Annual Report and Accounts 2025

01

Title page

02

JM at a glance

03

Leadership statements

04

Key performance indicators

05

Our business reviews

06

Our strategy

07

Sustainability

08

Downloads

JM at a glance

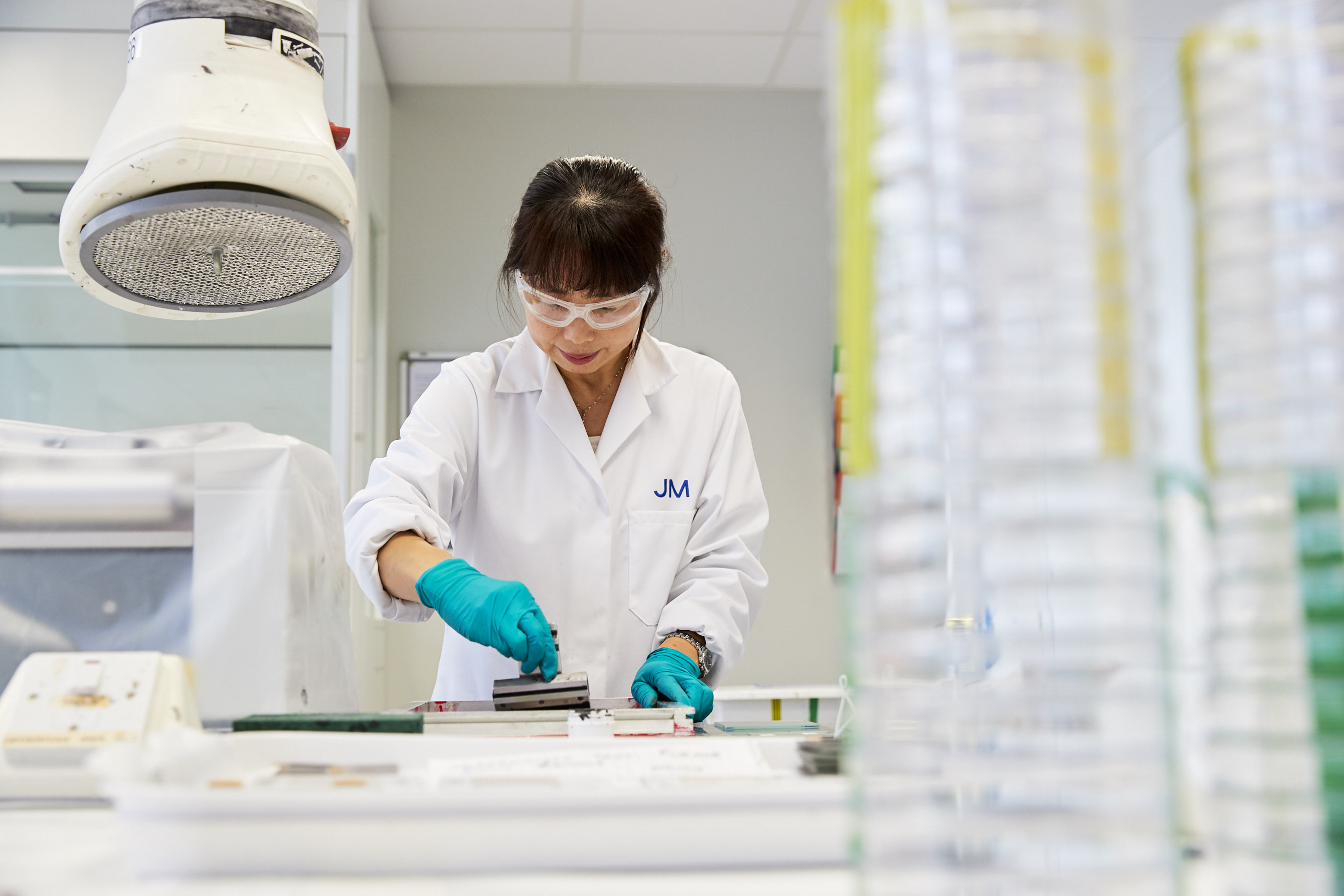

JM is built upon strong foundations including innovative metals chemistry, world-class technologies and operational excellence.

