Runaway Costs

Under-performing Fleet

Inadequate Service Levels

Lack of Strategic Oversight

56%

Customers are paying, on average, 56% higher labor rates vs. most competitive rates

80%

80% of customers don’t have the ability to track historical parts and labor costs

87%

87% of customers �don’t get enough predictability to budget for future MHE spend

Click to find out more

OEM Labor Rates & Parts with Higher Margins

Lack of Historical Data & Dashboards

Inconsistent Billing Practices

1. OEM Labor Rates & Parts with Higher Margins

Many companies default to using OEM technicians and parts because they assume it’s the safest or only option. Over time, these costs stack up—OEM rates typically carry a premium markup for labor and parts, often without a measurable improvement in service quality. Since these expenses are accepted as “industry standard,” they go unchallenged, leading to runaway spending.

2. Lack of Historical Data & Dashboards

Without a centralized way to track parts and labor spend over months or years, trends stay hidden. This means:

You can’t pinpoint repeat failures or equipment that’s costing more than it should.

You miss opportunities to negotiate rates or switch suppliers because there’s no data to back the conversation.

Leadership can’t forecast accurately—so budgets are always reactive, not proactive.

3. Inconsistent Billing Practices

Multiple vendors, unclear invoices, and different formats make it difficult to reconcile what you’re actually paying for. You might be charged twice for similar work, billed for unnecessary parts, or simply unable to separate preventative maintenance costs from emergency repairs. This lack of transparency creates confusion and makes cost overruns feel inevitable.

1

2

3

98% of customers do not �receive guaranteed �continuous improvement �recommendations annually

Lack of Strategic Oversight

2. How You Got Here

The Problem

Click to find out more

The "Handshake" Contract

1

The Uptime Blindspot

2

The Off-Site Technician Delay

3

1. The "Handshake" Contract

Many companies enter into vendor agreements without clear, guaranteed service levels written into the contract. It's often a verbal agreement or a "trust-based" relationship. When a lift truck goes down, there's no official commitment for response time, and vendors aren't held accountable for on-site arrival or repair time. This ambiguity sets the stage for future problems, as vendors have no contractual obligation to prioritize your needs over another client's.

2. The Uptime Blindspot

Without knowing your equipment's uptime, you’re operating in the dark. Many companies don't track this crucial metric, making it impossible to quantify the exact cost of downtime. This lack of data prevents you from seeing the full financial impact of every hour your equipment is out of service. As a result, you can't build a strong case for improvement or negotiate for better service.

3. The Off-Site Technician Delay

The practice of using off-site, shared technicians is a major cause of extended downtime. When your vendor's mechanics are split between multiple clients, your repair becomes a part of a larger, unpredictable schedule. Instead of an immediate fix, you're waiting for the next available technician, and every hour of that wait costs you productivity and money. This system creates a reactive, rather than proactive, maintenance strategy.

92%

of customers don’t have guaranteed service levels written in their contract

97%

of customers don’t know their equipment up-time (productivity)

54%

of customers do not have a dedicated technician onsite, delaying turnaround time for repairs

Click to find out more

The Missing Data

1

The Reactive Supplier

2

The Status Quo

3

1. The Missing Data

You can't fix what you can't see. When vendors don't provide KPI reporting and data analysis on a regular basis, you're operating with a blind spot. Without visibility into your fleet's performance—like uptime, repair times, and cost-per-hour—you can't identify trends, hold vendors accountable, or justify investments in new equipment. Your decisions are based on guesswork and reactive fixes, not a clear understanding of your operation's health.

2. The Reactive Supplier

You may have a primary contact, but are they truly a partner? A transactional vendor fulfills a repair request, but a strategic partner looks for ways to improve your entire operation. Without guaranteed continuous improvement recommendations, you’re missing out on opportunities to save money, enhance productivity, and improve safety. This could be anything from recommending a fleet right-sizing initiative to implementing a new technology that would significantly reduce your costs.

3. The Status Quo

You might have monthly or quarterly meetings, but without a dedicated strategic account manager, they often lack substance. These meetings become reactive, focused on putting out fires rather than proactive, focusing on future planning. Without a primary contact who understands your business objectives, you'll never have a true business review with meaningful KPIs or scorecards that align with your long-term goals. Your vendor becomes a reactive supplier, not a trusted advisor.

