of jobs data in the U.S. and the control of inflation in various economies to name but a few. Meanwhile, investors have factored in or digested the majority of negative news items such as Brexit, fears of interest rate hikes by the U.S. Fed, and non-performing asset provisioning by Indian banks. India has also witnessed a robust level of primary capital market activities during 2017 as compared to past years due to various reasons including improvements in earnings, better valuations, healthy liquidity in the primary market and a continuous flow of capital. One of the major factors for healthy growth in capital markets is the participation by investors, particularly retail investors, by investing in mutual funds through SIPs (Systemic Investment Plans). We believe the flow of funds into mutual funds through SIPs in India will likely be healthy for the rest of 2018 on the back of improvements in retail savings rates and the low level of interest rates from fixed deposits.

What are you seeing in terms of IPO activity in the first half of 2018 compared to last year?

In India, we have seen volatility in equity capital markets and a surge in valuations of various sectors such as fast-moving consumer goods, business services, information technology and healthcare. Further, the biggest concern faced by the market was poor performance of public sector banks, provisioning for bad loans and trade concerns related to the U.S., particularly in key sectors such as pharmaceuticals, information technology and steel. Further, there was a surge in valuation of listed small and mid-cap companies, which many fund managers and experts viewed as unsustainable and which had raised valuation concerns for various unlisted companies which planned to visit the capital market through an IPO. During the first half of 2018, the number of Indian IPOs increased by around 40 percent compared to the same period in 2017.

What is your firm’s role in the IPO process?

We are a category I merchant banker registered with the Securities and Exchange Board of India. We are one of the top investment banking houses in India with significant focus on executing IPO and advisory deals among others. We play an important role in bringing new products to the market and understand and highlight key regulatory aspects to assist clients in raising capital through an IPO or other securities.

In India, the virtual data room been used mainly for the convenience of various parties in the secure exchange of information. For the capital markets practice, we have seen that user-friendly VDR platforms with competitive pricing are among the key requirements for any client to select a VDR. Further, the client always looks for flexibility from the VDR vendor while finalizing pricing or commercial terms as generally IPO deals are completed in 6-12 months and there is lot of uncertainty on the timing of launch of any IPO.

Are there any sectors where you are seeing especially high levels of IPO activity?

We are already seeing a lot of dealss in the financials sector, while the manufacturing, services and consumer spaces may see a lot of IPO activity in the coming two years. We also expect to see momentum pick up in the infrastructure sector and other capital-intensive sectors seeking to raise capital for their next phase of growth.

Given the buoyant levels of both the M&A and IPO markets, some companies are choosing dual-track exit processes where they pursue an IPO alongside an M&A transaction to see which can give the highest valuation. Are dual-track processes popular in India?

We haven’t seen such a trend in India –

most of the businesses are family-managed and complicated structures are rarely seen in the Indian market. However, we have seen that various Indian controlling shareholders have tried to raise capital or market secondary deals to private equity investors. Due to a valuation mismatch, they failed to conclude the deal and chose an IPO instead, as an easier option to raise capital due to attractive valuations.

Do you see any risks to the growth of the IPO market in 2018, especially given the threat of a trade war between the U.S. and China?

A trade war between two large global economies would have a cascading impact on the Indian economy, particularly through its impact on global liquidity, trade friction, commodity prices (particularly oil and steel) and applicable tariffs/taxes. During the second half of 2018, there are a few IPOs in the pipeline but we see very few stable market windows to launch any IPO as we have holiday seasons in November and December and Indian elections (state and/or central) which will give direction to the market depending on their outcome. Generally, during election time in India, we see a slowdown in projects, delays in decision making and, with such uncertainty, it would be difficult for investors to price any company or business and investors would prefer to take decisions after the election outcome. For the final quarter of 2018, we see a robust build-up of the IPO pipeline by Indian corporates, who will be ready to raise capital in the months to come, particularly immediately after the state elections.

References

Disclaimer: Please note that the contents of this interview are Rupesh Khant’s personal views and not the views of the ICICI Group. Rupesh Khant is not obligated to revise the article once published or publicly available to modify or change his views.

[6 & 7] Source: https://www.thomsonone.com

6

7

© Intralinks 2018. All rights reserved.

Yellow = stable early-stage M&A activity (YOY)

Deeper green = increasing early-stage M&A activity (YOY)