Our purpose is �to catalyse the �net zero �transition for �our customers

Announced 22nd May 2025, Johnson Matthey Plc agreed to sell its Catalyst Technologies business to Honeywell International Inc.

Liam Condon

Chief Executive Officer

Patrick Thomas

Chair

Richard Pike

Chief Financial Officer

Patrick Thomas

Chair

At the end of 2024/25, we find ourselves at a pivotal moment in the company’s history for several reasons. Firstly, the transformation programme initiated by Liam Condon in 2022 has now been successfully delivered. A clear turning point for JM, this ambitious change programme set out a strategy to drive value, including cost reduction, capital discipline, portfolio rationalisation and growth.

�I am pleased to report that we met all of the strategic milestones we laid out in 20221 other than two investment milestones which were delayed2. As a result, we end the year with established leadership positions in mature markets. JM is a far more resilient and agile business than it was before. This is essential given the challenging macroeconomic backdrop and industry-wide headwinds we continue to face.

BACK

Female representation across all management levels

32%

(2023/24: 30%)

Total recordable injury and illness rate (employees and contractors)

0.36

(2023/24: 0.36)

Recycled PGM content in JM’s manufactured products

76%

(2023/24: 69%)

GHG emissions avoided from

our technologies (compared

to conventional offerings)1

1,606,644 tCO2e

(2023/24: 1,335,881)

Total Scope 3 (Category 1) purchased goods and services

GHG emissions1

3,085,054 tCO2e

(2023/24: 3,258,688)

Total Scope 1 and 2 GHG emissions (market-based)1

246,533 tCO2e

(2023/24: 281,912)

R&D spend contributing to our

four priority SDGs

87%

(2023/24: 92%)

Sales contributing to our four priority UN Sustainable Development Goals (SDGs)

82%

(2023/24: 89%)

KPI linked to remuneration policy

1. Prior year rebaselined to remove divested businesses.

Download KPIs

Ordinary dividend per share

77.0p

(2023/24: 77.0p)

Underlying earnings per share1

149.2p

(2023/24: 141.3p)

Earnings per share

211.8p

(2023/24: 58.6p)

Clean Air cash flow

£367m

(2023/24: £625m)

Underlying operating profit1

£389m

(2023/24: £410m)

Operating profit

£538m

(2023/24: £249m)

Sales1 (excl. precious metals)

£3,470m

(2023/24: £3,904m)

Revenue

£11,674m

(2023/24: £12,843m)

1. Non-GAAP measures are defined and reconciled in note 33 of the financial statements.

KPI linked to remuneration policy

Key performance indicators are from continuing operations.

Financial performance

Sustainability performance

Key performance indicators

Our business model and reviews

Catalyst Technologies

Designs and licenses process technology, and designs and manufactures catalysts for a wide range of processes used in the energy and chemicals industries to create products used in transportation fuels, fertilisers, wood products, paints, coatings and polymers.

Hydrogen Technologies

Designs and manufactures the key performance-defining components (catalyst-coated membranes) used at the heart of fuel cells and electrolysers for the creation of electrolytic (green) hydrogen.

Platinum Group Metal (PGM) Services

Supports customers with short and long-term metal planning and supply management; refines and recycles both used and mined PGMs; and processes metal into more complex, value-added products for a vast array of uses.