85%

of customers do not receive KPI reporting and data analysis on a regular basis

60%

of customers do not have a strategic, dedicated account manager

98%

of customers do not receive guaranteed continuous improvement recommendations annually

96%

of customers have multiple vendors across their fleet

This combination leaves most companies reacting to problems rather than preventing them, with no clear path to hold vendors accountable or measure whether service is truly meeting business needs.

4. Too Many Hands on Deck

When you have a different vendor for every type of equipment—lifts, batteries, chargers, attachments—accountability gets lost in the shuffle. A breakdown leads to a round of finger-pointing, with each vendor blaming the other. This fragmentation creates inconsistent service quality, drives up costs, and leaves you with no single point of contact to take ownership of your fleet's overall performance.

91%

of customers fleets are underutilized

85%

of customers utilize rental equipment for longer than 6 months

72%

of customers do not have established PM schedules

83%

experience extended downtime due to delayed repairs from offsite technicians

Click to find out more

Underutilized Fleets

1

The Rental Trap

2

No Preventative Maintenance Schedules

3

The Domino Effect of Downtime

4

1. Underutilized Fleets

Without a strategic partner analyzing your fleet data, it’s easy to overlook imbalances. You may have equipment sitting idle in one area while other parts of the operation rely on rentals or overworked trucks. Without visibility and reporting, fleet optimization becomes guesswork, leading to wasted assets and higher costs.

2. The Rental Trap

Rentals are meant to be a stopgap, but without someone managing the big picture, temporary fixes turn into expensive long-term habits. Instead of proactively right-sizing the fleet, companies often keep rentals far beyond what’s cost-effective—driving up costs and hiding the root causes of the demand.

3. No Preventative Maintenance Schedules

A lack of consistent PM schedules is usually a symptom of reactive operations. Without a partner to track maintenance intervals and enforce a schedule, breakdowns happen more often, downtime increases, and costs spike due to emergency repairs rather than planned service.

4. The Domino Effect of Downtime

When there’s no dedicated technician or account manager advocating for your site, repair requests can get stuck in a queue. Offsite technicians may take hours—or days—to arrive, stretching downtime and stalling productivity. A strategic partner ensures response times are tracked, measured, and improved over time.

Too Many Hands on Deck

4

Tell Me More

91% of customers claim their �fleet is underutilized

Underperforming Fleet

Tell Me More

92% of customers don’t have guaranteed service levels written in their contract

Inadequate �Service Levels

Tell Me More

Customers are paying, on average, 56% higher labor rates vs. most competitive rates

Runaway �Costs

Tell Me More

higher labor rates are what customers are paying on average versus the most competitive rates

56%

of customers don’t have the ability to track historical parts and labor costs

80%

of customers don’t get enough predictability �to budget for future �MHE spend

87%

Is your equipment too old?

Is the equipment being properly utilized? Is the right leasing plan in place?

Are lifts under-utilized or over-utilized?

Is there a better way to operate your fleet and do you have the right equipment?

Is your team considering automation use cases appropriately?

Does your team understand the fleet composition? How many rentals are currently in use? How many leased trucks? How much equipment is owned?

Do you know when the leases expire? Do you understand market lead times to plan accordingly?

Which OEM has the lowest cost of ownership of our application?

Are you using the correct piece of equipment for application?

How much has a particular piece of equipment cost us over a given period of time?

a

b

c

d

e

f

Are the PMs being completed on time?

Is the equipment being properly repaired the first time?

Are you being double charged for repairs that should be covered under my agreement?

Is equipment downtime impacting productivity?

Do you have mechanics dedicated specifically to our site? Or are the mechanics shared amongst several customers?

What is the response time from the vendor today? How long are repairs taking? Immediate, hours, days, etc.?

Are you using more than (1) vendor to maintain our MHE fleet (lifts, batteries, chargers, attachments, etc.)?

Does your team have visibility to equipment out of service with estimated repair times?

Are there any established KPIs that the vendors are judged against?

g

h

i

Ready for Progress

Survival Guide

MHE Explorer Map

3. The Path Forward

3. The Path Forward

The Unspoken Gaps in Your MHE Service

2. How You Got Here

Many don’t realize their vendor agreements lack guaranteed service levels until downtime becomes a recurring problem. At first, the arrangement seems fine—repairs get done eventually, and there’s little thought given to measuring uptime or holding vendors accountable. But over time, the cracks start to show:

2. How You Got Here

The Problem

When vendor agreements lack guaranteed service levels, the outcome is all too familiar—lost productivity, frustrated teams, and recurring downtime. Without clear expectations in the contract, service delays, finger-pointing, and missed commitments can quickly slip through the cracks.