Read more on our strategy

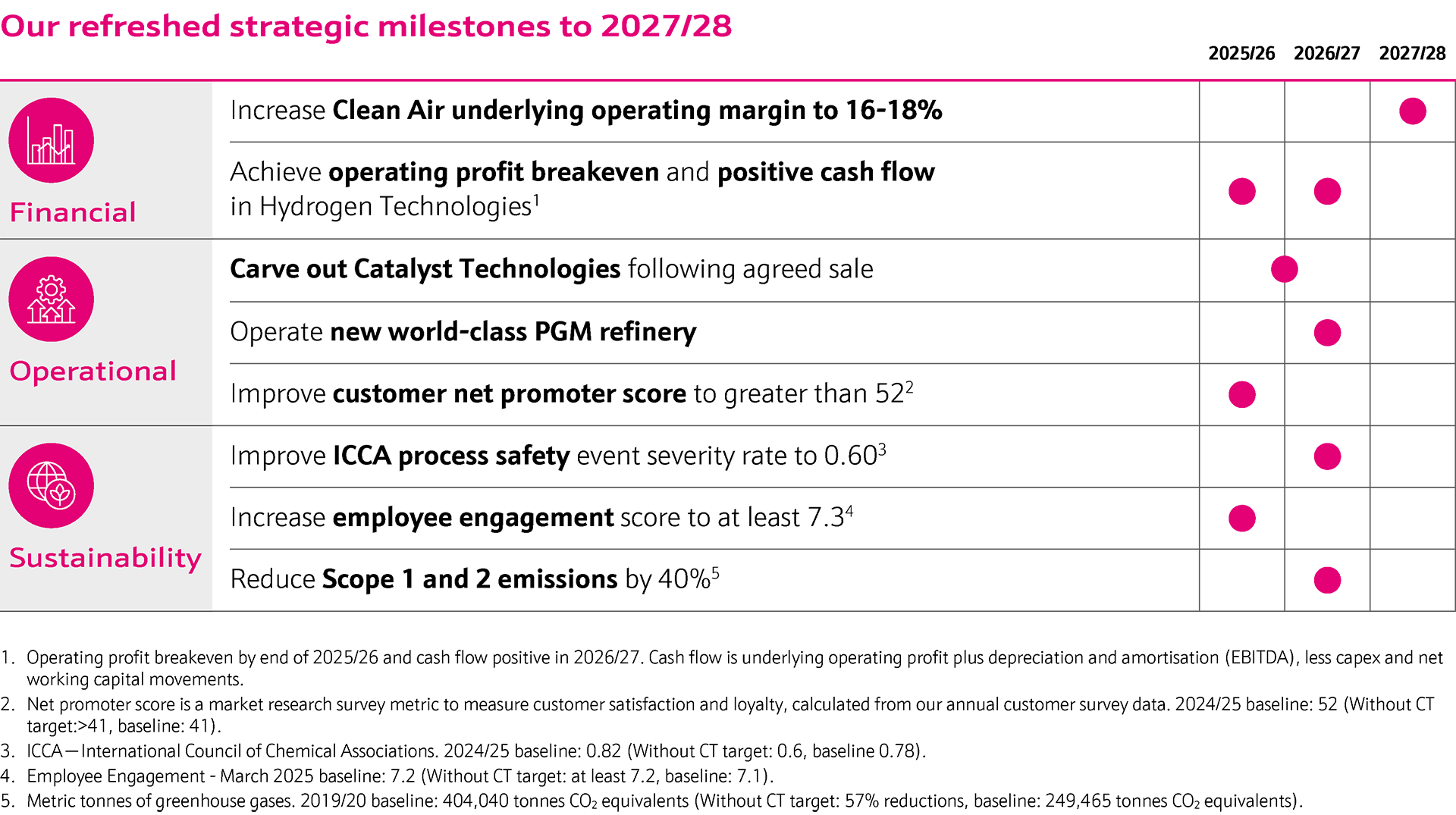

Our refreshed strategic milestones

A new JM fit for the future

Driving the business

A resilient strategy

We are pivoting towards a cash-focused business model centred around Clean Air and PGM Services. As we re-shape JM and create a leaner organisation, we are committed to driving a step change in cash generation and sustainable value creation for our shareholders.

Optimised capital deployment�We significantly reduced growth capital expenditure in Hydrogen Technologies, ensuring that our current installed capacity is sufficient to meet near-term demand while preserving financial flexibility.

�

Stronger governance for capital efficiency�We established an Investment Committee of the board to reinforce our disciplined approach to capital allocation.

Calibrated to markets, with cash generation at its core

A resilient strategy

This year�Over the past year, we delivered significant commercial wins and strategic partnerships across key markets, despite market headwinds and pressure on sales:

Relentless focus on cost efficiency and cashflow

Driving the business

JM will be a highly focused, lean and agile business

A new JM fit for the future

The sale to Honeywell, announced on 22nd May 2025, reflects the highly attractive long-term growth prospects of Catalyst Technologies.

Our refreshed strategic milestones

RETURN TO ORIGINAL VIEW

Our strategy

CLICK EACH PILLAR TO LEARN MORE

A portfolio based on strong synergies�Our portfolio is built on the synergies between our businesses, leveraging world-class technologies, cutting-edge R&D and deep industry expertise.

Shareholder returns�Shareholder returns have been further strengthened by our transformation strategy, which has prioritised cost efficiency, capital discipline and a focus on cash generation. £388 million has been returned to shareholders via dividends and share buyback during the year.

Sustainability

Sustainability is fundamental to our strategy. For over 200 years our expertise in metal chemistry has helped to solve some of the world's most complex challenges and now our technologies are accelerating the transition to net zero. That is why we have firmly embedded our sustainabiity priorities of climate, nature and circularity, safety and diversity into how we operate as a company.

Planet: Protecting nature and advancing the circular economy

We commit to promoting nature protection, restoration and sustainable use of natural resources.

Planet: Protecting the climate

In line with our purpose to catalyse the net zero transition, we have committed to net zero 2040 for our own operations.

People: Promoting safe, diverse and equitable society

We rely on our 10,000+ talented and passionate employees to drive our purpose.

Download sustainability databook

Downloads

CLICK TO EXPAND

Full report

Strategic report

Governance

Financial statements

Sustainability

TCFD statement

Other information

ESEF HTML

ESEF ZIP

SASB

GRI content index

PAI statement

Assurance statement

Sustainability performance databook

Sustainability reporting

BACK

BACK

SCROLL TO READ OUR SUMMARY

£1.8bn

Sales1

£3,470m

Underlying profit

+5%

Expected completion: �First half of calendar year 2026

at constant FX rates, ex-divestments

in 2024/25

+10,000

Employees

A-

Climate change rating 2024

Total Scope 1 and 2 greenhouse (GHG) emissions (market-based)

in 2024/25

13% reduction

No business can last for over two centuries without successfully evolving. Throughout my seven years as Chair, Johnson Matthey has played a vital role in helping society towards the net zero transition. But there have also been challenges, difficult decisions and an unpredictable external environment. The JM I am leaving is a significantly different business to the one I joined, but one with a clear strategy and an exciting road ahead.

2024/25 saw a continuation of several trends that are having a significant impact on our ability to deliver on our strategic goals. We have always known that the energy transition would not be a linear journey, requiring many factors to come together and during my tenure, the energy transition market and the regulatory environment surrounding it have been incredibly dynamic. This year has been no different.

The pace of the global energy transition has slowed, with delayed electric vehicle penetration, the slowdown of the transition to hydrogen fuel cell and electrolyser technologies and evolving regulations creating uncertainties across key sectors. These changes have heightened business risks, challenged industry growth assumptions and reshaped demand patterns. In particular, the recent geopolitical uncertainty has never been greater.

Despite this, JM has demonstrated resilience and adaptability, responding decisively to the evolving landscape. By focusing on operational excellence, simplifying our portfolio and delivering efficiencies, the company has positioned itself to mitigate near-term challenges while capitalising on emerging opportunities in its core markets. The foundations laid over the last three years mean that JM is positioned to optimise value for shareholders and ready to adapt to the opportunities created by a changing world.