The Problem

back to map

3. The Path Forward

2. How You Got Here

The Problem

3. The Path Forward

The Problem

3. The Path Forward

2. How You Got Here

The Problem

Many companies don’t realize they’re overspending on MHE maintenance until it’s too late. Without clear insight into where their money is going, hidden costs pile up, budgets get blown, and frustration grows.

The Problem

MHE vendors often send technicians without providing a true strategic partner. Without that guidance, communication breaks down, reporting is inconsistent, and long-term planning never happens—leaving you stuck reacting instead of improving.

The Problem

Vendors do not have a strategic partner to pair with their technicians, creating a lack of communication, reporting, and poor strategic planning with the customer.

The Problem

The Problem

Unseen Costs Sinking Your Budget

Runaway costs don’t happen overnight—they build quietly over time. Most companies don’t realize how much they’re overspending on MHE maintenance until budget overruns become impossible to ignore. It usually starts with defaulting to “safe” but expensive OEM service options, continues with a lack of data to reveal trends, and is compounded by confusing, inconsistent invoices that make true cost visibility nearly impossible.

When these three factors combine, you end up with a budget that’s reactive instead of strategic, leaving you overpaying for labor and parts, unable to forecast spend, and frustrated by the lack of transparency.

2. How You Got Here

a

b

c

d

e

f

Is an itemized monthly statements from all of your MHE vendors broken into labor and parts?

What is the current hourly labor rate for MHE repairs and PMs?

Are OEM parts only being used, or sourcing best-value options?

Can you accurately forecast the annual MHE budget?

Is your team receiving monthly insights on avoidable damage and safety issues?

Is spend tracked against a budget with clear root-cause analysis for overruns?