Delivery of our 2022 transformation

Adapting to a changing world

DOWNLOAD THE FULL STATEMENT

Liam Condon

Chief Executive Officer

As we move forward, JM will focus on Clean Air and PGM Services by leveraging our differentiated technology and strong market positions to drive sustainable value creation. These are world-leading businesses in their markets with clear pathways to sustainable value creation. In addition, we have embedded in Clean Air and PGM Services strong growth optionality with Clean Air Solutions, and PGMS related Life Science Technologies, along with growth optionality in Hydrogen Technologies (HT). Together they represent the core of our value proposition and provide businesses all over the world with the solutions they need to reduce toxic emissions and enable the energy transition.

Our mission remains deeply committed to safeguarding the wellbeing of our people, partners and planet. The steps we are taking today focus on creating lasting shareholder value by leveraging our advanced technologies, industry partnerships and established infrastructure to support a cleaner and more resilient future.

Delivering change at scale

The attractive valuation of Catalyst Technologies (CT) would not have been possible without the implementation of our transformation programme. Since 2022, we have focused on our core competencies, with PGMs at the heart of our business. We have simplified our portfolio by undertaking significant divestments. The divestment of the Medical Device Components business generated over £480 million in additional value to shareholders, of which £250 million has now been returned. We also separated the CT business from PGMS. This ensured CT could be set up for success with a clear growth strategy that has unlocked significant value. In addition, we implemented efficiency and cost optimisation programmes that now set a stronger foundation for the remainder of JM to be successful in a volatile and highly competitive market environment which has resulted in the impairment of certain assets during the year. However, the transformation programme has enhanced our resilience and ability to adapt to changing conditions.

We have achieved the ambitious strategic milestones we set out in 2022. However, the slowdown in the global energy transition has impacted our growth and with that we have had to adjust our investment strategy and delay two of the investment milestones. The transformation programme has delivered £80 million savings in 2024/25 alone, bringing the total savings to £200 million in line with our target. Across the group, our teams now have a much stronger�foundation for streamlined business processes, which will benefit both customers and employees. With the initial transformation programme now complete, the business will begin embedding continuous improvement into every part of our culture. It’s not just about more efficiency, it’s about empowering everyone in the business to perform at their best and deliver for customers.

The sale of Catalyst Technologies marks a pivotal step in JM's transformation. It is the right move – adapting the business to market dynamics, sharpening our focus and unlocking immediate value. Importantly, it also paves the way for a more agile and focused version of JM. One that is leaner in structure and sharper in execution.

DOWNLOAD THE FULL STATEMENT

Richard Pike

Chief Financial Officer

The divestment of our Catalyst Technologies (CT) business at a highly attractive valuation of £1.8 billion, is a pivotal milestone for JM. It is a testament to the transformation programme’s success in increasing CT’s value as an asset, providing the platform for separation as well as clearly�showing our disciplined approach to portfolio management.

From a financial perspective, this transaction has an EV/EBITDA multiple of 15.5x based on 2024/25 EBITDA, with a transaction multiple of 13.3x EBITDA based on an agreed adjusted 2024/25 EBITDA of £136 million for the standalone CT business. Following completion, the transaction will enable around £1.4 billion to be returned to shareholders following regulatory clearance. This is in addition to the Medical Device Components business disposal that completed earlier in the year, which generated a profit on disposal of £491 million and underpinned the share buyback of £250 million, completed in December 2024.

Over the next couple of years, our primary focus will be to build on the transformation activity to date and materially reduce costs, capital expenditure and working capital levels. Together with increasing our targeted profitability in Clean Air and delivering a world-class refinery in Royston, UK during 2026/27, this will underpin our ability to deliver a share buyback programme that we will commence during 2026/27, in addition to maintaining our annual dividend.

Executing in a challenging environment

Since joining JM in February 2025, I have been struck by the passion and capability of our people together with the strong sense of purpose and the technical backbone to the business. As I joined, it was also clear that we were facing into a very pivotal point in time for the company. The organisation has clearly been working hard over the last three years, to deliver on the strategic milestones set out by Liam in 2022. But we are now entering a new phase for the company, aimed at enabling a step change in cash generation and shareholder value creation. I am excited by the opportunity to build on what has been achieved over the last 208 years (and particularly the last three) and to help the organisation step change in the next phase of its journey.

DOWNLOAD THE FULL STATEMENT

Looking back on the year, our performance was in line with guidance, despite a challenging market backdrop. Revenue was £11,674 million, a decrease from prior year driven by lower precious metal prices and the divestment of Value Businesses. Underlying operating profit, excluding divestments, was up 6% at constant PGM prices and constant currency. Our results were primarily driven by self-help actions, including approximately £80 million of cost savings from our group transformation programme. These actions were critical in offsetting macroeconomic headwinds and delivering sustainable improvements.

Since 2022�Since we set our strategy in 2022, we have focused on markets where we have a competitive edge, targeting investments that drive sustainable cash generation and enhance shareholder value.

This year�Over the past year, we faced market headwinds, including the deceleration of the hydrogen economy, outward pressure on energy transition markets, OEM pressures, and broader

geopolitical and macroeconomic volatility. In response, we took decisive actions to recalibrate our strategy to external market conditions, and protect and enhance shareholder value, including...

Looking forward

We see significant cash conversion enhancement, driven by the completion of our asset renewal programme and reduced working capital.

Clean Air�Our commercial wins helped secure approximately c. 90% of our pipeline for 2027/28. We were also awarded three hydrogen internal combustion engine autocatalyst contracts from separate heavy duty class customers.

Platinum Group Metal Services�We grew our refining business, supported by higher volumes from industrial customers and metal recoveries.

Catalyst Technologies�We won nine large-scale projects in our sustainable technologies portfolio, including selection for one of Europe’s largest planned e-methanol plants.

Hydrogen Technologies�We deepened key collaborations in renewable hydrogen, including a long-term collaboration with Bosch to accelerate fuel cell technologies.

Driving results�Our transformation strategy delivered tangible results through a disciplined approach to cost reduction and efficiency gains:

£80 million

in new annual savings achieved in 2024/25, contributing to a cumulative £200 million in savings relative to the 2021/22 baseline. These savings stem from procurement, IT, optimising management structures, and the expansion of JM Global Solutions (JMGS),�which enhances operational efficiency.

A leaner capital expenditure programme with a maximum of

� £0.9 billion

committed for 2024/25–2026/27, down from £1.1 billion in the previous three-year period. A disciplined approach, supported by the establishment of an Investment Committee, ensures that capital is only deployed where it delivers clear, measurable returns.

Sale of Catalyst Technologies�As part of JM’s strategy announced in May 2022, Catalyst Technologies has delivered significant commercial wins and partnerships, and developed a pipeline of more than 150 early-stage sustainable technologies projects.

In parallel, we will continue to advance our pipeline of PGM-based high growth opportunities, with a focus on Hydrogen Technologies, Clean Air Solutions and PGM Products, opportunities that will expand our portfolio and reinforce our market leadership over the long-term.�

We are pivoting towards a cash-focused business model which will deliver enhanced shareholder returns. This is underpinned by a high performance culture driving rigorous cost control, materially lower capex and significant working capital benefits.�

Our world-class science tightly aligned to our commercial opportunities ensures we deliver the greatest impact for our customers, and enable their transition to a cleaner, more resilient future.