back to map

back to map

back to map

The Problem

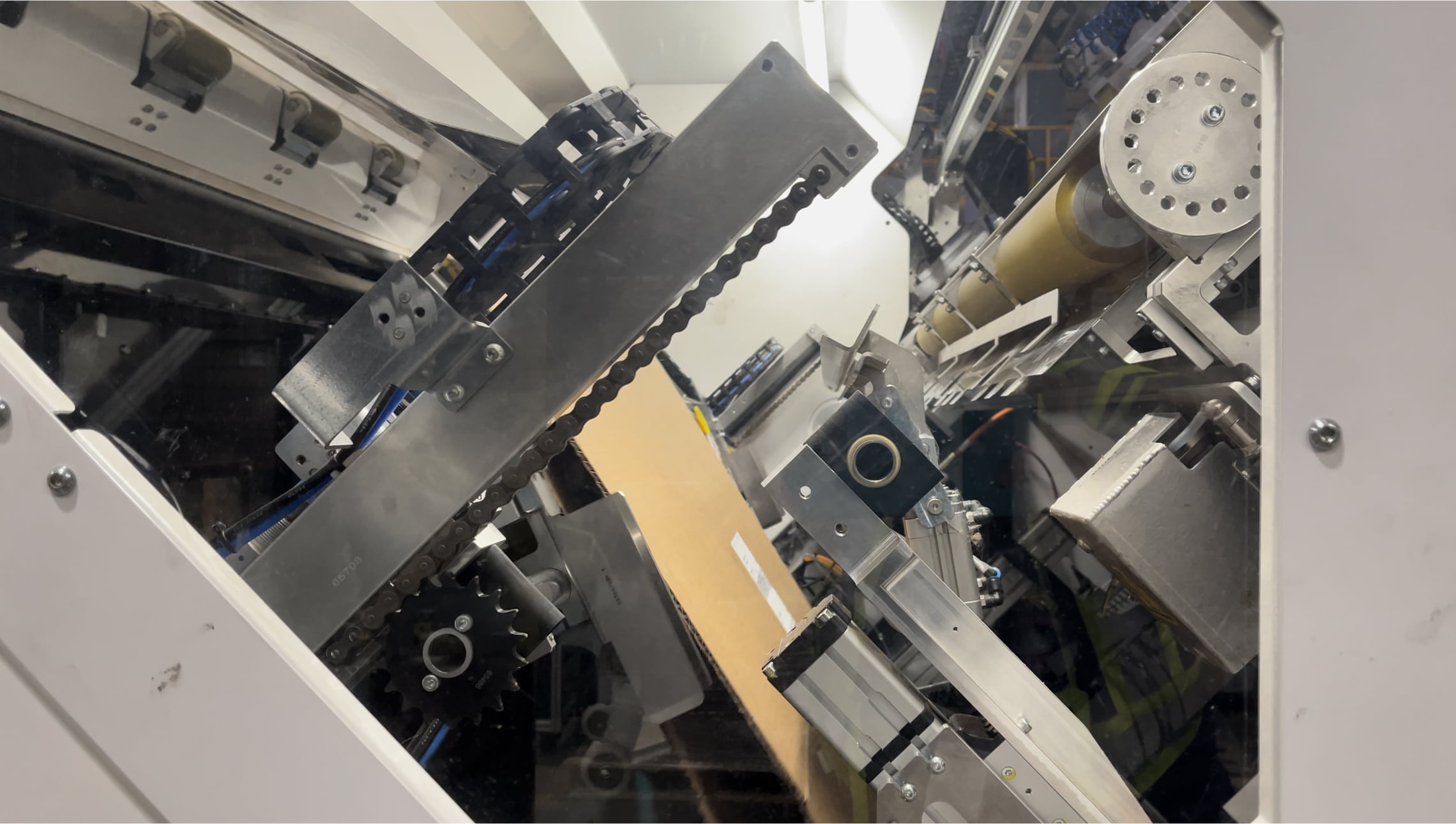

The Unseen Drag on Your Operations

When MHE is treated like a commodity, not an asset, your fleet is at risk of underperforming without you even knowing it. This pitfall isn't about one major problem—it's a series of small, manageable inefficiencies that compound over time, silently eating away at your bottom line.

2. How You Got Here

3. The Path Forward

a

b

c

d

e

f

g

h

Is your equipment too old?

Is the equipment being properly utilized? Is the right leasing plan in place?

• Are lifts under-utilized or over-utilized?

Is there a better way to operate your fleet and do you have the right equipment?

Is your team considering automation use cases appropriately?

Does your team understand the fleet composition? How many rentals are currently in use? How many leased trucks? How much equipment is owned?

• Do you know when the leases expire? Do you understand market lead times to plan accordingly?

Which OEM has the lowest cost of ownership of our application?

Are you using the correct piece of equipment for application?

How much has a particular piece of equipment cost us over a given period of time?

3. The Path Forward

3. The Path Forward

The Disconnected Fleet

This pitfall isn't about broken equipment; it's about a broken partnership. Many companies have technicians but lack a strategic advisor, creating a gap that drains efficiency and prevents long-term planning.

How You Got Here

Underperforming Fleet

Think of this as your diagnostic toolkit — the questions that separate reactive maintenance from a proactive, data-driven MHE strategy.

This section empowers you to take control of your MHE program by asking the right questions. Each pitfall includes a set of practical, thought-provoking questions designed to:

The Problem

2. How You Got Here

2. How You Got Here

Lack of Strategic Oversight

Inadequate Service Levels

MHE Explorer Map

a

b

c

d

e

Who is the primary contact for future fleet planning and MHE related initiatives

Is this primary contact able to provide unbiased guidance and recommendations that best suit our needs?

Does your team receive detailed monthly or quarterly performance reporting and KPI adherence to determine fleet performance?

Is the current vendor providing continuous improvement opportunities that impact operations and reduce costs?

Is your vendor a trusted advisor a reactive supplier?

Think of this as your diagnostic toolkit — the questions that separate reactive maintenance from a proactive, data-driven MHE strategy.

This section empowers you to take control of your MHE program by asking the right questions. Each pitfall includes a set of practical, thought-provoking questions designed to:

3. The Path Forward

Think of this as your diagnostic toolkit — the questions that separate reactive maintenance from a proactive, data-driven MHE strategy.

This section empowers you to take control of your MHE program by asking the right questions. Each pitfall includes a set of practical, thought-provoking questions designed to:

3. The Path Forward

Survival Guide

Ask Us a Question

Think of this as your diagnostic toolkit — the questions that separate reactive maintenance from a proactive, data-driven MHE strategy.

This section empowers you to take control of your MHE program by asking the right questions. Each pitfall includes a set of practical, thought-provoking questions designed to:

Reveal hidden gaps �in your current operations, costs, and vendor performance.

Spark internal conversations �with your team and leadership about opportunities for improvement.

3. The Path Forward

Runaway Costs

Evaluate your current vendors �to see if they’re providing the transparency, service levels, and strategic guidance you deserve.

Reveal hidden gaps �in your current operations, costs, and vendor performance.

Spark internal conversations �with your team and leadership about opportunities for improvement.

Evaluate your current vendors �to see if they’re providing the transparency, service levels, and strategic guidance you deserve.