A highly focused, lean and agile business�Following the agreed sale of Catalyst Technologies, JM will be a highly focused, lean and agile business, centred around Clean Air and PGM Services. These businesses have leading market positions, underpinned by our strong heritage and expertise in PGMs, combined with a circular business model based on our world-class refining capabilities and our ability to manage PGMs for our customers.

Our future portfolio

2027/28

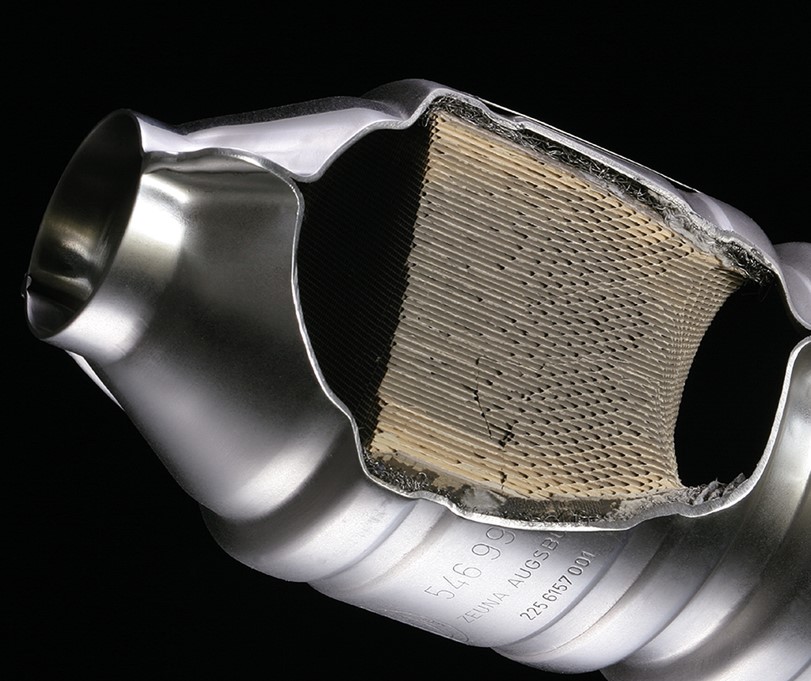

Clean Air

Designs and manufactures emission control catalysts to reduce harmful pollutants, e.g. NOx, from vehicle exhausts and a range of stationary sources.

Download business reviews

BACK

CLICK TO EXPAND

BACK

CLICK TO EXPAND

BACK

Read more

Read more

Read more

Download business model

Download KPIs

Download full report

01

Title page

08

Downloads

07

Sustainability

06

Our strategy

05

Our business reviews

04

Key performance indicators

03

Leadership statements

02

JM at a glance

01

Title page

08

Downloads

07

Sustainability

06

Our strategy

05

Our business reviews

04

Key performance indicators

03

Leadership statements

02

JM at a glance

01

Title page

08

Downloads

07

Sustainability

06

Our strategy

05

Our business reviews

04

Key performance indicators

03

Leadership statements

02

JM at a glance

01

Title page

08

Downloads

07

Sustainability

06

Our strategy

05

Our business reviews

04

Key performance indicators

03

Leadership statements

02

JM at a glance

01

Title page

08

Downloads

07

Sustainability

06

Our strategy

05

Our business reviews

04

Key performance indicators

03

Leadership statements

02

JM at a glance

01

Title page

08

Downloads

07

Sustainability

06

Our strategy

05

Our business reviews

04

Key performance indicators

03

Leadership statements

02

JM at a glance

Sales is revenue excluding the cost of precious metal to customers. See note 33 to the financial statements for further information. Figures above refers to external sales.

Across Clean Air Solutions (emissions control technology for emerging applications), Hydrogen Technologies and PGM Products.

Equivalent to the total dividend for2024/25 of 77.0 pence per share.

Our current intention is for these returns to be delivered through ordinary dividends for 2025/26, and be broadly equally weighted between dividends and share buybacks for 2026/27.

Read more on our strategy

Download business reviews

Download full statement

Download full statement