Reveal hidden gaps �in your current operations, costs, and vendor performance.

Spark internal conversations �with your team and leadership about opportunities for improvement.

Evaluate your current vendors �to see if they’re providing the transparency, service levels, and strategic guidance you deserve.

Survival Guide

Ask Us a Question

Survival Guide

Ask Us a Question

Survival Guide

Ask Us a Question

Survival Guide

Ask Us a Question

Reveal hidden gaps �in your current operations, costs, and vendor performance.

Spark internal conversations �with your team and leadership about opportunities for improvement.

Evaluate your current vendors �to see if they’re providing the transparency, service levels, and strategic guidance you deserve.

MHE Explorer Map

higher labor rates are what customers are paying on average versus the most competitive rates

56%

of customers don’t have the ability to track historical parts and labor costs

80%

of customers don’t get enough predictability �to budget for future �MHE spend

87%

1.

The Problem

1.

The Problem

1.

The Problem

1.

The Problem

1.

The Problem

1.

The Problem

1.

The Problem

2. �How You Got Here

2. �How You Got Here

2. �How You Got Here

2. �How You Got Here

2. �How You Got Here

2. �How You Got Here

2. �How You Got Here

3. �The Path Forward

3. �The Path Forward

3. �The Path Forward

3. �The Path Forward

3. �The Path Forward

3. �The Path Forward

3. �The Path Forward

back to map

back to map

back to map

Lack of Strategic Oversight

Runaway Costs

Inadequate Service Levels

Reveal hidden gaps �in your current operations, costs, and vendor performance.

Spark internal conversations �with your team and leadership about opportunities for improvement.

Evaluate your current vendors �to see if they’re providing the transparency, service levels, and strategic guidance you deserve.

Think of this as your diagnostic toolkit — the questions that separate reactive maintenance from a proactive, data-driven MHE strategy.

This section empowers you to take control of your MHE program by asking the right questions. Each pitfall includes a set of practical, thought-provoking questions designed to:

3. The Path Forward

Reveal hidden gaps �in your current operations, costs, and vendor performance.

Spark internal conversations �with your team and leadership about opportunities for improvement.

Evaluate your current vendors �to see if they’re providing the transparency, service levels, and strategic guidance you deserve.

Think of this as your diagnostic toolkit — the questions that separate reactive maintenance from a proactive, data-driven MHE strategy.

This section empowers you to take control of your MHE program by asking the right questions. Each pitfall includes a set of practical, thought-provoking questions designed to:

3. The Path Forward

Reveal hidden gaps �in your current operations, costs, and vendor performance.

Spark internal conversations �with your team and leadership about opportunities for improvement.

Evaluate your current vendors �to see if they’re providing the transparency, service levels, and strategic guidance you deserve.

Think of this as your diagnostic toolkit — the questions that separate reactive maintenance from a proactive, data-driven MHE strategy.

This section empowers you to take control of your MHE program by asking the right questions. Each pitfall includes a set of practical, thought-provoking questions designed to:

3. The Path Forward

Survival Guide

Ask Us a Question

Survival Guide

Ask Us a Question

Survival Guide

Ask Us a Question

Click to find out more

OEM Labor Rates & Parts with Higher Margins

1

Lack of Historical Data & Dashboards

2

Inconsistent Billing Practices

3

1. OEM Labor Rates & Parts with Higher Margins

Many companies default to using OEM technicians and parts because they assume it’s the safest or only option. Over time, these costs stack up—OEM rates typically carry a premium markup for labor and parts, often without a measurable improvement in service quality. Since these expenses are accepted as “industry standard,” they go unchallenged, leading to runaway spending.

2. Lack of Historical Data & Dashboards

Without a centralized way to track parts and labor spend over months or years, trends stay hidden. This means:

You can’t pinpoint repeat failures or equipment that’s costing more than it should.

You miss opportunities to negotiate rates or switch suppliers because there’s no data to back the conversation.

Leadership can’t forecast accurately—so budgets are always reactive, not proactive.

3. Inconsistent Billing Practices

Multiple vendors, unclear invoices, and different formats make it difficult to reconcile what you’re actually paying for. You might be charged twice for similar work, billed for unnecessary parts, or simply unable to separate preventative maintenance costs from emergency repairs. This lack of transparency creates confusion and makes cost overruns feel inevitable.

Click to find out more

The "Handshake" Contract

1

The Uptime Blindspot

2

934

The Off-Site Technician Delay

3

Too Many Hands on Deck

4

1. The "Handshake" Contract

Many companies enter into vendor agreements without clear, guaranteed service levels written into the contract. It's often a verbal agreement or a "trust-based" relationship. When a lift truck goes down, there's no official commitment for response time, and vendors aren't held accountable for on-site arrival or repair time. This ambiguity sets the stage for future problems, as vendors have no contractual obligation to prioritize your needs over another client's.

2. The Uptime Blindspot

Without knowing your equipment's uptime, you’re operating in the dark. Many companies don't track this crucial metric, making it impossible to quantify the exact cost of downtime. This lack of data prevents you from seeing the full financial impact of every hour your equipment is out of service. As a result, you can't build a strong case for improvement or negotiate for better service.

3. The Off-Site Technician Delay

The practice of using off-site, shared technicians is a major cause of extended downtime. When your vendor's mechanics are split between multiple clients, your repair becomes a part of a larger, unpredictable schedule. Instead of an immediate fix, you're waiting for the next available technician, and every hour of that wait costs you productivity and money. This system creates a reactive, rather than proactive, maintenance strategy.

4. Too Many Hands on Deck

When you have a different vendor for every type of equipment—lifts, batteries, chargers, attachments—accountability gets lost in the shuffle. A breakdown leads to a round of finger-pointing, with each vendor blaming the other. This fragmentation creates inconsistent service quality, drives up costs, and leaves you with no single point of contact to take ownership of your fleet's overall performance.

91%

of customers fleets are underutilized

85%

of customers utilize rental equipment for longer than 6 months

72%

of customers do not have established PM schedules

83%

experience extended downtime due to delayed repairs from offsite technicians

Click to find out more

Underutilized Fleets

1

The Rental Trap

2

No Preventative Maintenance Schedules

3

The Domino Effect of Downtime

4

1. Underutilized Fleets

Without a strategic partner analyzing your fleet data, it’s easy to overlook imbalances. You may have equipment sitting idle in one area while other parts of the operation rely on rentals or overworked trucks. Without visibility and reporting, fleet optimization becomes guesswork, leading to wasted assets and higher costs.

2. The Rental Trap

Rentals are meant to be a stopgap, but without someone managing the big picture, temporary fixes turn into expensive long-term habits. Instead of proactively right-sizing the fleet, companies often keep rentals far beyond what’s cost-effective—driving up costs and hiding the root causes of the demand.

3. No Preventative Maintenance Schedules

A lack of consistent PM schedules is usually a symptom of reactive operations. Without a partner to track maintenance intervals and enforce a schedule, breakdowns happen more often, downtime increases, and costs spike due to emergency repairs rather than planned service.

4. The Domino Effect of Downtime

When there’s no dedicated technician or account manager advocating for your site, repair requests can get stuck in a queue. Offsite technicians may take hours—or days—to arrive, stretching downtime and stalling productivity. A strategic partner ensures response times are tracked, measured, and improved over time.

60%

of customers do not have a strategic, dedicated account manager

98%

of customers do not �receive guaranteed continuous improvement recommendations annually

85%

of customers do not receive KPI reporting and data analysis on a regular basis

Click to find out more

The Missing Data

1

The Reactive Supplier

2

The Status Quo

3

1. The Missing Data

You can't fix what you can't see. When vendors don't provide KPI reporting and data analysis on a regular basis, you're operating with a blind spot. Without visibility into your fleet's performance—like uptime, repair times, and cost-per-hour—you can't identify trends, hold vendors accountable, or justify investments in new equipment. Your decisions are based on guesswork and reactive fixes, not a clear understanding of your operation's health.

2. The Reactive Supplier

You may have a primary contact, but are they truly a partner? A transactional vendor fulfills a repair request, but a strategic partner looks for ways to improve your entire operation. Without guaranteed continuous improvement recommendations, you’re missing out on opportunities to save money, enhance productivity, and improve safety. This could be anything from recommending a fleet right-sizing initiative to implementing a new technology that would significantly reduce your costs.

3. The Status Quo

You might have monthly or quarterly meetings, but without a dedicated strategic account manager, they often lack substance. These meetings become reactive, focused on putting out fires rather than proactive, focusing on future planning. Without a primary contact who understands your business objectives, you'll never have a true business review with meaningful KPIs or scorecards that align with your long-term goals. Your vendor becomes a reactive supplier, not a trusted advisor.

2. How You Got Here

3. The Path Forward

2. How You Got Here

MHE Explorer Map

Survival Guide

Ready for Progress

MHE Explorer Map

Ask Us a Question